|

Since the end of World War II, the provision of medical care in the United States and other advanced countries has displayed three major features: first, rapid advance in the science of medicine; second, large increases in spending, both in terms of inflation-adjusted dollars per person and the fraction of national income spent on medical care; and third, rising dissatisfaction with the delivery of medical care, on the part of both consumers of medical care and physicians and other suppliers of medical care.

Rapid technological advance has occurred repeatedly since the industrial revolution – in agriculture, steam engine, railroad, telephone, electricity, automobile, radio, television, and, most recently, computers and telecommunication. The other two features seem unique to medicine. It is true that spending initially increased after nonmedical technical advances, but the fraction of national income spent did not increase dramatically after the initial phase of widespread acceptance. On the contrary, technological development lowered cost, so that the fraction of national income spent on food, transportation, communication, and much more has gone down, releasing resources to produce new products or services. Similarly, there seems no counterpart in these other areas to the rising dissatisfaction with the delivery of medical care.

I. International comparison

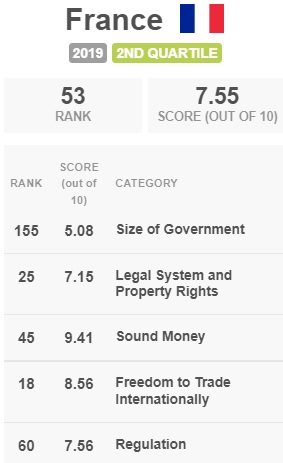

These developments in medicine have been worldwide. By their very nature, scientific advances know no geographical boundaries. Data on spending are readily available for 29 Organization for Economic Cooperation and Development (OECD) countries. In every one, medical spending has gone up both in inflation-adjusted dollars per person and as a fraction of national income. Data are available for both 1960 and 1997 for 21 countries. In 13, spending more than doubled as a fraction of gross domestic product. The smallest increase was 67 percent, the largest, 378 percent. In 1997, 16 of the 29 OECD countries spent between 7 percent and 9 percent of gross domestic product on medical care. The United States spent 14 percent, the highest of any OECD country. Germany was a distant second at 11 percent; Turkey was the lowest at 4 percent.

A key difference between medical care and the other technological revolutions is the role of government. In other technological revolutions, the initiative, financing, production, and distribution were primarily private, though government sometimes played a supporting or regulatory role. In medical care, government has come to play a leading role in financing, producing, and delivering medical service. Direct government spending on health exceeds 75 percent of total health spending for 15 OECD countries. The United States is next to the lowest of the 29 countries, at 46 percent. In addition, some governments indirectly subsidize medical care through favorable tax treatment. For the United States, such subsidization raises the fraction of health spending financed directly or indirectly by government to over 50 percent.

What are countries getting for the money they are spending on medical care? What is the relation between input and output? Spending on medical care provides a reasonably good measure of input, but, unfortunately, there is no remotely satisfactory objective measure of output. For the hospital segment, number of beds occupied may at first seem like an objective measure. However, improvements in medicine have included a reduction in the length of hospital stay required for various medical procedures or illnesses. So, fewer patient days may be a sign of greater, not lesser, output. The desired output of medical care is “good health.” But how can we quantify “good health,” and equally important, allow for the role that factors other than medical care – such as plentiful food, pure water, and protective clothing – play in producing “good health”?

The least objectionable measure I have been able to find is expected length of life at birth or at various later ages, though that too is a far from unambiguous measure of the output attributable to spending on medical care. The remarkable increase in life span in advanced countries during the past century reflects much more than spending on medical care proper. Moreover, it does not allow for changes in the quality of life-attempted measurement of which is still in its infancy.

Figure 1 (see Appendix) shows the relation in 1996 for the 29 OECD countries between the percentage of the gross domestic product spent on medical care and the expected length of life at birth for females.1 The relation is clearly positive, though very loose.2 The United States and Germany are clear outliers, ranking first and second in spending but twentieth and seventeenth in length of life. As another indication of looseness, nine countries spent between 7 and 8 percent of GDP on medicine. The group includes Japan, which has the highest expected length of life (83.6 years), and the Czech Republic, fourth from the bottom (77.3 years). Clearly, many factors other than spending on medical care affect expected length of life.

Exploring that relation more fully, however worthwhile a project, is not the purpose of this article, which is to examine the situation in the United States. I have presented the data on the OECD countries primarily to document the two (related?) respects in which the United States is an outlier: We spend a higher percentage of national income on medical care (and more per capita) than any other OECD country, and government finances a smaller fraction of that spending than all except Korea.

