—

An enormous “stimulus” package was signed into law on Thursday, which is expected to bring government spending for this year to $6.9 trillion. This will add dramatically add to the national debt, which is currently at $28 trillion. Pictured: Speaker of the House Nancy Pelosi, D-Calif., conducts a news conference on the on the stimulus bill on Tuesday. (Photo: Tom Williams/CQ-Roll Call, Inc./Getty Images)

President Joe Biden signed into law an enormous, debt-financed “stimulus” package on Thursday. This was the final step in a multi-month process to pass a heavily flawed piece of legislation.

We might be tempted to hope that this will finally sate the left’s appetite for big government. After all, the size and scope of government will expand more than 54%—from $4.5 trillion of annual spending in 2019 to about $6.9 trillion this year—once the new spending bill is factored in, based on calculations by experts at The Heritage Foundation.

Washington added $4.5 trillion to the national debt over the last year alone. This brings the total debt level to $28 trillion, or roughly $225,000 per U.S. household.

Unfortunately, even that might not be enough to get congressional leaders and the Biden administration to pump the brakes on the spending spree. A planned infrastructure spending package could top $2 trillion, and there is little appetite to pay for it.

Want to keep up with the 24/7 news cycle? Want to know the most important stories of the day for conservatives? Need news you can trust? Subscribe to The Daily Signal’s email newsletter. Learn more >>

There are plenty of reasons why Congress should avoid another bloated spending deal. The nonpartisan Congressional Budget Office issued a report last week detailing one of the most important reasons: our nation’s finances are rapidly heading into dangerous territory.

While the numbers involved can seem incomprehensibly large, these charts can help to visualize the looming disaster.

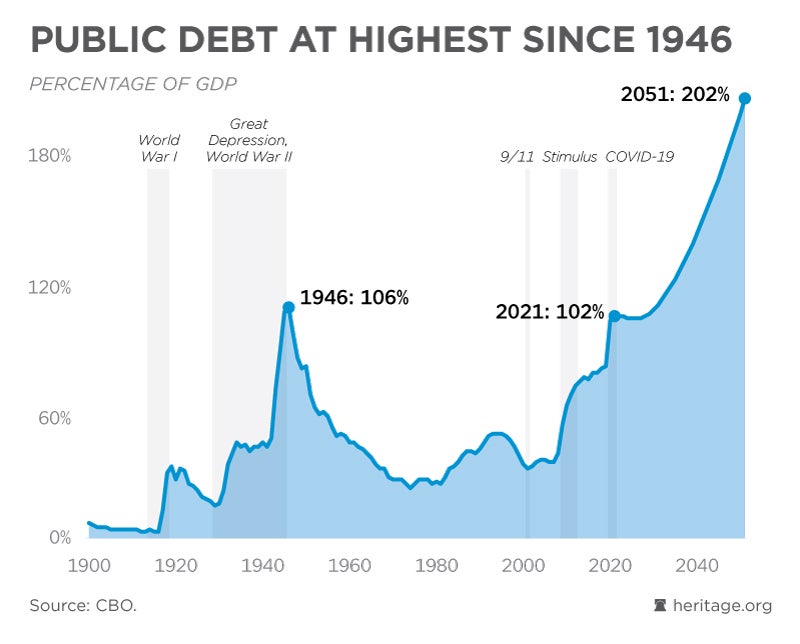

The federal government amassed a record-setting amount of debt during the Great Depression and World War II. When the war was over, federal spending was adjusted from 41% of the economy in 1945 to 11.4% in 1948.

A combination of lower spending and rapid revenue increases from the post-war economic boom meant that the national debt shrank dramatically relative to the economy.

Unfortunately, such rapid debt reduction would be almost impossible to duplicate today.

Even the most optimistic growth forecasts fall well short of what was seen after World War II. More importantly, because most federal spending goes towards established benefit programs like Social Security and Medicare, it would be extremely difficult to cut spending at a similar pace.

