Rob Bluey / @RobertBluey / December 21, 2022

Rep. James Comer, R-Ky., the incoming chairman of the House Oversight and Reform Committee, is urging his Senate counterparts to reject the $1.85 trillion omnibus spending bill in order to strengthen GOP’s oversight authority for the next Congress.

Comer will ascend to chairman of the powerful House committee Jan. 3 with a range of investigations planned. Before he’s even able to get started, however, Senate Republicans who support the omnibus spending bill could strip Comer of important leverage—the power of the purse.

With 20 Republican senators already votingTuesday on a procedural motion to advance the bill, Senate Majority Leader Chuck Schumer, D-N.Y., appears to have enough GOP support to get the bill done this week.

That hasn’t stopped Comer and other House Republicans from warning about the consequences.

“It’s imperative that we stop the massive omnibusso that Republicans can use our majority power next Congress to conduct oversight of the federal government, hold the Biden Administration accountable, and enact good government reforms,” Comer told The Daily Signal in a statement.

Withholding money from the Biden administration is one tool House Republicans can use to exercise effective oversight—particularly if federal agencies and government officials are uncooperative or not forthcoming with information in the new year.

“The primary method that Congress can use to hold federal agencies accountable is via appropriations,” said Paul Winfree, former budget policy director for President Donald Trump and a distinguished fellow at The Heritage Foundation. “They should not be appropriating until they’ve figured out just how to use their oversight powers.” (The Daily Signal is the multimedia news organization of The Heritage Foundation.)

Passage of the omnibus spending bill would insulate the Biden administration from a spending fight for the next year. The bill making its way through the Senate funds the president’s agenda from through Sept. 30, 2023.

>>> No Surprise: Republicans Won’t Hold Biden Accountable

Comer was first elected to Congress in 2016 and served as ranking member on the House Oversight and Reform Committee while Democrats had the majority. He’ll ascend to the top spot once the 118th Congress starts in less than two weeks.

He’s among a vocal group of House Republicans who are warning about implications of passing the massive spending bill during the current lame-duck Congress rather than waiting until next year when Republicans have control of the House.

“It’s no surprise that Democrats are racing to use their waning days of power to force through trillions of dollars in new spending and a host of bad policies that will weaken our country,” Comer told The Daily Signal. “Democrats’ unhinged, inflation-inducing spending binge over the last two years caused 40-year high inflation that’s harming the pocketbooks of Americans and has allowed rampant government waste.”

In addition to Comer, 13 House Republicans are promising to oppose and stymie the legislative priorities of any Republican senator who votes in favor of the omnibus spending bill this week. They have the support of likely incoming House Speaker Kevin McCarthy, R-Calif., as well.

