-

Recent Posts

- RESPONDING TO HARRY KROTO’S BRILLIANT RENOWNED ACADEMICS!! (PAUSING TO LOOK AT THE LIFE OF Peter Ware Higgs (29 May 1929 – 8 April 2024) Part 184 Peter Higgs, Nobel Prize winner in Physics, University of Edinburgh, (The article “The Higgs Boson: A Blow to Christianity? By Dr. Jake Herbert, July 13, 2012)

- MUSIC MONDAY Billy Joel was inspired to write “Uptown Girl” after hanging out with Christie Brinkley, Whitney Houston and Elle Macpherson. He later married Brinkley

- Friedman Friday US retirement system earns just a C+ in global study (Plus Milton Friedman – The Social Security Myth)

- FRANCIS SCHAEFFER ANALYZES ART AND CULTURE Part 527 Is there a categorical difference in us and animals? Dr. John Shea recommended I read Carl Sagan’s book SHADOWS OF FORGOTTEN ANCESTORS FEATURED ARTIST IS PIERO

- FRANCIS SCHAEFFER ANALYZES ART AND CULTURE Part 526 Carl Sagan ”Is it wrong to abort a pregnancy? Always? Sometimes? Never? How do we decide?”(My 1995 correspondence with Sagan) How Pulitzer Prize-winning Paul Greenberg, one of the most respected and honored commentators in America, changed his mind about abortion! Featured Artist is MONDRIAN

-

Recent Comments

-

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

-

Categories

- Adrian Rogers

- Atheists Confronted

- Biblical Archaeology

- Bill Clinton

- Capital Punishment

- Cato Institute

- Current Events

- David Barton

- Economist Dan Mitchell

- Famous Arkansans

- Founding Fathers

- Francis Schaeffer

- Gun Control

- Healthcare

- Hillary Clinton

- Jason Tolbert

- Mike Huckabee

- Milton Friedman

- President Donald J. Trump

- President Donald Trump

- President Obama

- Prolife

- Ronald Reagan

- Social Security

- spending out of control

- Taxes

- Uncategorized

- Unconfirmed Quotes of Founders

- Vouchers

- War Heroes

- Woody Allen

-

Meta

Author Archives: Everette Hatcher III

MUSIC MONDAY Billy Joel was inspired to write “Uptown Girl” after hanging out with Christie Brinkley, Whitney Houston and Elle Macpherson. He later married Brinkley

–

Billy Joel was inspired to write “Uptown Girl” after hanging out with Christie Brinkley, Whitney Houston and Elle Macpherson. He later married Brinkley

Related posts:

Rolling Stones Jumping Jack Flash

__________ __ The Rolling Stones ~ Jumpin’ Jack Flash. (1968) The Dirty Mac Band (John Lennon, Eric Clapton, Keith Richards & Mitch Mitchell) | FeelNumb.com John Lennon, Eric Clapton, Keith Richards, Mitch Mitchell, Jimi Hendrix ____

“Music Monday” Katy Perry and the Rolling Stones

News/ Katy Perry Sings With Mick Jagger at Rolling Stones Concert—Watch Now by Rebecca Macatee Today 5:45 AM PDT The Rolling Stones & Katy Perry – Beast Of Burden – Live – By Request Published on May 12, 2013 The Rolling Stones and special guest Katy Perry perform ‘Beast Of Burden’ at the Las Vegas […]

Katy Perry performs song “Beast of Burden” with Rolling Stones

News/ Katy Perry Sings With Mick Jagger at Rolling Stones Concert—Watch Now by Rebecca Macatee Today 5:45 AM PDT The Rolling Stones & Katy Perry – Beast Of Burden – Live – By Request Published on May 12, 2013 The Rolling Stones and special guest Katy Perry perform ‘Beast Of Burden’ at the Las Vegas […]

MUSIC MONDAY Eric Clapton and Jimi Hendrix were good friends!!

Jimi Hendrix & Cream – Sunshine Of Your Love Jimi Hendrix & Eric Clapton Jimi Hendrix & Mick Jagger Jimi Hendrix & Keith Richards Jimi Hendrix & Brian Jones Jimi Hendrix & Janis Joplin Jimi Hendrix with Cream & Pink Floyd Even “Legends” want to meet a “Legend” Jimi Hendrix: ‘You never told me he […]

Eric Clapton and Jimi Hendrix were good friends!!

Eric Clapton and Jimi Hendrix were good friends!! Jimi Hendrix & Cream – Sunshine Of Your Love Uploaded on Feb 5, 2012 Hey Joe JIMI HENDRIX live images in 1969, in London! BBC! dedicated to cream”Sunshine of Your Love”. High quality and superior sound. ¡¡¡¡¡full screen!!!!! Everyone wanted to meet or take a picture with […]

Open letter to George F. Will concerning Donald Trump!!!

The following was emailed to George F. Will on 6-27-16: Scott Ableman / Wikimedia Dear Mr. Will, I really enjoyed your You Tube cllip “George Will Keynotes 2010 Milton Friedman Prize Dinner:” If you google ARKANSAS MILTON FRIEDMAN you will be brought to my website http://www.thedailyhatch.org since I have written so many posts on my economic hero […]

MUSIC MONDAY Christian Rock Pioneer Larry Norman’s Songs Part 14

Christian Rock Pioneer Larry Norman’s Songs Part 14 I posted a lot in the past about my favorite Christian musicians such as Keith Green (I enjoyed reading Green’s monthly publications too), and 2nd Chapter of Acts and others. Today I wanted to talk about one of Larry Norman’s songs. David Rogers introduced me to Larry […]

FRANCIS SCHAEFFER ANALYZES ART AND CULTURE PART 107 A look at the BEATLES as featured in 7th episode of Francis Schaeffer film HOW SHOULD WE THEN LIVE? Was popularity of OCCULTISM in UK the reason Aleister Crowley appeared on SGT PEP cover? Schaeffer notes, “People put the Occult in the area of non-reason in the hope of some kind of meaning even if it is a horrendous kind of meaning” Part E (Artist featured today is Gerald Laing )

On the cover of Sergeant Pepper’s Lonely Hearts Club Band Album there were many individuals that were historical figures that changed history. Many of these individuals had died before the release June 1, 1967 of the album. Aldous Huxley was a major figure in the drug culture and he had died on November 22, 1963. Aleister […]

Friedman Friday US retirement system earns just a C+ in global study (Plus Milton Friedman – The Social Security Myth)

–

Milton Friedman – The Social Security Myth

https://www.foxbusiness.com/economy/u

–

US retirement system earns just a C+ in global study

US retirement system grade on par with Kazakhstan and Colombia

In a new ranking of global retirement systems, the U.S. notched a C+ grade that puts it on par with nations like Kazakhstan, Colombia, Spain and France.

The new Mercer CFA Institute Global Pension Index, released Tuesday, rates retirement income systems across the world by using the weighted averages of adequacy, sustainability and integrity.

The C+ rating means that America’s retirement system“has some good features but also has major risks and/or shortcomings that should be addressed; without these improvements, its efficacy and/or long-term sustainability can be questioned,” according to the study.

The U.S. scored 63 out of 100 possible points, coming in 22nd place out of the 47 countries examined.

“Retirement savings coverage and institutional quality retirement vehicles remain out of reach for many Americans, creating a significant adequacy gap that needs to be addressed,” Katie Hockenmaier, partner and U.S. defined contribution research director at Mercer, said in a statement.

A couple reviews their retirement plan at their home. (IStock / iStock)

The three most common sources of retirement income in the U.S. are Social Security benefits, employee pensions and personal savings – a trio dubbed the “three-legged stool” by financial planners.

Not every worker has access to a retirement-savings plan through work. More than half of Americans did not qualify for a retirement plan through their job, according to a recent study by the Economic Innovation Group.

INFLATION RISES MORE THAN EXPECTED IN SEPTEMBER AS HIGH PRICES PERSIST

Social Security only replaces about 40% of pre-retirement income for the average worker when they retire, meaning there are often significant financial gaps.

The entitlement program also faces long-term solvency issues, with the latest findings indicating that it could begin running out of money as soon as 2033.

A Social Security card sits alongside checks from the U.S. Treasury on Oct. 14, 2021, in Washington, D.C. (Kevin Dietsch/Getty Images / Getty Images)

Unless major changes are made before 2034 to shore up the trust fund, more than 66 million Americans would see a benefit reduction between about 23% to 25%.

The Mercer study said that the U.S. could improve its retirement system by raising the minimum Social Security payment for low-income retirees, improving the vesting benefits for individuals with retirement-savings accounts and reducing “pre-retirement leakage” by making it more difficult to access those funds before retirement.

Only four countries – the Netherlands, Denmark, Iceland and Israel – scored an A grade, which means they have a “first-class and robust retirement income system that delivers good benefits, is sustainable and has a high level of integrity.”

Social Security’s $60 Trillion-Plus Problem

The 2023 Social Security Trustees Report was released yesterday, and just like I did last year (and the year before, and the year before that, etc), let’s look at the fiscal status of the retirement program.

There is a lot of data in the Report. But the most important set of numbers can be found in Table VI.G9.

