–

Government’s War on Dishwashers

Bureaucrats must have a knee-jerk desire to make citizens miserable. That’s the most logical explanation for their various initiatives to lower our quality of life.

Inferior light bulbs

Inferior light bulbs- Substandard toilets

- Inadequate washing machines

- Dribbling showers

- Dysfunctional gas cans

- Crummy dishwashers

- The existence of gas stoves

Let’s focus on one of those examples today.

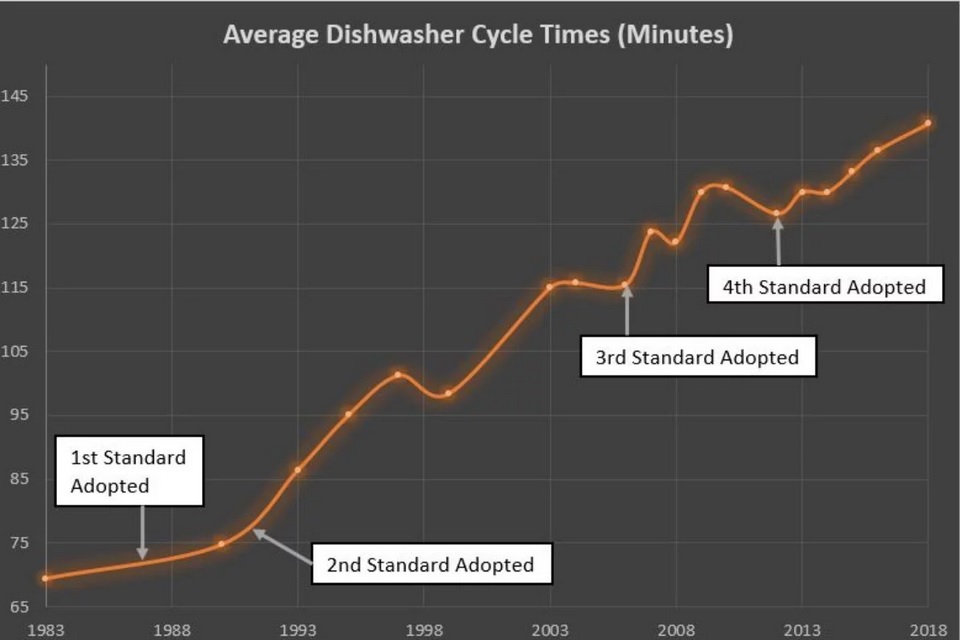

George Will has a new column in the Washington Postabout the bureaucracy’s war against dishwashers that…well…actually clean dishes.

The Energy Department’s busy beavers, with their unsleeping search for reasons to boss us around for our own good, decided that dishwashers use too much water and energy… Responding to the Biden administration…, a slew of states sued the Energy Department… This dispute reached the U.S. Court of Appeals for the 5th Circuit, which, in its Jan. 8 ruling,

swatted away what it tartly called the department’s “government-always-wins” argument…the court said, not only has the Energy Department acted in excess of statutory authority, but the record also contains “ample evidence” that the department’s new rules reduced efficiency in both energy and water use because “purportedly ‘energy efficient’ appliances do not work.” People “may use more energy and more water to preclean, reclean, or handwash their stuff before, after, or in lieu of using DOE-regulated appliances.” …DOE itself estimated in 2011 that handwashing consumes 350% more water and 140% more energy than machine washing.

The case involves the Biden Administration basically reversing some deregulation that took place during the Trump Administration.

The Wall Street Journal editorialized about this issue last year.

…the Energy Department dropped a sweeping proposal for “efficiency” mandates on dishwashers. Did you enjoy last night’s spaghetti, still crusted on the plate? Now you can taste it twice. …Americans have learned the hard way that stricter efficiency rules on already efficient appliances translate into higher costs, inconvenience, and ultimately waste.

The Obama Administration’s dishwasher regulations raised the average price of a machine nearly $100, while producing a new norm of dirty forks and smelly glasses. …Machines can only meet much higher efficiency standards by recirculating water in longer cycles, meaning run times of two or three hours. Yet if the dishes aren’t clean, owners run them again, undermining the argument about conservation. The U.S. Energy Information Administration says that in 2020 nearly 20% of American households that owned a dishwasher never used it. That means they hand washed, which is as inefficient as it comes. The Biden …Energy Department plan gives manufacturers only until 2027 to produce the miracle of costlier washers that do a worse job.

This issue is ridiculous. I’m not sure what’s worse, the fact that bureaucrats are making our lives less pleasant, or that they’re making our lives less pleasant in a way that doesn’t actually save water or energy.

