—

The homepage of the Internal Revenue Service website seen on a computer screen through a magnifying glass. The Inflation Reduction Act would massively increase the funding and scope of the tax agency. (Photo: Rafael Henrique/SOPA Images/LightRocket/Getty Images)

In 2021, the IRS issued a report that described what the tax-collecting agency could do with nearly $80 billion in new funding, if only Congress would pass the American Families Plan. The Internal Revenue Service was making the case that the Biden administration’s plan to supercharge funding of the IRS would reap dividends for the federal government.

In a table in that report, the IRS shows that part of the “return on investment” for America would be that by 2031 the IRS could increase the size of its workforce by 86,852 full-time employees.

Last week, that estimate took on renewed significance when the Senate passed HR 5376, the bill called the Inflation Reduction Act but would be more aptly dubbed the IRS Reinforcements Act.

The Inflation Reduction Act includes the same nearly $80 billion in new funding for the IRS over nine years as the American Families Plan, which would increase the IRS’ annual spending by an estimated $14.6 billion by 2031. Since the IRS funding plan remains almost the same, the IRS’ estimate of adding roughly 87,000 full-time employees to its ranks should still be a reasonable approximation.

Unfortunately for the nation’s tax-collecting agency, the idea of adding 87,000 new IRS agents doesn’t appeal to most Americans.

The Senate passage of the Inflation Reduction Act has led many Americans to recount horror stories of IRS harassment. Others remember the political weaponization of the IRS by presidential administrations from Richard Nixon to Barack Obama, not to mention the agency’s still unexplained leak of a massive trove of taxpayer data just a year ago. That data leak was exploited for political purposes.

Now, the IRS and its allies are downplaying the size of the reinforcements they’re receiving, portraying the boost in IRS staffing as a moderate increase that will be largely offset by attrition and other factors.

In a Time fact check, a counselor for tax policy at the Treasury Department was quoted as saying: “There’s a big wave of attrition that’s coming and a lot of these resources are just about filling those positions.”

The Time article claimed that the IRS might net roughly 20,000 to 30,000 more employees from the funding. But this is not what the IRS report from last year said.

While the political calculus may have changed, the numbers haven’t.

The 24-page IRS report has only one rather obscure reference to attrition and that’s not in the context of hiring new agents.

Here’s how the IRS describes the expansion of its workforce: “Because the expansion in the IRS’s budget is phased in over a 10-year horizon, each year the IRS’s workforce should grow by no more than a manageable 15%.”

Notice, the IRS describes a growing workforce, and notice that is a rapid rate. If the IRS were to grow by 15% each year for nine years, that would mean a 252% increase in the size of the IRS’ current 81,836-person workforce. That would mean more than 206,000 more IRS employees than today.

That number is clearly unrealistically high, even for the large amount of funding the IRS would receive. But even if the agency grew at an annual rate of 8.4% for nine years—barely over half of the ceiling described by the IRS—the agency would surpass 87,000 new employees.

But was the IRS right? Is there enough funding in this bill for the agency to add 87,000 employees to its ranks? The numbers projected by the Congressional Budget Office suggest the 87,000 figure is very close.

The IRS spent roughly $13.7 billion in 2021 and had 81,600 employees, or about $167,900 per employee. If the IRS were to hire 87,000 additional employees at the same cost per employee, it would cost $14.6 billion, the same amount of funding that the government forecasters projected the IRS would spend in 2031.

So, yes, the IRS’ own estimate of an 87,000-person expansion of the IRS was solid.

One would hope that with millions more audits of American taxpayers coming, at least taxpayer services would improve. But that’s unlikely.

Only $3.2 billion would go to taxpayer services, despite the IRS answering only 18% of the phone calls it received in 2022. That’s a mere 9% increase for funding in things like account services, taxpayer education, and filing assistance.

The lion’s share of the new funding, $45.6 billion, will go to enforcement activities like new audits, litigation, asset monitoring, and collections.

