–

The Looming Crisis of Demographic Decline and Entitlement Expansion

There are many compelling economic arguments against entitlement programs.

- They discourage savings.

- They discourage work.

- They are funded with taxes.

- They are funded with debt.

Since I’m a libertarian, I also have moral concerns about tax-and-transfer programs.

Today, though, let’s address the big problem of entitlements and demographics, especially with regards to social insurance programs that transfer money from young people to old people (most notably Social Security and Medicare).

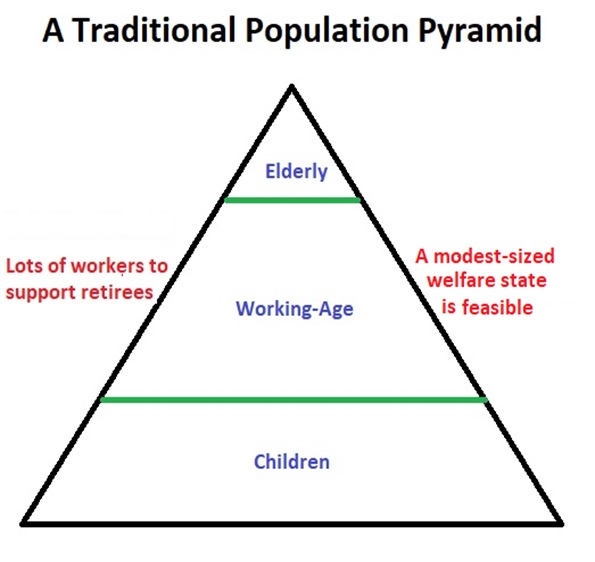

But I’ll start by acknowledging that demographics doesn’t have to be a problem. When nations first created such programs, they generally had “population pyramids” featuring a few old people, lots of working-age people (i.e., taxpayers), and then an even greater number of children (future workers and taxpayers).

As illustrated by this image, entitlement programs can be sustainable with that type of demographic profile.

But there’s been a big shift in demographics in developed nations.

Simply stated, we’re living longer and having fewer kids. In some sense, population pyramids are becoming population cylinders.

Simply stated, we’re living longer and having fewer kids. In some sense, population pyramids are becoming population cylinders.

And this creates major challenges for entitlement programs because instead of there being many workers supporting just a few retirees, you wind up with “old-age dependency ratios” that require very onerous tax burdens (or very high levels of government borrowing).

I’ve already written how this is a big problem for the United States.

I’ve already written how this is a big problem for the United States.

Indeed, I periodically cite long-run forecasts from the Congressional Budget Office to warn about the worrisome fiscal implications.

And I’ve also noted that Japan is in serious trouble.

Today, let’s look at some recent data to show that Europe is another part of the world where this problem is acute.

The European Commission published its 2021 Ageing Reportlate last year and there are three visuals that deserve attention.

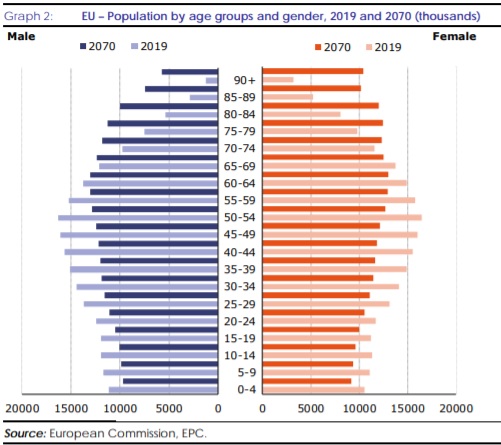

First, here’s a look at the European Union’s population cylinder (or maybe an upside-down pyramid).

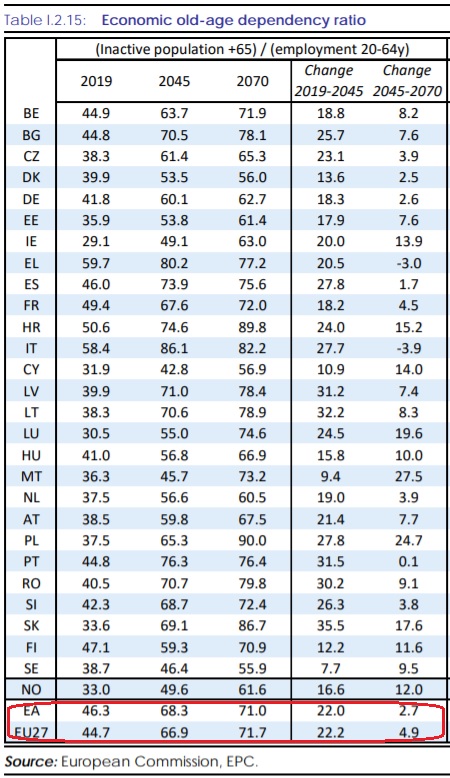

And here’s a table that compares the number of old people with the working-age population in 2019, 2045, and 2070.