I’ll close on a related note. I was in Mexico City last week and was happily surprised at the quality of the hotel’s shower.

But then I realized that I was enjoying strong water pressure because Mexico presumably does not impose (or does not enforce) the stupid water-flow regulations we have in the United States.

This type of red tape is supposed to save water, but I wonder if that happens since you have to spend twice as long in the shower?

P.S. To its credit, the Trump Administration also tried to deregulation shower head regulations.

Lessons from Reaganomics for the 21st Century, Part IV

When Reagan campaigned for the White House, his economic plan was based on four pillars. I wrote a study about those policies for the Club for Growth Foundation and I wanted to answer two questions.

First, was Reaganomics successful? Second, should similar policies be pursued today?

Today’s column is Part IV of a five-part series.

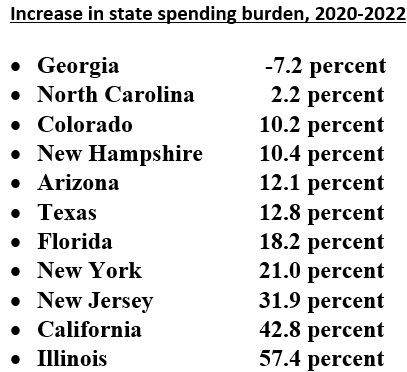

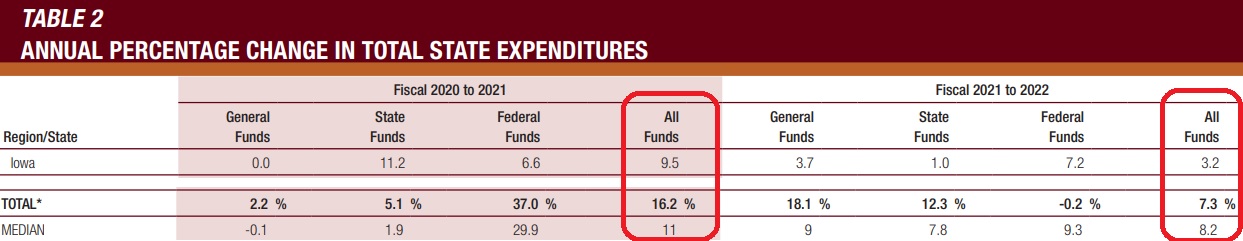

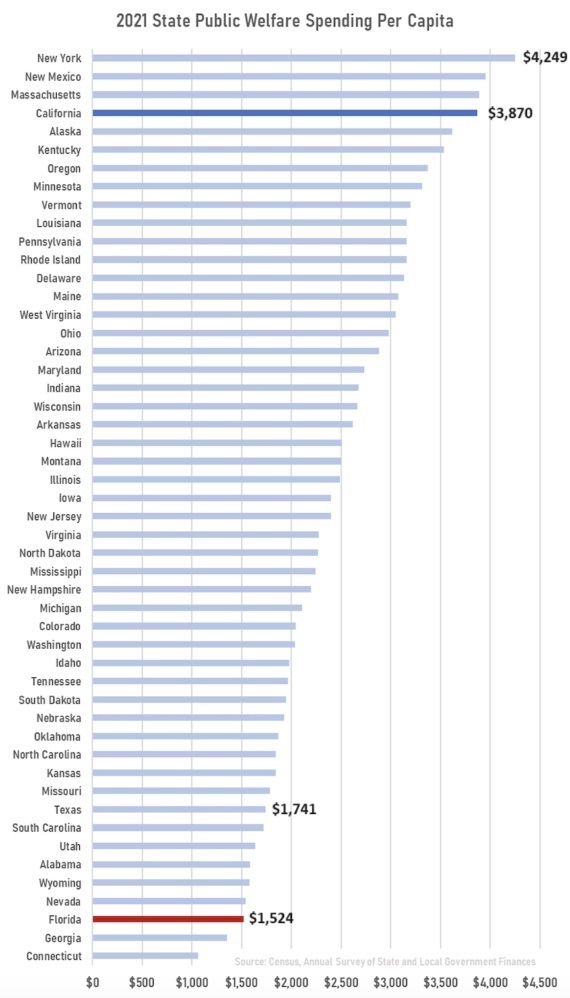

- In Part I, we reviewed Reagan’s successful record of spending restraint and explained why the same approach is needed today, particularly to control entitlements.

- In Part II, we examined Reagan’s much-needed supply-side tax reforms and said the same insights are needed today to address the problem of double taxation.