And don’t be fooled by bogus claims that the middle class won’t be affected by the new audits. As Heritage Foundation senior research fellow Rachel Greszler explains, even a 3,000% increase in audit rates for taxpayers making more than $400,000 would fall well short of raising the new revenues being claimed in 2031.

So, if the Inflation Reduction Act passes the House of Representatives and is signed into law, get ready to dust off your copy of the 7,000-pagetax code and 14,000 pages of IRS regulations.

Have an opinion about this article? To sound off, please email letters@DailySignal.com and we’ll consider publishing your edited remarks in our regular “We Hear You” feature. Remember to include the url or headline of the article plus your name and town and/or state.

Laura Ingraham: We have now learned more about just how petty and venal Attorney General Merrick Garland is

Ingraham slams Garland or raiding Trump’s home

Laura Ingraham analyzed how the raid of former President Donald Trump’s home at Mar-a-Lago happened because of a document dispute even after Trump’s legal team voluntarily met with government investigators on “The Ingraham Angle.”

LAURA INGRAHAM: Just hours ago, we learned more about just how petty and venal Attorney General Merrick Garland is that he would send federal agents into the home of a former president and likely 2024 candidate over a document dispute. The Washington Post is reporting tonight that Monday’s raid came months after the Trump legal team voluntarily met with government investigators at Mar-a-Lago.

This was back in June. Now, the ostensible reason for the visit was the concern that some documents were retained by Trump when he left office rather than being turned in to the National Archives. Trump stopped by the meetings as it began to greet the investigators, but was not interviewed. The lawyer showed the federal officials the boxes, and DOJ officials spent some time looking through the material.

Attorney General Merrick Garland. (Photo by Drew Angerer/Getty Images)

According to Trump’s attorney, Christina Bobb, Justice Department officials commented that they did not believe the storage unit where these moving boxes were kept was properly secured. So Trump officials added a lock to the facility. Sounds reasonable. When the FBI agents searched the property on Monday, Bobb added, that they broke through the lock that had been added to the door. Of course, at the federal authorities‘ request, they broke their own lock. Keystone Cops here with DOJ credentials. This is absurd.

CLICK HERE TO GET THE FOX NEWS APP

WATCH FULL VIDEO HERE:

Open letter to President Obama (Part 644)

(Emailed to White House on 6-10-13.)

President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500

Dear Mr. President,

I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here.

The federal government debt is growing so much that it is endangering us because if things keep going like they are now we will not have any money left for the national defense because we are so far in debt as a nation. We have been spending so much on our welfare state through food stamps and other programs that I am worrying that many of our citizens are becoming more dependent on government and in many cases they are losing their incentive to work hard because of the welfare trap the government has put in place. Other nations in Europe have gone down this road and we see what mess this has gotten them in. People really are losing their faith in big government and they want more liberty back. It seems to me we have to get back to the founding principles that made our country great. We also need to realize that a big government will encourage waste and corruption. The recent scandals in our government have proved my point. In fact, the jokes you made at Ohio State about possibly auditing them are not so funny now that reality shows how the IRS was acting more like a monster out of control. Also raising taxes on the job creators is a very bad idea too. The Laffer Curve clearly demonstrates that when the tax rates are raised many individuals will move their investments to places where they will not get taxed as much.

______________________

We can fix the IRS problem by going to the flat tax and lowering the size of government.

Did President Obama and his team of Chicago cronies deliberately target the Tea Party in hopes of thwarting free speech and political participation?

Was this part of a campaign to win the 2012 election by suppressing Republican votes?

Perhaps, but I’ve warned that it’s never a good idea to assume top-down conspiracies when corruption, incompetence, politics, ideology, greed, and self-interest are better explanations for what happens in Washington.

Writing for the Washington Examiner, Tim Carney has a much more sober and realistic explanation of what happened at the IRS.

