–

The Simple Solution to America’s Horrific Long-Run Fiscal Crisis

Yesterday’s column analyzed some depressing datain the new long-run fiscal forecast from the Congressional Budget Office.

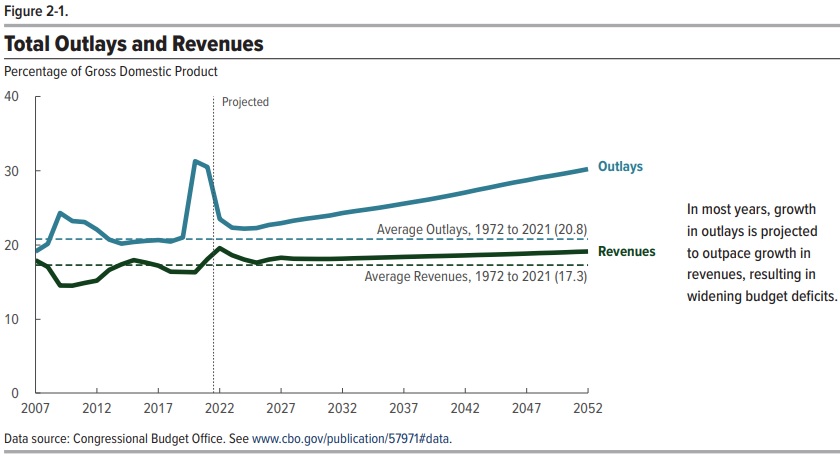

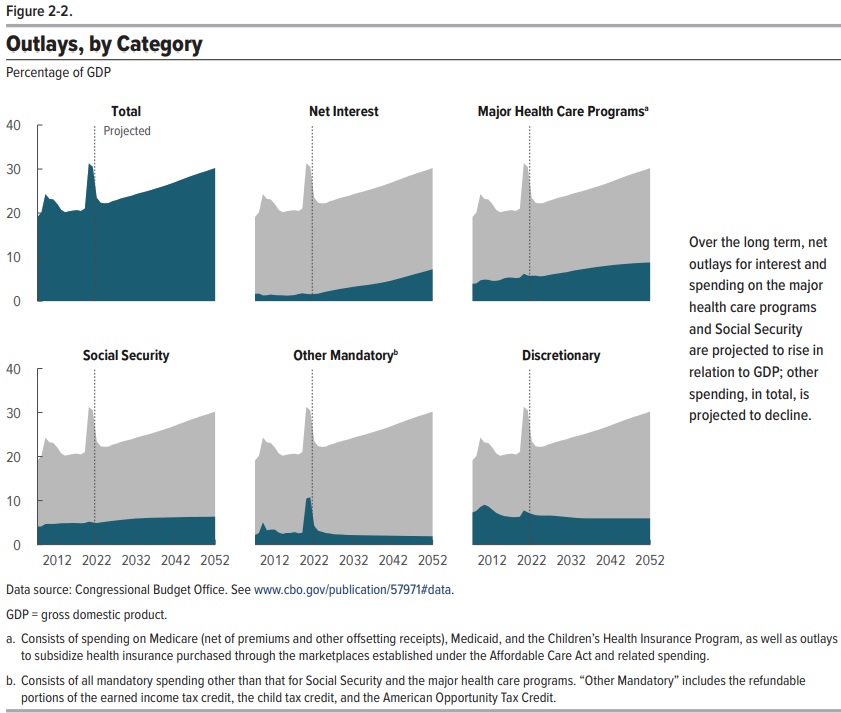

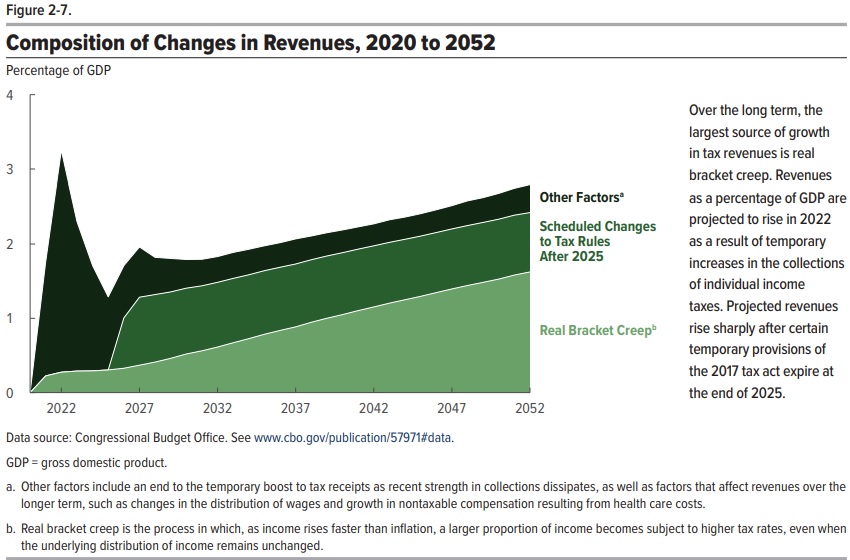

Simply stated, if we leave fiscal policy on auto-pilot, government spending is going to consume an ever-larger share of America’s economy. Which means some combination of more taxes, more debt, and more reckless monetary policy.

