1 Of 5 / The Bible’s Influence In America / American Heritage Series / David Barton

Great Speeches: George Washington’s Farewell Address

On this day in history, Sept. 19, 1796, President George Washington issues Farewell Address

Father of the country spoke proudly of young American nation, prophetically warned of dangers of party politics

He triumphantly celebrated the burgeoning young nation and his role in its creation, while soberly warning of the threat posed by regional and sectarian division.

“In looking forward to the moment which is intended to terminate the career of my public life, my feelings do not permit me to suspend the deep acknowledgment of that debt of gratitude which I owe to my beloved country for the many honors it has conferred upon me,” wrote Washington in an address that first appeared in the American Daily Advertiser, a newspaper in Philadelphia.

ON THIS DAY IN HISTORY, SEPT. 16, 1620, MAYFLOWER DEPARTS PLYMOUTH, ENGLAND

Washington was the hero of the American Revolution — and his Abrahamic faith in the cause of independence inspired and held the nation together in the darkest hours of the rebellion.

But party divisions arose in the United States during his time in office.

He warned in 1796 of their potential to shred the hard-fought unity of the previous 20 years.

A reproduction of a painting of George Washington, Benjamin Franklin and others signing the U.S. Constitution in Philadelphia, Pennsylvania. The beloved war hero Washington would become the first president of the United States under the new Constitution. (Library of Congress)

“One of the expedients of party to acquire influence within particular districts is to misrepresent the opinions and aims of other districts,” Washington said in his address.

“They tend to render alien to each other those who ought to be bound together by fraternal affection.”

‘The name of American … must always exalt the just pride of patriotism’ – George Washington

He added, “The alternate domination of one faction over another, sharpened by the spirit of revenge, natural to party dissension, which in different ages and countries has perpetrated the most horrid enormities, is itself a frightful despotism.”

ON THIS DAY IN HISTORY, SEPT. 6,1757, MARQUIS DE LAFAYETTE IS BORN, HERO OF TWO REVOLUTIONS

Washington issued his farewell statement after choosing not to run for a third term as president.

He proved the rare leader in history who willingly forfeited what might have been many more years of power.

George Washington’s Farewell Address inspired the nation for generations, including during the Civil War. The first line reads, “Upon the couch of death the champion of the free,” and the illustration artist is listed as “Clayton.” (Photo by Sheridan Libraries/Levy/Gado/Getty Images)

His decision set the stage for the tradition of presidents serving only two terms.

The two-term tradition was codified by the 22nd Amendment, ratified in 1951, six years after Franklin D. Roosevelt died in office while serving his fourth term as president.

ON THIS DAY IN HISTORY, AUGUST 22, 1776, THE BRITISH INVADE BROOKLYN BY SEA

Washington was so beloved in his era he was unanimously voted the nation’s first president by the electoral college in late 1788-early 1789.

John Adams was elected the first vice president.

Washington and Adams both easily won re-election in 1792.

But the vice presidential race of that second national election began to divide along party lines, setting the stage for Washington’s farewell warning.

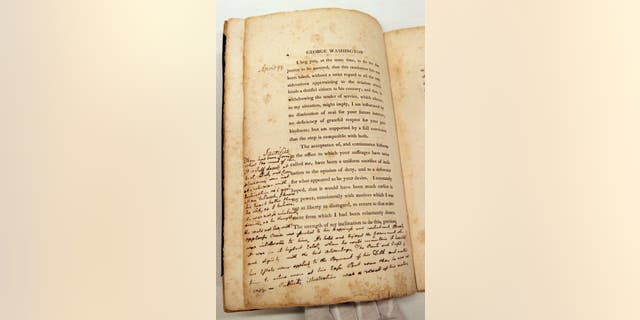

George Washington’s farewell address to the nation is shown here, as annotated by John Adams. (Photo by Tom Allen/The The Washington Post via Getty Images)

Adams, of the Federalist Party, defeated Thomas Jefferson, of the Democratic-Republican Party, in November 1796, two months after Washington’s farewell.

The father of his ountry invoked pride in his new nation, one unique in the history of mankind, as he left public life.

“The name of American, which belongs to you in your national capacity, must always exalt the just pride of patriotism more than any appellation derived from local discriminations,” he said.

“Washington’s Farewell Address spoke to contemporary concerns that the Union was weak and vulnerable to attacks from internal and external enemies,” writes the library of George Washington’s Mount Vernon.

“But even after the uncertainty of the early national period had passed, his message of unity remained powerful.”

CLICK HERE TO GET THE FOX NEWS APP

Washington’s words, Mount Vernon adds, are “still recited annually in the United States Senate, a tradition dating back to the Civil War. The Farewell Address endures as a critical founding document for issues of Union, partisanship and isolationism.”

Kerry J. Byrne is a lifestyle reporter with Fox News Digital.

2 Of 5 / The Bible’s Influence In America / American Heritage Series / David Barton

Barton in 2016

Unconfirmed Quotations

![]()

Unconfirmed QuotationsIn his 1989 book Myth of Separation, WallBuilders’ founder David Barton argued that the Founding Fathers would be appalled by the government-enforced secularization of the public square that became widespread in the latter half of the twentieth-century. In the course of making his argument, he utilized a number of quotations from America’s Founders that he found in secondary sources on the subject. He carefully cited each quotation. However, he subsequently realized that some of the quotations he used for Myth of Separation came from sources other than original ones.

Scholars and popular historians routinely utilize secondary sources or take quotations from these sources, 1 but when David returned to this subject for his 1996 book Original Intent, he decided to only rely on quotations that could be found in original primary source material. In an effort to be thoroughly transparent, he placed the handful of secondary quotations from Myth of Separation on an “Unconfirmed Quotations” list which he posted on WallBuilders’ website. At that time, he challenged writers on all sides of the debate over religion in the Founding Era to stop relying on secondary sources and quotations from later eras and instead to utilize original sources.

