—

The Case Against Higher Taxes

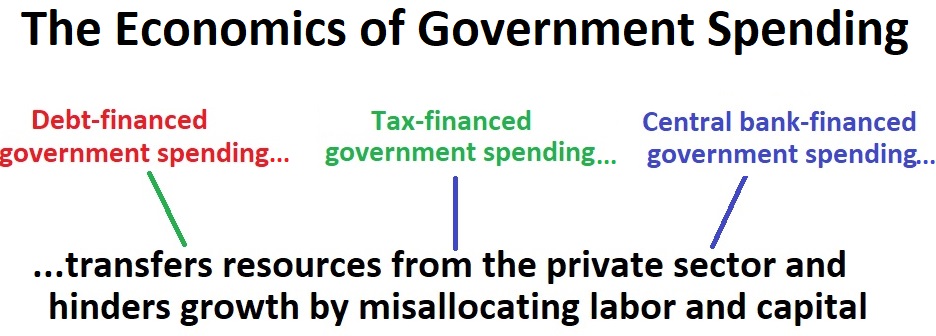

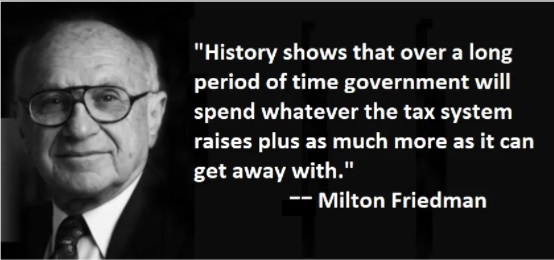

I’ve identified seven reasons to oppose tax increases, but explain in this interview that the biggest reason is that it would be a mistake to give politicians more money to finance an ever-larger burden of government spending.

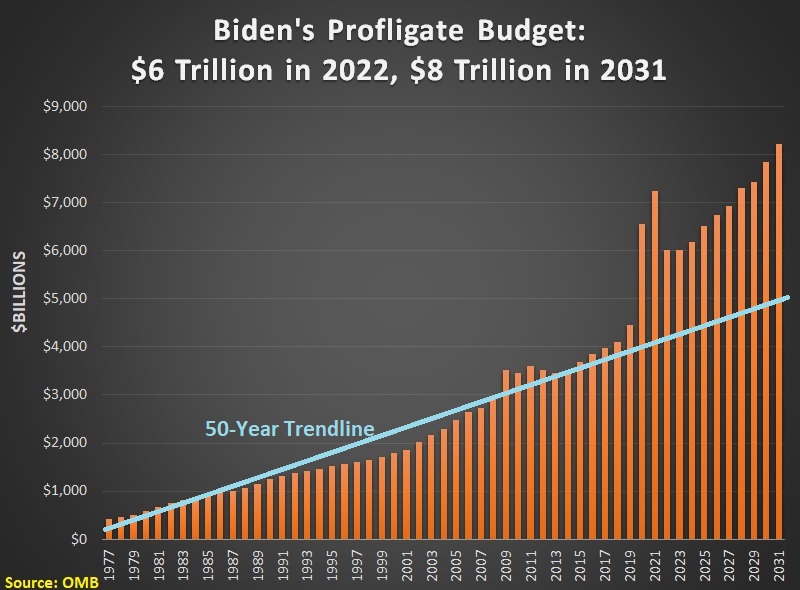

First, I wanted to help viewers understand that America’s fiscal problem is too much government spending and that red ink is simply a symptom of that problem.

