–

A climate change activist wearing a mask depicting Sen. Joe Manchin, D-W.Va., pretends to be a puppet master stringing along Senate Majority Leader Chuck Schumer, D-N.Y., and President Joe Biden on Capitol Hill on Oct. 20. But that was before Manchin caved this week on the misnamed Inflation Reduction Act, which includes hundreds of billions of dollars in funding for green energy boondoggles. (Photo: Jabin Botsford/The Washington Post/Getty Images)

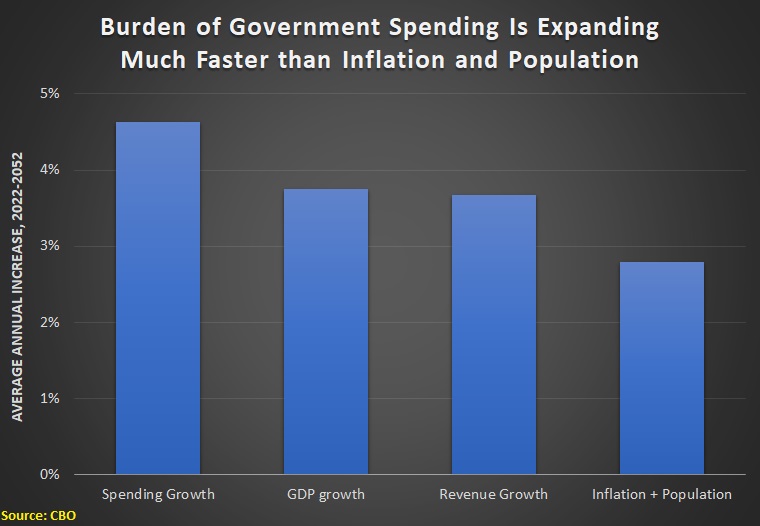

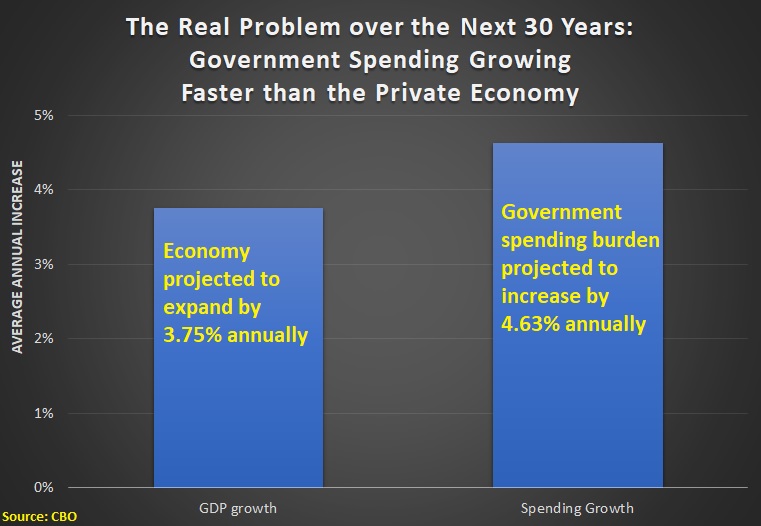

In the midst of a recession, with inflation eating away an average of $6,800 in purchasing power from the incomes of families with two workers, the so-called Inflation Reduction Act would impose tax increases, manipulative federal subsidies, and price controls on every American family.

The bill would deepen the growing recession, continue to depress household incomes, and will continue to increase prices.

