–

Biden and Pelosi’s Tax Plan Will Penalize Success

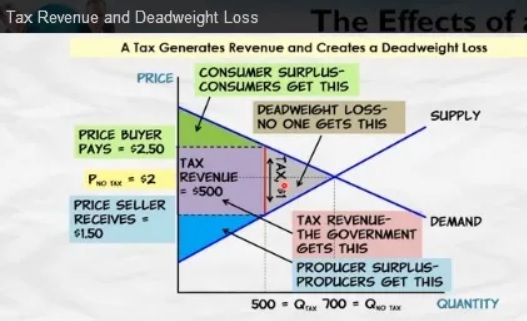

When I discuss class-warfare tax policy, I want people to understand deadweight loss, which is the term for the economic output that is lost when high tax rates discourage work, saving, investment, and entrepreneurship.

And I especially want them to understand that the economic damage grows exponentially as tax rates increase (in other words, going from a 30 percent tax rate to a 40 percent tax rate is a lot more damaging than going from a 10 percent tax rate to a 20 percent tax rate).

And I especially want them to understand that the economic damage grows exponentially as tax rates increase (in other words, going from a 30 percent tax rate to a 40 percent tax rate is a lot more damaging than going from a 10 percent tax rate to a 20 percent tax rate).

But all of this analysis requires a firm grasp of supply-and-demand curves. And most people never learned basic microeconomics, or they forgot the day after they took their exam for Economics 101.

So when I give speeches about the economics of tax policy, I generally forgo technical analysis and instead appeal to common sense.

Part of that often includes showing an image of a “philoso-raptor” pondering whether the principle that applies to tobacco taxation also applies to taxes on work.

Part of that often includes showing an image of a “philoso-raptor” pondering whether the principle that applies to tobacco taxation also applies to taxes on work.

Almost everyone gets the point, especially when I point out that politicians explicitly say they want higher taxes on cigarettes because they want less smoking.

And if you (correctly) believe that higher taxes on tobacco lead to less smoking, then you also should understand that higher taxes on work will discourage productive behavior.

Unfortunately, these common-sense observations don’t have much impact on politicians in Washington. Joe Biden and Democrats in Congress are pushing a huge package of punitive tax increases.

Should they succeed, all taxpayers will suffer. But some will suffer more than others. In an article for CNBC, Robert Frank documents what Biden’s tax increase will mean for residents of high-tax states.

Top earners in New York City could face a combined city, state and federal income tax rate of 61.2%, according to plans being proposed by Democrats in the House of Representatives. The plans being proposed include a 3% surtax on taxpayers earning more than $5 million a year.

The plans also call for raising the top marginal income tax rate to 39.6% from the current 37%. The plans preserve the 3.8% net investment income tax, and extend it to certain pass-through companies. The result is a top marginal federal income tax rate of 46.4%. …In New York City, the combined top marginal state and city tax rate is 14.8%. So New York City taxpayers…would face a combined city, state and federal marginal rate of 61.2% under the House plan. …the highest in nearly 40 years. Top earning Californians would face a combined marginal rate of 59.7%, while those in New Jersey would face a combined rate of 57.2%.

You don’t have to be a wild-eyed “supply-sider” to recognize that Biden’s tax plan will hurt prosperity.

After all, investors, entrepreneurs, business owners, and other successful taxpayers will have much less incentive to earn and report income when they only get to keep about 40 cents out of every $1 they earn.