II. Why third-party payment?

Two simple observations are key to explaining both the high level of spending on medical care and the dissatisfaction with that spending. The first is that most payments to physicians or hospitals or other caregivers for medical care are made not by the patient but by a third party – an insurance company or employer or governmental body. The second is that nobody spends somebody else’s money as wisely or as frugally as he spends his own. These statements apply equally to other OECD countries. They do not by themselves explain why the United States spends so much more than other countries.

No third party is involved when we shop at a supermarket. We pay the supermarket clerk directly. The same for gasoline for our car, clothes for our back, and so on down the line. Why, by contrast, are most medical payments made by third parties? The answer for the United States begins with the fact that medical-care expenditures are exempt from the income tax if, and only if, medical care is provided by the employer. If an employee pays directly for medical care, the expenditure comes out of the employee’s income after income tax. If the employer pays for the employee’s medical care, the expenditure is treated as a tax-deductible expense for the employer and is not included as part of the employee’s income subject to income tax. That strong incentive explains why most consumers get their medical care through their employer or their spouse’s or their parents’ employer. In the next place, the enactment of Medicare and Medicaid in 1965 made the government a third-party payer for persons and medical care covered by those measures.

We have become so accustomed to employer-provided medical care that we regard it as part of the natural order. Yet it is thoroughly illogical. Why single out medical care? Food is more essential to life than medical care. Why not exempt the cost of food from taxes if provided by the employer? Why not return to the much-reviled company store when workers were in effect paid in kind rather than in cash?

The revival of the company store for medicine has less to do with logic than pure chance. It is a wonderful example of how one bad government policy leads to another. During World War II, the government financed much wartime spending by printing money while, at the same time, imposing wage and price controls. The resulting repressed inflation produced shortages of many goods and services, including labor. Firms competing to acquire labor at government-controlled wages started to offer medical care as a fringe benefit. That benefit proved particularly attractive to workers and spread rapidly.

Initially, employers did not report the value of a fringe benefit to the Internal Revenue Service as part of their workers’ wages. It took some time before the IRS realized what was going on. When it did, it issued regulations requiring employers to include the value of medical care as part of reported employees’ wages. By this time, workers had become accustomed to the tax exemption of that particular fringe benefit and made a big fuss. Congress responded by legislating that medical care provided by employers should be tax-exempt.

III. Effect of third-party payment on medical costs

The tax exemption of employer-provided medical care has two different effects, both of which raise health costs. First, it leads employees to rely on their employer, rather than themselves, to make arrangements for medical care. Yet employees are likely to do a better job of monitoring medical-care providers, because it is in their own interest, than is the employer or the insurance company or companies designated by the employer. Second, it leads employees to take a larger fraction of their total remuneration in the form of medical care than they would if spending on medical care had the same tax status as other expenditures.

If the tax exemption were removed, employees could bargain with their employers for a higher take-home pay in lieu of medical care and provide for their own medical care either by dealing directly with medical-care providers or by purchasing medical insurance. Removal of the tax exemption would enable governments to reduce the tax rate on income while raising the same total revenue. This hidden subsidy for medical care, currently more than $100 billion a year, is not included in reported figures on government health spending.

Extending the tax exemption to all medical care – as in the current limited provision for medical savings accounts and the proposals to make such accounts more widely available – would reduce reliance on third-party payment. But, by extending the hidden subsidy to all medical-care expenditures, it would increase the tendency of employees to take a larger portion of their remuneration in the form of medical care. (I will more fully discuss medical savings accounts in the conclusion.)

Enactment of Medicare and Medicaid provided a direct subsidy for medical care. The cost grew much more rapidly than originally estimated – as the cost of all handouts invariably do. Legislation cannot repeal the non-legislated law of demand and supply. The lower the price, the greater the quantity demanded; at a zero price, the quantity demanded becomes infinite. Some method of rationing must be substituted for price and that invariably means administrative rationing.

Figure 2 provides an estimate of the effect on medical costs of tax exemption and the subsequent enactment of Medicare and Medicaid. The top line in the chart is actual per capita spending on medical care expressed in constant 1992 prices, to allow for the effect of inflation. Spending multiplied more than 23-fold from 1919 to 1997, going from $155 per capita to $3,625. The bottom line shows what would have happened to per capita spending if it had continued to rise at the same rate as it did from 1919 to 1940 (3.1 percent per year). On that assumption, per capita spending would have risen to $1,751, instead of $3,625 by 1997, or less than half as much.3,4

To estimate the separate effects of tax exemption and of Medicare and Medicaid, the second line shows what would have happened to spending if, after Medicare and Medicaid were enacted, spending had continued to rise at the same rate as it did from 1946 to 1965 (4 percent per year). The segment between the two bottom lines shows the effect of tax exemption; the segment between the two top lines shows the effect of the enactment of Medicare and Medicaid. According to these estimates, tax exemption accounts for 57 percent of the increase in cost; Medicare and Medicaid, 43 percent.

