A Senate race now a spectacle.

John Fetterman (00:03):

He chose money over his conscience.

Dr. Mehmet Oz (00:07):

My opponent, John Fetterman, by his own admission grew up in luxury and privilege.

Speaker 1 (00:11):

Insults stealing the spotlight while voters want a voice on the issues.

Speaker 2 (00:16):

I’m thinking about women’s rights.

Speaker 3 (00:17):

Speaker 4 (00:19):

I’m looking for civility.

Speaker 5 (00:20):

I think public health is most important.

Speaker 6 (00:23):

Our leaders are not leaders at all.

Speaker 1 (00:25):

Tonight, Lieutenant Governor John Fetterman and Dr. Mehmet Oz, face-to-face for the first and only time. Both been looking to prove they have what it takes to represent the people of Pennsylvania.

John Fetterman (00:37):

Send Dr. Oz back to New Jersey.

Dr. Mehmet Oz (00:40):

I stand for Pennsylvania values and I’m proud of it.

Speaker 1 (00:42):

Live from the ABC27 Studios in Harrisburg, this is the Pennsylvania US Senate Debate.

Leland Vittert (00:51):

Welcome to Debate Night in America. I’m Leland Vittert from News Nation. The stakes tonight could not be higher, not only for the Keystone State, but for the country. Control of the US Senate for either party runs through Pennsylvania. Dennis Owens, WHTM political reporter and anchor here in Harrisburg, along with Lisa Sylvester from WPXI in Pittsburgh, will moderate tonight’s debate.

(01:16)

We want to welcome our viewers watching tonight from across the country on News Nation. Voters can watch this debate in all 67 Pennsylvania counties on nine television stations serving the Commonwealth. Before we get started, let’s go over tonight’s rules. Mr. Fetterman, Mr. Oz, you will have 60 seconds to answer each question. If there’s a follow-up question or rebuttal, you will have up to 30 seconds. Each candidate will also have 90 seconds for a closing statement. When your time is up, you’ll hear this bell. Gentlemen, thank you for being here. Dennis and Lisa,

Dennis Owens (01:57):

Thank you, Leland. Good evening, candidates, who moments ago just met for the first time. We’re happy to have you here. Welcome to our audience watching at home on air, online and on News Nation. And we encourage everyone who is watching tonight to share your thoughts on social media. Remember to use the #PASenateDebate.

Lisa Sylvester (02:16):

And you may notice these large monitors that are behind us. This is part of our closed captioning system. It was requested by John Fetterman to help him process the questions that we are asking him tonight, and approved by both campaigns and both candidates can see the monitors.

Dennis Owens (02:31):

One of the screens will show only the questions being asked tonight. The second screen will caption the questions and responses from Mehmet Oz. We have live, experienced captioners in studio to ensure we are as accurate as possible in what Sure to be a fast-paced program.

Lisa Sylvester (02:50):

And just to note, for those of you using closed captioning at home, the captions you see are not tied to the captions that the candidates will see here tonight.

Dennis Owens (03:00):

Thank you, Lisa. With that, let’s get started. Mr. Fetterman, we’re going to begin with you. Your political experience includes serving as the mayor of Braddock, a small borough near Pittsburgh, and one term as Lieutenant Governor. You’re running for a seat that could decide the balance of power in Washington. What qualifies you to be a US Senator? You have 60 seconds.

John Fetterman (03:24):

Hi. Good night, everybody. I’m running to serve Pennsylvania. He’s running to use Pennsylvania. Here’s a man that spent more than $20 million of his own money to try to buy that seat. I’m also having to talk about something called the Oz rule, that if he’s on TV, he’s lying. He did that during his career on his TV show. He’s done that during his campaign about lying about our record here. And he’s also lying probably during this debate. And let’s also talk about the elephant in the room. I had a stroke. He’s never let me forget that. And I might miss some words during this debate, mush two words together, but it knocked me down. But I’m going to keep coming back up. And this campaign is all about, to me, is about fighting for everyone in Pennsylvania that ever got knocked down, that needs to get back up, and fighting for all forgotten communities all across Pennsylvania that also got knocked down that needs to keep get back up.

Dennis Owens (04:28):

Thank you very much Mr. Fetterman. Mr. Oz, you are a doctor, a businessman and television personality, but this is your first run for elected office. What qualifies you to be a US senator from Pennsylvania? You have 60 seconds.

Dr. Mehmet Oz (04:41):

I’m running for the US Senate because Washington keeps getting it wrong with extreme positions. I want to bring civility, balance, all the things that you want to see because you’ve been telling it to me on the campaign trail. And by doing that, we can bring us together in a way that has not been done of late. Democrats, Republicans talking to each other. John Fetterman takes everything to an extreme and those extreme positions hurt us all.

(05:05)

Let’s take crime as an example because it’s been such a big problem. Maureen Faulkner accompanied me today to the studio. You know that her husband was a police officer in Philadelphia, was brutally murdered. John Fetterman, during this crime wave, has been trying to get as many murderers convicted and sentenced to life in prison, out of jail as possible, including people who are similar to the men who murdered her husband. He does it without the rest of the parole board agreeing. He’s doing it without the families on board. These radical positions extend beyond crime to wanting to legalize all drugs, to open the border, to raising our taxes. I want Washington to be civil again. We need it to be less radical. John Fetterman, unfortunately, would bring that.

Dennis Owens (05:48):

Okay, Mr. Oz. Thank you. Lisa.

Lisa Sylvester (05:50):

All right. Gentlemen, onto the economy. Pennsylvanians are struggling to put food on the table and gas in their cars. Our Nexstar Emerson College The Hill Pole shows the economy and inflation are the biggest concerns for voters. 39% of them listed that as the top issue. Beginning with you, Mr. Oz, you have blamed President Biden and reckless democratic spending for the inflation crisis, but voters would like to hear your specific plan to cut spending. Please explain in 60 seconds.

Dr. Mehmet Oz (06:22):

Well, if you ask the US government, they’ll tell you. They have 4% waste in fraud. Now, I’ve traveled over the Commonwealth and spoken to countless people. There was a lady in Beaver County at a county fair who told me with fear in her heart that she wanted to provide food for her son, highly nutritious chicken. She couldn’t afford it anymore. That’s a big problem. If we’ve got 4% waste in fraud, we ought to be take to be able to take care of that.

(06:45)

John Fetterman’s, however response, continually is to raise taxes. He raised taxes as mayor. He tried to raise taxes as Lieutenant Governor, 46%. That’s a big tax rate. He supported Joe Biden’s recent tax rate increase and he’s done that without paying his own taxes 67 times. I’ll say that again. He hasn’t paid his own taxes 67 times, but he is raising mine and yours. Those are radical positions. They’re extreme. They’re out of touch with the values of Pennsylvanians and I can make the difficult decisions as you do in the operating room as a surgeon. I’ll make them cutting our budget as well to make sure we don’t have to raise taxes on a population already desperately in pain from the high inflation rate.

Lisa Sylvester (07:25):

Mr. Fetterman, I will allow a 15 second rebuttal. He has specifically said you have not paid your taxes and that you want to raise taxes on Americans. How do you respond?

John Fetterman (07:36):

Absolutely. The Oz rule, of course, he’s lying. It was helping two students 17 years ago to help them buy their own homes. They didn’t pay the bills and it got paid and it has never been an issue in any of the campaign before. It was all about nonprofit.

Lisa Sylvester (07:55):

All right. Thank you, Mr. Fetterman. Continuing with you, Mr. Fetterman, your opponent has criticized Democratic spending as you heard. Has the Biden administration overspent and if so, where do you think spending should be cut? You have 60 seconds.

John Fetterman (08:13):

No. Here’s what I think. We have to fight about inflation here right now. That’s what we need to fight about inflation right now because it’s a tax on working families. And Dr. Oz can’t possibly understand what that is like. He has 10 gigantic mansions. We must push back against corporate greed. We must make sure that we’re also pushing back against price gouging as well, too. We also be able to make more in Pennsylvania, make more in America. When he had a choice to make his merchandise, the Oz label is on, he made it all in China. Who can you believe that can fight against inflation and pushing back against corporate greed or somebody that has chosen working in China versus over American workers?

Lisa Sylvester (09:02):

All right. I will allow a 15 second rebuttal to his comments that you have been making things in China. Mr. Oz.

Dr. Mehmet Oz (09:08):

I’ve been trying to talk about policy issues with the people of Pennsylvania. As a doctor, I listen to their ideas and I want to talk about them. When John Fetterman brings up houses, the irony is he didn’t pay for his own house. He got it for a dollar from his sister and he hasn’t been able to earn a living on his own. He’s lived off his parents. So it’s not a topic that we should be debating on the stage. We should be talking about crime and inflation, the issues that are hurting Pennsylvanians that they’re talking about at their kitchen table.

John Fetterman (09:34):

No. That’s like He got his Pennsylvania house-

Lisa Sylvester (09:38):

All right, Mr. Fetterman-

John Fetterman (09:38):

From his inlays from a dollar. That’s typical.

Lisa Sylvester (09:41):

Mr. Fetterman, we have to continue on. We’ll continue on with a question. A follow-up question to you, Mr. Oz. This one is just for you. You tweeted in August that you will never stop fighting to lower gas prices for Pennsylvanians. Does that include supporting a suspension of the federal gas tax? You have 30 seconds.

Dr. Mehmet Oz (09:58):

I’m supportive of reducing taxes, but we want to be thoughtful about the long-term game plan to get gas taxes down, and frankly, all energy prices down. I have gone around the Commonwealth. I’ve witnessed people say, “I’m not going on vacation this year because I can’t afford to pay to take my trailer to the campground.” They can’t even get there. What we have to do is ensure that we don’t have increased inflation, and the best way to do that is reduce gas prices. John Fetterman has gone after the energy industry. He’s called it a a stain on Pennsylvania and argued we have to ban fracking. That is disconnected from Pennsylvanians.