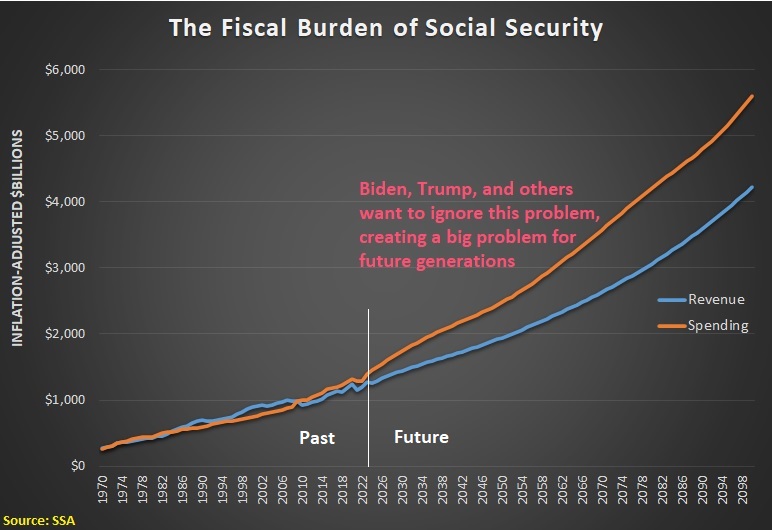

As you can see from this chart, these numbers show the amount of revenue coming into the program each year, adjusted for inflation, as well as the amount of yearly spending. Both are rising rapidly.

Since the orange line (spending) is climbing faster than the blue line (revenue), the obvious takeaway is that Social Security has a deficit.

But that would be an understatement.

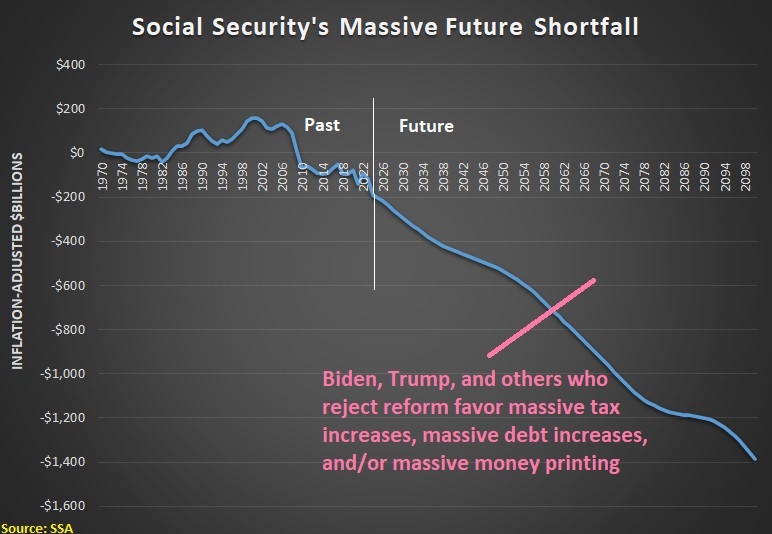

As you can see from the second chart, the cumulative deficit over the next 77 years is more than $60 trillion.

You’ll notice, of course, that I added a bit of editorializing to both charts.

That’s because it is reprehensible that Joe Bidenand Donald Trump are opposed to reforms that would modernize the program.

They won’t admit it, but their approach necessarilyand unavoidably means huge tax increases on lower-income and middle-class households.

P.S. If you are not Biden or Trump and want to do what’s best for America, I suggest learning about reforms in Australia, Chile, Switzerland, Hong Kong, Netherlands, the Faroe Islands, Denmark, Israel, and Sweden.

Social Security’s Inevitable Decline

It’s understandable that we’re now paying a lot of attention to Joe Biden’s risky proposals for higher taxes and a bigger welfare state.

After all, it’s a very bad idea to copy the economic policies of nations such as Italy, France, and Greece (unless, of course, you want much lower living standards).

(unless, of course, you want much lower living standards).

But let’s not forget that that the United States also has some big economic challenges that existed before President Biden ever took office.

Most notably the entitlement programs.

Medicaid and Medicare are the biggest problems, but let’s focus today on Social Security.

Richard Rahn has a column in the Washington Times that summarizes the program’s grim outlook. Here are some excerpts.

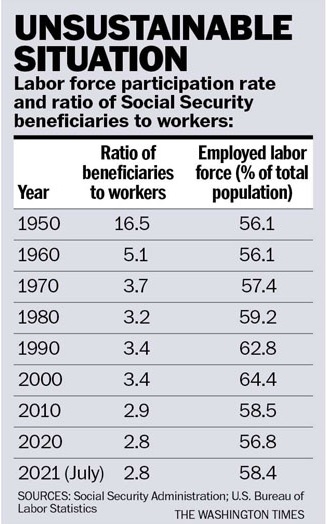

Politicians love to talk about the Social Security “trust fund” and assure us that it will not be raided. But the unfortunate fact is the “trust fund” is an accounting fiction without any real assets. In actuality, Social Security is a

giant Ponzi scheme operated by the government. Benefits that are paid to existing retirees come from the current taxes from those working today and borrowing. …But now, Americans have fewer children, and life expectancies are growing rapidly. …There is no easy way out. Future Social Security benefits will be cut (probably by not fully indexing for inflation), and/or taxes will be greatly and continuously increased until the system collapses.

The fact that Social Security is a Ponzi scheme isn’t necessarily fatal. After all, the government has the ability to coerce new workers into the system.

The problem is that there are fewer and fewer of those new workers to support the growing number of people getting benefits.

Here are the numbers from Richard’s column. As the old saying goes, read ’em and weep.

Richard ends his column by fretting that the United States is on a dangerous path.

The world has seen this play before. In 1906, Argentina on a per-capita income basis was one of the richest countries in the world, rivaling the United States. It has bountiful agricultural and mineral resources and had a relatively well-educated population of mainly European origin. But after a century of fascist/socialist/welfare-state governments, it is now a poor country. Venezuela went from a rich country with civil liberties to a poor oppressed country in only two decades. As Margaret Thatcher famously said, “the problem with socialism is that eventually, you run out of other peoples’ money.” The Greeks built a nice welfare state, largely using German taxpayers’ money – the Euro – until the Germans said, “no more.” As a result, the Greeks have seen a drop in real incomes of more than 30 percent in seven or so years.

The good news is that our economic policy won’t be nearly as bad as Argentina and Venezuela, even if some of Biden’s crazy ideas – such a massive per-child handouts – are enacted.

The bad news is that we could become a lot more like Greece.

And that’s where Margaret Thatcher’s famous warning could become an American reality.

There is a solution to this problem, by the way. It’s been implemented in a couple of dozen nations around the world.

Sadly, American politicians are more interested in making the problem worse (with predictable consequences).

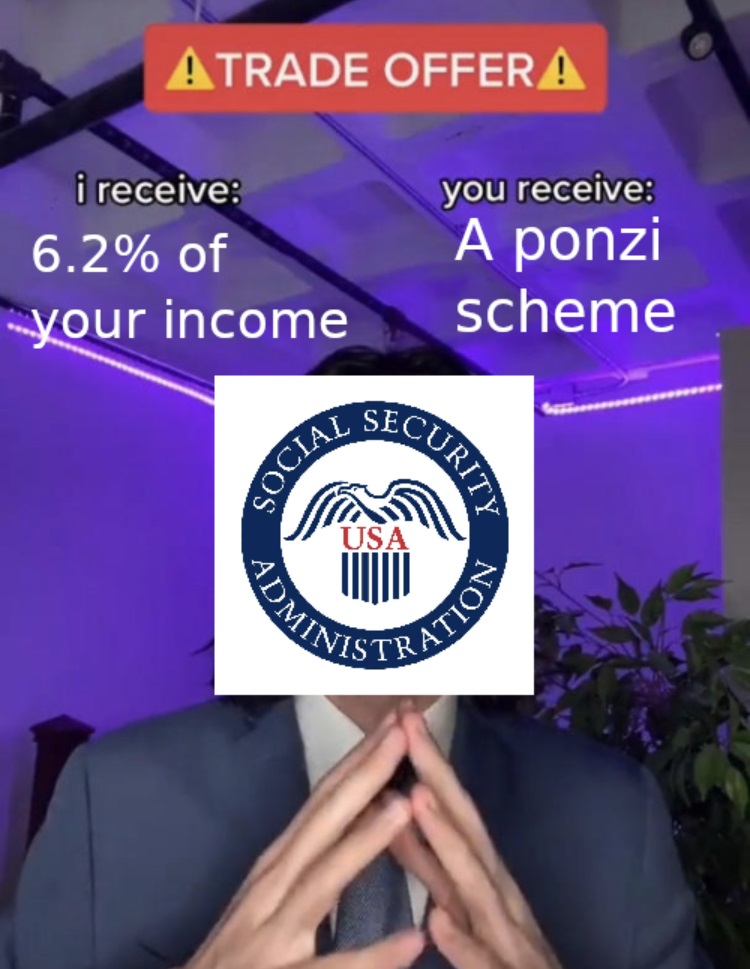

P.S. Here are a couple of humorous items about Social Security.

