____

Red States vs. Blue States, Part I

I’ve written favorably about the pro-growth policies of low-tax states such as Texas, Florida, and Tennessee, while criticizing the anti-growth policies of high-tax states such as Illinois, California, and New York.

Does that mean we should conclude that “red states” are better than “blue states”? In this video for Prager University, Steve Moore says the answer is yes.

_

____

The most persuasive part of the video is the data on people “voting with their feet” against the blue states.

There’s lots of data showing a clear relationship between the tax burden and migration patterns. Presumably for two reasons:

People don’t like being overtaxed and thus move from high-tax states to low-tax states.

People don’t like being overtaxed and thus move from high-tax states to low-tax states.- More jobs are created in low-tax states, and people move for those employment opportunities.

There’s a debate about whether people also move because they want better weather.

I’m sure that’s somewhat true, but Steve points out in the video that California has the nation’s best climate yet also is losing taxpayers to other states.

Since we’re discussing red states vs blue states, let’s look at some excerpts from a column by Nihal Krishan of the Washington Examiner.

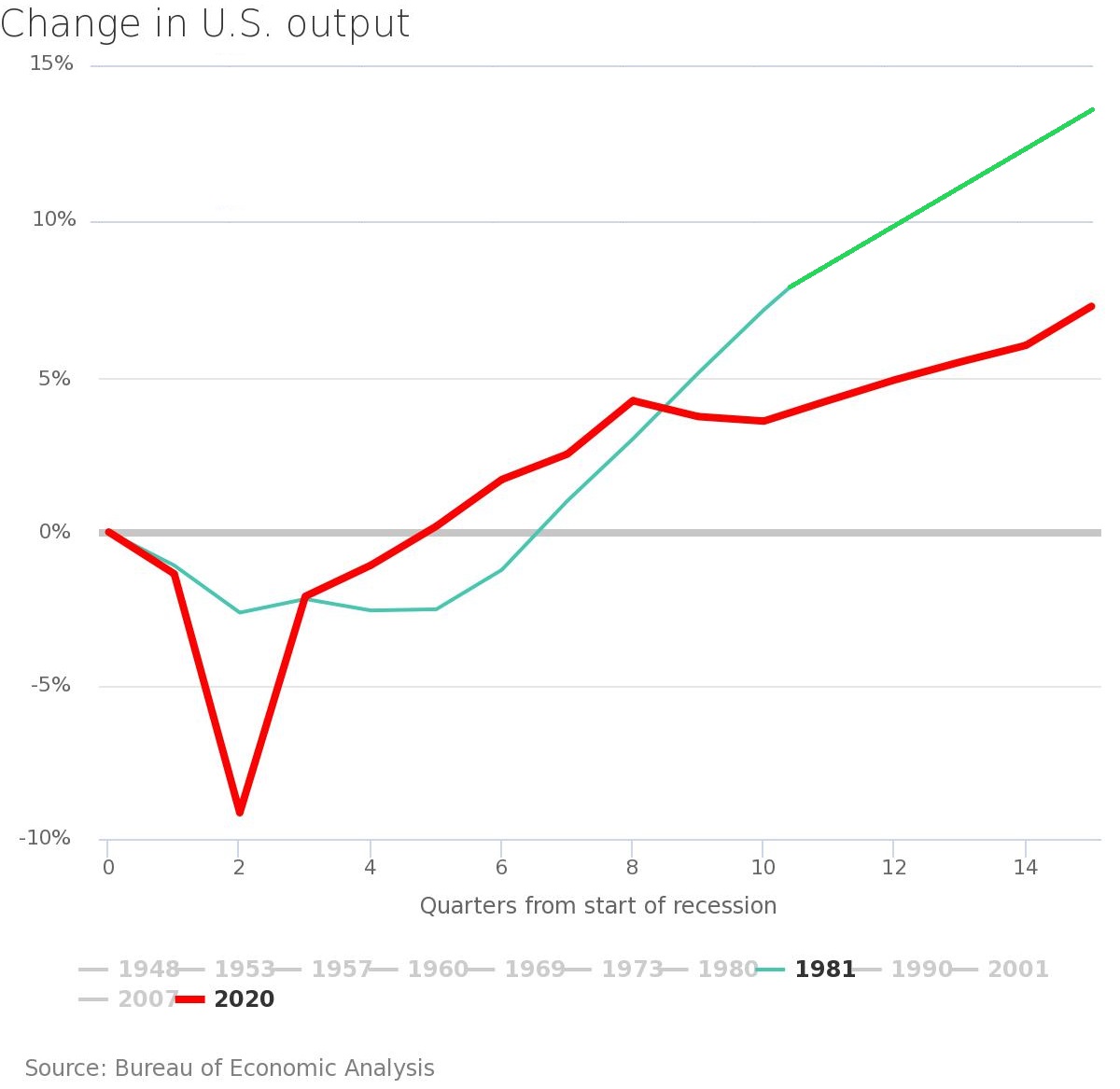

States run by Republican governors on average have economically outperformed states run by Democratic governors in recent months. …Overall, Democratic-run states, particularly those in the Northeast and Midwest, had larger contractions in gross domestic product than Republican-run states in the Plains and the South,