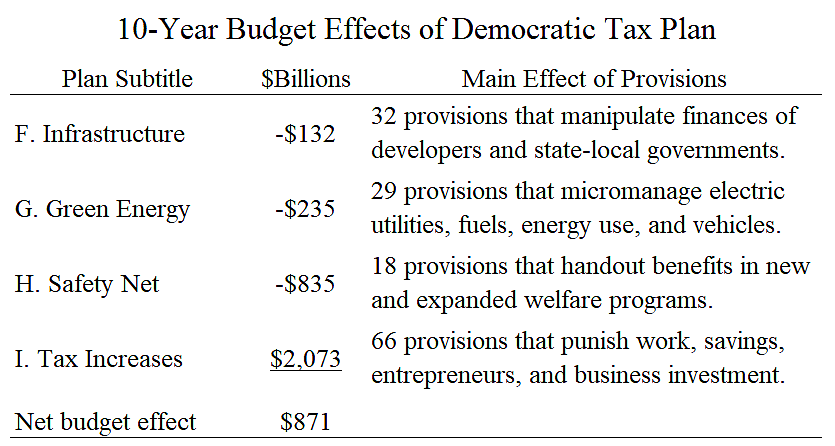

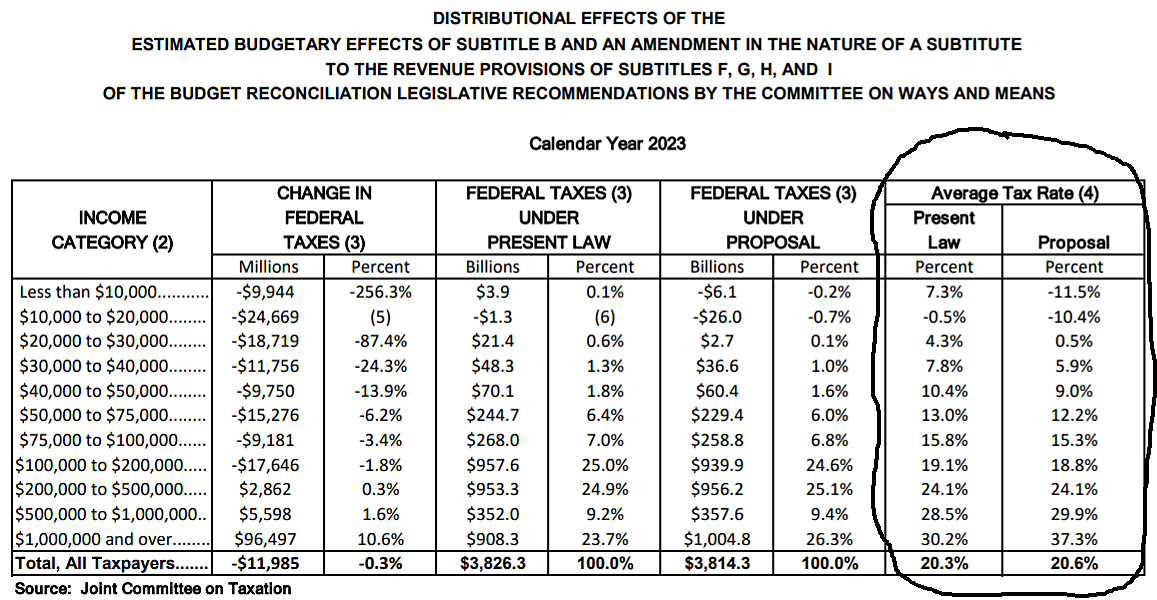

The release of the bill would mark a major reversal for its key supporter, Sen. Joe Manchin, D-W.Va., who in 2010 said, “I don’t think during a time of recession you mess with any of the taxes, or increase any taxes.” Yet this proposal, negotiated chiefly by Manchin and Senate Majority Leader Chuck Schumer, D-N.Y., is intended to raise taxes by roughly $570 billion over the next decade—$4,500 per household.

Further, the bill would increase spending on crony corporatist subsidies and wealth redistribution by roughly $510 billion over the next decade. However, the true cost would be nearly $200billion higher after accounting for budget gimmicks.

Want to keep up with the 24/7 news cycle? Want to know the most important stories of the day for conservatives? Need news you can trust? Subscribe to The Daily Signal’s email newsletter. Learn more >>

The bulk of the new subsidies are designed to have a far greater impact than their price tag implies. These subsidies could shift trillions of dollars of investment away from conventional energy sources and into green energy pipe dreams.

This shift would leave our economy smaller, less dynamic, and less innovative, and will trap millions in poverty. The bill also contains $250 billion in on-paper spending cuts that simply reflect the burdens of the drug price controls in the bill.

Far from helping consumers, these price controls will mean fewer lifesaving drugs are produced and will slash vital research budgets.

To add insult to injury, the spending will be front-loaded, and the revenues will be back-loaded. Though supporters of the bill claim it will reduce deficits over the next decade, it will likely increase deficits in the first few years, stoking inflationary pressures in the near term.

When the spending expires in a few years, some in Congress will want to repeat the gimmick all over again, claiming to pay for three years of spending with 10 years of taxes.

The legislation also follows immediately after the enactment of a $280 billion corporate welfarespending spree.

