Mirror, Mirror, on the Wall, Which State Provides the Most Handouts of All?

Back in 2010, I put together a “Moocher Index” based on the percentage of non-poor people in each state getting government handouts.

Based on that back-of-the-envelope calculation, Vermont, Mississippi, and Maine were the biggest moocher states and Nevada, Colorado, and Arizona were the most self-reliant states.

Then, in 2013, I shared some data looking at the value of welfare benefits in each state, compared to both the median wage and to the federal poverty rate.

Sadly, those numbers showed it was more lucrative in many states (especially in the Northeast and Hawaii) to live off the government rather than work.

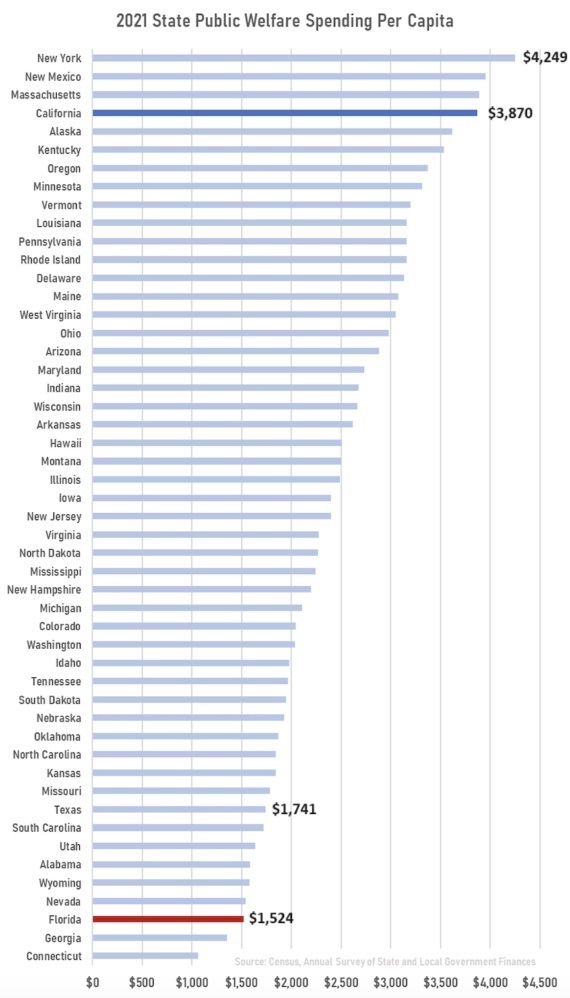

Today, let’s look at which states are the most generous with handouts. The Committee to Unleash Prosperity shared this table yesterday, which ranks states based on the level of per-capita spending on public welfare.

The folks at CTUP highlighted California and Florida. Since I usually do New York-vs-Florida and California-vs-Texas comparisons, I added a couple more numbers.

P.S. Looking at the above numbers, keep in mind that there is a Laffer Curve-type relationship between redistribution spending and the poverty rate. So states like Florida and Texas presumably are reducing poverty while states such as New York and California are subsidizing it.

P.P.S. Compared to other industrialized nations, the United States has a relatively low level of welfare spending.

The best way to destroy the welfare trap is to put in Milton Friedman’s negative income tax.

A Picture of How Redistribution Programs Trap the Less Fortunate in Lives of Dependency

I wrote last year about the way in which welfare programs lead to very high implicit marginal tax rates on low-income people. More specifically, they lose handouts when they earn income. As such, it is not very advantageous for them to climb the economic ladder because hard work is comparatively unrewarding.

Thanks to the American Enterprise Institute, we now have a much more detailed picture showing the impact of redistribution programs on the incentive to earn more money.

It’s not a perfect analogy since people presumably prefer cash to in-kind handouts, but the vertical bars basically represent living standards for any given level of income that is earned (on the horizontal axis).

Needless to say, there’s not much reason to earn more income when living standards don’t improve. May as well stay home and good off rather than work hard and produce.

This is why income redistribution is so destructive, not just to taxpayers, but also to the people who get trapped into dependency. Which is exactly the point made in this video.