However, policies to boost economic growth and restrain spending are still the best way to prevent the national debt from reaching crisis proportions.

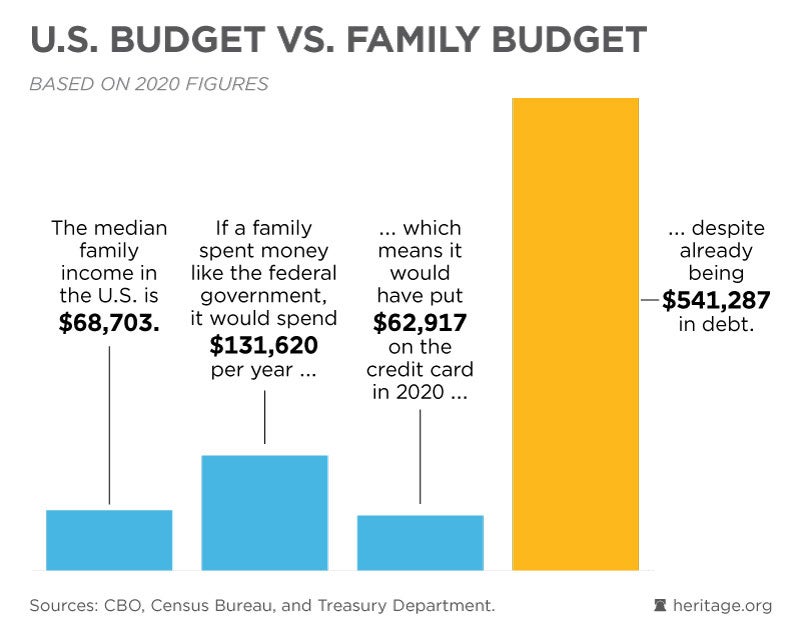

In 2020, the federal government spent almost twice as much as it took in from taxes. The new legislative package means that this year’s deficit will likely be even bigger than last year’s.

These sky-high deficits add to an even larger total debt.

Uncle Sam has benefitted from a run of low interest rates over the last several years, blunting the cost of the escalating debt. Yet we can’t assume that this will last forever.

If you went to a bank for a big loan, you would expect them to ask some tough questions about your finances. The same holds true for the global financial system, which we count on to buy our debt.

While short-term federal bonds are still considered a safe investment, markets are demanding much higher yields for longer-term debt. Credit rating agencies have recently warnedthat our credit rating could be downgraded unless steps are taken to address overspending and the debt.

They have also cautioned us that interest rates will rise. This signals that our days of cheap creditcould be coming to an end sooner than we would want. If that happens, America will pay a steep price.