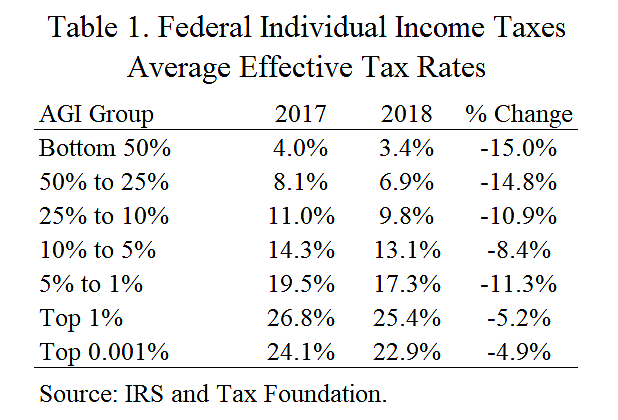

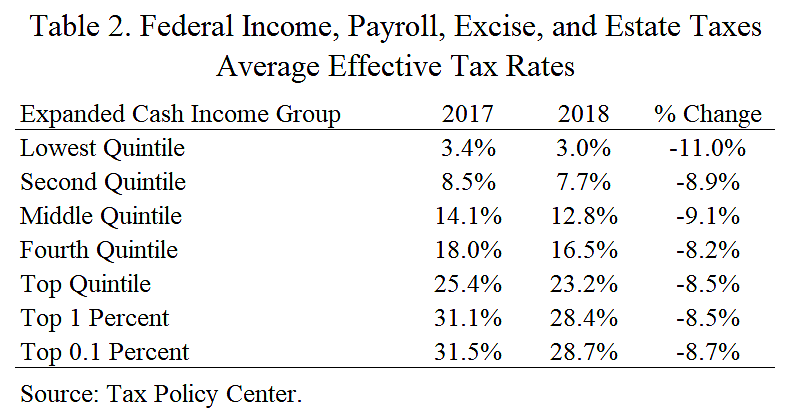

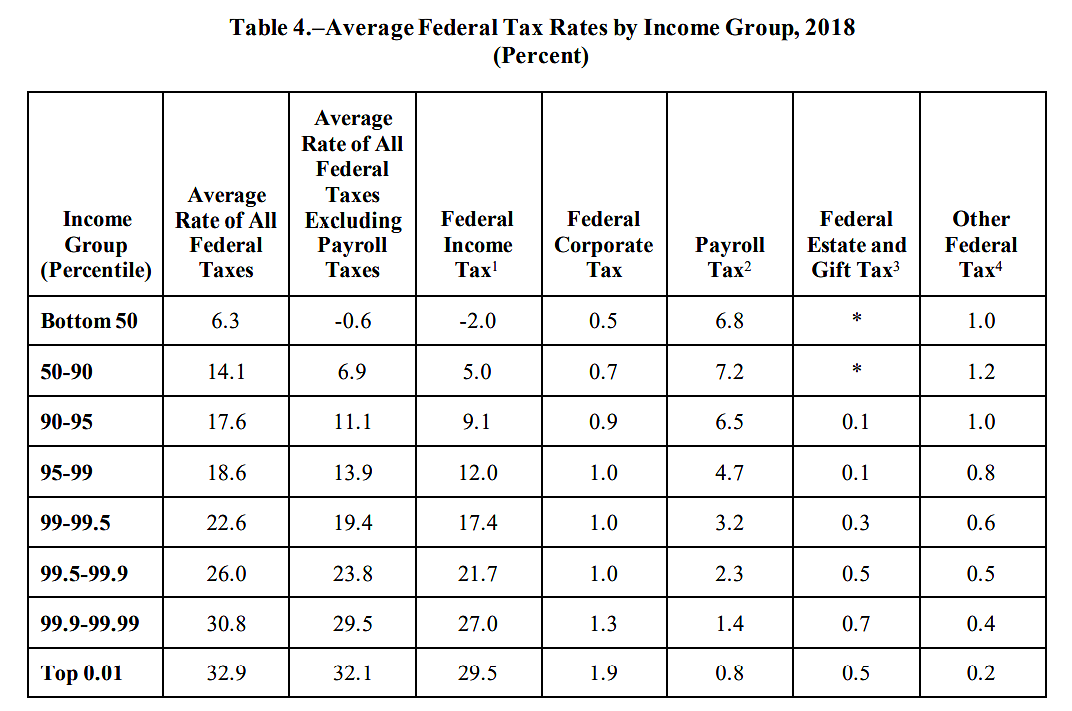

Folks on the left claim that punitive tax rates are necessary for “fairness,” yet the United States already has the developed world’s most “progressive” tax system.

