(Emailed to White House on 3-20-13.)

President Obama c/o The White House

1600 Pennsylvania Avenue NW

Washington, DC 20500

Dear Mr. President,

I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here.

I don’t think we should keep raising taxes.

Will Higher Tax Rates Balance the Budget?

Published on Apr 11, 2012

As the U.S. debt and deficit grows, some politicians and economist have called for higher tax rates in order to balance the budget. The question becomes: when the government raises taxes, does it actually collect a larger portion of the US economy?

Professor Antony Davies examines 50 years of economic data and finds that regardless of tax rates, the percentage of GDP that the government collects has remained relatively constant. In other words, no matter how high government sets tax rates, the government gets about the same portion. According to Davies, if we’re concerned about balancing the budget, we should worry less about raising tax revenue and more about growing the economy. The recipe for growth? Lower tax rates and a simplified tax code.

_____________

We are taxed too high and raising taxes at this point will not help.

Cartoonists Mock Obama’s Class-Warfare Agenda

November 16, 2012 by Dan Mitchell

I suppose I should write something serious about Obama’s class-warfare agenda, but I’m in Iceland and it’s almost time to head into Reykjavik for dinner. So let’s simply enjoy some humor that gets across the points I would make anyhow.

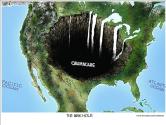

We’ll start with this great cartoon from Lisa Benson. In a perfect world, this monster would be named “Big Government.” But I’m not complaining too much since the obvious implication of the cartoon is that the soak-the-rich tax hikes will make the deficit worse – which implies that politicians will spend the money and/or that there will be a Laffer Curve response leading to less revenue than politicians predict.

You can see some of my favorite Benson cartoons here, here, here, here, here, here, here, here, here, here, and here.

Here’s a similar cartoon. But instead of feeding a deficit monster, it shows that a tax hike will enable a bunch of politicians to continue their binging at our expense.

Holbert is relatively new to me. The only other cartoon of his that I’ve used (at least than I can remember) can be seen here.

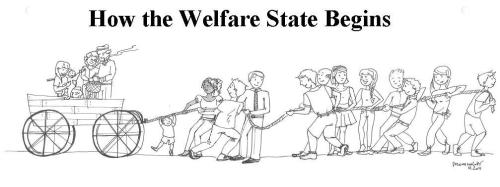

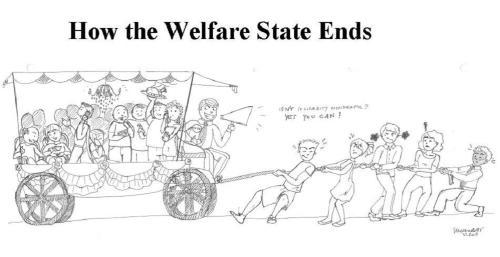

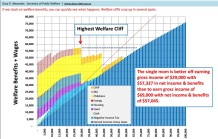

Our final cartoon isn’t about Obama’s class-warfare proposal, but it does show where we’re going if we allow the politicians to continue down the path of tax-and-spend dependency.

You can see two additional Glenn Foden cartoons by clicking here and here.

I especially like the “spa” comment in the basket cartoon. Sort of reminds me of the “frog” story showing how it would be impossible to impose statism in one fell swoop. People would recognize the danger and immediately revolt, much as a frog would immediately hop out if you tried to drop it in boiling water. But just as you can lure a frog into danger by putting it in lukewarm water and slowing turning up the heat until it’s been too weakened to escape, you can also slowly but surely hook people on dependency by creating little programs and eventually turning them into big programs.

That’s sort of where we are today. The burden of government spending has exploded and will get even worse if we don’t enact serious entitlement reform. But too many people now can’t envision a world other than the status quo and they are fearful of change – even though inaction eventually means a Greek-style fiscal crisis.

P.S. Given the theme of this post, you will probably enjoy this Chuck Asay cartoon and this Henry Payne cartoon. Or perhaps you won’t enjoy them if you stop and think about what they’re really saying. But they are both gems, so try to focus only on the humor.

____________

Thank you so much for your time. I know how valuable it is. I also appreciate the fine family that you have and your commitment as a father and a husband.

Sincerely,

Everette Hatcher III, 13900 Cottontail Lane, Alexander, AR 72002, ph 501-920-5733, lowcostsqueegees@yahoo.com