_——

The Academic Case for Spending Limits

Since I’m a big fan of spending caps in Switzerlandand Colorado, I’m always on the lookout for research and analysis about fiscal rules.

For instance, there are pro-spending-cap studies from left-leaning bureaucracies such as the International Monetary Fund (here and here) and the Organization for Economic Cooperation and Development (here and here). There are also similar studies from the European Central Bank (here and here).

We can now add to that research with a new working paper from Switzerland’s Federal Finance Administration.

Authored by Thomas Brändle and Marc Elsener, it’s a very helpful review of different fiscal rules.

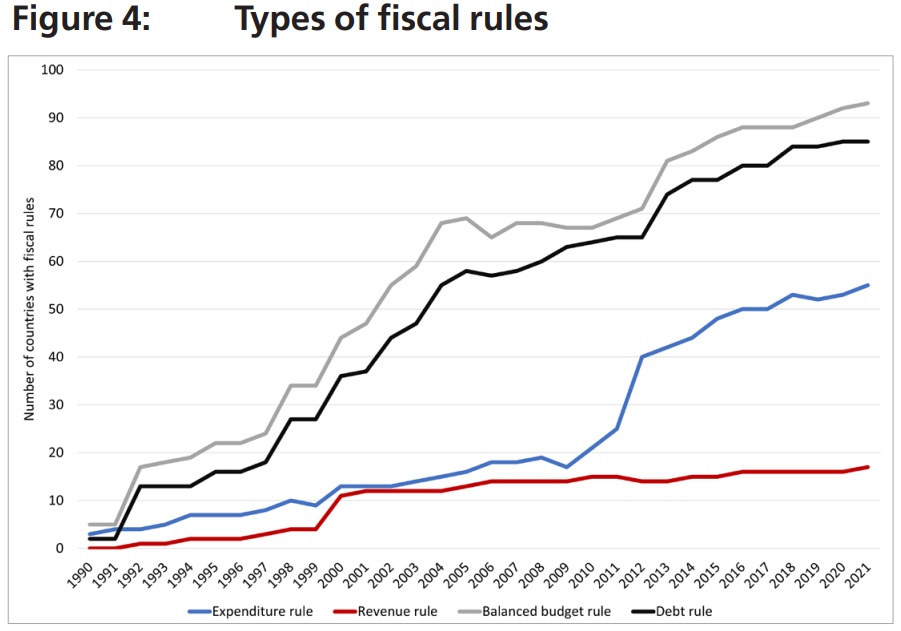

Let’s start by sharing a chart from the study on the number of fiscal rules. As you can see, the most dominant types of rules are anti-deficit (gray line) and anti-debt (black line).

Since I don’t think those rules are very effective, I’m more encouraged by the growing number of expenditure rules (blue line).

Here are some of the findings from the report.

A rich empirical literature investigates the impact of fiscal rules. First, the focus is on surveying recent studies that investigate the relationship between fiscal rules and “traditional” fiscal performance measures, such as public debt and budget balances.

…For EU countries and the period 1990-2012, Nerlich and Reuter (2013)…find that the introduction of fiscal rules is related to lower public expenditures as well as to lower revenues. As the impact on revenues is smaller, the primary balance improves. This impact is stronger when fiscal rules are enacted in law or constitution and supported by independent fiscal institutions and effective medium-term expenditure frameworks. Fiscal rules have the strongest limiting impact on social spending, compensation of public employees.

