______________

It’s time for citizens to hold elected officials accountable about spending – even if that means their favorite government-funded program gets axed

January 14, 2014 at 9:30 am

Credit: SHAWN THEW/EPA/Newscom

It’s time for citizens to hold elected officials accountable about spending – even if that means their favorite government-funded program gets axed.

There’s no hint that Washington is starting to take our outrageous spending levels seriously. On the contrary, on Capitol Hill this week, lawmakers are preparing to vote in favor of an omnibus spending bill that totals over one trillion dollars – even though our nation is currently $17 trillion in debt.

After all, very few politicians want to risk cutting a constituent’s favorite program during an election year. Even some of the most egregious examples of wasteful spending – just think of the $98,670 outhouse on a remote road in Alaska – may be well-loved by some constituents.

But if Americans are serious about getting the country’s finances under control and not passing on a huge debt to our children and grandchildren, more than outhouses will have to go. In an October 2013 poll, 88 percent of respondents said Congress should focus on a long-term plan to lower the national debt. Yet last year in a Pew Research Center poll, significantly lower percentages of Americans, when asked which government programs should be cut or reduced, agreed on what programs to cut. While there were 19 options included in the survey, a majority of Republican respondents only supported cuts in two programs, foreign aid and unemployment benefits. Democrats couldn’t identify even one program they would reduce.

I’ve done my own surveys of friends on both sides of the political spectrum. Those on the left say we should get out of all wars, cut defense and make the top one percent of Americans pay more. They don’t think we’ll ever run out of other “rich” people’s money. But what Margaret Thatcher said of the Labour Party running Great Britain in 1976 remains true, even for today’s liberals: “They always run out of other people’s money.” Even in the prosperous United States, the wealthy simply aren’t wealthy enough to finance all the government programs the left wants, even if the rich were taxed at a higher rate. As it is, the top one percent of taxpayers in the United States pay thirty-five percent of total federal income taxes, according to the Tax Foundation.

Those of us on the right push different ideas. I’d like us to revisit our spending on foreign aid ($24 billion in 2012) and the Corporation for Public Broadcasting ($445 million in 2012). And think of all the money we could save by eliminating the bureaucracies and bureaucrats that spend their time determining what kind of light bulbs we can use and to which schools we should send our children.

Yet the troubling fact is that you could do all these things and still our unsustainable debt would continue to grow. Even ideas that cross ideological lines, such as cutting government wasteand eliminating programs that actually help the wealthy as opposed to the little guy they claim to help (just consider the farm bill which has almost nothing to do with small family farms but is rather a form of corporate welfare for mega-agri-businesses), aren’t enough to solve Washington’s spending benders.

Ultimately, Americans have to address the main driver of our debt: entitlements. Social Security, Medicare, and Medicaid together account for 43 percent of federal spending as of 2012. And while many Americans are understandably concerned about what changes to Social Security would mean for them, there are common sense solutions such as raising the retirement age and making Social Security a true insurance program instead of a program promising unaffordable benefits to all without regard to need.

The world is full of countries which have kicked the can down the road, increased taxes, tried to avoid the unavoidable, and yes, finally run out of other people’s money. Those nation’s economies are now in shambles. Look at Greece or Portugal. For that matter, look at California and Illinois.

We can’t let the United States go down that path.

So first, let’s elect people to office who believe in limited government and who care more about the next generation than their next election. The reforms we need require lawmakers with courage – something you’re likely to see little of in the “debate” on the Hill this week over the spending bill.

But we also need courageous citizens. Unless we the voters lead and tell our politicians we’ll support spending cuts, even painful ones, we won’t change the culture of spending in Washington. And sooner rather than later, we will run out of other people’s money.

– Genevieve Wood is a Senior Contributor to The Foundry.

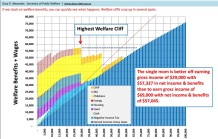

If you want to cut government waste then stop allowing people to get addicted to government programs!!!!

______________ If you want to cut government waste then stop allowing people to get addicted to government programs!!!! November 3, 2013 1:07PM Lindbeck’s Law: The Self-Destructive Nature of Expanding Government Benefits By Alan Reynolds Share Relevant foresight from Swedish economist Assar Lindbeck, “Hazardous Welfare State Dynamics,” American Economic Review, May 1995: The basic dilemma of […]

Lots of Waste at the Federal Mediation and Conciliation Service!!!!

____________ Lots of Waste at the Federal Mediation and Conciliation Service!!!! November 5, 2013 12:50PM ICYMI: FMCS By Jim Harper Share During the hullaballoo around the government shutdown, the Washington Examiner published a jaw-dropping series of stories about blatant waste in an obscure federal agency called the Federal Mediation and Conciliation Service. These stories shouldn’t […]

Open letter to President Obama (Part 440) A suggestion to cut some wasteful spending out of the government Part 6 (includes editorial cartoon)

(Emailed to White House on 3-15-13.) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is […]

Cato held a

Cato held a