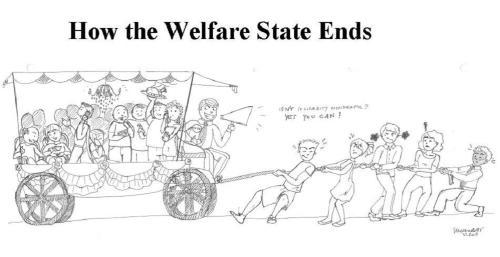

Inflation occurs when the government prints money to cover budget deficits. It’s good that Senate Democrats want to reduce the deficit, but front-loading new deficits and raising taxes are counterproductive. Raising taxes on firms increases their costs, which fall on households through higher prices, reduced production of goods and services, less investment, lower productivity, and lower wages.

The best path to take would be to drop the distortionary tax increases and spending subsidies, and instead reduce the deficit by cutting spending.

In truth, reducing the size, scope, and coercive intrusions of the government is the only way to mitigate inflation and lift the economy out of a recession at the same time.

Tragically, this bill does none of those things. Instead, it doubles down on the disastrous policies that got us into this “stagflationary” mess.

Here’s what’s in the bill:

Green New Deal Policies

Americans are suffering under the weight of high inflation. And two areas where that pain is being felt especially hard is at the gas pump and at the grocery store. Regular retail gas prices are about double what they were when President Joe Biden took office. Food price inflation is at levels not seen in more than 40 years.

The left and the Biden administration can try and play all the word games they want, but the Inflation Reduction Act may be their biggest misinformation campaign yet. Instead of addressing the underlying issues causinginflation, especially when it comes to energy and food, the bill only will exacerbate the problems.

There’s no end to the Biden war on energy in this legislative monstrosity. In fact, the bill is a signal to the energy sector that the war is going to be taken to a whole new level. The government-imposed shift away from conventional fuels that provide us affordable and abundant energy is going to shift even further.

If you are an oil company or refiner, why invest? Especially when this bill is telling them that Washington politicians want to kill off their industry. We have already seen the damage inflicted by efforts to block affordable and abundant energy and centrally plan a far-left vision for a “clean energy” future.

And it means pain for Americans. But the Biden administration and the left appear to be perfectly fine with inflicting this pain on Americans. In fact, rising energy prices are not unintended consequences of their policies, but rather the envisioned outcomes. This is something the left hasn’t been shy about acknowledging:

- Biden stated: “[When] it comes to the gas prices, we’re going through an incredible transition that is taking place that, God willing, when it’s over, we’ll be stronger, and the world will be stronger and less reliant on fossil fuels when this is over.”

- Then-President Barack Obama said: “Under my plan … electricity rates would necessarily skyrocket.”

- Transportation Secretary Pete Buttigieg reportedly “argued that more Americans should purchase electric vehicles so that they ‘never have to worry about gas prices again.’”

If Congress and the administration were serious about high energy and food prices, they would be reducing spending, not ramping it up. They would be reducing regulatory obstacles across supply chains, not increasing them. And they wouldn’t be presuming that Washington politicians should dictate how energy is generated and consumed in this nation.

The reported overall spending for the climate and clean energy provisions is $369 billion. Here are just some of the bill’s lowlights:

It spends $9 billion for promoting electric appliances and energy-efficient retrofits.

Do you like your natural gas stove or fireplace? Well, this bill is part of a broader effort to make these appliances relics of the past. If that seems like an exaggeration, there are already left-wing cities and states banning new hookups for natural gas appliances.

It creates tax credits to have homes run on “clean energy” and for the purchase of “clean vehicles.”

If American consumers demand those types of products and features, that’s one thing. The creation of this tax credit is a recognition that Americans don’t desire the products and, therefore, Washington politicians must induce Americans to “do the right thing.”

An important point to bear in mind: All of this new spending will come on top of the federal government’s voluminous regulations. Americans will be getting the worst of both worlds. There was already the Biden regulatory avalanche, and now this proposed bill would force taxpayers to use their hard-earned money to subsidize wasteful spending.

For example, as Washington politicians spend money to try to induce people to buy the appliances the government wants you to buy, there are currently proposed new conservation regulatory standards at the Department of Energy for commercial water heating equipment; consumer furnaces; walk-in coolers and freezers; commercial refrigerators, freezers, and refrigerator-freezers; packaged terminal air conditioners and packaged terminal heat pumps; dehumidifiers; dedicated-purpose pool pump motors; general service fluorescent lamps; clothes dryers; and distribution transformers.