Although many people, including several respected academics, have told David that they admire his honesty and transparency, others have attempted to use this practice against him. For instance, in a recent critique of David’s work, Professor Gregg Frazer of The Master’s College writes:

Having been confronted over the use of false quotes, Barton was forced to acknowledge their illegitimacy in some way on his website. There, he describes them as “unconfirmed” – as if there is some doubt about their legitimacy. In a computer age with search capabilities, we know that these quotes are false – the fact that they are listed as “unconfirmed” reflects a stubborn attempt to hold onto them and to suggest to followers that they might be true. That is made worse by the fact that under these “unconfirmed” quotes are paragraphs maintaining that the bogus quote is something that the person might have said. 2

What an interesting reward for trying to be honest and transparent.

As stated in the piece “Taking on the Critics,” David was not confronted by any individual or group about these quotes. To the contrary, he was the first to step forward and challenge all sides in the historical debate over religion in the Founding to “raise the bar” and use only quotations that could be verified by primary sources.

Calling these unconfirmed quotes “bogus” implies that they were simply made up by David. Yet each and every one of them can be found in secondary sources, which David cited in his earlier works; and many academics, especially on the secularist side, continue to rely on secondary sources for their authorities. But Frazer and others suggest that David and WallBuilders live in a fantasy world where they stubbornly engage in wishful thinking that these unconfirmed quotations are accurate. However, Frazer ignores the fact that WallBuilders has been able to confirm some quotations on our original list. The now Confirmed Quotations are listed below, followed by those that remain unconfirmed in original documents.

Original sources for these latter quotes may yet be found. After all, James Madison’s detached memoranda, much beloved by secularists, did not surface until 1946. And original letters and documents from Founders are still being discovered today in dusty archives, private estates, and other uncatalogued sources. Additionally, existing collections are still being digitized and regularly added to the web, thus steadily increasing the field of searchable materials for these unconfirmed quotes. While WallBuilders has now located original sources for several of the quotes (see below), we continue to recommend that individuals refrain from using those that still remain on the Unconfirmed list until such time that an original primary source may be found; or if using these quotes, clearly identify that they come from a secondary and not a primary source.

Confirmed Quotations

#1: Benjamin Franklin“Whosoever shall introduce into public affairs the principles of primitive Christianity will change the face of the world.”

– Benjamin Franklin

This particular quote has been used in many works since the 1970s that seek to remind Americans of our religious heritage. 3 It originally appeared on WallBuilders’ “Unconfirmed” list, but we are now able to report that we have found an early primary source that attributes this message to Franklin.

In initial attempts to document this quote, David found it in George Bancroft’s 1866 History of the United States, which stated:

He [Franklin] remarked to those in Paris who learned of him the secret of statesmanship: “He who shall introduce into public affairs the principles of primitive Christianity will change the face of the world.” 4

This is no insignificant source, for Bancroft is considered “The Father of American History.” He is most famous for his thorough, systematic history of the nation published in ten volumes from 1854-1878. Contrary to the claims of Gregg Frazer and other critics, David did not simply invent this quote. It appeared in one of the greatest histories of the United States ever written! But adhering to his own standards, David stopped using this quote until it could be confirmed in an original source. However, such a source was recently discovered.

Before turning to the quotation, it may be useful to provide some context. In 1776 Franklin was sent by America as an ambassador to France, a position he held until 1785. He was beloved by the French, and he offered them many useful and friendly recommendations, including political advice for those who would listen. 5 Shortly after Franklin’s death in 1790, Jacques Mallet Du Pan, a French journalist and political leader, published his historical memoirs, in which he reported:

Franklin often told his disciples in Paris that whoever should introduce the principles of primitive Christianity into the political state would change the whole order of society. 6

While this 1793 work does not contain the word-for-word quotation regularly cited today, its similarity is obvious and it clearly communicates the main idea in the quotation. One reason for the difference may be that because the work was written in French, there are variations in how a particular translator renders that statement into English. 7

It may be objected that a second-hand account of what someone said is not as reliable as, say, a letter clearly penned by Franklin in which he writes the same quotation. We agree. And yet students of the American founding repeatedly utilize such sources. For instance, speeches made in the Federal Convention of 1787 are regularly quoted as if they were directly spoken by particular delegates, although in most (but not all) cases what is being quoted is James Madison’s notes of those speeches.

Those who wish to deny America’s Christian heritage will undoubtedly brush off Du Pan’s account of Franklin’s views. Yet those interested in an accurate account of religion in the American Founding cannot afford to be so dismissive of this important find.

Confirmed Quotations

#2: Thomas Jefferson“I have always said and always will say that the studious perusal

of the Sacred Volume will make us better citizens.”

– Thomas Jefferson

This quote, also used in numerous modern works, 8 appears in an 1869 book edited by Samuel W. Bailey; 9 but because it did not appear in Jefferson’s works or writings, and because the occasion in which it might have been spoken by him could not be identified, it was left as unconfirmed. Its source, however, has now been found: the writings of the great Daniel Webster (1782-1852).

Webster was part of the second generation of American statesmen. Born at the end of the American Revolution, he grew up with the speeches of Presidents George Washington, John Adams, Thomas Jefferson, and James Madison. Following his own entry into politics, he became a leading national figure, serving almost a decade in the U. S. House, nearly two decades in the U. S. Senate, and being Secretary of State for three different Presidents.

Webster gained a reputation as an exceptional orator. He was considered the greatest attorney in his generation and personally argued and won numerous cases before the U. S. Supreme Court. 10His strong commitment to the principles of law and the Constitution earned him the title “The Defender of the Constitution.”

