Open letter to President Obama (Part 526)

(Emailed to White House on 6-6-13.)

President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500

Dear Mr. President,

I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here.

I have been writing on my blog for over two years now concerning the disturbing trend of more and more people becoming dependent on the federal government for more of their income than ever before. This encourages laziness in my view and in the case of the food stamp system many people find themselves in what Milton Friedman calls the “Welfare Trap.” (Much of this trend started under President Bush and had Republican support.) I wanted to point out that we should cut back on government spending and let the private economy do it’s magic.

If the increase in food stamps was just because of the recession then why did the spending go from $19.8 billion in 2000 to $37.9 billion in 2007?

Newscom

A recent US News & World Report article set out to unveil the “facts” about food stamps.

What are the so-called “facts”?

For one, the article claims that the food stamps program is not “bloated,” but rather, the surge in participation and spending is a result of the program “doing what it’s supposed to do.”

But what is it “supposed to do”?

Food stamps (or the Supplemental Nutrition Assistance Program (SNAP), as it is now called) were designed to ensure that Americans without the ability to provide for themselves are able to receive basic nutrition. However, application loopholes and policy changes over the past decade or so have allowed recipients to bypass income and asset tests, meaning many people are receiving food stamps who would not have been eligible under the program’s original purposes.

One of the changes in eligibility requirements is “broad-based categorical eligibility.” This type of eligibility means that an individual who receives any service under another welfare program, such as Temporary Assistance for Needy Families (TANF)—even something as small as a TANF brochure—can be deemed eligible for food stamps. A full 50 percent of all food stamp recipients now enroll in the program through this broad-based categorical eligibility procedure. As Heritage welfare experts Robert Rector and Kiki Bradley write:

In states using this loophole, a middle-class family with one earner who becomes unemployed for one or two months can receive $668 per month in food stamps even if the family has $20,000 in cash sitting in the bank. Because of this, food stamps has been transformed from a program for the truly needy to a routine bonus payment stacked on top of conventional unemployment benefits.

In addition, the U.S. Department of Agriculture (USDA) has operated substantial outreach programs to pull more people onto the food stamp rolls. Some states have gone so far as to hire food stamp recruiters, tasked with filling a monthly quota of new food stamp enrollees.

Another “fact,” according to the author, is that much of the growth in food stamp costs is due to the recession and is temporary.

That’s partially true. Food stamp spending has roughly doubled in the past four years, and part of this is clearly due to the recession. However, food stamp spending has been on an upward climb since the program began back in the 1960s. In the decade prior to the recession, total government food stamp spending nearly doubled, from $19.8 billion in 2000 to $37.9 trillion in 2007.

Moreover, according to Obama’s budget plans, food stamp spending will not return to pre-recession levels when the economy improves. “For most of the next decade, food stamp spending, adjusted for inflation and population growth, would remain at nearly twice the levels seen during the non-recessionary periods under President Bill Clinton,” note Rector and Bradley.

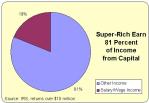

What’s more, food stamps are just one of roughly 80 federally funded means-tested welfare programs. The total cost of government welfare spending has been on a nearly continual climb over the past five decades and has increased 16-fold, to nearly $1 trillion annually, since the 1960s. Welfare is the fastest growing part of government spending, and under Obama’s fiscal year 2013 budget, total welfare spending will permanently increase from 4.5 percent of gross domestic product (GDP) to 6 percent of GDP.

US News & World Report also suggests as a “fact” that most food stamp recipients work.

However, a significant portion of able-bodied recipients of food stamps perform little to no work. Of the roughly 10.5 million households receiving food stamps containing an able-bodied, non-elderly adult (there are approximately 20 million households receiving food stamps total), more than half—5.5 million—performed no work during a given month in 2010. Another 1.5 million to 2 million performed fewer than 30 hours of work per week. This isn’t unique to the recession, but is typical even during good economic times.

The food stamp program is just one of dozens that comprise the complex system of federal means-tested welfare programs. Instead of continuing to pour more dollars into these programs, which have failed to promote self-sufficiency, policymakers should roll back aggregate spending on means-tested welfare to pre-recession levels when employment recovers. Likewise, programs like food stamps should be reformed to promote self-reliance through work, empowering individuals and families to become free from government dependence.

_______________________

Thank you so much for your time. I know how valuable it is. I also appreciate the fine family that you have and your commitment as a father and a husband.