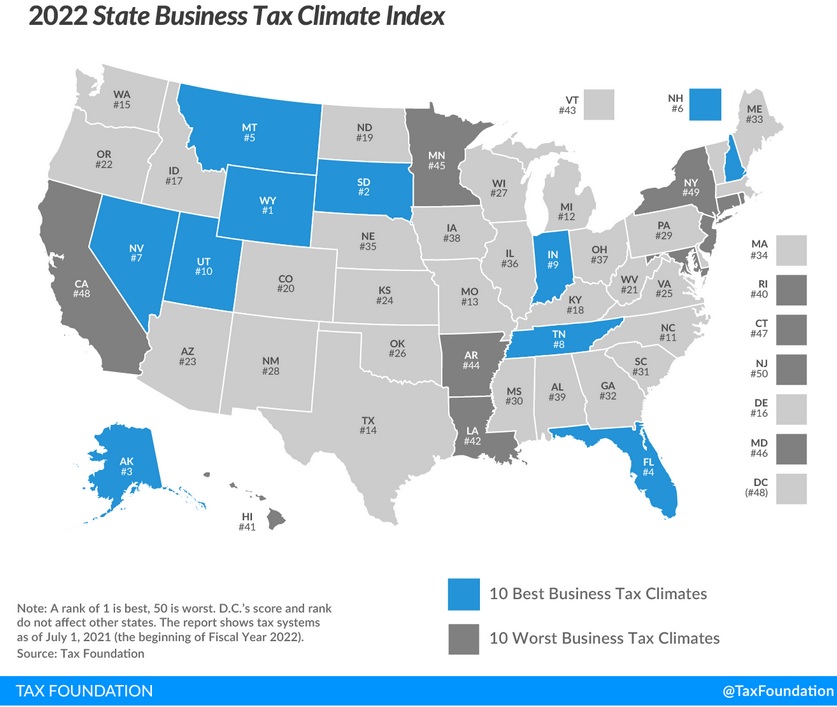

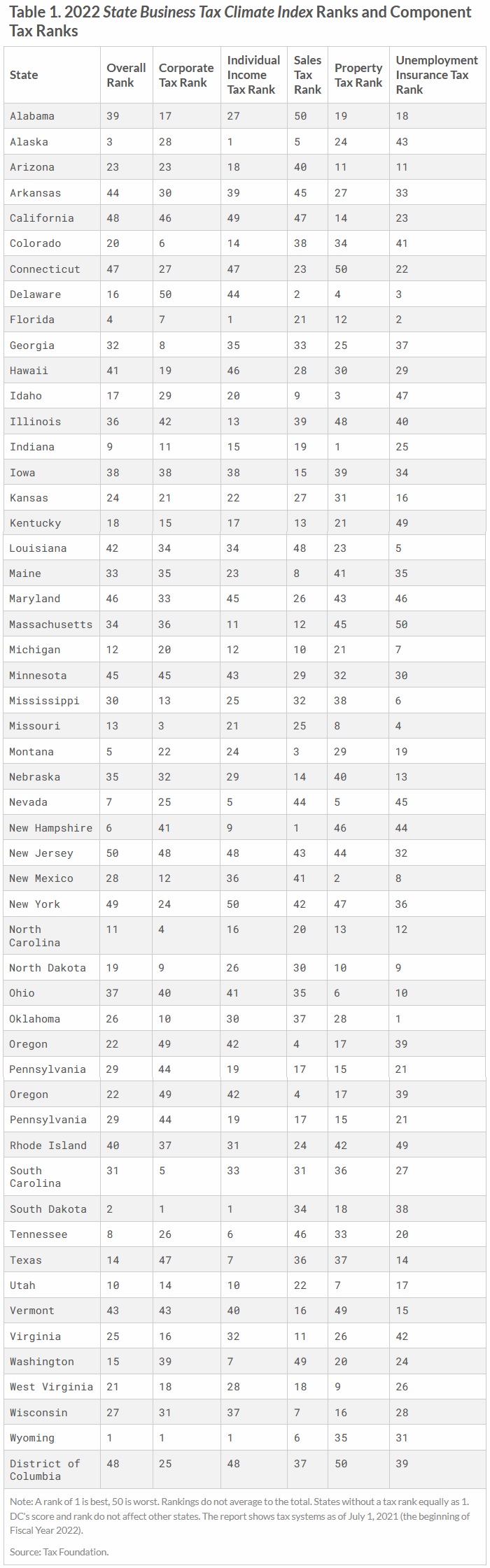

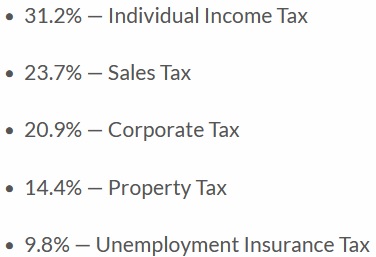

Over the years, I’ve concocted all sorts of visuals to make this point. Like this one.

And this one.

And this one.

Second, I wanted viewers to understand that higher taxes will simply make a bad situation even worse.

From my perspective, the biggest problem with tax increases is that they will enable a bigger burden of government spending.

But even the folks who fixate on red ink should adopt a no-tax increase position.

Why? Because politicians who want big tax increases want even bigger spending increases.

Joe Biden is pushing for a massive tax increase, for instance, but his proposed spending increase is far larger.

We also have decades of evidence from Europe. There’s been a huge increase in the tax burden in Western Europe since the 1960s (largely enabled by the enactment of value-added taxes).

Did that massive increase in revenue lead to less red ink?

Nope, just the opposite, as I showed in both 2012 and 2016.

If you don’t agree with me on this issue, maybe you should heed the words of these four former presidents.

P.S. Some people warn that endlessly increasing debt is a recipe for an eventual crisis. They’re probably right. Which is why it is important to oppose tax-increase deals that wind up saddling us with more red ink. Besides, the long-run damage of tax-financed spending is very similar to the long-run damage of debt-financed spending.