At the bottom of the table, I’ve circled in red the averages for the eurozone (nations using the single currency) and the entire European Union. From the perspective of fiscal policy, these are horrific numbers.

But there are numbers that are even worse.

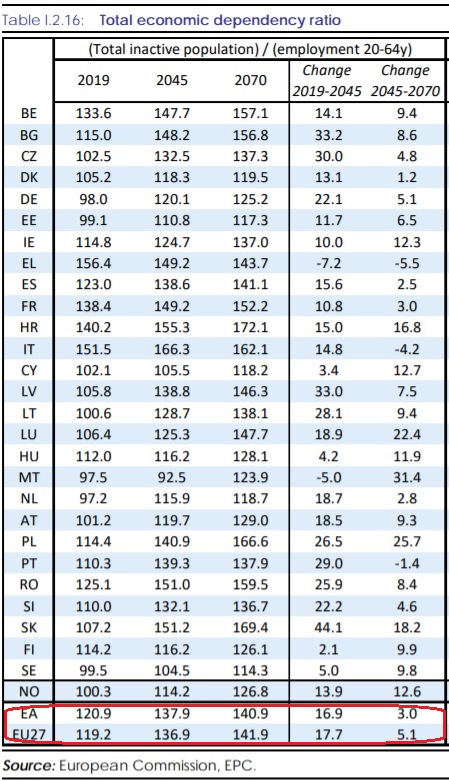

Our final visual is a table showing the economic dependency ratio, which the European Commission defines as “… the ratio between the total inactive population and employment. It gives a measure of the average number of individuals that each employed person ‘supports’ economically.”

Once again, I’ve circled the averages at the bottom of the table.

The bottom line is that most European nations already have a stifling fiscal burden, yet it’s all but certain that there will be even higher taxes and more government spending in the near future.

Which means more economic stagnation for Europe (and those of us in America face that possibility as well).

At the risk of stating the obvious, there is a solution to both Europe’s woes and America’s woes. Simply stated, there needs to be genuine entitlement reform.

That means “pre-funding,” which is the jargon for mandatory private savings, presumably augmented by some form of safety net.

Singapore is probably the world’s leading example for mandatory savings, while Australia, Denmark, Chile, Switzerland, Hong Kong, Netherlands, Faroe Islands, and Sweden are a few of the many other jurisdictions that have fully or partially shifted to systems based on real savings.

Security from CRADLE TO GRAVE never quite works out!!!

Free to Choose Part 4: From Cradle to Grave Featuring Milton Friedman

The Entitlement Disaster that Hillary Clinton and Donald Trump Are Ignoring

July 8, 2016 by Dan Mitchell

I’m like a broken record when it comes to entitlement spending. I’ve explained, ad nauseam, that programs such as Medicare, Medicaid, Obamacare, and Social Security must be reformed.

In part, genuine entitlement reform is a good idea because you get better economic performance when you replace tax-and-transfer schemes with private savings and competitive markets.

But reform also is desperately needed because ofchanging demographics. Simply stated, leaving all the entitlement programs on autopilot is a recipe for a Greek-style fiscal crisis.

But reform also is desperately needed because ofchanging demographics. Simply stated, leaving all the entitlement programs on autopilot is a recipe for a Greek-style fiscal crisis.

If you want a rigorous explanation of the issue, my colleague Jeff Miron has a must-read monograph on the topic. You should peruse the entire study, but here’s the key conclusion if you’re pressed for time.

…this paper projects fiscal imbalance as of every year between 1965 and 2014, using data-supported assumptions about gross domestic product (GDP) growth, revenue, and trends in mandatory spending on Social Security, Medicare, Medicaid, and other programs. The projections reveal that the United States has faced a growing fiscal imbalance since the early 1970s, largely as a consequence of continuous growth in mandatory spending. As of 2014, the fiscal imbalance stands at $117.9 trillion, with few signs of future improvement even if GDP growth accelerates or tax revenues increase relative to historic norms. Thus the only viable way to restore fiscal balance is to scale back mandatory spending policies, particularly on large health care programs such as Medicare, Medicaid, and the Affordable Care Act (ACA).

Jeff’s report is filled with sobering charts. I’ve picked out three that deserve special attention.

First, here’s a look back in history at the growing fiscal burden of entitlement programs.

Second, here’s a look forward at how the fiscal burden of entitlement programs will get even worse in coming decades.

Keep in mind, by the way, that the two above charts only show the fiscal burden of entitlement programs (sometimes referred to as “mandatory spending” since the laws “mandate” that money be given to anyone who is “entitled” based on various criteria).

When you add discretionary (annually appropriated) spending to the mix, as well as interest that is paid on the national debt, the numbers get even more grim.

