—

Milton Friedman: “It is the spending, not the debt itself, that has negative effects on the economy.“

———

America’s Top Fiscal Problem Is…?

I narrated a six-minute video in 2009 to explain why America’s fiscal problem is spending rather than red ink. Here’s the same message in just 51 seconds.

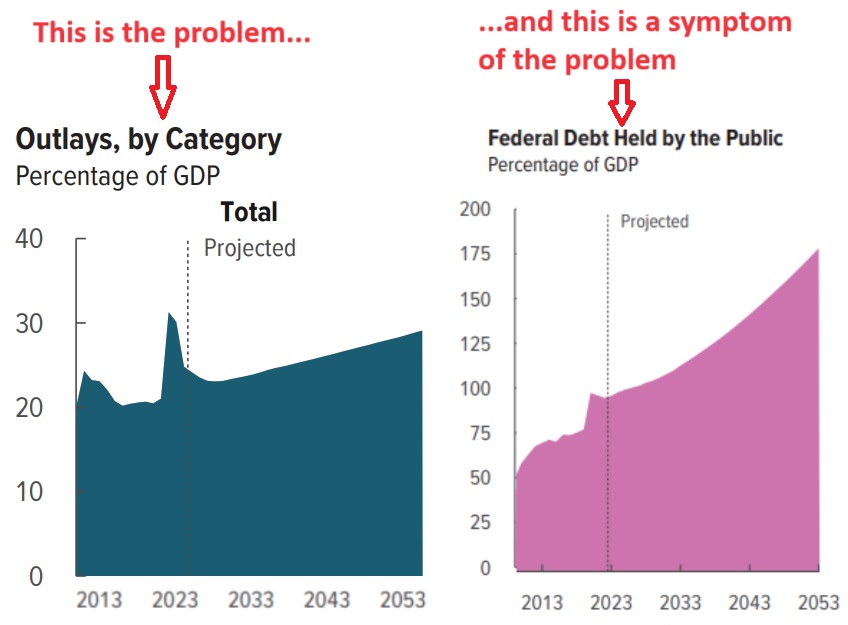

If 51 seconds is too much, here’s a visual I created using the latest long-run forecast from the Congressional Budget Office.

The key thing to understand is causality. America’s ever-growing burden of government spending is causing rising levels of debt.

This is a point I’ve made several times in the past.

But there are two reasons why I’m revisiting the issue today.

First, Mark Warshawsky of the American Enterprise Institute has a new article explaining that the federal government’s deficit is much bigger if you use accrual accounting rather than cash-flow accounting. Here are some excerpts.

Last week, the Treasury Department released…the massive Financial Report (FR) of the US Government. Using an accrual accounting basis, rather than a cash basis,

the FR shows a much poorer picture of the current finances of the federal government than the conventional budget. …The budget deficit under the conventional cash-basis terms increased from $1.4 trillion in 2022 to $1.7 trillion in 2023, or about 6.2 percent of GDP… The alternative measure presented in the FR of…$3.4 trillion in 2023…was double the cash basis deficit.

In other words, the symptom of red ink, measured on an accrual basis, is twice as bad as shown in the official numbers.

But I point this out because the real lesson to be learned is that our spending problem is worse than what is shown in the official numbers (blame entitlements).

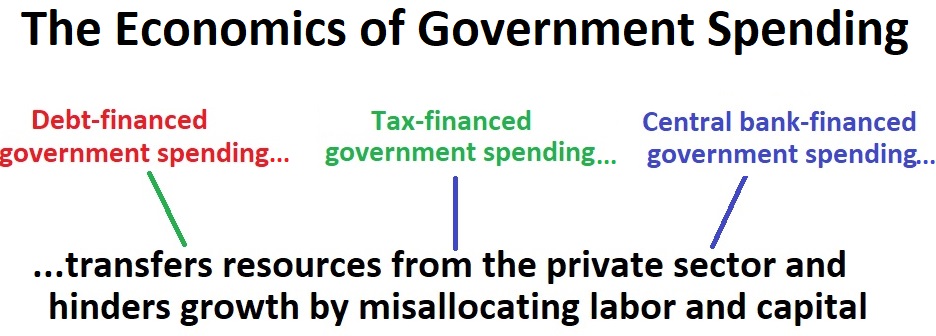

Second, I want to again share this visual from 2021. It shows that debt-financed spending is bad for prosperity, but also shows that tax-financed spendingand inflation-financed spending are similarly bad.

One takeaway from this little flowchart is that replacing debt-financed spending with tax-financed spending doesn’t solve the problem.

If we correctly identify spending as the problem, by contrast, then the only practical solution is to restrain spending.

P.S. This analysis is why a spending cap amendment (like TABOR or the Swiss Debt Brake) is much betterthan a balanced budget amendment.

