House Republicans for a Balanced Budget Amendment

Uploaded by HouseConference on Nov 17, 2011

This week, House Republican freshmen Members held a press conference to discuss the importance of passing a balanced budget amendment to the United States Constitution and how now is the time for a permanent solution to our nation’s spending-driven debt crisis. We need a balanced budget amendment to ensure a prosperous future for our children and grandchildren. It’s the right thing to do.

______________

President Obama c/o The White House

1600 Pennsylvania Avenue NW

Washington, DC 20500

Dear Mr. President,

I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here.

Over and over in the past Milton Friedman pleaded for restraint in our federal spending. Below you will see a fine article supporting the Balanced Budget Amendment and it points out that Friedman favored this mechanism to control our spending.

The Answer Is a Balanced Budget Amendment

By Steven G. Calabresi from the October 2011 issue

The question is how to solve our problem of unsustainable debt.

The United States of America is on the road to bankruptcy, with a federal debt of more than $14.2 trillion, almost half of which is owned by foreign countries. (Communist China alone owns fully a quarter of the foreign-held portion). The problem is so well known that it almost came as an anticlimax when Standard & Poor’s recently downgraded U.S. debt from its coveted AAA rating to an unheard-of AA+. As for the budget deficit, it is expected to total $1.3 trillion for this year alone, with tax revenues of about $2.3 trillion and total expenditures of about $3.6 trillion. If a household ran its budget like that, we would say it was headed for a rude shock.

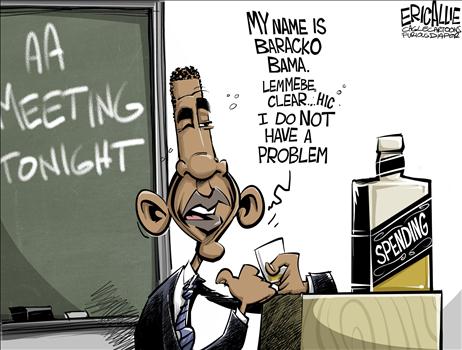

Making matters worse is that our debt is structural rather than cyclical: the federal budget is in deficit both in good economic times and bad. When George W. Bush took office in 2001, the gross federal debt was $5.76 trillion. When he left eight years later, the debt was up to $10.626 trillion, an increase of $607 billion a year. During Barack Obama’s presidency it has risen by $1.7 trillion a year and now almost 40 percent higher than when he took office. Deficits of this size are quite simply unsustainable.

The only way to fix this mess is to radically cut federal spending, cap the budget with pay-as-you-go spending rules, and then enact a balanced budget amendment (BBA).

The most important point is that we need to cut spending, not raise taxes. Total federal spending as a percentage of Gross Domestic Product (GDP) has skyrocketed from around 18 percent, when George W. Bush became president, to more than 25 percent today. This shows that our current deficit problem is entirely due to overspending. If tomorrow we cut spending back to the levels of January 20, 2001, when Bush took office, the deficit would almost disappear.

Then we need to cap and balance the budget, once we’ve cut overall spending back to 2001 levels. To do this effectively, we need to enact a federal BBA to the U.S. Constitution. This amendment should have several features.

First, it should require that the president submit to Congress each year a balanced federal budget with no fiscal gimmicks. Presidential failure to do so would be an impeachable offense. Congress should be constitutionally required to hold a vote in both houses on the president’s proposed budget within three months, with the president and Congress having up to six months to adopt a final budget in any given calendar year (this requirement should be waivable during any time of declared war for up to two years). If they fail to do that, all federal spending except for payments on the debt should be frozen at levels 10 percent lower than in the preceding fiscal year. To help impose this, any one of the several states should have standing to sue in the Supreme Court’s original jurisdiction for enforcement of this requirement.

Second, the BBA should cap federal spending at 18 percent of GDP. A spending cap of this proportion would keep the federal government at the size it was under President Bill Clinton — hardly onerous or severe. The amendment should require a two-thirds vote of both houses of Congress to enact any new taxes or to raise tax rates. Votes to raise the national debt limit should also require a two-thirds majority. These provisions are essential to prevent a BBA from becoming just an excuse to raise taxes.

THE USUAL RESPONSE to calls for such an amendment is that we ought not tamper with the Constitution. Critics of a BBA also claim it is not needed since a majority of Congress could balance the budget today if it really wanted to. There are at least five reasons why those critics are dead wrong.

First, it is a core principle of American constitutionalism that there be no taxation without representation. The American Revolution was fought in part to prevent taxation by a British Parliament in which Americans were not represented. When Congress borrows 40 cents of every dollar it spends, as it is doing today, it passes the burden of paying for current spending on to our children and grandchildren who cannot vote right now — nothing less than taxation without representation.

Second, a core purpose of the Constitution is to protect fundamental principles like freedom of speech and of the press from being whittled away during moments of legislative passion. Exactly the same argument holds true with respect to spending more money than the government collects in tax revenue. Constitutionalizing the balanced budget requirement is as necessary as constitutionalizing the protection of freedom of speech and of the press. This is an argument that was first made more than 30 years ago by Noble Prize laureate Milton Friedman. It is just as true today as it was then.