It invests in unreliable electricity sources (and goods) while sending a clear signal that other electricity sources and gas-powered vehicles are disfavored.

The legislation includes production tax credits to manufacture solar panels and wind turbines, and a $10 billion tax credit to build “clean technology manufacturing facilities” that make electric vehicles, as well as those wind turbines and solar panels.

It also includes grants to retool auto manufacturing plants to manufacture clean vehicles and up to $20 billion in loans to build “clean vehicle” manufacturing facilities.

There are also “roughly $30 billion in targeted grant and loan programs” to get states and utilities to shift toward “clean electricity,” and tax credits and grants for clean fuels and clean commercial vehicles.

It punishes conventional fuel sources that provide affordable and reliable energy.

For example, the legislation would increase the costs for oil and gas drilling by increasing the royalties companies have to pay for offshore drilling from 12.5% to 16.66% (and as high as 18.75%), and for onshore oil drilling from 12.5% to 16.66%. It also includes a methane emissions fee for petroleum and natural gas companies.

It funds efforts that try to dictate agricultural practices.

The bill would provide more than $20 billion to support “climate-smart agricultural practices.” The climate efforts within the bill should be considered in a broader light. There is a major disdain on the left for American agriculture practices, which they view as causing “incalculable damages.” This bill just helps to support that disdain.

But there is another issue. Congress would be blessing the Biden administration’s egregious abuses at the U.S. Department of Agriculture in which, without proper authority, it used the Commodity Credit Corp. as a climate change slush fund to create out of whole cloth funding for “climate-smart agricultural practices.”

Transforming Economy, Not Reducing Costs

By changing energy production in such a dramatic fashion, this legislation is also a pretext for far greater changes to our country.

Energy impacts every aspect of our lives and every sector of the economy. By dictating how we produce and consume energy, this bill would dictate how we live our lives and limit the freedoms we enjoy.

It’s a pretext for control. And there is little to no regard for the high prices incurred by Americans and the costs that will arise for trying to achieve the left’s radical climate agenda. And what’s even worse, this is all pain for no gain.

As explained in a new Heritage Foundation report:

Eliminating all U.S. emissions would mitigate global temperatures by less than 0.2 of a degree Celsius by 2100. Even if all other Organization for Economic Cooperation and Development economies eliminated greenhouse gas emissions as well, the world average temperature increase would be mitigated by no more than 0.5 of a degree Celsius by 100.

This legislation is many things (e.g., cronyism, wasteful, costly, controlling, and arrogant), but it certainly isn’t about improving our lives, which affordable and abundant energy does. And regardless of the bill’s name—which is an insult to the intelligence of every American—it has nothing to do with addressing inflation.

Expanding Government-Run Health Plans

The health care provisions are the latest play out of the single-payer, government-run health plan playbook. The plan would extend the Obamacare COVID-19 expansion beyond its current end date, force government price controls on pharmaceuticals in Medicare, and claim Medicare savings to offset the cost of the entire package.

Sold as a temporary measure in response to COVID-19, the American Rescue Plan made Obamacare subsidies more generous for those who were already receiving subsidies and made subsidies available to individuals who were previously not eligible (those earning above 400% of poverty rate, which equals $106,000 for a family of four).

This COVID-19-related provision is set to expire at the end of the year. The Schumer-Manchin proposal would extend the Obamacare expansion for another three years.

The Congressional Budget Office has noted that allowing this expansion to end (as originally intended) would save taxpayers $64 billion and not reduce the number of people with individual health insurance coverage.

As Heritage Foundation senior fellow Edmund Haislmaier has explained, the expiration would not cause premiums to soar, and many of those higher-income individuals who lose the subsidies have other coverage options.

So, as Heritage senior fellow Doug Badger notes, the real winners of the extension are the big insurance plans that pocket the government subsidies. Of course, those aiming for government-run health care are also winners as they most certainly are eyeing to make this next “temporary” expansion permanent in the future.

(The Daily Signal is the news outlet of The Heritage Foundation.)

Medicare Drug Price ‘Negotiations’

The proposal’s Medicare price “negotiation” is another win for single-payer, government-run advocates. Heritage senior fellow Bob Moffit explains that the so-called Medicare prescription drug “negotiation” plan has nothing to do with negotiation and everything to do with government price setting.