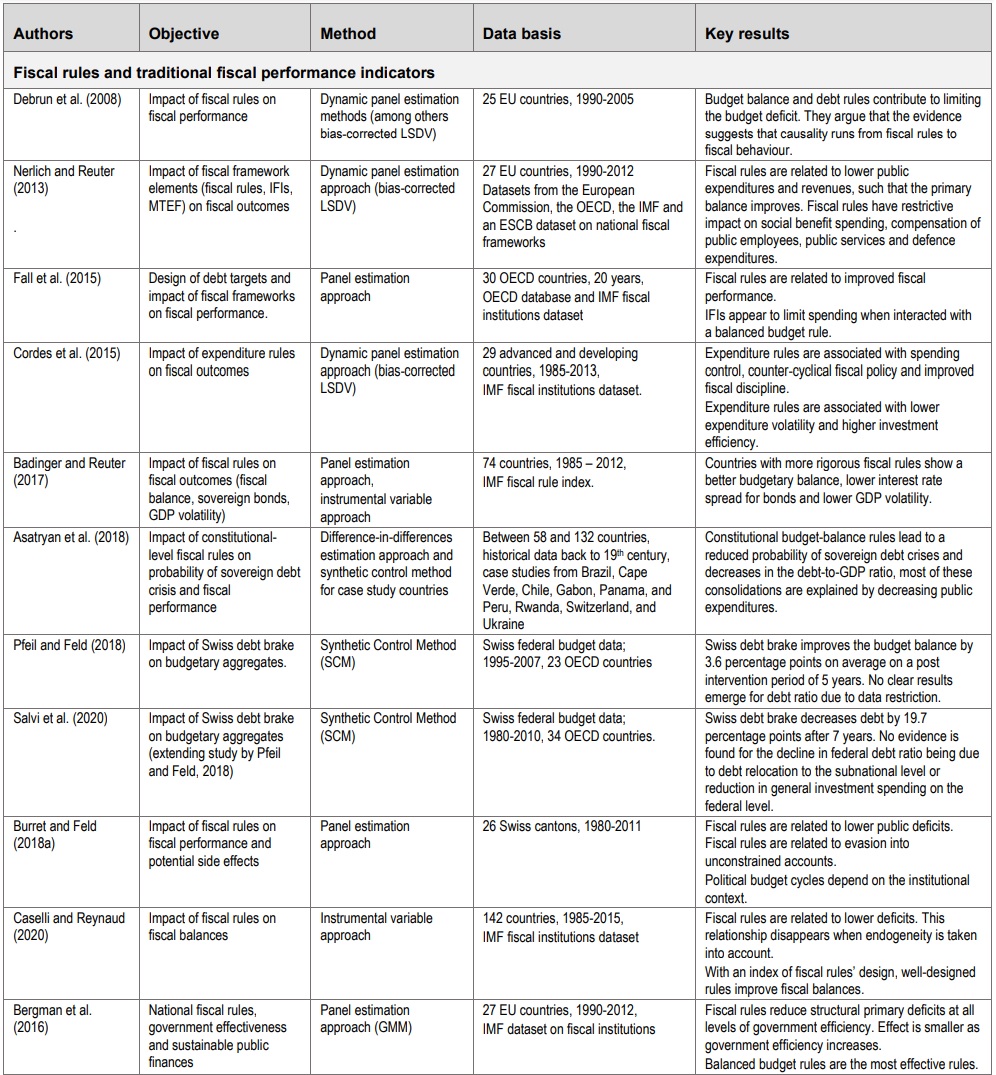

Here are some additional studies that are cited in the paper.

Based on a panel of 30 OECD countries, Fall et al. (2015) find that fiscal rules are related to improved fiscal performance. In particular, a budget balance rule appears to have a positive and significant effect on the primary balance and a negative and significant effect on public spending. Expenditure rules are associated with lower expenditure volatility and higher public investment efficiency. …Focusing on expenditure rules, Cordes et al. (2015) present an analysis for 29 advanced and developing countries for the period 1985–2013. Using a dynamic panel estimation approach, the analysis shows that these rules are associated with better spending control…and improved fiscal discipline. …Asatryan et al. (2018) study whether constitutional-level fiscal rules – expected to be more binding – impact fiscal outcomes. …they find that the introduction of a constitutional balance budget rule leads to a lower probability of sovereign debt crisis. For their most preferred sample of 132 countries between 1945 and 2015, they find that the debt-to-GDP ratio decreases by around 11 percentage points on average with constitutional balance budget rules. Most of these consolidations are explained by decreasing expenditures rather than increasing tax revenues.

I’m most interested in controlling the burden of government spending.

For my friends who are mostly fixated on red ink, it’s worth noting that Switzerland’s spending cap – which took effect in 2003 – has caused a dramatic shift from rising debt to falling debt.

Debt did increase during the pandemic, of course, but Switzerland’s debt increase was very small compared to the United States.

And Swiss lawmakers will now be required to impose additional spending restraint to make up for that extra red ink.

Needless to say, there is no similar “clawback” requirement in the United States.

I’ll close by sharing this table from the study, which summarizes the recent academic research on fiscal rules.

My takeaway from all this research is that spending restraint is the only practical solution to protect against “goldfish government.”

Especially given the demographic changes that are making modern-day welfare states unsustainable,

——

Everything You Need to Know about Federal Handouts for State and Local Governments

Ideally, the federal government should be limited to the functions specified by the Founders in Article 1, Section 8, of the Constitution.