- In Part III, we looked at Reagan’s track record on red tape, noting that he arrested the growth of regulatory restrictions and regulatory budgets and urged the same policies today.

For Part IV, let’s look at Reagan’s approach to inflation.

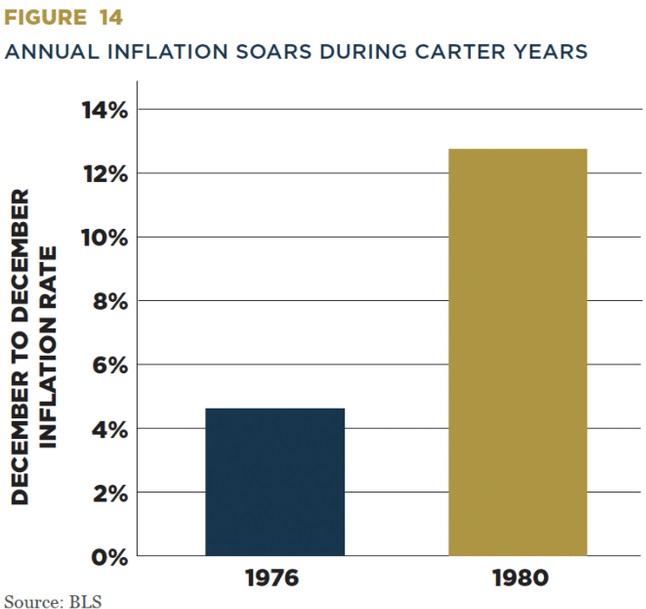

We’ll start with Figure 14 from the study, which shows how inflation dramatically increased during the 1970s.

That was the problem Reagan faced when he took office.

Here’s some of what I wrote in the study.

The United States was plagued by double-digit inflation when Reagan was elected. Rising prices were a problem throughout the 1970s, and the problem became particularly acute during the Carter Administration (see Figure 14), with prices climbing by nearly 50 percent in just four years.

…The Federal Reserve deserved the blame for the surge in prices. The central bank created too much liquidity, motivated in part by a belief in Keynesian monetary policy and in part by a desire to appease politicians who like the sugar high of easy money. To make a bad situation worse, prices were increasing faster than income, which meant that the average household was falling behind. According to the Census Bureau, when Reagan took office in 1981, both median and mean household income was several hundred dollars lower than when Carter took office in 1977.

Here’s what Reagan achieved.

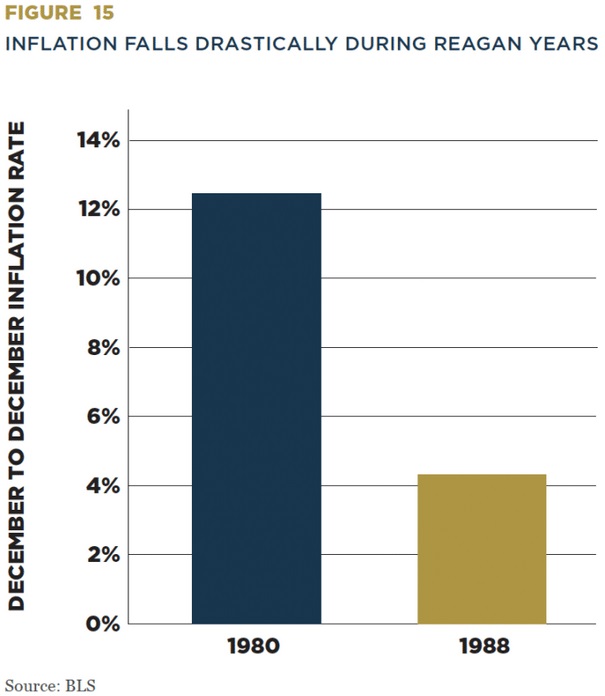

Unlike other presidents, who favored the sugar high of easy money, Reagan understood that the Federal Reserve needed a restrictive policy to bring inflation under control. He supported Chair Paul Volcker’s efforts to slow monetary growth even when it became politically unpopular. He courageously did what was best for the nation, even though it hurt his party in the 1982 mid-term elections. …Reagan’s courage paid dividends. The inflation rate came down very quickly. As shown Figure 15 below, inflation was down to about 4 percent in 1988:

Here’s the chart showing what Reagan achieved.

As I did with Part I, Part II, and Part III, let’s now consider whether Reagan’s policies are still relevant today.