The first one actually understates how bad the trade is because workers actually pay 12.4 percent of their income into the program (the so-called employer share simply means lower pre-tax pay).

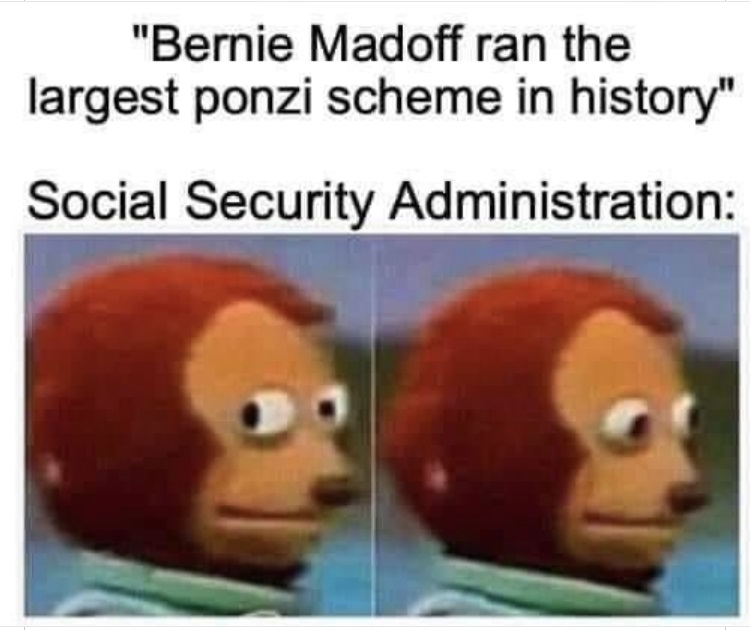

And the second item points out that Bernie Madoff was an amateur.

P.P.S. If you want more jokes and cartoons about Social Security, click here. There are other Social Security cartoons here, here, and here. And a Social Security joke if you appreciate grim humor.

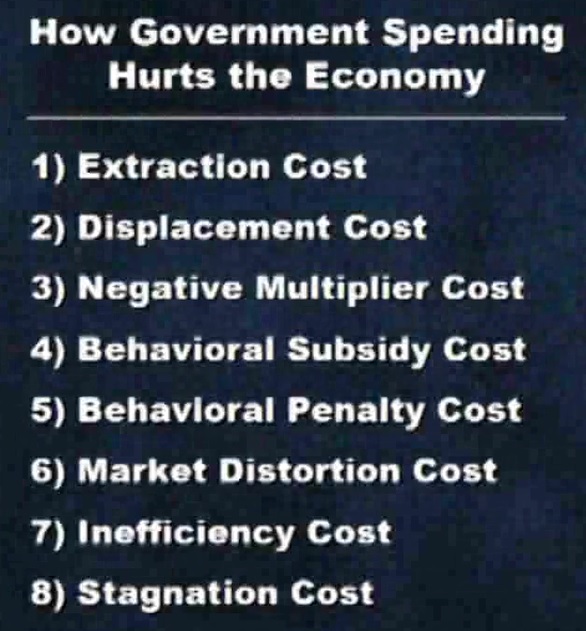

Sunk Costs, Inertia, and the Burden of Government Spending

Back in 2009 and 2010, when I had less gray hair, I narrated a four-part series on the economic burden of government spending.

Here’s Part II, which discusses the theoretical reasons why big government reduces prosperity.

I provide eight examples to illustrate how and why government spending can hinder economic growth.

The last item is what I called the “stagnation cost,” which is the tendency of politicians and bureaucrats to throw good money after bad because there is no incentive to adapt.

because there is no incentive to adapt.

When giving speeches, I usually refer to this as the “inertia cost.”

But, regardless of what I call it, I explain that every government program has a group of beneficiaries that are strongly motivated to keep their gravy train moving even if money is being wasted.

And since politicians like getting votes from those beneficiaries, it’s very difficult to derail programs.

In an article for National Review, Sean-Michael Pigeon offers one very plausible explanation for why this happens.

He says politicians fall victim to the fallacy of sunk costs.

…we need an understanding of government inefficiency… One reason government spending is so needlessly costly is somewhat paradoxical: The state is wasteful precisely because people are so concerned about wasting money. …This is a classic sunk-cost fallacy: Costs that can’t be recovered are “sunk,” and therefore irrelevant for future decision-making.

But while this fallacy is well known in economics, sunk costs are a big deal in the practical world of politics. Nobody wants to waste money, and politicians don’t want to cause waste directly. No member of Congress wants to be publicly responsible for a half-built bridge, especially when they have to tell taxpayers they still have to foot the bill for it. …Congress’s unwillingness to cut the funding of poorly run projects is a significant reason government projects always spend too much. …Politicians are nervous about cutting ongoing projects because they don’t want to leave taxpayers empty-handed, but stomaching sunk costs is worth it. Not only is it economically sound to stop government agencies from bleeding money, but it also sets the precedent that shoddy work will be held accountable. …to save money, sometimes you have to lose money.

In other words, it would be good to stop the bleeding.

But that’s not politically easy. Mr. Pigeon has examples in his column, but he should have included California’s (supposed) high-speed rail project.

That boondoggle has been draining money from state and federal coffers for about a decade. Cost estimates have exploded (something that almost always happens with government projects), yet construction has barely started.

Yet now Biden wants to increase federal subsidies for that money pit, along with other long-distance rail schemes.

And you won’t be surprised that a big argument from supporters is that we’ve already wasted billions and billions of dollars on the project, so therefore we should continue to waste even more money (sort of like hitting yourself on the head with a hammer because it feels good when you stop).

(sort of like hitting yourself on the head with a hammer because it feels good when you stop).

The big-picture bottom line is that the burden of federal spending should be reduced so that politicians have less ability to waste money.

And that also means that Americans will be able to enjoy more growth and more prosperity.

The targeted bottom line is that we should get Washington out of infrastructure.

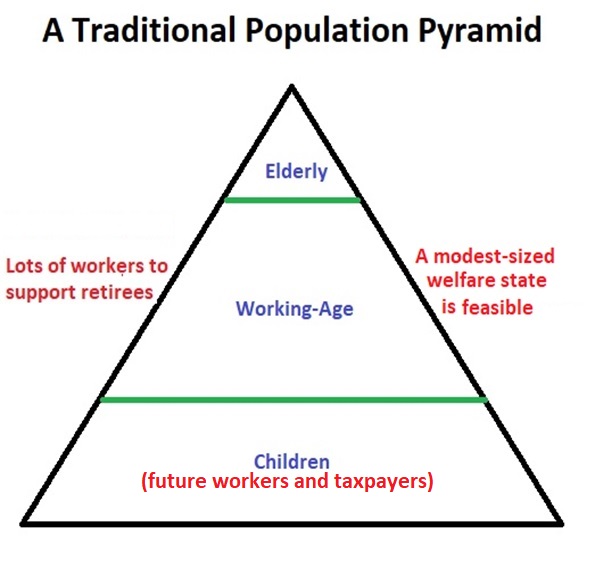

Demographic Decline = Fiscal Crisis

As a libertarian, I don’t care if couples have zero children or 10 children.

But as an economist, I’m horrified that big changes in demographics are going to lead to fiscal crises thanks to poorly designed entitlement programs.

Simply stated, modest-sized welfare states are sustainable if more and more new taxpayers enter the system to finance benefits for a burgeoning population of old people.

Simply stated, modest-sized welfare states are sustainable if more and more new taxpayers enter the system to finance benefits for a burgeoning population of old people.

But that’s not happening any more. In most nations, traditional population pyramids are becoming population cylinders because of falling birthrates and increasing longevity.

That’s the bad news.

The good news is that there is growing awareness the demographic changes are happening. Indeed, Damien Cave, Emma Bubola and have a big article on population decline in the New York Times.

All over the world, countries are confronting population stagnation and a fertility bust, a dizzying reversal unmatched in recorded history that will make first-birthday parties a rarer sight than funerals, and empty homes a common eyesore. Maternity wards are already shutting down in Italy. Ghost cities are appearing in northeastern China. Universities in South Korea can’t find enough students, and in Germany, hundreds of thousands of properties have been razed, with the land turned into parks.

…Demographers now predict that by the latter half of the century or possibly earlier, the global population will enter a sustained decline for the first time. …The strain of longer lives and low fertility, leading to fewer workers and more retirees, threatens to upend how societies are organized — around the notion that a surplus of young people will drive economies and help pay for the old. …The change may take decades, but once it starts, decline (just like growth) spirals exponentially. With fewer births, fewer girls grow up to have children, and if they have smaller families than their parents did — which is happening in dozens of countries — the drop starts to look like a rock thrown off a cliff. …according to projections by an international team of scientists published last year in The Lancet, 183 countries and territories — out of 195 — will have fertility rates below replacement level by 2100.

Plenty of interesting data, though remarkably little focus on the fiscal implications. Sort of like writing about 1943 France with almost no reference to World War II.

In any event, the article takes a closer look at the challenges in certain nations., including South Korea.