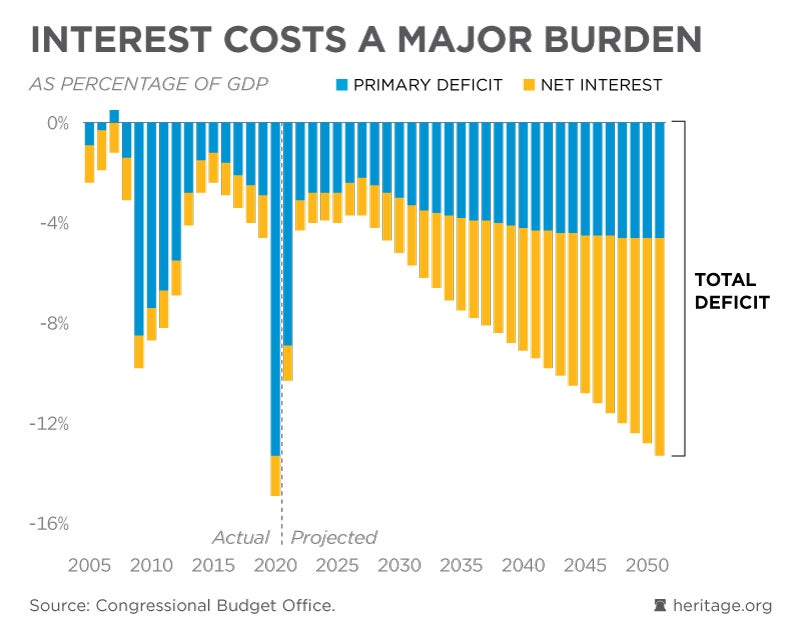

That “steep price” is not metaphorical. The Congressional Budget Office’s new report shows that the cost of servicing the national debt was already set to explode before the stimulus package passed.

Right now, interest on the debt is a burden the economy can handle. However, even a modest interest rate increase—coupled with continued irresponsibility from Washington—will cause interest costs to increase more than five-fold in the next few decades.

This would be an anchor around the neck for the economy, and would make the growth and prosperity we take for granted next to impossible for future generations to experience.

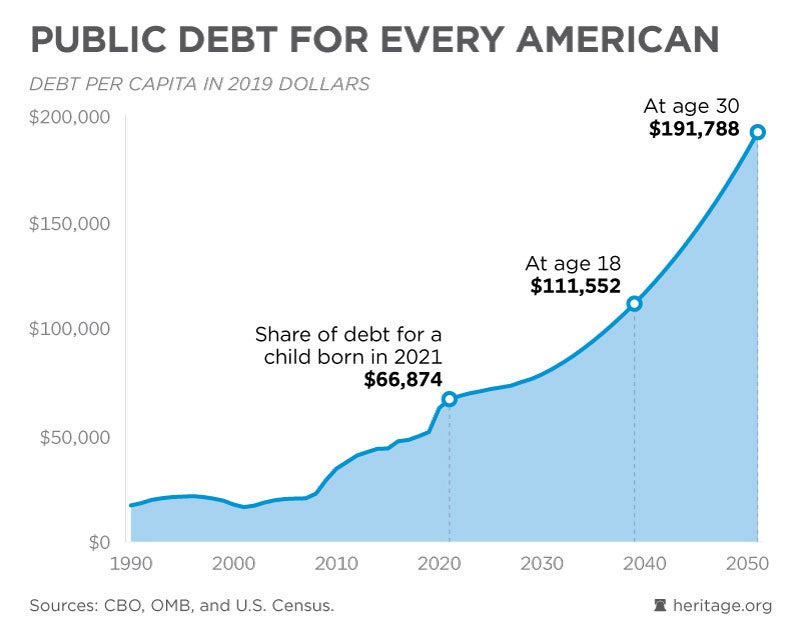

In the not-so-distant past—specifically, the year 2018—the amount of public debt per person was just under $50,000. Today, it stands at nearly $67,000 for every American, including children.

It only gets worse from there. A baby born tomorrow is expected to have over $111,000 in debt to their name when they turn 18, and nearly $192,000 by age 30.

Those numbers do not account for the new stimulus bill, a potential infrastructure package, or expanded benefit programs. Instead, the main reason why debt will skyrocket over the coming years is because federal spending is being allowed to grow without limits.