Based on previous versions of this scheme, the secretary of health and human services would extend a purchase price to the manufacturers, the manufacturers could submit a counteroffer, but the secretary has the final authority to set the price and, in certain cases, could impose penalties on the manufactures for not agreeing to it.

Government price controls are a key piece in single-payer advocates’ plans for the health care sector, and pharmaceuticals are just the beginning.

Seniors only need to look at the Department of Veterans Affairs to see a version of this in practice. Seniors should expect less access to critical drugs and treatments than they have today, and everyone will be harmed by lack of newer drugs and cures being developed as a result in the future.

Independent analysts, whether they are from the Congressional Budget Office or academia, might differ on estimates of the number of new medications that will not be produced and distributed. But there is no doubt that the proposal will discourage investment in research and development of new and breakthrough medications.

Equally as damaging, it appears the savings generated from rationing prescription drugs for seniors will go to offset the Obamacare expansion and the new climate change agenda, rather than shoring up and protecting Medicare’s solvency.

There are plenty of better ideas for tackling the high cost of health care, prescription drugs, and Medicare’s fiscal condition. This plan misses the mark.

Yet Another Minimum Tax

The Manchin-Schumer bill would impose a new 15% corporate minimum tax on businesses. Unlike the regular U.S. corporate income tax, which is applied to taxable income, the new minimum tax would start from a taxpayer’s financial statement income under U.S. financial accounting principles and would then apply a complex series of adjustments to ultimately tax companies’ “adjusted financial statement income.”

To some, the idea of a minimum tax on businesses may not sound controversial on first blush, but the devil is in the details.

One important detail is that the tax code already has several provisions that explicitly or implicitly act as minimum taxes. In addition to having to calculate corporate income taxes the usual way, many businesses already must calculate their tax liability under the Base Erosion Anti-Abuse Tax system. They also must calculate a minimum tax on so-called global intangible low-taxed income. Business income received by individuals is subject to individual alternative minimum-tax rules.

Regardless of what happens with the corporate minimum tax in the current Senate bill, there may well be another minimum tax coming down the pike soon. Since the Manchin-Schumer tax doesn’t comport with the Organization for Economic Cooperation and Development’s global minimum tax scheme, there will be continued pressure from the left to add still another minimum tax on businesses.

This situation is a bit like a king imposing a tax on the people of his kingdom based on the “size” of their crop yield. He then proceeds to measure each of their crop yields by weight, by volume, by price, and by area, and for each farmer he collects the tax based on the measure that is least favorable to the farmer.

In the case of the Manchin-Schumer bill, the new measure of income used—adjusted financial statement income—is problematic. In addition to significantly complicating the tax system, this way of measuring taxpayer income disfavors those who make capital investments to grow their businesses.

When businesses purchase capital goods such as machinery and equipment, under the current corporate tax system they can deduct those costs when determining their regular tax liability. However, under the new minimum tax calculations, things like newly purchased farm or factory equipment wouldn’t be fully deductible for many years. All the while, inflation would eat away at the value of that legitimate business deduction.

In other words, the corporate minimum tax would punish businesses for investing. That is exactly the wrong prescription for American workers, because when businesses stop growing, good jobs are hard to come by.

And contrary to the stated aim of the bill—reducing inflation—smothering business investment will reduce production and, if anything, drive up prices.

‘Carried Interest’ Tax Hike

Current law requires that capital gains and wages be treated differently. Wages are deductible as a business expense by the employer and taxable to the recipient as ordinary income. Income generated by capital assets is taxed and then capital gains from the sale of those assets are also generally taxed (but at a lower rate if held more than one year). Payments to purchase capital assets are generally not deductible.

Many investment managers are compensated with a combination of wage or salary income and some incentive-based compensation based on the profits from the investments (if any profits are forthcoming). The latter portion of the compensation, known as the “carried interest,” is usually taxed as a capital gain.

The bill effectively treats all capital gains from certain partnerships, financial instruments, and contracts as if they were wage income, but does not allow a deduction for those wage payments. It applies to “any interest in a partnership which, directly or indirectly, is transferred to (or is held by) the taxpayer in connection with the performance of substantial services by the taxpayer, or any other related person.”

