—

President Joe Biden delivers remarks on his Build Back Better agenda from the East Room of the White House after meeting with members of the House Democratic Caucus at the U.S. Capitol on Oct. 28. (Photo: Kent Nishimura/Los Angeles Times/Getty Images)

The White House released on Thursday a framework for the Build Back Better agenda—a massive, $1.75 trillion spending bill that will radically transform the American way of life as we know it—and Democrats in Congress are intent on rapidly moving it immediately. We asked analysts from The Heritage Foundation to examine what is in the bill text. We will update their responses as they come in:

Budget Gimmicks

The White House’s newly released frameworkreturns to a tried-and-true way to obscure the true cost of the legislation: budget gimmicks. The current reconciliation instructions place caps on the 10-year deficit impact of provisions that could be included in the bill.

However, the new framework provides partial funding for many programs—creating temporary benefits that are clearly intended to be made permanent. This means that the cost estimates in this framework are only the tip of the iceberg of what the White House has planned.

For example, both the child care and pre-K provisions are reported as being given “funding for six years” despite both being listed also as “a long-term program.” The Obamacare tax credit extension would last only through 2025. The expanded child and earned income tax credits would each be extended for only one year.

Keep in mind that the annual cost for each of these programs would, likely, be higher in the 10th year of the budgetary window than in the first year. As such:

- Child care and Pre-K: Actual 10-year cost is likely more than twice the reported cost of $400 billion.

- Obamacare Tax Credit: Actual 10-year cost is likely much more than three times the reported cost of $130 billion.

- Child and Earned Income Tax Credits: Actual 10-year cost is likely more than 10 times the reported cost of $200 billion.

In total, these programs would likely cost well over $2.3 trillion above the estimate in this framework over 10 years. This excess would be more than $18,700 of new spending per American household.

These gimmicks will set up future congresses with intentionally tough votes whether to extend new entitlement benefits. This process is clearly intended to circumvent the fiscally responsible controls in the reconciliation process. Using these gimmicks, the bill could be used to sneak in much larger debt-busting spending.

The issue here is not simply the spending—it is where that money comes from and where it goes.

By front-loading the spending and spreading tax hikes across 10 years, the framework would increase already-high inflationary pressures. Even worse, the taxes would suppress business investment at a time when the economic recovery is in danger of stalling out.

The drafters of this framework use the term “investment” to cover their planned corporate cronyism and wealth redistribution. This bill would make no investment—it would only misdirect the wealth generated by all Americans through their hard work.

Make no mistake, this plan is ultimately a framework for how much President Joe Biden wants to take out of your wallet to fund his ideological interests.

– Richard Stern is a senior policy analyst focusing on budget policy at The Heritage Foundation and David Ditch is a policy analyst at Heritage’s Grover M. Hermann Center for the Federal Budget

Child Allowance Tax Credit

In March, Democrats transformed the child tax credit into a $250 to $300 per child monthly child allowance—no work conditions attached. Now, Democrats’ newly released framework would extend the monthly child allowance for another year, through the end of 2022.

The child tax credit used to increase as low-income parents worked more. The Biden child allowance, however, now goes to nonworking families because it removed the child tax credit’s existing requirement to work. Proponents insist that this giveaway won’t substantially affect low-income parents’ interest in working, but a new study has made it clear what history also teachesus: Fewer low-income families will work.

The Biden administration has claimed that this change would provide tax relief to families; in reality, this is a “bait and switch” claim. The vast majority of the spending would send unconditional welfare checks to low-income Americans.

This policy will subsidize nonworking families, increasing the likelihood that the most vulnerable will remain outside the workforce. It also will subsidize single parenthood, including among teens, thereby weakening the probability that children will be raised by a married mother and father. Overall, the policy will undermine marriage and discourage work, fewer children will experience social success and upward mobility, and low-income Americans will be left behind.

History teaches us the failures of such a flawed policy. In the 1990s, Congress replaced a failed program, Aid to Families with Dependent Children, with Temporary Assistance for Needy Families, a work-based program. Prior to the Temporary Assistance for Needy Families program, income families faced profoundly negative results from no-strings-attached cash benefits.

One in seven children was dependent on the Aid to Families with Dependent Children welfare program, and intergenerational poverty worsened. Some 90% of cash safety-net recipients were single mothers; the majority were never married. The majority of families were on Aid to Families with Dependent Children welfare program rolls for an average of eight years. Work among the recipient parents was extremely low—nearly nine in 10 families were workless. Many remained in long-term poverty.

Moreover, researchers at the University of Chicagohave warned that the Democrats’ effort to rollback work requirements in welfare would lay the stage for history to repeat itself. The researchers found that 1.5 million workers—2.6% of all working parents—would exit the labor force if the child allowance is made permanent. Accounting for the drop in work, the authors calculate that the child allowance would not ease deep child poverty (families making less than $18,945). This is a far cry from the 39% reduction in deep poverty the left promised.

Unpublished data from the Bureau of Labor Statistics suggests the payments may already be reducing work. When the pandemic began, parents experienced fewer employment losses. But since the late spring of this year—coinciding with the beginning of the child payments—that trend reversed, and parents’ employment actually declined.

Our nation’s safety net already serves tens of millions of people with over $1.1 trillion federal tax dollars allocated to 89 means-tested federal welfare programs, including nearly $500 billion spent on means-tested cash, food, housing, and medical care for poor and low-income families with children. This money has a direct impact on the well-being of poor and lower-income Americans and often provides incentives that are actively harmful to the poor, including by undermining marriage formation.

Policymakers are rightly looking for ways to support marriage, encourage work, foster upward mobility, and help more Americans to overcome poverty and attain self-sufficiency. Those who want to achieve that goal should begin by rejecting Biden’s plan to reverse the successes of a quarter-century of work-based welfare reform.