Today, let’s show how that problem can be solved.

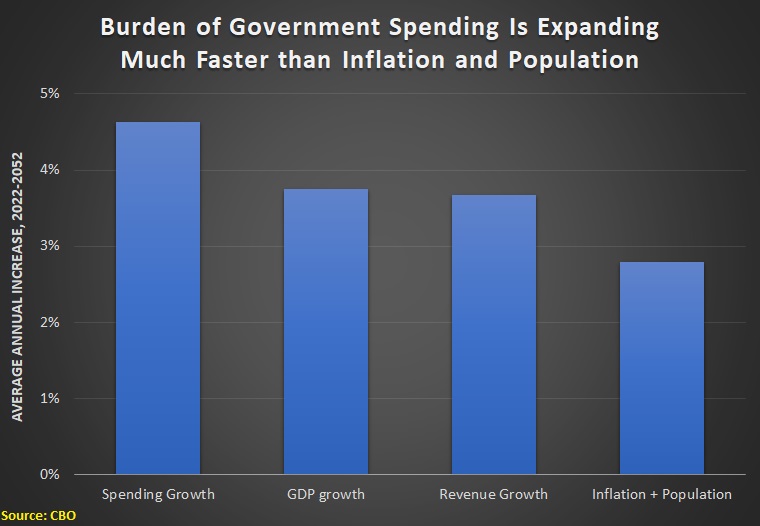

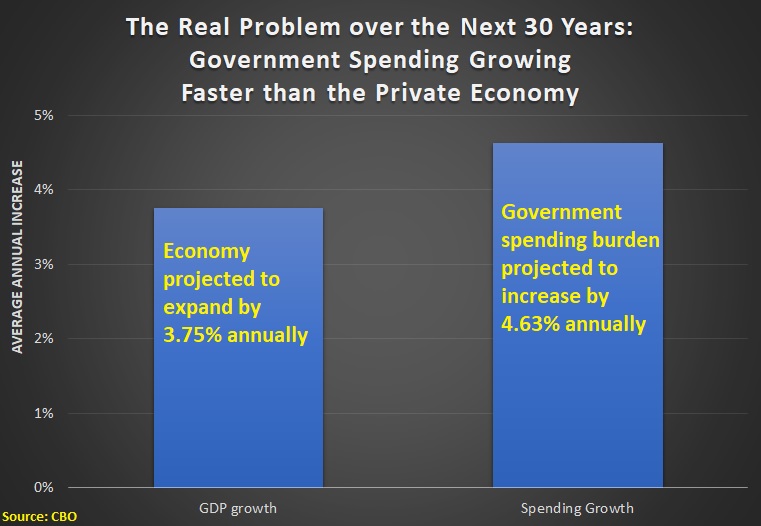

My final chart yesterday showed that the fundamental problem is that government spending is projected to grow faster than the private economy, thus violating the “golden rule” of fiscal policy.

Here’s a revised version of that chart. I have added a bar showing how fast tax revenues are expected to grow over the next 30 years, as well as a bar showing the projection for population plus inflation.