If we are to have any hope of getting back to that system, it may require two practical steps.

- If Washington is operating a program, the first step

may be to replace it with block grants and let state and local governments decide how to spend the money.

may be to replace it with block grants and let state and local governments decide how to spend the money. - If Washington is providing block grants, the second step may be to phase out that funding and let state and local governments figure out if they want to pick up the cost.

To elaborate, programs that are both funded by Washington and operated by Washington not only suffer from waste (common to all government activities), but also produce the inefficiency and stagnation common to a one-size-fits-all approach.

This is why welfare reform under Bill Clinton was a good idea.

Taxpayers saved some money because the block grant was capped. But the best outcome was that states then could use their flexibility to innovate and find approaches that actually helped poor people by encouraging employment and reducing dependency.

In an ideal world, however, there should not be block grants. State and local governments should decide not only how to operate welfare programs, but also how to finance them.

To understand the problems associated with block grants, let’s look at a new study published by the National Bureau of Economic Research. Authored by , it finds that pandemic grants were grotesquely inefficient.

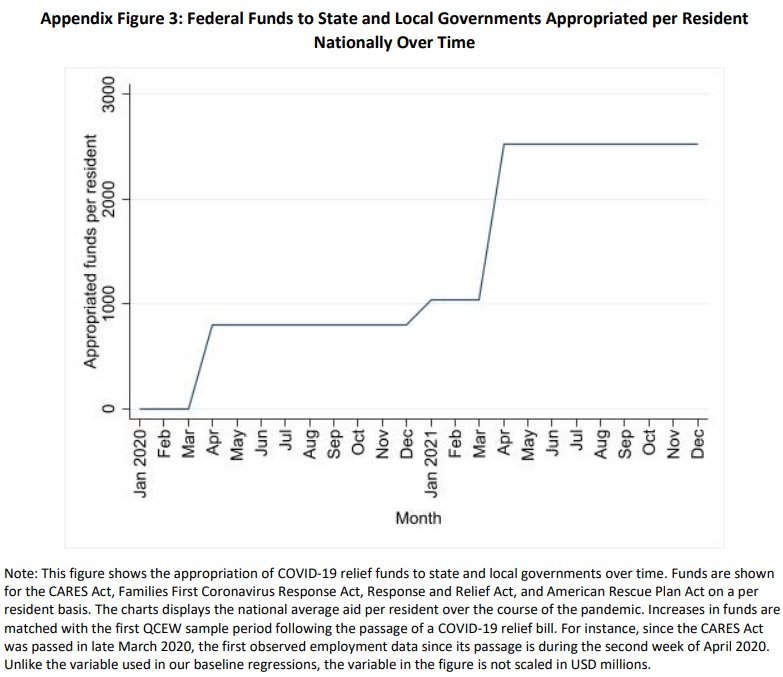

We use an instrumental-variables estimator reliant on variation in congressional representation to analyze the effects of federal aid to state and local governments across all four major pieces of COVID-19 response legislation.

Through September 2021, we estimate that the federal government allocated $855,000 for each state or local government job-year preserved. Our baseline confidence interval allows us to rule out estimates of less than $433,000. Our estimates of effects on aggregate income and output are centered on zero and imply modest if any spillover effects onto the broader economy.

Needless to say, it’s absurd to spend $433,000-$855,000 to save a job that pays an average of $100,000. Or less.

On net, that’s going to reduce total employmentwhen you count the private-sector jobs that are foregone because politicians are diverting so much money from the economy’s productive sector.

And if you want to know how much money was diverted specifically for state and local governments, Figure 3 shows both Trump’s pandemic boondoggle in 2020 and Biden’s pandemic boondoggle in 2021.

In a column for the Foundation for Economic Education, Peter Jacobsen discusses the new study.

The authors find that federal aid to state and local governments to save jobs was incredibly ineffective. In fact, this program was even more inefficient than the notoriously inefficient Paycheck Protection Program (PPP). …The PPP was estimated to have cost somewhere from $169,000 to $258,000 per job each year.

This program to save state and local government jobs cost in the range of $433,000 to $855,000 per job each year. This is as much as 5x more waste! …So how did the government spend more than $800,000 per job to save jobs which normally pay five figures? …a business engaging in an ineffective and wasteful policy like this would make a loss on each worker and go out of business. …government is particularly prone to generating these wasteful jobs. …Without a mechanism like profit and loss to evaluate the value of alternative options, we are left with a policy which spends nearly a million dollars to preserve a single job with a salary less than one tenth of that.

