Remarks at a Rally Supporting the Proposed Constitutional Amendment for a Balanced Federal Budget

For more information on the ongoing works of President Reagan’s Foundation, please visit http://www.reaganfoundation.org

Time for a Constitutional Convention?

Yesterday’s column was about the referendum for a new leftist constitution in Chile.

Fortunately, Chilean voters overwhelmingly rejected that awful plan (a surprisingly positive outcome since those same voters were foolish enough to vote for a leftist president last December).

Today, we’re going to look at potential constitutional changes in the United States. But our focus won’t be on how the Constitution should (or should not) be changed, but rather on the process.

Why? Because there’s a serious effort for a constitutional convention, similar to the meeting back in 1787 (though it’s unclear whether we have people like James Madison and Alexander Hamiltontoday).

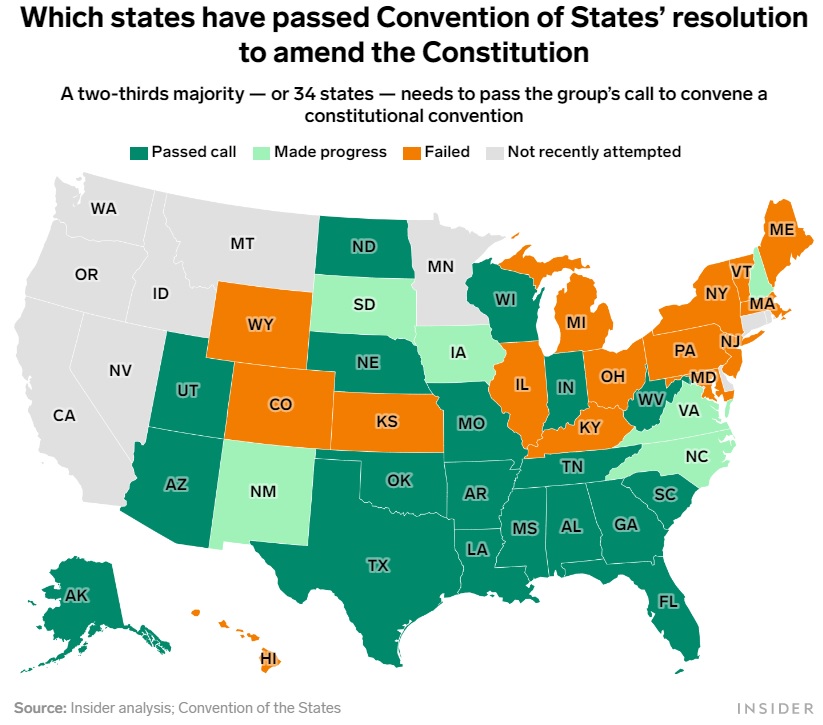

This is something that is allowed by the Constitution, so long as it has support from 34 states. Here’s a map showing what’s happened to date.

The map comes from an article that Grace Panetta and Brent Griffiths wrote for Business Insider.

They have a good description of how the process works.

Article V to the US Constitution provides two ways to amend the nation’s organizing document… The first is for a two-thirds majority of Congress to propose an amendment, with three-fourths of states ratifying it.

This is how all 27 of the current amendments to the Constitution were added… The second method — never before accomplished — involves two-thirds of US states to call a convention. …two-thirds of the state legislatures are needed to call a convention and three-fourths must vote to ratify any amendments. …Conservatives and liberals alike say this requirement would doom hyperpartisan or plain loony amendments.

Conservatives are the main proponents of a constitutional convention.

The December 2021 ALEC meeting represents a flashpoint in a movement spearheaded by powerful conservative interests…to alter the nation’s bedrock legal text since 1788. It’s an effort that has largely taken place out of public view. But interviews with a dozen people involved in the constitutional convention movement, along with documents and audio recordings reviewed by Insider, reveal a sprawling, well-funded…and impassioned campaign taking root across multiple states. …Rob Natelson, a constitutional scholar and senior fellow at the Independence Institute who closely studies Article V of the Constitution, predicted to Insider there’s a 50% chance that the United States will witness a constitutional convention in the next five years.

Some folks on the left also like the idea.

The right isn’t alone in pursuing a convention. On the left, Cenk Uygur, a progressive commentator, founded Wolf PAC… Five Democratic states passed Wolf PAC’s call for a campaign finance reform-focused convention: California, New Jersey, Illinois, Vermont, and Rhode Island.

Now the issue is getting more attention.

Writing for the New York Times yesterday, Carl Hulse reports on the campaign for a new constitutional convention.

Elements on the right have for years been waging a quiet but concerted campaign to convene a gathering to consider changes to the Constitution. They hope to take advantage of a never-used aspect of Article V, which says in part that Congress, “on the application of the legislatures of two-thirds of the several states, shall call a convention for proposing amendments.”

…backers of the convention idea now hope to harness the power of Republican-controlled state legislatures to…strip away power from Washington and impose new fiscal restraints, at a minimum. …leading proponents of the convention idea come from the right and include representatives of the Tea Party movement, the Federalist Society, grass-roots right-wing activists… And some liberals have welcomed the idea of a convention as a way to modernize the Constitution and win changes in the makeup and power of the Supreme Court, ensure abortion rights, impose campaign finance limits and find ways to approach 21st-century problems such as climate change.

I have two comments regarding this effort.

