I have put up lots of cartoons from Dan Mitchell’s blog before and they have got lots of hits before. Many of them have dealt with the sequester, economy, eternal unemployment benefits, socialism, minimum wage laws, tax increases, social security, high taxes in California, Obamacare, Greece, welfare state or on gun control.

President Obama’s favorite state must be California because they are running that state like Obama is trying to run the country. No wonder they have a huge deficit and the people there are trying to leave.

California’s Golden Bureaucrat Snags $400K of Yearly Compensation – for the Rest of Her Life!

March 26, 2013 by Dan Mitchell

A regular feature of this blog used to be a “taxpayers vs bureaucrats” series, which featured outrageous examples of government employees getting wildly overcompensated.

I even narrated a video on the topic of excessive pay and benefits for bureaucrats.

But I stopped the series because it was too depressing. How often can read stories like this, after all, and not feel glum about America’s future?

- The chief bureaucrat of a low-income California city getting almost $800,000 per year.

- Cops in Oakland getting average compensation of $188,000.

- A school superintendent in New York raking in more than $500 thousand of annual compensation.

- A California government official raking in $822,000 of taxpayer-financed loot in just one.

- A Philadelphia bureaucrat, after working only 2-1/2 years, nailing down a guaranteed pension of $50,000 per year.

- A New York school bureaucrat simultaneously getting a $225,000 salary and $300,000 pension.

- California taxpayers being forced to pay a fired bureaucrat $550,000 for unused vacation time.

- An employee of the New Jersey Turnpike system raking in annual compensation of $320,000.

But I must lack willpower because I can’t resist writing about the latest scandal involving bureaucratic bloat.

Check out some of the ridiculous details about the woman who has earned the title of California’s Golden Bureaucrat.

Alameda County supervisors have really taken to heart the adage that government should run like a business — rewarding County Administrator Susan Muranishi with the Wall Street-like wage of $423,664 a year. For the rest of her life. …Muranishi’s annual pension will be equal to the dollar total of her entire yearly package — $413,000. She also has a separate executive private pension plan, for which the county chips in $46,500 a year.

Yes, you read correctly. She’ll be ripping off taxpayers “for the rest of her life.”

But if you want to get even more upset, check out how she’s bilking the people.

…in addition to her $301,000 base salary, Muranishi receives:

- $24,000, plus change, in “equity pay’’ to guarantee that she makes at least 10 percent more than anyone else in the county.

- About $54,000 a year in “longevity” pay for having stayed with the county for more than 30 years.

- An annual performance bonus of $24,000.

- And another $9,000 a year for serving on the county’s three-member Surplus Property Authority, an ad hoc committee of the Board of Supervisors that oversees the sale of excess land.

Like other county executives, Muranishi also gets an $8,292-a-year car allowance.

I’m relieved she’s getting a car allowance. The poor thing otherwise would have to rely on public transit. And isn’t it nice that she automatically gets a “performance bonus”? Sort of defeats the purpose, though, if it’s automatic. But what do I know, I’m just a taxpayer.

Even though I obviously lack the special insight needed to justify bloated compensation packages for California bureaucrats, I have enough common sense to know that the over-burdened taxpayers of California are being stretched beyond the breaking point – especially now that the looters and moochers have imposed a new 13.3 percent top tax rate on the state’s dwindling supply of high earners.

Even though I obviously lack the special insight needed to justify bloated compensation packages for California bureaucrats, I have enough common sense to know that the over-burdened taxpayers of California are being stretched beyond the breaking point – especially now that the looters and moochers have imposed a new 13.3 percent top tax rate on the state’s dwindling supply of high earners.

It’s no surprise that lots of high-paying jobs are relocating to states like Texas with better tax policy. Nor is it a surprise when pro golfers like Phil Mickelson warn they may leave the state. But when even a certified leftist like Bill Maher says he’s thinking about escaping, you know the situation is serious.

