Will Taxing the Rich Fix the Deficit?

Published on Jul 2, 2012

The government’s budget deficit in 2009 was $1.5 trillion. Many have suggested raising taxes on the rich to cover the difference between what the government collected in revenue and what it spent. Is that a realistic solution? Economics professor Antony Davies uses data to demonstrate why taxing the rich will not be sufficient to make the budget deficit disappear. He says, “The budget deficit is so large that there simply aren’t enough rich people to tax to raise enough to balance the budget.” Instead, it’s time to work on legitimate solutions, like cutting spending.

___________

(This letter was emailed to White House on 12-12-12.)

President Obama c/o The White House

1600 Pennsylvania Avenue NW

Washington, DC 20500

Dear Mr. President,

I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here.

Can you blame the rich for moving when you raise taxes up too high? Milton Friedman rightly noted that people will seek their own self interest. He asked, “Is it really true that political self-interest is nobler somehow than economic self-interest?” The obvious answer is no. Take a look at this exchange between Friedman and Phil Donahue and then look at this article below that discusses what is going on now in France. No wonder that people are fleeing California for Texas too.

Phil Donohue: Seems to reward not virtue as much as the ability to manipulate the system.

Milton Friedman: And what does reward virtue? You think the Communist commissar rewards virtue? You think a Hitler rewards virtue? Do you think… American presidents reward virtue? Do they choose their appointees on the basis of the virtue of the people appointed or on the basis of political clout? Is it really true that political self-interest is nobler somehow than economic self-interest? You know I think you are taking a lot of things for granted. And just tell me where in the world you find these angels that are going to organize society for us? Well, I don’t even trust you to do that.

Sniveling and Despicable French Thief Complains that Victims Are Running Away

December 12, 2012 by Dan Mitchell

Atlas is shrugging and Dan Mitchell is laughing.

I predicted back in May that well-to-do French taxpayers weren’t fools who would meekly sit still while the hyenas in the political class confiscated ever-larger shares of their income.

But the new President of France, Francois Hollande, doesn’t seem overly concerned by economic rationality and decided (Obama must be quite envious) that a top tax rate of 75 percent is fair.” And patriotic as well!

French Prime Minister: “I’m upset that the wildebeest aren’t remaining still for their disembowelment.”

French Prime Minister: “I’m upset that the wildebeest aren’t remaining still for their disembowelment.”So I was pleased – but not surprised – when the news leaked out that France’s richest man was saying au revoir and moving to Belgium.

But he’s not the only one. The nation’s top actor also decided that he doesn’t want to be a fatted calf. Indeed, it appears that there are entire communities of French tax exiles living just across the border in Belgium.

Best of all, the greedy politicians are throwing temper tantrums that the geese have found a better place for their golden eggs.

France’s Prime Minister seems particularly agitated about this real-world evidence for the Laffer Curve. Here are some excerpts from a story in the UK-based Telegraph.

France’s prime minister has slammed wealthy citizens fleeing the country’s punitive tax on high incomes as greedy profiteers seeking to “become even richer”. Jean-Marc Ayrault’s outburst came after France’s best-known actor, Gerard Dépardieu, took up legal residence in a small village just over the border in Belgium, alongside hundreds of other wealthy French nationals seeking lower taxes. “Those who are seeking exile abroad are not those who are scared of becoming poor,” the prime minister declared after unveiling sweeping anti-poverty measures to help those hit by the economic crisis. These individuals are leaving “because they want to get even richer,” he said. “We cannot fight poverty if those with the most, and sometimes with a lot, do not show solidarity and a bit of generosity,” he added.

In the interests of accuracy, let’s re-write Monsieur Ayrault’s final quote from the excerpt. What he’s really saying is: “We cannot buy votes and create dependency if those that produce, and sometimes produce a lot, do not act like morons and let us rape and pillage without consequence.”

So what’s going to happen? Well, I wrote in September that France was going to suffer a fiscal crisis, and I followed up in October with a post explaining how a bloated welfare state was a form of economic suicide.

Yet French politicians don’t seem to care. They don’t seem to realize that a high burden of government spending causes economic weakness by misallocating labor and capital. They seem oblivious to basic tax policy matters, even though there is plenty of evidence that the Laffer Curve works even in France.

So as France gets ever-closer to fiscal collapse, part of me gets a bit of perverse pleasure from the news. Not because of dislike for the French. The people actually are very nice, in my experience, and France is a very pleasant place to visit. And it was even listed as the best place in the world to live, according to one ranking.

But it helps to have bad examples. And just as I’ve used Greece to help educate American lawmakers about the dangers of statism, I’ll also use France as an example of what not to do.

P.S. France actually is much better than the United States in that rich people actually are free to move across the border without getting shaken down with exit taxes that are reminiscent of totalitarian regimes.

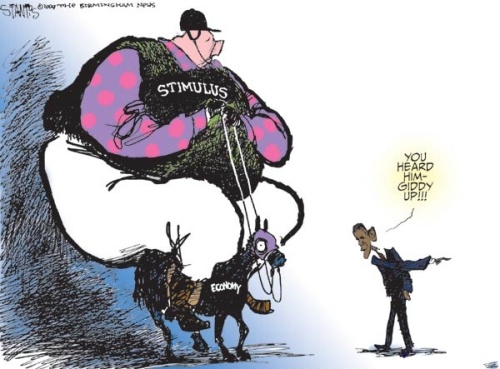

P.P.S. This Chuck Asay cartoon seems to capture the mentality of the French government.

_____________

Thank you so much for your time. I know how valuable it is. I also appreciate the fine family that you have and your commitment as a father and a husband.

Sincerely,

Everette Hatcher III, 13900 Cottontail Lane, Alexander, AR 72002, ph 501-920-5733, lowcostsqueegees@yahoo.com

“I’m going back in my bottle if you don’t cut spending!”

“I’m going back in my bottle if you don’t cut spending!”

“Since you are all such good customers,” he said, “I’m going to reduce the cost of your daily beer by $20″. Drinks for the ten men would now cost just $80.

“Since you are all such good customers,” he said, “I’m going to reduce the cost of your daily beer by $20″. Drinks for the ten men would now cost just $80.