– Leslie Ford, a visiting fellow focusing on domestic policy studies at The Heritage Foundation, and Rachel Greszler, a research fellow focusing on economics, the budget, and entitlements at The Heritage Foundation

Corporate Tax

The framework claims it will raise $325 billion from a 15% corporate minimum tax on large companies’ book income. Book income is what companies report in their financial statements. Different accounting rules apply for determining taxable income and book income, and that’s by design.

It’s troubling that the rules for determining book income are determined by a Connecticut-based nonprofit, the Financial Accounting Standards Board. Effectively, Congress could be handing some of its taxing authority over to a private organization.

Advocates of the new minimum tax justify the tax on the grounds that some corporations “get away with” not paying tax in certain years.

Corporations often pay zero taxes in a year because of losses in that year or because they accrued net operating losses in prior years. Net operating losses are an efficient, desirable feature of a corporate income tax because they help ensure that the tax code is not biased against businesses with large year-over-year fluctuations in loss and income.

Suppose Company A has $1 million of profit one year and another $1 million profit in the second year. Company B, on the other hand, suffers a loss of $10 million in the first year, followed by a gain of $12 million in the second year. Note: Both companies have a total profit of $2 million over the second years. If not for the allowance of net operating losses, Company B would have to pay tax on $12 million of profit in the second year but would get no tax relief for the $10 million of losses incurred in the first year.

Introducing a minimum tax on book income complicates and distorts the net operating losses system by leaving certain taxpayers unable to use net operating losses to offset future gains. Book income does not factor in net operating losses, introducing a bias in the tax code against companies with large fluctuations in loss and income. This bias would extend to companies that have a significant one-time investment expense leading to a taxable loss. Effectively, this plan would force certain taxpayers to pay taxes on their losses, dollar for dollar, as if they were income.

Since the 2017 Tax Cuts and Jobs Act, companies have been able to immediately expense investments in short-lived assets. By encouraging capital investment, this is one of the most pro-growth policies in the tax code. The minimum tax would counterproductively work to offset these pro-growth expensing provisions, because under current financial accounting rules, such expenses may only be deducted over the course of several years.

Under the present tax system, when companies do consistently avoid paying tax, it is usually because they are able to claim preferential tax credits that are only available to favored businesses or industries. Unfortunately, there are dozens of provisions now being considered that would expand corporate tax credits.

Minimum taxes are burdensome to administer and comply with, as they effectively represent entirely new parallel tax systems. In addition to the corporate profits minimum tax, Congress is also weighing expansion of another minimum tax system in the international tax code. These additional layers of complexity are good news for auditors and accountants, but bad news for businesses that want to focus on improving the goods and services they provide.

– Preston Brashers is a senior policy analyst focusing on tax policy at The Heritage Foundation

Energy

Democrats went back to the playbook of the 2000s and are regurgitating stale energy policies that don’t work to subsidize politically preferred energy technologies through the tax code. Included in the House Democrats’ massive spending package is a $553 billion wealth transfer from taxpayers to fund the lifestyle choices of wealthy Americans, corporations, and environmental activists.

The biggest ticket item is $320 billion in tax subsidies for electric vehicles, solar energy, wind turbines, biofuels and other boutique fuels, and other so-called green energy technologies. This is to say nothing of the $10 billion for college programs to train a generation of environmental activists, $2.5 billion for “tree equity,” and $5 million apiece for desert fish and bee conservation.

It’s bad enough that years of lobbying by special interests appears to be working. Back in 2015, Republicans and Democrats reached a compromise in the omnibus spending bill to extend credits one more time and put them on a schedule to sunset in 2022, a decision that diverted over $14 billion to the green energy industry. From the beginning, these credits were designed to be temporary but have expired, been extended, re-extended, and retroactively extended for decades.

The bill would not only renew these tax credits—it would expand them by making them available for cash rebates. Of course companies are taking the hint and already figuring out creative ways to cash in—for example, by buying electric vehicles to offer as rental cars and loaners just to get the tax write-off. While that may be a shrewd business move one can’t blame companies for making, one should blame Congress for being all too willing to push policies that put taxpayers on the bill for it.

Yet somehow, the left has managed to make these green energy subsidies even worse. Tied to tax credits for electric vehicles, wind, and solar are additional bonuses for labor unions. While the framework promises to help “more Americans to join and remain in the labor force,” it intentionally rigs the game against workers who choose not to join a labor union and against foreign-owned companies investing in the U.S.

Ironically, this could harm plans for expansive new manufacturing spaces for electric vehicles and batteries—allegedly the very technologies the left wants—by companies that don’t fit the bill’s narrow agenda.

To be very clear—the problem isn’t green energy technologies. The problem is cronyist energy policy that is patently unfair, increases barriers to entry for innovative technologies that don’t fit the government’s mold, masks risks and costs, and encourages behavior our common sense might otherwise dissuade us from.

If Congress wants to support energy innovation in the U.S., it should be moving closer to—not further from—a pro-growth, competitive tax policy. This should include getting rid of all targeted energy tax credits and championing policies like full and immediate expensing of R&D, short-term assets (like tools and equipment) and long-term assets (like manufacturing space).

We know what the results of good energy policy can look like. Between 2018 and 2019, the economy was breaking records in growth and employment as average energy costs fell 5% and Americans’ per capita energy costs decreased in every state except California. And yet the left wants the rest of America to look like California and is trying to export the state’s climate policy experiment through the tax code and the Biden administration’s regulatory agenda.

If green energy technologies are low-cost and competitive, why is Congress still throwing billions of taxpayer dollars at them every year? And what will it take to get Congress to keep the promise it made in 2015?

– Katie Tubb is a senior policy analyst focusing on energy and environment at The Heritage Foundation

Health Care

The proposal would make existing Affordable Care Act subsidies more generous and make them available to more people, regardless of income.