As already stated, it’s a big problem that government spending is growing faster (an average of 4.63 percent per year) than the growth of the private economy (an average of 3.75 percent per years.

But the goal of fiscal policy should not be to maintain the bloated budget that currently exists. That would lock in all the reckless spending we got under Bush, Obama, and Trump. Not to mention the additional waste approved under Biden.

Ideally, fiscal policy should seek to reduce the burden of federal spending.

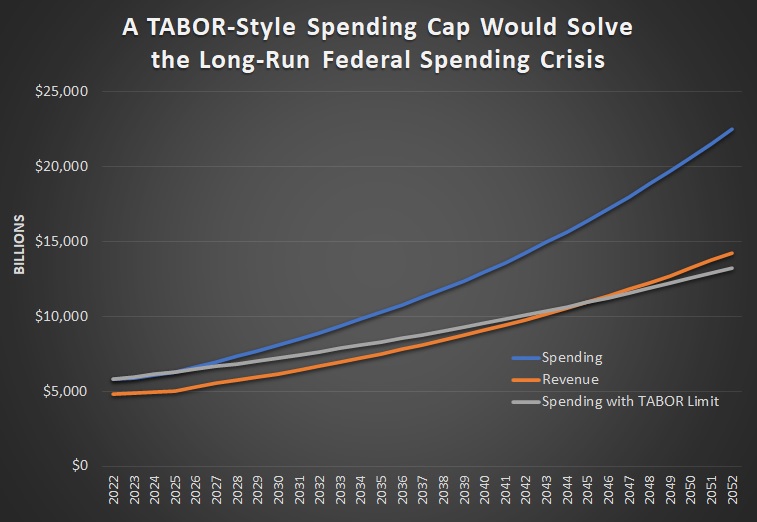

Which is why this next chart is key. It shows what would happen if the federal government adopted a TABOR-style spending cap, modeled after the very successful fiscal rule in Colorado.

If government spending can only grow as fast as inflation plus population, we avoid giant future deficits. Indeed, we eventually get budget surpluses.

But I’m not overly concerned with fiscal balance. The proper goal should be to reduce the burden of spending, regardless of how it is financed.

And a spending cap linked to population plus inflation over the next 30 years would yield impressive results. Instead of the federal government consuming more than 30 percent of the economy’s output, only 17.8 percent of GDP would be diverted by federal spending in 2052.

P.S. A spending cap also could be modeled on Switzerland’s very successful “debt brake.”

P.P.S. Some of my left-leaning friends doubtlessly will think a federal budget that consumes “only” 17.8 percent of GDP is grossly inadequate. Yet that was the size of the federal government, relative to economic output, at the end of Bill Clinton’s presidency.

The Optimum Level of Government Spending

Echoing remarks earlier this month to a group in Nigeria, I spoke today about fiscal economics to the 2022 Africa Liberty Camp in Entebbe, Uganda.

During the Q&A session, I was asked to specify the ideal amount of government spending. I addressed that issue in an April interview while visiting Spain.

You’ll notice that I didn’t give a specific number in the above video. Just like I didn’t give a specific number to the audience in Uganda.

That’s because there is not an exact answer. The only thing we can definitively state is that government in most nations should be far smaller than it is today.

This is illustrated by the “Rahn Curve,” which I discussed both in the interview and in my speech today.

What is the Rahn Curve? Here’s some of what I wrote back in 2015.

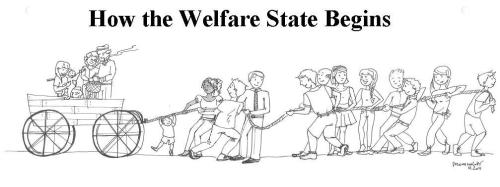

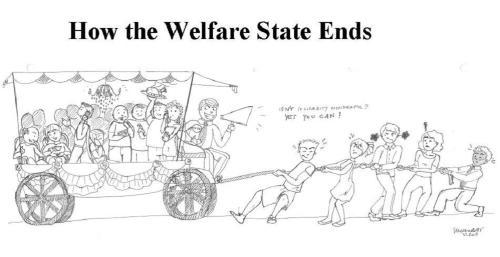

…it shows the non-linear relationship between the size of government and economic performance. Simply stated, some government spending presumably enables growth by creating the conditions (such as rule of law and property rights) for commerce. But as politicians learn to buy votes and enhance their power by engaging in redistribution, then government spending is associated with weaker economic performance because of perverse incentives and widespread misallocation of resources.