Figure 3 presents a different breakdown of the cost of medical care: between the part paid directly by the government and the part paid privately. As the figure shows, the government share has been growing over the whole period. Government’s share went from one-eighth of the total in 1919 to nearly a quarter in 1946 to a quarter in 1965 to nearly half in 1997. The rise in the government’s share has been accompanied by centralization of spending – from primarily by state and local governments to primarily by the federal government. We are headed toward completely socialized medicine and are already halfway there, if in addition to direct costs, we include indirect tax subsidies.

Expressed as a fraction of national income, spending on medical care went from 3 percent of the national income in 1919 to 4.5 percent in 1946, to 7 percent in 1965 to a mind-boggling 17 percent in 1997.5 No other country in the world approaches that level of spending as a fraction of national income no matter how its medical care is organized. The change in the role of medical care in the U.S. economy is truly breathtaking. To illustrate, in 1946, seven times as much was spent on food, beverages, and tobacco as on medical care; in 1996, 50 years later, more was spent on medical care than on food, beverages, and tobacco. In 1946, twice as much was spent on transportation as on medical care; in 1996, one-and-a-half times as much was spent on medical care as on transportation.

IV. The changing meaning of insurance

Employer financing of medical care has caused the term “insurance” to acquire a rather different meaning in medicine than in most other contexts. We generally rely on insurance to protect us against events that are highly unlikely to occur but involve large losses if they do occur – major catastrophes, not minor regularly recurring expenses. We insure our houses against loss from fire, not against the cost of having to cut the lawn. We insure our cars against liability to others or major damage, not against having to pay for gasoline. Yet in medicine, it has become common to rely on insurance to pay for regular medical examinations and often for prescriptions.

This is partly a question of the size of the deductible and the co-payment, but it goes beyond that. “Without medical insurance” and “without access to medical care” have come to be treated as nearly synonymous. Moreover, the states and the federal government have increasingly specified the coverage of insurance for medical care to a detail not common in other areas. The effect has been to raise the cost of insurance and to limit the options open to individuals. Many, if not most, of the “medically uninsured” are persons who for one reason or another do not have access to employer-provided medical care and are not willing to pay the cost of the only kinds of insurance contracts available to them.

If tax exemption for employer-provided medical care and Medicare and Medicaid had never been enacted, the insurance market for medical care would probably have developed as other insurance markets have. The typical form of medical insurance would have been catastrophic insurance – i.e., insurance with a very high deductible.

V. Bureaucratization and Gammon’s Law

Third-party payment has required the bureaucratization of medical care and, in the process, has changed the character of the relation between physicians or other caregivers and patients. A medical transaction is not simply between a caregiver and a patient; it has to be approved as “covered” by a bureaucrat and the appropriate payment authorized. The patient, the recipient of the medical care, has little or no incentive to be concerned about the cost – since it’s somebody else’s money. The caregiver has become, in effect, an employee of the insurance company or, in the case of Medicare and Medicaid, the government. The patient is no longer the one, and the only one, the caregiver has to serve. An inescapable result is that the interest of the patient is often in direct conflict with the interest of the caregiver’s ultimate employer. That has been manifest in public dissatisfaction with the increasingly impersonal character of medical care.

Some years ago, the British physician Max Gammon, after an extensive study of the British system of socialized medicine, formulated what he called “the theory of bureaucratic displacement.” In Health and Security, he observed that in “a bureaucratic system … increase in expenditure will be matched by fall in production…. Such systems will act rather like ‘black holes,’ in the economic universe, simultaneously sucking in resources, and shrinking in terms of ’emitted production.'” Gammon’s observations for the British system have their exact parallel in the partly socialized U.S. medical system. Here too input has been going up sharply relative to output. This tendency can be documented particularly clearly for hospitals, thanks to the availability of high quality data for a long period.

Before 1940, output, as measured by number of patient days per 1,000 population (equal to the number of occupied beds per 1,000 population) and input, as measured by cost per 1,000 population, both rose (input somewhat more than output presumably because of the introduction of more sophisticated and expensive treatments). The number of occupied beds per resident of the United States rose from 1929 to 1940 at the rate of 2.4 percent per year; the cost of hospital care per resident, adjusted for inflation, at 5 percent per year; and the cost per patient day, adjusted for inflation, at 2 percent per year.