Ronald Reagan Describes Milton Friedman

Uploaded by CommonSenseCap on Oct 2, 2011

_____________

My hero Milton Friedman was a big supporter of the Balanced Budget Amendment and in an article on this subject in 1983 he wrote:

“The key problem is not deficits but the size of government spending. […] I have never supported an amendment directed solely at a balanced budget. I have written repeatedly that while I would prefer that the budget be balanced, I would rather have government spend $500 billion and run a deficit of $100 billion than have it spend $800 billion with a balanced budget. It matters greatly how the budget is balanced, whether by cutting spending or by raising taxes.”

A Balanced Budget Amendment Should Make Tax & Debt Increases Difficult

As a member of the Conservative Action Project, CEO Susan Carleson and leaders of 28 other organizations, representing a broad cross section of the conservative movement, are united in supporting a Balanced Budget Amendment that actually reins in national spending and increasing our national debt – without raising taxes.

MEMO FOR THE MOVEMENT: A Balanced Budget Amendment — in addition to balancing the budget — should make it difficult to raise taxes, tough to increase the debt, and prohibit any court from ordering a tax increase or deciding budget priorities.

“I wish it were possible to obtain a single amendment to our Constitution. I would be willing to depend on that alone for the reduction of the administration of our government; I mean an additional article taking from the Federal Government the power of borrowing.”

Thomas Jefferson, 1798

RE: In accordance with the Budget Control Act of 2011, sometime between October 1 and December 31, 2011 both houses of Congress must vote on a balanced budget amendment (BBA) to the U.S. Constitution. It is important that any such amendment must protect taxpayers by not forcing automatic tax increases to keep revenues in line with rising expenditures. Our fiscal problems are caused not by under taxation–but by over-spending.

ISSUE-IN-BRIEF: Not all balanced budget Amendments were created equal. The most comprehensive BBA proposed is S.J. Resolution 10 co-sponsored by all 47 Republican members of the United States Senate. It caps spending at 18% of GDP; requires a 2/3 vote of congress to raise taxes; requires a 3/5 vote of congress to increase the debt ceiling; and prohibits any court from ordering an increase in taxes. Proposed BBA’s that do less can have the unintended effect of managing a tax increase instead of limiting spending and would be counter-productive and must be opposed.

A STRONG BBA MUST BE EASY TO UNDERSTAND AND NOT HAVE LOOPHOLES:

- Require a Balanced Budget every year: The federal debt is on track to consume our country’s entire Gross Domestic Product. The BBA would force Washington to live within its means.

- Prohibit Perpetual Deficit Spending: Deficit spending is a tax on future earnings.

- A debt ceiling will actually be a ceiling: The debt ceiling has been raised 11 times in the past decade. S.J. 10–co-sponsored by 47 members of the U.S. Senate– would require a three-fifths majority in both chambers to raise the debt ceiling. This is also an important provision to prevent cheating and other budget gimmicks because actual spending cannot exceed actual revenue for long without hitting the debt limit.

- Congress may waive BBA requirement by simple majority if a declaration of war is in effect; and it would require a three-fifths majority to waive if the country is engaged in a military conflict that causes an imminent and serious military threat to our national security.

- Courts setting any budget priorities would be a problem. Court-ordered military cuts or activist “declaratory judgments” requiring increased welfare spending would also be intolerable. S.J. 10 can be improved with an explicit ban on courts exercising jurisdiction on any of these essential political questions.

A “Weak” BBA will increase the size of Government and pave the way for Tax Increases:

- Unlike other proposals, such as a “Weak” BBA, not only should a BBA have a supermajority requirement to raise taxes, there should be no loopholes for creative accounting.

- Without a limitation on tax increases and a specific prohibition on courts ordering revenue increases a “Weak” BBA would allow judges the power to implement higher taxes to bring the budget into balance.

- A “Weak” BBA would allow a simple majority of Members of Congress to raise the federal debt ceiling and continue to borrow against future generations. That’s why there is a three-fifths majority requirement to raise the debt ceiling in S.J. 10

Why the Tax Hike Limitation Component is Important to any BBA:

As Milton Friedman wrote in defense of the Balanced Budget Amendment in 1983 in response to skepticism from the Wall Street Journal editorial board: http://www.theatlantic.com/magazine/archive/1983/02/washington-less-red-ink/5450/

“The key problem is not deficits but the size of government spending. […] I have never supported an amendment directed solely at a balanced budget. I have written repeatedly that while I would prefer that the budget be balanced, I would rather have government spend $500 billion and run a deficit of $100 billion than have it spend $800 billion with a balanced budget. It matters greatly how the budget is balanced, whether by cutting spending or by raising taxes.”

Americans Support a Balanced Budget Amendment:

Americans have always overwhelmingly support a balanced budget amendment. A Fox News poll (June 30), shows support is 72-20.

On Message, Inc., on behalf of Let Freedom Ring, shows 81% of the American people (including 74% of Democrats) support Congress balancing their budget every year. In addition 66% of Americans favor capping federal spending at the historically average 18% of GDP.

“Of course, the best way to permanently reduce spending would be to enact a balanced-budget amendment to the Constitution requiring a supermajority in both houses of Congress to run an annual deficit, raise tax rates, or increase the debit ceiling.”

James A. Baker III, Ronald Reagan’s Secretary of the Treasury from 1985-1988