Lisa Sylvester (10:32):

Thank you. Thank you, Mr. Oz. We will get to the issue of fracking later on in this discussion. But meantime, turning back to you, Mr. Fetterman, for a follow-up. In an OpEd for the Wilkes-Barre Times Leader, you wrote, “It is time we crack down on the big, price gouging corporations that are making record profits while jacking up prices for all of us.” How do you plan to do this, sir? You mentioned going after price gouging corporations. How do you plan to do this? You have 30 seconds.

John Fetterman (11:01):

Yeah, exactly. We have to keep pushing back on that and he would never make that choice to fight for families here in Pennsylvania. He has never met an oil company that he doesn’t swipe right about. He has never been able to stand up for working families all across Pennsylvania. We must push back. Inflation has hurt Americans and Pennsylvania’s families and it has given the oil companies record profits.

Lisa Sylvester (11:31):

All right. Thank you, Mr. Fetterman. Turning to the next issue, Dennis.

Dennis Owens (11:34):

The minimum wage in Pennsylvania and at the national level currently sits at $7.25 an hour and has not been increased since 2009. Each of our neighboring states has raised minimum wages, you see them there on your screen, including New Jersey at $13 an hour and West Virginia at $8.75. But Pennsylvania has not followed suit. The first question is for you, Mr. Fetterman. Do you support raising the federal minimum wage to $15 an hour? Why or why not? You have 60 seconds.

John Fetterman (12:07):

Yeah, I do. Absolutely. I think it’s a disgrace at $7.25 an hour. And how can a man with 10 gigantic mansions has unwilling to talk about a willing wage for anybody? Imagine a signal mom trying with two children trying to raise with them. Realizing making $31,000 a year, $15 an hour. I believe every work has dignity and every paycheck must have dignity in it as well. True. I’ve always supported a living wage and we make sure that everyone has economic security.

Dennis Owens (12:41):

I have a follow up for you, Mr. Fetterman. What do you say to small business owners who have told us that if the minimum wage were increased to $15 an hour, it would put them out of business? You have 30 seconds

John Fetterman (12:53):

No. We all have to make sure that everyone that works is able to. That’s the most American bargain, that if you work full-time, you should be able to live in dignity as well true. And I believe they haven’t have any businesses being… You can’t have businesses being subsidized by not paying individuals that just simply can’t behave to pay their own way.

Dennis Owens (13:19):

Okay, Mr. Fetterman. Thank you. Mr. Oz, turning to you. Do you support raising the federal minimum wage to $15 an hour? Why or why not? You have 60 seconds.

Dr. Mehmet Oz (13:28):

I think market forces have already driven up the minimum wage. I was with a hotel worker actually here in Harrisburg a few months ago and he was telling me how hard it was to live on the $15 an hour that he was getting paid. John Fetterman shoots too low. We want much more money than that and there are many ways to achieve that, but John Fetterman thinks the minimum wage is his weekly allowance from his parents. He’s not really cognizant of the real challenges of business owners who’ve got to balance that with employees. Thankfully, we have a solution. And John, you didn’t answer the question. You can’t put businesses out of commission in order to pay more wages because the wages will go to zero, which is John Fetterman’s radical plan if you really follow it to conclusion.

(14:07)

Here’s what I would do. We have one of the richest energy states in the country. I believe if we could unleash the energy beneath our feet here in Pennsylvania, there’d be plenty of money to go around. We’d have increased wages, a more reason for students to take vocational classes to be able to learn trades, which I’m strongly supportive of. We’d also be able to pipe that gas and improve our economy and reduce inflation. That’s a plan that works and it’s humble enough that I can say broadly-

Dennis Owens (14:34):

Thank you. I want to give you, Mr. Fetterman, a 15 second follow-up to what he just said about you.

John Fetterman (14:40):

No. Again, it’s remarkable. He hasn’t really had any answer that he actually had about that in his… He doesn’t want to talk about having somebody having a living wage and to having somebody able to survive again.

Dennis Owens (14:53):

And I want to come back to you now, Mr. Oz, for a quick follow-up. What do you say to those Pennsylvanians that he just spoke of that are trying to survive on $7.25 an hour, which is less than all of our neighbors?

Dennis Owens (15:00):

… Survive on $7.25 an hour, which is less than all of our neighbors. You have 30 seconds.

Dr. Mehmet Oz (15:05):

Oh, I don’t think you should have to survive on $7.25 an hour. I want the minimum wage up as high as it can go. I want to highlight that I have an agenda for prosperity, unlike John Fetterman, I want us all getting paid a lot more than $15. And I answered your question directly in a way that would preserve business owners, job creators, so they thrive, and we’d have lots more employees entering the workforce and then prospering getting paid $25, $35, $45 an hour. But we’re never going to get there if we don’t unleash our energy. And John Fetterman’s stubbornness on calling it a stain on Pennsylvania is an insult to those workers.

Dennis Owens (15:38):

To be clear, you said you want people making a lot more, but that’s not through a federal law of minimum wage, that’s through market forces?

Dr. Mehmet Oz (15:43):

Market forces should drive it up anyway, and it’s already done that.

Dennis Owens (15:46):

Dr. Mehmet Oz (15:47):

You should be able to get paid much more than $15 an hour.

Dennis Owens (15:49):

Lisa Sylvester (15:50):

All right, thank you gentlemen. Another big issue for voters is abortion. Mr. Oz, we will begin with you. You say that you’re pro-life, but you do support abortion exceptions in the cases of rape, incest, and to protect the life of the mother. Aside from those three exceptions, should abortion be banned in America? 60 seconds.

Dr. Mehmet Oz (16:10):

There should not be involvement from the federal government in how states decide their abortion decisions. As a physician, I’ve been in the room when there’s some difficult conversations happening. I don’t want the federal government involved with that at all. I want women, doctors, local political leaders letting the democracy that’s always allowed our nation to thrive to put the best ideas forward so states can decide for themselves. Contrast that with my opponent, John Fetterman, who on this debate stage said that he would demand federally mandated rules for all states they’d have to follow that would allow abortion at 38 weeks on the delivery table, and he would force it to be subsidized by taxpayers across the country no matter what their personal beliefs are. That’s radical. That’s extreme. That is out of touch with what the average voter in Pennsylvania believes is appropriate.

(16:57)

Now, ironically, John Fetterman has been running ads on this topic, dishonest ads. I need to correct the record. They were so bad they got pulled off television stations. Even on this station, he was running dishonest ads that I had pulled off. I haven’t had a single ad pulled down. My ads tell the truth. John Fetterman’s are a fiction of his imagination.

Lisa Sylvester (17:14):

All right, I’m going to let Mr. Fetterman respond specifically about the ads being pulled off the air, and then we will return to you, Mr. Oz. Mr. Fetterman?

John Fetterman (17:23):

Yeah, I want to look into the face of every woman in Pennsylvania. If you believe that the choice of your reproductive freedom belongs with Dr. Oz, then you have a choice. But if you believe that the choice for abortion belongs between you and your doctor, that’s what I fight for. Roe v. Wade for me should be the law. He celebrated when Roe v. Wade went down. And my campaign would fight for Roe v. Wade, and if given the opportunity to codify it into law.

Lisa Sylvester (17:55):

All right. Thank you, Mr. Fetterman. Going back to you, I want to circle back to something that you said, Mr. Oz, you mentioned the decision to regulate abortion should be something that is left up to the states. Now, Republican Senator Lindsey Graham has introduced a federal bill to ban abortion after 15 weeks. I know that you’ve been asked about this question before. If the vote were held today, you were elected senator, you’re on the Senate floor, the clerk calls you, there’s a roll call vote, are you a yay or a nay? How would you vote on the Lindsey Graham bill? You have 30 seconds.

Dr. Mehmet Oz (18:25):

Lisa, I don’t even need 30 seconds. I’ll give you a bigger answer. I am not going to support federal rules that block the ability of states to do what they wish to do. The abortion decision should be left up the states and specifically when John Fetterman-

John Fetterman (18:39):

You roll with Doug Mastriano.

Dr. Mehmet Oz (18:42):

John, you’ll have your turn, John.

Lisa Sylvester (18:43):

One moment, Mr. Fetterman. Continue, Mr. Oz.

Dr. Mehmet Oz (18:45):

I’ve been very clear on my desire as a physician not to interfere with how states decide. So when John purposely, knowingly misrepresents that to women, he scares them. He’s purposely trying to alarm them. And the fear mongering isn’t working. Running tens of millions of dollars of ads claiming that I’m against all abortions when he knows that’s not right, claiming that I’m going to strict with Pennsylvania when he knows that’s not honest. I can’t be any clearer than I’ve been on this stage today. John Fetterman, if you just hear that one story today, I’d be really happy. But I know you’re not going to, because you’re going to go right back to telling the fables that you believe.

Lisa Sylvester (19:17):

Mr. Oz, I want a 15 second clarification. You are saying that you would leave it up to the states if the federal government does not have a role here. So are you saying you would not vote for the Lindsey Graham bill?

Dr. Mehmet Oz (19:29):

Any bill that violates what I said, which is the federal government interfering with the state rule and abortion, I would vote against. What I feel strongly about is that women in Pennsylvania understand what I’m saying and not believe that someone who’s taken an extreme position like John Fetterman represents them. Because most women do not believe that we should, at a federal level, codify 38 weeks of permission to have an abortion and have taxpayers pay of it.

Lisa Sylvester (19:53):

So a yes or no on the Lindsay Graham Bill?

Dr. Mehmet Oz (19:55):

I think I’ve answered this very clearly three times now.