The situation changed drastically after the war, as Figure 4 and the top part of Table 1 show. From 1946 to 1996, the number of beds per 1,000 population fell by more than 60 percent; the fraction of beds occupied, by more than 20 percent. In sharp contrast, input skyrocketed. Hospital personnel per occupied bed multiplied nine-fold, and cost per patient day, adjusted for inflation, an astounding 40-fold, from $30 in 1946 to $1,200 in 1996 (at 1992 prices). A major engine of these changes was the enactment of Medicare and Medicaid in 1965. A mild rise in input was turned into a meteoric rise; a mild fall in output, into a rapid decline. The 40-fold increase in the cost per patient day was converted into a 13-fold increase in hospital cost per resident of the United States by the sharp decline in output. Hospital days per person per year were cut by two-thirds, from three days in 1946 to an average of less than a day by 1996.

Taken by itself, the decline in hospital days is evidence of progress in medical science. A healthy population needs less hospitalization, and advances in science and medical technology have reduced the length of hospital stays and increased outpatient surgery. Progress in medical science may well explain most of the decline in output; it does not explain much, if any, of the rise in input per unit of output. True, medical machines have become more complex. However, in other areas where there has been great technical progress – whether it be agriculture or telephones or steel or automobiles or aviation or, most recently, computers and the Internet – progress has led to a reduction, not an increase, in cost per unit of output. Why is medicine an exception? Gammon’s law, not medical miracles, was clearly at work. The provision of medical care as an untaxed fringe benefit by employers, and then the federal government’s assumption of responsibility for hospital and medical care of the elderly and the poor, provided a fresh pool of money. And there was no shortage of takers. Growing costs, in turn, led to more regulation of hospitals and medical care, further increasing administrative costs, and leading to the bureaucratization that is so prominent a feature of medical care today.

Medicine is not the only area where this pattern has prevailed. Aside from defense and medicine, schooling is the only other major area of our society that is largely financed and administered by government, and here too Gammon’s law has clearly operated. Input per unit of output, however measured, has clearly been going up; output, especially if measured in terms of quality, has been going down, and dissatisfaction, as in medicine, is growing. The same may well be true also in defense. However, measuring output independently of input is even more baffling for defense than for medicine.

To return to medicine, hospital cost has risen as a percentage of total medical cost from 24 percent in 1946 to 32 percent half a century later. The cost of physician services is currently the second largest component of total medical cost. It too has risen sharply, though less sharply than hospital costs. In 1946, the cost of physician services exceeded the cost of hospital services. According to the estimates in Table 1, the cost of physician services has multiplied four-fold since 1946, the major rise coming after the adoption of Medicare and Medicaid in 1965.

Figure 5 shows what has happened to the number of physicians and their income. The number almost doubled, and the income per physician almost tripled over the half-century from 1946 to 1996. Both reflect the increase in funds available to finance medical care and the third-party character of payment. The demand for physician services went up, and income had to go up to attract additional physicians. Paradoxically, the attempt by third-party payers – particularly the federal government – to keep costs down has been at least partly self-defeating, because it took the form of imposing onerous rules and regulations on physicians. The resultant bureaucratization of medical practice has made the practice of medicine less attractive as an occupation to most actual and potential physicians, which increased the necessary rise in incomes. It has also reduced their productivity.

VI. Medical-care output

So much for input. What about output? What have we gotten in return for quadrupling the share of the nation’s income spent on medical care?

I have already referred to one component of output – days of hospital care per person per year. That has gone down from three days in 1946 to less than one in 1996. Insofar as the reduction reflects the improvements in medicine, it clearly is a good thing. However, it also reflects the pressure to keep hospital stays short in order to keep down cost. That this is not a good thing is clear from protests by patients, widespread enough to have led Congress to mandate minimum stays for some medical procedures.

The output of the medical-care industry that we are interested in is its contribution to better health. How can we measure better health in a reasonably objective way that is not greatly influenced by other factors? For example, if medical care enables people to live longer and healthier lives, we might expect that the fraction of persons aged 65 to 70 who continue to work would go up. In fact, of course, the fraction has gone down drastically – thanks to higher incomes reinforced by financial incentives from Social Security. With the same “if” we might expect the fraction of the population classified as disabled to go down, but that fraction has gone up, again not for reasons of health but because of government social security programs. And so I have found with one initially plausible measure after another – all of them are too contaminated by other factors to reflect the output of the medical-care industry.

As noted earlier, the least bad measure that I have been able to come up with is length of life, though that too is seriously contaminated by other factors – improvements in diet, housing, clothing, and so on generated by greater affluence, better garbage collection and disposal, the provision of purer water, and other governmental public-health measures. Wars, epidemics, and natural and man-made disasters have played a part. Even more important, the quality of life is as meaningful as the length of life. Perhaps the extensive research on aging currently underway will lead to a better measure than length of life.