In 1852, Webster described a conversation he had with Thomas Jefferson, reporting:

Many years ago I spent a Sabbath with Thomas Jefferson at his residence in Virginia. It was in the month of June, and the weather was delightful. While engaged in discussing the beauties of the Bible, the sound of the bell broke upon our ears, when, turning to the sage of Monticello, I remarked, “How sweetly – how very sweetly sounds that Sabbath bell!” The distinguished statesman for a moment seemed lost in thought, and then replied: “Yes, my dear Webster; yes, it melts the heart, it calms the passions, and makes us boys again.” . . . “[British statesman Edmund] Burke,” said he, “never uttered a more important truth than when he exclaimed that a ‘religious education was the cheap defense of nations’.” “Raikes [the founder of the Sunday School movement in England],” said Mr. Jefferson, “has done more for our country than the present generation will acknowledge. Perhaps when I am cold, he will obtain his reward. I hope so – earnestly hope so. I am considered by many, Mr. Webster, to have little religion; but now is not the time to correct errors of this sort. I have always said, and always will say, that the studious perusal of the Sacred Volume will make better citizens, better fathers, and better husbands.” 11

So, while the quote is not found in Thomas Jefferson’s personal writings, it was recorded by a respected eye-witness. Because this quote fits well with Jefferson’s numerous attempts to promote the study of the Bible (thoroughly documented in The Jefferson Lies), it seems reasonable to attribute it to him.

Confirmed Quotations

#3: John Quincy Adams“The highest glory of the American Revolution was this: it connected, in one indissoluble bond, the principles of

civil government with the principles of Christianity.”

– John Quincy Adams

This quote has also had wide circulation in recent decades. 12 It appeared as early as 1860 in John Wingate Thornton’s The Pulpit of the American Revolution, which reprinted a number of sermons preached during the Revolution. In that work, Thornton stated:

Thus the church polity [form of government] of New England begat like principles in the state. The pew and the pulpit had been educated to self-government. They were accustomed “TO CONSIDER.” The highest glory of the American Revolution, said John Quincy Adams, was this: it connected, in one indissoluble bond, the principles of civil government with the principles of Christianity. 13

Initially, this quote was not found in any of Adams’ own writings; and it seemed unlikely that Thornton was reporting what Adams had personally told him, so we therefore placed it on the Unconfirmed list. We have now found the origin of this quote. It turns out that Thornton had simply, but accurately, summarized an opening section from one of Adams’ famous published orations: his 1837 Fourth of July address at Newburyport, Massachusetts.

Adams began that discourse by observing that Christmas and the Fourth of July were America’s two most-celebrated holidays, and that the two were connected. He queried of his audience that day:

Why is it that next to the birthday of the Savior of the World, your most joyous and most venerated festival returns on this day [July 4th]? . . . Is it not that in the chain of human events, the birthday of the nation is indissolubly linked with the birthday of the Savior? That it forms a leading event in the progress of the Gospel dispensation? Is it not that the Declaration of Independence first organized the social compact on the foundation of the Redeemer’s mission upon earth? That it laid the corner stone of human government upon the first precepts of Christianity, and gave to the world the first irrevocable pledge of the fulfillment of the prophecies, announced directly from Heaven at the birth of the Savior and predicted by the greatest of the Hebrew prophets six hundred years before? 14

Comparing Adams’ original 1837 quotation with Thornton’s 1860 summation of it, one immediately sees the origin of Thornton’s statement. He had accurately related the essence of Adams’ message; and while he never presented his statement as being an exact quotation from Adams, those who used Thornton’s work in subsequent generations assumed that it was. Consequently, this Unconfirmed Quotation originally attributed to Adams can now be replaced with his exact statement as delivered in his 1837 speech.

Confirmed Quotations

#4: Supreme Court“Our laws and our institutions must necessarily be based upon and embody the teachings of the Redeemer of mankind. It is impossible

that it should be otherwise. In this sense and to this extent, our

civilizations and our institutions are emphatically Christian.”

– Supreme Court

This quotation, too, appeared in numerous modern works 15 and was identified as being a quote from the “Supreme Court.” Those who used the quote assumed that it was from the U. S. Supreme Court, but when searching the Court’s opinions, it was not found, even though it was consistent with the tone and rhetoric of the U. S. Supreme Court’s “Christian nation” decision in Church of the Holy Trinity v. United States (1892). 16 Not finding the quote in that case, the next thought was that it perhaps appeared in Supreme Court Justice David Brewer’s book subsequently written on the same subject after he had penned the language in the Court’s unanimous decision in the Holy Trinity case. While he definitely used phrases similar to this quotation, 17 it did not appear in his work. But after more than a decade of searching, this quote was finally found; and it definitely was from a ruling by a “Supreme Court” – the 1883 Illinois Supreme Court! 18 This quote is now authenticated and can be cited, providing that it is attributed to the proper court.

Confirmed Quotations

#5: Samuel Adams“A general dissolution of principles and manners will more surely overthrow the liberties of America than the whole force of the common enemy. While the people are virtuous they cannot be subdued; but when once they lose their virtue they will be ready to surrender their liberties to the first external or internal invader.”

– Samuel Adams

This quote was found in multiple modern works about the Founding Fathers and the Founding Era. 19 But because it lacked primary source documentation, this statement was held as suspect. But eventually this exact quote was found in a letter from Samuel Adams to fellow patriot James Warren on February 12, 1779, 20 and thus it has been removed from the Unconfirmed list and placed it on the Confirmed list.

Unconfirmed Quotations

#1: George Washington“It is impossible to rightly govern the world without God and the Bible.”

– George Washington

This quotation, used in numerous modern works, 21 also appeared in a number of books in the 1800s and early 1900s. 22 It is not found in any modern, critical edition of Washington’s writings, but it appears as early as 1835, when James K. Paulding (a Secretary of the Navy) reports Washington as saying:

It is impossible to account for the creation of the universe without the agency of a Supreme Being. It is impossible to govern the universe without the aid of a Supreme Being. 23

The similarity between this and the unconfirmed quotation is obvious, and a subsequent paraphrase of these words could have generated the quote in question. It is unlikely that Paulding actually heard Washington say these words, but this early record should not be lightly dismissed. And the tone and rhetoric of this currently unconfirmed quotation is consistent with Washington’s numerous statements on religion. For an extensive selection of his religious sayings, see:

- Maxims of Washington: Political, Social, Moral, and Religious, John F. Schroeder, editor (New York: D. Appleton and Company, 1855). This work has been reprinted multiple times since 1855, including by The Mount Vernon Ladies Association in 1942. However, due to unwise editorial changes made by the modern editor, John Riley, in the most recent edition, the current version is considered unreliable. We therefore highly recommend older versions.