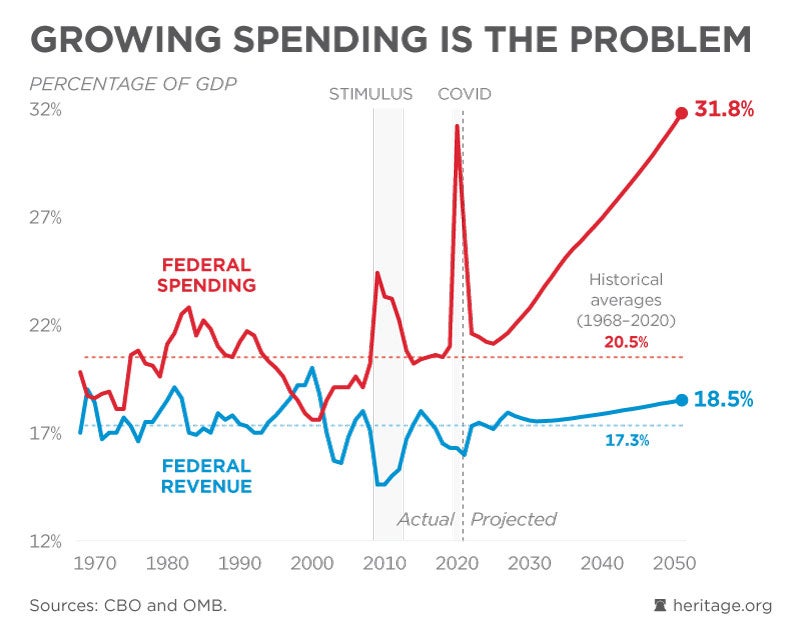

While some on the left blame the 2017 tax cuts for deficits, this chart makes it clear that the culprit for our long-term financial gap is an explosion in federal spending.

Spending was already above the historical average in 2019, and will grow much faster than the economy from 2022 onwards. Meanwhile, revenue will soon return to normal levels.

Why do we expect such a rapid increase in federal spending? A handful of programs, primarily Social Security, Medicare, and Medicaid, have been set up in an unsustainable way. Reforming these programs by balancing the needs of both retirees and future generations would be a tremendous breakthrough.

However, Congress has consistently avoided the issue of unsustainable programs, and has even made things worse by expanding benefits. The longer Washington waits to confront this problem, the more drastic the remedies will have to be.

Experts from The Heritage Foundation have provided legislators with the policy tools they need to address this mounting crisis, meaning members of Congress can’t plead ignorance.

Those in positions of leadership have a responsibility to do the right thing for present and future Americans, and the public must hold them accountable if they do not.

Have an opinion about this article? To sound off, please email letters@DailySignal.com and we will consider publishing your remarks in our regular “We Hear You” feature.

—-

March 31, 2021

President Biden c/o The White House

1600 Pennsylvania Avenue NW

Washington, DC 20500

Dear Mr. President,

Please explain to me if you ever do plan to balance the budget while you are President? I have written these things below about you and I really do think that you don’t want to cut spending in order to balance the budget. It seems you ever are daring the Congress to stop you from spending more.

“The credit of the United States ‘is not a bargaining chip,’ Obama said on 1-14-13. However, President Obama keeps getting our country’s credit rating downgraded as he raises the debt ceiling higher and higher!!!!

Washington Could Learn a Lot from a Drug Addict

Just spend more, don’t know how to cut!!! Really!!! That is not living in the real world is it?

Making more dependent on government is not the way to go!!

Why is our government in over 16 trillion dollars in debt? There are many reasons for this but the biggest reason is people say “Let’s spend someone else’s money to solve our problems.” Liberals like Max Brantley have talked this way for years. Brantley will say that conservatives are being harsh when they don’t want the government out encouraging people to be dependent on the government. The Obama adminstration has even promoted a plan for young people to follow like Julia the Moocher.

David Ramsey demonstrates in his Arkansas Times Blog post of 1-14-13 that very point:

Arkansas Politics / Health Care Arkansas’s share of Medicaid expansion and the national debt

Posted by David Ramsey on Mon, Jan 14, 2013 at 1:02 PM

- Mark Herreid

- Baby carrot image via Shutterstock

Imagine standing a baby carrot up next to the 25-story Stephens building in Little Rock. That gives you a picture of the impact on the national debt that federal spending in Arkansas on Medicaid expansion would have, while here at home expansion would give coverage to more than 200,000 of our neediest citizens, create jobs, and save money for the state.

Here’s the thing: while more than a billion dollars a year in federal spending would represent a big-time stimulus for Arkansas, it’s not even a drop in the bucket when it comes to the national debt.