And here’s a visual depiction of the Rahn Curve. The upward-sloping part of the curve shows that spending on genuine public goods is associated with more prosperity. But once government budgets exceed a certain level, additional spending means weaker economic performance.

In the above graph, I show that growth is maximized when government consumes about 15 percent-20 percent of economic output.

But I actually think prosperity would be maximized if government was a smaller burden, perhaps about 5 percent-10 percent of GDP.

In 2017, I explained the appropriate role of government in a libertarian society. My analysis was based on my “minarchist” views, which imply government only spends money for national defense and rule of law.

By contrast, my anarcho-capitalist friends would say we don’t need any government.

Meanwhile, moderate libertarians (or conservative Republicans) might be amenable to having state and local governments play a role in education and infrastructure.

The bottom line is that I think growth would be maximized if government consumes – at most – 10 percent of economic output (which was the size of government in the 1800s when the Western world became rich).

But I will be happy with any progress (particularly since government is projected to become an even bigger burden if left on autopilot).

If you want to watch more videos related to the Rahn curve, there are many options.

- The video I narrated explaining the basics of the Rahn Curve, which was produced by the Center for Freedom and Prosperity.

- A video from the Fraser Institute in Canada that reviews the evidence about the growth-maximizing size of government.

- A video from the Centre for Policy Studies in the United Kingdom that explores the relationship between prosperity and the size of the public sector.

- Even a video on the Rahn Curve from a critic who seems to think that I’m a closeted apologist for big government.

- And a video from the Institute for Market Economics that shows how there will be more growth with smaller government.

P.S. Here’s my response to a critic from the left.

P.P.S. Interestingly, some normally left-leaning international bureaucracies have acknowledged you get more prosperity with smaller government. Check out the analysis from the IMF, ECB, World Bank, and OECD.Thanks

Dan Mitchell does a great job explaining the Laffer Curve

Free-market economics meets free-market policies at The Heritage Foundation’s Tenth Anniversary dinner in 1983. Nobel Laureate Milton Friedman and his wife Rose with President Ronald Reagan and Heritage President Ed Feulner.

Since the passing of Milton Friedman who was my favorite economist, I have been reading the works of Daniel Mitchell and he quotes Milton Friedman a lot, and you can reach Dan’s website here.

Mitchell’s career as an economist began in the United States Senate, working for Oregon Senator Bob Packwood and the Senate Finance Committee. He also served on the transition team of President-Elect Bush and Vice President-Elect Quayle in 1988. In 1990, he began work at the Heritage Foundation. At Heritage, Mitchell worked on tax policy issues and began advocating for income tax reform.[1]

In 2007, Mitchell left the Heritage Foundation, and joined the Cato Institute as a Senior Fellow. Mitchell continues to work in tax policy, and deals with issues such as the flat tax and international tax competition.[2]

In addition to his Cato Institute responsibilities, Mitchell co-founded the Center for Freedom and Prosperity, an organization formed to protect international tax competition.[1]

President Biden c/o The White House

1600 Pennsylvania Avenue NW

Washington, DC 20500

Dear Mr. President,

I enjoyed this article below because it demonstrates that the Laffer Curve has been working for almost 100 years now when it is put to the test in the USA. I actually got to hear Arthur Laffer speak in person in 1981 and he told us in advance what was going to happen the 1980’s and it all came about as he said it would when Ronald Reagan’s tax cuts took place. I wish we would lower taxes now instead of looking for more revenue through raised taxes. We have to grow the economy:

What Mitt Romney Said Last Night About Tax Cuts And The Deficit Was Absolutely Right. And What Obama Said Was Absolutely Wrong.

Mitt Romney repeatedly said last night that he would not allow tax cuts to add to the deficit. He repeatedly said it because over and over again Obama blathered the liberal talking point that cutting taxes necessarily increased deficits.