- William J. Johnson, George Washington The Christian (New York: The Abingdon Press, 1919; reprinted in 1976 by Mott Media, and in 1992 by Christian Liberty Press).

- George Washington, The Writings of George Washington, Jared Sparks, editor (Boston: Hilliard, Gray and Co., 1837), Vol. 12, pp. 399-411, “The Religious Opinions and Habits of Washington.”

There are numerous indications of Washington’s lifelong conviction concerning the inseparability of God, and specifically Christianity, from both private and public life. Notice some of the many examples in which he expressed this belief:

To his brother-in-law:

I was favored with your epistle [letter] wrote on a certain 25th of July when you ought to have been at church, praying as becomes every good Christian man who has as much to answer for as you have. Strange it is that you will be so blind to truth that the enlightening sounds of the Gospel cannot reach your ear, nor no examples awaken you to a sense of goodness. Could you but behold with what religious zeal I hye [i.e., hie – that is, hasten] me to church on every Lord’s Day, it would do your heart good, and fill it, I hope, with equal fervency. 24

To his military troops:

While we are zealously performing the duties of good citizens and soldiers, we certainly ought not to be inattentive to the higher duties of religion. To the distinguished character of Patriot, it should be our highest glory to add the more distinguished character of Christian. 25

To a church:

I readily join with you, that “while just government protects all in their religious rights, true religion affords to government its surest support.” 26

To the nation:

Of all the dispositions and habits which lead to political prosperity, religion and morality are indispensable supports. In vain would that man claim the tribute of patriotism who should labor to subvert these great pillars of human happiness – these firmest props of the duties of man and citizens. The mere politician, equally with the pious man, ought to respect and to cherish them. A volume could not trace all their connections with private and public felicity. 27

There is certainly abundant evidence to support thesis of the quotation in question as generally consistent with Washington’s beliefs, although the exact wording of this quotation currently remains unconfirmed.

Unconfirmed Quotations

#2: Patrick Henry“It cannot be emphasized too strongly or too often that this great

nation was founded, not by religionists, but by Christians;

not on religions, but on the gospel of Jesus Christ!”

– Patrick Henry

This quote, which has been utilized in numerous works over recent decades; 28 seems to have first appeared in The Virginia magazine in 1956. 29 Few could dispute that this quotation is consistent with Henry’s life and character.

Henry’s dedication to the Christian faith, and even his use of what today would be considered evangelical rhetoric, is seen repeatedly throughout his life. For example, on one occasion when attacked by critics who attempted to weaken his standing by publicly diminishing his religiosity, he told his daughter:

Amongt other strange things said of me, I hear it is said by the deists that I am one of their number; and, indeed, that some good people think I am no Christian. This thought gives me much more pain than the appellation of Tory [i.e., being called a traitor]; because I think religion of infinitely higher importance than politics; and I find much cause to reproach myself that I have lived so long and have given no decided and public proofs of my being a Christian. But, indeed, my dear child, this is a character which I prize far above all this world has, or can boast. 30

Henry repeatedly demonstrated his firm commitment to Christianity. For example, not only did he distribute Soame Jennings’ 1776 book, View of the Internal Evidence of Christianity 31 but he also made clear that he “looked to the restraining and elevating principles of Christianity as the hope of his country’s institutions.” 32 And when Thomas Paine penned his Age of Reason attacking religion in general and Christianity and the Bible in particular, Henry wrote a refutation of what he described as “the puny efforts of Paine.” 33 But after reading Bishop Richard Watson’s Apology for the Bible written against Paine, Henry deemed that work sufficient and decided not to publish his own. 34

When Henry passed away in 1799, his personal legal documents and his will were opened and publicly read by his executors. Included with his will was an original copy of the 1765 Stamp Act Resolutions (early precursors to the American Revolution) passed by the Virginia Legislature, of which Henry had been a member. On the back of those resolutions Henry penned a handwritten message, knowing it would be read at his death. He recounted the early colonial resistance to British policy that eventually resulted in the American Revolution, and then concluded with this warning:

Whether this [the American War for Independence] will prove a blessing or a curse will depend upon the use our people make of the blessings which a gracious God hath bestowed on us. If they are wise, they will be great and happy. If they are of a contrary character, they will be miserable. Righteousness alone can exalt them as a nation [Proverbs 14:34]. Reader! – whoever thou art, remember this! – and in thy sphere practice virtue thyself and encourage it in others. P. Henry 35

And in his will, after having dispersed his earthy possessions to his family, he told them:

This is all the inheritance I can give my dear family. The religion of Christ can give them one which will make them rich indeed. 36

There are many similar quotes; so while the specific statement above is currently unconfirmed, it is certainly consistent with the tone and rhetoric of other of Henry’s declarations about Christianity.

—

Unconfirmed Quotations

#3: James Madison“We have staked the whole future of American

civilization, not upon the power of government, far from it.

We have staked the future of all of our political institutions

upon the capacity of each and all of us to govern ourselves . . .

according to the Ten Commandments of God.”

– James Madison

This quotation, like the others in this list, has been used in numerous modern works as well as works dating back to 1939. 37 These words have not been found in any of Madison’s writings. However, the key thought of the necessity of individual self-government according to a Biblical standard is reflective of Madison’s expressed beliefs.

For example, in Federalist #39, Madison speaks of “that honorable determination which animates every votary of freedom to rest all our political experiments on the capacity of mankind for self-government.” 38 He also spoke of Christianity as “the religion which we believe to be of Divine origin” 39 and as “the best and purest religion.” 40 It is consistent that he would favorably view God’s standards as the measure for the governance and guidance of society. In fact, he declared:

[T]he belief in a God All-Powerful, wise, and good is so essential to the moral order of the world and to the happiness of man that arguments which enforce it cannot be drawn from too many sources nor adapted with too much solicitude to the different characters and capacities to be impressed with it. 41

Despite other quotations consistent with the emphasis of the one in question above, this specific quotation remains unconfirmed, and it should not be used unless it can be verified in an original primary source document.