Folks on the left claim that punitive tax rates are necessary for “fairness,” yet the United States already has the developed world’s most “progressive” tax system.

I’ll close with the observation that the punitive tax rates being considered will generate less revenue than projected.

Why? Because households and businesses will have big incentives to use clever lawyers and accountants to protect their income.

Looking for loopholes is a waste of time when rates are low, but it’s a very profitable use of time and energy when rates are high.

P.S. Tax rates were dramatically lowered in the United States during the Reagan years, a policy that boosted the economy and led to more revenues from the rich. Biden now wants to run that experiment in reverse, so don’t expect positive results.

P.P.S. Though if folks on the left are primarily motivated by envy, then presumably they don’t care about real-world outcomes.

Promoting Upward Mobility Is a Better Goal than Pushing Class Warfare in Hopes of Reducing Inequality

There are divisions of the right between small-government conservatives, reform conservatives, common-good capitalists, nationalist conservatives, and compassionate conservatives.

There are also divisions on the left, as illustrated by this flowchart, which shows the Nordic Model (a pro-free marketwelfare state) on one end, and then different versions of hard-core leftism on the other end.

I’m showing these different strains on the left because it will help decipher the editorial position of the Washington Post.

I cited one of their editorials a couple of weeks ago that had some very sensible criticisms of a wealth tax. But it also embraced other class-warfare taxes (higher capital gains taxesand more onerous death taxes).

In other words, the Washington Post is on the left, but not as crazy as Bernie Sanders or Elizabeth Warren.

Now we have another editorial from the Post that illustrates this distinction.

The bad news is that the editorial (once again) endorses class-warfare tax policy.

…inequality of wealth is a serious problem in the United States. …to an unhealthy degree, wealth in the United States is

being gained through unproductive activity — “rent-seeking”… Well-designed government interventions can reduce inequality from the top down, through more aggressive taxation of capital gains and estates… …everyone, poor and rich, has a lot to gain from curbing wealth inequality. The policies that can achieve that goal are neither radical nor complicated.

The good news is that the Post understands that there are serious consequences of going too far.

What remains to be considered are the counterarguments. …could a more aggressive attack on wealth inequality undermine incentives and result in an economic pie that is smaller and, inevitably, more difficult to distribute? If too aggressive, of course, at the bottom of that slippery slope lies Venezuela’s bankrupt socialism.

I suppose I should be happy that the editorial acknowledges the danger of hard-core leftism.

But my concern is that going in the wrong direction at 60 miles per hour still gets a nation to the wrong destination.

But my concern is that going in the wrong direction at 60 miles per hour still gets a nation to the wrong destination.

Yes, going in the wrong direction at 90 miles per hour gets to Venezuela even sooner, so I’d rather delay a very bad outcome.

That being said, it would be nice if the Washington Post (or any other rational leftists) drew some lines in the sand about limiting the size and scope of government.

- For instance, would they agree that top tax rates should never exceed 60 percent?

- Or that the burden of government spending should never exceed 50 percent?

Both numbers are far too high, of course, but setting some sort of limit would at least show that there is some long-run difference between the rational left and the AOC crowd.

Let’s conclude with some extracts that show why I’m worried that the Post will always be on the wrong side. After acknowledging that there are risks of going too far to the left, the editorial tell us we shouldn’t worry about going that direction.

In fact, too much inequality can undermine growth, too. …the perpetuation of steep inequalities, over generations, can turn into a drag on output…by wasting the potential of those who might have acquired skills or started businesses if not consigned by poverty to society’s margins. …extreme inequality fosters demands for populist policies, which, in turn, damage growth.

To be fair, the Washington Post is at least semi-good on the issue of school choice, so I take somewhat seriously their concerns about not wasting potential.

And it’s also worth noting that the editorial understands that populist policies (which presumably includes lots of anti-market nonsense such as protectionism) would be misguided. Though I’d feel much better about that part if the editorial recognized the difference between moral and immoral inequality.

P.S. The core problem is that our friends on the left don’t appreciate that low-income people will be better off if the focus is on growth rather than inequality.