Figures 6 and 7 present two different sets of data on expected length of life: Figure 6, expected length of life at birth; Figure 7, remaining length of life at age 65. Both cover the whole century, from 1900 to 1997, the last year for which I was able to get data. For Figure 6 the data are annual; for Figure 7, decennial until recent years. The two tell very different, but equally remarkable, stories.

Expected longevity went from 47 years in 1900 to 68 years in 1950, a truly remarkable rise that proceeded at a fairly steady rate, averaging four-tenths of a year per year. Public-health activities, such as those leading to cleaner water and air and better control of epidemics, played a major role in lengthening life, no doubt; but so too did improvements in medical practice and hospital care, particularly those leading to a sharp reduction in infant and maternal mortality. Whatever its source, the increase in longevity did not have any systematic relation to spending on medical care as a fraction of income. We have reasonably accurate data on spending only from 1929 on; crude data from 1919 on. Except for the deep depression years of 1932 and 1933, national health spending never exceeded 5 percent of national income, and from 1919 to 1948, varied between 3 and 5 percent, primarily as a result of wider swings in national income than in health spending.

The most striking feature of Figure 6 is the sharp slowdown in the increase in longevity after 1950. From 1950 on, longevity grew at less than half the rate that it grew from 1900 to 1950-averaging less than two-tenths of a year per year compared to the earlier four-tenths.6 In the first 50 years of the century, the life span increased by 21 years; in the next 47 years, by eight years. As in the first 50 years, the increase proceeded at a surprisingly steady pace. I have no good explanation for the shift from one trend to the other. I conjecture that it reflects the exhaustion by the end of World War II of the possibility of further major improvements from public-health activity. I leave it to scholars more knowledgeable about medicine than I to give a more satisfactory answer.

The later trend was accompanied, as the earlier one was not, by a major increase in spending as a fraction of national income. However, I attribute that increase in spending to the changes in the economic organization of medical care discussed earlier. I doubt that it is related as either cause or effect to the slowdown in the growth of longevity.

Data are much less readily available for longevity at age 65 than at birth, so I have resorted to the use of decennial estimates except for the most recent year. Figure 7 is almost the mirror image of Figure 6 – that is, the same picture reversed. Instead of first rising rapidly and then slowly, longevity at age 65 at first rose slowly and then rapidly. Until 1940, longevity rose at an average of only .025 years per year. Remaining years of life went from 12 – or to age 77 – in 1900 to 13 – or age 78 – in 1940. Then there was a sharp acceleration, and in the next 57 years, remaining years of life went up by an additional five years to 18 – or age 83, rising at the average rate of .085 years per year. Understandably, both the earlier and the later rates of growth in longevity at age 65 are much smaller than the comparable figures for longevity at birth. The remarkable phenomenon is the shift in trend around 1940, and the steadiness of the trend both before and after 1940.

Data for later years of life suggests that the steadiness of the trend in longevity at age 65 is not likely to continue. At these later ages, there has been a distinct slowing of increases in longevity since about 1980. At age 85, remaining years of life for females has not changed in the 17 years from 1980 to 1997. It was 6.4 years in both 1980 and 1997.7

What caused the change in the trend at age 65, and why was that change in the opposite direction from the change in the trend at birth, and why did it occur about 10 years earlier? Could it have been the emergence of penicillin and sulfa at around 1940 that explains the dating of the shift? No doubt many other advances in medicine, from the handling of blood pressure to the perfecting of open-heart surgery, the improved treatment of cancer, and the better understanding of diet were of special importance for preventing death at later ages. I am incompetent to judge these matters and their relative importance. But I have no doubt that one economic change also played an important role. That was the sharp improvement in the economic status of the elderly brought about by government transfer programs, notably Social Security. From being among the poorest groups in society, the elderly have become among the most affluent in the post-World War II period.

However interesting these speculations may be, they are a long way from providing an answer to the question with which we started this section, namely, “What have we gotten in return for quadrupling the share of the nation’s income spent on medical care?” The slowdown in the increase of longevity at birth started before tax exemption and Medicare had any effect on spending. Similarly, the acceleration in the increase in longevity at age 65 started 25 years before Medicare was enacted and showed no speedup thereafter. Perhaps better measures of the health of the population and various subgroups will show a relation to total spending. But on the evidence to date, it is hard to see that we have gotten much for that spending other than bureaucratization and widespread dissatisfaction with the economic organization of medical care.