It is, therefore, an asymmetric “heads the government wins, tails the taxpayer loses” treatment since the compensation is taxed as if it were wages, but the wages paid are not deductible. It can be expected to reduce the return on investments and therefore have an adverse effect on productivity and wages in the long run.

IRS Slush Fund

The bill would provide an upfront appropriation totaling $78.9 billion for the Internal Revenue Service. That would effectively be a slush fund for the IRS, which could be spent with little congressional direction through 2031.

According to the Biden administration’s proposal, this funding would be used to add nearly 87,000 new IRS agents. The bill provides the Treasury secretary or her designee the flexibility to take such personnel actions as are deemed necessary to administer the Internal Revenue Code.

The Congressional Budget Office projectsadditional IRS enforcement spending could yield approximately $200 billion in higher revenues (for a net deficit reduction of about $120 billion). However, the CBO acknowledges this estimate is uncertain and differs from previous analysis.

What we do know is that the IRS bureaucracy will be charged with finding about a quarter of the Inflation Reduction Act’s deficit reduction.

The new agents and new funding could be used to subject small businesses and middle-class taxpayers to more IRS scrutiny. The bill includes a disclaimer stating: “Nothing in this subsection is intended to increase taxes on any taxpayer with a taxable income of [less than] $400,000.”

Of course, examining and enforcing payment of legally owed taxes is unlikely to be interpreted as increasing taxes. Based on IRS data, individual filers reporting less than $50,000 of income accounted for 62% of underreported taxes.

The new funding is equal to six times the normal annual IRS budget, which supports about 35,000 enforcement agents. It’s implausible that the scandal–ridden and union-dominated agency will be able to absorb so much extra funding, personnel, and power and avoid waste, fraud, and abuse.

Although the authority is not included in this legislation, Biden has even proposed requiring financial institutions to provide the IRS sensitive information on bank accounts with as little as $600.

According to Gallup, only 37% of Americans have a favorable opinion of the IRS, making it one of the least popular federal agencies. With the IRS’ politicized history, that’s not surprising.

Inflation Recession Act

The Biden administration and its liberal allies in Congress have gone out of their way to impose new burdens and to bloat the government. The result has been the ensuing inflationary crisis and now a recession.

Instead of heeding the economic warning lights, they have offered this bill, which is identical in purpose and philosophy to what created the current economic mess. If enacted into law, this bill would exacerbate the economic crisis and lead to a longer and much more painful stagflation.

Have an opinion about this article? To sound off, please email letters@DailySignal.com and we’ll consider publishing your edited remarks in our regular “We Hear You” feature. Remember to include the url or headline of the article plus your name and town and/or state.

Open letter to President Obama (Part 644)

(Emailed to White House on 6-10-13.)

President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500

Dear Mr. President,

I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here.

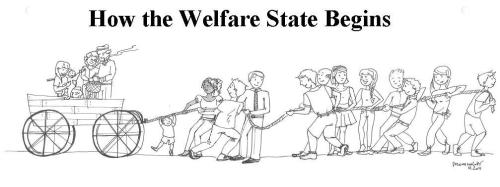

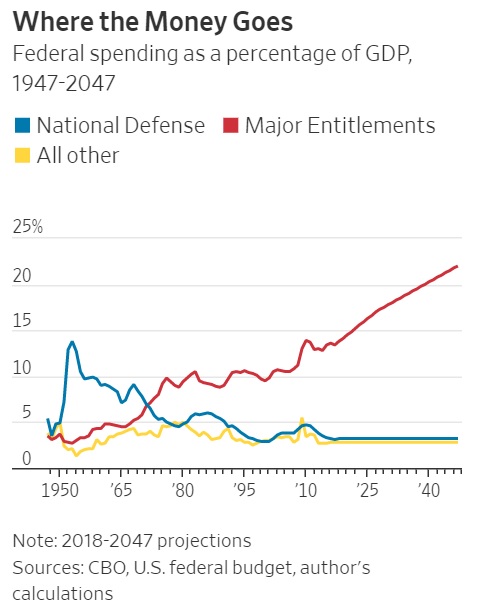

The federal government debt is growing so much that it is endangering us because if things keep going like they are now we will not have any money left for the national defense because we are so far in debt as a nation. We have been spending so much on our welfare state through food stamps and other programs that I am worrying that many of our citizens are becoming more dependent on government and in many cases they are losing their incentive to work hard because of the welfare trap the government has put in place. Other nations in Europe have gone down this road and we see what mess this has gotten them in. People really are losing their faith in big government and they want more liberty back. It seems to me we have to get back to the founding principles that made our country great. We also need to realize that a big government will encourage waste and corruption. The recent scandals in our government have proved my point. In fact, the jokes you made at Ohio State about possibly auditing them are not so funny now that reality shows how the IRS was acting more like a monster out of control. Also raising taxes on the job creators is a very bad idea too. The Laffer Curve clearly demonstrates that when the tax rates are raised many individuals will move their investments to places where they will not get taxed as much.