Walter Williams and America’s Founding

In 1794, when Congress appropriated $15,000 to assist some French refugees, James Madison, the acknowledged father of our Constitution, stood on the floor of the House to object, saying, “I cannot undertake to lay my finger on that article of the Constitution which granted a right to Congress of expending, on objects of benevolence, the money of their constituents.” He later added, “(T)he government of the United States is a definite government, confined to specified objects. It is not like the state governments, whose powers are more general. Charity is no part of the legislative duty of the government.” Two hundred years later, at least two-thirds of a multi-trillion-dollar federal budget is spent on charity or “objects of benevolence.” What would the founders think about our respect for democracy and majority rule? Here’s what Thomas Jefferson said: “The majority, oppressing an individual, is guilty of a crime, abuses its strength, and by acting on the law of the strongest breaks up the foundations of society.” John Adams advised, “Remember democracy never lasts long. It soon wastes, exhausts, and murders itself. There never was a democracy yet that did not commit suicide.” The founders envisioned a republican form of government, but as Benjamin Franklin warned, “When the people find they can vote themselves money, that will herald the end of the republic.” What would the founders think about the U.S. Supreme Court’s 2005 Kelo v. City of New London decision where the court sanctioned the taking of private property of one American to hand over to another American? John Adams explained: “The moment the idea is admitted into society that property is not as sacred as the laws of God, and that there is not a force of law and public justice to protect it, anarchy and tyranny commence. If ‘Thou shalt not covet’ and ‘Thou shalt not steal’ were not commandments of Heaven, they must be made inviolable precepts in every society before it can be civilized or made free.”

New Leak of Taxpayer Info Is (More) Evidence of IRS Corruption

I sometimes try to go easy on the IRS. After all, our wretched tax system is largely the fault of politicians, who have spent the past 108 years creating a punitive and corrupt set of tax laws.

But there is still plenty of IRS behavior to criticize. Most notably, the tax agency allowed itself to be weaponized by the Obama White House, using its power to persecute and harass organizations associated with the “Tea Party.”

using its power to persecute and harass organizations associated with the “Tea Party.”

That grotesque abuse of power largely was designed to weaken opposition to Obama’s statist agenda and make it easier for him to win re-election.

Now there’s a new IRS scandal. In hopes of advancing President Biden’s class-warfare agenda, the bureaucrats have leaked confidential taxpayer information to ProPublica, a left-wing website.

Here’s some of what that group posted.

ProPublica has obtained a vast trove of Internal Revenue Service data on the tax returns of thousands of the nation’s wealthiest people, covering more than 15 years. …ProPublica undertook an analysis that has never been done before.

We compared how much in taxes the 25 richest Americans paid each year to how much Forbes estimated their wealth grew in that same time period. We’re going to call this their true tax rate. …those 25 people saw their worth rise a collective $401 billion from 2014 to 2018. They paid a total of $13.6 billion in federal income taxes in those five years, the IRS data shows. That’s a staggering sum, but it amounts to a true tax rate of only 3.4%.

Since I’m a policy wonk, I’ll first point out that ProPublicacreated a make-believe number. We (thankfully) don’t tax wealth in the United States.

So Elon Musk’s income is completely unrelated to what happened to the value of his Tesla shares. The same is true for Jeff Bezos’ income and the value of his Amazon stock.*

And the same thing is true for the rest of us. If our IRA or 401(k) rises in value, that doesn’t mean our taxable income has increased. If our home becomes more valuable, that also doesn’t count as taxable income.

The Wall Street Journal opined on this topic today and made a similar point.

There is no evidence of illegality in the ProPublica story. …ProPublica knows this, so its story tries to invent a scandal by calculating

what it calls the “true tax rate” these fellows are paying. This is a phony construct that exists nowhere in the law and compares how much the “wealth” of these individuals increased from 2014 to 2018 compared to how much income tax they paid. …what Americans pay is a tax on income, not wealth.

Some journalists don’t understand this distinction between income and wealth.

Or perhaps they do understand, but pretend otherwise because they see their role as being handmaidens of the Biden Administration.