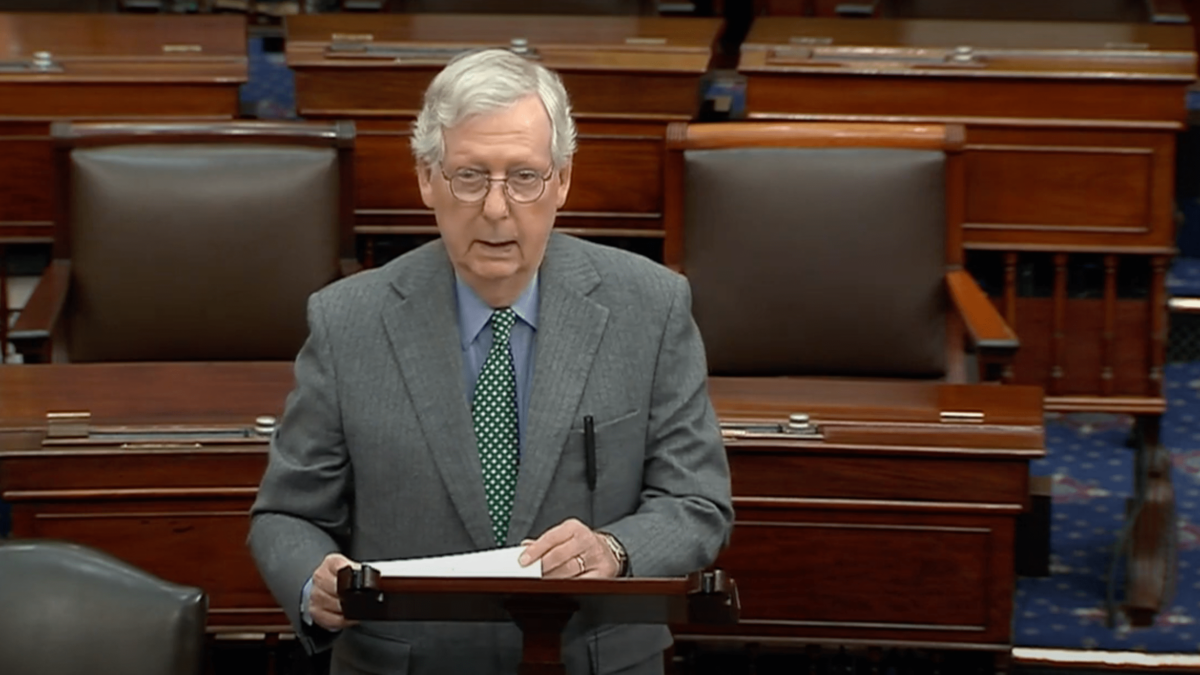

Schumer already has the support of Senate Minority Leader Mitch McConnell, R-Ky., and Sens. Richard Shelby, R-Ala., vice chairman of the Senate Appropriations Committee. They were among the 20 Senate Republicans who voted to move forward on the bill Tuesday.

Earlier this year, House Republicans outlined an ambitious oversight agenda. It includes an investigation of Homeland Security Alejandro Mayorkas’ failures leading to the border crisis, the government’s collusion with Big Tech to censor speech, the origins of COVID-19, Hunter Biden’s corrupt business dealings, the disastrous withdrawal from Afghanistan, politicization of the FBI, the administration’s promotion of critical race theory, and many other topics.

Have an opinion about this article? To sound off, please email letters@DailySignal.com and we’ll consider publishing your edited remarks in our regular “We Hear You” feature. Remember to include the url or headline of the article plus your name and town and/or state.

—

Incoming House Oversight Chairman: ‘Imperative’ to Stop Omnibus Spending Bill

“It’s imperative that we stop the massive omnibus so that Republicans can use our majority power next Congress to conduct oversight of the federal government, hold the Biden Administration accountable, and enact good government reforms,” Rep. James Comer, incoming chairman of the House Oversight and Reform Committee, said in a statement. (Photo by Anna Moneymaker/Getty Images)

Rep. James Comer, R-Ky., the incoming chairman of the House Oversight and Reform Committee, is urging his Senate counterparts to reject the $1.85 trillion omnibus spending bill in order to strengthen GOP’s oversight authority for the next Congress.

Comer will ascend to chairman of the powerful House committee Jan. 3 with a range of investigations planned. Before he’s even able to get started, however, Senate Republicans who support the omnibus spending bill could strip Comer of important leverage—the power of the purse.

With 20 Republican senators already votingTuesday on a procedural motion to advance the bill, Senate Majority Leader Chuck Schumer, D-N.Y., appears to have enough GOP support to get the bill done this week.

That hasn’t stopped Comer and other House Republicans from warning about the consequences.

“It’s imperative that we stop the massive omnibusso that Republicans can use our majority power next Congress to conduct oversight of the federal government, hold the Biden Administration accountable, and enact good government reforms,” Comer told The Daily Signal in a statement.

Withholding money from the Biden administration is one tool House Republicans can use to exercise effective oversight—particularly if federal agencies and government officials are uncooperative or not forthcoming with information in the new year.

“The primary method that Congress can use to hold federal agencies accountable is via appropriations,” said Paul Winfree, former budget policy director for President Donald Trump and a distinguished fellow at The Heritage Foundation. “They should not be appropriating until they’ve figured out just how to use their oversight powers.” (The Daily Signal is the multimedia news organization of The Heritage Foundation.)

Passage of the omnibus spending bill would insulate the Biden administration from a spending fight for the next year. The bill making its way through the Senate funds the president’s agenda from through Sept. 30, 2023.

>>> No Surprise: Republicans Won’t Hold Biden Accountable

Comer was first elected to Congress in 2016 and served as ranking member on the House Oversight and Reform Committee while Democrats had the majority. He’ll ascend to the top spot once the 118th Congress starts in less than two weeks.

He’s among a vocal group of House Republicans who are warning about implications of passing the massive spending bill during the current lame-duck Congress rather than waiting until next year when Republicans have control of the House.

“It’s no surprise that Democrats are racing to use their waning days of power to force through trillions of dollars in new spending and a host of bad policies that will weaken our country,” Comer told The Daily Signal. “Democrats’ unhinged, inflation-inducing spending binge over the last two years caused 40-year high inflation that’s harming the pocketbooks of Americans and has allowed rampant government waste.”

In addition to Comer, 13 House Republicans are promising to oppose and stymie the legislative priorities of any Republican senator who votes in favor of the omnibus spending bill this week. They have the support of likely incoming House Speaker Kevin McCarthy, R-Calif., as well.