P.P.S. As I mention in the interview, the only real solution is spending restraint. And a spending cap is the best way of enforcing that approach.

Biden’s Boondoggle(s) and the Burden of Government Spending

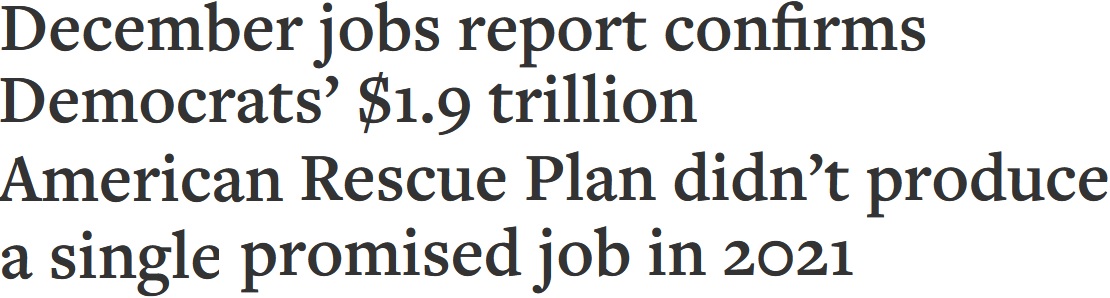

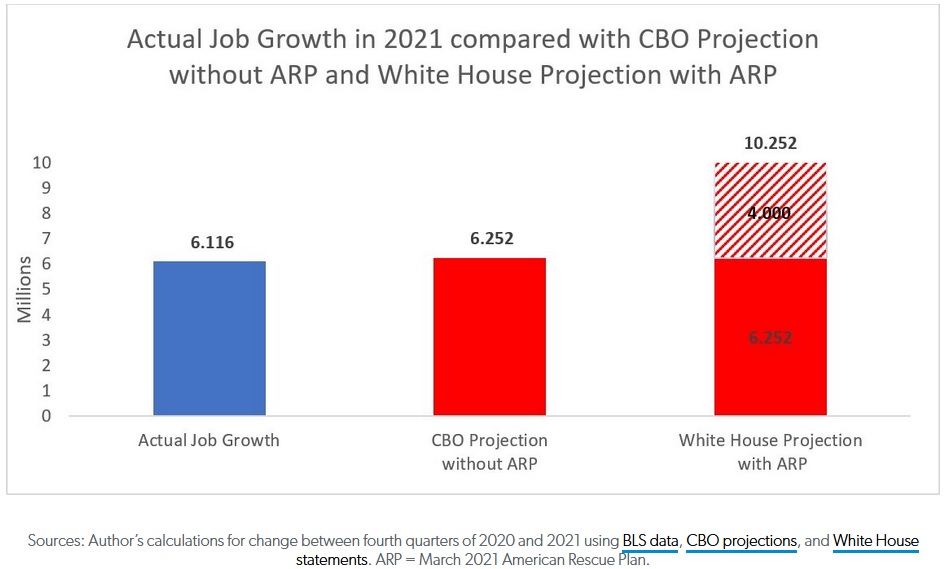

First we got Biden’s $1.9 trillion so-called stimulus.

Then we got his $1 trillion-plus infrastructure boondoggle.

Now Congress may be on the verge of approving the President’s budget, which (if we use honest numbers) is a $5 trillion plan to expand the welfare state.

And…

Keep in mind that Biden’s orgy of new spending is on top of record spending increases that occurred when Republicans were in charge.

Keep in mind that Biden’s orgy of new spending is on top of record spending increases that occurred when Republicans were in charge.- Keep in mind that Biden’s orgy of new spending is on top of built-in spending increases because of poorly designed entitlement programs.

So it’s hardly a surprise that recent changes will lead to a much-larger burden of government spending.

This is bad news for our economy, as measured by my recent study (with similar findings from a wide range of academics – as well as normally left-leaning bureaucracies such as the IMF, World Bank, and OECD).

For purposes of today’s column, let’s put America’s fiscal decline in global context.

Here are some excerpts from a very depressing article in the Economist, starting with some discussion of how Biden’s spending binge is similar to the mistakes made by other nations.

President Joe Biden is building on what started as emergency pandemic-related policy, expanding the child-tax credit,

creating a universal federally funded child-care system, subsidising paid family leave and expanding Obamacare. America’s government spending remains somewhat below the developed-world average. But this change is not just a matter of catching up; the target is moving. Government spending as a share of gdp in the oecd as a whole has consistently inched higher in the six decades since the club was formed in 1961.