Consider these excerpts from a column by Binyamin Appelbaum of the New York Times.

Jeff Bezos…added an estimated $99 billion in wealth between 2014 and 2018 but reported only $4.22 billion in taxable income during that period.

Warren Buffett, who amassed $24.3 billion in new wealth over those years, reported $125 million in taxable income. …some of the wealthiest people in the United States essentially live under a different system of income taxation from the rest of us.

Mr. Appelbaum is wrong. The rich have a lot more assets than the rest of us, but they operate under the same rules.

If I have an asset that increases in value, that doesn’t count as taxable income. And it isn’t income. It’s merely a change in net wealth.

And the same is true if Bill Gates has an asset that increases in value.

Now that we’ve addressed the policy mistakes, let’s turn our attention to the scandal of IRS misbehavior.

The WSJ‘s editorial addresses the agency’s grotesque actions.

Less than half a year into the Biden Presidency, the Internal Revenue Service is already at the center of an abuse-of-power scandal. …ProPublica, a website whose journalism promotes progressive causes, published information from what it said are 15 years of the tax returns of Jeff Bezos, Warren Buffett and other rich Americans. …The story arrives amid the Biden Administration’s effort to pass the largest tax increase as a share of the economy since 1968. …The timing here is no coincidence, comrade. …someone leaked confidential IRS information about individuals to serve a political agenda. This is the same tax agency that pursued a vendetta against conservative nonprofit groups during the Obama Administration. Remember Lois Lerner? This is also the same IRS that Democrats now want to infuse with $80 billion more… As part of this effort, Mr. Biden wants the IRS to collect “gross inflows and outflows on all business and personal accounts from financial institutions.” Why? So the information can be leaked to ProPublica? …Congress should also not trust the IRS with any more power and money than it already has.

And Charles Cooke of National Review also weighs in on the implications of a weaponized and partisan IRS.

We cannot trust the IRS. “Oh, who cares?” you might ask. “The victims are billionaires!” And indeed, they are. But I care. For a start, they’re American citizens, and they’re entitled to the same rights — and protected by the same laws — as everyone else. …Besides, even if one wants to be entirely amoral about it, one should consider that if their information can be spilled onto the Internet, anyone’s can.

…A government that is this reckless or sinister with the information of men who are lawyered to the eyeballs is unlikely to worry too much about being reckless or sinister with your information. …The IRS wields an extraordinary amount of power, and there will always be somebody somewhere who thinks that it should be used to advance their favorite political cause. Our refusal to indulge their calls is one of the many things that prevents us from descending into the caprice and chaos of your average banana republic. …Does that bother you? It should.

What’s especially disgusting is that the Biden Administration wants to reward IRS corruption with giant budget increases, bolstered by utterly fraudulent numbers.

Needless to say, that would be a terrible idea (sadly, Republicans in the past have been sympathetic to expanding the size of the tax bureaucracy).

*Financial assets such as stocks generally increase in value because of an expectation of bigger streams of income in the future (such as dividends). Those income streams are taxed (often multiple times) when (and if) they actually materialize.

Open letter to President Obama (Part 644)

(Emailed to White House on 6-10-13.)

President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500

Dear Mr. President,

I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here.