Currently, the national debt is around $16.4 trillion. In fiscal year 2015, the federal government would spend somewhere in the neighborhood of $1.2 billion to fund Medicaid expansion in Arkansas if we say yes. That’s about 1/13,700th of the debt.

It’s hard to get a handle on numbers that big, so to put that in perspective, let’s get back to the baby carrot. Imagine that the height of the Stephens building (365 feet) is the $16 trillion national debt. That $1.2 billion would be the length of a ladybug. Of course, we’re not just talking about one year if we expand. Between now and 2021, the federal government projects to contribute around $10 billion. The federal debt is projected to be around $25 trillion by then, so we’re talking about 1/2,500th of the debt. Compared to the Stephens building? That’s a baby carrot.

______________

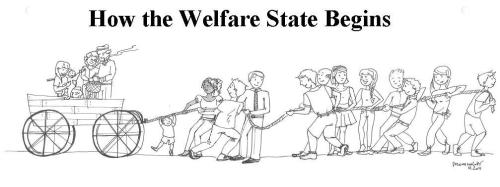

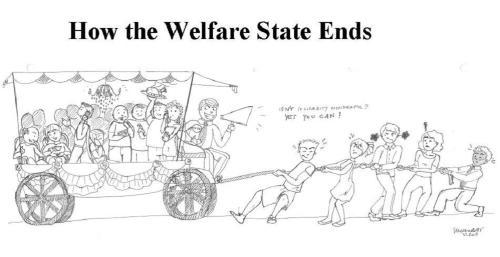

Here is how it will all end if everyone feels they should be allowed to have their “baby carrot.”

How sad it is that liberals just don’t get this reality.

Here is what the Founding Fathers had to say about welfare. David Weinberger noted:

While living in Europe in the 1760s, Franklin observed: “in different countries … the more public provisions were made for the poor, the less they provided for themselves, and of course became poorer. And, on the contrary, the less was done for them, the more they did for themselves, and became richer.”

Alexander Fraser Tytler, Lord Woodhouselee (15 October 1747 – 5 January 1813) was a Scottish lawyer, writer, and professor. Tytler was also a historian, and he noted, “A democracy cannot exist as a permanent form of government. It can only exist until the majority discovers it can vote itself largess out of the public treasury. After that, the majority always votes for the candidate promising the most benefits with the result the democracy collapses because of the loose fiscal policy ensuing, always to be followed by a dictatorship, then a monarchy.”

Thomas Jefferson to Joseph Milligan

April 6, 1816

[Jefferson affirms that the main purpose of society is to enable human beings to keep the fruits of their labor. — TGW]

![]()

To take from one, because it is thought that his own industry and that of his fathers has acquired too much, in order to spare to others, who, or whose fathers have not exercised equal industry and skill, is to violate arbitrarily the first principle of association, “the guarantee to every one of a free exercise of his industry, and the fruits acquired by it.” If the overgrown wealth of an individual be deemed dangerous to the State, the best corrective is the law of equal inheritance to all in equal degree; and the better, as this enforces a law of nature, while extra taxation violates it.

[From Writings of Thomas Jefferson, ed. Albert E. Bergh (Washington: Thomas Jefferson Memorial Association, 1904), 14:466.]

_______

Jefferson pointed out that to take from the rich and give to the poor through government is just wrong. Franklin knew the poor would have a better path upward without government welfare coming their way. Milton Friedman’s negative income tax is the best method for doing that and by taking away all welfare programs and letting them go to the churches for charity.

_____________

_________

Thank you so much for your time. I know how valuable it is. I also appreciate the fine family that you have and your commitment as a father and a husband.