Jeff adds everything together and shows, for each year between 1965 and 2014, the “present value” of the gap between what the government is promising to spend and how much revenue it is projected to collect.

These numbers are especially horrific because “present value” is a measure of how much money the government would have to somehow obtain and set aside in order to have a nest egg capable of offsetting future deficits.

Needless to say, the federal government did not have access to $118 trillion (yes, trillion with a “t”) in 2014. And if there were updated numbers for 2015 and 2016 (which would probably be even higher than $118 trillion), the federal government still wouldn’t have access to that amount of money either.

Especially since the total annual output of the American economy is about $18 trillion.

So now you can understand why international bureaucracies like the IMF, BIS, and OECD estimate that the fiscal challenge in the United States may be even bigger than the problems in decrepit welfare states such as France and Italy.

Let’s get another perspective on the issue. James Capretta of the Ethics and Public Policy Center warns about the scope of the problem.

Despite what presidential candidates Donald Trump and Hillary Clinton have been saying on the campaign trail, the need to reform the nation’s major entitlement programs cannot be wished away. The primary cause of the nation’s fiscal problems, now and in the future, is the rapid rise in entitlement spending. In 1970, spending on Social Security and the major health care entitlement programs was 3.6 percent of GDP. In 2015, spending on these programs was 10.3 percent of GDP. By 2040, CBO expects spending on these programs to reach 14.2 percent of GDP. …entitlement reform is needed to put the federal government’s finances on a more stable foundation.

He outlines his preferred reforms, some of which I heartily embrace and some of what I think are too timid, but the key point is that he succinctly explains the need to act soon to avoid a giant long-term problem.

…reforms are not intended to create budgetary balance in the short-run. Large-scale change cannot be implemented in the major programs without significant transition periods, which means the reforms need to be enacted soon to reduce costs in fifteen, twenty, and twenty-five years. Skeptics may say it’s pointless to worry about fiscal problems that are more than twenty years off. They’re wrong. …The result is a misallocation of resources that undermines long-term economic growth. …Entitlement reform is an absolute necessity, as will soon become evident to everyone, one way or another.

The recent testimony by Nicholas Eberstadt of the American Enterprise Institute also is must reading.

In just two generations, the government…has effectively become an entitlements machine. …transfers have become a major component in the family budget of the average American household-and our dependence on these government transfers continues to rise. …Fifty years into our great social experiment of massive expansion of entitlement programs, there is ample evidence to indicate that the unintended consequences of this reconfigutation of American political and economic life have been major and adverse.

You should read the entire testimony, which is a comprehensive explanation of how entitlements are eroding American exceptionalism.

And I’ve previously shared some of Eberstadt’s work on the growing dependency crisis in America.

And I’ve previously shared some of Eberstadt’s work on the growing dependency crisis in America.

In effect, our “social capital” of self reliance and the work ethic is beingreplaced by an entitlement mentality.

At the risk of understatement, that won’t end well. Heck, I don’t know which part is more depressing, theever-growing burden of spending or the fact that more and more Americans think it’s okay to live off the labor of others.

All I can say for sure is that this combination never was, is not now, and never will be a recipe for national success.

Let’s conclude with some sage observations by George Melloan of theWall Street Journal. He summarizes the problem as being a combination of too much spending and too little political courage. Here’s the too-much-spending part.

…we seem richer than we actually are because we have borrowed so heavily from future generations. …the nation’s slow growth and rising debt are already reducing the opportunities for upward mobility. …Recent projections of the future cost of current government obligations certainly won’t relieve…people’s worries. Those promises have expanded far beyond any reasonable projection of the government’s ability to extract enough revenue to cover them. …The Congressional Budget Office projects a steady rise in “mandatory” (i.e., entitlement) costs as a share of GDP out into the distant future. …The upshot: Americans are deep in debt, mainly thanks to government excesses.

And here’s the too-little-political-courage part.

The only real answer is that the entitlement programs will have to be reformed, and sooner better than later, because the longer reform is postponed the greater the fiscal imbalance will become and the greater its drain will be… Donald Trump is out to lunch on this issue, as he is on most questions that require more than a fatuous sound-bite answer. As for Hillary…, forget about it.

Sigh, how depressing. It seems like America will be “Europeanized.”

For additional background on the issue of debt, unfunded liabilities, and present value, this video is a great tutorial.

P.S. I must have taken LSD or crack earlier this year. That’s the only logical explanation for saying I was optimistic about entitlement reform.