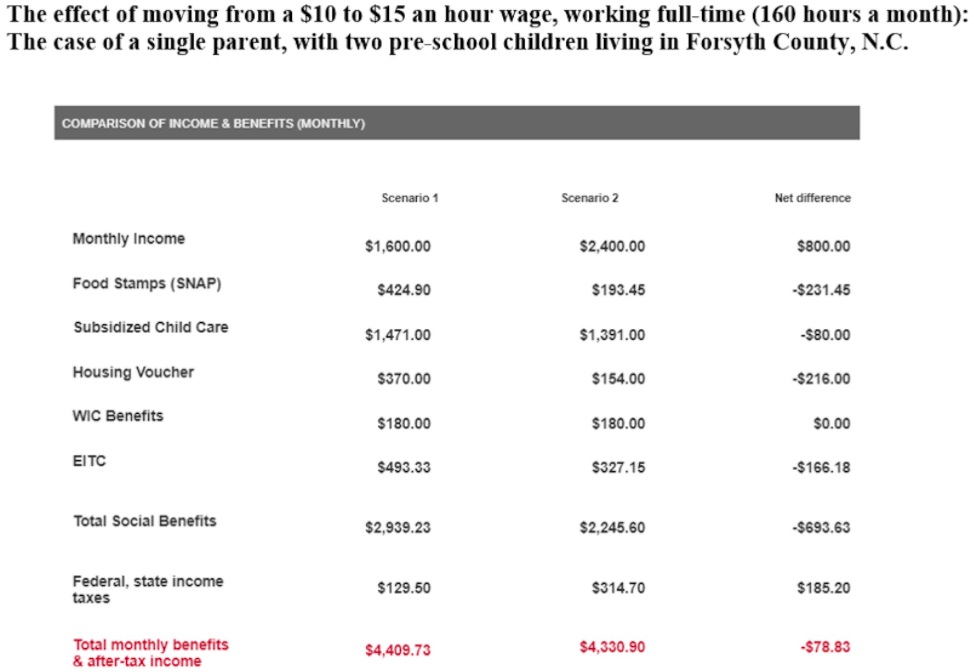

The federal government debt is growing so much that it is endangering us because if things keep going like they are now we will not have any money left for the national defense because we are so far in debt as a nation. We have been spending so much on our welfare state through food stamps and other programs that I am worrying that many of our citizens are becoming more dependent on government and in many cases they are losing their incentive to work hard because of the welfare trap the government has put in place. Other nations in Europe have gone down this road and we see what mess this has gotten them in. People really are losing their faith in big government and they want more liberty back. It seems to me we have to get back to the founding principles that made our country great. We also need to realize that a big government will encourage waste and corruption. The recent scandals in our government have proved my point. In fact, the jokes you made at Ohio State about possibly auditing them are not so funny now that reality shows how the IRS was acting more like a monster out of control. Also raising taxes on the job creators is a very bad idea too. The Laffer Curve clearly demonstrates that when the tax rates are raised many individuals will move their investments to places where they will not get taxed as much.

______________________

We can fix the IRS problem by going to the flat tax and lowering the size of government.

Did President Obama and his team of Chicago cronies deliberately target the Tea Party in hopes of thwarting free speech and political participation?

Was this part of a campaign to win the 2012 election by suppressing Republican votes?

Perhaps, but I’ve warned that it’s never a good idea to assume top-down conspiracies when corruption, incompetence, politics, ideology, greed, and self-interest are better explanations for what happens in Washington.

Writing for the Washington Examiner, Tim Carney has a much more sober and realistic explanation of what happened at the IRS.

If you take a group of Democrats who are also unionized government employees, and put them in charge of policing political speech, it doesn’t matter how professional and well-intentioned they are. The result will be much like the debacle in the Cincinnati office of the IRS. …there’s no reason to even posit evil intent by the IRS officials who formulated, approved or executed the inappropriate guidelines for picking groups to scrutinize most closely. …The public servants figuring out which groups qualified for 501(c)4 “social welfare” non-profit status were mostly Democrats surrounded by mostly Democrats. …In the 2012 election, every donation traceable to this office went to President Obama or liberal Sen. Sherrod Brown. This is an environment where even those trying to be fair could develop a disproportionate distrust of the Tea Party. One IRS worker — a member of NTEU and contributor to its PAC, which gives 96 percent of its money to Democratic candidates — explained it this way: “The reason NTEU mostly supports Democratic candidates for office is because Democratic candidates are mostly more supportive of civil servants/government employees.”

Tim concludes with a wise observation.

As long as we have a civil service workforce that leans Left, and as long as we have an income tax system that requires the IRS to police political speech, conservative groups can always expect special IRS scrutiny.

And my colleague Doug Bandow, in an article for the American Spectator, adds his sage analysis.