To goose the birthrate, the government has handed out baby bonuses. It increased child allowances and medical subsidies for fertility treatments and pregnancy. Health officials have showered newborns with gifts of beef, baby clothes and toys. The government is also building kindergartens and day care centers by the hundreds. In Seoul, every bus and subway car has pink seats reserved for pregnant women. But this month, Deputy Prime Minister Hong Nam-ki admitted that the government — which has spent more than $178 billion over the past 15 years encouraging women to have more babies — was not making enough progress.

I was struck by the statement from the Deputy Prime Minister that his nation “was not making enough progress”?

That’s a strange way of describing catastrophic decline in birthrates, as noted in the article.

South Korea’s fertility rate dropped to a record low of 0.92 in 2019 — less than one child per woman, the lowest rate in the developed world. Every month for the past 59 months, the total number of babies born in the country has dropped to a record depth.

Maybe, just maybe, government handouts are not the way to boost birthrates.

I’ll conclude by noting that the real problem is tax-and-transfer entitlement programs, not low birth rates.

Both Singapore and Hong Kong have extremely low birth rates, for instance, but they aren’t facing a huge fiscal crisis because they have very small welfare states and workers are obliged to save for their own retirement.

Other Asian jurisdictions, however, made the mistake of copying Western nations, meaning entitlement programs that become mathematically impossible when populations pyramids become population cylinders (or even upside-down pyramids!).

Other Asian jurisdictions, however, made the mistake of copying Western nations, meaning entitlement programs that become mathematically impossible when populations pyramids become population cylinders (or even upside-down pyramids!).

In addition to South Korea, Japan also faces a major challenge.

And the situation is very grim in Europe, even though birth rates haven’t fallen to the same degree (though the numbers is some Eastern European nations are staggeringly bad).

P.S. The United States isn’t far behind.

P.P.S. We know the answer to this crisis, but far too many politicians are focused on trying to make matters worse rather than better.

P.P.P.S. You can read my two-part series on this topic here and here.

Security from CRADLE TO GRAVE never quite works out!!!

Free to Choose Part 4: From Cradle to Grave Featuring Milton Friedman

The Entitlement Disaster that Hillary Clinton and Donald Trump Are Ignoring

July 8, 2016 by Dan Mitchell

I’m like a broken record when it comes to entitlement spending. I’ve explained, ad nauseam, that programs such as Medicare, Medicaid, Obamacare, and Social Security must be reformed.

In part, genuine entitlement reform is a good idea because you get better economic performance when you replace tax-and-transfer schemes with private savings and competitive markets.

But reform also is desperately needed because ofchanging demographics. Simply stated, leaving all the entitlement programs on autopilot is a recipe for a Greek-style fiscal crisis.

But reform also is desperately needed because ofchanging demographics. Simply stated, leaving all the entitlement programs on autopilot is a recipe for a Greek-style fiscal crisis.

If you want a rigorous explanation of the issue, my colleague Jeff Miron has a must-read monograph on the topic. You should peruse the entire study, but here’s the key conclusion if you’re pressed for time.

…this paper projects fiscal imbalance as of every year between 1965 and 2014, using data-supported assumptions about gross domestic product (GDP) growth, revenue, and trends in mandatory spending on Social Security, Medicare, Medicaid, and other programs. The projections reveal that the United States has faced a growing fiscal imbalance since the early 1970s, largely as a consequence of continuous growth in mandatory spending. As of 2014, the fiscal imbalance stands at $117.9 trillion, with few signs of future improvement even if GDP growth accelerates or tax revenues increase relative to historic norms. Thus the only viable way to restore fiscal balance is to scale back mandatory spending policies, particularly on large health care programs such as Medicare, Medicaid, and the Affordable Care Act (ACA).

Jeff’s report is filled with sobering charts. I’ve picked out three that deserve special attention.

First, here’s a look back in history at the growing fiscal burden of entitlement programs.

Second, here’s a look forward at how the fiscal burden of entitlement programs will get even worse in coming decades.

Keep in mind, by the way, that the two above charts only show the fiscal burden of entitlement programs (sometimes referred to as “mandatory spending” since the laws “mandate” that money be given to anyone who is “entitled” based on various criteria).

When you add discretionary (annually appropriated) spending to the mix, as well as interest that is paid on the national debt, the numbers get even more grim.

Jeff adds everything together and shows, for each year between 1965 and 2014, the “present value” of the gap between what the government is promising to spend and how much revenue it is projected to collect.

These numbers are especially horrific because “present value” is a measure of how much money the government would have to somehow obtain and set aside in order to have a nest egg capable of offsetting future deficits.

Needless to say, the federal government did not have access to $118 trillion (yes, trillion with a “t”) in 2014. And if there were updated numbers for 2015 and 2016 (which would probably be even higher than $118 trillion), the federal government still wouldn’t have access to that amount of money either.

Especially since the total annual output of the American economy is about $18 trillion.

So now you can understand why international bureaucracies like the IMF, BIS, and OECD estimate that the fiscal challenge in the United States may be even bigger than the problems in decrepit welfare states such as France and Italy.

Let’s get another perspective on the issue. James Capretta of the Ethics and Public Policy Center warns about the scope of the problem.

Despite what presidential candidates Donald Trump and Hillary Clinton have been saying on the campaign trail, the need to reform the nation’s major entitlement programs cannot be wished away. The primary cause of the nation’s fiscal problems, now and in the future, is the rapid rise in entitlement spending. In 1970, spending on Social Security and the major health care entitlement programs was 3.6 percent of GDP. In 2015, spending on these programs was 10.3 percent of GDP. By 2040, CBO expects spending on these programs to reach 14.2 percent of GDP. …entitlement reform is needed to put the federal government’s finances on a more stable foundation.

He outlines his preferred reforms, some of which I heartily embrace and some of what I think are too timid, but the key point is that he succinctly explains the need to act soon to avoid a giant long-term problem.

…reforms are not intended to create budgetary balance in the short-run. Large-scale change cannot be implemented in the major programs without significant transition periods, which means the reforms need to be enacted soon to reduce costs in fifteen, twenty, and twenty-five years. Skeptics may say it’s pointless to worry about fiscal problems that are more than twenty years off. They’re wrong. …The result is a misallocation of resources that undermines long-term economic growth. …Entitlement reform is an absolute necessity, as will soon become evident to everyone, one way or another.

The recent testimony by Nicholas Eberstadt of the American Enterprise Institute also is must reading.

In just two generations, the government…has effectively become an entitlements machine. …transfers have become a major component in the family budget of the average American household-and our dependence on these government transfers continues to rise. …Fifty years into our great social experiment of massive expansion of entitlement programs, there is ample evidence to indicate that the unintended consequences of this reconfigutation of American political and economic life have been major and adverse.

You should read the entire testimony, which is a comprehensive explanation of how entitlements are eroding American exceptionalism.

And I’ve previously shared some of Eberstadt’s work on the growing dependency crisis in America.

And I’ve previously shared some of Eberstadt’s work on the growing dependency crisis in America.

In effect, our “social capital” of self reliance and the work ethic is beingreplaced by an entitlement mentality.

At the risk of understatement, that won’t end well. Heck, I don’t know which part is more depressing, theever-growing burden of spending or the fact that more and more Americans think it’s okay to live off the labor of others.

All I can say for sure is that this combination never was, is not now, and never will be a recipe for national success.

Let’s conclude with some sage observations by George Melloan of theWall Street Journal. He summarizes the problem as being a combination of too much spending and too little political courage. Here’s the too-much-spending part.

…we seem richer than we actually are because we have borrowed so heavily from future generations. …the nation’s slow growth and rising debt are already reducing the opportunities for upward mobility. …Recent projections of the future cost of current government obligations certainly won’t relieve…people’s worries. Those promises have expanded far beyond any reasonable projection of the government’s ability to extract enough revenue to cover them. …The Congressional Budget Office projects a steady rise in “mandatory” (i.e., entitlement) costs as a share of GDP out into the distant future. …The upshot: Americans are deep in debt, mainly thanks to government excesses.

And here’s the too-little-political-courage part.

The only real answer is that the entitlement programs will have to be reformed, and sooner better than later, because the longer reform is postponed the greater the fiscal imbalance will become and the greater its drain will be… Donald Trump is out to lunch on this issue, as he is on most questions that require more than a fatuous sound-bite answer. As for Hillary…, forget about it.

Sigh, how depressing. It seems like America will be “Europeanized.”

For additional background on the issue of debt, unfunded liabilities, and present value, this video is a great tutorial.

P.S. I must have taken LSD or crack earlier this year. That’s the only logical explanation for saying I was optimistic about entitlement reform.