Third, there is an economic reason why it is easier to assemble lobbies for government spending than it is to assemble a nationwide lobby for a balanced budget. Consider the farm lobby that argues for agricultural price supports, or the AARP that lobbies for benefits for the elderly. It is cheaper and easier for small groups with a shared common interest to lobby Congress than for a large, diffuse majority of the American population to do the same. That’s why the silent majority is silent. A BBA in the Constitution would prevent the special interests from ripping off the children and grandchildren of the silent majority. James Madison wrote in The Federalist No. 51 that the secret of constitutional government was to make ambition counteract ambition. The way to check and balance over-spending is to constitutionalize a pay-as-you-go rule while making tax increases hard to enact.

Fourth, yet another economic reason for a BBA is that it would reduce risk and thereby promote investment. When people are looking for a place to invest, one of their first questions is how risky is the investment and how large is the potential reward. Foreign and American investors since World War II have invested in the U.S. and in its debt because our Constitution of checks and balances makes it hard to do crazy things like nationalize industries or set up a single payer health insurance monopoly.

A BBA would reduce further the risk of investing in the U. S., and that would promote investment and economic growth by constitutionally committing itself not to overspend. The risk of inflationary devaluation of the dollar would thus go way down. This in turn would bolster the dollar as the world’s reserve currency. It would also prevent federal borrowing from crowding out private sector borrowing in the U.S. This would free up a capital for investment in job-creating ventures.

A fifth argument for the BBA paradoxically grows out of one of the arguments commonly made against it: it would be purely symbolic. Or as James Madison would have said, “a mere parchment barrier” against overspending.

This criticism fails for many reasons. A BBA of the kind I argue for would have enforcement teeth. Presidential failure to submit a good-faith balanced budget would be a specific ground for impeachment. Then too, if Congress failed to enact a balanced budget, state governments could sue for an across theboard spending cut of 10 percent.

But suppose Congress wimps out and enacts a BBA without teeth. Would such a symbolic victory be worth anything? The answer again is clearly yes. Almost every state has some form of a balanced budget requirement in its constitution or law. The fact is that balanced budget requirements actually do work at the state level. This strongly suggests they would work at the federal level as well.

CONSTITUTIONAL PROVISIONS, even symbolic ones, set the agenda of political debate. The Second and Tenth Amendments clearly do that in the U.S. today, even though the federal courts almost never enforce them. A BBA would work very much the same way.

The case for a BBA is so powerful that Germany and Switzerland — both models of fiscal sobriety — actually require a balanced budget in their own constitutions. And now Germany and France have actually proposed requiring that all Eurozone countries amend their national constitutions to require a balanced budget. What is good enough for almost every state in the Union and for many countries of Europe is certainly worth trying at the federal level here.

So what harm could come from enacting a BBA to the U.S. Constitution? Is there any argument against such an amendment that outweighs the arguments in favor of it?

One concern conservatives have is that it might lead to tax increases. I share that concern and therefore would couple it with a super-majority requirement for tax increases. That should make a BBA clearly appealing to conservatives of all stripes. But what if such an amendment gets ratified that does not protect against tax increases? Would we then be worse off?

I think the answer is no. It is harder politically for Congress to tax real people living today than it is to borrow money from the children and grandchildren of the silent majority. People living today will mobilize in many ways against tax increases. The correct solution is to cut, cap, and balance, but I would not let concerns about tax increases stop us from doing what virtually every state constitution does.

Another real concern for conservatives is that a BBA could lead to dangerous cuts in spending on national defense. This concern I share. The U.S. is a world leader and the greatest force for liberty and economic opportunity in history. We must always be ready to defend liberty worldwide.

The problem is, however, that current levels of deficit spending — almost half of which is financed by foreign countries — is itself a threat to U.S. global might. We simply cannot defend liberty in Asia, for example, if we continue to borrow massively from the Chinese. We cannot defend freedom in Arab countries while being so dependent on Saudi Arabia and others for imported oil and purchases of our debt. The status quo is at least as threatening to America’s military might as is living under a BBA, for the status quo is not sustainable.

Finally, some conservatives argue that the solution to congressional deficit spending is a line item veto amendment giving the president the same power over spending enjoyed by a majority of state governors. I am quite skeptical about such an amendment because of the enormous power it would shift from Congress to the president. Imagine for a moment that President Obama could threaten senators or representatives with line item vetoes of locally important spending projects unless they voted his way on socialized medicine. Or on a card check law reform making it easy to fraudulently form a union. Do we really want to cede that much power from Congress to the president? I do not think so.

In sum, we need to cut, cap, and balance. To do that permanently, we must enact a BBA. Nothing less than the future of government of the people, by the people, and for the people is at stake.

____________

Thank you so much for your time. I know how valuable it is. I also appreciate the fine family that you have and your commitment as a father and a husband.

Sincerely,