according to the latest state GDP data for the second quarter of 2020, released by the Commerce Department on Friday. Of the 20 states with the smallest decrease in state GDP, 13 were run by Republican governors, while the bottom 25 states with the highest decrease in state GDP were predominantly Democratic-run states. …Republican-controlled Utah had the second-lowest unemployment rate in the country in August at 4.1%, and the second-lowest GDP drop, at just over 18% in the second quarter. Nevada, run by Democrats, had the highest unemployment rate, at 13.2%. It was closely followed by Democratic-run Rhode Island, 12.8%, and New York, 12.5%.

Krishan notes that this short-run data is heavily impacted by the coronavirus and the shutdown policies adopted by various states, so it presumably doesn’t tell us much about the overall quality (or lack thereof) of economic policy.

I wrote about some multi-year data last year (before coronavirus was a problem) and found that low-tax states were creating jobs at a significantly faster rate than high-tax states.

I wrote about some multi-year data last year (before coronavirus was a problem) and found that low-tax states were creating jobs at a significantly faster rate than high-tax states.

But even that data only covered a bit more than three years.

I prefer policy comparisons over a longer period of time since that presumably removes randomness. Indeed, when comparing California, Texas, and Kansasa few years ago, I pointed out how a five-year set of data can yield different results (and presumably less-robust and less-accurate results) than a fifteen-year set of data.

P.S. What would be best is if we had several decades of data that could be matched with rigorous long-run measures of economic freedom in various states – similar to the data I use for my convergence/divergence articles that compare nations. Sadly, we have the former, but don’t have the latter (there are very good measures of economic freedom in the various states today, but we don’t have good historical estimates).