SummaryChristians, of all people, should be known for their honesty. In David’s early works on religion and the Founders, he used quotations that he had every reason to believe were accurate. When he began to have questions about the validity of a few of these quotations, he publically acknowledged that they may not be accurate. Since 1996 he has been able to confirm some of these quotations, and has ceased to use those that he has not been able to confirm.

As the historical debates continue over the relation of church and state and the faith of the Founding Fathers, all involved should pursue the highest standard of scholarship. Anyone writing on this subject is encouraged to document their sources, and to always take quotations from primary rather than secondary sources.

Endnotes

1. See, for instance, Mark A. Noll, Nathan O. Hatch, and George M. Marsden, The Search for Christian America (Westchester: Crossway Books, 1983), passim and especially p. 73 (citing various secondary source to support the profoundly erroneous assertion that “The God of the founding fathers was a benevolent deity, not far removed from the God of eighteenth-century Deists or nineteenth century Unitarians.”); John Fea, Was America Founded as a Christian Nation: A Historical Introduction (Louisville: Westminster John Knox Press, 2011),118-19, 258 (quoting John Calvin from Gregg Frazer’s 2004 doctoral dissertation rather than the readily available Institutes of the Christian Religion); and, worst of all, Isaac Kramnick and R. Laurence Moore, The Godless Constitution: The Case Against Religious Correctness (New York: W.W. Norton, 1996) (within which the authors do not feel compelled to cite any sources whatsoever!).

2. From a hostile written review of David Barton and WallBuilders written by Gregg Frazer at the request of Jay Richards. That written critique was subsequently passed on to David Barton on August 13, 2012, by the Rev. James Robison, to whom Jay Richards had distributed it.

3. See, for example, Peter Marshall and David Manuel, The Light and the Glory (NJ: Fleming H. Revell Co., 1977), p. 370; Stephen McDowell, America’s Providential History (Charlottesville, VA: Providence Foundation, 1989), p. 1;William Federer, America’s God and Country: Encyclopedia of Quotations (Coppell, TX: Fame Publishing, Inc., 1994), p. 246; Martin H. Manser, Westminster Collection of Christian Quotations (Westminster: John Knox Press, 2001), p. 151; Classics of American Political and Constitutional Thought, Scott J. Hammond, Kevin R. Hardwick, Howard L. Lubert, editors (Indianapolis: Hackett Publishing Company, 2007), Vol. II, p. 228.

4. George Bancroft, History of the United States, From the Discovery of the American Continent (Boston: Little, Brown and Company, 1866), Vol. IX, p. 492.

5. See, for example, Benjamin Franklin, Two Tracts: Information to Those Who Would Remove to America. And, Remarks Concerning the Savages of North America (London: 1784), pp. 3-24, “Information to Those Who Would Remove to America.”

6. M. Mallet Du Pan, Considerations on the Nature of the French Revolution, and on the Causes which Prolong its Duration Translated from the French(London: J. Owen, 1793), p. 31.

7. The original reads: “Francklin répéta plus d’une fois à ses éleves de Paris, que celui qui transporteroit dans l’état politique les principes du christianisme primitif, changeroit la face de la société.” Jacques Mallet du Pan, Considerations Sur La Nature De La Révolution De France (Londres: Chez Emm. Flon, 1793), 28.

8. See, for example, Stephen McDowell, America’s Providential History (Charlottesville, VA: Providence Foundation, 1989), p. 178; John Vernon McGee, Thru the Bible (Nashville, TN: Thomas Nelson, 1991; originally printed in 1975), no page number; Dag Heward-Mills, BASIC Theology (Florida: Xulon Press, 2011), p. 29.

9. Homage of Eminent Persons to The Book, Samuel W. Bailey, editor (New York: Rand, Avery, & Frye, 1869), p. 67.

10. See, for example, Joseph Banvard, Daniel Webster: His Life and Public Services (Chicago: The Werner Co, 1895), pp. 131-132.

11. Daniel Webster, The Writings and Speeches of Daniel Webster Hitherto Uncollected (Boston: Little, Brown, & Company, 1903), Vol. IV, pp. 656-657, to Professor Pease on June 15, 1852; originally appearing in The National Magazine: Devoted to Literature, Art, and Religion. July to December, 1858, James Floy, editor (New York: Carolton & Porter, 1858), Vol. XIII, August, 1858, pp. 178-179.

12. See, for example, Stephen McDowell, America’s Providential History (Charlottesville, VA: Providence Foundation, 1989), p. 146; William Federer, America’s God and Country: Encyclopedia of Quotations (Coppell, TX: Fame Publishing, Inc., 1994), p. 18; William Federer, Treasury of Presidential Quotes (St. Louis, MO: Amerisearch, 2004), p. 459; D. James Kennedy and Jerry Newcombe, How Would Jesus Vote? A Christian Perspective on the Issues (New York: Random House, 2010), p. 28.

13. John Wingate Thornton, The Pulpit of the American Revolution (Boston: Gould And Lincoln, 1860), p. xxix.

14. John Quincy Adams, An Oration Delivered Before the Inhabitants of the Town of Newburyport, at Their Request, on the Sixty-first Anniversary of the Declaration of Independence, July 4th, 1837(Newburyport: Charles Whipple, 1837), pp. 5-6.

15. See, for example, Stephen McDowell, America’s Providential History (Charlottesville, VA: Providence Foundation, 1989), p. 178; William Federer, America’s God and Country: Encyclopedia of Quotations (Coppell, TX: Fame Publishing, Inc., 1994), p. 72; Joseph P. Hester, Ten Commandments: A Handbook of Religious, Legal and Social Issues(Jefferson, NC: McFarland & Company, 2002), p. 138l.

16. For example, “These, and many other matters which might be noticed, add a volume of unofficial declarations to the mass of organic utterances that this is a Christian nation.” Church of the Holy Trinity v. United States, 143 U. S. 457, 471 (1892).

17. Justice David J. Brewer, author of the 1892 Holy Trinity opinion, wrote a 1905 book, The United States: A Christian Nation. Brewer opened his work with these words: “This republic [the United States] is classified among the Christian nations of the world. It was so formally declared by the Supreme Court of the United States. . . . Nevertheless, we constantly speak of this republic as a Christian nation – in fact, as the leading Christian nation of the world.” David J. Brewer, The United States A Christian Nation (Philadelphia: John C. Winston Company, 1905), pp. 11-12.