Promo by Google

Are you looking for a way to save money on auto insurance? We’ve taken the mystery out of this confusing subject by outlining 10 simple steps to saving money while getting the best coverage for yourself and your car. Welcome:

Auto Insurance reviews

VII. The United States vs. other countries

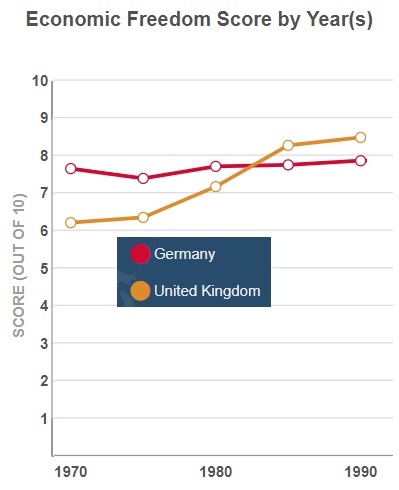

Our steady movement toward reliance on third-party payment no doubt explains the extraordinary rise in spending on medical care in the United States. However, other advanced countries also rely on third-party payment, many or most of them to an even greater extent than we do. What explains our higher level of spending?

I must confess that despite much thought and scouring of the literature, I have no satisfactory answer. One clue is my estimate that if the pre-World War II system had continued – that is, if tax exemption and Medicare and Medicaid had never been enacted – expenditures on medical care would have amounted to less than half its current level, which would have put us near the bottom of the OECD list rather than at the top.

In terms of holding down cost, one-payer directly administered government systems, such as exist in Canada and Great Britain, have a real advantage over our mixed system. As the direct purchaser of all or nearly all medical services, they are in a monopoly position in hiring physicians and can hold down their remuneration, so that physicians earn much less in those countries than in the United States. In addition, they can ration care more directly – at the cost of long waiting lists and much dissatisfaction.8

In addition, once the whole population is covered, there is little political incentive to increase spending on medical care. In an insightful analysis of political entrepreneurship, W. Allen Wallis noted that

one of the ways politicians compete for votes is by offering to have the government provide new services. For an offer of a new service to have substantial electoral impact, the service ordinarily must be one that a large number of voters is familiar with, and in fact already use. The most effective innovations for a political entrepreneur to offer, therefore, are those whose effect is to transfer from individuals to the government the costs of services which are already in existence, not to alter appreciably the amount of the service reaching the people.9

Medicare, Medicaid, the political stress on the “uninsured,” and the current political pressure for government financing of prescriptions all exemplify this phenomenon. Once the bulk of costs have been taken over by government, as they have in most of the other OECD countries, the political entrepreneur has no additional groups to attract, and attention turns to holding down costs.

An additional factor is the tax treatment of private expenditures on medical care. In most countries, any private expenditure comes out of after-tax income. It does in the United States also, unless the medical care is provided by the employer. For this reason, the bulk of medical care is provided through employers, and private expenditures on medical care are decidedly higher than they would be if medical care, like food, clothing, and other consumer goods, had to be financed out of post-tax income. It is consistent with this view that Germany, the country second to the United States in the fraction of income spent on medical care, has a system in which the employer plays a central role in the provision of medical care and in which, so far as I have been able to determine, half of the cost comes out of pre-tax income, half out of post-tax income.

Our mixed system has many advantages in accessibility and quality of medical care, but it has produced a higher level of cost than would result from either wholly individual choice or wholly collective choice.

VIII. Medical savings accounts and beyond

The high cost and inequitable character of our medical-care system is the direct result of our steady movement toward reliance on third-party payment. A cure requires reversing course, reprivatizing medical care by eliminating most third-party payment, and restoring the role of insurance to providing protection against major medical catastrophes.

The ideal way to do that would be to reverse past actions: repeal the tax exemption of employer-provided medical care; terminate Medicare and Medicaid; deregulate most insurance; and restrict the role of the government, preferably state and local rather than federal, to financing care for the hard cases. However, the vested interests that have grown up around the existing system, and the tyranny of the status quo, clearly make that solution not feasible politically. Yet it is worth stating the ideal as a guide to judging whether proposed incremental changes are in the right direction.

Most changes made in the final decade of the twentieth century have been in the wrong direction. Despite rejection of the sweeping socialization of medicine proposed by Hillary Clinton, subsequent incremental changes have expanded the role of government, increased regulation of medical practice, and further constrained the terms of medical insurance, thereby raising its cost and increasing the fraction of individuals who choose or are forced to go without insurance.