Lessons from the Texas Budget

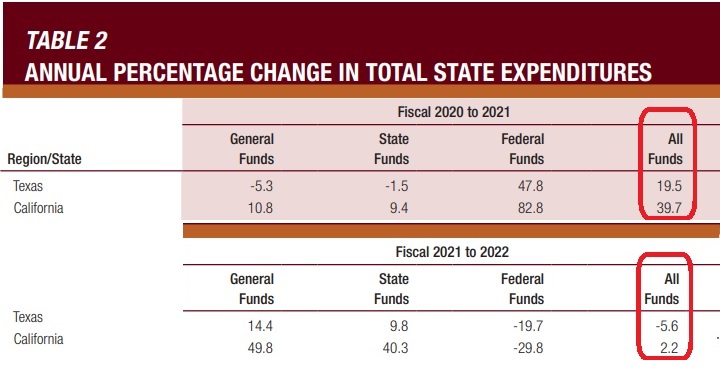

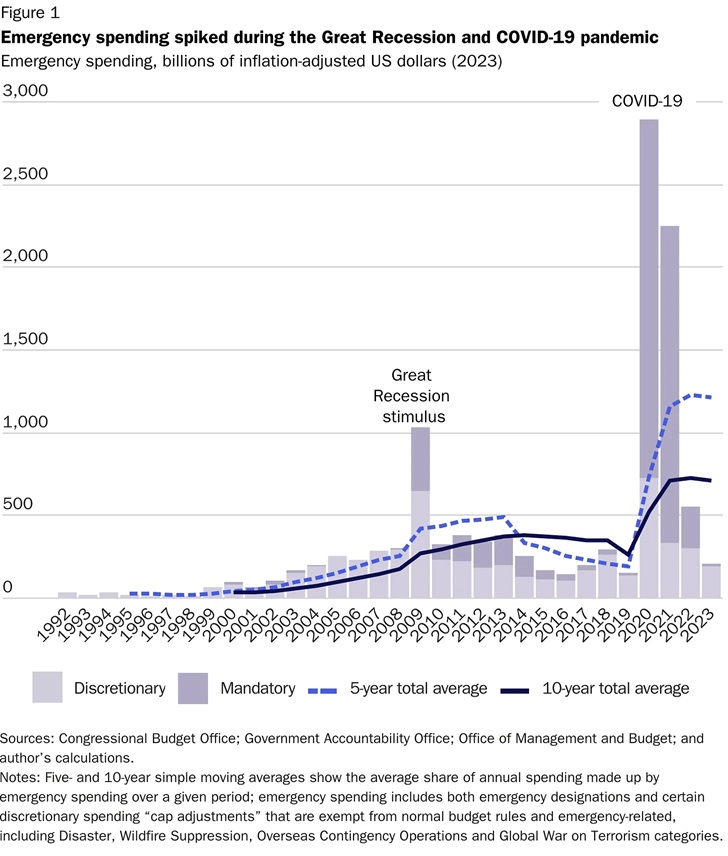

I shared some data last month from the National Association of State Budget Officers to show that Texas lawmakers have been more fiscally responsible than California lawmakers over the past couple of years.

California politicians were more profligate in 2021 when politicians in Washington were sending lots of money to states because of the pandemic.

California politicians were more profligate in 2021 when politicians in Washington were sending lots of money to states because of the pandemic.

And California politicians also increased spending faster in 2022 when conditions (sort of) returned to normal.

These results are not a surprise given California’s reputation for profligacy.

What may be a surprise, however, is that (relative) frugality in Texas has only existed for a handful of years. Here are some excerpts from a report written for the Texas Public Policy Foundation by Vance Ginn and Daniel Sánchez-Piñol.

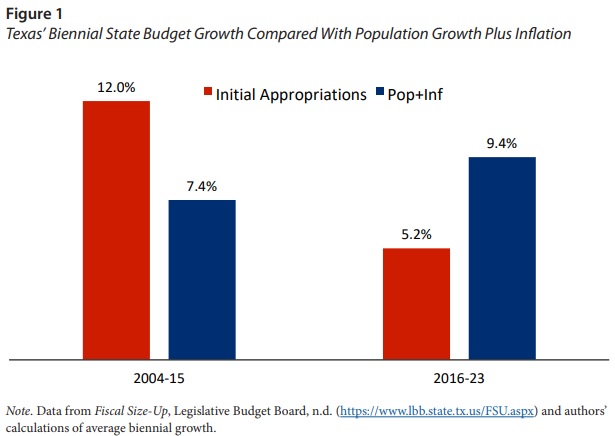

Over the last two decades, Texas’ total state biennial budget growth has had two different phases. The first phase had budget growth above the rate of population growth plus inflation for five of the six budgets from 2004–05 to 2014–15. The second phase…had budget growth below this rate… Figure 1 shows the average biennial growth rates for the six state budgets passed before 2015 and for the four since then.