P.S. Most of you know that I’m not a fan of the Organization for Economic Cooperation and Development because the Paris-based bureaucracy has such statist impulses. But even the OECD has written about the negative impact of overly generous welfare programs on incentives for productive behavior.

Related posts:

Open letter to President Obama (Part 117B)

Milton Friedman’s Free to Choose – Ep.4 (1/7) – From Cradle to Grave President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for […]

Milton Friedman remembered at 100 years from his birth (Part 5)

Testing Milton Friedman – Preview Uploaded by FreeToChooseNetwork on Feb 21, 2012 2012 is the 100th anniversary of Milton Friedman’s birth. His work and ideas continue to make the world a better place. As part of Milton Friedman’s Century, a revival of the ideas featured in the landmark television series Free To Choose are being […]

40% of USA on government dole, need to eliminate welfare and put in Friedman’s negative income tax

Eight Reasons Why Big Government Hurts Economic Growth We got to cut these welfare programs before everyone stops working and wants to get the free stuff. The Bible says if you don’t work then you should not eat. It also says that churches should help the poor but it doesn’t say that the government should […]

Free or equal? 30 years after Milton Friedman’s Free to Choose (Part 2)

Johan Norberg – Free or Equal – Free to Choose 30 years later 2/5 Published on Jun 10, 2012 by BasicEconomics In 1980 economist and Nobel laureate Milton Friedman inspired market reform in the West and revolutions in the East with his celebrated television series “Free To Choose.” Thirty years later, in this one-hour documentary, […]

Milton Friedman remembered at 100 years from his birth (Part 4)

I ran across this very interesting article about Milton Friedman from 2002: Friedman: Market offers poor better learningBy Tamara Henry, USA TODAY By Doug Mills, AP President Bush honors influential economist Milton Friedman for his 90th birthday earlier this month. About an economist Name:Milton FriedmanAge: 90Background: Winner of the 1976 Nobel Prize for economic science; […]

Transcript and video of Milton Friedman on Bill Clinton and Ronald Reagan (Part 2)

Below is a discussion from Milton Friedman on Bill Clinton and Ronald Reagan. February 10, 1999 | Recorded on February 10, 1999 audio, video, and blogs » uncommon knowledge PRESIDENTIAL REPORT CARD: Milton Friedman on the State of the Union with guest Milton Friedman Milton Friedman, Senior Research Fellow, Hoover Institution and Nobel Laureate in […]

If converted to cash and simply given to the recipients welfare check would be $44,000 per family of four

Milton Friedman came up with the idea of eliminating all welfare programs and putting in a negative income tax that would eliminate the welfare trap. However, our federal government just doesn’t listen to reason. Obama Ends Welfare Reform as We Know It, Calls for $12.7 Trillion in New Welfare Spending Robert Rector July 17, 2012 […]

Milton Friedman explains negative income tax to William F. Buckley in 1968

December 06, 2011 03:54 PM Milton Friedman Explains The Negative Income Tax – 1968 0 comments By Gordonskene enlarge Milton Friedman and friends.DOWNLOADS: 36 PLAYS: 35 Embed The age-old question of Taxes. In the early 1960′s Economist Milton Friedman adopted an idea hatched in England in the 1950′s regarding a Negative Income Tax, to […]

Listing of transcripts and videos of “Free to Choose” episode 4 – From Cradle to Grave on www.theDailyHatch.org

In the last few years the number of people receiving Food Stamps has skyrocketed. President Obama has not cut any federal welfare programs but has increased them, and he has used class warfare over and over the last few months and according to him equality at the finish line is the equality that we should […]

Milton Friedman remembered at 100 years from his birth (Part 2)

Testing Milton Friedman – Preview Uploaded by FreeToChooseNetwork on Feb 21, 2012 2012 is the 100th anniversary of Milton Friedman’s birth. His work and ideas continue to make the world a better place. As part of Milton Friedman’s Century, a revival of the ideas featured in the landmark television series Free To Choose are being […]