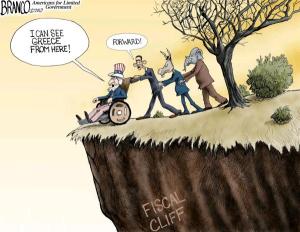

So for the umpteenth time, I will predict that the combination of bloated government and punitive taxation will lead to fiscal crisis in California.

Too much government spending and the Laffer Curve are not a good combination.

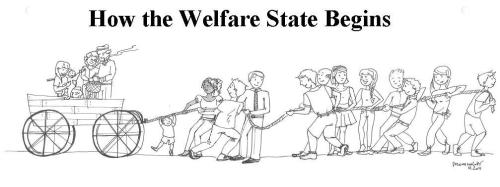

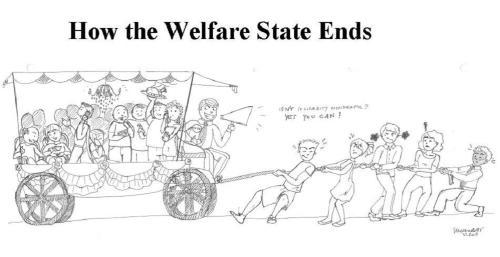

When you lure too many people into riding in the wagon and penalize those pulling the wagon, bad things happen. Doesn’t matter whether you’re looking at France or California.

Related posts:

Cartoons from Dan Mitchell’s blog that demonstrate what Obama is doing to our economy Part 2

Max Brantley is wrong about Tom Cotton’s accusation concerning the rise of welfare spending under President Obama. Actually welfare spending has been increasing for the last 12 years and Obama did nothing during his first four years to slow down the rate of increase of welfare spending. Rachel Sheffield of the Heritage Foundation has noted: […]

Cartoons from Dan Mitchell’s blog that demonstrate what Obama is doing to our economy Part 1

I have put up lots of cartoons from Dan Mitchell’s blog before and they have got lots of hits before. Many of them have dealt with the economy, eternal unemployment benefits, socialism, Greece, welfare state or on gun control. I think Max Brantley of the Arkansas Times Blog was right to point out on 2-6-13 that Hillary […]

Great cartoon from Dan Mitchell’s blog on government moochers

I thought it was great when the Republican Congress and Bill Clinton put in welfare reform but now that has been done away with and no one has to work anymore it seems. In fact, over 40% of the USA is now on the government dole. What is going to happen when that figure gets over […]

Gun Control cartoon hits the internet

Again we have another shooting and the gun control bloggers are out again calling for more laws. I have written about this subject below and on May 23, 2012, I even got a letter back from President Obama on the subject. Now some very interesting statistics below and a cartoon follows. (Since this just hit the […]

“You-Didn’t-Build-That” comment pictured in cartoons!!!

watch?v=llQUrko0Gqw] The federal government spends about 10% on roads and public goods but with the other money in the budget a lot of harm is done including excessive regulations on business. That makes Obama’s comment the other day look very silly. A Funny Look at Obama’s You-Didn’t-Build-That Comment July 28, 2012 by Dan Mitchell I made […]

Cartoons about Obama’s class warfare

I have written a lot about this in the past and sometimes you just have to sit back and laugh. Laughing at Obama’s Bumbling Class Warfare Agenda July 13, 2012 by Dan Mitchell We know that President Obama’s class-warfare agenda is bad economic policy. We know high tax rates undermine competitiveness. And we know tax increases […]

Cartoons on Obama’s budget math

Dan Mitchell Discussing Dishonest Budget Numbers with John Stossel Uploaded by danmitchellcato on Feb 11, 2012 No description available. ______________ Dan Mitchell of the Cato Institute has shown before how excessive spending at the federal level has increased in recent years. A Humorous Look at Obama’s Screwy Budget Math May 31, 2012 by Dan Mitchell I’ve […]

Funny cartoon from Dan Mitchell’s blog on Greece

Sometimes it is so crazy that you just have to laugh a little. The European Mess, Captured by a Cartoon June 22, 2012 by Dan Mitchell The self-inflicted economic crisis in Europe has generated some good humor, as you can see from these cartoons by Michael Ramirez and Chuck Asay. But for pure laughter, I don’t […]