There’s then some discussion about how a few nations – most notably Sweden and New Zealand – enjoyed period of genuine spending restraint, but accompanied by depressing observations about how fiscal responsibility is very rare.

Examples of genuine state retrenchment in developed countries are few and far between. Sweden managed it in the 1980s. In the early 1990s Ruth Richardson, then New Zealand’s finance minister, cut the size of the state drastically. …State spending is now six percentage points lower as a share of gdp than it was in 1990. But this is a rare achievement, and perhaps one doomed to pass. …This is a sorry state of affairs if you believe that low taxes and small government are the right, and possibly the only, conditions for reliable, enduring economic growth. …an argument made by Friedrich Hayek, an Austrian philosopher, Milton Friedman, an American economist, and others in the mid-20th century.

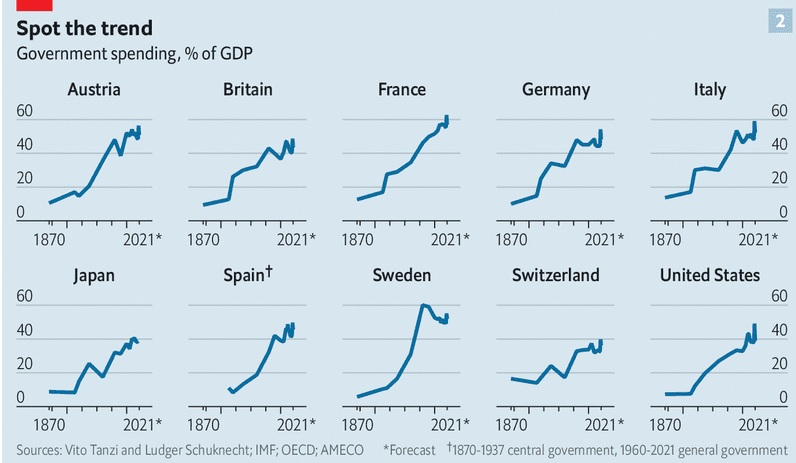

There’s also some historical analysis showing how the burden of government used to be relatively minor.

From 1274 to 1691 the English government raised less than 2% of gdp in tax. …In the 1870s the governments of rich countries were spending about 10% of gdp. In 1920 it was nearer 20%. It has been growing ever since (see chart 2).