The real issue is the expansive, expensive bureaucratic state and its inherent threat to any system of limited government, rule of law, and individual liberty. …the broader the government’s authority, the greater its need for revenue, the wider its enforcement power, the more expansive the bureaucracy’s discretion, the increasingly important the battle for political control, and the more bitter the partisan fight, the more likely government officials will abuse their positions, violate rules, laws, and Constitution, and sacrifice people’s liberties. The blame falls squarely on Congress, not the IRS.

I actually think he is letting the IRS off the hook too easily.

- It has thieving employees.

It has incompetent employees.

It has incompetent employees.- It has thuggish employees.

- It has brainless employees.

- It has protectionist employees.

- It has wasteful employees.

- And it has victimizing employees.

But Doug’s overall point obviously is true.

…the denizens of Capitol Hill also have created a tax code marked by outrageous complexity, special interest electioneering, and systematic social engineering. Legislators have intentionally created avenues for tax avoidance to win votes, and then complained about widespread tax avoidance to win votes.

So what’s the answer?

The most obvious response to the scandal — beyond punishing anyone who violated the law — is tax reform. Implement a flat tax and you’d still have an IRS, but the income tax would be less complex, there would be fewer “preferences” for the agency to police, and rates would be lower, leaving taxpayers with less incentive for aggressive tax avoidance. …Failing to address the broader underlying factors also would merely set the stage for a repeat performance in some form a few years hence. …More fundamentally, government, and especially the national government, should do less. Efficient social engineering may be slightly better than inefficient social engineering, but no social engineering would be far better.

Amen. Let’s rip out the internal revenue code and replace it with a simple and fair flat tax.

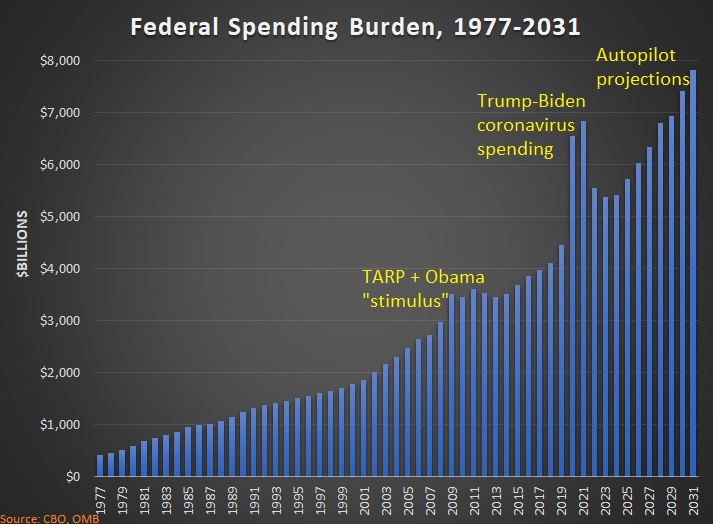

But here’s the challenge. We know the solution, but it will be almost impossible to implement good policy unless we figure out some way to restrain the spending side of the fiscal ledger.

___________________________

At the risk of over-simplifying, we will never get tax reform unless we figure out how to implement entitlement reform.

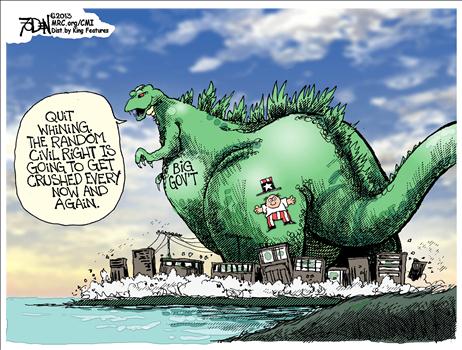

Here’s another Foden cartoon, which I like because it has the same theme asthis Jerry Holbert cartoon, showing big government as a destructive and malicious force.

_____________

Thank you so much for your time. I know how valuable it is. I also appreciate the fine family that you have and your commitment as a father and a husband.

Sincerely,

Everette Hatcher III, 13900 Cottontail Lane, Alexander, AR 72002, ph 501-920-5733, lowcostsqueegees@yahoo.com

Related Posts:

We know the IRS commissioner wasn’t telling the truth in March 2012, when he testified: “There’s absolutely no targeting.”