Specifically, individuals with income between 100% and 150% of the federal poverty line would no longer have to contribute to the cost of their Obamacare premiums. Obamacare subsidies would be extended to the “rich”—defined here as individuals with incomes above 400% poverty, and it would also offer new federal subsidies for those individuals in state that chose not to adopt the Obamacare Medicaid expansion in lieu of the creation of a new Medicaid public option.

Although the subsidies are temporary since they are tethered to Obamacare (another budget gimmick), these changes are intended to drive more people to the government-run Obamacare exchanges, including some of whom would have otherwise had insurance.

The more people enrolled in Obamacare, the more the government controls the delivery of care and benefits. Moreover, these changes attempt to cover up the fact that Obamacare is driving up—not down—the costs of coverage, and that means that the mega-insurance plans in Obamacare will continue to raise premiums, knowing that ultimately the taxpayers will pick up the cost.

It changes the requirements for those with access to employer-based coverage to qualify for Obamacare subsidies.

Under current law, individuals with access to employer-based coverage are not eligible for Obamacare subsidies unless their share of the premium costs exceed 9.2%. The bill would lower that threshold to 8.5%.

The private, employer-based market is where the majority of American still get their health care and remains a critical obstacle to a full-blown government-run health care plan. Lowering the threshold is a small, but significant, shift in the opposite direction.

This change alongside expanding the availability of subsidies could disrupt the employer-based market by driving more people out of their existing coverage and toward the government-run plan. A recent Congressional Budget Office estimate notes that the package of policies embedded in the plan would result in 2.8 million fewer people with employer-based coverage.

The proposal blocks access to information about non-Obamacare coverage options. The bill would prohibit federal funds from being used to “promote non-[Affordable Care Act] compliant health insurance coverage” and explicitly defines short-duration and association health plans as such options.

This comes on the heels of the Biden administration’s move earlier this year to use taxpayer money to fund a marketing campaign to promote Obamacare.

With rising costs and fewer options, many Americans have sought out alternative health care arrangements. Promoting Obamacare over non-Obamacare alternatives is yet another attempt to shut down private competition and drive people to the government-run Obamacare exchanges, where the government determines access to the coverage options.

– Nina Owcharenko Schaefer is a senior research fellow focusing on health policy at The Heritage Foundation

Higher Education

Biden’s framework would spend $40 billion to increase the maximum Pell Grant award by $550, send additional subsidies to historically black colleges and universities and minority-serving institutions, and provide additional funding for community colleges and workforce development.

These additional federal subsidies will only encourage schools to raise prices, shifting more of the burden of paying for higher education from the student who benefits to all taxpayers.

Colleges will have received an additional $76 billion in federal spending over the past year and a half in response to COVID-19—a monumental sum nearly equivalent to the Department of Education’s entire annual discretionary budget. This plan would add tens of billions more.

Colleges have needed a course-correction for decades, and new federal subsidies will continue to enable general fiscal maladministration, avoiding necessary structural reforms, and changes at the university level that would actually reduce college costs.

For example, from 2001 to 2011, the number of non-teaching employees and administrators increased 50% faster than teaching faculty. Non-instructional staff now accounts for more than half of university payroll costs.

Ever-increasing college costs fueled in part by federal subsidies have muddied colleges’ value proposition. Across the country, tuition and fees for in-state students attending four-year universities have nearly tripled in real terms since 1990. Since 1970, inflation-adjusted tuition rates have quintupled at both public and private colleges.

Federal subsidies have increased dramatically, with spending on student loans rising 328% over the last 30 years, from $20.4 billion during the 1989-90 school year to $87.5 billion during the 2019-20 school year. As University of Ohio economist Richard Vedder explains:

[I]t takes more resources today to educate a postsecondary student than a generation ago… Relative to other sectors of the economy, universities are becoming less efficient, less productive, and, consequently, more costly.

This spending package, by adding another $40 billion in federal subsidies, will only continue this trend, fueling increases in higher education costs while shifting more of the burden onto taxpayers.

– Lindsey Burke is the director of The Heritage Foundation’s Center for Education Policy and the Mark A. Kolokotrones fellow in education

Housing

The framework’s proposed spending on affordable housing will fund the efforts of D.C. bureaucrats to intrude on local housing policies in a concerted effort to socially reengineer communities through the Affirmatively Furthering Fair Housing Rule.

The Affirmatively Furthering Fair Housing Rule’s objectives are pursued by conditioning federal housing grants—particularly from the Community Development Block Grant program—on local governments approving affordable housing projects, transportation initiatives, and zoning guidelines preferred by the federal government.

The Trump administration suspended Affirmatively Furthering Fair Housing Rule in 2018, and terminated it in July 2020. Ben Carson, secretary of the Department of Housing and Urban Development, explained that the Affirmatively Furthering Fair Housing Rule is “unworkable and ultimately a waste of time for localities to comply with, too often resulting in funds being steered away from communities that need them most.”

The Biden administration restored the definitions and certification requirements of Affirmatively Furthering Fair Housing Rule in June 2021. Affordability concerns are best addressed by voluntary reforms of local land use regulations, eliminating rent control, and making it easier for landlords to evict nonpaying tenants.

Down payment assistance will further stoke price increases in the price of housing—especially for lower and moderately priced homes most likely to be purchased by recipients of these grants. Although a select few purchasers may benefit from the proceeds, other families seeking to purchase homes will suffer from the increase in costs.

Furthermore, property tax burdens may increase as the valuation of these properties increases from this artificial injection of additional capital into the housing market.

– Joel Griffith is a research fellow focusing on financial regulations at The Heritage Foundation

Immigration

The Biden administration has turned the U.S. immigration system into immigration chaos, and now the left wants American taxpayers to pay for it. The Democrats will continue to try to ram through amnesty using budget tricks. This will effectively reward illegal immigrants and will fuel the surge we are seeing play out every day at our southern border.