I’ll conclude with the should-be-obvious observation that politicians don’t actually care about net job creation. They care about buying votes with other people’s money.

So the state and local bureaucrats who directly benefited (by keeping their over-compensated jobs) presumably will remember and reward the politicians who supported for the boondoggles.

P.S. The rest of us also should care – and oppose spendthrift politicians, but most of us don’t pay enough attention to recognize the “unseen.”

Sadly last night the Democrats won control of Senate!

2021 Democrats control Government but has our National Debt reached a Tipping Point?

Is America Approaching the Tipping Point of Too Much Debt?

Yesterday, the Congressional Budget Office released updated budget projections. The most important numbers in that report show what’s happening with the overall fiscal burden of government – measured by both taxes and spending.

As you can see, there’s a big one-time spike in coronavirus-related spending this year. That’s not good news, but more worrisome is the the longer-run trend of government spending gradually climbing as a share of economic output (and the numbers are significantly worse if you look at CBO’s 30-year projection).

Most reporters and fiscal wonks overlooked the spending data, however, and instead focused on the CBO’s projection for government debt.

Since government spending is the problem and borrowing is merely a symptom of that problem, I think it’s a mistake to fixate on red ink.

That being said, Figure 3 from the CBO report shows that there’s also an upward-spike in federal debt.

And it is true (remember Greece) that high levels of debt can, by themselves, produce a crisis. This happens when investors suddenly stop buying government bonds because they think there’s a risk of default (which happens when a government is incapable or unwilling to make promised payments to lenders).

I think some nations are on the verge of having that kind of crisis, most notably Italy.

But what about the United States? Or Japan? And how’s the outlook for Europe’s welfare states?

In other words, what nations are approaching a tipping point?

A new study from the European Central Bank may help answer these questions. Authored by Pablo Burriel, Cristina Checherita-Westphal, Pascal Jacquinot, Matthias Schön, and Nikolai Stähler, it uses several economic models to measure the downside risks of excessive debt.

The 2009 global financial and economic crisis left a legacy of historically high levels of public debt in advanced economies, at a scale unseen during modern peace time. …The coronavirus (COVID-19) pandemic is a different type of shock

that has dramatically affected global economic activity… Fiscal positions are projected to be strongly hit by the crisis…once the crisis is over and the recovery firmly sets in, keeping public debt at high levels over the medium term is a source of vulnerability… The main objective of this paper is to contribute to the stabilisation vs. sustainability debate in the euro area by reviewing through the lens of large scale DSGE models the economic risks associated with regimes of high public debt.

Here’s what they found, none of which should be a surprise.

…we evaluate the economic consequences of high public debt using simulations with three DSGE models… Our DSGE simulations also suggest that high-debt economies…can lose more output in a crisis…have less scope for counter-cyclical fiscal policy and…are adversely affected in terms of potential (long-term) output, with a significant impairment in case of large sovereign risk premia reaction and use of most distortionary type of taxation to finance the additional public debt burden in the future.

Here’s a useful chart from the study. It shows some sort of shock on the left (2008 financial crisis or coronavirus being obvious examples), which then produces a recession (lower GDP) and rising debt.

That outcome isn’t good for nations with “low” levels of debt, but it can be really bad for nations with “high” debt burdens because they have to deal with much higher interest payments, much bigger tax increases, and much bigger reductions in economic output.

For what it’s worth, I don’t think the study actually gives us any way of determining which nations are near the tipping point. That’s because “low” and “high” are subjective. Japan has an enormous amount of debt, yet investors don’t think there’s any meaningful risk that Japan’s government will default, so it is a “low” debt nation for purposes of the above illustration.

By contrast, there’s a much lower level of debt in Argentina, but investors have almost no trust in that nation’s especially venal politicians, so it’s a “high” debt nation for purposes of this analysis.

The United States, in my humble opinion, is more like Japan. As I wrote last year, “We probably won’t even have a crisis in the next 10 years or 20 years.” And that’s still my view, even after all the spending and debt for coronavirus.

The study concludes with some common-sense advice about using spending restraint and pro-market reforms to create buffers (some people refer to this as “fiscal space“).