Lisa Sylvester (19:57):

Okay. All right. Thank you, Mr. Oz. Turning to you, Mr. Fetterman, you have frequently stated your belief that abortion should be safe and legal. Do you support any limits on when a woman can have an abortion? Please explain it. 60 seconds.

John Fetterman (20:10):

You know what I support, I support on Roe v. Wade. That was the law of the land for 50 years. He celebrated when it fell down and I would fight to reestablish on Roe v. Wade. That’s what I run on, that’s what I believe. And I’ve always believed that the choice [inaudible 00:20:27] women and their doctors and he believes that the choice should be with him or Republican legislators all across this nation.

Lisa Sylvester (20:34):

Dr. Mehmet Oz (20:34):

I’m sorry. I must correct that. Once again, he’s misrepresented what I’ve said. But he also said something very dishonest. On this debate stage, he said very specifically, in his primary debate, when he was still debating, that he would support 38 weeks of mandated rules by the federal government that would prevent any state from blocking it. So that’s not Roe v. Wade.

John Fetterman (20:54):

That’s that’s not true. I support Roe v. Wade. That’s the simple.

Dr. Mehmet Oz (20:57):

You said specifically you would support a federal rule on 38 weeks.

Lisa Sylvester (21:00):

Mr. Oz, Mr. Oz. Thank you. Thank you. We’ll move on.

Dr. Mehmet Oz (21:03):

I think it’s important that John at least acknowledge that he’s not honest here because you said the opposite on TV-

Lisa Sylvester (21:07):

All right, Mr. Oz, we must continue on. Mr. Fetterman, turning to you, we have a follow up question. Would you support allocating federal funds to transport women who live in states where abortion is banned to states where they can get one, and why? 30 seconds.

John Fetterman (21:23):

I would. I would. Because I believe abortion rights is a universal right for all women in America. I believe that abortion is healthcare, and I believe that that is a choice that belongs with each woman and their doctor.

Lisa Sylvester (21:41):

All right. Thank you, Mr. Fetterman. Turning to the next issue, Dennis.

Dennis Owens (21:44):

Thank you, Lisa. Let’s turn to what has become one of the key themes of this race, fitness to serve. For these individual questions, there will be no rebuttals allowed. Mr. Fetterman, we begin with you. You suffered, as you mentioned a moment ago, a stroke four days before the May primary. Last week, you released this note from your doctor saying you can work full duty in public office, but you have not released your detailed medical records surrounding your stroke. Mr. Fetterman, will you pledge tonight to release those records in the interest of transparency? You have 60 seconds.

John Fetterman (22:21):

To me, for transparency is about showing up. I’m here today to have a debate. I have speeches in front of 3000 people in Montgomery County, all across Pennsylvania, big, big crowds. I believe if my doctor believes that I’m fit to serve and that’s what I believe is appropriate, and now with two weeks before the election, I have run a campaign and I’ve been very transparent about being very open about the fact we’re going to use captioning. And I believe that, again, my doctors, the real doctors that I believe, they all believe that I’m ready to be served.

Dennis Owens (22:56):

Follow up. I didn’t hear you say you would release your full medical records. Why not? You have 30 seconds.

John Fetterman (23:03):

Again, my doctor believes that I’m fit to be serving, and that’s what I believe is where I’m standing.

Dennis Owens (23:09):

Okay. Mr. Fetterman, thank you. Mr. Oz, you have built a lucrative career around medicine, but you’ve been criticized even by some fellow physicians for promoting, quote, “Unproven, ill-advised, and at times potentially dangerous treatments.” What is your response to that? You have 60 seconds.

Dr. Mehmet Oz (23:26):

One of the great blessings of traveling around Pennsylvania is you run into people who have watched the show. They thank me very much for giving them lifesaving advice on chronic issues like high blood pressure or dealing with their anxiety. The show did very well because it provided high quality information that empowered people, which is exactly what I want to do when I’m a senator. Give people the power, let them make decisions for their wellbeing.

(23:48)

Now, John Fetterman’s approach to health is a very dangerous one. He believes we should socialize medicine. He embraced this with Bernie Sanders, who endorsed. The two candidates called themselves the two most progressive people in America. When you have socialized medicine, Dennis, you shut down the ability of people to get access to healthcare. Doctors stop practicing. There are no medications available. The lines get long. It’s a disaster, and it puts people at risk. So I don’t believe we should allow socialized medicine, the abolition of all private healthcare insurance in America. And radical positions like the ones taken by John Fetterman make him too extreme to serve. If we’re going to bring balance to Washington, you got to bring people who understand the ramifications. Even Joe Biden, even Joe Biden called John Fetterman’s idea, I’ll quote him, preposterous.

Dennis Owens (24:32):

Mr. Fetterman, I’m going to let you respond in just a minute, but I have a follow up for you first, Mr. Oz. Did you or your company make a profit from promoting those products? You have 30 seconds.

Dr. Mehmet Oz (24:41):

I never sold weight loss products as described in those commercials. It’s a television show, like this is a television show, so people can run commercials on the shows, and that’s a perfectly appropriate and very transparent process. I ruffled a lot of feathers on my show because I told people the truth and I’m proud of that and I’ll do the exact same thing as a US Senator. But there’s no way to defend what John Fetterman has done with socialized medicine. That is a radical departure from what we in America have accepted and [inaudible 00:25:12].

John Fetterman (25:11):

Again, I must respond to that.

Dr. Mehmet Oz (25:12):

John, you’ll have your turn. John, let me finish. There must be a relationship between a doctor and a patient, and that’s what I would direct patients to do.

Dennis Owens (25:21):

Thank you. Mr. Fetterman, he accused you of socialized medicine, supporting socialized medicine. What is your response?

John Fetterman (25:26):

Yeah. Again, it’s the Oz rule. He’s on TV and he is lying. I never supported any of that thing. He keeps talking about Bernie Sanders. Three years ago, he was on his show and he hugged him and he said, “I love this guy.” Why don’t you pretend that you live in Vermont instead of Pennsylvania and run against Bernie Sanders? Because all you can do is talk about Bernie Sanders. Because my truth is is that healthcare is a basic fundamental right, and I believe in expanding that, and I believe about supporting fighting for healthcare, the kind of healthcare that saved my life.

Dennis Owens (25:59):

Dr. Mehmet Oz (26:00):

Dennis, that was dishonest. He explicitly supported socialized medicine.

Dennis Owens (26:03):

Mr. Oz, we have a lot of topics to get to.

Lisa Sylvester (26:05):

Dennis Owens (26:06):

Lisa Sylvester (26:06):

We are going to move on to the next topic, and this has come up earlier, and that is the issue of fracking. Pennsylvania only trails Texas in terms of natural gas production. Both of you have taken shifting positions on the issue of fracking. Mr. Oz, we begin with you. You wrote a column in 2014 calling for no fracking pending health study results. But in a video posted on social media in March, you said, “Natural gas guarantees high paying skilled jobs right here in Pennsylvania. So back off Biden. Give us freedom to frack.” Mr. Oz. Please explain that changing position. 60 seconds.

Dr. Mehmet Oz (26:47):

I’ve been very consistent. Fracking has been demonstrated, it’s a very old technology, to be safe. It is a lifeline for this commonwealth to be able to build wealth similar to what they’ve been able to achieve in other states. For that reason, I strongly support fracking, drilling, the piping of that natural gas. In fact, I’d build a facility even in Philadelphia so we can export it to our allies and help them, the ones that are struggling now in Western Europe because of the Ukrainian war. John Fetterman calls fracking a stain on Pennsylvania. He says that he will sign a moratorium to ban its continued use. He’s against pipelines. He supported the vote against the Keystone pipeline that ended up shutting it down. He supports Biden’s desire to ban fracking on public lands, which are our lands, all of our lands together. This is a extreme position on energy. If we unleashed our energy here in Pennsylvania, it would help everybody. Why John Fetterman is so rigidly stuck on fighting against energy companies is stunning to me because it’s the jobs I want, tens of thousands of high paying jobs to help Pennsylvanians.

Lisa Sylvester (27:51):

Thank you, Mr. Oz. Mr. Fetterman, 15 seconds.

John Fetterman (27:52):

Oz Rule. I absolutely support fracking. In fact, I live across the street from a steel mill and they are going to frack to create their own energy in order to make them more competitive. And I support that, living closer to anybody else in Pennsylvania for fracking to myself. I believe that we need independence with energy. And I believe I’ve walked that line my entire career. I believe Democrats-

Lisa Sylvester (28:17):

Mr. Fetterman, I do have a specific question, which you can continue on this topic, but you have made two conflicting statements regarding fracking. In a 2018 interview, you said, quote, “I don’t support fracking at all. I never have.” But earlier this month, you told an interviewer, “I support fracking. I support the energy independence that we should have here in the United States.” So Mr. Fetterman, please explain your changing position. 60 seconds.

John Fetterman (28:47):

I’ve always supported fracking and I always believe that independence with our energy is critical. We can’t be held ransom to somebody like Russia. I’ve always believed that energy independence is critical and I’ve always believed that, and I do support fracking. I’ve never taken any money from their industry, but I support how critical it is that we produce our own energy and create energy independence.

Dr. Mehmet Oz (29:16):

I must correct the record. He-

Lisa Sylvester (29:17):

Just a second, Mr. Oz. I do want to clarify something. You’re saying tonight that you support fracking, that you’ve always supported fracking, but there is that 2018 interview that you said, quote, “I don’t support fracking at all.” So how do you square the two?

John Fetterman (29:36):

Oh, I do support fracking. I support fracking, and I stand, and I do support fracking.

Lisa Sylvester (29:47):

Okay. Thank you, Mr. Fetterman. Onto-

Dr. Mehmet Oz (29:49):

I’m sorry, Lisa. There’s not just a statement you read. There are multiple, pictures of him signing moratorium.