18. Richmond v. Moore, 107 Ill. 429, 1883 WL 10319 (Ill.), 47 Am.Rep. 445 (Ill. 1883).

19. See, for example, Stephen McDowell, America’s Providential History (Charlottesville, VA: Providence Foundation, 1989), p. 179; Stephen McDowell and Mark Beliles, Liberating the Nations: Biblical Principles of Government, Education, Economics, & Politics (Charlottesville, VA: Providence Foundation, 1995), p. 14; William Federer, America’s God and Country: Encyclopedia of Quotations (Coppell, TX: Fame Publishing, Inc., 1994), p. 23; Peter Marshall and David B. Manuel, Jr., The Light and the Glory: 1492-1793 (Grand Rapids, MI: Fleming H. Revell, 1977; revised 2009), p. 11; Ira Stoll, Samuel Adams: A Life (New York: Simon and Schuster, 2008), p. 203.

20. Samuel Adams, The Writings of Samuel Adams, Harry Alonzo Cushing, editor (New York: G. P. Putnam’s Sons, 1905), Vol. IV, p. 124, to James Warren on February 12, 1779.

21. See, for example, William J. Federer, America’s God and Country: Encyclopedia of Quotations(Coppell, TX: Fame Publishing Inc., 1994), p. 660; Henry H. Halley, Halley’s Bible Handbook (Grand Rapids: Zondervan, 2008; originally printed 1927), p. 18, “Notable Sayings About the Bible”; Martin H. Manser, Westminster Collection of Christian Quotations (Westminster: John Knox Press, 2001) p. 152.

22. See, for example, Howard H. Russell, A Lawyer’s Examination of the Bible (New York: Fleming H. Revell, 1893), p. 40, The Bible in New York. A Quarterly Review of the New York Bible Society (New York: November 1910), Vol. III, No. 9, p. 8, “What Some Men Have Said About the Bible,” Samuel Strahl Lappin, The Training of the Church: A Series of Thirty-Five Lessons Designed to Aid Those Who Would Know More, Do More and Be More in the Services of Jesus Christ (Cincinnati: Standard Publishing Company, 1911), p. 26, The Bible Champion, Jay Benson Hamilton, editor (New York: Bible League of North America, 1914), Vol. XVII, No. 2, February 1914, p. 85, Thomas M. Iden, The Upper Room Bulleton: 1920-1921 (Ann Arbor, MI: Ann Arbor Press, 1921), Vol. VII, No. 3, October 23, 1920, p. 35,”United States Presidents and the Bible,” John Calvin Leonard, Herald and Presbyter (Cincinnati: 1921), Vol. XCII, No. 38, September 21, 1921, p. 3.

23. James K. Paulding, A Life of Washington (New York: Harper & Brothers, 1835), Vol. II, p. 209.

24. George Washington, The Writings of George Washington, John C. Fitzpatrick, editor (Washington, D. C.: U. S. Government Printing Office, 1940), Vol. 37, p. 484, to Burwell Bassett, August 28, 1762.

25. George Washington, The Writings of George Washington, John C. Fitzpatrick, editor (Washington, D. C.: U. S. Government Printing Office, 1934), Vol. 11, pp. 342-343, General Orders of May 2, 1778.

26. George Washington, The Writings of George Washington, John C. Fitzpatrick, editor (Washington, D. C.: U. S. Government Printing Office, 1939), Vol. 30, p. 432 n., from his address to the Synod of the Dutch Reformed Church in North America in October, 1789.

27. George Washington, Address of George Washington, President of the United States . . . Preparatory to His Declination (Baltimore: George and Henry S. Keatinge, 1796), pp. 22-23.

28. See, for example, Stephen McDowell, America’s Providential History (Charlottesville, VA: Providence Foundation, 1989), p. 184; William Federer, America’s God and Country: Encyclopedia of Quotations (Coppell, TX: Fame Publishing, Inc., 1994), p. 289; Joseph P. Hester, The Ten Commandments: A Handbook of Religious, Legal and Social Issues (NC: McFarland & Company, Inc., 2003), p. 137; Newt Gingrich, Vince Haley, A Nation Like No Other: Why American Exceptionalism Matters(Houston: Regency Publishing, 2011), p. 76.

29. See, for example, information at Snopes.com.

30. S. G. Arnold, The Life of Patrick Henry (Auburn: Miller, Orton & Mulligan, 1854), p. 250, to his daughter Betsy on August 20, 1796.

31. Patrick Henry, Life, Correspondence and Speeches, William Wirt Henry, editor (New York: Charles Scribner’s Sons, 1891), Vol. II, p. 490.

32. Patrick Henry, Life, Correspondence and Speeches, William Wirt Henry, editor (New York: Charles Scribner’s Sons, 1891), Vol. II, p. 621.

33. S. G. Arnold, The Life of Patrick Henry of Virginia(Auburn and Buffalo: Miller, Orton and Mulligan, 1854), p. 250, to his daughter Betsy on August 20, 1796.

34. George Morgan, The True Patrick Henry(Philadelphia: J. B. Lippincott Company, 1907), p. 366 n. See also, Bishop William Meade, Old Churches, Ministers, and Families of Virginia (Philadelphia: J. B. Lippincott Company, 1857), Vol. II, p. 12.

35. Patrick Henry, Patrick Henry: Life, Correspondence and Speeches, William Wirt Henry, editor (New York: Charles Scribner’s Sons, 1891), Vol. I, pp. 81-82, from a handwritten endorsement on the back of the paper containing the resolutions of the Virginia Assembly in 1765 concerning the Stamp Act.

36. From a copy of Henry’s Last Will and Testament, dated November 20, 1798, obtained from Patrick Henry Memorial Foundation, Red Hill, Brookneal, VA.