The average biennial budget growth rate in the former period was 12% compared with the rate of population growth plus inflation of 7.4%. In the latter period, the average biennial growth rate of the budget was cut by more than half to 5.2%, which was well below the estimated rate of population growth plus inflation of 9.4%. This improved budget picture must be maintained to correct for the excessive budget growth in the earlier period. …there could be a $27 billion GR surplus at the end of the current 2022–23 biennium. …the priority should be to effectively limit or, even better, freeze the state budget. Texas should use most, if not all, of the resulting surplus to reduce…property tax collections…these taxes could be cut substantially by restraining spending and using the surplus to reduce school district M&O property taxes to ultimately eliminate them over time.

The article has this chart, which is a good illustration of the shift to fiscal restraint in Texas.

For all intents and purposes, Texas in 2016 started abiding by fiscal policy’s Golden Rule.

And this means the burden of government is slowly but surely shrinking compared to the private sector.

That approach is paying big dividends. Spending restraint means there is now a big budget surplus, which is enabling a discussion of how to reduce property taxes (Texas has no income tax).

P.S. I shared data back in 2020 looking at the fiscal performance of Texas and Florida compared to New York and California.

Texas vs. California, Part VII

To begin the seventh edition of our series comparing policy in Texas and California (previous entries in March 2010, February 2013, April 2013, October 2018, June 2019, and December 2020), here’s a video from Prager University.

There will be a lot of information in today’s column, so if you’re pressed for time, here are three sentences that tell you what you need to know.

California has all sorts of natural advantages over Texas, especially endless sunshine and beautiful topography.

California has all sorts of natural advantages over Texas, especially endless sunshine and beautiful topography.

Texas has better government policy than California, most notably in areas such as taxation and regulation.

Since people are moving from the Golden State to the Lone Star State, public policy seems to matter more than natural beauty.

Now let’s look at a bunch of evidence to support those three sentences.

We’ll start with an article by Joel Kotkin of Chapman University.

If one were to explore the most blessed places on earth, California, my home for a half century, would surely be up there. …its salubrious climate, spectacular scenery, vast natural resources… President Biden recently suggested that he wants to “make America California again”. Yet…he should consider whether the California model may be better seen as a cautionary tale than a roadmap to a better future…

California now suffers the highest cost-adjusted poverty rate in the country, and the widest gap between middle and upper-middle income earners. …the state has slowly morphed into a low wage economy. Over the past decade, 80% of the state’s jobs have paid under the median wage — half of which are paid less than $40,000…minorities do better today outside of California, enjoying far higher adjusted incomes and rates of homeownership in places like Atlanta and Dallas than in San Francisco and Los Angeles. Almost one-third of Hispanics, the state’s largest ethnic group, subsist below the poverty line, compared with 21% outside the state. …progressive…policies have not brought about greater racial harmony, enhanced upward mobility and widely based economic growth.

Next we have some business news from the San Francisco Chronicle.

Business leaders fear tech giant Oracle’s recent announcement that it is leaving the Bay Area for Austin, Texas, will lead to more exits unless some fundamental political and economic changes are made to keep the region attractive and competitive. “This is something that we have been warning people about for several years. California is not business friendly, we should be honest about it,” said Kenneth Rosen, chairman of the UC Berkeley Fisher Center for Real Estate and Urban Economics.

Bay Area Council President Jim Wunderman said… “From consulting companies to tax lawyers to bankers and commercial real estate firms, every person I talk with who provides services to big Bay Area corporations are telling me that their clients are strategizing about leaving…” Charles Schwab, McKesson and Hewlett Packard Enterprise have all exited the high-cost, high-tax, high-regulation Bay Area for a less-expensive, less-regulated and business-friendlier political climate. All of them rode off to Texas. …the pace of the departures appears to be increasing. …A recent online survey of 2,325 California residents, taken between Nov. 4 and Nov. 23 by the Public Policy Institute of California, found 26% of residents have seriously considered moving out of state and that 58% say that the American Dream is harder to achieve in California than elsewhere.