First, much of the impetus comes from prudent people who are disturbed by the reckless profligacy in Washington. These folks are right to be concerned, but I have been telling them that they need to pursue a spending limit amendment (like the Swiss “Debt Brake” or Article 107 of Hong Kong’s Basic Law) rather than a balanced budget requirement.

Simply stated, spending caps work.

Second, I wonder whether any sort of constitutional change can get the necessary support from 3/4ths of the states. I doubt left-wing states like California, New Jersey, and Illinois would ratify a good amendment to control spending, just like right-wing states like Texas, South Dakota, and Utah presumably would reject a leftist amendment to do something like restrict political speech.

Maybe Colorado’s TABOR can be a role model.

_______________

Ronald Reagan was a firm believer in the Balanced Budget Amendment and Milton Friedman was a key advisor to Reagan. Friedman’s 1980 film series taught the lesson of restraining growth of the federal budget.

UHLER: A better balanced budget amendment

Vital changes needed to keep road to further reforms open

There is a problem brewing in the House of Representatives of which most conservatives in and outside Congress are largely unaware. It has to do with H.J. Res. 1 – the balanced budget amendment – soon to be voted on per the debt-ceiling “deal” struck by Congress and the president. While H.J. Res. 1 is a solid first effort – and we have urged support for it as a symbolic vote – it is possibly fatally flawed and should be revised.

After years of indifference to constitutional fiscal discipline, Congress is once again stirring. In 1982, then-President Ronald Reagan, convened a federal amendment drafting committee led by Milton Friedman, Jim Buchanan, Bill Niskanen, Walter Williams and many others, and fashioned Senate Joint Resolution 58, a tax limitation-balanced budget amendment, which garnered 67 votes in the Senate under the able leadership of Sen. Orrin G. Hatch, Utah Republican. After a successful discharge petition forced a House vote, the amendment failed to achieve the two-thirds vote necessary in a Tip O’Neill-Jim Wright-controlled House. In 1996, Newt Gingrich and company came within one vote of passing a fiscal amendment in the House.

Currently, H.J. Res. 1 is designed as a classic balanced budget amendment in which outlays can be as great as, but no more than, receipts for that year. However, it requires an estimate of receipts, which is notoriously faulty, and it does not necessarily produce surpluses with which to pay down our massive debt. Furthermore, it contains a second limit on outlays – “not more than 18 percent of the economic output of the United States” – without defining such output or resolving the inevitable conflict between the outlay calculations in the two provisions.

This could be fixed by restructuring the amendment as a spending or outlay limit based on prior year receipts or outlays (known numbers), adjusted only for inflation and population changes. This will produce surpluses in most years with which to pay down debts and will reduce government spending as a share of gross domestic product over time, right-sizing government and increasing the rate of economic growth for the benefit of all citizens, especially those least able to compete.

Section 4 of H.J. Res. 1 might best be described as a supreme example of the law of unintended consequences. This section imposes on the president a constitutional responsibility to present a balanced budget. Surely, the drafters were saying to themselves “We’ll fix that guy in the White House. Now he will have to fess up and either propose specific tax increases or specific spending cuts. He won’t be able to duck reality any longer.” The only problem is that this section is at odds with our Constitution in that it gives the president a constitutional power over fiscal matters never intended by the Founders.

For much of our history, the president did not propose a budget. In the Budget and Accounting Act of 1921, which established the Bureau of the Budget, now the Office of Management and Budget and the General Accounting Office, the president was statutorily authorized to propose a budget. Presidents have always shaped the budget and spending using their negotiating opportunities and veto pen. Wearing their chief administrator hat, earlier presidents sought to save money from the amounts appropriated by Congress, getting things done for less, impounding funds they did not think essential to spend. Congress‘ ceiling on an appropriation was not also the spending floor for the president, as it is now.

Section 4 appears to give the president co-equal power with Congress not only to present a budget but to shape it, in conflict with congressional budget authority. At a minimum, it is likely to create a conflict over the amount of allowed annual spending. The president surely will be guided by his own Office of Management and Budget, whose budget and receipts calculations will undoubtedly differ from the Congressional Budget Office’s numbers that will direct Congress. We should not start the budget process each year with this kind of conflict.

It would be better to restore the historic role of the president to impound and otherwise reduce expenditures by repealing and revising appropriate portions of the Congressional Budget and Impoundment Control Act of 1974 so a fiscally conservative president is a revitalized partner in cutting the size of government.

Section 5 requires a supermajority vote for “a bill to increase revenues.” Whether one agrees or disagrees with making tax increases more difficult, this language is troublesome because it requires some government bureaucrat or bureaucracy to make a calculation or estimate of the effect of tax law changes on revenues. Proponents of a bill to increase cash flow to the government will argue that their tax law changes are “revenue neutral” and will likely persuade the Joint Committee on Taxation or Congressional Budget Office to back them up. Once again, estimators would be in control.

If we ever expect to convert our income-based tax system to a consumption tax, better not to require a two-thirds vote as liberals will use such a supermajority voting rule to stymie tax system reform.

There are other issues, as well, with debt limit and national emergency supermajority votes and definitions. While this balanced budget amendment – H.J. Res. 1 – has deserved a “yes” vote as a demonstration of commitment to constitutional fiscal discipline, it can and must be revised before the showdown vote in the House this fall.

Lewis K. Uhler is president of the National Tax Limitation Committee.