In the case of monetary policy, the answer clearly is yes. The Federal Reserve (and other central banks) recklessly expanded their balance sheets during the pandemic. In effect, they repeated the mistakes of the 1970s, albeit for a different reason.

Regardless of the reason for bad policy, the solution is the same. Replicate Reagan’s courage and bring inflation under control.

The bottom line is that Reaganism was the right approach in the 1980s and it is the right approach today

Tax Cartels Mean Ever-Higher Tax Rates

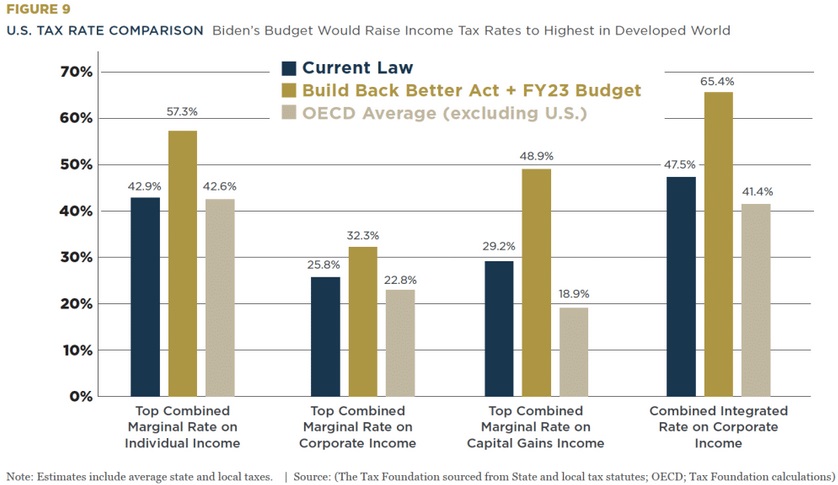

When President Biden proposed a “global minimum tax” for businesses, I immediately warned that would lead to ever-increasing tax rates.

Ross Kaminsky of KHOW and I discussed how this is already happening.

I hate being right, but it’s always safe to predict that politicians and bureaucrats will embrace policies that give more power to government.

Especially when they are very anxious to stifle tax competition.