Are California politicians trying to make things better, in hopes of stopping out-migration to places such as Texas?

Not according to this column by Hank Adler in the Wall Street Journal.

California’s Legislature is considering a wealth tax on residents, part-year residents, and any person who spends more than 60 days inside the state’s borders in a single year. Even those who move out of state would continue to be subject to the tax for a decade… Assembly Bill 2088 proposes calculating the wealth tax based on current world-wide net worth each Dec. 31. For part-year and temporary residents, the tax would be proportionate based on their number of days in California.

The annual tax would be on current net worth and therefore would include wealth earned, inherited or obtained through gifts or estates long before and long after leaving the state. …The authors of the bill estimate the wealth tax will provide Sacramento $7.5 billion in additional revenue every year. Another proposal—to increase the top state income-tax rate to 16.8%—would annually raise another $6.8 billion. Today, California’s wealthiest 1% pay approximately 46% of total state income taxes. …the Legislature looks to the wealthiest Californians to fill funding gaps without considering the constitutionality of the proposals and the ability of people and companies to pick up and leave the state, which news reports suggest they are doing in large numbers. …As of this moment, there are no police roadblocks on the freeways trying to keep moving trucks from leaving California. If A.B. 2088 becomes law, the state may need to consider placing some.

The late (and great) Walter Williams actually joked back in 2012that California might set up East German-style border checkpoints. Let’s hope satire doesn’t become reality.

But what isn’t satire is that people are fleeing the state (along with other poorly governed jurisdictions).

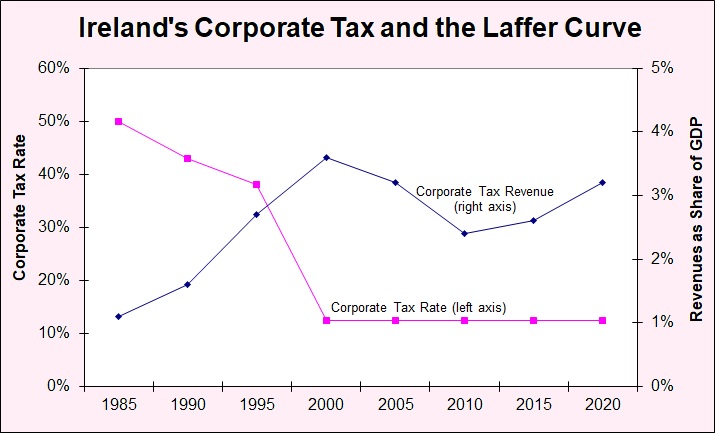

Simply state, the blue state model of high taxes and big government is not working (just as it isn’t working in countries with high taxes and big government).

Interestingly, even the New York Times recognizes that there is a problem in the state that used to be a role model for folks on the left.

Opining for that outlet at the start of the month, Brett Stephens raised concerns about the Golden State.

…today’s Democratic leaders might look to the very Democratic state of California as a model for America’s future. You remember California:

People used to want to move there, start businesses, raise families, live their American dream. These days, not so much. Between July 2019 and July 2020, more people — 135,400 to be precise — left the state than moved in… No. 1 destination: Texas, followed by Arizona, Nevada and Washington. Three of those states have no state income tax.

California, by contrast, has very high taxes. Not just an onerous income tax, but high taxes across the board.

Californians also pay some of the nation’s highest sales tax rates (8.66 percent) and corporate tax rates (8.84 percent), as well as the highest taxes on gasoline (63 cents on a gallon as of January, as compared with 20 cents in Texas).

Sadly, these high taxes don’t translate into good services from government.