Lisa Sylvester (29:54):

We have to go. We have to move on. I-

Dr. Mehmet Oz (29:55):

But we have to get the fundamentals of the truth out here.

Lisa Sylvester (29:58):

Dr. Mehmet Oz (29:58):

John Fetterman over and over again took positions against energy.

Lisa Sylvester (30:00):

We have a lot of topics. You will have a chance to have that in your closing-

Lisa Sylvester (30:00):

Energy. We have a lot of topics. You will have a chance to have that in [inaudible 00:30:04].

Dr. Mehmet Oz (30:03):

One comment then [inaudible 00:30:05].

Lisa Sylvester (30:04):

Dennis Owens (30:09):

Mr. Oz, we want it now turn to public safety. Mr. Fetterman, Republicans have called you dangerously soft on crime. The Pennsylvania State Troopers Association has endorsed Democrat Josh Shapiro for governor, but in this race it endorsed your Republican opponent. Mr. Oz, what is your response to those endorsements and what is your response to accusations that you are “dangerously soft on crime?” You have 60 seconds.

John Fetterman (30:37):

I believe that I run on my record on crime. I ran to be mayor back in 2005 in order to fight gun violence and that’s exactly what I did. In working with the police and working with our community, I would say I was able to stop gun violence for five and a half years as mayor ever accomplished before or since my time as mayor, because I’m the only person on this stage right now that was successful about pushing back against gun violence and being the community more safe.

(31:10)

All he’s done is just put a plan up on his website in the last 24 hours. He has no experience. He has never made any attempt to try to address crime during his entire career, except showing up for photo ops here in Philadelphia.

Dennis Owens (31:26):

I will give you 15 seconds to respond to that. And then I have a question for you.

Dr. Mehmet Oz (31:29):

The Fraternal Order of Police from Braddock, the small town he represented, endorsed me. They supported me because what he’s saying is not true. Violence skyrocketed in Braddock. The town wasn’t in a good shape when John got there. It got worse when he was there. People kept leaving, so of course you’re going to have all kinds of bear aberrations, but John, the city was dangerous under your leadership and that’s why [inaudible 00:31:52].

Dennis Owens (31:51):

Mr. Oz, this past summer Congress passed the first gun control bill in decades. That would not have happened without the support of the man you are running to replace, Pat Toomey. How would you have voted on that bill and would you continue Toomey’s legacy as being one of the lead Republicans in Congress on pushing for gun reforms? You have 60 seconds.

Dr. Mehmet Oz (32:13):

I have been supported by Pat Toomey. I have enjoyed working with him. I think he’s done a wonderful job. There are parts of that bill that I like a lot. For example, I like the fact that their background checks that are being strengthened now, so we can make sure that people who should not have guns don’t get guns. I also like the fact that there was a lot of money invested for mental health, which is an important part of the equation.

(32:34)

I’ve been to Philadelphia. I’ve done prayer vigils with Black clergy leaders who are desperately trying to save the people in their community. Half the murders in Philadelphia are committed by people under 18. We have got to get mental health services to these people and it’s not happening now.

(32:48)

But part of the problem is that we have taken away the ability of police to do their job and that’s on John Fetterrman, because John Fetterman has taken such a harsh position against them. He’s undermined them at every level, taken away some of their funding. He’s pushed for Crashner, who he admires tremendously and he’s spoken highly of him just this week. He’s taken his policies to a new extreme. He’s argued that people should be let out of jail without any bail, no matter what they did to get in there. He’s argued to release one third of all prisoners, one third of all prisoners out of touch.

Dennis Owens (33:17):

Quickly, 15 seconds. Would you have voted for that Pat Toomey supported bill?

Dr. Mehmet Oz (33:23):

I would’ve tried to improve that bill. There are things that I think most of us appreciate. I wasn’t there at the time, so I can’t speak to what was possible, but I do know there are parts of that bill that do make sense and the ones I described should be followed. Let’s see how it works out.

Dennis Owens (33:35):

Lisa Sylvester (33:35):

Onto our next issue. And that is illegal immigration. It has been a problem in the United States for decades, but it is now spiking. US Customs and Border Protection just released numbers from fiscal year 2022. They show more than 2.7 million total enforcement actions in the US. That is the most ever.

(33:56)

Mr. Oz, beginning with you. Republican governors in the South have been sending migrants to Democratic run cities and states without a plan or without any coordination. It is certainly gaining a lot of attention, but is it an effective way to deal with the influx of migrants? You have 60 seconds.

Dr. Mehmet Oz (34:13):

Lisa, we have a catastrophe at the border and we should not have sanctuary cities as John Fetterman has tried to introduce, but I’ve been into the parts of Philadelphia and Allentown and Redding where we have large Latino populations. I understand the challenges of the border. My father was an immigrant. My mother were immigrants. I understand what legal immigration offers us, but the completely porous, open nature of our border, which John Fetterman supports has created a humanitarian crisis with cartel’s profiting, with human trafficking operations.

(34:42)

They take the money, they buy narcotics from China and bring that into our country and it’s making every state a border state. Pennsylvania is already a border state, because we’re top three in the country in fentanyl overdoses. Lisa, I can’t go anywhere where and giving any big event where I don’t meet multiple people who say their personal lives have been destroyed because of fentanyl overdoses. Yet John Fetterman not only wants an open border, not only supports sanctuary cities, but he wants to legalize all hard drugs in America, including narcotics. That is out of touch with everybody, that radical position was tried in Oregon, which he endorsed, 50% homicide increase rate.

Lisa Sylvester (35:19):

One moment. I will give a 15 second rebuttal.

John Fetterman (35:22):

Yeah, that is again, [inaudible 00:35:24] rule. That is just not true. Here, his family’s company was levied the largest fine for immigration hiring of immigrate illegals. And I think he should sit this one out about in terms of what, a secure border.

Lisa Sylvester (35:43):

All right. We do have a follow up specifically for you. Mr. Fetterman, Vice President Kamala Harris says, “The southern border is secure, yet we are seeing an unprecedented number of migrants crossing.” Is the border secure? And if not, what would you do to fix what both parties are calling a crisis? You have 60 seconds Mr. Fetterman.

John Fetterman (36:05):

Yeah, I believe that that secure border can be compatible with compassion. I believe we need a comprehensive and bipartisan solution for immigration. That’s what I believe. I don’t ever recall in the Statue of Liberty did they say, “Take our tired, huddle masses and put them on a bus and use cheap political stunts about them.” I believe we have to develop a comprehensive and bipartisan solution to address our issue here for immigration here in our nation.

Lisa Sylvester (36:36):

All right, thank you gentlemen. Onto the next issue.

Dr. Mehmet Oz (36:38):

John’s not addressing the elephant in the room, fentanyl.

Lisa Sylvester (36:41):

We have to move on to the next issue. We will be circling back on that.

Dennis Owens (36:44):

Turning now to foreign policy. Mr. Fetterman, what do you believe is the greatest foreign threat to the United States of America? You have 60 seconds.

John Fetterman (36:55):

I believe is right now is China. I believe China is not our friend and I believe that we can’t be able to push back and we need to stand against China. And I believe that Dr. Oz has chosen to manufacture all of his merchandise on his name on it in China, which one of us on this stage is going to stand up against and stand firm against China. And I believe that’s our single biggest issue right now to make sure that we address China and make sure that we know that it’s not our friend.

Dennis Owens (37:27):

Mr. Oz, what do you believe is the greatest foreign threat to the United States of America? You have 60 seconds.

Dr. Mehmet Oz (37:33):

The fact that our country’s not projecting strength. Take for example what we’re doing with Iran. In order to try to get them to give us a little oil so we can deal with the catastrophe that Russia has caused, we have gone to them and tried to sign a deal that would allow them, once again, to have the nuclear power to blow up Israel, which they promised they would do. John Fetterman supports that deal.

(37:54)

It doesn’t make any sense for America to treat our enemies better than our allies. We have the message with our strong voice and the energy we have in our country that we have control over our future. And the best way for America to establish its dominance is to unleash the energy here in Pennsylvania and across the country. By not doing that, not only do we cause all kinds of problems with local jobs and inflation, but we’re destroying our ability to remain energy dominant and we’re not able to become allies like we should be for countries like European nations, which are going to struggle with their coldest winter ever.

(38:27)

It’s the best way to punch Putin back and to teach China lesson is American energy to reign supreme. And John Fetterman doesn’t like American energy and they’re scared of him, because they know they can’t trust them. He’s proven it.

Dennis Owens (38:38):

Lisa Sylvester (38:40):

All right to on our next issue. In our recent Nexstar poll, a hypothetical rematch between Joe Biden and Donald Trump in 2024 would be a statistical tie in Pennsylvania. 46% of people said they would vote for former President Trump, 45% for President Biden. Mr. Oz, would you support a Trump 2024 run and why? 60 seconds.

Dr. Mehmet Oz (39:03):

I’ll support whoever the Republican party puts up. And I have reached out across the aisle on my campaign because I want to bring balance to Washington. And I’ve tried to work with Democrats and Republicans and people in the middle and people aren’t sure and people who forgot and people who got angry with where their party was headed. I want to bring us together to make this country do what it’s always been able to do. Unify, not divide and address the problems as a surgeon because in the OR, that’s what I do.

(39:27)

I just fix the big problem in front of me. John Fetterman, however, cannot go to Washington and work with the other side because he doesn’t even get along with his own side. He criticized Joe Biden for not spending enough money and not sidling up close enough to Bernie Sanders. He says he won’t work with Joe Mansion. He said, “If you like Joe Mansion, don’t vote for me.” So if you’re picking fight with your own party, you’re not going to be able to reach across the aisle to the other side. His extreme positions have made him untenable For Republican lawmakers. We need to send someone to Washington who understands the importance of balance, sensible decision making and a common sense approach to the challenges that we all face. That’s not John Fetterman

Lisa Sylvester (40:03):

A Mr. Oz, Donald Trump has supported you. He has endorsed you. Why won’t you fully commit to supporting him in 2024?