37. See, for example, Harold K. Lane, Liberty! Cry Liberty! (Boston: Lamb and Lamb Tractarian Society, 1939), pp. 32-33; Frederick Nyneyer, First Principles in Morality and Economics: Neighborly Love and Ricardo’s Law of Association (South Holland; Libertarian Press, 1958), p. 31; Rus Walton, Biblical Principles of Importance to Godly Christians (New Hampshire: Plymouth Rock Foundation, 1984), p. 361; Stephen McDowell and Mark Beliles, Principles for the Reformation of the Nations (Charlottesville: Providence Press, 1988), p. 102; Stephen McDowell and Mark Beliles, The Spirit of the Constitution(Charlottesville: Providence Press, n.d.); Stephen McDowell and Mark Beliles, America’s Providential History (Charlottesville: Providence Press, 1989), pp. 263-264; William Federer, America’s God and Country: Encyclopedia of Quotations (Coppell, TX: Fame Publishing, Inc., 1994), p. 411; Gary DeMar, God and Government: A Biblical and Historical Study(Atlanta: American Vision Press, 1982), Vol. 1, pp. 137-138.

38. Alexander Hamilton, John Jay, and James Madison, The Federalist, on the New Constitution Written in 1788 (Philadelphia: Benjamin Warner, 1818), pp. 203-204, James Madison, Number 39.

39. James Madison, A Memorial and Remonstrance, on the Religious Rights of Man; Written in 1784-5, At the Request of the Religious Society of Baptists in Virginia(Washington City: S. C Ustick, 1828), pp. 5-6.

40. Religion and Politics in the Early Republic: Jasper Adams and the Churc

By WallBuilders|December 29th, 2016|Categories: Issues and Articles|0 Comments

3 Of 5 / The Bible’s Influence In America / American

Heritage Series / David Barton

4 Of 5 / The Bible’s Influence In America / American Heritage Series / David Barton

5 Of 5 / The Bible’s Influence In America / American Heritage Series / David Barton

__________________________________________

3 Of 3 / Faith Of The Founding Fathers / American Heritage Series / David Barton

________________Many inauthentic quotes attributed to the Founding Fathers have been in circulation for much of the 20th century. These are still being used frequently, especially by those in the religious right.

Fortunately we have many of the letters, diaries, and notes written by the Founding Fathers. Thomas Jefferson wrote many letters daily. John Quincy Adams wrote in his diary every day for 18 years straight. During the 1787 Constitutional Convention, James Madison wrote notes in shorthand which he converted into longhand every night. Newspapers of the day are also a good source. Actually, George Washington’s farewell Presidential Address in 1796 was only a newspaper article. In sum, our prolific Founders left us with many sources of material.

Misquotes

If one quotes the actual words of a Founding Father but does not give the context, then he is guilty of misquoting.

John Adams (1735-1826) “This would be the best of all possible worlds if there were no religion in it.”

John George and Paul Boller, Jr. in their book They Never Said It set the record straight:

Adams did indeed make the statement, but only to repudiate it. In a letter to Thomas Jefferson about religion on April 19, 1817, he mentioned reading some polemical books that reminded him of the way his boyhood minister, Lemuel Bryant, and his Latin schoolmaster, Joseph Cleverly, used to argue ad nausea about religion, and he told Jefferson: “Twenty times, in the course of my late reading, have I been on the point of breaking out, ‘this would be the best of all possible worlds, if there were no religion in it!!!!’ But in this exclamation, I should have been as fanatical as Bryant or Cleverly. Without religion, this world would be something not fit to be mentioned in public company–I mean hell.”

Benjamin Franklin (1706-1790) “I therefore beg leave to move–that henceforth prayers imploring the assistance of Heaven, and its blessing on our deliberations, be held in this assembly every morning before we proceed to business, and that one or more of the clergy of this city be requested to officiate in that article.”

This is exactly what Franklin said at the 1787 Constitutional Convention in Philadelphia. However, many in the religious right ignore that fact that his motion was tabled and never voted on. For instance, Tal Brooke comments, “It was Benjamin Franklin who called the Constitutional Convention to prayer with a powerful statement of their debt to God. As mere men, they could not presume to undertake so great a task without petitioning Him for guidance. America abounds with Christian evidences from its earliest days.”

Actually this version of the Franklin prayer motion originated with a letter written in September of 1825 from William Steele to his son, Jonathan. The letter told about William’s recollection of a conversation with General Jonathan Dayton, a member of the Constitutional Convention. This incorrect account later appeared in the National Intelligencer, and other sources as well. According to Steele, Dayton recalled that “the motion for appointing a chaplain was instantly seconded and carried.” However, James Madison in a letter to Thomas S. Grimke (January 6, 1834) stated that Franklin’s “proposition was received and treated with the respect due to it; but the lapse of time which had preceded, with consternations growing out of it, had the effect of limiting what was done, to a reference of the proposition to a highly respectable Committee… That the communication [Steele’s account of Dayton testimony] was erroneous is certain; whether from misapprehension or misrecollection, uncertain.”

We should learn a lesson from James Madison. It is one thing to correct a person who is mistaken about historical details, but it is quite another to accuse someone of intentionally fabricating a story. Note that Madison stopped short of doing the latter.

Fake Quotes

A fake quote is an inauthentic quote attributed to a Founding Father. The late Robert S. Alley, former professor at the University of Richmond has rightly stated that “proving that a quotation does not exist is a daunting task…” However, evidence exists that proves beyond a reasonable doubt that the following quote is not authentic.

James Madison (1751-1836) “Religion …[is] the basis and foundation of government.”

This fake quote is taken from Madison’s Memorial and Remonstrance. The subject in this sentence is not “Religion,” but actually the “Declaration of those rights ‘which pertain to the good people of Virginia.'” Nevertheless, this inauthentic quote has been circulated for many years.

Disputed Quotes

A disputed quote may actually be authentic, but no primary source has been found. Some scholars would put the following two quotes in the previous category of “Fake Quotes” while other scholars may hold out hope that a primary source will be found.

James Madison (1751-1836) “We have staked the whole future of American civilization, not upon the power of government, far from it. We have staked the future of all of our political institutions upon the capacity of each and all of us to govern ourselves…according to the Ten Commandments of God.”