Sincerely,

Everette Hatcher III, 13900 Cottontail Lane, Alexander, AR 72002, ph 501-920-5733

Williams with Sowell – Minimum Wage

Thomas Sowell

Thomas Sowell – Reducing Black Unemployment

—-

Related posts:

Welfare Spending Shattering All-Time Highs

We got to act fast and get off this path of socialism. Morning Bell: Welfare Spending Shattering All-Time Highs Robert Rector and Amy Payne October 18, 2012 at 9:03 am It’s been a pretty big year for welfare—and a new report shows welfare is bigger than ever. The Obama Administration turned a giant spotlight […]

We need more brave souls that will vote against Washington welfare programs

We need to cut Food Stamp program and not extend it. However, it seems that people tell the taxpayers back home they are going to Washington and cut government spending but once they get up there they just fall in line with everyone else that keeps spending our money. I am glad that at least […]

Welfare programs are not the answer for the poor

Government Must Cut Spending Uploaded by HeritageFoundation on Dec 2, 2010 The government can cut roughly $343 billion from the federal budget and they can do so immediately. __________ Liberals argue that the poor need more welfare programs, but I have always argued that these programs enslave the poor to the government. Food Stamps Growth […]

Private charities are best solution and not government welfare

Milton Friedman – The Negative Income Tax Published on May 11, 2012 by LibertyPen In this 1968 interview, Milton Friedman explained the negative income tax, a proposal that at minimum would save taxpayers the 72 percent of our current welfare budget spent on administration. http://www.LibertyPen.com Source: Firing Line with William F Buckley Jr. ________________ Milton […]

The book “After the Welfare State”

Dan Mitchell Commenting on Obama’s Failure to Propose a Fiscal Plan Published on Aug 16, 2012 by danmitchellcato No description available. ___________ After the Welfare State Posted by David Boaz Cato senior fellow Tom G. Palmer, who is lecturing about freedom in Slovenia and Tbilisi this week, asked me to post this announcement of his […]

President Obama responds to Heritage Foundation critics on welfare reform waivers

Is President Obama gutting the welfare reform that Bill Clinton signed into law? Morning Bell: Obama Denies Gutting Welfare Reform Amy Payne August 8, 2012 at 9:15 am The Obama Administration came out swinging against its critics on welfare reform yesterday, with Press Secretary Jay Carney saying the charge that the Administration gutted the successful […]

Welfare reform part 3

Thomas Sowell – Welfare Welfare reform was working so good. Why did we have to abandon it? Look at this article from 2003. The Continuing Good News About Welfare Reform By Robert Rector and Patrick Fagan, Ph.D. February 6, 2003 Six years ago, President Bill Clinton signed legislation overhauling part of the nation’s welfare system. […]

Welfare reform part 2

Uploaded by ForaTv on May 29, 2009 Complete video at: http://fora.tv/2009/05/18/James_Bartholomew_The_Welfare_State_Were_In Author James Bartholomew argues that welfare benefits actually increase government handouts by ‘ruining’ ambition. He compares welfare to a humane mousetrap. —– Welfare reform was working so good. Why did we have to abandon it? Look at this article from 2003. In the controversial […]

Why did Obama stop the Welfare Reform that Clinton put in?

Thomas Sowell If the welfare reform law was successful then why change it? Wasn’t Bill Clinton the president that signed into law? Obama Guts Welfare Reform Robert Rector and Kiki Bradley July 12, 2012 at 4:10 pm Today, the Obama Department of Health and Human Services (HHS) released an official policy directive rewriting the welfare […]

“Feedback Friday” Letter to White House generated form letter response July 10,2012 on welfare, etc (part 14)

I have been writing President Obama letters and have not received a personal response yet. (He reads 10 letters a day personally and responds to each of them.) However, I did receive a form letter in the form of an email on July 10, 2012. I don’t know which letter of mine generated this response so I have […]

Total Tax Burden Is Rising to Highest Level in History

Total Tax Burden Is Rising to Highest Level in History Each American’s Share of National Debt Is Growing

Each American’s Share of National Debt Is Growing