Schumer already has the support of Senate Minority Leader Mitch McConnell, R-Ky., and Sens. Richard Shelby, R-Ala., vice chairman of the Senate Appropriations Committee. They were among the 20 Senate Republicans who voted to move forward on the bill Tuesday.

Earlier this year, House Republicans outlined an ambitious oversight agenda. It includes an investigation of Homeland Security Alejandro Mayorkas’ failures leading to the border crisis, the government’s collusion with Big Tech to censor speech, the origins of COVID-19, Hunter Biden’s corrupt business dealings, the disastrous withdrawal from Afghanistan, politicization of the FBI, the administration’s promotion of critical race theory, and many other topics.

By voting for the $1.7 trillion spending bill, Senate Republicans would strip their House counterparts of the leverage they need on all those investigations and more by giving Biden and Democrats exactly what they want—money to continue on, unaffected, for another year.

Have an opinion about this article? To sound off, please email letters@DailySignal.com and we’ll consider publishing your edited remarks in our regular “We Hear You” feature. Remember to include the url or headline of the article plus your name and town and/or state.

March 31, 2021

President Biden c/o The White House

1600 Pennsylvania Avenue NW

Washington, DC 20500

Dear Mr. President,

Please explain to me if you ever do plan to balance the budget while you are President? I have written these things below about you and I really do think that you don’t want to cut spending in order to balance the budget. It seems you ever are daring the Congress to stop you from spending more.

“The credit of the United States ‘is not a bargaining chip,’ Obama said on 1-14-13. However, President Obama keeps getting our country’s credit rating downgraded as he raises the debt ceiling higher and higher!!!!

Washington Could Learn a Lot from a Drug Addict

Just spend more, don’t know how to cut!!! Really!!! That is not living in the real world is it?

Making more dependent on government is not the way to go!!

