Milton Friedman – Public Schools / Voucher System

Published on May 9, 2012 by BasicEconomics

Salter: It’s time for Texas to embrace school choice

The movement to give parents control over their childrens’ education is picking up steam. Iowa Gov. Kim Reynolds recently supported primary challengers to lawmakers from her own party because the incumbents opposed educational freedom. In Arizona, Gov. Doug Ducey just signed a transformative education bill, making all children K-12 eligible for $6,500 in scholarship funds. Now it’s Texas’s turn. Legislators should make funding students instead of systems a major goal in 2023.

School choice is a transformative policy that helps parents get a top-notch education for their children. By allowing funding to follow students, families can pick the options that best fit their unique circumstances. Vouchers and education savings accounts (ESAs) are good examples. Vouchers cover tuition at approved schools. ESAs are broader: The money can be used for a host of education-related expenses, such as tutoring and counseling. Either would be a welcome support for Texas families.

Direct student funding is not a new idea. Milton Friedman, the Nobel Prize-winning economist and one of the most influential thinkers of the 20th century, popularized school choice in the 1980s. Despite its potential, for a long time there was only limited experimentation with vouchers and other choice-enhancing projects, such as charter schools. Special interest groups, such as teachers’ unions, strongly opposed school choice. Good policy isn’t always good politics.

The coronavirus pandemic changed everything. Across the country, schools canceled in-person learning, placing huge burdens on children and working parents. Students suffered from diminished learning and social isolation. The remote lessons, which parents saw up-close for the first time, focused too much on cultural politics and not enough on core skills in reading, writing, and math. When families tried to voice their disapproval at school board meetings, they were often ridiculed. Small wonder they’re fed up with status-quo schooling.

In Virginia, Glenn Younkin unexpectedly won the governorship largely due to his opponent’s hostility to parents. Even in hyper-progressive San Francisco, three school board members were recalled by frustrated families. Everywhere the school choice movement picked up momentum. Flash forward to today: School choice is a winning issue for politicians, both right-wing and left-wing, who support a pro-family agenda.

School choice fits nicely with Texans’ support for educational equality. The Texas Constitution requires the government to provide free schooling, but not to build and run the schools itself. No less an authority than the Texas Supreme Court holds that the government satisfies its constitutional obligation by providing the necessary resources. Give parents the funds they need and all Texas schoolchildren can have a great education.

School choice is a fine idea in theory. But does it work in practice? The evidence is clear: It does. Researchers have published many studies on school choice over the years. When addressing policy-relevant questions, it’s important to consider the entire body of evidence, not just one or two papers in isolation. Anyone can cherry-pick studies to find results they like. What matters is the overall picture. And for school choice, the overall picture looks pretty good. Out of 17 important studies, 11 found school choice increased some or all students’ math and reading scores. Only two found a negative effect.

Educational achievement isn’t the only benefit of school choice. It also improves academic outcomes in existing public schools, saves taxpayers money, reduces crime, and bolsters racial integration. Each of these findings is supported by a preponderance of the evidence in a well-established scholarly literature.

Texans, don’t let the school choice movement pass us by. We have a once-in-a-generation opportunity to make sure all students get the education they deserve. The system we have now is discriminatory: the rich, who can afford private-school tuition, already have school choice, while the poor are trapped in underperforming schools. We can fix this by funding students directly. Here’s hoping legislators make school choice happen in 2023.

Alexander William Salter is the Georgie G. Snyder Associate Professor of Economics in the Rawls College of Business at Texas Tech University, the Comparative Economics Research Fellow at TTU’s Free Market Institute, and a community member of the Lubbock Avalanche-Journal’s editorial board. The views in this piece are solely his own.

Milton Friedman, School Choice Pioneer

As our new School Choice Timeline shows, calls for public funding to follow students to a variety of educational options date back centuries. However, Nobel Prize‐winning economist Milton Friedman is often considered the father of the modern school choice movement.