Dr. Mehmet Oz (40:13):

Oh, I do. I would support Donald Trump if he decided to run for president.

Lisa Sylvester (40:16):

Dr. Mehmet Oz (40:17):

But this is bigger than one candidate. This is a much bigger story about how we are going to build a bigger tent to let more Americans feel safe.

Lisa Sylvester (40:24):

Are you concerned about the ongoing legal investigations involving the former president? 30 seconds, sir.

Dr. Mehmet Oz (40:29):

I haven’t followed them very carefully. I’ve been campaigning pretty aggressively. They’ll work themselves out. I have tremendous confidence in the American legal system and I believe law and order will reign supreme. But speaking about that topic, there’s one person on this stage who’s broken the law, we believe. John Fetterman took a shotgun, chased an unarmed African American man and put the gun apparently according to that man, to his chest. John, you weren’t pulled over by the police. They let you go. You were the Mayor at the time. Why haven’t you apologize to that unarmed, innocent Black man who you put a shotgun to his chest?

Lisa Sylvester (41:00):

All right, we will allow a 30 response to that. Mr. Fetterman, specifically what he was saying, referring to the incident in Braddock.

John Fetterman (41:06):

No, I made the opportunity to defend our community as the chief law enforcement officer there. Everybody in Braddock, an overwhelmingly majority community of Black community, all understood what happened. They understood what happened and everybody agreed that. And nobody believes that it was anything about me making a split second decision to defend our community as well.

Dr. Mehmet Oz (41:32):

Lisa Sylvester (41:33):

Mr. Oz, please. We are still with Mr. Fetterman, turning to you right now. You support a Biden run. Do you support a Biden run in 2024? Why in 60 seconds?

John Fetterman (41:46):

That’s honestly, it’s up to his choice. Whether he, and if he does choose to run, I would absolutely support him. But ultimately that’s ultimately only his choice.

Lisa Sylvester (41:53):

All right. Thank you Mr. Fetterman. A follow up question on this, our Nexstar poll shows 51% of Pennsylvania voters disapprove of the President’s job performance. You have publicly supported many of his policy positions. Are there any that you disagree with? 30 seconds.

John Fetterman (42:15):

Oh, I just believe he needs to do more about supporting and fighting about inflation. And I do believe he can do more about that. But at the end of the day, I think Joe Biden is a good, good family man. And I believe he stands for the union way of life. And I believe that unemployment is already down to the lowest level in the last 50 years.

Lisa Sylvester (42:37):

All right. Thank you gentlemen. Dennis?

Dennis Owens (42:38):

Let’s turn now gentlemen to the issue of social security. It is only fully funded through 2034. Many Americans are worried that they will never receive their full benefit or have to accept cuts to their benefits. Mr. Fetterman, how are we going to make sure it is there for them? You have 60 seconds.

John Fetterman (42:58):

We need to make sure that Dr. Oz and the Republicans believe in cutting Medicare and Social Security. And I believe that they have to support and expand Social Security. And if somebody sends me to send me to Washington DC I would support and stand and to support security, Social Security.

Dennis Owens (43:20):

Okay. Thank you, Mr. Oz. Same question to you. How are you going to make sure that social security is available for future Americans? You have 60 seconds.

Dr. Mehmet Oz (43:28):

We made a deal with the wonderful seniors of our nation. They worked their hearts out. They paid into a program. No one’s going to touch it on my watch except to make sure that it’s stronger than it is right now. Social Security, Medicare, which I know a lot about as a doctor, are the fundamental element of security for our seniors. And they deserve to feel like they’re value by nation.

(43:47)

John Fetterman, again, has been burning ads and saying that I’m against those with no proof. I have never said anything different than what I’m saying to you on this stage. But in effort to fear monger with people who are older and can be taken advantage of, he’ll run these ads. John, it’s re reprehensible, but it’s also reflective of your approach to doing these things. You haven’t shown up on the campaign trail. You haven’t answered questions from voters, not once on the campaign trail.

(44:10)

You haven’t answered questions from media once on the campaign trail, even just to show that you could do it. And this is the only debate I could get you to come to talk to me on. And I had to beg on my knees to get you to come. And if it wasn’t for Dennis probably getting involved, I don’t think it would’ve happened. Seniors need to know more about your radical left positions, and I need to be able to tell them about my positions. That’s what democracy is built on. We exchange ideas. The voters decide you have hidden from that.

Dennis Owens (44:34):

Mr. Oz, I’m going to let you have 15 seconds at a moment, Mr. Fetterman, but can you give us a specific example of what you would do to protect social Security?

Dr. Mehmet Oz (44:41):

Well, for one, we have to make sure that it adequately increases with the higher inflation rates that we have. So we’ve got to make that 4% of wasted money that right now is in the budget redirected appropriately. And one of the first places that I would use it is Social Security and Medicare. And here’s the reason. One of the worst things we can do to a people is give them bad quality care. And so if you have-

Dr. Mehmet Oz (45:00):

Bad quality care. And so if you have people who are not going to see a doctor, for example, because they can’t afford it, they’ll get sicker. Bad medicine means more cost. No one benefits.

Dennis Owens (45:11):

Thank you Mr. Fetterman. He said a few things a moment ago. I want to give you 15 seconds to respond to those.

John Fetterman (45:19):

Now again, I just can’t say one thing other than that Dr. Oz would not support and he would support cutting Medicare.

Dr. Mehmet Oz (45:29):

John, why do you say that? I’ve never said that.

John Fetterman (45:31):

It’s absolutely a fact. It’s a fact. You would’ve voted against the inflation reduction act, which has dropped our prescription drugs and he doesn’t believe-

Dennis Owens (45:41):

Okay, gentlemen, we need to move on, Lisa.

Lisa Sylvester (45:42):

All right, we are moving on to the topic of education. The cost of college tuition is now out of reach for many, many families. Our question is for both of you. We start with Mr. Oz, What is your plan to bring down the cost of higher education long term? You have one minute, Mr. Oz.

Dr. Mehmet Oz (45:59):

I’ve worked in an academic medical centers my whole life, so I’m in higher education. And I can tell you the reason that the prices have gone up sixfold in the last 40 years is not because the education quality’s better. We’ve added extra layers of middle level individuals who don’t actually improve the quality education in my opinion. There’s a lot of expenses now incurred by these institutions. And it’s not right for the American people to be stuck with the bill. I would push them to offer more electronic classes. Half the kids don’t live on campus anyway.

(46:28)

John Fetterman’s approach, however, is not to deal with the unnecessarily high cost, but just to pay it. So if you want to pay students who didn’t pay their loans back, basically what John Fetterman and Joe Biden are arguing for is for plumbers who didn’t go to college and couldn’t for a bunch of reasons afford it, to pay the bills of lawyers who went to graduate school and haven’t paid their debt back. I don’t think that’s right for the American people. We want a fair system, drop the cost down by pushing for more value for the money we’re spending, and then ensure there’s a high quality education that lets people make a living when they graduate.

Lisa Sylvester (47:01):

All right, I will allow a 15 second rebuttal specifically on the issue of student loan debt, which Mr. Oz was referring to. Mr. Fetterman.

John Fetterman (47:09):

Again, Dr. Oz loves free money when it’s a half a million dollar tax break on one of his homes down in a ranch in Florida. And whether it was a $50 tax break about his farm in Montgomery County. So it’s about supporting and helping young earners, excuse me, young students to give them a break. I believe that supporting-

Lisa Sylvester (47:40):

All right, let me just ask specifically, with the plan to ease student loan debt, the debt forgiveness of $10,000, $20,000 for Pell Grant recipients, do you support that position?

John Fetterman (47:53):

I do absolutely support that. I believe, like I said, it’s about helping young learners be able to get a better start, getting off in the start of their life. And I do believe that, and I believe a majority of Americans support that as well too. Helping young learners.

Lisa Sylvester (48:11):

All right. Mr. Fetterman, I want to ask you the same question that I asked Mr. Oz, and what is your plan to bring down the cost of higher education long term? You have one minute.

John Fetterman (48:21):

Yeah, He didn’t answer the question whatsoever.

Dr. Mehmet Oz (48:24):

John Fetterman (48:26):

Lisa Sylvester (48:27):

Mr. Oz, please give him a moment.

John Fetterman (48:29):

You didn’t. I fundamentally believe that every quality public university education should be very affordable in every state. And I think that needs to be a significant investment to make sure that anyone be able to afford to go to get a four degree university degree at say at Penn State or at Pitt or any state schools, to make it much more affordable. And that means inquiring a significant investment to make sure and create it affordable that every family can afford.

Lisa Sylvester (49:03):

How exactly Mr. Fetterman do you propose doing that, to make it more affordable for families?

John Fetterman (49:10):

I just believe I just making it that much more. It costs too much. And I believe providing the resources to reduce the tuition to allow families to be able to afford it.

Lisa Sylvester (49:21):

All right. We have a follow up question. This one now is for both of you. This is from NewsNation viewer Ann Andrews a registered nurse from near Erie and is a vocational educational instructor for university and a practicing registered nurse.

Ann Andrews (49:38):

If you are elected, could you please tell me what you would be doing for vocational education in the state of Pennsylvania as well as our nation?

Lisa Sylvester (49:47):

So Mr. Oz, if elected, what would you do for vocational education? You have 30 seconds.

Dr. Mehmet Oz (49:52):

I’ve visited vocational schools. I’ve an answer, but John, because you obviously I wasn’t clear enough for you to understand this. There’s no question that cutting out the middle levels of higher education and providing digital programs would reduce the cost of education. It’s a concrete set of ideas that I’d like to move on. With regard to vocational education. This is really important for us to allow our trade unions to get more closely linked with the vocational schools. I was in a vocational school in Westmoreland and they have about a thousand kids. They could take 2000 kids. Funding those programs is the smartest way to invest our tax dollars, will turn out twice as many children who have a job as soon as they graduate. It supports our trade unions who want those kids in their positions anyway. It makes the whole program work.