Romney’s exact words: “I want to underline that — no tax cut that adds to the deficit.”

Meanwhile, Obama has promised to cut the deficit in half during his first four years – but instead gave America the highest deficits in the history of the entire human race.

I’ve written about this before. Let’s replay what has happened every single time we’ve ever cut the income tax rate.

The fact of the matter is that we can go back to Calvin Coolidge who said very nearly THE EXACT SAME THING to his treasury secretary: he too would not allow any tax cuts that added to the debt. Andrew Mellon – quite possibly the most brilliant economic mind of his day – did a great deal of research and determined what he believed was the best tax rate. And the Coolidge administration DID cut income taxes and MASSIVELY increased revenues. Coolidge and Mellon cut the income tax rate 67.12 percent (from 73 to 24 percent); and revenues not only did not go down, but they went UP by at least 42.86 percent (from $700 billion to over $1 billion).

That’s something called a documented fact. But that wasn’t all that happened: another incredible thing was that the taxes and percentage of taxes paid actually went UP for the rich. Because as they were allowed to keep more of the profits that they earned by investing in successful business, they significantly increased their investments and therefore paid more in taxes than they otherwise would have had they continued sheltering their money to protect themselves from the higher tax rates. Liberals ignore reality, but it is simply true. It is a fact. It happened.

Then FDR came along and raised the tax rates again and the opposite happened: we collected less and less revenue while the burden of taxation fell increasingly on the poor and middle class again. Which is exactly what Obama wants to do.

People don’t realize that John F. Kennedy, one of the greatest Democrat presidents, was a TAX CUTTER who believed the conservative economic philosophy that cutting tax rates would in fact increase tax revenues. He too cut taxes, and he too increased tax revenues.

So we get to Ronald Reagan, who famously cut taxes. And again, we find that Reagan cut that godawful liberal tax rate during an incredibly godawful liberal-caused economic recession, and he increased tax revenue by 20.71 percent (with revenues increasing from $956 billion to $1.154 trillion). And again, the taxes were paid primarily by the rich:

“The share of the income tax burden borne by the top 10 percent of taxpayers increased from 48.0 percent in 1981 to 57.2 percent in 1988. Meanwhile, the share of income taxes paid by the bottom 50 percent of taxpayers dropped from 7.5 percent in 1981 to 5.7 percent in 1988.”

So we get to George Bush and the Bush tax cuts that liberals and in particular Obama have just demonized up one side and demagogued down the other. And I can simply quote the New York Times AT the time:

Sharp Rise in Tax Revenue to Pare U.S. Deficit By EDMUND L. ANDREWS Published: July 13, 2005

WASHINGTON, July 12 – For the first time since President Bush took office, an unexpected leap in tax revenue is about to shrink the federal budget deficit this year, by nearly $100 billion.

A Jump in Corporate Payments On Wednesday, White House officials plan to announce that the deficit for the 2005 fiscal year, which ends in September, will be far smaller than the $427 billion they estimated in February.

Mr. Bush plans to hail the improvement at a cabinet meeting and to cite it as validation of his argument that tax cuts would stimulate the economy and ultimately help pay for themselves.

Based on revenue and spending data through June, the budget deficit for the first nine months of the fiscal year was $251 billion, $76 billion lower than the $327 billion gap recorded at the corresponding point a year earlier.

The Congressional Budget Office estimated last week that the deficit for the full fiscal year, which reached $412 billion in 2004, could be “significantly less than $350 billion, perhaps below $325 billion.”

The big surprise has been in tax revenue, which is running nearly 15 percent higher than in 2004. Corporate tax revenue has soared about 40 percent, after languishing for four years, and individual tax revenue is up as well.

And of course the New York Times, as reliable liberals, use the adjective whenever something good happens under conservative policies and whenever something bad happens under liberal policies: ”unexpected.” But it WASN’T ”unexpected.” It was EXACTLY what Republicans had said would happen and in fact it was exactly what HAD IN FACT HAPPENED every single time we’ve EVER cut income tax rates.

The truth is that conservative tax policy has a perfect track record: every single time it has ever been tried, we have INCREASED tax revenues while not only exploding economic activity and creating more jobs, but encouraging the wealthy to pay more in taxes as well. And liberals simply dishonestly refuse to acknowledge documented history.