In a 1955 essay, The Role of Government in Education, Friedman acknowledged some justifications for government mandates and funding when it comes to education. However, he said it’s difficult to justify government administration of education. He suggested governments could provide parents with vouchers worth a specified maximum sum per child per year to be spent on “approved” educational services.

Friedman would return to this idea repeatedly over the years in his writings and his popular Free to Choose television series. But he did more than just write and talk about his idea. In 1996, he and his wife Rose, who was also a noted economist, started the Milton and Rose D. Friedman Foundation for Educational Choice. Their original plan included the eventual removal of their name from the foundation, which happened in 2016; the organization is now known as EdChoice and is the go‐to source for up‐to‐date information on school choice in America.

Milton Friedman had a remarkable life. He was born in Brooklyn in 1912 to parents who emigrated to the U.S. from eastern Europe. His father died during his senior year in high school, leaving his mother and older sisters to support the family. He managed to attend Rutgers University through a combination of scholarships and various jobs. After earning a degree in economics, he was awarded a scholarship to pursue a graduate degree at the University of Chicago, where he met his future wife, Rose. The Friedmans had two children, a son and a daughter.

Friedman’s list of accomplishments is astonishingly long. In addition to his 1976 Nobel Prize for Economic Science, he was awarded the Presidential Medal of Freedom and the National Medal of Science in 1988. He was a Senior Research Fellow at Stanford University’s Hoover Institution from 1977 to 2006, a distinguished economics professor at the University of Chicago from 1946 to 1976, and a researcher at the National Bureau of Economic Research from 1937 to 1981. He was a prolific writer of newspaper and magazine columns, essays, and books.

Milton Friedman’s focus on education choice made perfect sense in light of his other work. He had a consistent focus on preserving and expanding individual freedom. He saw parental control and the ability to choose the environment that worked best for individual children as essential to a quality education. His 1962 book Capitalism and Freedom included chapters on economic and political freedom, trade, fiscal policy, occupational licenses, and poverty, along with his earlier essay on the role of government in education.

In 1980, Milton and Rose released Free to Choose, a discussion of economics and freedom, as a book and a television series. One segment/chapter asked, “What’s Wrong with Our Schools?” and then explained the importance of parents being able to choose what works for their individual children.