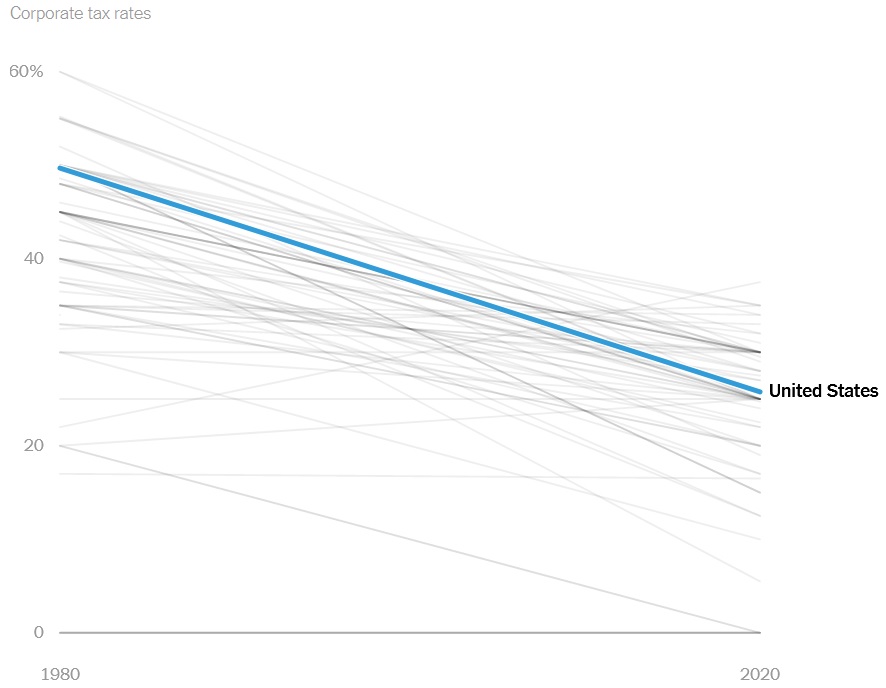

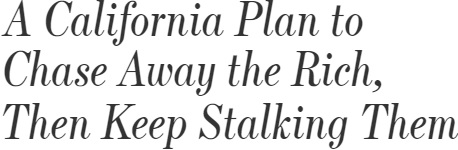

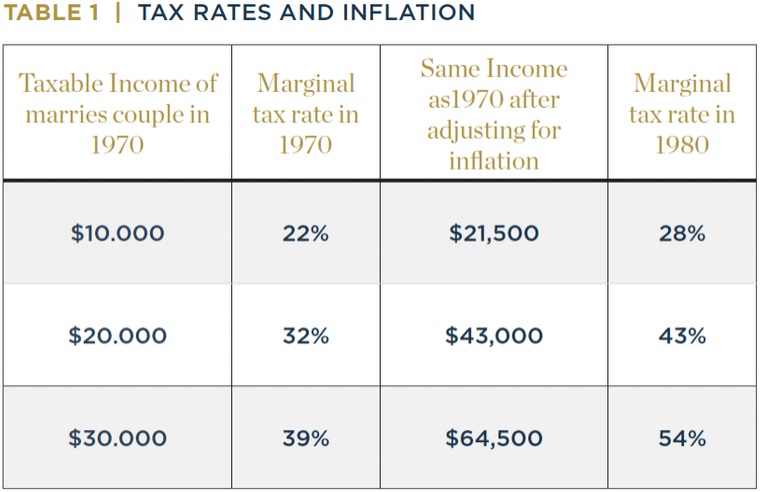

For decades, people in government have been upset that the tax cuts implemented by Ronald Reagan and Margaret Thatchertriggered a four-decade trend of lower tax rates and pro-growth tax reform.

For decades, people in government have been upset that the tax cuts implemented by Ronald Reagan and Margaret Thatchertriggered a four-decade trend of lower tax rates and pro-growth tax reform.

That’s the reason Biden and his Treasury Secretary proposed a 15 percent minimum tax rate for businesses.

And it’s the reason they now want the rate to be even higher.

Though even I’m surprised that they’re already pushing for that outcome when the original pact hasn’t even been approved or implemented.

Here are some passages from a report by Reuters.

Treasury Secretary Janet Yellen will press G20 counterparts this week for a global minimum corporate tax rate above the 15% floor agreed by 130 countries last week…the global minimum tax rate…is tied to the outcome of legislation to raise the U.S. minimum tax rate, a Treasury official said.

The Biden administration has proposed doubling the U.S. minimum tax on corporations overseas intangible income to 21% along with a new companion “enforcement” tax that would deny deductions to companies for tax payments to countries that fail to adopt the new global minimum rate. The officials said several countries were pushing for a rate above 15%, along with the United States.

Other kleptocratic governments naturally want the same thing.

A G7 proposal for a global minimum tax rate of 15% is too low and a rate of at least 21% is needed, Argentina’s finance minister said on Monday, leading a push by some developing countries…

“The 15% rate is way too low,” Argentine Finance Minister Martin Guzman told an online panel hosted by the Independent Commission for the Reform of International Corporate Taxation. …”The minimum rate being proposed would not do much to countries in Africa…,” Mathew Gbonjubola, Nigeria’s tax policy director, told the same conference.

Needless to say, I’m not surprised that Argentina is on the wrong side.

And supporters of class warfare also are agitating for a higher minimum rate. Here are some excerpts from a column in the New York Times by Gabriel Zucman and Gus Wezerek.

In the decades after World War II, close to 50 percent of American companies’ earnings went to state and federal taxes. …it was a golden period. …President Biden should be applauded for trying to end the race to the bottom on corporate tax rates.

But even if Congress approves the 15 percent global minimum corporate tax, it won’t be enough. …the Biden administration to give working families a real leg up, it should push Congress to enact a 25 percent minimum tax, which would bring in about $200 billion in additional revenue each year. …With a 25 percent minimum corporate tax, the Biden administration would begin to reverse decades of growing inequality. And it would encourage other countries to do the same, replacing a race to the bottom with a sprint to the top.

I can’t resist making two observations about this ideological screed.

- Even the IMF and OECD agree that the so-called race to the bottom has not led to a decline in corporate tax revenues, even when measured as a share of economic output.

- Since companies legally avoid rather than illegally evade taxes, the headline of the column is utterly dishonest – but it’s what we’ve learned to expect from the New York Times.

The only good thing about the Zucman-Wezerek column is that it includes this chart showing how corporate tax rates have dramatically declined since 1980.

P.S. For those interested, the horizontal line at the bottom is for Bermuda, though other jurisdictions (such as Monaco and the Cayman Islands) also deserve credit for having no corporate income taxes.

P.P.S. If you want to know why high corporate tax rates are misguided, click here. And if you want to know why Biden’s plan to raise the U.S. corporate tax rate is misguided, click here. Or here. Or here.