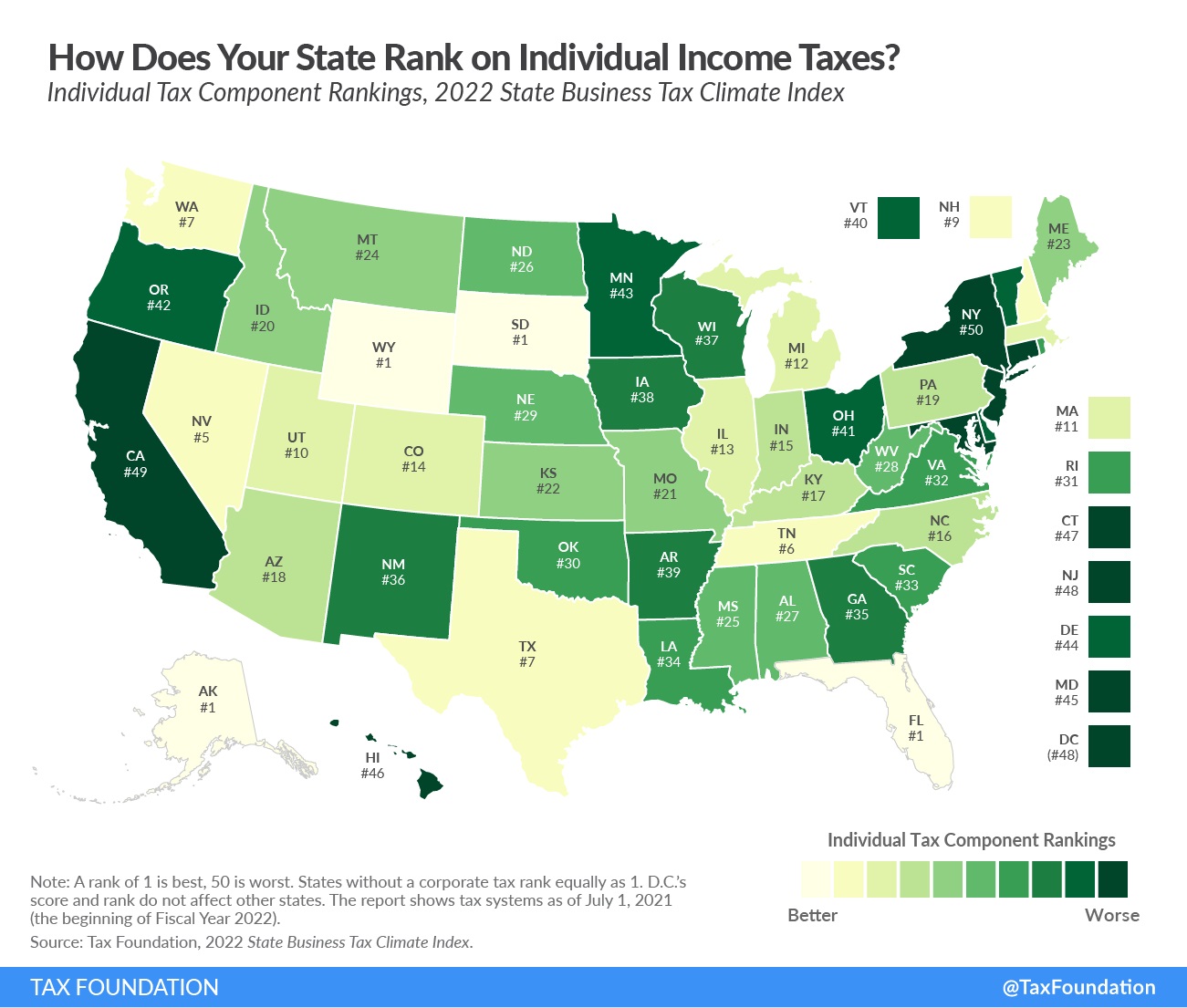

Here’s the aforementioned chart 2, and there are a lot of depressing numbers, though notice how Switzerland does better than other nations.

I’ve previously shared a version of this data, calling it the “world’s most depressing chart” – all of which was made possible by the imposition of income taxes.

But there is some good news. The ever-rising fiscal burden of government has been somewhat offset by reductions in other bad policies.

Governments have not grown more powerful by all measures. Bureaucrats no longer, as a rule, set wages or prices, nor impose strict currency controls, as many did in the 1960s or 1970s. In recent decades the public sector has raised hundreds of billions of dollars from privatisations of state assets such as mines and telecoms networks. If you find it faintly amusing to hear that, from 1948 to 1984, the British state ran its own chain of hotels, that is because the “neoliberal” outlook on the proper place of government has triumphed.

Last but not least, there’s some discussion of “public choice,” which explains why politicians and bureaucrats have incentives to expand the size and scope of government.

Governments and bureaucrats are at least partly self-interested: “public-choice theory” says that unrestrained bureaucracies will defend their turf and seek to expand it. …Politicians have their own incentives to expand the state. It is generally more rewarding for a politician to introduce a new programme than it is to close an old one down; costs are spread across all taxpayers while benefits tend to be concentrated, thus eliciting gratitude from interest groups

I’ll close by reiterating my warning that ever-rising spending burdens not only lead to less growth, but they also will lead to Greek-style fiscal crises.

Europe will get hit first, but it’s just a matter of time before the United States suffers a similar fate.

P.S. There is a simple solution to avoid such crises, and a specific policy to achieve that solution. But don’t hold your breath waiting for politicians to tie their own hands.

Biden’s Economic Alchemy: $3.5 Trillion = Zero

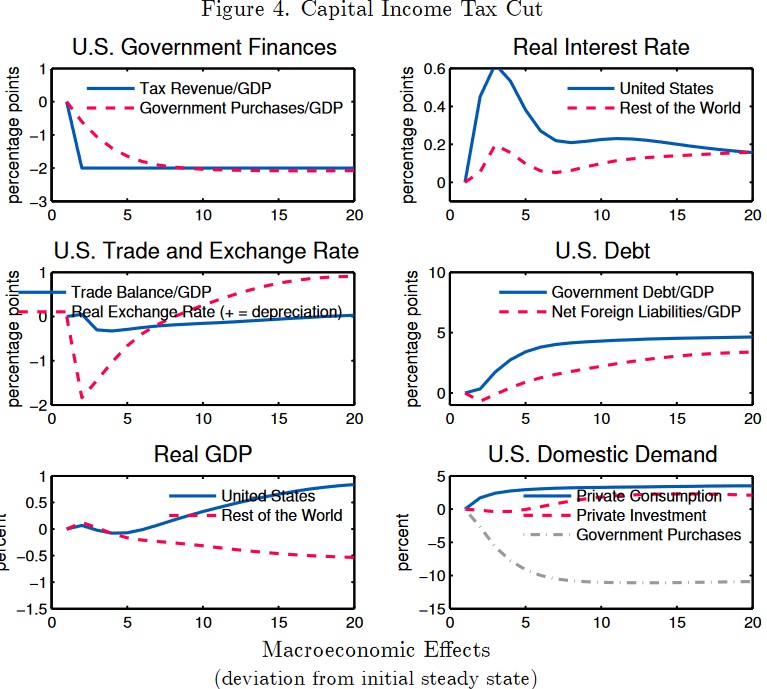

Last week, I wrote about a new study which estimates that Biden’s fiscal agenda of bigger government and higher taxeswould reduce economic output by about $3 trillion over the next decade.

