Cato Institute scholar Dan Mitchell is right about Greece and the fate of socialism:

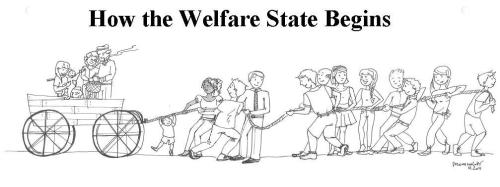

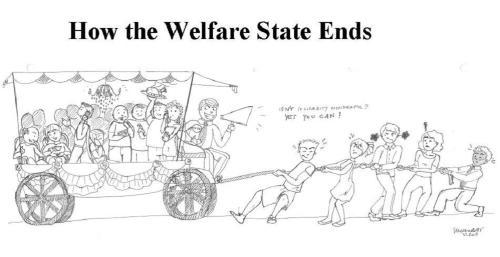

Two Pictures that Perfectly Capture the Rise and Fall of the Welfare State

July 15, 2011 by Dan Mitchell

In my speeches, especially when talking about the fiscal crisis in Europe (or the future fiscal crisis in America), I often warn that the welfare state reaches a point-of-no-return when the number of people riding in the wagon begins to outnumber the number of people pulling the wagon.

To be more specific, if more than 50 percent of the population is dependent on government (employed in the bureaucracy, living off welfare, receiving pensions, etc), it becomes rather difficult to form a coalition to fix the mess. This may explain why Greek politicians have resisted significant reforms, even though the nation faces a fiscal death spiral.

But you don’t need me to explain this relationship. One of our Cato interns, Silvia Morandotti, used her artistic skills to create two images (click pictures for better resolution) that show what a welfare state looks like when it first begins and what it eventually becomes.

These images are remarkably accurate. The welfare state starts with small programs targeted at a handful of genuinely needy people. But as politicians figure out the electoral benefits of expanding programs and people figure out the that they can let others work on their behalf, the ratio of producers to consumers begins to worsen.

Eventually, even though the moochers and looters should realize that it is not in their interest to over-burden the people pulling the wagon, the entire system breaks down.

Then things get really interesting. Small nations such as Greece can rely on permanent bailouts from bigger countries and the IMF, but sooner or later, as larger nations begin to go bankrupt, that approach won’t be feasible.

I often conclude my speeches by joking with the audience that it’s time to stock up on canned goods, bottled water, and ammo. Many people, I’m finding, don’t think that line very funny.

___________________

The Department of Health and Human Services administers the huge and fast-growing Medicare and Medicaid programs. These programs fuel rising health costs, distort health markets, and are plagued by waste and fraud. The department also runs an array of other expensive subsidy programs, including Head Start, TANF, and LIHEAP. Growth in HHS spending is creating a federal financial crisis, and the 2010 health care law sadly makes the situation worse.

The department will spend $910 billion in 2011, or $7,710 for every U.S. household. It employs 68,000 workers and runs more than 420 subsidy programs.

Milton Friedman – Roots Of The Welfare State

Timeline of Government Growth

- See this timeline for key events in the department’s growth.

Reading Room

- Here are background studies that examine the department’s activities.

Cato Experts

- Michael Cannon, Director, Health Policy Studies

- Michael Tanner, Senior Fellow

- Jagadeesh Gokhale, Senior Fellow

- Chris Edwards, Director, Tax Policy Studies

- Tad DeHaven, Budget Policy Analyst

Spending Cuts Summary

- Here are proposed reforms to save $81 billion annually in the short-run and prevent federal health costs from consuming a growing share of the economy in the long-run.

Downsize This!

- Medicare Reforms. Medicare should be transformed into a system based on vouchers, individual savings, and competitive insurance markets.

- Medicaid Reforms. Federal spending on low-income health care should be converted to block grants for the states.

- TANF and Welfare Spending. Welfare reforms in 1996 created Temporary Assistance for Needy Families, but this sort of aid should be provided by private charities.

- Head Start and Other Subsidies. HHS funds a vast array of other subsidy programs, many of which are wasteful and ineffective.

- 2010 Health Care Legislation. The law expanded Medicaid, added new taxes and subsidies, created new bureaucracies, and did little to reduce cost growth in health care.