P.P.P.S. And if you want more information about why Biden’s global tax cartel is bad, click here, here, and here.

I enjoyed this article below because it demonstrates that the Laffer Curve has been working for almost 100 years now when it is put to the test in the USA. I actually got to hear Arthur Laffer speak in person in 1981 and he told us in advance what was going to happen the 1980’s and it all came about as he said it would when Ronald Reagan’s tax cuts took place. I wish we would lower taxes now instead of looking for more revenue through raised taxes. We have to grow the economy:

What Mitt Romney Said Last Night About Tax Cuts And The Deficit Was Absolutely Right. And What Obama Said Was Absolutely Wrong.

Mitt Romney repeatedly said last night that he would not allow tax cuts to add to the deficit. He repeatedly said it because over and over again Obama blathered the liberal talking point that cutting taxes necessarily increased deficits.

Romney’s exact words: “I want to underline that — no tax cut that adds to the deficit.”

Meanwhile, Obama has promised to cut the deficit in half during his first four years – but instead gave America the highest deficits in the history of the entire human race.

I’ve written about this before. Let’s replay what has happened every single time we’ve ever cut the income tax rate.

The fact of the matter is that we can go back to Calvin Coolidge who said very nearly THE EXACT SAME THING to his treasury secretary: he too would not allow any tax cuts that added to the debt. Andrew Mellon – quite possibly the most brilliant economic mind of his day – did a great deal of research and determined what he believed was the best tax rate. And the Coolidge administration DID cut income taxes and MASSIVELY increased revenues. Coolidge and Mellon cut the income tax rate 67.12 percent (from 73 to 24 percent); and revenues not only did not go down, but they went UP by at least 42.86 percent (from $700 billion to over $1 billion).

That’s something called a documented fact. But that wasn’t all that happened: another incredible thing was that the taxes and percentage of taxes paid actually went UP for the rich. Because as they were allowed to keep more of the profits that they earned by investing in successful business, they significantly increased their investments and therefore paid more in taxes than they otherwise would have had they continued sheltering their money to protect themselves from the higher tax rates. Liberals ignore reality, but it is simply true. It is a fact. It happened.

Then FDR came along and raised the tax rates again and the opposite happened: we collected less and less revenue while the burden of taxation fell increasingly on the poor and middle class again. Which is exactly what Obama wants to do.

People don’t realize that John F. Kennedy, one of the greatest Democrat presidents, was a TAX CUTTER who believed the conservative economic philosophy that cutting tax rates would in fact increase tax revenues. He too cut taxes, and he too increased tax revenues.

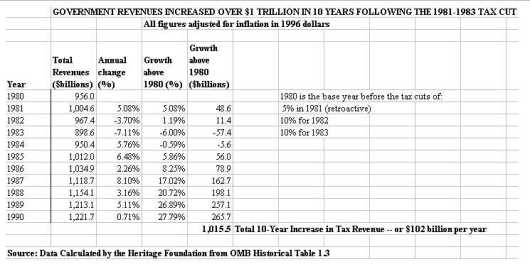

So we get to Ronald Reagan, who famously cut taxes. And again, we find that Reagan cut that godawful liberal tax rate during an incredibly godawful liberal-caused economic recession, and he increased tax revenue by 20.71 percent (with revenues increasing from $956 billion to $1.154 trillion). And again, the taxes were paid primarily by the rich:

“The share of the income tax burden borne by the top 10 percent of taxpayers increased from 48.0 percent in 1981 to 57.2 percent in 1988. Meanwhile, the share of income taxes paid by the bottom 50 percent of taxpayers dropped from 7.5 percent in 1981 to 5.7 percent in 1988.”

So we get to George Bush and the Bush tax cuts that liberals and in particular Obama have just demonized up one side and demagogued down the other. And I can simply quote the New York Times AT the time:

Sharp Rise in Tax Revenue to Pare U.S. Deficit By EDMUND L. ANDREWS Published: July 13, 2005

WASHINGTON, July 12 – For the first time since President Bush took office, an unexpected leap in tax revenue is about to shrink the federal budget deficit this year, by nearly $100 billion.

A Jump in Corporate Payments On Wednesday, White House officials plan to announce that the deficit for the 2005 fiscal year, which ends in September, will be far smaller than the $427 billion they estimated in February.

Mr. Bush plans to hail the improvement at a cabinet meeting and to cite it as validation of his argument that tax cuts would stimulate the economy and ultimately help pay for themselves.

Based on revenue and spending data through June, the budget deficit for the first nine months of the fiscal year was $251 billion, $76 billion lower than the $327 billion gap recorded at the corresponding point a year earlier.