Related posts:

FRIEDMAN FRIDAY More Great Moments in Federal Government Incompetence April 2, 2016 by Dan Mitchell (with video from Milton Friedman)

The War on Work Testing Milton Friedman: Government Control – Full Video More Great Moments in Federal Government Incompetence April 2, 2016 by Dan Mitchell I used to think the Equal Employment Opportunity Commission was the worst federal bureaucracy. After all, these are the pinheads who are infamous for bone-headed initiatives, such as: The EEOC making […]

FRIEDMAN FRIDAY The Left’s Inequality Fixation Is Economically Foolish and Politically Impotent April 22, 2015 by Dan Mitchell (with videos from Milton Friedman)

Dr. Walter Williams Highlights from – Testing Milton Friedman Milton Friedman PBS Free to Choose 1980 Vol 8 of 10 Who Protects the Worker The Left’s Inequality Fixation Is Economically Foolish and Politically Impotent April 22, 2015 by Dan Mitchell I don’t understand the left’s myopic fixation on income inequality. If they genuinely care about the […]

FRIEDMAN FRIDAY Walter Williams, Freedom Fighter March 23, 2011 by Dan Mitchell (with videos featuring Walter Williams and Milton Friedman)

Dr. Walter Williams Highlights from – Testing Milton Friedman Milton Friedman PBS Free to Choose 1980 Vol 8 of 10 Who Protects the Worker Walter E Williams – A Discussion About Fairness & Redistribution Testing Milton Friedman: Equality of Opportunity – Full Video Walter Williams, Freedom Fighter March 23, 2011 by Dan Mitchell I’ve been fortunate […]

FRIEDMAN FRIDAY Three Cheers for Profits and Free Markets April 7, 2015 by Dan Mitchell (with input from Milton Friedman)

__ Milton Friedman – The Four Ways to Spend Money What establishments are you most unsatisfied with? Probably government organizations like Dept of Motor Vehicles or Public Schools because there is no profit motive and they are not careful in the way they spend our money. Three Cheers for Profits and Free Markets April 7, 2015 […]

FRIEDMAN FRIDAY Dan Mitchell on Milton Friedman and Adam Smith’s perspective on spending other people’s money!!!

Dan Mitchell on Milton Friedman and Adam Smith’s perspective on spending other people’s money!!! Milton Friedman, Adam Smith, and Other People’s Money May 8, 2016 by Dan Mitchell From an economic perspective, too much government spending is harmful to economic performance because politicians and bureaucrats don’t have very good incentives to spend money wisely. More specifically, […]

FRIEDMAN FRIDAY If Milton Friedman was here he would attack Trump’s proposal for a 45 percent tax on Chinese products!

Milton Friedman – Free Trade vs. Protectionism If Milton Friedman was here he would attack Trump’s proposal for a 45 percent tax on Chinese products! Dissecting Trumponomics March 22, 2016 by Dan Mitchell At this stage, it’s quite likely that Donald Trump will be the Republican presidential nominee. Conventional wisdom suggests that this means Democrats […]

FRIEDMAN FRIDAY While attacking TRUMP Larry Elder quotes Milton Friedman concerning Protectionism!!!!

Milton Friedman – Free Trade vs. Protectionism Free to Choose Part 2: The Tyranny of Control (Featuring Milton Friedman Donald Trump: Clueless about free trade Larry Elder rebuts candidate’s ‘they’re taking our jobs’ claim Published: 02/03/2016 at 6:39 PM One of Donald Trump’s talking points and biggest applause lines is how “they” – Japan, […]

FRIEDMAN FRIDAY Milton Friedman destroys Donald Trump on issue of PROTECTIONISM!!!

Milton Friedman – Free Trade vs. Protectionism Free to Choose Part 2: The Tyranny of Control (Featuring Milton Friedman Mark J. Perry@Mark_J_Perry March 5, 2016 9:26 pm | AEIdeas Some economic lessons about international trade for Donald Trump from Milton Friedman and Henry George Carpe Diem Trump vs Friedman – Trade Policy Debate In […]

FRIEDMAN FRIDAY Free Market Conservatives like Dan Mitchell and Milton Friedman would destroy TRUMP and SANDERS in a debate on PROTECTIONISM Part 2

Milton Friedman – Free Trade vs. Protectionism Free to Choose Part 2: The Tyranny of Control (Featuring Milton Friedman Eight Questions for Protectionists September 23, 2011 by Dan Mitchell When asked to pick my most frustrating issue, I could list things from my policy field such as class warfare or income redistribution. But based on […]

FRIEDMAN FRIDAY Free Market Conservatives like Dan Mitchell and Milton Friedman would destroy TRUMP and SANDERS in a debate on PROTECTIONISM Part 1

Milton Friedman – Free Trade vs. Protectionism Free to Choose Part 2: The Tyranny of Control (Featuring Milton Friedman Trump, Sanders, and the Snake-Oil Economics of Protectionism March 19, 2016 by Dan Mitchell John Cowperthwaite deserves a lot of credit for Hong Kong’s prosperity. As a British appointee, he took a hands-off policy and allowed […]

____

FRANCIS SCHAEFFER ANALYZES ART AND CULTURE Part 527 Is there a categorical difference in us and animals? Dr. John Shea recommended I read Carl Sagan’s book SHADOWS OF FORGOTTEN ANCESTORS FEATURED ARTIST IS PIERO

_____________

John J. Shea

Professor

Professor

Ph.D., Harvard University, 1991

Uploaded on Nov 23, 2010

“Out of Africa: Who, Where, and When?” Sept. 27, 2005. Stony Brook University.

Convened by Richard Leakey.

1. Welcome – Bob McGrath, Provost, Stony Brook University

2. Opening remarks – Richard Leakey, Stony Brook University

3. Introduction of Speakers – William Jungers, Stony Brook University

4. “Out of Africa Again and Again: Some Thoughts about Hominin Dispersals” – Marta Lahr, Cambridge University

5. Meave Leakey, Stony Brook University – “Early Pleistocene Mammals from Africa: Background to Dispersal”

6. John J. Shea, Stony Brook University – “The Levant: A Corridor and a Cul-de-Sac?”

_________________

Uploaded on Feb 25, 2011

__________________________________________________________

Dr. John J. Shea appeared on the TV series APE MAN with Walter Cronkite back in the 1990’s and claimed that there is only a degree of difference between monkeys and humans and not a categorical difference. After that program aired I had the opportunity to correspond with Dr. Shea and he was kind enough to send me a two page response to my questions. (This correspondence took place back in 1994 and 1995.)

Dr. Shea also suggested that I read SHADOWS OF FORGOTTEN ANCESTORS by Carl Sagan and his wife Ann Druyan, and I did so. Here are my thoughts on the question.

First, only humans lie in the sense we are held morally responsible. Sagan wrote, “Deception in the social relations of animals…is an emerging and productive topic in biology…” (p. 379). This may be true, but are animals responsible to God? I think not. Romans 3:23 teaches that “All MEN have sinned and fall short of the glory of God.” Animals may deceive but they are not morally responsible.

Second, only men feel guilt. Sagan refers briefly to the fact that men feel guilt (p. 4.14), but he does not spend a lot of time on this. Romans 1:19 asserts, “For that which is known about God is evident to them and made plain in their inner consciousness, because God has show it to them” (Amplified Bible). Here Sagan turns to Thomas Henry Huxley who he quotes:

On all sides, I shall hear the cry–“We are men and women, not a mere better sort of apes, a little longer in the leg, more compact in the foot, and bigger in brain than your brutal Chimpanzees and Gorillas. The power of knowledge–the conscience of good and evil--the pitiful tenderness of human affections, raise us out of all real fellowship with the brutes, however, closely they may seem to approximate us.”

To this I can reply that the exclamation would be just and would be most just and would have my entire sympathy, if it were only relevant. But, it is not I who seek to base Man’s dignity upon this great toe, or insinuate that we are lost if an Ape has a hippocampus minor (in its brain). On the contrary, I have done my best to sweep away this vanity…

WHY DID SAGAN AND HUXLEY FACE SUCH A LARGE CHORUS THAT WAS OBJECTING TO THIS VIEW THAT WE DON’T HAVE A GOD-GIVEN CONSCIENCE? The answer is very simple and it deals with the consequences of Social Darwinism. Chuck Colson said that Larry King was not very impressed with his long talk on the historical accuracy of the scriptures, but when he touched on this subject things got interesting:

Larry King invited me to dinner. “I don’t believe in God,” Larry told me straight out. “But tell me why you believe.” I responded, “Have you seen Woody Allen‘s movie CRIMES AND MISDEMEANORS?

Yes, he loved it, in fact. It’s about a doctor who is haunted by GUILT after hiring a killer to murder his mistress. His Jewish father has taught him that God will surely bring justice. In the end the doctor suppresses his GUILT, convincing himself that LIFE IS AN DARWINIAN STRUGGLE WHERE ONLY THE RUTHLESS SURVIVE.

I asked Larry, “Is that our only choice–to be tormented by GUILT or else kill our conscience? Larry, how do you deal with your conscience?” He dropped his fork. I said, “What do you do with the GUILT that is in here? What do you do with what you know you have done wrong?

Then he was ready to listen. I went on and shared with him from Romans which teaches about the voice of conscience that God has given us.

__________

Third, men have a longing for significance which expresses itself most clearly in the fear of non being.

Fourth, I would point to the fact that only people worship.

Fifth, men are not satisfied unless they have their spiritual needs met. Carl Sagan quotes the poet Walt Whitman, “Not one (animal) is dissatisfied…Not one is respectable or unhappy over the whole earth…” Sagan comments, “On this basis of the evidence presented in this book, we doubt if any of Whitman’s six purported differences between other animals and humans is true…” (p. 389).