______________________

We can fix the IRS problem by going to the flat tax and lowering the size of government.

Did President Obama and his team of Chicago cronies deliberately target the Tea Party in hopes of thwarting free speech and political participation?

Was this part of a campaign to win the 2012 election by suppressing Republican votes?

Perhaps, but I’ve warned that it’s never a good idea to assume top-down conspiracies when corruption, incompetence, politics, ideology, greed, and self-interest are better explanations for what happens in Washington.

Writing for the Washington Examiner, Tim Carney has a much more sober and realistic explanation of what happened at the IRS.

If you take a group of Democrats who are also unionized government employees, and put them in charge of policing political speech, it doesn’t matter how professional and well-intentioned they are. The result will be much like the debacle in the Cincinnati office of the IRS. …there’s no reason to even posit evil intent by the IRS officials who formulated, approved or executed the inappropriate guidelines for picking groups to scrutinize most closely. …The public servants figuring out which groups qualified for 501(c)4 “social welfare” non-profit status were mostly Democrats surrounded by mostly Democrats. …In the 2012 election, every donation traceable to this office went to President Obama or liberal Sen. Sherrod Brown. This is an environment where even those trying to be fair could develop a disproportionate distrust of the Tea Party. One IRS worker — a member of NTEU and contributor to its PAC, which gives 96 percent of its money to Democratic candidates — explained it this way: “The reason NTEU mostly supports Democratic candidates for office is because Democratic candidates are mostly more supportive of civil servants/government employees.”

Tim concludes with a wise observation.

As long as we have a civil service workforce that leans Left, and as long as we have an income tax system that requires the IRS to police political speech, conservative groups can always expect special IRS scrutiny.

And my colleague Doug Bandow, in an article for the American Spectator, adds his sage analysis.

The real issue is the expansive, expensive bureaucratic state and its inherent threat to any system of limited government, rule of law, and individual liberty. …the broader the government’s authority, the greater its need for revenue, the wider its enforcement power, the more expansive the bureaucracy’s discretion, the increasingly important the battle for political control, and the more bitter the partisan fight, the more likely government officials will abuse their positions, violate rules, laws, and Constitution, and sacrifice people’s liberties. The blame falls squarely on Congress, not the IRS.

I actually think he is letting the IRS off the hook too easily.

- It has thieving employees.

It has incompetent employees.

It has incompetent employees.- It has thuggish employees.

- It has brainless employees.

- It has protectionist employees.

- It has wasteful employees.

- And it has victimizing employees.

But Doug’s overall point obviously is true.

…the denizens of Capitol Hill also have created a tax code marked by outrageous complexity, special interest electioneering, and systematic social engineering. Legislators have intentionally created avenues for tax avoidance to win votes, and then complained about widespread tax avoidance to win votes.

So what’s the answer?

The most obvious response to the scandal — beyond punishing anyone who violated the law — is tax reform. Implement a flat tax and you’d still have an IRS, but the income tax would be less complex, there would be fewer “preferences” for the agency to police, and rates would be lower, leaving taxpayers with less incentive for aggressive tax avoidance. …Failing to address the broader underlying factors also would merely set the stage for a repeat performance in some form a few years hence. …More fundamentally, government, and especially the national government, should do less. Efficient social engineering may be slightly better than inefficient social engineering, but no social engineering would be far better.

Amen. Let’s rip out the internal revenue code and replace it with a simple and fair flat tax.

But here’s the challenge. We know the solution, but it will be almost impossible to implement good policy unless we figure out some way to restrain the spending side of the fiscal ledger.

___________________________

At the risk of over-simplifying, we will never get tax reform unless we figure out how to implement entitlement reform.

Here’s another Foden cartoon, which I like because it has the same theme asthis Jerry Holbert cartoon, showing big government as a destructive and malicious force.