The Biden administration has itself to blame for inflating the backlog of immigration benefit applications. When it continues to add hundreds of thousands of illegal aliens to the application line, those who followed the law and apply for legitimate benefits are forced to wait years longer to have their application adjudicated.

What’s more, immigration benefits are fee-based. This is sound fiscal policy as applicants, not taxpayers, should pay for their own benefit application. To force U.S. taxpayers to pay for the Biden administration’s own backlog punishes Americans, fails to hold the administration accountable for their open border policies, and hurts lawful immigrants, their family members, and employers.

“Expanding legal representation” is a euphemism for taxpayer-funded attorneys for deportable aliens. Aliens already have a right to counsel in (civil) immigration proceedings, but at no expense to the government. The left has sought to chip away at this sound fiscal policy for decades, starting with illegal alien minors.

Requiring taxpayers to fund attorneys would be a fiscal bottomless pit, given the unknown millions of illegal aliens already in the country, plus the unending flow of illegal aliens currently crossing the border, plus the yearslong immigration court backlogs.

Furthermore, it would treat deportable aliens better than U.S. citizens, who do not have a right to taxpayer-funded attorneys in civil proceedings.

The left continues to ruin our asylum system while calling it “efficient and humane.” Asylum is intended to protect those who suffered or have a well-founded fear of persecution based on their race, religion, nationality, political opinion, or membership in a particular social group. Yet the left shoe horns in general violence, crime, and climate change into membership in a particular social group and labels them asylees.

Those conditions do not meet the definition for asylum and such applicants are not eligible. Watering down asylum to declare every applicant eligible hurts those who truly faced or fear real persecution. This is chaotic and inhumane.

– Lora Ries is the director of The Heritage Foundation’s Center for Technology Policy and a senior research fellow focused on homeland security at Heritage’s Davis Institute for National Security and Foreign Policy

IRS Slush Fund

The bill would provide a massive $79 billion slush fund for the Internal Revenue Service, paid in a lump sum and available to use through 2031.

This slush fund is about six times the IRS’ entire annual budget. The IRS had a $13 billion budget in 2021, including $5 billion for nearly 35,000 enforcement agents.

The bill would even give the secretary of the Treasury, “or the Secretary’s delegate,” “personnel flexibilities” “to take such personnel actions as the Secretary (or the Secretary’s delegate) determines necessary to administer the Internal Revenue Code.”

There simply is no credible way for the scandal–ridden and union-dominated agency to absorb so much extra funding and power while avoiding waste, fraud, and abuse.

This slush fund raises the risk of returning to a politicized IRS. The IRS has a decadeslong history of overreach and abuse, from the collecting of a list of enemies of the Nixon administration to attempting to fire a whistleblower who participated in a series of hearings on IRS abuse in the Clinton administration to the infamous targeting scandal under the Obama administration to the leak of confidential taxpayer records and associating the teachings of the Bible with a political party this year.

The bill would also provide $105 million to the Treasury’s Office of Tax Policy to issue new regulations and $153 million to the U.S. Tax Court.

– Matthew Dickerson

Labor Unions

The framework includes $350,000,000 that will be allocated to the National Labor Relations Board for the fiscal year 2022. The funds will remain available until Sept. 30, 2026.

According to the Build Back Better plan, this money will be used to fund the implementation of electronic voting for union elections. The federal government should not involve itself in union elections. Unions should fund electronic voting through the dues they receive from their members.

As a self-professed “union guy,” Biden has strongly advocated greater unionization in the U.S. workforce. American workers, however, do not seem to agree.

According to the Bureau of Labor Statistics, the union membership rate declined to 10.8% in 2020 with strong union presence among public sector workers. In fact, the union membership rate has been in decline for approximately the past 40 years.

The Biden administration’s plans to increase unionization are evidently misaligned with the needs of the current labor market. With long-term societal trends showing diminished union favorability, Biden insists on using taxpayer funding to support his political objectives.

Biden’s pro-union, anti-business economic policies are harmful to American firms, workers, and consumers. This provision uses taxpayer money to support union efforts, in essence, raising taxes on all Americans to provide a political giveaway to unions.

Unions are partially to blame for the supply chain crisis plaguing the Los Angeles and Long Beach ports. Strong union presence and restrictive operating procedures that resulted from union pressure and collective bargaining have left many Americans unconvinced that they should provide more of their earnings to support union activities.

With the salary of dock workers at the Los Angeles and Long Beach ports averaging $171,000annually, it is difficult to argue that these union workers are unable to fund their own election infrastructure.

Aside from high costs, Biden’s unionization efforts promote lower productivity that typically coincides with union participation. At a time when Americans are struggling with a supply chain crisis and rising consumer prices that are partially a result of unions, Americans would be better served by an administration that is more focused on free enterprise and free market labor policies.

Now would be a good time for Biden to invoke his promise of unity and do what’s best for all Americans.

– Elizabeth Hanke is a research fellow focusing on labor economics and policy at The Heritage Foundation

Medicare

The bill adds a hearing services benefit to the Medicare program, effective Jan. 1, 2024. The provision would reimburse “qualified” audiologists and physicians for providing a variety of hearing services, as well as reimbursement for hearing aids. Payment rates are to be set by the secretary of health and human services, and $370 million is appropriated for the implementation of the program.

As anticipated, the bill does not add dental or vision coverage. That’s a good thing—because all these benefits are a solution in search of a problem. They duplicate coverage already provided in private supplemental coverage as well as Medicare Advantage plans. Thus, the provision continues the step-by-step government crowd-out of the private financing and delivery of coverage and care.

– Robert Moffit is a senior fellow focusing on health care and entitlement programs, particularly Medicare, at The Heritage Foundation

Medicaid and Medicare

The legislation assumes a larger role for the federal government in Medicaid. The proposal would create a new grant program within Medicaid that would add new federal funding for home and community-based services.