I read Sagan’s book cover to cover and made over 15 pages of notes, and I have yet to find any of the “evidence” that Sagan speaks of on page 389. I find the comments of NOAM CHOMSKY more logical. He calls animal language an “evolutionary miracle” akin to “finding an island of humans who could be taught to fly.”

I like Francis Schaeffer‘s term “Mannishness” of man. He defines it as those aspects of man, such as significance, love, rationality and the fear of non being, which mark him off from animals and machines and give evidence of his being created in the image of a personal God.

The scientist Blaise Pascal is quoted by Sagan on page 364 and then Sagan notes, “Most of the philosophers adjudged great in the history of western thought held that humans are fundamentally different from other animals…”

As you know Pascal was the inventor of the barometer and he lived from 1623 to 1662. Pascal also observed, “There is a God-shaped vacuum in the heart of every man,and only God can fill it.”

What is the solution? “For God so loved the world that He gave his one and only Son, that whoever believes in him should not perish but have eternal life” (John 3:16). The scriptural directive is not for us to work harder to achieve God’s favor (Romans 3:20), but to accept God’s mercy through our repentance and receiving Christ as a free gift (Ephesians 2:8-10).

The Bible and Archaeology – Is the Bible from God? (Kyle Butt)

Is the Bible historically accurate? Here are some of the posts I have done in the past on the subject: 1. The Babylonian Chronicle, of Nebuchadnezzars Siege of Jerusalem, 2. Hezekiah’s Siloam Tunnel Inscription. 3. Taylor Prism (Sennacherib Hexagonal Prism), 4. Biblical Cities Attested Archaeologically. 5. The Discovery of the Hittites, 6.Shishak Smiting His Captives, 7. Moabite Stone, 8. Black Obelisk of Shalmaneser III, 9A Verification of places in Gospel of John and Book of Acts., 9B Discovery of Ebla Tablets. 10. Cyrus Cylinder, 11. Puru “The lot of Yahali” 9th Century B.C.E., 12. The Uzziah Tablet Inscription, 13. The Pilate Inscription, 14. Caiaphas Ossuary, 14 B Pontius Pilate Part 2, 14c. Three greatest American Archaeologists moved to accept Bible’s accuracy through archaeology.,

FEATURED ARTIST IS PIERO

PIERO DELLA FRANCESCA (1416-1492)

Despite being one of the most important figures of the quattrocento, the art of Piero della Francesca has been described as “cold”, “hieratic” or even “impersonal”. But with the apparition of Berenson and the great historians of his era, like Michel Hérubel -who admired the “metaphysical dimension” of the paintings by Piero-, his precise and detailed Art finally occupied the place that it deserves in the History of Art.

FRANCIS SCHAEFFER ANALYZES ART AND CULTURE Part 526 Carl Sagan ”Is it wrong to abort a pregnancy? Always? Sometimes? Never? How do we decide?”(My 1995 correspondence with Sagan) How Pulitzer Prize-winning Paul Greenberg, one of the most respected and honored commentators in America, changed his mind about abortion! Featured Artist is MONDRIAN

_

How Pulitzer Prize-winning Paul Greenberg, one of the most respected and honored commentators in America, changed his mind about abortion and endorses now the pro-life view. Paul is the editorial page editor of the Arkansas Democrat-Gazette. This article below is from April 11, 2011.

The Doctor Who Saw What He Did

The good doctor could have stepped out of a Louis Auchincloss short story. A fashionable but conscientious professional on the Upper West Side, his ideas, like his Brooks Brothers suits, were tailored to fit in. His ideals were those of the enlightened, modern urban America of his time, which was the mid- to late 20th century. And he was always doing what he could to further them.

The doctor’s political, medical and social convictions were much what one would have expected of a New York liberal, as clear as his curriculum vitae. The son of a secular Jewish ob/gyn, he would follow his prominent father’s footsteps, graduate from McGill Medical College in Montreal, and start his practice in Manhattan. He was a quick study, whether absorbing the latest medical knowledge or political trend. Especially when it came to abortion.

Having no convictions about the sacredness of human life, he was defenseless against its growing and increasingly legal appeal. Indeed, he was soon a leader in Pro-Choice ranks.

By his own count, Bernard Nathanson, M.D., was responsible for some 75,000 abortions — without a twinge of conscience intervening. Not back then. Not when he picketed a New York City hospital in his campaign for the legalization of abortion in New York state. Preaching what he practiced, Dr. Nathanson became a tireless spokesman for NARAL, the National Association for the Repeal of Abortion Laws.

As director of the Center for Reproductive and Sexual Health in Manhattan, where he routinely performed abortions and taught others to do the same, Dr. Nathanson knew of what he spoke. And never grew tired of rationalizing it. He wasn’t destroying human life but just “an undifferentiated mass of cells.” He was performing a social service, really. He was on a humanitarian mission.

Then something happened. The something was quite specific — the newest EKG and ultrasound imagery. Always a follower of the latest scientific evidence, he couldn’t deny what he was seeing. Political theory is one thing, but facts are facts.

By 1974, soon after Roe v. Wade had opened the way to his dream of abortion-on-demand, his eyes were opened. Literally. As he put it, “There is no longer any serious doubt in my mind that human life exists within the womb from the very onset of pregnancy.” He changed his beliefs and his ways — and sides.

I can identify. When Roe v. Wade was first pronounced, I welcomed it. As a young editorial writer in Pine Bluff, Ark., I believed the court’s assurances that its ruling was not blanket permission for abortion, but a carefully crafted, limited decision applicable only in some exceptional cases. Which was all a lot of hooey, but I swallowed it, and regurgitated it in editorials.

The right to life need not be fully respected from conception on, I explained, but grew with each stage of fetal development until a full human being was formed. I went into all this in an extended debate in the columns of the Pine Bluff Commercial with a young Baptist minister in town named Mike Huckabee.

Yes, I’d been taught by Mary Warters in her biology and genetics courses at Centenary that human life was one unbroken cycle from life to death, and the code to its development was present from its microscopic origins. But I wanted to believe human rights developed differently, especially the right to life. My reasons were compassionate. Who would not want to spare mothers carrying the deformed? Why not just allow physicians to eliminate the deformity? I hadn’t yet come across Flannery O’Connor’s warning that tenderness leads to the gas chambers.

Then something happened. I noticed that the number of abortions in the country had begun to mount year by year — into the millions. Perfectly healthy babies were being aborted for socio-economic reasons. Among ethnic groups, the highest proportions of abortions were being performed on black women. (Last I checked, 37 percent of American abortions were being done on African-American women, though they make up less than 13 percent of the U.S. population.)

Eugenics was showing its true face again. And it wasn’t pretty.

Abortion was even being touted as a preventative for poverty. All you had to do, after all, was eliminate the poor. They were, in the phrase of the advanced, Darwinian thinkers of the last century, surplus population.

With a little verbal manipulation, any crime can be rationalized, even promoted. Verbicide precedes homicide. The trick is to speak of fetuses, not unborn children. So long as the victims are a faceless abstraction, anything can be done to them. Just don’t look too closely at those sonograms. We are indeed strangely and wondrously made.

By now the toll has reached some 50 million aborted babies in America since 1973. That is not an abstract theory. It is fact, and facts are stubborn things. Some carry their own imperatives with them. And so, like Dr. Nathanson, I changed my mind, and changed sides.

There is something about simple human dignity, whether the issue is civil rights in the 1960s or abortion and euthanasia today, that in the end will not be denied. And it keeps asking: Whose side are you on? Life or death?

Long before he died the other day at 84, Bernard Nathanson had chosen life. He became as ardent an advocate for life as he had once been for death. He wrote books and produced a film, “The Silent Scream,” laying out the case for the unborn, and for humanity. He would join the Catholic Church in 1996 and continue to practice medicine as chief of obstetrical services at Saint Luke’s-Roosevelt hospital in Manhattan.

“I have such heavy moral baggage to drag into the next world,” he told the Washington Times in 1996. But he also had sought to redeem himself. He could not have been expected to do other than he did in his younger years, given his appetite for fashionable ideas. He was, after all, only human. Which is no small or simple thing.

_________

223 × 373Images may be subject to copyright. Learn More

Recently I have been revisiting my correspondence in 1995 with the famous astronomer Carl Sagan who I had the privilege to correspond with in 1994, 1995 and 1996. In 1996 I had a chance to respond to his December 5, 1995letter on January 10, 1996 and I never heard back from him again since his cancer returned and he passed away later in 1996. Below is what Carl Sagan wrote to me in his December 5, 1995 letter:

Thanks for your recent letter about evolution and abortion. The correlation is hardly one to one; there are evolutionists who are anti-abortion and anti-evolutionists who are pro-abortion.You argue that God exists because otherwise we could not understand the world in our consciousness. But if you think God is necessary to understand the world, then why do you not ask the next question of where God came from? And if you say “God was always here,” why not say that the universe was always here? On abortion, my views are contained in the enclosed article (Sagan, Carl and Ann Druyan {1990}, “The Question of Abortion,” Parade Magazine, April 22.)

I was introduced to when reading a book by Francis Schaeffer called HE IS THERE AND HE IS NOT SILENT written in 1968.