_____________

Thank you so much for your time. I know how valuable it is. I also appreciate the fine family that you have and your commitment as a father and a husband.

Sincerely,

Everette Hatcher III, 13900 Cottontail Lane, Alexander, AR 72002, ph 501-920-5733, lowcostsqueegees@yahoo.com

Related Posts:

We know the IRS commissioner wasn’t telling the truth in March 2012, when he testified: “There’s absolutely no targeting.”

We know the IRS commissioner wasn’t telling the truth in March 2012, when he testified: “There’s absolutely no targeting.”However, Lois Lerner knew different when she misled people with those words. Two important points made by Noonan in the Wall Street Journal in the article below: First, only conservative groups were targeted in this scandal by […]

A great cartoonist takes on the IRS!!!!

Ohio Liberty Coalition versus the I.R.S. (Tom Zawistowski) Published on May 20, 2013 The Ohio Liberty Coalition was among tea party groups that received special scrutiny from the I.R.S. Tom Zawistowski says his story is not unique. He argues the kinds of questions the I.R.S. asked his group amounts to little more than “opposition research.” Video […]

“Schaeffer Sundays” Francis Schaeffer’s own words concerning what the First Amendment means

Francis Schaeffer: “Whatever Happened to the Human Race?” (Episode 2) SLAUGHTER OF THE INNOCENTS Published on Oct 6, 2012 by AdamMetropolis The 45 minute video above is from the film series created from Francis Schaeffer’s book “Whatever Happened to the Human Race?” with Dr. C. Everett Koop. This book really helped develop my political views concerning […]

Cartoonists show how stupid the IRS is acting!!!

We got to lower the size of government so we don’t have these abuses like this in the IRS. Cartoonists v. the IRS May 23, 2013 by Dan Mitchell Call me perverse, but I’m enjoying this IRS scandal. It’s good to see them suffer a tiny fraction of the agony they impose on the American people. I’ve already […]

Dear Senator Pryor, why not pass the Balanced Budget Amendment? (“Thirsty Thursday”, Open letter to Senator Pryor)

Dear Senator Pryor, Why not pass the Balanced Budget Amendment? As you know that federal deficit is at all time high (1.6 trillion deficit with revenues of 2.2 trillion and spending at 3.8 trillion). On my blog http://www.HaltingArkansasLiberalswithTruth.com I took you at your word and sent you over 100 emails with specific spending cut ideas. However, […]

Video from Cato Institute on IRS Scandal

Is the irs out of control? Here is the link from cato: MAY 22, 2013 8:47AM Can You Vague That Up for Me? By TREVOR BURRUS SHARE As the IRS scandal thickens, targeted groups are coming out to describe their ordeals in dealing with that most-reviled of government agencies. The Ohio Liberty Coalition was one of […]

IRS cartoons from Dan Mitchell’s blog

Get Ready to Be Reamed May 17, 2013 by Dan Mitchell With so many scandals percolating, there are lots of good cartoons being produced. But I think this Chip Bok gem deserves special praise. It manages to weave together both the costly Obamacare boondoggle with the reprehensible politicization of the IRS. So BOHICA, my friends. If […]

Obama jokes about audit of Ohio St by IRS then IRS scandal breaks!!!!!

You want to talk about irony then look at President Obama’s speech a few days ago when he joked about a potential audit of Ohio St by the IRS then a few days later the IRS scandal breaks!!!! The I.R.S. Abusing Americans Is Nothing New Published on May 15, 2013 The I.R.S. targeting of tea party […]

Dear Senator Pryor, why not pass the Balanced Budget Amendment? (“Thirsty Thursday”, Open letter to Senator Pryor)

Dear Senator Pryor, Why not pass the Balanced Budget Amendment? As you know that federal deficit is at all time high (1.6 trillion deficit with revenues of 2.2 trillion and spending at 3.8 trillion). On my blog http://www.HaltingArkansasLiberalswithTruth.com I took you at your word and sent you over 100 emails with specific spending cut ideas. However, […]

We could put in a flat tax and it would enable us to cut billions out of the IRS budget!!!!

We could put in a flat tax and it would enable us to cut billions out of the IRS budget!!!! May 14, 2013 2:34PM IRS Budget Soars By Chris Edwards Share The revelations of IRS officials targeting conservative and libertarian groups suggest that now is a good time for lawmakers to review a broad range […]