The proposal would also impose new federal requirements on state Medicaid programs, would allow states to remove certain income limits to qualify for Medicaid and the Children’s Health Insurance Program, and would weaken oversight and accountability through various policy changes.

Congress already provided significant federal Medicaid resources to the states, including for home- and community-based services earlier this year. Using Medicaid to solve the country’s health care woes is shortsighted and poorly targeted, and supplanting state flexibility with federal mandates only makes matters worse.

These efforts would drive out private alternatives and stretch an already overburdened safety-net program.

While the legislation drops dental and vision benefits, it still adds a new hearing benefit to the traditional Medicare program. To avoid an even bigger price tag, the benefit would be phased-in in 2024.

While traditional Medicare does not include dental, vision, or hearing coverage, Medicare Advantage—the private Medicare alternatives—already offers many of these benefits to seniors without government intervention or interference.

Not only does this proposal inject the government where it isn’t necessary, but also piles new obligations onto the already overdrawn Medicare program that will only accelerate the fragile fiscal circumstances facing the program.

– Nina Owcharenko Schaefer

Pre-K and Child Care

The framework includes $400 billion in new spending for universal pre-K and large child care subsidies that cap parents’ child care costs at 7% of families’ income for those earning up to 250% of the state median income (topping out at $429,000 for a family of four in D.C.). Both programs would initially be funded for six years.

Instead of reducing child care costs, expanding options, and helping more parents achieve the child care they desire, the proposals would drastically increase costs and restrict options to government-controlled providers.

A whole host of government dictates—such as requiring subsidized providers to pay “living wages” ($27 per hour for a single mom in Mississippi and $39 in Boston) and that all pre-K workers have a bachelor’s degree (despite zero evidence that such degrees make someone a better caretaker)—would easily drive up costs by 50% or more.

And at the same time, the proposal would limit access to child care. In Chicago, the rollout of universal pre-K is “strangling private day care,” as most parents send children to the government program, even if it doesn’t meet their needs. New Jersey’s “model” pre-K program has an accountability crisis and is wrought with political favoritism.

The proposed federal subsidies would likely be out-of-reach to faith-based providers, because in declaring them recipients of federal funds, it would compromise their ability to run their programs and hire workers according to their beliefs.

Pushing children into government-controlled, center-based child care that’s been shown to have negative impacts on kids’ and families’ long-term outcomes is not a sound “investment.”

In fact, the preeminent author of studies upon which these proposal are based, James Heckman, said, “I have never supported universal pre-school … Public preschool programs can potentially compensate for the home environments of disadvantaged children. No public preschool program can provide the environments and the parental love and care of a functioning family and the lifetime benefits that ensue.” He estimated that parental care has “rates of return of more like 30 or 40%.”

While this proposal provides nothing to the majority of disproportionately low-income parents who prefer family-based care, it would provide $30,000 in child care subsidies to a couple with $344,000 income and two children living in D.C.

If policymakers really want to help families in need, they should expand choices for existing child care funds, including allowing parents to use the roughly $10,000 per child worth of ineffective Head Start spending at a provider of their choice.

– Lindsey Burke and Rachel Greszler

Prescription Drugs

Still to be determined is whether the bill will include provisions to impose government price controls on prescription drugs.

Previous versions would have the federal government set prices for certain prescription drugs in the Medicare program, based on prices paid in other countries. Companies that refused to accept the government price would be subject to an excise tax.

Government control over the price of pharmaceuticals means government control over access to pharmaceuticals. Like residents in those selected other countries, seniors would face less access and fewer choices under this model.

Moreover, government price controls would not end with pharmaceuticals. Similar mechanisms are envisioned with a full-blown government-run program, where the government sets payment rates for all health care services.

Americans only need to look to Canada and the United Kingdom to see the impact such controls have on access to care, where wait lists are common and expected, and where access to treatments are limited or denied.

– Nina Owcharenko Schaefer

State and Local Tax Deduction

Biden’s newest big government socialism framework makes no mention of repealing the cap on the deduction for state and local taxes—popularly known as “SALT.”

An important reform included in the Tax Cuts and Jobs Act was to cap the SALT deduction at $10,000. The SALT deduction subsidizes high taxes imposed by state and local governments. The primary beneficiary of the SALT deduction is high-income taxpayers in high-tax states. Prior to the cap being put in place, the average millionaire from New York or California deducted more than $450,000 per year of SALT, while the average Texas millionaire only deducted about $50,000 resulting in a federal tax liability nearly $180,000 higher than their high-tax state counterparts.

Restoring subsidies for high-income taxpayers in high-tax states has been a priority for some blue-state lawmakers that have said “No SALT, no deal.” There have been reports that House Speaker Nancy Pelosi, D-Calif., and Rep. Richard Neal, D-Mass., chairman of the Ways and Means Committee, “have given NJ/NY Democrats assurance it will be in bill.”

Instead of this harmful proposal, Congress should finish the job and repeal the SALT deduction.

– Matthew Dickerson is the director of The Heritage Foundation’s Grover M. Hermann Center for the Federal Budget

Woke Gender Ideology

According to Senate rules, a reconciliation package should be limited to budget questions. But in 2021, the reconciliation process offers the chance for radical gender activists to slip the language and assumptions of their ideology into federal legislation.

For instance, the text on “Maternal Mortality” consists of 15 sections that appropriate funds for a range of grants and programs for research and education on women’s health.

And yet, in these sections discussing mothers who might face high-risk conditions related to childbearing, we find gender-neutral terminology repeated 18 times in more than half of the 15 sections. The most common phrase? “Pregnant, lactating, and postpartum individuals.”

While “individual” or “person” is common in legal documents when the referent could be male or female, that doesn’t explain what’s happening here. The use of vague, ungendered terms is an attempt to make legal language compliant with an ideology that denies the innate binary of male and female.

