–

The Unavoidable Choice: Entitlement Reform or Massive Middle-Class Tax Increases

I worry about big tax increases because of America’s grim long-run fiscal outlook.

The video clip is less than two minutes (taken from this longer discussion with Fergus Hodgson), but I can summarize my key point in just one very important sentence

Anybody who opposes entitlement reform is unavoidably in favor of big tax increases on lower-income and middle-class Americans.

There are three reasons for this bold (and bolded) statement.

- The burden of spending in the United States is going to dramatically expand in coming decades because of demographic change combined with poorly designed entitlement programs.

- There presumably is a limit to how much of this future spending burden can be financed by borrowing from the private sector (or with printing money by the Federal Reserve).

- Many politicians claim that future spending on entitlements (as well spending on new entitlements!) can be financed with class-warfare taxes, but there are not enough rich people.

My left-leaning friends almost surely would agree with the first two points. But some of them (particularly the ones who don’t understand budget numbers) might argue with the third point.

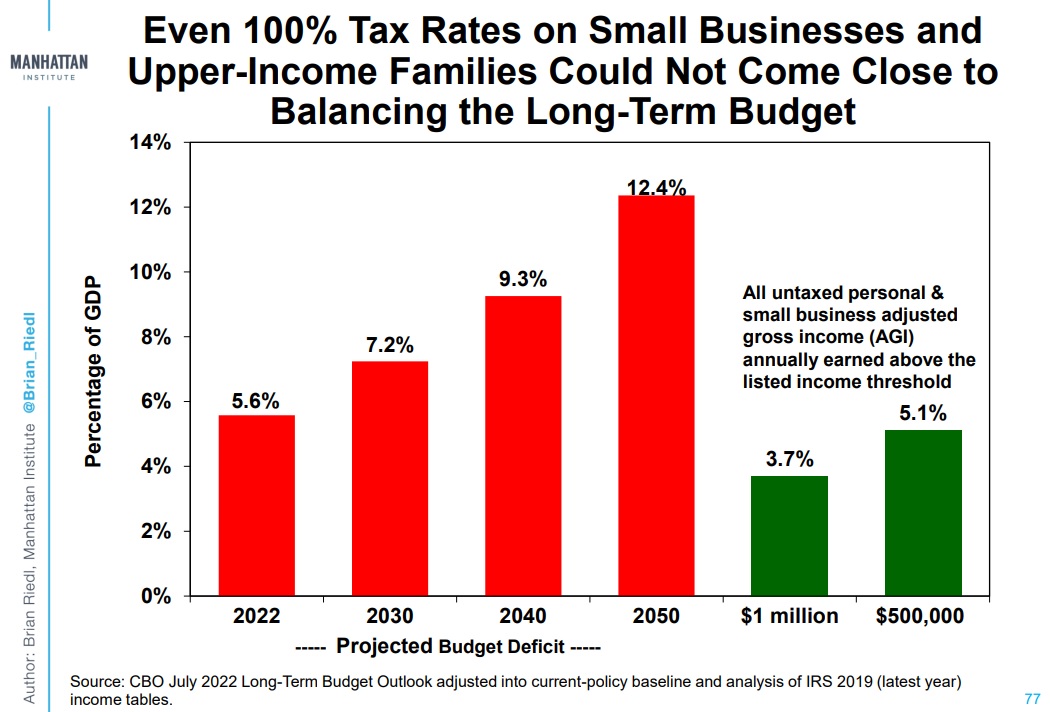

To confirm the accuracy of the argument, let’s look at this chart from Brian Riedl’s famous Chartbook.

As you can see, even confiscatory 100-percent taxes on the rich (which obviously would cripple the economy) would not be nearly enough to eliminate America’s medium-term fiscal gap.