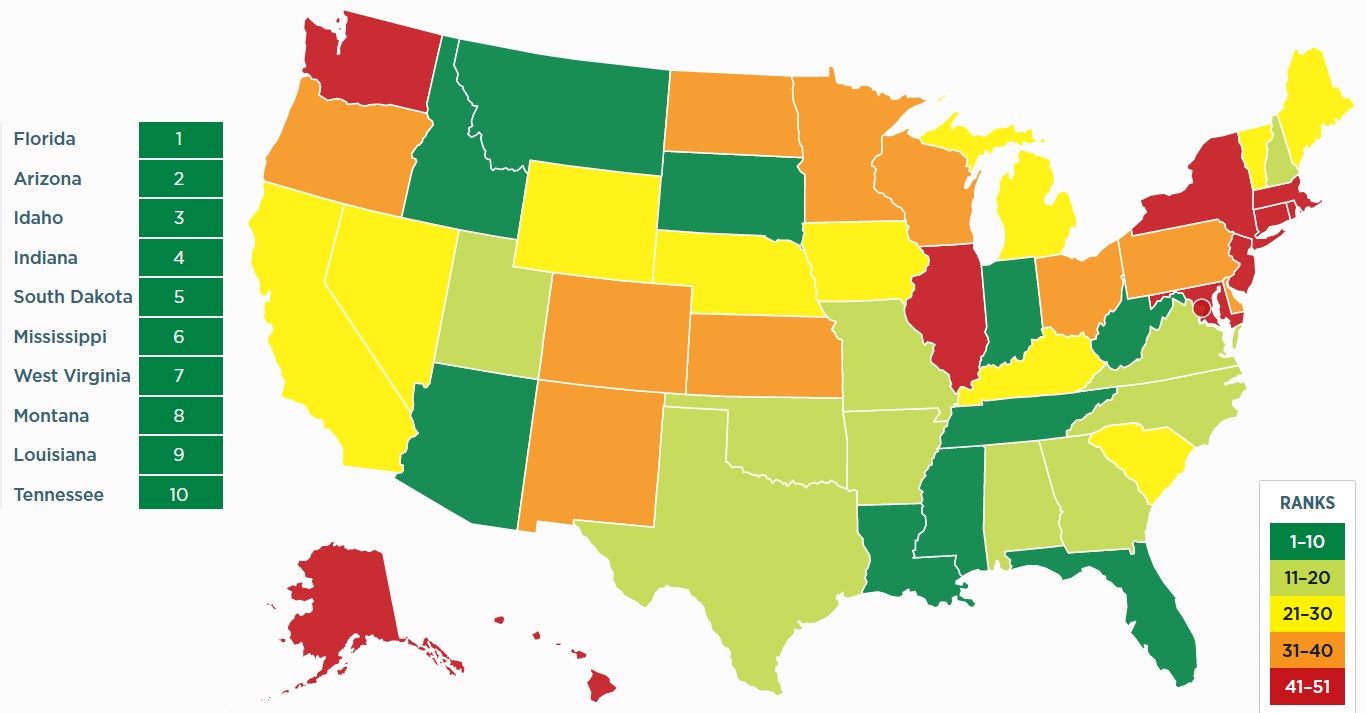

When the Friedman Foundation was launched, there were five education choice programs in the U.S. with fewer than 10,000 students participating. Today, according to EdChoice, there are 74 programs in 32 states, Washington, D.C., and Puerto Rico, with 670,000 students participating.

While there is a long and deep history of individuals and organizations calling for various forms of school choice, it is clear that Milton Friedman played an enormous role in its advance in the U.S. He helped lay the intellectual groundwork for the programs in place today, and his relatable writings and videos helped explain his ideas to parents, policymakers, and thought leaders. As we celebrate National School Choice Week—and Cato’s new School Choice Timeline—it’s a great time to commemorate Milton Friedman’s important contributions to the movement.

The School Choice Revolution

It’s time to celebrate another victory for school choice.

In 2021, West Virginia adopted statewide school choice.

In 2021, West Virginia adopted statewide school choice.- In 2022, Arizona adopted statewide school choice.

- In 2023, Iowa adopted statewide school choice.

Now Utah has joined the club, with Governor Spencer Cox approving a new law that will give families greater freedom to choose the best educational options for their children.

Here are some details from , reporting for the Deseret News.

The Utah Senate gave final passage to legislation that will provide $8,000 scholarships to qualifying families for private schools and other private education options…

The bill passed by a two-thirds margin in each legislative house, which means it cannot be challenged by referendum. …The bill creates the Utah Fits All Scholarship, which can then be used for education expenses like curriculum, textbooks, education, software, tutoring services, micro-school teacher salaries and private school tuition.

As you might expect, teacher unions and their allies are very disappointed – which is a very positive sign.

…the Utah Education Association…opposed HB215… The bill was also opposed by the Utah State Board of Education, Utah PTA, school superintendents, business administrators and school boards. The Alliance for a Better Utah was pointed in its reaction… “Conservative lawmakers just robbed our neighborhood schools of $42 million. Private school vouchers have been and continue to be opposed by Utahns but these lawmakers are instead pursuing a national agenda to ‘destroy public education.’

The Wall Street Journal opined on this great development.

School choice is gaining momentum across the country, and this week Utah joined Iowa in advancing the education reform cause. …Utah’s bill,

which the Senate passed Thursday, 20-8, makes ESAs of $8,000 available to every student. There’s no income cap on families who can apply, though lower-income families receive preference and the program is capped at $42 million. The funds can be used for private school tuition, home-schooling expenses, tutoring, and more.

But the best part of the editorial is the look at other states that may be poised to expand educational freedom.