Sincerely,

Everette Hatcher III, 13900 Cottontail Lane, Alexander, AR 72002, ph 501-920-5733, lowcostsqueegees@yahoo.com

Related posts:

Tell the 48 million food stamps users to eat more broccoli!!!!

Welfare Can And Must Be Reformed Uploaded on Jun 29, 2010 If America does not get welfare reform under control, it will bankrupt America. But the Heritage Foundation’s Robert Rector has a five-step plan to reform welfare while protecting our most vulnerable. __________________________ We got to slow down the growth of Food Stamps. One […]

Republicans for more food stamps?

Eight Reasons Why Big Government Hurts Economic Growth __________________ We got to cut spending and we must first start with food stamp program and we need some Senators that are willing to make the tough cuts. Food Stamp Republicans Posted by Chris Edwards Newt Gingrich had fun calling President Obama the “food stamp president,” but […]

Obama promotes food stamps but Milton Friedman had a better suggestion

Milton Friedman’s negative income tax explained by Friedman in 1968: We need to cut back on the Food Stamp program and not try to increase it. What really upsets me is that when the government gets involved in welfare there is a welfare trap created for those who become dependent on the program. Once they […]

400% increase in food stamps since 2000

Welfare Can And Must Be Reformed Uploaded by HeritageFoundation on Jun 29, 2010 If America does not get welfare reform under control, it will bankrupt America. But the Heritage Foundation’s Robert Rector has a five-step plan to reform welfare while protecting our most vulnerable. __________________________ If welfare increases as much as it has in the […]

Food stamp spending has doubled under the Obama Administration

The sad fact is that Food stamp spending has doubled under the Obama Administration. A Bumper Crop of Food Stamps Amy Payne May 21, 2013 at 7:01 am Tweet this Where do food stamps come from? They come from taxpayers—certainly not from family farms. Yet the “farm” bill, a recurring subsidy-fest in Congress, is actually […]

Which states are the leaders in food stamp consumption?

I am glad that my state of Arkansas is not the leader in food stamps!!! Mirror, Mirror, on the Wall, Which State Has the Highest Food Stamp Usage of All? March 19, 2013 by Dan Mitchell The food stamp program seems to be a breeding ground of waste, fraud, and abuse. Some of the horror stories […]

Why not cancel the foodstamp program and let the churches step in?

Government Must Cut Spending Uploaded by HeritageFoundation on Dec 2, 2010 The government can cut roughly $343 billion from the federal budget and they can do so immediately. __________ We are becoming a country filled with people that dependent on the federal government when we should be growing our economy by lowering taxes and putting […]

Food Stamp Program is constantly ripped off and should be discontinued

Uploaded by oversightandreform on Mar 6, 2012 Learn More athttp://oversight.house.gov The Oversight Committee is examining reports of food stamp merchants previously disqualified who continue to defraud the program. According to a Scripps Howard News Service report, food stamp fraud costs taxpayers hundreds of millions every year. Watch the Oversight hearing live tomorrow at 930 […]

Open letter to President Obama (Part 326)

(This letter was emailed to White House on 11-21-11.) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse […]

Welfare state may drag England down the tubes!!!!

Welfare state may drag England down the tubes!!!! Very Funny but Very Un-PC British Video on Welfare and Immigration May 19, 2013 by Dan Mitchell I’ve shared this bit of political incorrect terrorism humor from England, as well asthis somewhat un-PC bit of tax humor. But perhaps motivated by the scandal of giving welfare to terrorists, this new video is […]

…And the reason for their bold fashion choices lay not just in the pop glamour of the late 70s and early 80s, but also in the Swedish tax code. According to Abba: The Official Photo Book, published to mark 40 years since they won Eurovision with Waterloo, the band’s style was influenced in part by laws that allowed the cost of outfits to be deducted against tax – so long as the costumes were so outrageous they could not possibly be worn on the street.

…And the reason for their bold fashion choices lay not just in the pop glamour of the late 70s and early 80s, but also in the Swedish tax code. According to Abba: The Official Photo Book, published to mark 40 years since they won Eurovision with Waterloo, the band’s style was influenced in part by laws that allowed the cost of outfits to be deducted against tax – so long as the costumes were so outrageous they could not possibly be worn on the street. Or, returning to the example of ABBA, perhaps they should have used these outfits since there wouldn’t be much cost to deduct and that would have boosted taxable income.

Or, returning to the example of ABBA, perhaps they should have used these outfits since there wouldn’t be much cost to deduct and that would have boosted taxable income.