Perhaps more relevant, that foregone economic growth would translate into more than $10,000 of lost compensation per job. And a lifetime drop in living standards of more than 4 percent for younger people.

And these numbers are based on research by the Congressional Budget Office, which is hardly a bastion of libertarian analysis.

The Biden White House has a different perspective.

How different? Well, the President actually claims that expanding the burden of government won’t cost anything.

President Biden promised Friday that his sweeping domestic agenda package will cost “nothing” because Democrats will pay for it through tax hikes on the wealthy and corporations… The remarks were an attempt by Biden

to assuage some of the cost concerns pointedly expressed by the moderate Democrats about the size of the legislation… The total spending outlined in the plan is $3.5 trillion… “It is zero price tag on the debt we’re paying. We’re going to pay for everything we spend,” Biden said in remarks from the State Dining Room at the White House.

Biden’s strange analysis has generated some amusing responses.

For instance, Gerard Baker opined in the Wall Street Journalabout Biden’s magical approach.

…this is a novel way of estimating the cost of something. That eye-wateringly expensive dinner you had last week didn’t really cost you anything because you paid for it. …You could have used the money to invest

in your children’s college fund. You could have paid off some of your credit card bill, the debt on which has quadrupled in the last year. But you chose instead to blow it on a few morsels of raw fish and a couple of bottles of 1982 Château Lafite Rothschild. Don’t worry, It didn’t cost you anything.

Biden and his team definitely deserve to be mocked for their silly argument.

For all intents and purposes, they want us to believe that there’s no downside if you combine anti-growth spending increases with anti-growth tax increases – so long as there’s no increase in red ink.

But there’s actually a fiscal theory that sort of supports what the White House is saying.

- Capital (saving and investment) is a key driver of productivity and long-run growth.

- Budget deficits divert capital from the economy’s productive sector to government.

- Budget deficits raise interest rates, reducing incentives for investment.

- Therefore, budget deficits are bad for prosperity.

For what it’s worth, all four of those statements are correct.

But the theory is nonetheless wrong because it elevates one variable – fiscal balance – while ignoring other variables that have a much bigger impact on economic performance.

For instance, the Congressional Budget Office at one point embraced this approach – even though it led to absurd implications such as growth being maximized with tax rates of 100 percent.

For further background, here’s a table I prepared back in 2012.

The White House today is basically embracing the IMF’s “austerity” argument that deficits/surpluses are the variable that has the biggest impact on growth.

P.S. Folks on the left must get whiplash because some days they embrace the Keynesian argument that deficits are good for growth and other days they argue that a big expansion of government will have zero cost because there is no increase in the deficit.

P.P.S. The folks on the right who focus solely on tax cuts also are guilty of elevating one variable while ignoring others (humorously depicted in this cartoon strip).

Two (Humorous) Images to Understand Biden’s Fiscal Policy

Yesterday’s column was a completely serious look at five graphs and tables that show why Biden’s tax plan is misguided.

Today, we’re going to make the same point with satire. And we’ll only need two images.

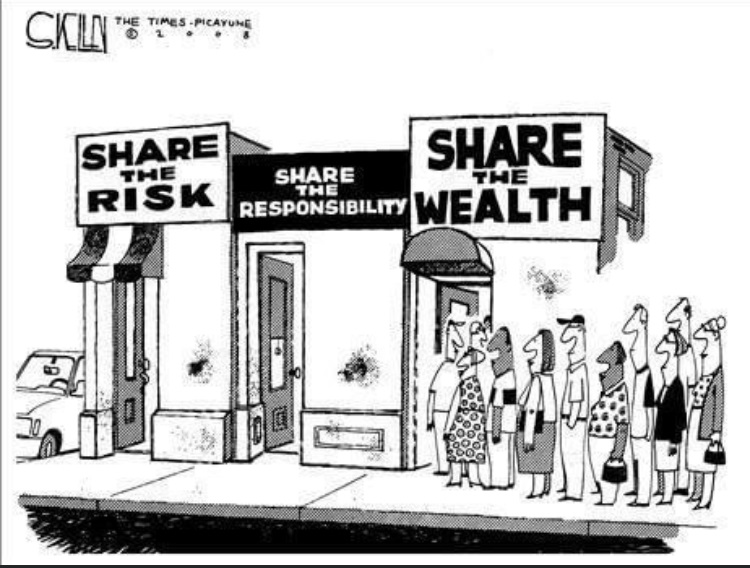

First, here’s a look at what happens when politicians create never-ending handouts financed by ever-higher taxes on an ever-smaller group of rich taxpayers.