Lisa Sylvester (50:34):

Thank you Mr. Oz. Mr. Fetterman, if elected, what would you do for vocational education? You have 30 seconds.

John Fetterman (50:41):

Again, it’s just the same, the way that University for degrees as well too. Supporting that and partnering with the unions and making sure that vocation training is affordable and providing the resources to make sure everyone has the opportunity. Going to college isn’t the right choice for every person, but going to those kind of vocational schools, able to create a career to weigh, to, excuse me, to raise a lot of high salary. And again, supporting to reduce those costs are critical too.

Lisa Sylvester (51:16):

All right. Thank you gentlemen. Dennis.

Dennis Owens (51:18):

Moving now. Multiple members of Congress, specifically Democrats have called for the Supreme Court to be expanded candidates. We want to know where you stand on this, Mr. Fetterman. Should the Supreme Court be expanded? And if so, by how many justices. You have 60 seconds.

John Fetterman (51:35):

I don’t believe. I don’t stand and I don’t believe in that. I fundamentally believe that even though I don’t agree with the ideological breakup of the Supreme Court, I believe it’s not about changing the rules, it’s about acknowledging where we’re at. Much the way the Republicans want to try to change the Constitution about how our Supreme Court in Pennsylvania is going to be done. And I don’t support that. So I think it’s critical that we be consistent and I do not believe in supporting the Supreme Court.

Dennis Owens (52:08):

Mr. Oz, same question to you. Should the Supreme Court be expanded? If so, by how many justices you have? 60 seconds.

Dr. Mehmet Oz (52:14):

I would never touch the make up of the Supreme Court and I would advocate to leave it the exact same size it is, but John Fetterman’s radical positions have spilled over into what he would do in Washington. One of the first things he has said, and he came back to the campaign trail, is that he wanted to bust the filibuster, which means removing the brakes on the Senate overreacting. That’s a risk.

John Fetterman (52:34):

That’s true. That is true.

Dr. Mehmet Oz (52:36):

But if you do that, then you would free up the Democrats in the Senate without getting the normal amount of votes to actually expand the Supreme Court, add more states, do things that are detrimental to the wellbeing of the country. So I think, and your first day back arguing that we should get rid of the filibuster is a dangerously radical move that would hurt Washington. It’s not in our nation’s best interest.

Dennis Owens (52:58):

Thank you both very much.

Lisa Sylvester (52:59):

All right. At this time we are ready for our closing statements. You each have 90 seconds to convince Pennsylvanians to vote for you on Election Day. Mr. Fetterman, you are first. 90 seconds.

John Fetterman (53:13):

Once again, I would just like to say that my campaign is all about fighting for anyone in Pennsylvania that ever got knocked down, that had to get back up again. I’m also fighting for any forgotten community all across Pennsylvania that ever got knocked down, that had to be made to get back up. And I’ve made my entire career dedicating to those kinds of pursuits. I started as a GED instructor back in Braddock over 20 years ago because I believe it’s about serving Pennsylvania, not about using Pennsylvania for their own end, interests as well. To me, careers are or field… By your real underlying values. And my values have always been about fighting for forgotten communities all across Pennsylvania.

Lisa Sylvester (54:04):

All right, thank you Mr. Fetterman. Mr. Oz, your final thoughts? 90 seconds.

Dr. Mehmet Oz (54:09):

I’ve loved traveling to the four corners of the beautiful Commonwealth, and I’ve heard your problems. I’m a surgeon doctor. I listen to what you say and I’m trying to help address them today. I’ve talked to seniors worried their social security checks wouldn’t go far enough with the raging inflation. I’ve talked to couples want to make their first down payment on a new house and they can’t afford it anymore because of interest rates. I’ve talked to families.

John Fetterman (54:30):

You want to cut Social Security.

Lisa Sylvester (54:32):

Mr. Fetterman, It’s his turn for his closing.

Dr. Mehmet Oz (54:34):

I’ve talked to families worried about fentanyl, showing up in their mailbox and literally taking the lives of their children, who they find blue in bed. I’ve talked to families who won’t let their kids go outside because of the crime wave that’s been facilitated by left radical policies like the ones John Fetterman has been advocating for. But here’s the deal, right? None of this has to happen. This is all very addressable. I’m a surgeon, I’m not a politician. We take big problems, we focus on them and we fix them. We do it by uniting, by coming together, not dividing. And by doing that we can get ahead. But I’ve got one question to challenge you with. Just one question. If you take what I’m saying to heart, ask yourself this and others in your family, are you unhappy with where America’s headed? I am. And if you are as well that I’m the candidate for change.

(55:22)

I’m a living embodiment of the American dream. I believe we’re the land of opportunity, the land of plenty. I believe we can balance a budget without recklessly spending. I believe we can have an unleashed energy policy that helps us all. I believe that we can have safe city streets and a secure border so legal immigrants can come across, but you shut the fentanyl out. I believe we can give parents choice in where their kids go to school. We can have affordable healthcare. But most of all, I believe in you. And if you can do this together and we can, I would ask for your vote on Election Day. God bless you.

Dennis Owens (55:50):

We do have one final question. An important issue in Pennsylvania. The eyes of the state are on this debate tonight, but on Sunday they will be on Lincoln Financial Field in Philadelphia as the state’s two NFL teams go head to head, Mr. Fetterman, Steelers or Eagles. And why?

John Fetterman (56:08):

Oh, clearly always for the Steelers.

Dennis Owens (56:11):

Dr. Mehmet Oz (56:12):

I’ll be at the game rooting for my Eagles. Fly eagles, fly.

Dennis Owens (56:17):

Gentlemen, thank you both so much. This does conclude our debate. We do want to thank our candidates for being with us, Mr. Fetterman and Mr. Oz, and for all of you at home who have been watching, thank you so much.

Lisa Sylvester (56:28):

And we want to thank our team at WHTM for hosting us at their studios tonight. Remember, voters on Election Day is just two weeks from today on Tuesday, November 8th. Thanks for being with us and have a great night.

Today, let’s focus on what happened in the United Kingdom.