Overall, once the COVID-19 crisis is over and the economic recovery firmly re-established, further efforts to build fiscal buffers in good times and mitigate fiscal risks over the medium term are needed at the national level. Such efforts should be guided by risks to debt sustainability. High debt countries, in particular, should implement a mix of fiscal discipline and wide-ranging growth-enhancing reforms.

Needless to say, there’s an obvious and successful way of achieving this goal.

P.S. Here’s another chart from the ECB study that is worth sharing because it confirms that not all tax increases do the same amount of economic damage.

We see that consumption taxes (red line) are bad, but income taxes on workers (green line) are even worse.

And if the study included an estimate of what would happen if there were higher income taxes on saving and investment, there would be another line showing even more economic damage.

P.P.S. History shows that nations can reduce very large debt burdens if they follow my Golden Rule.

P.P.P.S. There’s a related study from the IMF that shows how excessive spending is a major warning sign that nations will be vulnerable to fiscal crisis.

Great article below from Daniel Mitchell!!

Positive Rights vs Negative Rights

Back in 2017, I compared the welfare state vision of “positive rights” with the classical liberal vision of “negative rights.”

To elaborate, here’s a video from Learn Liberty that compares these visions.

—

For what it’s worth, I don’t like the terms “positive rights” and “negative rights” for the simple reason that an uninformed person understandably might conclude that “positive” is good and “negative” is bad.

Needless to say, I don’t think it’s good for people to think they have a right to other people’s money.

That’s why I prefer Professor Skoble’s use of the terms “liberties” and “entitlements,” which we also find in this slide from Professor Imran Ahmad Sajid of the University of Pakistan.

As you might expect, there are plenty of politicians who try to buy votes with an agenda of “positive rights.” Bernie Sanders, for instance, constantly argued that people have a “right” to all sorts of goodies.

But he wasn’t the first to make the case for unlimited entitlements.

Franklin Roosevelt was one of America’s worst presidents, in part because his policies deepened and lengthened the Great Depression. But also because he pushed the idea that people have the right to get all sorts of taxpayer-financed handouts.

Let’s see what some other people have to say about this topic.

In his National Review column, Kevin Williamson looks at the logical fallacy of positive rights.

Positive rights run into some pretty obvious problems if you think about them for a minute, which is why so much of our political discourse is dedicated to moralistic thundering specifically designed to prevent such thinking. Consider, in the American context, the notion that health care is a right. Declaring a right in a scarce good such as health care is intellectually void, because moral declarations about rights do not change material facts.

If you have five children and three apples and then declare that every child has a right to an apple of his own, then you have five children and three apples and some meaningless posturing — i.e., nothing in reality has changed, and you have added only rhetoric instead of adding apples. In the United States, we have so many doctors, so many hospitals and clinics, so many MRI machines, etc. This imposes real constraints on the provision of health care. If my doctor works 40 hours a week, does my right to health care mean that a judge can order him to work extra hours to accommodate my rights? For free? If I have a right to health care, how can a clinic or a physician charge me for exercising my right? If doctors and hospitals have rights of their own — for example, property rights in their labor and facilities — how is it that my rights supersede those rights?

And here’s what he says about “negative rights.”

A negative right is a right to not be constrained. The right to free speech, for example, implies only non-interference. The right to freedom of the press doesn’t mean the government has to give you a press. The good of negative freedom is, in the economic sense, not rivalrous — your exercise of free speech doesn’t leave less freedom of speech out there for others to enjoy

And Larry Reed opines on the issue for the Foundation for Economic Education.

America is a nation founded on the notion of rights. …Despite the centrality of rights in American history, it’s readily apparent today

that Americans are of widely different views on what a right is, how many we have, where rights come from, or why we have any in the first place. …if you need something, does that mean you have a right to it? If I require a kidney, do I have a right to one of yours? Is a right something that can or should be granted or denied by majority vote?

He helpfully provides a list of negative rights (a.k.a., liberties).

And he argues that positive rights (a.k.a., entitlements) are not real rights.

The bottom line, he explains, is that so-called positive rights impose obligations on other people.

Indeed, they can only be provided by coercion.

The first list comprises what are often called both “natural rights” and “negative rights”—natural because they derive from our essential nature as unique, sensate individuals and negative because they don’t impose obligations on others beyond a commitment to not violate them. The items in the second are called “positive rights” because others must give them to you or be coerced into doing so if they decline. …while I believe neither you nor I have a right to any of those disparate things in the second list, I hasten to add that we certainly have the right to seek them, to create them, to receive them as gifts from willing benefactors, or to trade for them. We just don’t have a right to compel anyone to give them to us or pay for them.