In the past, I’ve referred to this as “Greece-ification” and Biden’s fiscal plan definitely qualifies.

It’s also a different way of looking at the second cartoon from this depiction of how a welfare state evolves over time.

This Chuck Asay cartoon makes the same point.

Second, here’s a cartoon that nicely captures why I think Biden’s agenda will erode the nation’s societal capital.

The same theme as this excellent cartoon.

While amusing, there’s a very serious point to be made. Politicians already have created a system that rewards people for doing nothing while punishing them for creating wealth.

Those policies hinder American prosperity (as honest folks on the left acknowledge), but we can survive with slower growth. What really worries me is that we may eventually reach a tipping point of too many people riding in the wagon (and out-voting the people who pull the wagon).

Simply stated, we don’t want America to become another Greece.

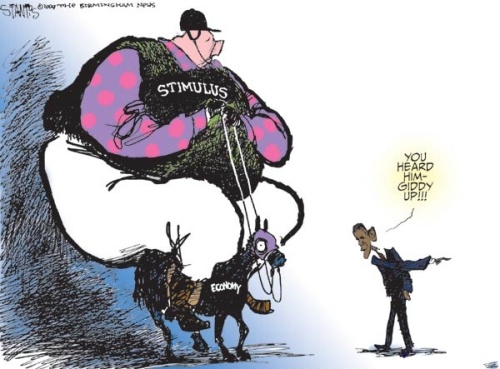

I have put up lots of cartoons from Dan Mitchell’s blog before and they have got lots of hits before. Many of them have dealt with the economy, eternal unemployment benefits, socialism, Greece, welfare state or on gun control.

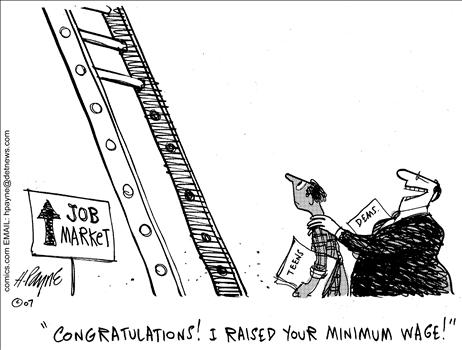

My Cato colleague, Mark Calabria, recently explained how the minimum wage destroys jobs, and I’ve written on several occasions why government-mandated wages can create unemployment by making it unprofitable to hire people with low work skills and/or poor work histories. And I’ve attacked Republicans for going along with these job-killing policies, and also pointed out the racist impact of such intervention.

But this cartoon may be a more effective argument for getting government out of the business of interfering with market forces. It’s simple, direct, and gets the point across. I’m not sure that always happens with my writing.

My former intern, Orphe Divougny, also did a very good job in explaining why politicians shouldn’t interfere with the right of workers and employers to enter into labor contracts.

Related posts:

Cartoons from Dan Mitchell’s blog that demonstrate what Obama is doing to our economy Part 2

Max Brantley is wrong about Tom Cotton’s accusation concerning the rise of welfare spending under President Obama. Actually welfare spending has been increasing for the last 12 years and Obama did nothing during his first four years to slow down the rate of increase of welfare spending. Rachel Sheffield of the Heritage Foundation has noted: […]

Cartoons from Dan Mitchell’s blog that demonstrate what Obama is doing to our economy Part 1

I have put up lots of cartoons from Dan Mitchell’s blog before and they have got lots of hits before. Many of them have dealt with the economy, eternal unemployment benefits, socialism, Greece, welfare state or on gun control. I think Max Brantley of the Arkansas Times Blog was right to point out on 2-6-13 that Hillary […]

Great cartoon from Dan Mitchell’s blog on government moochers

I thought it was great when the Republican Congress and Bill Clinton put in welfare reform but now that has been done away with and no one has to work anymore it seems. In fact, over 40% of the USA is now on the government dole. What is going to happen when that figure gets over […]

Gun Control cartoon hits the internet

Again we have another shooting and the gun control bloggers are out again calling for more laws. I have written about this subject below and on May 23, 2012, I even got a letter back from President Obama on the subject. Now some very interesting statistics below and a cartoon follows. (Since this just hit the […]

“You-Didn’t-Build-That” comment pictured in cartoons!!!

watch?v=llQUrko0Gqw] The federal government spends about 10% on roads and public goods but with the other money in the budget a lot of harm is done including excessive regulations on business. That makes Obama’s comment the other day look very silly. A Funny Look at Obama’s You-Didn’t-Build-That Comment July 28, 2012 by Dan Mitchell I made […]