We know the IRS commissioner wasn’t telling the truth in March 2012, when he testified: “There’s absolutely no targeting.”However, Lois Lerner knew different when she misled people with those words. Two important points made by Noonan in the Wall Street Journal in the article below: First, only conservative groups were targeted in this scandal by […]

A great cartoonist takes on the IRS!!!!

Ohio Liberty Coalition versus the I.R.S. (Tom Zawistowski) Published on May 20, 2013 The Ohio Liberty Coalition was among tea party groups that received special scrutiny from the I.R.S. Tom Zawistowski says his story is not unique. He argues the kinds of questions the I.R.S. asked his group amounts to little more than “opposition research.” Video […]

“Schaeffer Sundays” Francis Schaeffer’s own words concerning what the First Amendment means

Francis Schaeffer: “Whatever Happened to the Human Race?” (Episode 2) SLAUGHTER OF THE INNOCENTS Published on Oct 6, 2012 by AdamMetropolis The 45 minute video above is from the film series created from Francis Schaeffer’s book “Whatever Happened to the Human Race?” with Dr. C. Everett Koop. This book really helped develop my political views concerning […]

Cartoonists show how stupid the IRS is acting!!!

We got to lower the size of government so we don’t have these abuses like this in the IRS. Cartoonists v. the IRS May 23, 2013 by Dan Mitchell Call me perverse, but I’m enjoying this IRS scandal. It’s good to see them suffer a tiny fraction of the agony they impose on the American people. I’ve already […]

Dear Senator Pryor, why not pass the Balanced Budget Amendment? (“Thirsty Thursday”, Open letter to Senator Pryor)

Dear Senator Pryor, Why not pass the Balanced Budget Amendment? As you know that federal deficit is at all time high (1.6 trillion deficit with revenues of 2.2 trillion and spending at 3.8 trillion). On my blog http://www.HaltingArkansasLiberalswithTruth.com I took you at your word and sent you over 100 emails with specific spending cut ideas. However, […]

Video from Cato Institute on IRS Scandal

Is the irs out of control? Here is the link from cato: MAY 22, 2013 8:47AM Can You Vague That Up for Me? By TREVOR BURRUS SHARE As the IRS scandal thickens, targeted groups are coming out to describe their ordeals in dealing with that most-reviled of government agencies. The Ohio Liberty Coalition was one of […]

IRS cartoons from Dan Mitchell’s blog

Get Ready to Be Reamed May 17, 2013 by Dan Mitchell With so many scandals percolating, there are lots of good cartoons being produced. But I think this Chip Bok gem deserves special praise. It manages to weave together both the costly Obamacare boondoggle with the reprehensible politicization of the IRS. So BOHICA, my friends. If […]

Obama jokes about audit of Ohio St by IRS then IRS scandal breaks!!!!!

You want to talk about irony then look at President Obama’s speech a few days ago when he joked about a potential audit of Ohio St by the IRS then a few days later the IRS scandal breaks!!!! The I.R.S. Abusing Americans Is Nothing New Published on May 15, 2013 The I.R.S. targeting of tea party […]

Dear Senator Pryor, why not pass the Balanced Budget Amendment? (“Thirsty Thursday”, Open letter to Senator Pryor)

Dear Senator Pryor, Why not pass the Balanced Budget Amendment? As you know that federal deficit is at all time high (1.6 trillion deficit with revenues of 2.2 trillion and spending at 3.8 trillion). On my blog http://www.HaltingArkansasLiberalswithTruth.com I took you at your word and sent you over 100 emails with specific spending cut ideas. However, […]

We could put in a flat tax and it would enable us to cut billions out of the IRS budget!!!!

We could put in a flat tax and it would enable us to cut billions out of the IRS budget!!!! May 14, 2013 2:34PM IRS Budget Soars By Chris Edwards Share The revelations of IRS officials targeting conservative and libertarian groups suggest that now is a good time for lawmakers to review a broad range […]