Meanwhile, liberals also have a perfect record … of FAILURE. They keep raising taxes and keep not understanding why they don’t get the revenues they predicted.

The following is a section from my article, “Tax Cuts INCREASE Revenues; They Have ALWAYS Increased Revenues“, where I document every single thing I said above:

The Falsehood That Tax Cuts Increase The Deficit

Now let’s take a look at the utterly fallacious view that tax cuts in general create higher deficits.

Let’s take a trip back in time, starting with the 1920s. From Burton Folsom’s book, New Deal or Raw Deal?:

In 1921, President Harding asked the sixty-five-year-old [Andrew] Mellon to be secretary of the treasury; the national debt [resulting from WWI] had surpassed $20 billion and unemployment had reached 11.7 percent, one of the highest rates in U.S. history. Harding invited Mellon to tinker with tax rates to encourage investment without incurring more debt. Mellon studied the problem carefully; his solution was what is today called “supply side economics,” the idea of cutting taxes to stimulate investment. High income tax rates, Mellon argued, “inevitably put pressure upon the taxpayer to withdraw this capital from productive business and invest it in tax-exempt securities. . . . The result is that the sources of taxation are drying up, wealth is failing to carry its share of the tax burden; and capital is being diverted into channels which yield neither revenue to the Government nor profit to the people” (page 128).

Mellon wrote, “It seems difficult for some to understand that high rates of taxation do not necessarily mean large revenue to the Government, and that more revenue may often be obtained by lower taxes.” And he compared the government setting tax rates on incomes to a businessman setting prices on products: “If a price is fixed too high, sales drop off and with them profits.”

And what happened?

“As secretary of the treasury, Mellon promoted, and Harding and Coolidge backed, a plan that eventually cut taxes on large incomes from 73 to 24 percent and on smaller incomes from 4 to 1/2 of 1 percent. These tax cuts helped produce an outpouring of economic development – from air conditioning to refrigerators to zippers, Scotch tape to radios and talking movies. Investors took more risks when they were allowed to keep more of their gains. President Coolidge, during his six years in office, averaged only 3.3 percent unemployment and 1 percent inflation – the lowest misery index of any president in the twentieth century.

Furthermore, Mellon was also vindicated in his astonishing predictions that cutting taxes across the board would generate more revenue. In the early 1920s, when the highest tax rate was 73 percent, the total income tax revenue to the U.S. government was a little over $700 million. In 1928 and 1929, when the top tax rate was slashed to 25 and 24 percent, the total revenue topped the $1 billion mark. Also remarkable, as Table 3 indicates, is that the burden of paying these taxes fell increasingly upon the wealthy” (page 129-130).

Now, that is incredible upon its face, but it becomes even more incredible when contrasted with FDR’s antibusiness and confiscatory tax policies, which both dramatically shrunk in terms of actual income tax revenues (from $1.096 billion in 1929 to $527 million in 1935), and dramatically shifted the tax burden to the backs of the poor by imposing huge new excise taxes (from $540 million in 1929 to $1.364 billion in 1935). See Table 1 on page 125 of New Deal or Raw Deal for that information.

FDR both collected far less taxes from the rich, while imposing a far more onerous tax burden upon the poor.

It is simply a matter of empirical fact that tax cuts create increased revenue, and that those [Democrats] who have refused to pay attention to that fact have ended up reducing government revenues even as they increased the burdens on the poorest whom they falsely claim to help.

Let’s move on to John F. Kennedy, one of the most popular Democrat presidents ever. Few realize that he was also a supply-side tax cutter.

“It is a paradoxical truth that tax rates are too high and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now … Cutting taxes now is not to incur a budget deficit, but to achieve the more prosperous, expanding economy which can bring a budget surplus.”

– John F. Kennedy, Nov. 20, 1962, president’s news conference

“Lower rates of taxation will stimulate economic activity and so raise the levels of personal and corporate income as to yield within a few years an increased – not a reduced – flow of revenues to the federal government.”