If you take a group of Democrats who are also unionized government employees, and put them in charge of policing political speech, it doesn’t matter how professional and well-intentioned they are. The result will be much like the debacle in the Cincinnati office of the IRS. …there’s no reason to even posit evil intent by the IRS officials who formulated, approved or executed the inappropriate guidelines for picking groups to scrutinize most closely. …The public servants figuring out which groups qualified for 501(c)4 “social welfare” non-profit status were mostly Democrats surrounded by mostly Democrats. …In the 2012 election, every donation traceable to this office went to President Obama or liberal Sen. Sherrod Brown. This is an environment where even those trying to be fair could develop a disproportionate distrust of the Tea Party. One IRS worker — a member of NTEU and contributor to its PAC, which gives 96 percent of its money to Democratic candidates — explained it this way: “The reason NTEU mostly supports Democratic candidates for office is because Democratic candidates are mostly more supportive of civil servants/government employees.”

Tim concludes with a wise observation.

As long as we have a civil service workforce that leans Left, and as long as we have an income tax system that requires the IRS to police political speech, conservative groups can always expect special IRS scrutiny.

And my colleague Doug Bandow, in an article for the American Spectator, adds his sage analysis.

The real issue is the expansive, expensive bureaucratic state and its inherent threat to any system of limited government, rule of law, and individual liberty. …the broader the government’s authority, the greater its need for revenue, the wider its enforcement power, the more expansive the bureaucracy’s discretion, the increasingly important the battle for political control, and the more bitter the partisan fight, the more likely government officials will abuse their positions, violate rules, laws, and Constitution, and sacrifice people’s liberties. The blame falls squarely on Congress, not the IRS.

I actually think he is letting the IRS off the hook too easily.

- It has thieving employees.

It has incompetent employees.

It has incompetent employees.- It has thuggish employees.

- It has brainless employees.

- It has protectionist employees.

- It has wasteful employees.

- And it has victimizing employees.

But Doug’s overall point obviously is true.

…the denizens of Capitol Hill also have created a tax code marked by outrageous complexity, special interest electioneering, and systematic social engineering. Legislators have intentionally created avenues for tax avoidance to win votes, and then complained about widespread tax avoidance to win votes.

So what’s the answer?

The most obvious response to the scandal — beyond punishing anyone who violated the law — is tax reform. Implement a flat tax and you’d still have an IRS, but the income tax would be less complex, there would be fewer “preferences” for the agency to police, and rates would be lower, leaving taxpayers with less incentive for aggressive tax avoidance. …Failing to address the broader underlying factors also would merely set the stage for a repeat performance in some form a few years hence. …More fundamentally, government, and especially the national government, should do less. Efficient social engineering may be slightly better than inefficient social engineering, but no social engineering would be far better.

Amen. Let’s rip out the internal revenue code and replace it with a simple and fair flat tax.

But here’s the challenge. We know the solution, but it will be almost impossible to implement good policy unless we figure out some way to restrain the spending side of the fiscal ledger.

___________________________

At the risk of over-simplifying, we will never get tax reform unless we figure out how to implement entitlement reform.

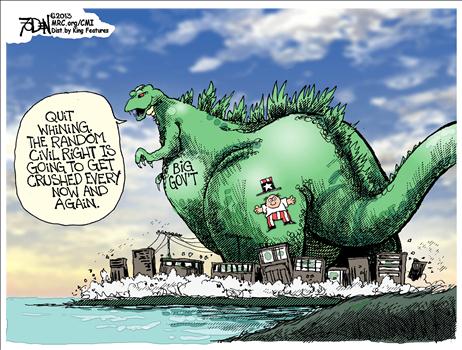

Here’s another Foden cartoon, which I like because it has the same theme asthis Jerry Holbert cartoon, showing big government as a destructive and malicious force.

_____________

Thank you so much for your time. I know how valuable it is. I also appreciate the fine family that you have and your commitment as a father and a husband.

Sincerely,

Everette Hatcher III, 13900 Cottontail Lane, Alexander, AR 72002, ph 501-920-5733, lowcostsqueegees@yahoo.com

Related Posts:

We know the IRS commissioner wasn’t telling the truth in March 2012, when he testified: “There’s absolutely no targeting.”