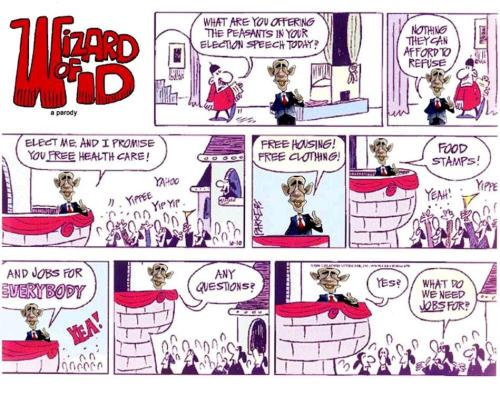

Obama on creating jobs!!!!(Funny Cartoon)

Another great cartoon on President Obama’s efforts to create jobs!!! A Simple Lesson about Job Creation for Barack Obama December 7, 2011 by Dan Mitchell Even though leftist economists such as Paul Krugman and Larry Summers have admitted that unemployment insurance benefits are a recipe for more joblessness, the White House is arguing that Congress should […]

Get people off of government support and get them in the private market place!!!!(great cartoon too)

Dan Mitchell hits the nail on the head and sometimes it gets so sad that you just have to laugh at it like Conan does. In order to correct this mess we got to get people off of government support and get them in the private market place!!!! Chuck Asay’s New Cartoon Nicely Captures Mentality […]

2 cartoons illustrate the fate of socialism from the Cato Institute

Cato Institute scholar Dan Mitchell is right about Greece and the fate of socialism: Two Pictures that Perfectly Capture the Rise and Fall of the Welfare State July 15, 2011 by Dan Mitchell In my speeches, especially when talking about the fiscal crisis in Europe (or the future fiscal crisis in America), I often warn that […]

Cartoon demonstrates that guns deter criminals

John Stossel report “Myth: Gun Control Reduces Crime Sheriff Tommy Robinson tried what he called “Robinson roulette” from 1980 to 1984 in Central Arkansas where he would put some of his men in some stores in the back room with guns and the number of robberies in stores sank. I got this from Dan Mitchell’s […]

Gun control posters from Dan Mitchell’s blog Part 2

I have put up lots of cartons and posters from Dan Mitchell’s blog before and they have got lots of hits before. Many of them have dealt with the economy, eternal unemployment benefits, socialism, Greece, welfare state or on gun control. Amusing Gun Control Picture – Circa 1999 April 3, 2010 by Dan Mitchell Dug this gem out […]

We got to cut spending and stop raising the debt ceiling!!!

We got to cut spending and stop raising the debt ceiling!!! When Governments Cut Spending Uploaded on Sep 28, 2011 Do governments ever cut spending? According to Dr. Stephen Davies, there are historical examples of government spending cuts in Canada, New Zealand, Sweden, and America. In these cases, despite popular belief, the government spending […]

Gun control posters from Dan Mitchell’s blog Part 1

I have put up lots of cartons and posters from Dan Mitchell’s blog before and they have got lots of hits before. Many of them have dealt with the economy, eternal unemployment benefits, socialism, Greece, welfare state or on gun control. On 2-6-13 the Arkansas Times Blogger “Sound Policy” suggested, “All churches that wish to allow concealed […]

Taking on Ark Times bloggers on the issue of “gun control” (Part 3) “Did Hitler advocate gun control?”

Gun Free Zones???? Stalin and gun control On 1-31-13 ”Arkie” on the Arkansas Times Blog the following: “Remember that the biggest gun control advocate was Hitler and every other tyrant that every lived.” Except that under Hitler, Germany liberalized its gun control laws. __________ After reading the link from Wikipedia that Arkie provided then I responded: […]

Taking on Ark Times bloggers on the issue of “gun control” (Part 2) “Did Hitler advocate gun control?”

On 1-31-13 I posted on the Arkansas Times Blog the following: I like the poster of the lady holding the rifle and next to her are these words: I am compensating for being smaller and weaker than more violent criminals. __________ Then I gave a link to this poster below: On 1-31-13 also I posted […]