– John F. Kennedy, Jan. 17, 1963, annual budget message to the Congress, fiscal year 1964

“In today’s economy, fiscal prudence and responsibility call for tax reduction even if it temporarily enlarges the federal deficit – why reducing taxes is the best way open to us to increase revenues.”

– John F. Kennedy, Jan. 21, 1963, annual message to the Congress: “The Economic Report Of The President”

“It is no contradiction – the most important single thing we can do to stimulate investment in today’s economy is to raise consumption by major reduction of individual income tax rates.”

– John F. Kennedy, Jan. 21, 1963, annual message to the Congress: “The Economic Report Of The President”

“Our tax system still siphons out of the private economy too large a share of personal and business purchasing power and reduces the incentive for risk, investment and effort – thereby aborting our recoveries and stifling our national growth rate.”

– John F. Kennedy, Jan. 24, 1963, message to Congress on tax reduction and reform, House Doc. 43, 88th Congress, 1st Session.

“A tax cut means higher family income and higher business profits and a balanced federal budget. Every taxpayer and his family will have more money left over after taxes for a new car, a new home, new conveniences, education and investment. Every businessman can keep a higher percentage of his profits in his cash register or put it to work expanding or improving his business, and as the national income grows, the federal government will ultimately end up with more revenues.”

– John F. Kennedy, Sept. 18, 1963, radio and television address to the nation on tax-reduction bill

Which is to say that modern Democrats are essentially calling one of their greatest presidents a liar when they demonize tax cuts as a means of increasing government revenues.

So let’s move on to Ronald Reagan. Reagan had two major tax cutting policies implemented: the Economic Recovery Tax Act (ERTA) of 1981, which was retroactive to 1981, and the Tax Reform Act of 1986.

Did Reagan’s tax cuts decrease federal revenues? Hardly:

We find that 8 of the following 10 years there was a surplus of revenue from 1980, prior to the Reagan tax cuts. And, following the Tax Reform Act of 1986, there was a MASSIVE INCREASEof revenue.

So Reagan’s tax cuts increased revenue. But who paid the increased tax revenue? The poor? Opponents of the Reagan tax cuts argued that his policy was a giveaway to the rich (ever heard that one before?) because their tax payments would fall. But that was exactly wrong. In reality:

“The share of the income tax burden borne by the top 10 percent of taxpayers increased from 48.0 percent in 1981 to 57.2 percent in 1988. Meanwhile, the share of income taxes paid by the bottom 50 percent of taxpayers dropped from 7.5 percent in 1981 to 5.7 percent in 1988.”

So Ronald Reagan a) collected more total revenue, b) collected more revenue from the rich, while c) reducing revenue collected by the bottom half of taxpayers, and d) generated an economic powerhouse that lasted – with only minor hiccups – for nearly three decades. Pretty good achievement considering that his predecessor was forced to describe his own economy as a “malaise,” suffering due to a “crisis of confidence.” Pretty good considering that President Jimmy Carter responded to a reporter’s question as to what he would do about the problem of inflation by answering, “It would be misleading for me to tell any of you that there is a solution to it.”

Reagan whipped inflation. Just as he whipped that malaise and that crisis of confidence.

________

Thank you so much for your time. I know how valuable it is. I also appreciate the fine family that you have and your commitment as a father and a husband.

Sincerely,

Everette Hatcher III, 13900 Cottontail Lane, Alexander, AR 72002, ph 501-920-5733

________

The Laffer Curve, Part III: Dynamic Scoring

Related posts:

“The Power of the Market” episode of Free to Choose in 1990 by Milton Friedman (Part 5)

Milton Friedman The Power of the Market 5-5 How can we have personal freedom without economic freedom? That is why I don’t understand why socialists who value individual freedoms want to take away our economic freedoms. I wanted to share this info below with you from Milton Friedman who has influenced me greatly over the […]

“The Power of the Market” episode of Free to Choose in 1990 by Milton Friedman (Part 4)

Milton Friedman The Power of the Market 4-5 How can we have personal freedom without economic freedom? That is why I don’t understand why socialists who value individual freedoms want to take away our economic freedoms. I wanted to share this info below with you from Milton Friedman who has influenced me greatly over the […]

“The Power of the Market” episode of Free to Choose in 1990 by Milton Friedman (Part 3)