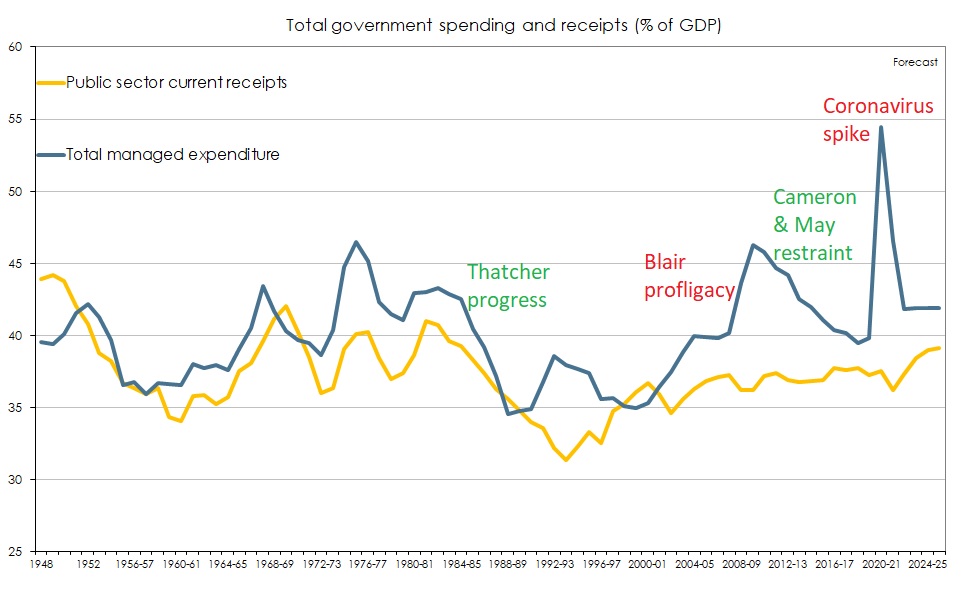

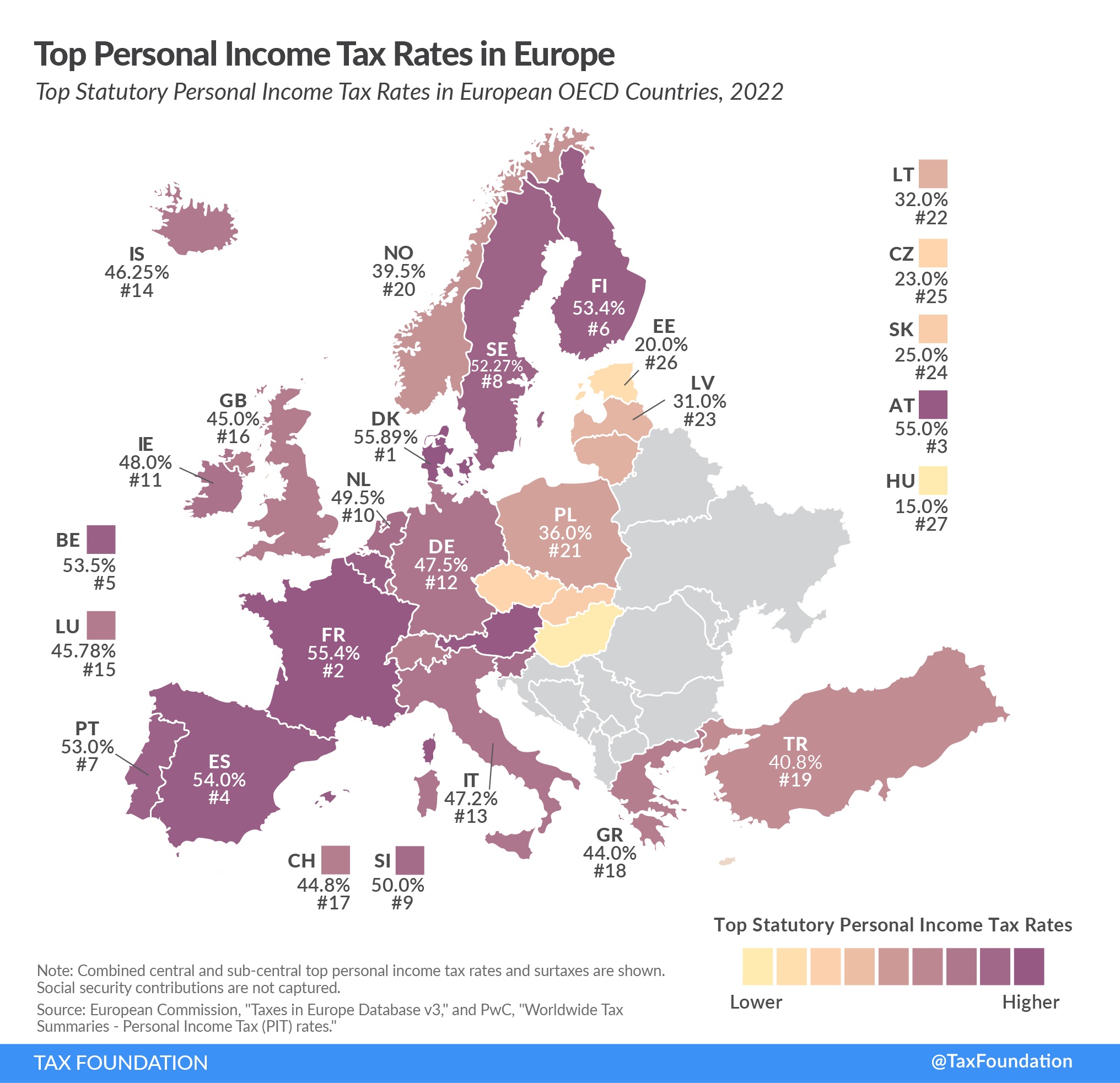

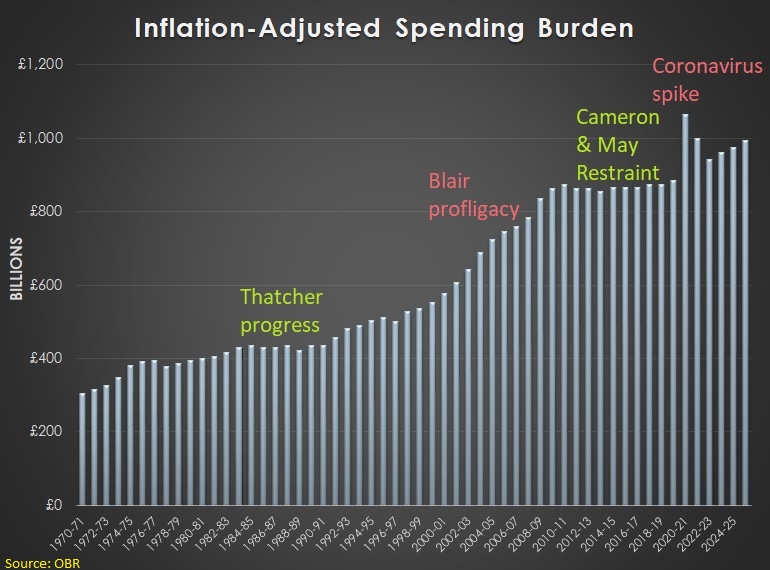

Today, let’s focus on what happened in the United Kingdom.By the time Margaret Thatcher led the Tories into office in May 1979, inflation was raging and the country had been wracked by strikes in its “winter of discontent”… Lawson entered Thatcher’s administration… He made his historic mark as Chancellor of the Exchequer starting in 1983. He’s best known for his tax reforms, which reduced the top personal income-tax rate to 40% from 60% and brought the top corporate rate to 35% from a 1970s high of 52%. He also was a steward of the Thatcher administration’s privatizations of large state-owned firms and the “Big Bang” financial reforms that would transform London into a global financial center.

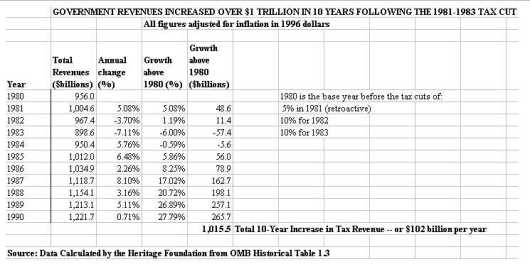

…During his tenure, Britain was transformed from being an economy in which most major businesses and services were owned and run by the state, into one in which they became private businesses, paying taxes instead of receiving taxpayer subsidies. Failing and outdated state enterprises became modern, successful private ones. …His 1988 Budget…announced that all taxes above 40% would be abolished, and that the basic rate would be cut to 25%, its lowest for 50 years… Within a very short time, more money was coming into the Treasury from the lower rates than it had been taking in from the higher ones. It was a vindication of the Laffer Curve. …The top 10% of earners had been paying 35% of the total income tax take. Under Lawson’s lower rate that went up to 48%. In rough terms this meant that the top 10% went from paying just over a third to just under a half of total income taxes.

Especially since her predecessor, Boris Johnson, turned out to be an empty-suit populist who supported higher taxes and a bigger burden of government spending.

Especially since her predecessor, Boris Johnson, turned out to be an empty-suit populist who supported higher taxes and a bigger burden of government spending.Yet her chancellor of the exchequer, Kwasi Kwarteng, faced a quick reality check when his mini-budget, packed with unfunded tax cuts and unaccompanied by independent forecasts, …triggered mayhem… Truss fired Kwarteng and replaced him with Jeremy Hunt as she was forced into a dramatic u-turn over her tax plans. …Truss conceded…and dropped her plan to freeze corporation tax. …Still, some believers are sticking by “Trussonomics”…Patrick Minford,..a professor at Cardiff University, said..“Liz Truss’s policies for growth are absolutely right, and to be thrown off them by a bit of market turbulence is insane.” …Eamonn Butler, co-founder of the Adam Smith Institute, similarly insisted that Truss “is not the source of the problem — she’s trying to cure the problem.”

What happened next is dispiriting in the extreme. …Truss and her Chancellor moved too quickly and, paradoxically, given their warnings about the rottenness of the system, ended up pulling out the last block from the Jenga tower, sending all of the pieces tumbling down. …they didn’t crash the economy – it was about to come tumbling down anyway – but they had the misfortune of precipitating and accelerating the day of reckoning. …Andrew Bailey, the Governor of the Bank of England…, has been deeply unimpressive in all of this, helping to keep interest rates too low… The idea, now accepted so widely, that the price of money must be kept extremely low and quantitative easing deployed at every opportunity has undermined every aspect of the economy and society. …Too few people realise how terribly the easy money, high tax, high regulation orthodoxy has failed.

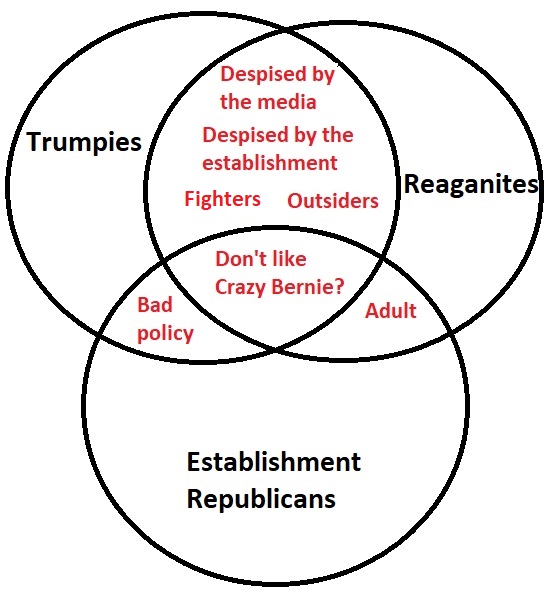

To be fair, they usually don’t try to claim their dirigiste policies will produce higher living standards. Instead, they blindly assert that it will be easier to win elections if Republicans abandon Reaganism.

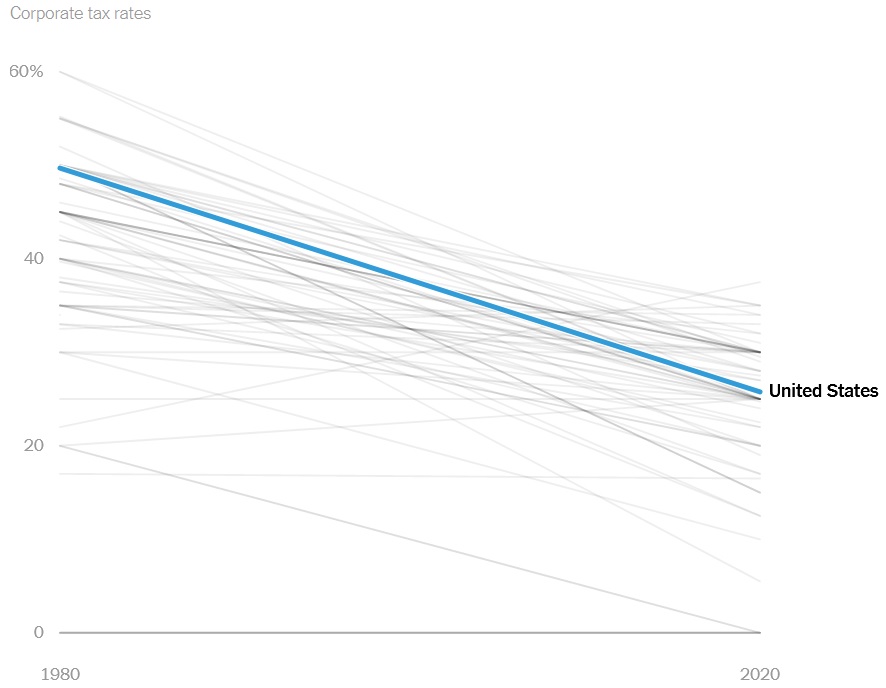

To be fair, they usually don’t try to claim their dirigiste policies will produce higher living standards. Instead, they blindly assert that it will be easier to win elections if Republicans abandon Reaganism. For decades, people in government have been upset that the tax cuts implemented by Ronald Reagan and Margaret Thatchertriggered a four-decade trend of lower tax rates and pro-growth tax reform.