About a dozen other state legislatures have introduced bills to create new ESA programs, and several want to expand the ones they have. In Florida a Republican proposal would extend the state’s already robust scholarship programs to any student in the state. The bill would remove income limits that are currently in place for families who want to apply, though lower-income applicants would receive priority. …South Carolina legislators are mulling a new ESA program for lower-income students. In Indiana, a Senate bill would make state ESAs available to more students. An Ohio bill would remove an income cap and other eligibility rules for the state’s school vouchers. Two Oklahoma Senate bills propose new ESA programs… ESA bills are in some stage of moving in Nebraska, New Hampshire, Texas and Virginia.

Let’s hope there is more progress.

School choice is a win-win for both students and taxpayers.

P.S. Here’s a must-see chart showing how more and more money for the government school monopoly has produced zero benefit.

P.P.S. There are very successful school choice systems in Canada, Sweden, Chile, and the Netherlands.

P.P.P.S. Getting rid of the Department of Education would be a good idea, but the battle for school choice is largely going to be won and lost on the state and local level.

The Machine: The Truth Behind Teachers Unions

Published on Sep 4, 2012 by ReasonTV

America’s public education system is failing. We’re spending more money on education but not getting better results for our children.

That’s because the machine that runs the K-12 education system isn’t designed to produce better schools. It’s designed to produce more money for unions and more donations for politicians.

For decades, teachers’ unions have been among our nation’s largest political donors. As Reason Foundation’s Lisa Snell has noted, the National Education Association (NEA) alone spent $40 million on the 2010 election cycle (source: http://reason.org/news/printer/big-education-and-big-labor-electio). As the country’s largest teachers union, the NEA is only one cog in the infernal machine that robs parents of their tax dollars and students of their futures.

Students, teachers, parents, and hardworking Americans are all victims of this political machine–a system that takes money out of taxpayers’ wallets and gives it to union bosses, who put it in the pockets of politicians.

Our kids deserve better.

“The Machine” is 4:17 minutes.

Written and narrated by Evan Coyne Maloney. Produced by the Moving Picture Institute in partnership with Reason TV.

Visit http://www.MovingPictureInstitute.org to learn more.

No one did more to advance the cause of school vouchers than Milton and Rose Friedman. Friedman made it clear in his film series “Free to Choose” how sad he was that young people who live in the inner cities did not have good education opportunities available to them.

I have posted often about the voucher system and how it would solve our education problems. What we are doing now is not working. Milton Friedman’s idea of implementing school vouchers was hatched about 50 years ago.

Poor families are most affected by this lack of choice. As Friedman noted, “There is no respect in which inhabitants of a low-income neighborhood are so disadvantaged as in the kind of schooling they can get for their children.” It is a sad statement quantified by data on low levels of academic achievement and attainment. Take a look at this article below.

September 25, 2012 at 5:46 pm

SAT scores among the nation’s test-takers are at a 40-year low.

As The Washington Post reports:

Reading scores on the SAT for the high school class of 2012 reached a four-decade low, putting a punctuation mark on a gradual decline in the ability of college-bound teens to read passages and answer questions about sentence structure, vocabulary and meaning on the college entrance exam.

The decline over the decades has been significant. The average reading (verbal) score is down 34 points since 1972. Sadly, the historically low SAT scores are only the latest marker of decline. Graduation rates have been stagnant since the 1970s, reading and math achievement has been virtually flat over the same time period, and American students still rank in the middle of the pack compared to their international peers.

On the heels of the news about the SAT score decline, President Obama filmed a segment with NBC’s Education Nation earlier today. The President notably praised the concept of charter schools and pay for performance for teachers.

But those grains of reform were dwarfed by his support of the status quo. During the course of the interview, President Obama suggested hiring 100,000 new math and science teachers and spending more money on preschool. He also stated that No Child Left Behind had good intentions but was “under-resourced.”

Efforts by the federal government to intervene in preschool, most notably through Head Start, have failed—despite a $160 billion in spending on the program since 1965. And No Child Left Behind is far from “under-resourced.” The $25 billion, 600-page law has been on the receiving end of significant new spending every decade since the original law was first passed nearly half a century ago.