Related posts:

FRIEDMAN FRIDAY More Great Moments in Federal Government Incompetence April 2, 2016 by Dan Mitchell (with video from Milton Friedman)

The War on Work Testing Milton Friedman: Government Control – Full Video More Great Moments in Federal Government Incompetence April 2, 2016 by Dan Mitchell I used to think the Equal Employment Opportunity Commission was the worst federal bureaucracy. After all, these are the pinheads who are infamous for bone-headed initiatives, such as: The EEOC making […]

FRIEDMAN FRIDAY The Left’s Inequality Fixation Is Economically Foolish and Politically Impotent April 22, 2015 by Dan Mitchell (with videos from Milton Friedman)

Dr. Walter Williams Highlights from – Testing Milton Friedman Milton Friedman PBS Free to Choose 1980 Vol 8 of 10 Who Protects the Worker The Left’s Inequality Fixation Is Economically Foolish and Politically Impotent April 22, 2015 by Dan Mitchell I don’t understand the left’s myopic fixation on income inequality. If they genuinely care about the […]

FRIEDMAN FRIDAY Walter Williams, Freedom Fighter March 23, 2011 by Dan Mitchell (with videos featuring Walter Williams and Milton Friedman)

Dr. Walter Williams Highlights from – Testing Milton Friedman Milton Friedman PBS Free to Choose 1980 Vol 8 of 10 Who Protects the Worker Walter E Williams – A Discussion About Fairness & Redistribution Testing Milton Friedman: Equality of Opportunity – Full Video Walter Williams, Freedom Fighter March 23, 2011 by Dan Mitchell I’ve been fortunate […]

FRIEDMAN FRIDAY Three Cheers for Profits and Free Markets April 7, 2015 by Dan Mitchell (with input from Milton Friedman)

__ Milton Friedman – The Four Ways to Spend Money What establishments are you most unsatisfied with? Probably government organizations like Dept of Motor Vehicles or Public Schools because there is no profit motive and they are not careful in the way they spend our money. Three Cheers for Profits and Free Markets April 7, 2015 […]

FRIEDMAN FRIDAY Dan Mitchell on Milton Friedman and Adam Smith’s perspective on spending other people’s money!!!

Dan Mitchell on Milton Friedman and Adam Smith’s perspective on spending other people’s money!!! Milton Friedman, Adam Smith, and Other People’s Money May 8, 2016 by Dan Mitchell From an economic perspective, too much government spending is harmful to economic performance because politicians and bureaucrats don’t have very good incentives to spend money wisely. More specifically, […]

FRIEDMAN FRIDAY If Milton Friedman was here he would attack Trump’s proposal for a 45 percent tax on Chinese products!

Milton Friedman – Free Trade vs. Protectionism If Milton Friedman was here he would attack Trump’s proposal for a 45 percent tax on Chinese products! Dissecting Trumponomics March 22, 2016 by Dan Mitchell At this stage, it’s quite likely that Donald Trump will be the Republican presidential nominee. Conventional wisdom suggests that this means Democrats […]

FRIEDMAN FRIDAY While attacking TRUMP Larry Elder quotes Milton Friedman concerning Protectionism!!!!

Milton Friedman – Free Trade vs. Protectionism Free to Choose Part 2: The Tyranny of Control (Featuring Milton Friedman Donald Trump: Clueless about free trade Larry Elder rebuts candidate’s ‘they’re taking our jobs’ claim Published: 02/03/2016 at 6:39 PM One of Donald Trump’s talking points and biggest applause lines is how “they” – Japan, […]

FRIEDMAN FRIDAY Milton Friedman destroys Donald Trump on issue of PROTECTIONISM!!!

Milton Friedman – Free Trade vs. Protectionism Free to Choose Part 2: The Tyranny of Control (Featuring Milton Friedman Mark J. Perry@Mark_J_Perry March 5, 2016 9:26 pm | AEIdeas Some economic lessons about international trade for Donald Trump from Milton Friedman and Henry George Carpe Diem Trump vs Friedman – Trade Policy Debate In […]

FRIEDMAN FRIDAY Free Market Conservatives like Dan Mitchell and Milton Friedman would destroy TRUMP and SANDERS in a debate on PROTECTIONISM Part 2

Milton Friedman – Free Trade vs. Protectionism Free to Choose Part 2: The Tyranny of Control (Featuring Milton Friedman Eight Questions for Protectionists September 23, 2011 by Dan Mitchell When asked to pick my most frustrating issue, I could list things from my policy field such as class warfare or income redistribution. But based on […]

FRIEDMAN FRIDAY Free Market Conservatives like Dan Mitchell and Milton Friedman would destroy TRUMP and SANDERS in a debate on PROTECTIONISM Part 1

Milton Friedman – Free Trade vs. Protectionism Free to Choose Part 2: The Tyranny of Control (Featuring Milton Friedman Trump, Sanders, and the Snake-Oil Economics of Protectionism March 19, 2016 by Dan Mitchell John Cowperthwaite deserves a lot of credit for Hong Kong’s prosperity. As a British appointee, he took a hands-off policy and allowed […]

____