Francis Schaeffer when he was a young pastor in St. Louis pictured above.

Francis Schaeffer and Adrian Rogers

(both Adrian Rogers and Francis Schaeffer mentioned Carl Sagan in their books and that prompted me to write Sagan and expose him to their views.

Carl Sagan pictured below:

_________

Francis Schaeffer

I mentioned earlier that I was blessed with the opportunity to correspond with Dr. Sagan. In his December 5, 1995 letter Dr. Sagan went on to tell me that he was enclosing his article “The Question of Abortion: A Search for Answers”by Carl Sagan and Ann Druyan. I am going to respond to several points made in that article. Here is a portion of Sagan’s article (here is a link to the whole article):

Carl Sagan and Ann Druyan pictured above

“The Question of Abortion: A Search for Answers”

by Carl Sagan and Ann Druyan

For the complete text, including illustrations, introductory quote, footnotes, and commentary on the reaction to the originally published article see Billions and Billions.

The issue had been decided years ago. The court had chosen the middle ground. You’d think the fight was over. Instead, there are mass rallies, bombings and intimidation, murders of workers at abortion clinics, arrests, intense lobbying, legislative drama, Congressional hearings, Supreme Court decisions, major political parties almost defining themselves on the issue, and clerics threatening politicians with perdition. Partisans fling accusations of hypocrisy and murder. The intent of the Constitution and the will of God are equally invoked. Doubtful arguments are trotted out as certitudes. The contending factions call on science to bolster their positions. Families are divided, husbands and wives agree not to discuss it, old friends are no longer speaking. Politicians check the latest polls to discover the dictates of their consciences. Amid all the shouting, it is hard for the adversaries to hear one another. Opinions are polarized. Minds are closed.

Is it wrong to abort a pregnancy? Always? Sometimes? Never? How do we decide? We wrote this article to understand better what the contending views are and to see if we ourselves could find a position that would satisfy us both. Is there no middle ground? We had to weigh the arguments of both sides for consistency and to pose test cases, some of which are purely hypothetical. If in some of these tests we seem to go too far, we ask the reader to be patient with us–we’re trying to stress the various positions to the breaking point to see their weaknesses and where they fail.

In contemplative moments, nearly everyone recognizes that the issue is not wholly one-sided. Many partisans of differing views, we find, feel some disquiet, some unease when confronting what’s behind the opposing arguments. (This is partly why such confrontations are avoided.) And the issue surely touches on deep questions: What are our responses to one another? Should we permit the state to intrude into the most intimate and personal aspects of our lives? Where are the boundaries of freedom? What does it mean to be human?

Of the many actual points of view, it is widely held–especially in the media, which rarely have the time or the inclination to make fine distinctions–that there are only two: “pro-choice” and “pro-life.” This is what the two principal warring camps like to call themselves, and that’s what we’ll call them here. In the simplest characterization, a pro-choicer would hold that the decision to abort a pregnancy is to be made only by the woman; the state has no right to interfere. And a pro-lifer would hold that, from the moment of conception, the embryo or fetus is alive; that this life imposes on us a moral obligation to preserve it; and that abortion is tantamount to murder. Both names–pro-choice and pro-life–were picked with an eye toward influencing those whose minds are not yet made up: Few people wish to be counted either as being against freedom of choice or as opposed to life. Indeed, freedom and life are two of our most cherished values, and here they seem to be in fundamental conflict.

Let’s consider these two absolutist positions in turn. A newborn baby is surely the same being it was just before birth. There ‘s good evidence that a late-term fetus responds to sound–including music, but especially its mother’s voice. It can suck its thumb or do a somersault. Occasionally, it generates adult brain-wave patterns. Some people claim to remember being born, or even the uterine environment. Perhaps there is thought in the womb. It’s hard to maintain that a transformation to full personhood happens abruptly at the moment of birth. Why, then, should it be murder to kill an infant the day after it was born but not the day before?

As a practical matter, this isn’t very important: Less than 1 percent of all tabulated abortions in the United States are listed in the last three months of pregnancy (and, on closer investigation, most such reports turn out to be due to miscarriage or miscalculation). But third-trimester abortions provide a test of the limits of the pro-choice point of view. Does a woman’s “innate right to control her own body” encompass the right to kill a near-term fetus who is, for all intents and purposes, identical to a newborn child?

We believe that many supporters of reproductive freedom are troubled at least occasionally by this question. But they are reluctant to raise it because it is the beginning of a slippery slope. If it is impermissible to abort a pregnancy in the ninth month, what about the eighth, seventh, sixth … ? Once we acknowledge that the state can interfere at any time in the pregnancy, doesn’t it follow that the state can interfere at all times?

Abortion and the slippery slope argument above

This conjures up the specter of predominantly male, predominantly affluent legislators telling poor women they must bear and raise alone children they cannot afford to bring up; forcing teenagers to bear children they are not emotionally prepared to deal with; saying to women who wish for a career that they must give up their dreams, stay home, and bring up babies; and, worst of all, condemning victims of rape and incest to carry and nurture the offspring of their assailants. Legislative prohibitions on abortion arouse the suspicion that their real intent is to control the independence and sexuality of women…

And yet, by consensus, all of us think it proper that there be prohibitions against, and penalties exacted for, murder. It would be a flimsy defense if the murderer pleads that this is just between him and his victim and none of the government’s business. If killing a fetus is truly killing a human being, is it not the duty of the state to prevent it? Indeed, one of the chief functions of government is to protect the weak from the strong.

If we do not oppose abortion at some stage of pregnancy, is there not a danger of dismissing an entire category of human beings as unworthy of our protection and respect? And isn’t that dismissal the hallmark of sexism, racism, nationalism, and religious fanaticism? Shouldn’t those dedicated to fighting such injustices be scrupulously careful not to embrace another?

Adrian Rogers’ sermon on animal rights refutes Sagan here

There is no right to life in any society on Earth today, nor has there been at any former time… : We raise farm animals for slaughter; destroy forests; pollute rivers and lakes until no fish can live there; kill deer and elk for sport, leopards for the pelts, and whales for fertilizer; entrap dolphins, gasping and writhing, in great tuna nets; club seal pups to death; and render a species extinct every day. All these beasts and vegetables are as alive as we. What is (allegedly) protected is not life, but human life.

Genesis 3 defines being human

And even with that protection, casual murder is an urban commonplace, and we wage “conventional” wars with tolls so terrible that we are, most of us, afraid to consider them very deeply… That protection, that right to life, eludes the 40,000 children under five who die on our planet each day from preventable starvation, dehydration, disease, and neglect.

Those who assert a “right to life” are for (at most) not just any kind of life, but for–particularly and uniquely—human life. So they too, like pro-choicers, must decide what distinguishes a human being from other animals and when, during gestation, the uniquely human qualities–whatever they are–emerge.

The Bible talks about the differences between humans and animals

Despite many claims to the contrary, life does not begin at conception: It is an unbroken chain that stretches back nearly to the origin of the Earth, 4.6 billion years ago. Nor does human life begin at conception: It is an unbroken chain dating back to the origin of our species, hundreds of thousands of years ago. Every human sperm and egg is, beyond the shadow of a doubt, alive. They are not human beings, of course. However, it could be argued that neither is a fertilized egg.

In some animals, an egg develops into a healthy adult without benefit of a sperm cell. But not, so far as we know, among humans. A sperm and an unfertilized egg jointly comprise the full genetic blueprint for a human being. Under certain circumstances, after fertilization, they can develop into a baby. But most fertilized eggs are spontaneously miscarried. Development into a baby is by no means guaranteed. Neither a sperm and egg separately, nor a fertilized egg, is more than a potential baby or a potential adult. So if a sperm and egg are as human as the fertilized egg produced by their union, and if it is murder to destroy a fertilized egg–despite the fact that it’s only potentially a baby–why isn’t it murder to destroy a sperm or an egg?

Hundreds of millions of sperm cells (top speed with tails lashing: five inches per hour) are produced in an average human ejaculation. A healthy young man can produce in a week or two enough spermatozoa to double the human population of the Earth. So is masturbation mass murder? How about nocturnal emissions or just plain sex? When the unfertilized egg is expelled each month, has someone died? Should we mourn all those spontaneous miscarriages? Many lower animals can be grown in a laboratory from a single body cell. Human cells can be cloned… In light of such cloning technology, would we be committing mass murder by destroying any potentially clonable cells? By shedding a drop of blood?

All human sperm and eggs are genetic halves of “potential” human beings. Should heroic efforts be made to save and preserve all of them, everywhere, because of this “potential”? Is failure to do so immoral or criminal? Of course, there’s a difference between taking a life and failing to save it. And there’s a big difference between the probability of survival of a sperm cell and that of a fertilized egg. But the absurdity of a corps of high-minded semen-preservers moves us to wonder whether a fertilized egg’s mere “potential” to become a baby really does make destroying it murder.

Opponents of abortion worry that, once abortion is permissible immediately after conception, no argument will restrict it at any later time in the pregnancy. Then, they fear, one day it will be permissible to murder a fetus that is unambiguously a human being. Both pro-choicers and pro-lifers (at least some of them) are pushed toward absolutist positions by parallel fears of the slippery slope.