The newest reconciliation draft makes this agenda even more obvious.

In an earlier version, for instance, in a separate section on Medicaid, the text retained “pregnant and postpartum women”—since it was referring to past legislation. In the current version, this doesn’t slip through. Whereas before it referred to “pregnant and postpartum women,” it now calls for the offending “w” word (in the singular) with “individual.” To be clear, this is a deliberate erasure of the word “women.”

They did let a shocking reference to “she” slip through. (Perhaps they’ll catch that during the next round of edits.)

There is now only one use of “women” in the entire document that is not directly quoting a previous law. It’s here: “Assessing the potential causes of relatively low rates of maternal mortality among Hispanic individuals and foreign-born Black women.”

The trajectory is unmistakable: Whenever feasible, references to woman are being neutered. We’ve seen this Congress’ commitment to radical gender ideology since its opening days. In early January, House Speaker Nancy Pelosi, D-Calif., made gender-neutral language standard practice for Congress.

This approach persists even when the bill is dealing with topics unique to women. In 2021, opting to refer to a woman as a “pregnant, lactating, and postpartum individual” suggests that someone need not be a female to be pregnant, to lactate, or to suffer postpartum health complications.

That is, of course, exactly the point. For certain radical gender activists, being a woman is more a function of nurture and self-designation than nature and biology. That language reflects that conviction.

– Jay Richards, the William E. Simon senior research fellow in Heritage’s DeVos Center for Religion and Civil Society, and Jared Eckert a research assistant at Heritage’s DeVos Center for Religion and Civil Society

Have an opinion about this article? To sound off, please email letters@DailySignal.com and we’ll consider publishing your edited remarks in our regular “We Hear You” feature. Remember to include the URL or headline of the article plus your name and town and/or state.

Biden’s Befuddlement on Corporate Taxation

Let’s look today at the wonky issue of “book income” because it’s an opportunity to point out that there are three types of leftists.

- Honest leftists who understand economics and recognize tradeoffs (I think of them as “Okunites“).

- Dishonest leftists who understand economics but pretend that tradeoffs don’t exist (the “demagogues“).

- Leftists who have no idea what they’re saying or thinking (I think of them as, well, Joe Biden).

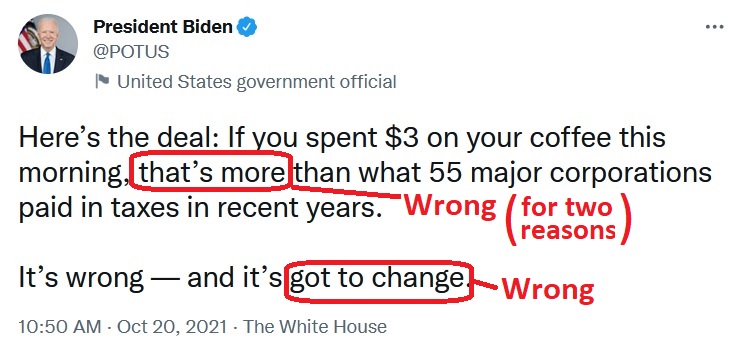

I’m being snarky about the President because of this recent tweet, which contains a couple of big, glaring mistakes.

What are the mistakes (I’m not calling them lies because I don’t think Biden has the slightest idea that he is wrong, much less why he’s wrong).

- The first mistake is that corporations pay a lot of tax (payroll tax, property tax, etc) even if they are losing money and don’t owe any corporate income tax.

- The second mistakes is that Biden is relying on a report about corporate income taxes that has been debunkedbecause it relied on book income rather than taxable income.

- The third mistake is that the President implies that his plan force all big companies to pay the corporate tax when that’s obviously not true.

Regarding that third mistake, Kyle Pomerleau of the American Enterprise Institute explains why there will still be companies paying zero corporate income tax.

While the Biden administration’s proposals would increase the tax burden on corporations by about $2 trillion over the next decade, they would not change the basic structure of the corporate income tax. The Democrats’ proposal would not end corporations paying zero federal income tax in certain years.

Corporations will still be able to carryforward losses, and credits will still be available for corporations to offset their tax liability. The administration has proposed a minimum tax to address these headlines by tying federal tax liability to book income. The minimum tax would require corporations with net income over $2 billion to pay the greater of their ordinary corporate tax liability or 15 percent of their book or financial statement income. Corporations would still be able to offset the book minimum tax with losses and general business credits.

Glenn Kessler of the Washington Post tried to defend Biden’s tweet as part of his misnamed “Fact Checker.”

He had to acknowledge Biden was using a made-up number, but nonetheless concluded that the President’s assertion was “probably in the ballpark.”

This is one of Biden’s favorite statistics. …the president has used it in speeches or interviews 10 times since April. Normally he is careful to refer to “federal income taxes” so the tweet is little off by referring just to “taxes.” …Let’s dig into this statistic. It’s not necessarily wrong but there are some limitations.

…The number comes from…the left-leaning Institute on Taxation and Economic Policy (ITEP). …Company tax returns generally are not made public, so ITEP’s numbers are the product of its own research and analysis of public filings. But it is an imperfect measure. …the information in the filings may not reflect what is in the tax returns. …Nevertheless, the notion that 10 to 20 percent of Fortune 500 companies do not pay federal income taxes is consistent with a 2020 report by the nonpartisan Joint Committee of Taxation. …This “55 corporations” number is probably in the ballpark.

For what it’s worth, I don’t care that Kessler gave Biden a pass for writing “taxes” instead of “federal income taxes.”

After all, that’s almost surely what he meant to write (just like Trump almost surely meant “highest corporate tax rate” when complaining about America being the “highest taxed nation”).

But I’m not in a forgiving mood about the rest of Biden’s tweet (or Kessler’s biased analysis) for the simple reason that there is zero recognition that companies occasionally don’t pay tax for the simple reason that they sometimes lose money.