President Obama was also pressed on the issue of education unions by host Savannah Guthrie:

Some people think, President Obama gets so much support from the teachers’ unions, he can’t possibly have an honest conversation about what they’re doing right or wrong. Can you really say that teachers’ unions aren’t slowing the pace of reform?

President Obama responded: “You know, I just really get frustrated when I hear teacher-bashing as evidence of reform.”

Criticizing education unions for standing in the way of reform should not be conflated with criticizing teachers, as the President does in the interview. The unions have blocked reforms such as performance pay and charter schools (which the President supports), have opposed alternative teacher certification that would help mid-career professionals enter the classroom, and have consistently fought the implementation of school choice options for children.

If we ever hope to move the needle on student achievement—or see SAT scores turn in the right direction again—we’ll need to implement many of those exact reforms, particularly school choice.

And as he has in the past, President Obama stated that his Administration wants to “use evidenced-based approaches and find out what works.” We know what works: giving families choices when it comes to finding schools that best meet their children’s needs. Instead of continuing to call for more spending and more Washington intervention in education, let’s try something new: choice and freedom.

Related posts:

Milton Friedman remembered at 100 years from his birth (Part 4)

I ran across this very interesting article about Milton Friedman from 2002: Friedman: Market offers poor better learningBy Tamara Henry, USA TODAY By Doug Mills, AP President Bush honors influential economist Milton Friedman for his 90th birthday earlier this month. About an economist Name:Milton FriedmanAge: 90Background: Winner of the 1976 Nobel Prize for economic science; […]

Milton Friedman videos and transcripts Part 11

Milton Friedman videos and transcripts Part 11 On my blog http://www.thedailyhatch.org I have an extensive list of posts that have both videos and transcripts of MiltonFriedman’s interviews and speeches. Here below is just small list of those and more can be accessed by clicking on “Milton Friedman” on the side of this page or searching […]

Open letter to President Obama (Part 117.3)

A Taxing Distinction for ObamaCare Published on Jun 28, 2012 by catoinstitutevideo http://www.cato.org/publications/commentary/it-now-falls-congress http://www.cato.org/publications/commentary/taxing-decision http://www.cato-at-liberty.org/supreme-court-unlawfully-rewrites-obamacare-to… http://www.cato-at-liberty.org/congress-its-not-a-tax-scotus-yes-it-is/ The Cato Institute’s Roger Pilon, Ilya Shapiro, Michael F. Cannon, Michael D. Tanner and Trevor Burrus evaluate today’s ruling on ObamaCare at the Supreme Court. Video produced by Caleb O. Brown and Austin Bragg. ____________ President Obama c/o The […]

Milton Friedman videos and transcripts Part 10

Milton Friedman videos and transcripts Part 10 On my blog http://www.thedailyhatch.org I have an extensive list of posts that have both videos and transcripts of MiltonFriedman’s interviews and speeches. Here below is just small list of those and more can be accessed by clicking on “Milton Friedman” on the side of this page or searching […]

Milton Friedman videos and transcripts Part 9

Milton Friedman videos and transcripts Part 9 On my blog http://www.thedailyhatch.org I have an extensive list of posts that have both videos and transcripts of MiltonFriedman’s interviews and speeches. Here below is just small list of those and more can be accessed by clicking on “Milton Friedman” on the side of this page or searching […]

Milton Friedman’s biography (Part 2)(Interview by Charlie Rose of Milton Friedman part 3)

Biography Part 2 In 1977, when I reached the age of 65, I retired from teaching at the University of Chicago. At the invitation of Glenn Campbell, Director of the Hoover Institution at Stanford University, I shifted my scholarly work to Hoover where I remain a Senior Research Fellow. We moved to San Francisco, purchasing […]

Milton Friedman at Hillsdale College 2006 (part 2)

Milton Friedman at Hillsdale College 2006 July 2006 Free to Choose: A Conversation with Milton Friedman Milton Friedman Economist Milton Friedman is a senior research fellow at the Hoover Institution at Stanford University and a professor emeritus of economics at the University of Chicago, where he taught from 1946-1976. Dr. Friedman received the Nobel Memorial […]