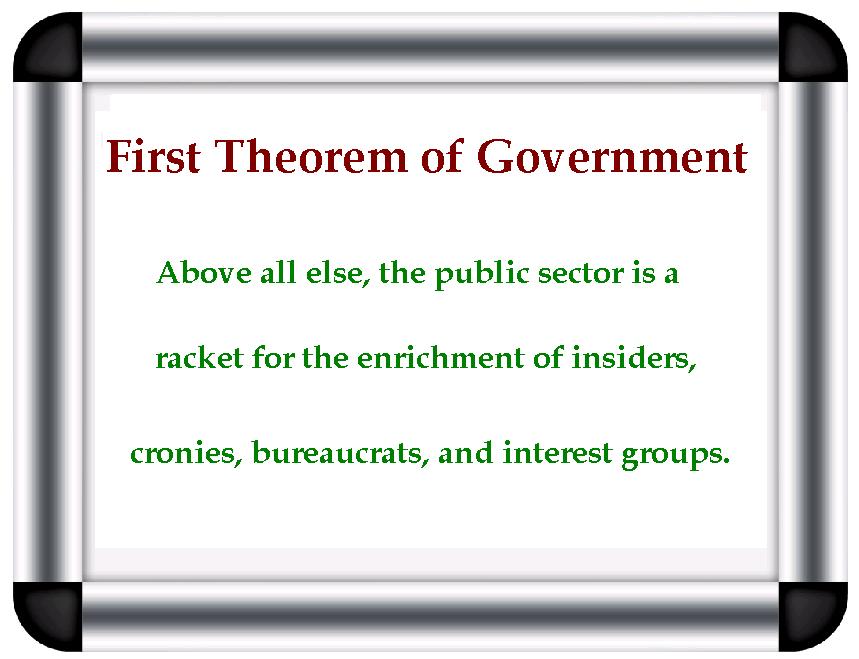

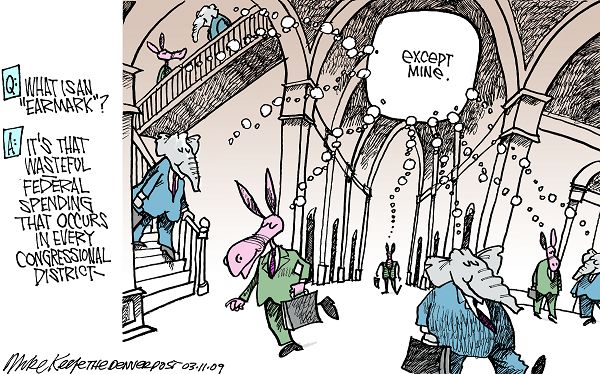

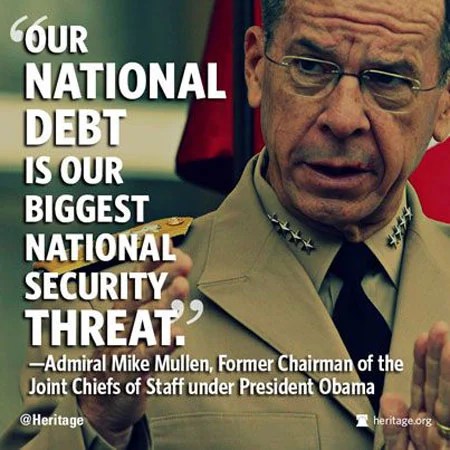

Why is our government in over 16 trillion dollars in debt? There are many reasons for this but the biggest reason is people say “Let’s spend someone else’s money to solve our problems.” Liberals like Max Brantley have talked this way for years. Brantley will say that conservatives are being harsh when they don’t want the government out encouraging people to be dependent on the government. The Obama adminstration has even promoted a plan for young people to follow like Julia the Moocher.

David Ramsey demonstrates in his Arkansas Times Blog post of 1-14-13 that very point:

Arkansas Politics / Health Care Arkansas’s share of Medicaid expansion and the national debt

Posted by David Ramsey on Mon, Jan 14, 2013 at 1:02 PM

Imagine standing a baby carrot up next to the 25-story Stephens building in Little Rock. That gives you a picture of the impact on the national debt that federal spending in Arkansas on Medicaid expansion would have, while here at home expansion would give coverage to more than 200,000 of our neediest citizens, create jobs, and save money for the state.

Here’s the thing: while more than a billion dollars a year in federal spending would represent a big-time stimulus for Arkansas, it’s not even a drop in the bucket when it comes to the national debt.

Currently, the national debt is around $16.4 trillion. In fiscal year 2015, the federal government would spend somewhere in the neighborhood of $1.2 billion to fund Medicaid expansion in Arkansas if we say yes. That’s about 1/13,700th of the debt.

It’s hard to get a handle on numbers that big, so to put that in perspective, let’s get back to the baby carrot. Imagine that the height of the Stephens building (365 feet) is the $16 trillion national debt. That $1.2 billion would be the length of a ladybug. Of course, we’re not just talking about one year if we expand. Between now and 2021, the federal government projects to contribute around $10 billion. The federal debt is projected to be around $25 trillion by then, so we’re talking about 1/2,500th of the debt. Compared to the Stephens building? That’s a baby carrot.

______________

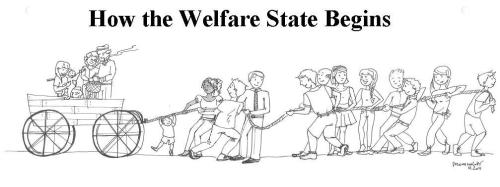

Here is how it will all end if everyone feels they should be allowed to have their “baby carrot.”

How sad it is that liberals just don’t get this reality.

Here is what the Founding Fathers had to say about welfare. David Weinberger noted:

While living in Europe in the 1760s, Franklin observed: “in different countries … the more public provisions were made for the poor, the less they provided for themselves, and of course became poorer. And, on the contrary, the less was done for them, the more they did for themselves, and became richer.”

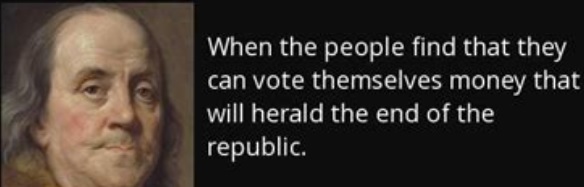

Alexander Fraser Tytler, Lord Woodhouselee (15 October 1747 – 5 January 1813) was a Scottish lawyer, writer, and professor. Tytler was also a historian, and he noted, “A democracy cannot exist as a permanent form of government. It can only exist until the majority discovers it can vote itself largess out of the public treasury. After that, the majority always votes for the candidate promising the most benefits with the result the democracy collapses because of the loose fiscal policy ensuing, always to be followed by a dictatorship, then a monarchy.”

Thomas Jefferson to Joseph Milligan

April 6, 1816

[Jefferson affirms that the main purpose of society is to enable human beings to keep the fruits of their labor. — TGW]

![]()

To take from one, because it is thought that his own industry and that of his fathers has acquired too much, in order to spare to others, who, or whose fathers have not exercised equal industry and skill, is to violate arbitrarily the first principle of association, “the guarantee to every one of a free exercise of his industry, and the fruits acquired by it.” If the overgrown wealth of an individual be deemed dangerous to the State, the best corrective is the law of equal inheritance to all in equal degree; and the better, as this enforces a law of nature, while extra taxation violates it.