We know the IRS commissioner wasn’t telling the truth in March 2012, when he testified: “There’s absolutely no targeting.”However, Lois Lerner knew different when she misled people with those words. Two important points made by Noonan in the Wall Street Journal in the article below: First, only conservative groups were targeted in this scandal by […]

A great cartoonist takes on the IRS!!!!

Ohio Liberty Coalition versus the I.R.S. (Tom Zawistowski) Published on May 20, 2013 The Ohio Liberty Coalition was among tea party groups that received special scrutiny from the I.R.S. Tom Zawistowski says his story is not unique. He argues the kinds of questions the I.R.S. asked his group amounts to little more than “opposition research.” Video […]

“Schaeffer Sundays” Francis Schaeffer’s own words concerning what the First Amendment means

Francis Schaeffer: “Whatever Happened to the Human Race?” (Episode 2) SLAUGHTER OF THE INNOCENTS Published on Oct 6, 2012 by AdamMetropolis The 45 minute video above is from the film series created from Francis Schaeffer’s book “Whatever Happened to the Human Race?” with Dr. C. Everett Koop. This book really helped develop my political views concerning […]

Cartoonists show how stupid the IRS is acting!!!

We got to lower the size of government so we don’t have these abuses like this in the IRS. Cartoonists v. the IRS May 23, 2013 by Dan Mitchell Call me perverse, but I’m enjoying this IRS scandal. It’s good to see them suffer a tiny fraction of the agony they impose on the American people. I’ve already […]

Dear Senator Pryor, why not pass the Balanced Budget Amendment? (“Thirsty Thursday”, Open letter to Senator Pryor)

Dear Senator Pryor, Why not pass the Balanced Budget Amendment? As you know that federal deficit is at all time high (1.6 trillion deficit with revenues of 2.2 trillion and spending at 3.8 trillion). On my blog http://www.HaltingArkansasLiberalswithTruth.com I took you at your word and sent you over 100 emails with specific spending cut ideas. However, […]

Video from Cato Institute on IRS Scandal

Is the irs out of control? Here is the link from cato: MAY 22, 2013 8:47AM Can You Vague That Up for Me? By TREVOR BURRUS SHARE As the IRS scandal thickens, targeted groups are coming out to describe their ordeals in dealing with that most-reviled of government agencies. The Ohio Liberty Coalition was one of […]

IRS cartoons from Dan Mitchell’s blog

Get Ready to Be Reamed May 17, 2013 by Dan Mitchell With so many scandals percolating, there are lots of good cartoons being produced. But I think this Chip Bok gem deserves special praise. It manages to weave together both the costly Obamacare boondoggle with the reprehensible politicization of the IRS. So BOHICA, my friends. If […]

Obama jokes about audit of Ohio St by IRS then IRS scandal breaks!!!!!

You want to talk about irony then look at President Obama’s speech a few days ago when he joked about a potential audit of Ohio St by the IRS then a few days later the IRS scandal breaks!!!! The I.R.S. Abusing Americans Is Nothing New Published on May 15, 2013 The I.R.S. targeting of tea party […]

Dear Senator Pryor, why not pass the Balanced Budget Amendment? (“Thirsty Thursday”, Open letter to Senator Pryor)

Dear Senator Pryor, Why not pass the Balanced Budget Amendment? As you know that federal deficit is at all time high (1.6 trillion deficit with revenues of 2.2 trillion and spending at 3.8 trillion). On my blog http://www.HaltingArkansasLiberalswithTruth.com I took you at your word and sent you over 100 emails with specific spending cut ideas. However, […]

We could put in a flat tax and it would enable us to cut billions out of the IRS budget!!!!

We could put in a flat tax and it would enable us to cut billions out of the IRS budget!!!! May 14, 2013 2:34PM IRS Budget Soars By Chris Edwards Share The revelations of IRS officials targeting conservative and libertarian groups suggest that now is a good time for lawmakers to review a broad range […]