There’s not much I can add to this issue, given the wisdom contained in the video and in the articles by Williamson and Reed.

So I’ll close with the should-be-obvious point that a system based on entitlements only works if there are enough people pulling the wagon to support all the people riding in the wagon.

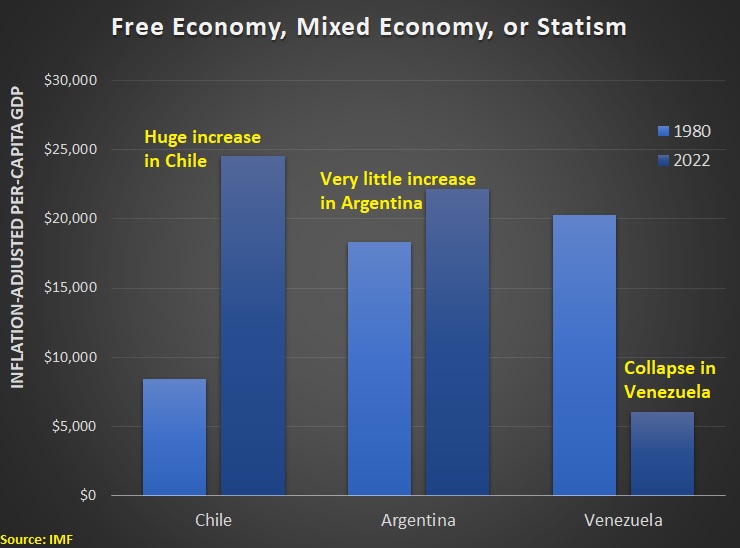

But that kind of society contains the seeds of its own downfall(think Greece or Venezuela) because it subsidizes dependency and penalizes production.

Which means, as Margaret Thatcher warned us, that positive rights can’t be provided when politicians run out of other people’s money.

—

-_

Free-market economics meets free-market policies at The Heritage Foundation’s Tenth Anniversary dinner in 1983. Nobel Laureate Milton Friedman and his wife Rose with President Ronald Reagan and Heritage President Ed Feulner.

Since the passing of Milton Friedman who was my favorite economist, I have been reading the works of Daniel Mitchell and he quotes Milton Friedman a lot, and you can reach Dan’s website here.

In 2007, Mitchell left the Heritage Foundation, and joined the Cato Institute as a Senior Fellow. Mitchell continues to work in tax policy, and deals with issues such as the flat tax and international tax competition.[2]

In addition to his Cato Institute responsibilities, Mitchell co-founded the Center for Freedom and Prosperity, an organization formed to protect international tax competition.[1]

January 29, 2020

President Biden, c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500

Dear Mr. President,

The FOUNDERS never intended the government to get into the welfare business!!!!

The federal government debt is growing so much that it is endangering us because if things keep going like they are now we will not have any money left for the national defense because we are so far in debt as a nation. We have been spending so much on our welfare state through food stamps and other programs that I am worrying that many of our citizens are becoming more dependent on government and in many cases they are losing their incentive to work hard because of the welfare trap the government has put in place. Other nations in Europe have gone down this road and we see what mess this has gotten them in. People really are losing their faith in big government and they want more liberty back. It seems to me we have to get back to the founding principles that made our country great. We also need to realize that a big government will encourage waste and corruption. The recent scandals in our government have proved my point. In fact, the jokes you made at Ohio State about possibly auditing them are not so funny now that reality shows how the IRS was acting more like a monster out of control. Also raising taxes on the job creators is a very bad idea too. The Laffer Curve clearly demonstrates that when the tax rates are raised many individuals will move their investments to places where they will not get taxed as much.

______________________

One is the growing welfare state. I have posted an article below about what the welfare state is doing to England because we need to learn from their mistakes.

Welfare state may drag England down the tubes!!!!

I almost didn’t post this because it singles out immigrants from the developing world, but since I’ve shared horror stories from home-grown moochers in the U.K., as well as examples of scroungers from Europe who are robbing British taxpayers, I think I’ve covered all the bases.

But in the spirit of inclusiveness, here are other satirical videos worth sharing.

My all-time favorite video satire is from Iowahawk, featuring the Pelosimobile.

And I’ve always thought this left-wing attack against libertarianism is very funny.

And this Tim Hawkins video on the government Candyman is great, as isanother version of the song.