I’ve made this point when writing about boring issues such as depreciation, carry forwards, and net operating losses.

At the risk of stating the obvious, companies shouldn’t pay any corporate income tax in years when they don’t have any corporate income.

P.S. I’m not mocking Biden’s tweet for partisan reasons. I was similarly critical of one of Trump’s tweets that was glaringly wrong on the issue of trade.

Corporate Taxes and the Laffer Curve

In a new documentary film, Race to the Bottom, I had an opportunity to pontificate briefly about corporate tax and the Laffer Curve.

Dan Mitchell on Corporate Tax Rates and the Laffer Curve

—

At the risk of understatement, I represented a minority viewpoint in the documentary. Most of the people interviewed had a negative view of tax competition, considering it to be (as suggested by the title) a “race to the bottom.”

By contrast, I view tax competition as a way of constraining the “stationary bandit” so that we don’t wind up with “goldfish government.”

For purposes of today’s column, though, I want to focus on the narrower issue of the relationship between corporate tax rates and corporate tax revenue.

In the above video, I asserted that lower rates did not result in lower revenue. Indeed, I even made the bold statement that revenues increased.

Fortunately, I don’t need to do any elaborate calculations to prove my point. I’ll simply direct readers to the work of two left-leaning international bureaucracies.

Back in 2017, I cited an article form the International Monetary Fund that included a graph clearly illustrating that the drop in tax rates has not been accompanied by a drop in tax revenue.

This was a remarkable admission considering that the article argued in favor of higher tax burdens.

Likewise, last year I cited a study from the Organization for Economic Cooperation and Development that also acknowledged that falling tax rates on companies did not translate into lower revenues.

Given that the OECD has a big project to increase business tax burdens, that also was a startling admission.

None of this means, by the way, that lower rates always lead to more revenue.

Indeed, most tax cuts cause revenue to decline (though not as much as predicted by static estimates).

The bottom line is that lower tax rates are good for economic performance and my friends on the left shouldn’t get too worried about disappearing tax revenue.

P.S. There’s also some 2017 OECD data and 2018 OECD dataabout business tax rates and business tax revenues.

P.P.S. Earlier this year, I cited OECD data that also included personal income tax rates and tax revenue.

—-

Emailed to White House on 1-3-13.)

President Obama c/o The White House

1600 Pennsylvania Avenue NW

Washington, DC 20500

Dear Mr. President,

I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here.

Class Warfare just don’t pay it seems. Why can’t we learn from other countries’ mistakes?

Class Warfare Tax Policy Causes Portugal to Crash on the Laffer Curve, but Will Obama Learn from this Mistake?

December 31, 2012 by Dan Mitchell

Back in mid-2010, I wrote that Portugal was going to exacerbate its fiscal problems by raising taxes.

Needless to say, I was right. Not that this required any special insight. After all, no nation has ever taxed its way to prosperity.

We’re now at the end of 2012 and Portugal is still saddled with a weak economy. And the higher taxes haven’t resulted in less red ink. Indeed, according to the Economist Intelligence Unit, government debt has jumped from 93 percent of GDP in 2010 to 124 percent of GDP this year.

We’re now at the end of 2012 and Portugal is still saddled with a weak economy. And the higher taxes haven’t resulted in less red ink. Indeed, according to the Economist Intelligence Unit, government debt has jumped from 93 percent of GDP in 2010 to 124 percent of GDP this year.

Why did higher taxes backfire in Portugal? For the same reasons that higher taxes have failed in Greece, Spain, Bulgaria, France, Italy, the United Kingdom, and so many other nations.

- Higher taxes undermine incentives for productive behavior, thus reducing an economy’s potential for growth. This means less economic output, which also means a smaller tax base. This Laffer Curve effect doesn’t necessarily mean less revenue, but it certainly means that tax increases rarely raise as much money as initially projected.

- Higher taxes usually are a substitute for the real solution of spending restraint (i.e., Mitchell’s Golden Rule). Politicians oftentimes refuse to reduce the burden of government spending because of an expectation of additional tax revenue. Heck, in many cases, higher taxes trigger an increase in the size and scope of the public sector.

So did Portugal learn any lessons from this failed experiment in Obamanomics?

Hardly. Indeed, the government plans to double down on this approach – even though it’s increasingly apparent that higher tax burdens won’t translate into much – if any – additional tax revenue. Here are some excerpts from a report in the Financial Times.

Lisbon plans to lift income tax revenue by more than 30 per cent, raising the effective average rate by more than a third from 9.8 to 13.2 per cent. Anyone receiving more than the minimum wage of €485 a month, including pensioners, will also pay an extraordinary tax of 3.5 per cent on their income. …the steep tax increases facing many families have made the outlook for 2013 – the third consecutive year of austerity, recession and rising unemployment – the grimmest yet. Total tax revenue has fallen considerably below target this year, forcing the government to implement additional austerity measures… The coalition will be relying on increased state revenue to account for about 80 per cent of the fiscal adjustment required in 2013 – a reversal of the original bailout plan, in which consolidation was to be achieved mainly through spending cuts.

Amazing. The government imposes huge tax hikes, which don’t generate any positive results. Yet even though “tax revenue has fallen considerably below target,” confirming that there are significant Laffer Curve issues, the government chooses to repeat the snake-oil fiscal therapy of higher taxes.

Anybody want to guess what’s going to happen? The answer, of course, is that this will further dampen incentives to generate income and comply with the government’s fiscal demands.

The latest increases have stretched the tax system to the limit, says Carlos Loureiro, a tax partner at Deloitte. “The current model is exhausted. We need to do something different,” he says. “Any further increase in tax rates is unlikely to result in increased revenue.” Income from value added tax, the government’s biggest source of tax revenue representing about 36 per cent of the total, has been falling since 2008, despite a sharp increase in the rate – the main rate is now 23 per cent. Both the government and the European Commission have acknowledged the risks of depending on increased tax revenue, which is more growth sensitive, to meet fiscal targets and contingency spending cuts amounting to 0.5 per cent of national output have prepared in case of another tax shortfall.