Milton Friedman videos and transcripts Part 8

Milton Friedman videos and transcripts Part 8 On my blog http://www.thedailyhatch.org I have an extensive list of posts that have both videos and transcripts of MiltonFriedman’s interviews and speeches. Here below is just small list of those and more can be accessed by clicking on “Milton Friedman” on the side of this page or searching […]

Milton Friedman remembered at 100 years from his birth (Part 2)

Testing Milton Friedman – Preview Uploaded by FreeToChooseNetwork on Feb 21, 2012 2012 is the 100th anniversary of Milton Friedman’s birth. His work and ideas continue to make the world a better place. As part of Milton Friedman’s Century, a revival of the ideas featured in the landmark television series Free To Choose are being […]

Milton Friedman believed in liberty (Interview by Charlie Rose of Milton Friedman part 1)

Charlie Rose interview of Milton Friedman My favorite economist: Milton Friedman : A Great Champion of Liberty by V. Sundaram Milton Friedman, the Nobel Prize-winning economist who advocated an unfettered free market and had the ear of three US Presidents – Nixon, Ford and Reagan – died last Thursday (16 November, 2006 ) in San Francisco […]

Free or equal? 30 years after Milton Friedman’s Free to Choose (Part 1)

Free or Equal?: Johan Norberg Updates Milton & Rose Friedman’s Free to Choose I got this below from Reason Magazine: Swedish economist Johan Norberg is the host of the new documentary Free or Equal, which retraces and updates the 1980 classic Free to Choose, featuring Milton and Rose Friedman. Like the Friedmans, Norberg travels the globe […]

Reason Magazine’s rightly praises Milton Friedman but makes foolish claim along the way

I must say that I have lots of respect for Reason Magazine and for their admiration of Milton Friedman. However, I do disagree with one phrase below. At the end of this post I will tell you what sentence it is. Uploaded by ReasonTV on Jul 28, 2011 There’s no way to appreciate fully the […]

Video clip:Milton Friedman discusses his view of numerous political figures and policy issues in (Part 1)

Milton Friedman on Hayek’s “Road to Serfdom” 1994 Interview 1 of 2 Uploaded by PenguinProseMedia on Oct 25, 2011 Says Federal Reserve should be abolished, criticizes Keynes. One of Friedman’s best interviews, discussion spans Friedman’s career and his view of numerous political figures and public policy issues. ___________________ Two Lucky People by Milton and Rose Friedman […]

Milton Friedman remembered at 100 years from his birth (Part 1)

What a great man Milton Friedman was. The Legacy of Milton Friedman November 18, 2006 Alexander Tabarrok Great economist by day and crusading public intellectual by night, Milton Friedman was my hero. Friedman’s contributions to economics are profound, the permanent income hypothesis, the resurrection of the quantity theory of money, and his magnum opus with […]

Milton Friedman videos and transcripts Part 7

Milton Friedman videos and transcripts Part 7 On my blog http://www.thedailyhatch.org I have an extensive list of posts that have both videos and transcripts of MiltonFriedman’s interviews and speeches. Here below is just small list of those and more can be accessed by clicking on “Milton Friedman” on the side of this page or searching […]

Transcript and video of Milton Friedman on Bill Clinton and Ronald Reagan (Part 1)

Below is a discussion from Milton Friedman on Bill Clinton and Ronald Reagan. February 10, 1999 | Recorded on February 10, 1999 audio, video, and blogs » uncommon knowledge PRESIDENTIAL REPORT CARD: Milton Friedman on the State of the Union with guest Milton Friedman Milton Friedman, Senior Research Fellow, Hoover Institution and Nobel Laureate in […]

Dan Mitchell’s article on Chili and video clip on Milton Friedman’s influence

Milton Friedman and Chile – The Power of Choice Uploaded by FreeToChooseNetwork on May 13, 2011 In this excerpt from Free To Choose Network’s “The Power of Choice (2006)”, we set the record straight on Milton Friedman’s dealings with Chile — including training the Chicago Boys and his meeting with Augusto Pinochet. Was the tremendous […]