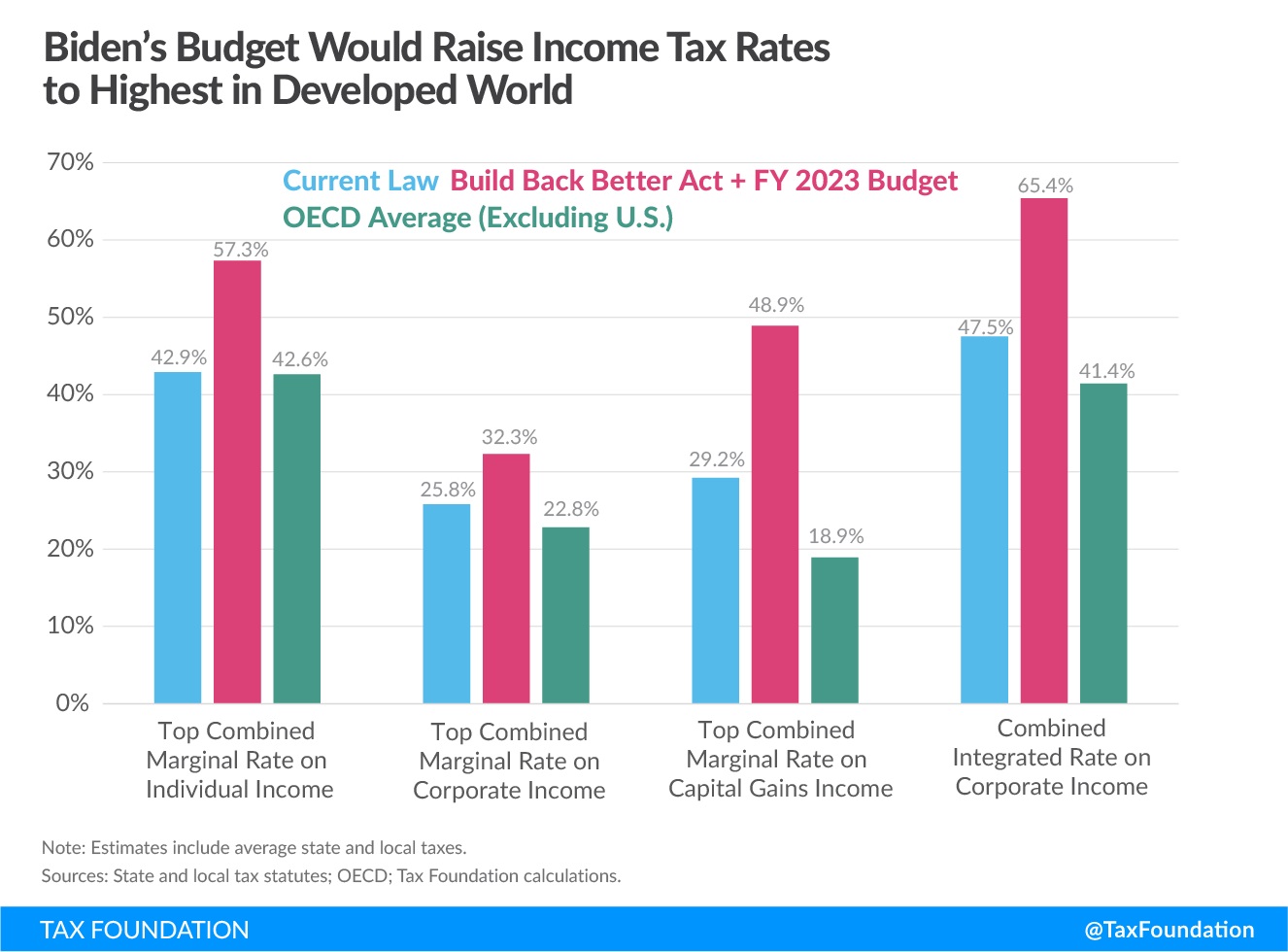

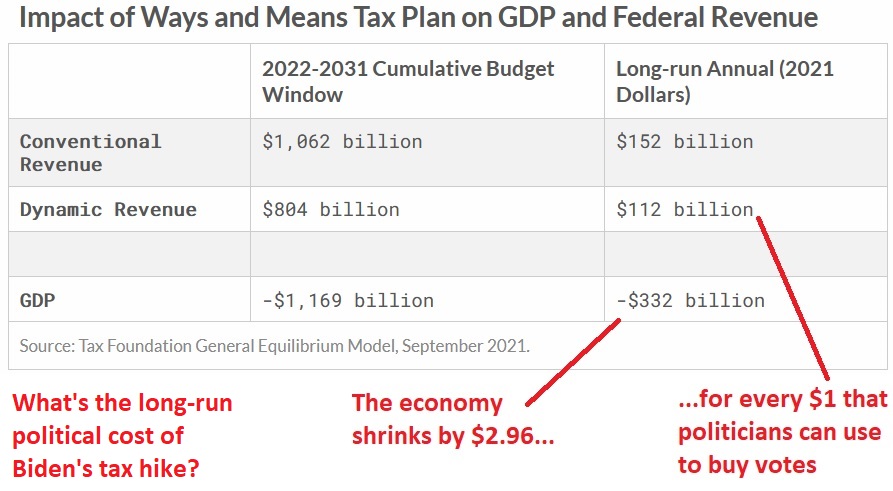

For decades, people in government have been upset that the tax cuts implemented by Ronald Reagan and Margaret Thatchertriggered a four-decade trend of lower tax rates and pro-growth tax reform.The Biden administration has proposed doubling the U.S. minimum tax on corporations overseas intangible income to 21% along with a new companion “enforcement” tax that would deny deductions to companies for tax payments to countries that fail to adopt the new global minimum rate. The officials said several countries were pushing for a rate above 15%, along with the United States.

“The 15% rate is way too low,” Argentine Finance Minister Martin Guzman told an online panel hosted by the Independent Commission for the Reform of International Corporate Taxation. …”The minimum rate being proposed would not do much to countries in Africa…,” Mathew Gbonjubola, Nigeria’s tax policy director, told the same conference.

But even if Congress approves the 15 percent global minimum corporate tax, it won’t be enough. …the Biden administration to give working families a real leg up, it should push Congress to enact a 25 percent minimum tax, which would bring in about $200 billion in additional revenue each year. …With a 25 percent minimum corporate tax, the Biden administration would begin to reverse decades of growing inequality. And it would encourage other countries to do the same, replacing a race to the bottom with a sprint to the top.

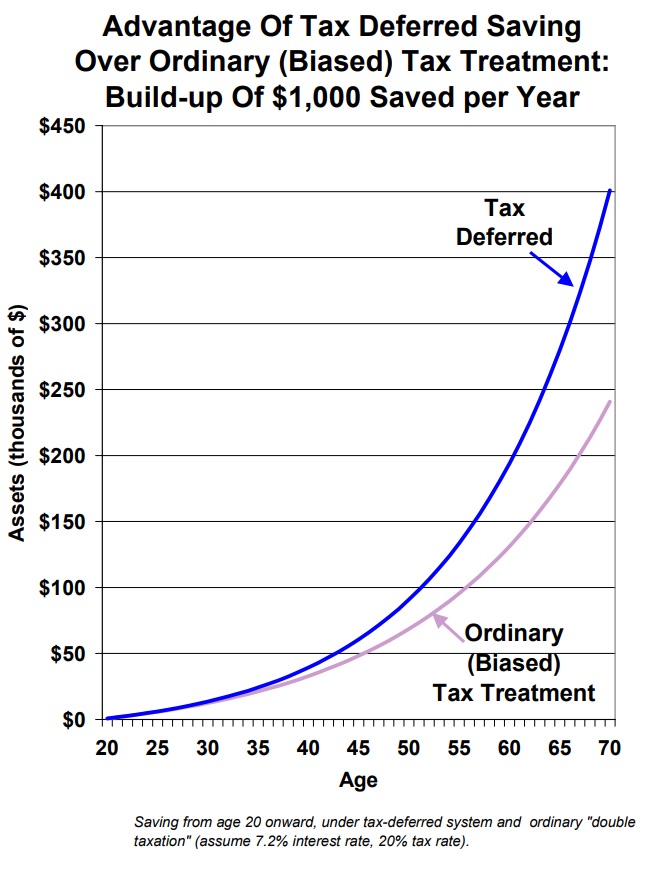

Now, that is incredible upon its face, but it becomes even more incredible when contrasted with FDR’s antibusiness and confiscatory tax policies, which both dramatically shrunk in terms of actual income tax revenues (from $1.096 billion in 1929 to $527 million in 1935), and dramatically shifted the tax burden to the backs of the poor by imposing huge new excise taxes (from $540 million in 1929 to $1.364 billion in 1935). See Table 1 on page 125 of New Deal or Raw Deal for that information.