The state ranks 21st in the country in terms of spending per public school pupil, but 27th in its K-12 educational outcomes. It ties Oregon for third place among states in terms of its per capita homeless rate. Infrastructure? As of 2019, the state had an estimated $70 billion in deferred maintenance backlog. Debt? The state’s unfunded pension liabilities in 2019 ran north of $1.1 trillion, …or $81,300 per household.

Makes you wonder whether the rest of the nation should copy that model?

Democrats hold both U.S. Senate seats, 42 of its 53 seats in the House, have lopsided majorities in the State Assembly and Senate, run nearly every big city and have controlled the governor’s mansion for a decade. If ever there was a perfect laboratory for liberal governance, this is it. So how do you explain these results? …If California is a vision of the sort of future the Biden administration wants for Americans, expect Americans to demur.

Some might be tempted to dismiss Stephens’ column because he is considered the token conservative at the New York Times.

But Ezra Klein also acknowledges that California has a problem, and nobody will accuse him of being on the right side of the spectrum.

Here’s some of what he wrote in his column earlier this month for the New York Times.

I love California. I was born and raised in Orange County. I was educated in the state’s public schools and graduated from the University of California system… But for that very reason, our failures of governance worry me. California has the highest poverty rate in the nation,

when you factor in housing costs, and vies for the top spot in income inequality, too. …but there’s a reason 130,000 more people leave than enter each year. California is dominated by Democrats, but many of the people Democrats claim to care about most can’t afford to live there. …California, as the biggest state in the nation, and one where Democrats hold total control of the government, carries a special burden. If progressivism cannot work here, why should the country believe it can work anywhere else?

Kudos to Klein for admitting problems on his side (just like I praise the few GOPers who criticized Trump’s big-government policies).

But his column definitely had some quirky parts, such as when he wrote that, “There are bright spots in recent years…a deeply progressive plan to tax the wealthy.”

That’s actually a big reason for the state’s decline, not a “bright spot.”

I’m not the only one to recognize the limitations of his column.

Kevin Williamson wrote an entire rebuttal for National Review.

Who but Ezra Klein could survey the wreck left-wing Democrats have made of California and conclude that the state’s problem is its excessive conservatism? …Klein the rhetorician anticipates objections on this front and writes that he is not speaking of “the political conservatism that privatizes Medicare, but the temperamental conservatism that” — see if this formulation sounds at all familiar — “stands athwart change and yells ‘Stop!’”

…California progressives have progressive policies and progressive power, and they like it that way. That is the substance of their conservatism. …Klein and others of his ilk like to present themselves as dispassionate pragmatists, enlightened empiricists who only want to do “what works.” …Klein mocks San Francisco for renaming schools (Begone, Abraham Lincoln!) while it has no plan to reopen them, but he cannot quite see that these are two aspects of a single phenomenon. …Klein…must eventually understand that the troubles he identifies in California are baked into the progressive cake. …That has real-world consequences, currently on display in California to such a spectacular degree that even Ezra Klein is able dimly to perceive them. Maybe he’ll learn something.

I especially appreciate this passage since it excoriates rich leftists for putting teacher unions ahead of disadvantaged children.

Intentions do not matter very much, and mere stated intentions matter even less. Klein is blind to that, which is why he is able to write, as though there were something unusual on display: “For all the city’s vaunted progressivism, [San Francisco] has some of the highest private school enrollment numbers in the country.” Rich progressives have always been in favor of school choice and private schools — for themselves. They only oppose choice for poor people, whose interests must for political reasons be subordinated to those of the public-sector unions from which Democrats in cities such as San Francisco derive their power.

Let’s conclude with some levity.

Here’s a meme that contemplates whether California emigrants bring bad voting habits with them.

Though that’s apparently more of a problem in Colorado rather than in Texas.

And here’s some clever humor from Genesius Times.

P.S. My favorite California-themed humor (not counting the state’s elected officials) can be found here, here, here, here, and here.