The Congressional Budget Office estimated last week that the deficit for the full fiscal year, which reached $412 billion in 2004, could be “significantly less than $350 billion, perhaps below $325 billion.”

The big surprise has been in tax revenue, which is running nearly 15 percent higher than in 2004. Corporate tax revenue has soared about 40 percent, after languishing for four years, and individual tax revenue is up as well.

And of course the New York Times, as reliable liberals, use the adjective whenever something good happens under conservative policies and whenever something bad happens under liberal policies: ”unexpected.” But it WASN’T ”unexpected.” It was EXACTLY what Republicans had said would happen and in fact it was exactly what HAD IN FACT HAPPENED every single time we’ve EVER cut income tax rates.

The truth is that conservative tax policy has a perfect track record: every single time it has ever been tried, we have INCREASED tax revenues while not only exploding economic activity and creating more jobs, but encouraging the wealthy to pay more in taxes as well. And liberals simply dishonestly refuse to acknowledge documented history.

Meanwhile, liberals also have a perfect record … of FAILURE. They keep raising taxes and keep not understanding why they don’t get the revenues they predicted.

The following is a section from my article, “Tax Cuts INCREASE Revenues; They Have ALWAYS Increased Revenues“, where I document every single thing I said above:

The Falsehood That Tax Cuts Increase The Deficit

Now let’s take a look at the utterly fallacious view that tax cuts in general create higher deficits.

Let’s take a trip back in time, starting with the 1920s. From Burton Folsom’s book, New Deal or Raw Deal?:

In 1921, President Harding asked the sixty-five-year-old [Andrew] Mellon to be secretary of the treasury; the national debt [resulting from WWI] had surpassed $20 billion and unemployment had reached 11.7 percent, one of the highest rates in U.S. history. Harding invited Mellon to tinker with tax rates to encourage investment without incurring more debt. Mellon studied the problem carefully; his solution was what is today called “supply side economics,” the idea of cutting taxes to stimulate investment. High income tax rates, Mellon argued, “inevitably put pressure upon the taxpayer to withdraw this capital from productive business and invest it in tax-exempt securities. . . . The result is that the sources of taxation are drying up, wealth is failing to carry its share of the tax burden; and capital is being diverted into channels which yield neither revenue to the Government nor profit to the people” (page 128).

Mellon wrote, “It seems difficult for some to understand that high rates of taxation do not necessarily mean large revenue to the Government, and that more revenue may often be obtained by lower taxes.” And he compared the government setting tax rates on incomes to a businessman setting prices on products: “If a price is fixed too high, sales drop off and with them profits.”

And what happened?

“As secretary of the treasury, Mellon promoted, and Harding and Coolidge backed, a plan that eventually cut taxes on large incomes from 73 to 24 percent and on smaller incomes from 4 to 1/2 of 1 percent. These tax cuts helped produce an outpouring of economic development – from air conditioning to refrigerators to zippers, Scotch tape to radios and talking movies. Investors took more risks when they were allowed to keep more of their gains. President Coolidge, during his six years in office, averaged only 3.3 percent unemployment and 1 percent inflation – the lowest misery index of any president in the twentieth century.

Furthermore, Mellon was also vindicated in his astonishing predictions that cutting taxes across the board would generate more revenue. In the early 1920s, when the highest tax rate was 73 percent, the total income tax revenue to the U.S. government was a little over $700 million. In 1928 and 1929, when the top tax rate was slashed to 25 and 24 percent, the total revenue topped the $1 billion mark. Also remarkable, as Table 3 indicates, is that the burden of paying these taxes fell increasingly upon the wealthy” (page 129-130).

Now, that is incredible upon its face, but it becomes even more incredible when contrasted with FDR’s antibusiness and confiscatory tax policies, which both dramatically shrunk in terms of actual income tax revenues (from $1.096 billion in 1929 to $527 million in 1935), and dramatically shifted the tax burden to the backs of the poor by imposing huge new excise taxes (from $540 million in 1929 to $1.364 billion in 1935). See Table 1 on page 125 of New Deal or Raw Deal for that information.

FDR both collected far less taxes from the rich, while imposing a far more onerous tax burden upon the poor.

It is simply a matter of empirical fact that tax cuts create increased revenue, and that those [Democrats] who have refused to pay attention to that fact have ended up reducing government revenues even as they increased the burdens on the poorest whom they falsely claim to help.

Let’s move on to John F. Kennedy, one of the most popular Democrat presidents ever. Few realize that he was also a supply-side tax cutter.