I almost want to laugh at the part of the excerpt which notes that tax revenue “has been falling…despite a sharp increase in the rate.”

Maybe it’s time for these fiscal pyromaniacs to realize that revenues might be falling because rates are higher. In other words, Portugal not only isn’t at the ideal point on the Laffer Curve (collecting the amount of revenue needed to finance legitimate activities of government), it may even be past the revenue-maximizing part of the curve.

Maybe it’s time for these fiscal pyromaniacs to realize that revenues might be falling because rates are higher. In other words, Portugal not only isn’t at the ideal point on the Laffer Curve (collecting the amount of revenue needed to finance legitimate activities of government), it may even be past the revenue-maximizing part of the curve.

To be fair, there are lots of factors that determine economic performance, so higher tax burdens are just one possible explanation for why the tax base is shrinking or stagnant.

The one thing we can state with certainty, though, is that Portugal’s fiscal problem is too much government spending. The failure to address this problem then leads to very unpleasant symptoms, such as lots of red ink and self-destructive class-warfare tax policy.

If all that sounds familiar, that’s because it’s also a description of what President Obama is proposing for the United States.

P.S. I don’t want to imply that Portugal is a total basket case. True, I’m not optimistic about the country’s future, but at least some lawmakers now acknowledge that Keynesian spending was a big mistake. And there are even signs that Portuguese officials are beginning to realize that lower tax rates should be part of the solution. But good policy may be impossible since so many people now have a moocher mentality.

P.P.S. At the risk of bearing bad news to close the year, research from both the Bank for International Settlements and the Organization for Economic Cooperation and Development shows the United States actually faces a bigger long-run fiscal challenge than Portugal.

The Laffer Curve – Explained

Uploaded by Eddie Stannard on Nov 14, 2011

This video explains the relationship between tax rates, taxable income, and tax revenue. The key lesson is that the Laffer Curve is not an all-or-nothing proposition, where we have to choose between the exaggerated claim that “all tax cuts pay for themselves” and the equally silly assumption that tax policy doesn’t effect the economy and there is never any revenue feedback. From http://www.freedomandprosperity.org 202-285-0244

__________________________________

__________

Thank you so much for your time. I know how valuable it is. I also appreciate the fine family that you have and your commitment as a father and a husband.

Sincerely,

Everette Hatcher III, 13900 Cottontail Lane, Alexander, AR 72002, ph 501-920-5733, lowcostsqueegees@yahoo.com

Open letter to President Obama (Part 201)Tea Party favorite Representative links article “Prescott and Ohanian: Taxes Are Much Higher Than You Think”

(Emailed to White House on 12-21-12.) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on […]

Open letter to President Obama (Part 200.2)Tea Party Republican Representative takes on the President concerning fiscal cliff

(Emailed to White House on 12-21-12.) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is […]

Open letter to President Obama (Part 200.1)Tea Party favorite Representative shares link on facebook

(Emailed to White House on 12-21-12) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is […]

Open letter to President Obama (Part 199) Tea Party favorite takes on President

The federal government has a spending problem and Milton Friedman came up with the negative income tax to help poor people get out of the welfare trap. It seems that the government screws up about everything. Then why is President Obama wanting more taxes? _______________ Milton Friedman – The Negative Income Tax Published on […]

Tea Party Heroes Rep. David Schweikert (R-AZ),Justin Amash (R-MI), Tim Huelskamp (R-KS) have been punished by Boehner

I was sad to read that the Speaker John Boehner has been involved in punishing tea party republicans. Actually I have written letters to several of these same tea party heroes telling them that I have emailed Boehner encouraging him to listen to them. Rep. David Schweikert (R-AZ),Justin Amash (R-MI), and Tim Huelskamp (R-KS). have been contacted […]

Some Tea Party heroes (Part 10)

Michael Tanner of the Cato Institute in his article, “Hitting the Ceiling,” National Review Online, March 7, 2012 noted: After all, despite all the sturm und drang about spending cuts as part of last year’s debt-ceiling deal, federal spending not only increased from 2011 to 2012, it rose faster than inflation and population growth combined. […]

Some Tea Party heroes (Part 9)

Michael Tanner of the Cato Institute in his article, “Hitting the Ceiling,” National Review Online, March 7, 2012 noted: After all, despite all the sturm und drang about spending cuts as part of last year’s debt-ceiling deal, federal spending not only increased from 2011 to 2012, it rose faster than inflation and population growth combined. […]

49 posts on Tea Party heroes of mine

Some of the heroes are Mo Brooks, Martha Roby, Jeff Flake, Trent Franks, Duncan Hunter, Tom Mcclintock, Devin Nunes, Scott Tipton, Bill Posey, Steve Southerland and those others below in the following posts. THEY VOTED AGAINST THE DEBT CEILING INCREASE IN 2011 AND WE NEED THAT TYPE OF LEADERSHIP NOW SINCE PRESIDENT OBAMA HAS BEEN […]

Some Tea Party Republicans win and some lose

I hated to see that Allen West may be on the way out. ABC News reported: Nov 7, 2012 7:20am What Happened to the Tea Party (and the Blue Dogs?) Some of the Republican Party‘s most controversial House members are clinging to narrow leads in races where only a few votes are left to count. […]

Some Tea Party heroes (Part 8)

Rep Himes and Rep Schweikert Discuss the Debt and Budget Deal Michael Tanner of the Cato Institute in his article, “Hitting the Ceiling,” National Review Online, March 7, 2012 noted: After all, despite all the sturm und drang about spending cuts as part of last year’s debt-ceiling deal, federal spending not only increased from 2011 […]