High-tax states are languishing but zero-income-tax states such as Texas are growing rapidly!!!!

Texas Is Booming…but CNN Doesn’t Want You to Know Why

September 30, 2014 by Dan Mitchell

Much of my writing is focused on the real-world impact of government policy, and this is why I repeatedly look at the relative economic performance of big government jurisdictions and small government jurisdictions.

But I don’t just highlight differences between nations. Yes, it’s educational to look at North Korea vs. South Korea or Chile vs. Venezuela vs. Argentina, but I also think you can learn a lot by looking at what’s happening with different states in America.

So we’ve looked at high-tax states that are languishing, such as California and Illinois, and compared them to zero-income-tax states such as Texas.

With this in mind, you can understand that I was intrigued to see that even the establishment media is noticing that Texas is out-pacing the rest of the nation.

Here are some excerpts from a report by CNN Money on rapid population growth in Texas.

More Americans moved to Texas in recent years than any other state: A net gain of more than 387,000 in the latest Census for 2013. …Five Texas cities — Austin, Houston, San Antonio, Dallas and Fort Worth — were among the top 20 fastest growing large metro areas. Some smaller Texas metro areas grew even faster. In oil-rich Odessa, the population grew 3.3% and nearby Midland recorded a 3% gain.

But why is the population growing?

Well, CNN Money points out that low housing prices and jobs are big reasons.

And on the issue of housing, the article does acknowledge the role of “easy regulations” that enable new home construction.

But on the topic of jobs, the piece contains some good data on employment growth, but no mention of policy.

Jobs is the No. 1 reason for population moves, with affordable housing a close second. …Jobs are plentiful in Austin, where the unemployment rate is just 4.6%. Moody’s Analytics projects job growth to average 4% a year through 2015. Just as important, many jobs there are well paid: The median income of more than $75,000 is nearly 20% higher than the national median.

That’s it. Read the entire article if you don’t believe me, but the reporter was able to write a complete article about the booming economy in Texas without mentioning – not even once – that there’s no state income tax.

But that wasn’t the only omission.

The article doesn’t mention that Texas is the 4th-best state in the Tax Foundation’s ranking of state and local tax burdens.

The article doesn’t mention that Texas was the least oppressive state in the Texas Public Policy Foundation’s Soft Tyranny Index.

The article doesn’t mention that Texas was ranked #20 in a study of the overall fiscal condition of the 50 states.

The article doesn’t mention that Texas is in 4th place in a combined ranking of economic freedom in U.S. state and Canadian provinces.

The article doesn’t mention that Texas was ranked #11 in the Tax Foundation’s State Business Tax Climate Index.

The article doesn’t mention that Texas is in 14th place in the Mercatus ranking of overall freedom for the 50 states (and in 10th place for fiscal freedom).

By the way, I’m not trying to argue that Texas is the best state.

Indeed, it only got the top ranking in one of the measures cited above.

My point, instead, is simply to note that it takes willful blindness to write about the strong population growth and job performance of Texas without making at least a passing reference to the fact that it is a low-tax, pro-market state.

At least compared to other states. And especially compared to the high-tax states that are stagnating.

Such as California, as illustrated by this data and this data, as well as this Lisa Benson cartoon.

Such as Illinois, as illustrated by this data and this Eric Allie cartoon.

And I can’t resist adding this Steve Breen cartoon, if for no other reason that it reminds me of another one of his cartoons that I shared last year.

Speaking of humor, this Chuck Asay cartoon speculates on how future archaeologists will view California. And this joke about Texas, California, and a coyote is among my most-viewed blog posts.

All jokes aside, I want to reiterate what I wrote above. Texas is far from perfect. There’s too much government in the Lone Star state. It’s only a success story when compared to California.

P.S. Paul Krugman has tried to defend California, which has made him an easy target. I debunked him earlier this year, and I also linked to a superb Kevin Williamson takedown of Krugman at the bottom of this post.