Another slippery slope is reached by those pro-lifers who are willing to make an exception in the agonizing case of a pregnancy resulting from rape or incest. But why should the right to live depend on the circumstances of conception? If the same child were to result, can the state ordain life for the offspring of a lawful union but death for one conceived by force or coercion? How can this be just? And if exceptions are extended to such a fetus, why should they be withheld from any other fetus? This is part of the reason some pro-lifers adopt what many others consider the outrageous posture of opposing abortions under any and all circumstances–only excepting, perhaps, when the life of the mother is in danger.

By far the most common reason for abortion worldwide is birth control. So shouldn’t opponents of abortion be handing out contraceptives and teaching school children how to use them? That would be an effective way to reduce the number of abortions. Instead, the United States is far behind other nations in the development of safe and effective methods of birth control–and, in many cases, opposition to such research (and to sex education) has come from the same people who oppose abortions.continue on to Part 3

For the complete text, including illustrations, introductory quote, footnotes, and commentary on the reaction to the originally published article see Billions and Billions.

The attempt to find an ethically sound and unambiguous judgment on when, if ever, abortion is permissible has deep historical roots. Often, especially in Christian tradition, such attempts were connected with the question of when the soul enters the body–a matter not readily amenable to scientific investigation and an issue of controversy even among learned theologians. Ensoulment has been asserted to occur in the sperm before conception, at conception, at the time of “quickening” (when the mother is first able to feel the fetus stirring within her), and at birth. Or even later.

Different religions have different teachings. Among hunter-gatherers, there are usually no prohibitions against abortion, and it was common in ancient Greece and Rome. In contrast, the more severe Assyrians impaled women on stakes for attempting abortion. The Jewish Talmud teaches that the fetus is not a person and has no rights. The Old and New Testaments–rich in astonishingly detailed prohibitions on dress, diet, and permissible words–contain not a word specifically prohibiting abortion. The only passage that’s remotely relevant (Exodus 21:22) decrees that if there’s a fight and a woman bystander should accidentally be injured and made to miscarry, the assailant must pay a fine.

Neither St. Augustine nor St. Thomas Aquinas considered early-term abortion to be homicide (the latter on the grounds that the embryo doesn’t look human). This view was embraced by the Church in the Council of Vienne in 1312, and has never been repudiated. The Catholic Church’s first and long-standing collection of canon law (according to the leading historian of the Church’s teaching on abortion, John Connery, S.J.) held that abortion was homicide only after the fetus was already “formed”–roughly, the end of the first trimester.

But when sperm cells were examined in the seventeenth century by the first microscopes, they were thought to show a fully formed human being. An old idea of the homunculus was resuscitated–in which within each sperm cell was a fully formed tiny human, within whose testes were innumerable other homunculi, etc., ad infinitum. In part through this misinterpretation of scientific data, in 1869 abortion at any time for any reason became grounds for excommunication. It is surprising to most Catholics and others to discover that the date was not much earlier.

From colonial times to the nineteenth century, the choice in the United States was the woman’s until “quickening.” An abortion in the first or even second trimester was at worst a misdemeanor. Convictions were rarely sought and almost impossible to obtain, because they depended entirely on the woman’s own testimony of whether she had felt quickening, and because of the jury’s distaste for prosecuting a woman for exercising her right to choose. In 1800 there was not, so far as is known, a single statute in the United States concerning abortion. Advertisements for drugs to induce abortion could be found in virtually every newspaper and even in many church publications–although the language used was suitably euphemistic, if widely understood.

But by 1900, abortion had been banned at any time in pregnancy by every state in the Union, except when necessary to save the woman’s life. What happened to bring about so striking a reversal? Religion had little to do with it.Drastic economic and social conversions were turning this country from an agrarian to an urban-industrial society. America was in the process of changing from having one of the highest birthrates in the world to one of the lowest. Abortion certainly played a role and stimulated forces to suppress it.

One of the most significant of these forces was the medical profession. Up to the mid-nineteenth century, medicine was an uncertified, unsupervised business. Anyone could hang up a shingle and call himself (or herself) a doctor. With the rise of a new, university-educated medical elite, anxious to enhance the status and influence of physicians, the American Medical Association was formed. In its first decade, the AMA began lobbying against abortions performed by anyone except licensed physicians. New knowledge of embryology, the physicians said, had shown the fetus to be human even before quickening.

Their assault on abortion was motivated not by concern for the health of the woman but, they claimed, for the welfare of the fetus. You had to be a physician to know when abortion was morally justified, because the question depended on scientific and medical facts understood only by physicians. At the same time, women were effectively excluded from the medical schools, where such arcane knowledge could be acquired. So, as things worked out, women had almost nothing to say about terminating their own pregnancies. It was also up to the physician to decide if the pregnancy posed a threat to the woman, and it was entirely at his discretion to determine what was and was not a threat. For the rich woman, the threat might be a threat to her emotional tranquillity or even to her lifestyle. The poor woman was often forced to resort to the back alley or the coat hanger.

This was the law until the 1960s, when a coalition of individuals and organizations, the AMA now among them, sought to overturn it and to reinstate the more traditional values that were to be embodied in Roe v. Wade.continue on to Part 4

If you deliberately kill a human being, it’s called murder. If you deliberately kill a chimpanzee–biologically, our closest relative, sharing 99.6 percent of our active genes–whatever else it is, it’s not murder. To date, murder uniquely applies to killing human beings. Therefore, the question of when personhood (or, if we like, ensoulment) arises is key to the abortion debate. When does the fetus become human? When do distinct and characteristic human qualities emerge?

Section 8 Sperm journey to becoming Human

We recognize that specifying a precise moment will overlook individual differences. Therefore, if we must draw a line, it ought to be drawn conservatively–that is, on the early side. There are people who object to having to set some numerical limit, and we share their disquiet; but if there is to be a law on this matter, and it is to effect some useful compromise between the two absolutist positions, it must specify, at least roughly, a time of transition to personhood.

Every one of us began from a dot. A fertilized egg is roughly the size of the period at the end of this sentence. The momentous meeting of sperm and egg generally occurs in one of the two fallopian tubes. One cell becomes two, two become four, and so on—an exponentiation of base-2 arithmetic. By the tenth day the fertilized egg has become a kind of hollow sphere wandering off to another realm: the womb. It destroys tissue in its path. It sucks blood from capillaries. It bathes itself in maternal blood, from which it extracts oxygen and nutrients. It establishes itself as a kind of parasite on the walls of the uterus.By the third week, around the time of the first missed menstrual period, the forming embryo is about 2 millimeters long and is developing various body parts. Only at this stage does it begin to be dependent on a rudimentary placenta. It looks a little like a segmented worm.By the end of the fourth week, it’s about 5 millimeters (about 1/5 inch) long. It’s recognizable now as a vertebrate, its tube-shaped heart is beginning to beat, something like the gill arches of a fish or an amphibian become conspicuous, and there is a pronounced tail. It looks rather like a newt or a tadpole. This is the end of the first month after conception.By the fifth week, the gross divisions of the brain can be distinguished. What will later develop into eyes are apparent, and little buds appear—on their way to becoming arms and legs.By the sixth week, the embryo is 13 millimeteres (about ½ inch) long. The eyes are still on the side of the head, as in most animals, and the reptilian face has connected slits where the mouth and nose eventually will be.By the end of the seventh week, the tail is almost gone, and sexual characteristics can be discerned (although both sexes look female). The face is mammalian but somewhat piglike.By the end of the eighth week, the face resembles that of a primate but is still not quite human. Most of the human body parts are present in their essentials. Some lower brain anatomy is well-developed. The fetus shows some reflex response to delicate stimulation.By the tenth week, the face has an unmistakably human cast. It is beginning to be possible to distinguish males from females. Nails and major bone structures are not apparent until the third month.By the fourth month, you can tell the face of one fetus from that of another. Quickening is most commonly felt in the fifth month. The bronchioles of the lungs do not begin developing until approximately the sixth month, the alveoli still later.

So, if only a person can be murdered, when does the fetus attain personhood? When its face becomes distinctly human, near the end of the first trimester? When the fetus becomes responsive to stimuli–again, at the end of the first trimester? When it becomes active enough to be felt as quickening, typically in the middle of the second trimester? When the lungs have reached a stage of development sufficient that the fetus might, just conceivably, be able to breathe on its own in the outside air?

The trouble with these particular developmental milestones is not just that they’re arbitrary. More troubling is the fact that none of them involves uniquely humancharacteristics–apart from the superficial matter of facial appearance. All animals respond to stimuli and move of their own volition. Large numbers are able to breathe. But that doesn’t stop us from slaughtering them by the billions. Reflexes and motion are not what make us human.

Sagan’s conclusion based on arbitrary choice of the presence of thought by unborn baby

Other animals have advantages over us–in speed, strength, endurance, climbing or burrowing skills, camouflage, sight or smell or hearing, mastery of the air or water. Our one great advantage, the secret of our success, is thought–characteristically human thought. We are able to think things through, imagine events yet to occur, figure things out. That’s how we invented agriculture and civilization. Thought is our blessing and our curse, and it makes us who we are.