There is one exception, which, though minor in current scope, is pregnant of future possibilities. The Kassebaum-Kennedy bill, passed in 1996 after lengthy and acrimonious debate, included a narrowly limited four-year pilot program authorizing medical savings accounts. A medical savings account enables individuals to deposit tax-free funds in an account usable only for medical expense, provided they have a high-deductible insurance policy that limits the maximum out-of-pocket expense. As noted earlier, it eliminates third-party payment except for major medical expenses and is thus a movement very much in the right direction. By extending tax exemption to all medical expenses whether paid by the employer or not, it eliminates the present bias in favor of employer-provided medical care. That too is a move in the right direction. However, the extension of tax exemption increases the bias in favor of medical care compared to other household expenditures. This effect would tend to increase the implicit government subsidy for medical care, which would be a step in the wrong direction.10 But, on balance, given how large a fraction of current medical expenditures are exempt, it seems likely that the net effect of widely available and flexible medical savings accounts would be very much in the right direction.

However, the current pilot program is neither widely available nor flexible. The act limits the number of medical savings accounts to no more than 750,000 policies, available only to the self-employed who are uninsured and employees at firms with 50 or fewer employees. Moreover, the act specifies the precise terms of the medical savings account and the associated insurance. Finally, at the end of four years (the year 2000) Congress will have to vote to continue or change the program. (Those who signed up in the first four years would be entitled to continue their accounts even if Congress terminates the program.) A number of representatives and senators have indicated their intention to introduce bills to extend and widen the availability of medical savings accounts.

Prior to this pilot project, a number of large companies (e.g., Quaker Oats, Forbes, Golden Rule Insurance Co.) had offered their employees the choice of a medical savings account instead of the usual low-deductible employer-provided insurance policy. In each case, the employer purchased a high-deductible major medical insurance policy for the employee and deposited a stated sum, generally about half of the deductible, in a medical savings account for the employee. That sum could be used by the employee for medical care. Any part not used during the year was the property of the employee and had to be included in taxable income. Despite this loss of tax exemption, this alternative has generally been very popular with both employers and employees. It has reduced costs for the employer and empowered the employee, eliminating much third-party payment.

Medical savings accounts offer one way to resolve the growing financial and administrative problems of Medicare and Medicaid. Each current participant could be given the alternative of continuing with present arrangements or receiving a high-deductible major medical insurance policy and a specified deposit in a medical savings account. New entrants would be required to accept the alternative. Many details would have to be worked out: the size of the deductible and the deposit in the medical savings account, the size of any co-payment, and whether additional medical spending would be tax-exempt. Yet it seems clear from private experience that a program along these lines would be less expensive and bureaucratic than the current system, and more satisfactory to the participants. In effect, it would be a way to voucherize Medicare and Medicaid. It would enable participants to spend their own money on themselves for routine medical care and medical problems, rather than having to go through HMOs and insurance companies, while at the same time providing protection against medical catastrophes.

An interesting and instructive experiment with medical savings accounts has recently taken place in South Africa, as explained by Shaun Matisonn of the National Center for Policy Analysis:

For most of the last decade [the nineties] – under the leadership of Nelson Mandela – South Africa enjoyed what was probably the freest market for health insurance anywhere in the world…. South Africa’s insurance regulations were and are sufficiently flexible to allow the type of innovation and experimentation that American law stifles…. The result has been remarkable…. In just five years, MSA plans captured half the market, proving that they are popular and meet consumer needs as well as or better than rival products. South Africa’s experience with MSAs shows that MSA holders save money, spending less on discretionary items in a way that does not increase the cost of inpatient care. Contrary to allegations by some critics, the South African experience also shows that MSAs attract individuals of all different ages and different degrees of health.

A more radical reform would, first, end both Medicare and Medicaid, at least for new entrants, and replace them by providing every family in the United States with catastrophic insurance – i.e., a major medical policy with a high deductible. Second, it would end tax exemption of employer-provided medical care. And third, it would remove the restrictive regulations that are now imposed on medical insurance – hard to justify with universal catastrophic insurance.

This reform would solve the problem of the currently medically uninsured, eliminate most of the bureaucratic structure, free medical practitioners from an increasingly heavy burden of paperwork and regulation, and lead many employers and employees to convert employer-provided medical care into a higher cash wage. The taxpayer would save money because total government costs would plummet. The family would be relieved of one of its major concerns – the possibility of being impoverished by a major medical catastrophe – and most could readily finance the remaining medical costs. Families would once again have an incentive to monitor the providers of medical care and to establish the kind of personal relations with them that were once customary. The demonstrated efficiency of private enterprise would have a chance to improve the quality and lower the cost of medical care. The first question asked of a patient entering a hospital might once again become “What’s wrong?” and not “What’s your insurance?”

While so radical a reform is almost surely not politically feasible at the moment, it may become so as dissatisfaction with the current arrangements continue to grow. And again, it gives a standard – if less than an ideal one – against which to judge incremental changes.