“The government of the United States is a definite government, confined to specified objects. It is not like the state governments, whose powers are more general. Charity is no part of the legislative duty of the government.”

– James Madison. A paraphrase from Elliot’s Debates regarding a proposed subsidy bill, House of Representatives, January 10, 1794.

Related posts:

FRIEDMAN FRIDAY Levin on Milton Friedman: ‘One Thing to Have Free Immigration to Jobs, Another for Welfare’ By Michael Morris | January 16, 2015

____________ Levin on Milton Friedman: ‘One Thing to Have Free Immigration to Jobs, Another for Welfare’ By Michael Morris | January 16, 2015 | 5:12 PM EST During his show on January 15, 2015, Nationally syndicated radio host Mark Levin recalled the famed economist Milton Friedman and explored an important reason why open immigration, despite […]

Levin on Milton Friedman: ‘One Thing to Have Free Immigration to Jobs, Another for Welfare’ By Michael Morris | January 16, 2015

_____________________ Levin on Milton Friedman: ‘One Thing to Have Free Immigration to Jobs, Another for Welfare’ By Michael Morris | January 16, 2015 | 5:12 PM EST During his show on January 15, 2015, Nationally syndicated radio host Mark Levin recalled the famed economist Milton Friedman and explored an important reason why open immigration, despite […]

Open letter to President Obama (Part 691) Milton Friedman did not favor free immigration with existing welfare state in USA

Open letter to President Obama (Part 691) Milton Friedman (Emailed to White House on 6-25-13.) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to […]

Open letter to President Obama (Part 683) Milton Friedman’s solution to the welfare state

Open letter to President Obama (Part 683) Milton Friedman (Emailed to White House on 6-25-13.) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to […]

“Friedman Friday” Milton Friedman had a solution to the welfare state!!!

I have written about the tremendous increase in the food stamp program the last 9 years before and that means that both President Obama and Bush were guilty of not trying to slow down it’s growth. Furthermore, Republicans have been some of the biggest supporters of the food stamp program. Milton Friedman had a good […]

Thomas Sowell and Milton Friedman’s answer to the welfare problem in 1980 will still work today

_____________________________________ Milton Friedman On Charlie Rose (Part One) The late Milton Friedman discusses economics and otherwise with Charlie Rose. _________________________________________ Milton Friedman: Life and ideas – Part 01 Milton Friedman: Life and ideas A brief biography of Milton Friedman _____________________________________ Stossel – “Free to Choose” (Milton Friedman) 1/6 6-10-10. pt.1 of 6. Stossel discusses Milton […]

Milton Friedman had a solution to today’s welfare mentality!!!

I have written about the tremendous increase in the food stamp program the last 9 years before and that means that both President Obama and Bush were guilty of not trying to slow down it’s growth. Furthermore, Republicans have been some of the biggest supporters of the food stamp program. Milton Friedman had a […]

Milton Friedman did not favor free immigration with existing welfare state in USA

Milton Friedman did not favor free immigration with existing welfare state in USA Milton Friedman – Illegal Immigration – PT 2 Uploaded on Dec 18, 2009 (2 of 2) Professor Friedman fields a question on the dynamics of illegal immigration ________________ Heritage Responds to Senator Rubio on Immigration Study Amy Payne May 8, 2013 at […]

The Welfare trap can be destroyed by Milton Friedman’s negative income tax

The best way to destroy the welfare trap is to put in Milton Friedman’s negative income tax. A Picture of How Redistribution Programs Trap the Less Fortunate in Lives of Dependency I wrote last year about the way in which welfare programs lead to very high implicit marginal tax rates on low-income people. More specifically, they […]

Hong Kong and the Miracle of Compounding Long-Run Growth March 11, 2016 by Dan Mitchell (with video from Milton Friedman)

Testing Milton Friedman: Free Markets – Full Video Hong Kong and the Miracle of Compounding Long-Run Growth March 11, 2016 by Dan Mitchell Hong Kong is a truly remarkable jurisdiction. Can you name, after all, another government in the world that brags about how little it spends on redistribution programs andhow few people are dependent on […]