Speaking of Tim Hawkins, his home-schooling video is superb.

This spoof of the Chevy Volt also is extremely well done.

Last but not least, here are two brutal Obama teleprompter videos.

_____________

_____________

Thank you so much for your time. I know how valuable it is.

Sincerely,

Everette Hatcher III, 13900 Cottontail Lane, Alexander, AR 72002, ph 501-920-5733, everettehatcher@gmail.com

Related posts:

“The Power of the Market” episode of Free to Choose in 1990 by Milton Friedman (Part 5)

Milton Friedman The Power of the Market 5-5 How can we have personal freedom without economic freedom? That is why I don’t understand why socialists who value individual freedoms want to take away our economic freedoms. I wanted to share this info below with you from Milton Friedman who has influenced me greatly over the […]

“The Power of the Market” episode of Free to Choose in 1990 by Milton Friedman (Part 4)

Milton Friedman The Power of the Market 4-5 How can we have personal freedom without economic freedom? That is why I don’t understand why socialists who value individual freedoms want to take away our economic freedoms. I wanted to share this info below with you from Milton Friedman who has influenced me greatly over the […]

“The Power of the Market” episode of Free to Choose in 1990 by Milton Friedman (Part 3)

Milton Friedman The Power of the Market 3-5 How can we have personal freedom without economic freedom? That is why I don’t understand why socialists who value individual freedoms want to take away our economic freedoms. I wanted to share this info below with you from Milton Friedman who has influenced me greatly over the […]

“The Power of the Market” episode of Free to Choose in 1990 by Milton Friedman (Part 2)

Milton Friedman The Power of the Market 2-5 How can we have personal freedom without economic freedom? That is why I don’t understand why socialists who value individual freedoms want to take away our economic freedoms. I wanted to share this info below with you from Milton Friedman who has influenced me greatly over the […]

“The Power of the Market” episode of Free to Choose in 1990 by Milton Friedman (Part 1)

Milton Friedman The Power of the Market 1-5 How can we have personal freedom without economic freedom? That is why I don’t understand why socialists who value individual freedoms want to take away our economic freedoms. I wanted to share this info below with you from Milton Friedman who has influenced me greatly over the […]

Washington is lecturing us about eating too much when they are spending addicts!!!!

Washington is lecturing us about eating too much when they are spending addicts!!!! Let’s Fix the Real Obesity Problem in Washington May 11, 2013 by Dan Mitchell Whenever someone proposes that we need more intervention from the federal government, I always go to the Constitution and check Article I, Section VIII. This is because I’m old fashioned and […]

Dan Mitchell of the Cato Institute:HUD has to go!!!! (includes political cartoon)

You want a suggestion on how to cut the government then start at HUD. I would prefer to eliminate all of it. Here are Dan Mitchell’s thoughts below: Sequestration’s Impact on HUD: Just 358 More Days and Mission Accomplished March 12, 2013 by Dan Mitchell As part of my “Question of the Week” series, I had […]

Open letter to President Obama (Part 138 B)

Real Time with Bill Maher March 16 2012 – Alexandra Pelosi Interviews Welfare Recipients in NYC Published on Mar 18, 2012 by vclubscenedotcom Real Time with Bill Maher March 16 2012 – Alexandra Pelosi Interviews Welfare Recipients __________ President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I […]

Are conservatives generous or are liberals?

Real Time with Bill Maher March 16 2012 – Alexandra Pelosi Interviews Welfare Recipients in NYC Published on Mar 18, 2012 by vclubscenedotcom Real Time with Bill Maher March 16 2012 – Alexandra Pelosi Interviews Welfare Recipients __________ Liberals like the idea of the welfare state while conservatives suggest charity through private organizations serve the […]

Democrats lied about spending cuts in 1982 and 1990

Washington Could Learn a Lot from a Drug Addict What kind of intervention does Congress need to get it to spend with its spending addiction? Back in 1982 Reagan was promised $3 in cuts for every $1 in tax increases but the cuts never came. In 1990 Bush was promised 2 for 1 but they […]

Senator Pryor asks for Spending Cut Suggestions! Here are a few!(Part 1) (Al Green, Famous Arkansan)

Senator Mark Pryor wants our ideas on how to cut federal spending. Take a look at this video clip below: Senator Pryor has asked us to send our ideas to him at cutspending@pryor.senate.gov and I have done so (at 4:04 pm CST on April 7th, 2011, and will continue to do so in the […]