Notes

1 Females only are included to remove one source of irrelevant difference among countries. In general, females tend to have a longer expected length of life than males, and countries differ in the ratio of males to females. The correlation of expected length of life with per capita spending on medical care in dollars is almost the same as with percent of GDP spent on medical care.

2 The correlation is partly spurious because percent spent tends to be positively correlated with real GDP, and real GDP is positively correlated with length of life for given percent spent. However, the partial correlation of percent spent with length of life is statistically significant and higher than the partial correlation of real GDP with length of life.

3 In an extensive study, the Rand Corporation compared the effect of different health-insurance plans, varying from one with no deductible and no co-payment – that is, free medical care – to one with 95 percent co-payment, very close to complete private responsibility. In his summary of the results, Joseph Newhouse concluded that, “had there been no MDE [maximum deductible expense], demand on the 95 percent coinsurance plan would have been a little over half as large as on the free care plan,” and an accompanying table gives 55 percent as the actual fraction.

The 1997 value of the extrapolated trend from 1919-1940 is 48 percent of on a completely independent set of data. See Joseph P. Newhouse, Free for All? Lessons from Rand Health Insurance Experiment (Harvard University Press, 1993), p. 458.

4 Had this been the total expenditure in 1996, the United States would have ranked twenty-first, rather than first, among the 29 OECD countries in fraction of income spent on medical care.

5 The figure of 14 percent referred to earlier was from OECD data; it referred to 1996 rather than 1997 and to percent of gross domestic product, not national income.

6 I have used data for the population as a whole, although data are also available by sex and race. There are minor differences between the sexes and between the races, but the broad picture is essentially the same for all, so I have not thought it worthwhile to present more detailed data, as I did in Input and Output in Medical Care (Stanford: Hoover Institution Press, 1992).

7 I am indebted to James Fries, a leading expert on aging, for calling this phenomenon to my attention. The data cited are from Metropolitan Life Insurance Statistical Bulletin, Oct.-Dec., 1998.

8 See Cynthia Ramsay and Michael Walker, Critical Issues Bulletin: Waiting Your Turn, 7th edition (Vancouver, B.C., Canada: Fraser Institute, 1997).

9 W. Allen Wallis, An Overgoverned Society (Free Press, 1976), p. 256.

10 Whether medical savings accounts increase or decrease the government subsidy to medical care, including the hidden tax subsidy of tax exemption, depends on whether they raise or lower total medical expenditures exempted from tax. First-party payment works toward reducing such expenditures by giving consumers an incentive to economize and by reducing administrative costs. The availability of tax exemption to a wider class of medical expenses has the opposite effect. Such experience as we have with medical savings accounts or their equivalent suggests that the first effect is highly significant and is likely to overwhelm the second. However, this issue deserves more systematic investigation.

Milton Friedman is a senior research fellow at the Hoover Institution and author (with Rose D. Friedman) of Two Lucky People (University of Chicago Press, 1998). He received the Nobel Prize for Economic Science in 1976.

|

I look at the mess across the ocean.

I look at the mess across the ocean.…Maiia Habruk escaped Kyiv last spring along with around five million fellow citizens and found a safe haven with a couple in south east London. But she returned to Ukraine in mid-December after failing to get the treatment she needed from her local hospital in Lewisham. …She decided the only way to get the treatment she believed she required was to make the 24-hour trip back to Ukraine, which includes a flight to Poland and a long and dangerous train journey to Kyiv. …Maiia, who witnessed almost daily bombing raids by the Russians while in Kyiv, knows three other Ukrainians in London who sought emergency health procedures back in their war-torn country due to the lack of availability of quick treatment from the NHS.

Once patients reach the emergency room, 35% now face waits above four hours… As of November, some 7.2 million patients have been referred for treatment but are waiting for it to start. Of those, 2.9 million have been waiting more than 18 weeks. The NHS considers itself a success if it starts treatment within that four-month window, which is the epitome of defining failure down. …Excess deaths in 2022 were the most since 1951, excluding the pandemic. …The U.S. suffers a chronic problem of healthcare financing but not of health-care delivery. Britain shows that with single-payer you end up with both. The U.K. also shows that single-payer’s biggest victims are low-income people who can’t afford to opt out.

NHS spending is up 12 per cent in real terms since 2019-20; there are 13 per cent more doctors and 11 per cent more nurses, and yet the service delivered 5 per cent fewer treatments in the first nine months of 2022 than in the same period in 2019. …Its six pillars – that it is “free” at the point of use, the full state ownership of hospitals, its complete dependence on taxpayer funding, its supposed culture of altruism, its nature as a shared moral project uniting rich and poor, and its centrally planned workforce – are the very causes of its disintegration.