[From Writings of Thomas Jefferson, ed. Albert E. Bergh (Washington: Thomas Jefferson Memorial Association, 1904), 14:466.]

_______

Jefferson pointed out that to take from the rich and give to the poor through government is just wrong. Franklin knew the poor would have a better path upward without government welfare coming their way. Milton Friedman’s negative income tax is the best method for doing that and by taking away all welfare programs and letting them go to the churches for charity.

_____________

_________

Thank you so much for your time. I know how valuable it is. I also appreciate the fine family that you have and your commitment as a father and a husband.

Sincerely,

Everette Hatcher III, 13900 Cottontail Lane, Alexander, AR 72002, ph 501-920-5733

Williams with Sowell – Minimum Wage

Thomas Sowell

Thomas Sowell – Reducing Black Unemployment

—-

Related posts:

Welfare Spending Shattering All-Time Highs

We got to act fast and get off this path of socialism. Morning Bell: Welfare Spending Shattering All-Time Highs Robert Rector and Amy Payne October 18, 2012 at 9:03 am It’s been a pretty big year for welfare—and a new report shows welfare is bigger than ever. The Obama Administration turned a giant spotlight […]

We need more brave souls that will vote against Washington welfare programs

We need to cut Food Stamp program and not extend it. However, it seems that people tell the taxpayers back home they are going to Washington and cut government spending but once they get up there they just fall in line with everyone else that keeps spending our money. I am glad that at least […]

Welfare programs are not the answer for the poor

Government Must Cut Spending Uploaded by HeritageFoundation on Dec 2, 2010 The government can cut roughly $343 billion from the federal budget and they can do so immediately. __________ Liberals argue that the poor need more welfare programs, but I have always argued that these programs enslave the poor to the government. Food Stamps Growth […]

Private charities are best solution and not government welfare

Milton Friedman – The Negative Income Tax Published on May 11, 2012 by LibertyPen In this 1968 interview, Milton Friedman explained the negative income tax, a proposal that at minimum would save taxpayers the 72 percent of our current welfare budget spent on administration. http://www.LibertyPen.com Source: Firing Line with William F Buckley Jr. ________________ Milton […]

The book “After the Welfare State”

Dan Mitchell Commenting on Obama’s Failure to Propose a Fiscal Plan Published on Aug 16, 2012 by danmitchellcato No description available. ___________ After the Welfare State Posted by David Boaz Cato senior fellow Tom G. Palmer, who is lecturing about freedom in Slovenia and Tbilisi this week, asked me to post this announcement of his […]

President Obama responds to Heritage Foundation critics on welfare reform waivers

Is President Obama gutting the welfare reform that Bill Clinton signed into law? Morning Bell: Obama Denies Gutting Welfare Reform Amy Payne August 8, 2012 at 9:15 am The Obama Administration came out swinging against its critics on welfare reform yesterday, with Press Secretary Jay Carney saying the charge that the Administration gutted the successful […]

Welfare reform part 3

Thomas Sowell – Welfare Welfare reform was working so good. Why did we have to abandon it? Look at this article from 2003. The Continuing Good News About Welfare Reform By Robert Rector and Patrick Fagan, Ph.D. February 6, 2003 Six years ago, President Bill Clinton signed legislation overhauling part of the nation’s welfare system. […]

Welfare reform part 2

Uploaded by ForaTv on May 29, 2009 Complete video at: http://fora.tv/2009/05/18/James_Bartholomew_The_Welfare_State_Were_In Author James Bartholomew argues that welfare benefits actually increase government handouts by ‘ruining’ ambition. He compares welfare to a humane mousetrap. —– Welfare reform was working so good. Why did we have to abandon it? Look at this article from 2003. In the controversial […]

Why did Obama stop the Welfare Reform that Clinton put in?

Thomas Sowell If the welfare reform law was successful then why change it? Wasn’t Bill Clinton the president that signed into law? Obama Guts Welfare Reform Robert Rector and Kiki Bradley July 12, 2012 at 4:10 pm Today, the Obama Department of Health and Human Services (HHS) released an official policy directive rewriting the welfare […]

“Feedback Friday” Letter to White House generated form letter response July 10,2012 on welfare, etc (part 14)

I have been writing President Obama letters and have not received a personal response yet. (He reads 10 letters a day personally and responds to each of them.) However, I did receive a form letter in the form of an email on July 10, 2012. I don’t know which letter of mine generated this response so I have […]