Possibly this quote was originally given by Bishop James Madison (a cousin) or from James Madison’s father, James Madison, Sr., but this is pure speculation. There is always a distant chance that a quote could turn up from a primary source that was found in someone’s attic. In fact, a primary document from James Madison surfaced as late as 1946, but don’t hold your breath till that happens again. The fact remains that there is not a shred of evidence that links James Madison to this quote. Moreover, Paul F. Boller, Jr. in a personal letter to me stated, “The Madison quote about the Ten Commandments sounds un-Madisonian. I’ve read a lot of Madison, and I know he didn’t express himself that way…Sometimes the questionable quote can’t be found in any of the writings that have survived of the person who is supposed to have made the statement. The Madison quote doesn’t appear in any of Madison’s writings.”

Christian apologist Gary DeMar wrote concerning his research concerning the quote:

I credited this quotation to Madison in the first edition of the first volume of God and Government. Nearly every book written by a Christian author to support the Christian America thesis claims Madison as the quotation’s author. I have searched in vain for the quotation’s original source. American Vision even contacted a Madison scholar for help. He was not familiar with the quotation. Further study led me to the January 1958 calendar published by Spiritual Mobilization. What was Spiritual Mobilization’s source for the quotation? None was listed. Additional detective work led me to another James Madison, a cousin of President Madison. Madison served as president of William and Mary College and was the first Protestant Episcopal bishop of Virginia. Is he the source of the quotation? Very possibly. Christians should stop attributing of the quotation to President James Madison until we find out.

It is my opinion that this disputed quote attributed to Madison has been the one used more than any other by the religious right. This is probably due to the fact that the Supreme Court banned the display of the Ten Commandments in the public school rooms in the case Stone v. Graham in 1980.

George Washington (1732-1799) “It is impossible to rightly govern the world without God and the Bible.”

Several years ago, I was guilty of using this disputed quote, and the late Professor John George of the University of Central Oklahoma, Political Science Department, told me that there is not a shred of evidence to link Washington to this quote. Professor George was a leading expert on this subject, and he co-authored They Never Said It: A Book of Fake Quotes, Misquotes, and Misleading Attributions with Paul F. Boller, Jr. of Texas Christian University.

I had copied this disputed quote off of a bumper sticker that my friend from church had on his truck. However, I was surprised at my friend’s reaction when I told him he should remove his sticker. He said, “Is Professor George a Christian? If not then he probably has an axe to grind.” I later discovered that Professor George had corrected many atheists too. Nevertheless, I tried to find someone in the religious right who also had some knowledge on the subject.

So I called up the company that specialized at putting out bumper stickers with quotes from the Founding Fathers dealing with God. The owner of the company actually spent a whole year researching the Washington quote and he said he concluded that Washington did not say it. He commented, “Washington did not talk that way. He did not use the word ‘Bible’ any that I can remember, and I believe, I have read everything available that Washington wrote.”

This fellow was a Christian lawyer, and he said he could no longer sell the Washington bumper sticker even though it made up 90% of his sales. Again I went back to my friend, but he replied, “That fellow is not a historian. David Barton has studied the history of the founding fathers for over 20 years. I have a lot of respect for Barton.”

Then I contacted Barton’s organization, Wallbuilders Inc of Aledo, Texas. They mailed me the “Unconfirmed or Questionable Quote” list and it featured the Washington quote. Furthermore, it recommended not using this quote until it is authenticated.

When confronted with this opinion from Barton my friend responded, “I am not going to take my bumper sticker off until I have an explanation of how the quote could have possibly been mistakenly attributed to Washington in the first place.”

Then I received a few weeks later an updated “Unconfirmed Quote” list from Wallbuilders, and under the Washington disputed quote is this explanation:

There is a very real possibility that the quotation has its origin in an 1835 biography by James K. Paulding. In a description of Washington’s character, with supporting quotations, Paulding declares Washington to have said, “It is impossible to account for the creation of the universe without the agency of a Supreme Being. It is impossible to govern the universe without the aid of a Supreme Being.” The similarities are obvious; a paraphrase of these quotes could have easily generated the words in question. However, we have not been able to trace Paulding’s cite to a more scholarly reference. He offers no footnotes.

I thought my friend would finally back down when I showed him this evidence, but I was about to learn something about human nature. I explained to him that this quote originated around 1835 when someone read Paulding’s book A Life of Washington. This is because it contained another unconfirmed quote of Washington which also had the words “impossible” and “govern.” Obviously a paraphrase took place at that time. My friend replied, “Are you 100% sure it is a bad quote? If not then I am going to continue to use it!”

Needless to say I have learned a lot about people’s tendency to ignore evidence when it goes against their presuppositions. Furthermore, I have quit trying to convince my friend that a disputed quote should be shelved until it is authenticated. He truly believes if Washington were here today he would say it now even if he didn’t say it the first time.

Everette Hatcher is a businessman in Little Rock, and his blog is www.thedailyhatch.org . He is a conservative Republican and he has confronted over 30 religious right authors over their misuse of disputed quotes. (The article above has been recommended by unlikely advocates such as the atheist Farrell Till of the Skepitcal Review.)

(Update: You will notice above in the section labeled “Fake Quotes” that I linked a comment by the late Dr. Robert Alley to an article by Rob Boston of Americans United published in 1996. I posted earlier how I was the source for the two articles that Rob Boston wrote on David Barton but unfortunately he implied that Barton made up these quotes. Fortunately I was given the opportunity to set the record straight in The Freedom Writer.

Later I got several board members of Americans United to contact Boston on my behalf and voice their opinion of how unfair Boston had been to Barton in his article “Consumer Alert”. On March 7, 1997, I spoke with Barry Lynn the executive director of Americans United. Lynn was very gracious on the phone and promised to consider an article from me in response to the slanted “Consumer Alert” article Boston had written earlier. Americans United board member Dr. Paul Simmons of Louisville helped me write the aritcle, but ultimately it was never published until today.)

:max_bytes(150000):strip_icc()/usdebtbypresidentnewimage-9e919ca2f1344875a671e38b091cc49d.jpg)