“It is a paradoxical truth that tax rates are too high and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now … Cutting taxes now is not to incur a budget deficit, but to achieve the more prosperous, expanding economy which can bring a budget surplus.”

– John F. Kennedy, Nov. 20, 1962, president’s news conference

“Lower rates of taxation will stimulate economic activity and so raise the levels of personal and corporate income as to yield within a few years an increased – not a reduced – flow of revenues to the federal government.”

– John F. Kennedy, Jan. 17, 1963, annual budget message to the Congress, fiscal year 1964

“In today’s economy, fiscal prudence and responsibility call for tax reduction even if it temporarily enlarges the federal deficit – why reducing taxes is the best way open to us to increase revenues.”

– John F. Kennedy, Jan. 21, 1963, annual message to the Congress: “The Economic Report Of The President”

“It is no contradiction – the most important single thing we can do to stimulate investment in today’s economy is to raise consumption by major reduction of individual income tax rates.”

– John F. Kennedy, Jan. 21, 1963, annual message to the Congress: “The Economic Report Of The President”

“Our tax system still siphons out of the private economy too large a share of personal and business purchasing power and reduces the incentive for risk, investment and effort – thereby aborting our recoveries and stifling our national growth rate.”

– John F. Kennedy, Jan. 24, 1963, message to Congress on tax reduction and reform, House Doc. 43, 88th Congress, 1st Session.

“A tax cut means higher family income and higher business profits and a balanced federal budget. Every taxpayer and his family will have more money left over after taxes for a new car, a new home, new conveniences, education and investment. Every businessman can keep a higher percentage of his profits in his cash register or put it to work expanding or improving his business, and as the national income grows, the federal government will ultimately end up with more revenues.”

– John F. Kennedy, Sept. 18, 1963, radio and television address to the nation on tax-reduction bill

Which is to say that modern Democrats are essentially calling one of their greatest presidents a liar when they demonize tax cuts as a means of increasing government revenues.

So let’s move on to Ronald Reagan. Reagan had two major tax cutting policies implemented: the Economic Recovery Tax Act (ERTA) of 1981, which was retroactive to 1981, and the Tax Reform Act of 1986.

Did Reagan’s tax cuts decrease federal revenues? Hardly:

We find that 8 of the following 10 years there was a surplus of revenue from 1980, prior to the Reagan tax cuts. And, following the Tax Reform Act of 1986, there was a MASSIVE INCREASEof revenue.

So Reagan’s tax cuts increased revenue. But who paid the increased tax revenue? The poor? Opponents of the Reagan tax cuts argued that his policy was a giveaway to the rich (ever heard that one before?) because their tax payments would fall. But that was exactly wrong. In reality:

“The share of the income tax burden borne by the top 10 percent of taxpayers increased from 48.0 percent in 1981 to 57.2 percent in 1988. Meanwhile, the share of income taxes paid by the bottom 50 percent of taxpayers dropped from 7.5 percent in 1981 to 5.7 percent in 1988.”

So Ronald Reagan a) collected more total revenue, b) collected more revenue from the rich, while c) reducing revenue collected by the bottom half of taxpayers, and d) generated an economic powerhouse that lasted – with only minor hiccups – for nearly three decades. Pretty good achievement considering that his predecessor was forced to describe his own economy as a “malaise,” suffering due to a “crisis of confidence.” Pretty good considering that President Jimmy Carter responded to a reporter’s question as to what he would do about the problem of inflation by answering, “It would be misleading for me to tell any of you that there is a solution to it.”

Reagan whipped inflation. Just as he whipped that malaise and that crisis of confidence.

________

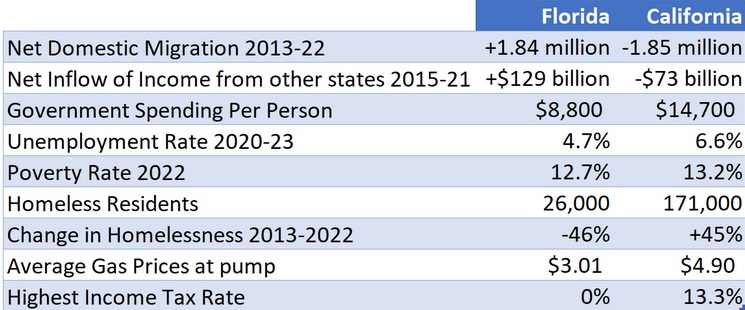

The Laffer Curve, Part III: Dynamic Scoring