Cartoons about Obama’s class warfare

I have written a lot about this in the past and sometimes you just have to sit back and laugh. Laughing at Obama’s Bumbling Class Warfare Agenda July 13, 2012 by Dan Mitchell We know that President Obama’s class-warfare agenda is bad economic policy. We know high tax rates undermine competitiveness. And we know tax increases […]

Cartoons on Obama’s budget math

Dan Mitchell Discussing Dishonest Budget Numbers with John Stossel Uploaded by danmitchellcato on Feb 11, 2012 No description available. ______________ Dan Mitchell of the Cato Institute has shown before how excessive spending at the federal level has increased in recent years. A Humorous Look at Obama’s Screwy Budget Math May 31, 2012 by Dan Mitchell I’ve […]

Funny cartoon from Dan Mitchell’s blog on Greece

Sometimes it is so crazy that you just have to laugh a little. The European Mess, Captured by a Cartoon June 22, 2012 by Dan Mitchell The self-inflicted economic crisis in Europe has generated some good humor, as you can see from these cartoons by Michael Ramirez and Chuck Asay. But for pure laughter, I don’t […]

Obama on creating jobs!!!!(Funny Cartoon)

Another great cartoon on President Obama’s efforts to create jobs!!! A Simple Lesson about Job Creation for Barack Obama December 7, 2011 by Dan Mitchell Even though leftist economists such as Paul Krugman and Larry Summers have admitted that unemployment insurance benefits are a recipe for more joblessness, the White House is arguing that Congress should […]

Get people off of government support and get them in the private market place!!!!(great cartoon too)

Dan Mitchell hits the nail on the head and sometimes it gets so sad that you just have to laugh at it like Conan does. In order to correct this mess we got to get people off of government support and get them in the private market place!!!! Chuck Asay’s New Cartoon Nicely Captures Mentality […]

2 cartoons illustrate the fate of socialism from the Cato Institute

Cato Institute scholar Dan Mitchell is right about Greece and the fate of socialism: Two Pictures that Perfectly Capture the Rise and Fall of the Welfare State July 15, 2011 by Dan Mitchell In my speeches, especially when talking about the fiscal crisis in Europe (or the future fiscal crisis in America), I often warn that […]

Cartoon demonstrates that guns deter criminals

John Stossel report “Myth: Gun Control Reduces Crime Sheriff Tommy Robinson tried what he called “Robinson roulette” from 1980 to 1984 in Central Arkansas where he would put some of his men in some stores in the back room with guns and the number of robberies in stores sank. I got this from Dan Mitchell’s […]

Gun control posters from Dan Mitchell’s blog Part 2

I have put up lots of cartons and posters from Dan Mitchell’s blog before and they have got lots of hits before. Many of them have dealt with the economy, eternal unemployment benefits, socialism, Greece, welfare state or on gun control. Amusing Gun Control Picture – Circa 1999 April 3, 2010 by Dan Mitchell Dug this gem out […]

We got to cut spending and stop raising the debt ceiling!!!

We got to cut spending and stop raising the debt ceiling!!! When Governments Cut Spending Uploaded on Sep 28, 2011 Do governments ever cut spending? According to Dr. Stephen Davies, there are historical examples of government spending cuts in Canada, New Zealand, Sweden, and America. In these cases, despite popular belief, the government spending […]

Gun control posters from Dan Mitchell’s blog Part 1

I have put up lots of cartons and posters from Dan Mitchell’s blog before and they have got lots of hits before. Many of them have dealt with the economy, eternal unemployment benefits, socialism, Greece, welfare state or on gun control. On 2-6-13 the Arkansas Times Blogger “Sound Policy” suggested, “All churches that wish to allow concealed […]

Taking on Ark Times bloggers on the issue of “gun control” (Part 3) “Did Hitler advocate gun control?”

Gun Free Zones???? Stalin and gun control On 1-31-13 ”Arkie” on the Arkansas Times Blog the following: “Remember that the biggest gun control advocate was Hitler and every other tyrant that every lived.” Except that under Hitler, Germany liberalized its gun control laws. __________ After reading the link from Wikipedia that Arkie provided then I responded: […]

Taking on Ark Times bloggers on the issue of “gun control” (Part 2) “Did Hitler advocate gun control?”

On 1-31-13 I posted on the Arkansas Times Blog the following: I like the poster of the lady holding the rifle and next to her are these words: I am compensating for being smaller and weaker than more violent criminals. __________ Then I gave a link to this poster below: On 1-31-13 also I posted […]

Two great Americans

Two great Americans