Milton Friedman The Power of the Market 3-5 How can we have personal freedom without economic freedom? That is why I don’t understand why socialists who value individual freedoms want to take away our economic freedoms. I wanted to share this info below with you from Milton Friedman who has influenced me greatly over the […]

“The Power of the Market” episode of Free to Choose in 1990 by Milton Friedman (Part 2)

Milton Friedman The Power of the Market 2-5 How can we have personal freedom without economic freedom? That is why I don’t understand why socialists who value individual freedoms want to take away our economic freedoms. I wanted to share this info below with you from Milton Friedman who has influenced me greatly over the […]

“The Power of the Market” episode of Free to Choose in 1990 by Milton Friedman (Part 1)

Milton Friedman The Power of the Market 1-5 How can we have personal freedom without economic freedom? That is why I don’t understand why socialists who value individual freedoms want to take away our economic freedoms. I wanted to share this info below with you from Milton Friedman who has influenced me greatly over the […]

Open letter to President Obama (Part 282, How the Laffer Curve worked in the 20th century over and over again!!!)

Dan Mitchell does a great job explaining the Laffer Curve President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a […]

President Obama ignores warnings about Laffer Curve

The Laffer Curve – Explained Uploaded by Eddie Stannard on Nov 14, 2011 This video explains the relationship between tax rates, taxable income, and tax revenue. The key lesson is that the Laffer Curve is not an all-or-nothing proposition, where we have to choose between the exaggerated claim that “all tax cuts pay for themselves” […]

By Everette Hatcher III | Posted in Cato Institute, President Obama, Taxes | Tagged cato institute | Edit | Comments (0)The Laffer Curve Wreaks Havoc in the United Kingdom

I got to hear Arthur Laffer speak back in 1981 and he predicted what would happen in the next few years with the Reagan tax cuts and he was right with every prediction. The Laffer Curve Wreaks Havoc in the United Kingdom July 1, 2012 by Dan Mitchell Back in 2010, I excoriated the new […]

Open letter to President Obama (Part 197)

President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here. David […]

Open letter to President Obama (Part 123)

President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here. I got […]

Open letter to President Obama (Part 111)

President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here. If our […]

By Everette Hatcher III | Posted in President Obama, spending out of control, Taxes | Edit | Comments (0)Open letter to President Obama (Part 103)

President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here. I personally […]

High taxes are self-defeating

We got to lower taxes in order to encourage job growth and if we go down the road of higher taxes then we will go further into a recession. Debating Whether States Should Impose Class-Warfare Tax Policy June 4, 2012 by Dan Mitchell I wrote last week about the destructive and self-defeating impact of high state […]

California has forgotten the lessons of Ronald Reagan

If our country is the grow the economy and get our budget balanced it will not be by raising taxes!!! The recipe for success was followed by Ronald Reagan in the 1980′s when he cut taxes and limited spending. As far as limiting spending goes only Bill Clinton (with his Republican Congress) were ability to […]

By Everette Hatcher III | Posted in Cato Institute, President Obama, spending out of control, Taxes | Edit | Comments (0)Some liberal economics want top tax rate above 70% but economy would be crushed

I got to see Arthur Laffer speak in 1981 in Memphis and he predicted what would happen the next few years with tax revenue as a result of the Reagan Tax Cuts and he was right on every prediction. Alan Reynolds Dismantles the Silly Claim that Top Tax Rates Should be 70 Percent (or Higher!) May […]

Spain raises tax rates and revenues fall!!!!

The way to grow the economy is to cut taxes. Last night in the State of the Union address President Obama said he wanted to close tax loopholes which is another way of saying that he is not through raising taxes yet. The Laffer Curve Strikes Again: Revenues Falling in Spite of (or Perhaps Because […]

Ronald Wilson Reagan Part 13

President Reagan and Nancy Reagan greeting Billy Graham at the National Prayer Breakfast held at the Washington Hilton Hotel. 2/5/81. HALT:HaltingArkansasLiberalswithTruth.com Recently on my series on Ronald Reagan (part 10), a gentleman by the name of Elwood who a regular on the Ark Times Blog site, rightly noted, “Ray-gun created the highest unemployment rate we […]