P.P.S. Once again, I repeat the two-part challenge I’ve issued to the left. I’ll be happy if any statists can successfully respond to just one of the two questions I posed.

Related posts:

California is the Greece of the USA, but Texas is not perfect either!!!

California is the Greece of the USA, but Texas is not perfect either!!! Just Because California Is Terrible, that Doesn’t Mean Texas Is Perfect January 21, 2013 by Dan Mitchell Texas is in much better shape than California. Taxes are lower, in part because Texas has no state income tax. No wonder the Lone Star State […]

Dan Mitchell on Texas v. California (includes editorial cartoon)

We should lower federal taxes because jobs are going to states like Texas that have low taxes. (We should lower state taxes too!!) What Can We Learn by Comparing the Employment Situation in Texas vs. California? April 3, 2013 by Dan Mitchell One of the great things about federalism, above and beyond the fact that it […]

Ark Times blogger claims California is better than Texas but facts don’t bear that out (3 great political cartoons)

I got on the Arkansas Times Blog and noticed that a person on there was bragging about the high minimum wage law in San Francisco and how everything was going so well there. On 2-15-13 on the Arkansas Times Blog I posted: Couldn’t be better (the person using the username “Couldn’t be better) is bragging […]

California burdensome government causing some of business community to leave for Texas

Does Government Have a Revenue or Spending Problem? People say the government has a debt problem. Debt is caused by deficits, which is the difference between what the government collects in tax revenue and the amount of government spending. Every time the government runs a deficit, the government debt increases. So what’s to blame: too […]

Arkansas Times blogger picks California business environment over Texas, proves liberals don’t live in real world(Part 2)

Former California Governor Arnold Schwarzenegger with his family I posted a portion of an article by John Fund of the Wall Street Journal that pointed out that many businesses are leaving California because of all of their government red tape and moving to Texas. My username is SalineRepublican and this is […]

John Fund’s talk in Little Rock 4-27-11(Part 4):Responding to liberals who criticize states like Texas that don’t have the red tape that California has

John Fund at Chamber Day, Part 1 Last week I got to attend the first ever “Conservative Lunch Series” presented by KARN and Americans for Prosperity Foundation at the Little Rock Hilton on University Avenue. This monthly luncheon will be held the fourth Wednesday of every month. The speaker for today’s luncheon was John Fund. John […]

California and France have raised taxes so much that it has hurt economic growth!!!

___________ California and France have raised taxes so much that it has hurt economic growth!!! Mirror, Mirror, on the Wall, which Nation and State Punish Success Most of All? September 25, 2014 by Dan Mitchell I’ve shared some interested rankings on tax policy, including a map from the Tax Foundation showing which states have the earliest […]

Jerry Brown raised taxes in California and a rise in the minimum wage, but it won’t work like Krugman thinks!!!

___________ Jerry Brown raised taxes in California and a rise in the minimum wage, but it won’t work like Krugman thinks!!!! This cartoon below shows what will eventually happen to California and any other state that keeps raising taxes higher and higher. Krugman’s “Gotcha” Moment Leaves Something to Be Desired July 25, 2014 by […]

Open letter to President Obama (Part 573) Are the states of Illinois and California going to join Detroit in Bankruptcy one day?

Open letter to President Obama (Part 573) (Emailed to White House on 7-29-13.) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get […]

Open letter to President Obama (Part 561) We should lower federal taxes because jobs are going to states like Texas that have low taxes

Open letter to President Obama (Part 561) (Emailed to White House on 6-25-13.) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get […]

We live in a world that, for the most part, has no absolute standard for life and behavior. We are under a system of morality by majority vote—in other words, whatever feels right sets the standard for behavior.

We live in a world that, for the most part, has no absolute standard for life and behavior. We are under a system of morality by majority vote—in other words, whatever feels right sets the standard for behavior.