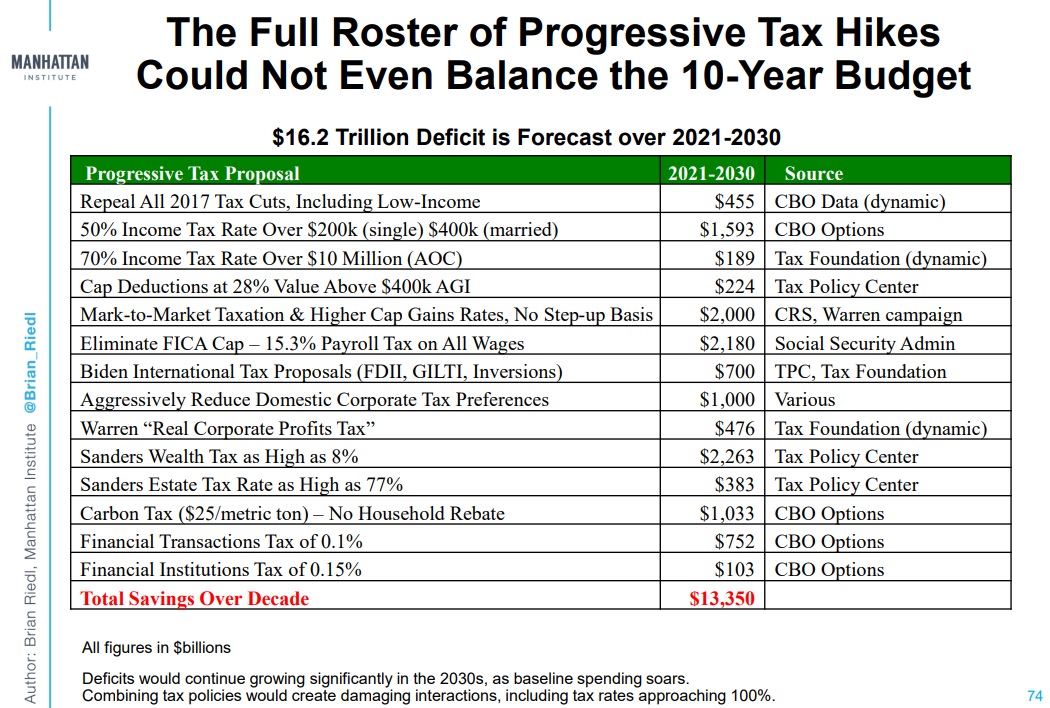

Heck, even if we look at just the next 10 years and include every possible tax hike, it’s obvious that a class-warfare agenda (which also would have negative economic effects) would not be enough to finance all the spending that is currently in the pipeline.

Here’s another Riedl chart (which even includes some proposals that would hit the middle class).

I’ll conclude with two further observations.

- First, there are plenty of honest leftists (the ones who understand budget numbers,

including Paul Krugman) who openly admit that big tax increases will be needed if the burden of government spending is allowed to increase.

including Paul Krugman) who openly admit that big tax increases will be needed if the burden of government spending is allowed to increase. - Second, there are plenty of disingenuous (or perhaps naive) folks on the right who oppose entitlement reform while not admitting that their approach means massive tax increases on lower-income and middle-class taxpayers.

Needless to say, genuine entitlement reform would be far preferable to any type of tax increase.

P.S. In the absence of entitlement reform, politicians will first choose class warfare taxes, of course, but that simply will be a precursor to higher taxes on the rest of us.

P.P.S. The bottom line is that you can’t have European-sized government without European-style taxes. Including a money-siphoning value-added tax.

If our country is the grow the economy and get our budget balanced it will not be by raising taxes!!! The recipe for success was followed by Ronald Reagan in the 1980’s when he cut taxes and limited spending. As far as limiting spending goes only Bill Clinton (with his Republican Congress) were ability to control the growth of government better than Reagan.

I had the pleasure of hearing Arthur Laffer speak in 1981 and he predicted all the economic growth that we would see because of the Reagan tax cuts and he was right. Unfortunately in California today they have forgotten all of those lessons!!!

California Is the Canary in the Class-Warfare Coal Mine

May 14, 2012 by Dan Mitchell

President Obama’s fiscal policy is a dismal mixture. On spending, he wants a European-style welfare state. On taxes, he is fixated on class-warfare tax policy.

If we want to know the consequences of that approach, we can look at the ongoing collapse of Greece. Or, if we don’t like overseas examples, we can look at California.

If the (formerly) Golden State is any example, it turns out that having high tax rates doesn’t necessarily translate into high tax revenues. Here’s a blurb from an editorial in today’s Wall Street Journal.

California Controller John Chiang reported last week that April tax collections were a gigantic 20.2%, or $2.44 billion, below 2012-13 budget projections. …Among the biggest surprises is a 21.5% or nearly $2 billion decline in personal income tax payments from what Governor Jerry Brown had anticipated. This reinforces the point that when states rely too heavily on the top 1% of taxpayers to pay the bills, fiscal policy is a roller coaster ride. California is suffering this tax drought even as most other states enjoy a revenue rebound. State tax collections were up nationally by 8.9% last year, according to the Census Bureau, and this year revenues are up by double digits in many states. The state comptroller reports that Texas is enjoying 10.9% growth in its sales taxes (it has no income tax), while California can’t seem to keep up despite one of the highest tax rates in the land.

The WSJ editorial suggests a supply-side response, but you won’t be surprised to learn that the state’s kleptomaniac governor is pushing an Obama-style soak-the-rich tax hike.

This would seem to suggest that California should try cutting tax rates to keep more people and business in the state, but Sacramento is intent on raising them again. Governor Brown and the public-employee unions are sponsoring a ballot initiative in November to raise the state sales tax by a quarter point to 7.5% and to raise the top marginal income-tax rate to 13.3% from 10.3%. This will make the state even more reliant on the fickle revenue streams provided by the rich. Meanwhile, an analysis by Joseph Vranich, who studies migration of businesses from one state to another, finds that since 2009 the flight of businesses out of California “has increased fivefold due to high taxes and regulatory costs.”

I’ll be very curious to see what happens this November when the people of California vote in the referendum. Will they be like the morons in Oregon, who approved a class-warfare tax hike? Or will they be like the voters of Switzerland and reject class warfare?

Sadly, I suspect Oregon will be their role model – even though that decision hurt the Beaver State’s economy.

But while voters can impose higher taxes, they can’t repeal the laws of economics. So if California voters do the wrong thing, they will learn a hard lesson about the Laffer Curve.

And then, as this cartoon demonstrates, they’ll learn the ultimate lesson about not biting the hand that you mooch from.

The Laffer Curve, Part III: Dynamic Scoring