–

Florida’s One-Man Laffer Curve

Inflation is having an effect on everything, even policy analysis.

Back in 2013, I wrote that Phil Mickelson was “California’s One-Man Laffer Curve”  because he wanted to escape the Golden State to save about $1.2 million per year in taxes.

because he wanted to escape the Golden State to save about $1.2 million per year in taxes.

But now, when a goose that lays golden eggs wants to escape, the numbers are much bigger.

How much bigger?

According to this story by CNBC, Jeff Bezos saved more than $600 million by moving from Seattle to Miami. That’s the steroid-fueled version of a one-man Laffer Curve.

Here are some excerpts from the report, which was authored by Robert Frank.

Jeff Bezos’ $2 billion stock sale last week came with an added perk: no state taxes. Last year, Bezosannounced on Instagram that he was leaving Seattle after nearly 30 years to move to Miami. He said the move was to be closer to his parents and his rocket launches at Blue Origin. The timing also suggested another reason: taxes. In 2022 Washington state imposed a new, 7% capital gains tax on sales of stocks or bonds of more than $250,000.

Washington state doesn’t have a personal income tax, so the new levy marked the first time Bezos would face state taxes on his stock sales. …In 2022, when the tax took effect, Bezos stopped selling. He didn’t sell any Amazon stock in 2022 or 2023… After his move to Miami, Bezos made up for lost time. Last week, a filing with the SEC revealed that Bezos launched a pre-scheduled stock-selling plan to unload 50 million shares before Jan. 31, 2025. At today’s price, that would total more than $8.7 billion. Florida has no state income tax or a tax on capital gains. So on the $2 billion sale last week, he saved $140 million that he would have paid to Washington state. On the entire sale of 50 million shares over the next year, he will save at least $610 million. …he’s more than paid for his 417-foot yacht, Koru, with just his Florida tax savings.

I have two reactions to this report, one analytical and one visceral.

- My analytical reaction is that this story is good news because it keeps money in the private sector where it will be used more productively and also because it sends a powerful signal to the proponents of a state suicide pact that it is foolish to overtax people who can easily move.

- My visceral reaction is to cheer that the greedy politicians in the state of Washington wound up with an exploding cigar rather then several hundred million dollars that they could use to buy votes. For what it’s worth, I expect more rich people follow in Bezos’ footsteps.

P.S. I wonder about the revenue implications of the state capital gains tax in Washington. Notwithstanding Bezos moving out, I’m sure there will be some revenue collected from this misguided levy. But that doesn’t mean the tax will be a net plus for politicians. You also need to consider that the exodus of successful taxpayers will lead to less revenue from sales taxes, property taxes, and other levies.

Lessons from Reaganomics for the 21st Century, Part I

As a long-time admirer of President Reagan and his economic policies, I was very pleased to author a new study for the Club for Growth Foundation entitled Reaganomics for the 21st Century.

In the report, I ask “Is it time for Reaganomics 2.0?”

This week, I’m going to look at key economic issues and see whether Reagan’s policies worked and whether similar policies are needed again today.

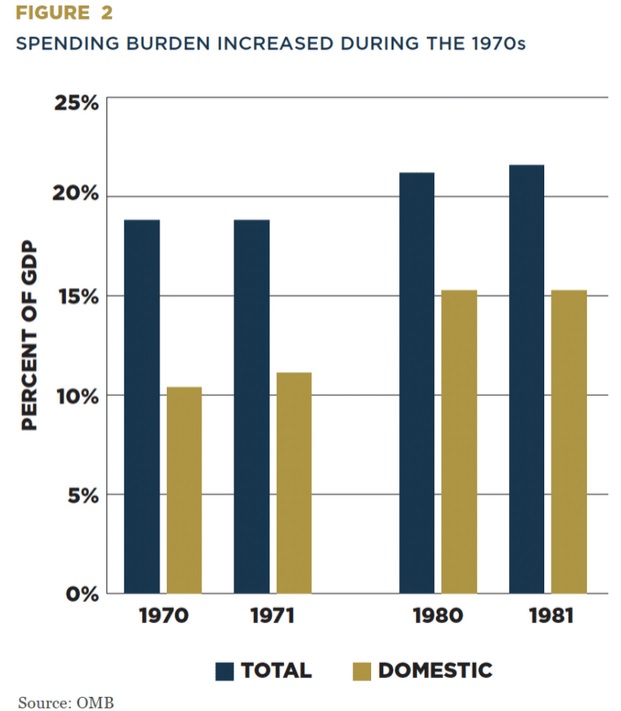

We’ll start with fiscal policy. Here’s Figure 2 from the study, showing that the burden of federal spending, measured as a share of economic output, increased significantly during the 1970s.

We’ll start with fiscal policy. Here’s Figure 2 from the study, showing that the burden of federal spending, measured as a share of economic output, increased significantly during the 1970s.

Most troubling, almost all of the increase was because of additional domestic spending.

What happened during the Reagan years? Did policy improve?

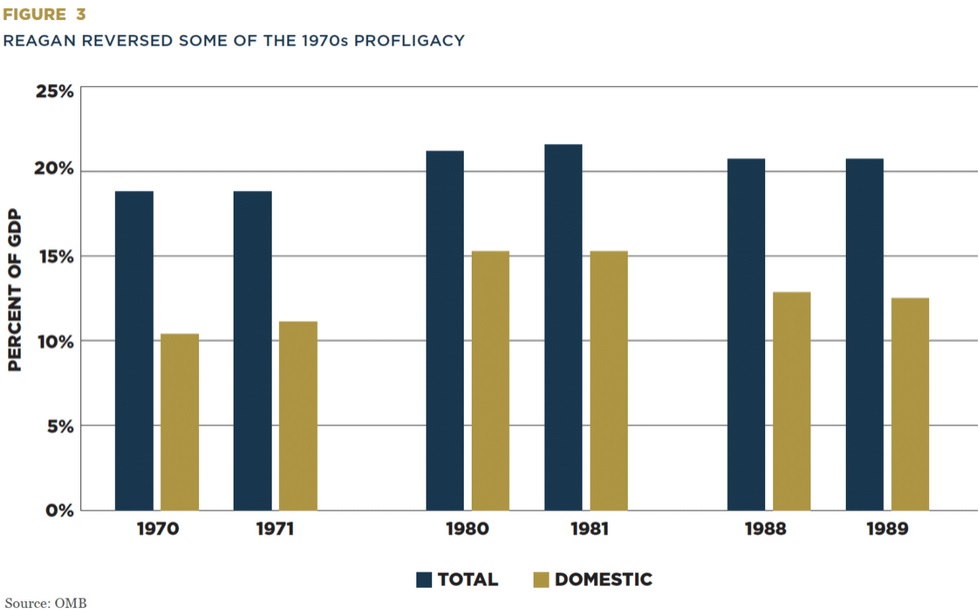

As you can see from this next chart, Figure 3, Reagan reversed that worrisome trend. The burden of government spending fell during his years in office (Reagan’s budgets covered 1981-1989, but I also included 1980 and 1988 for people who focus on election years).

Most impressively, Reagan reduced the burden of domestic spending (both entitlements and discretionary) by 2.5 percentage points of GDP.

For those who want more information on Reagan’s successful spending restraint, I recommend this 2011 video.

The purpose of today’s column, though, is to focus on the future. Specifically, what are the challenges we face today and would a Reagan-style approach be appropriate?

The first part of that question is easy to answer. The federal government is far too big and America’s fiscal burden is projected to become an even bigger problem in the near future.

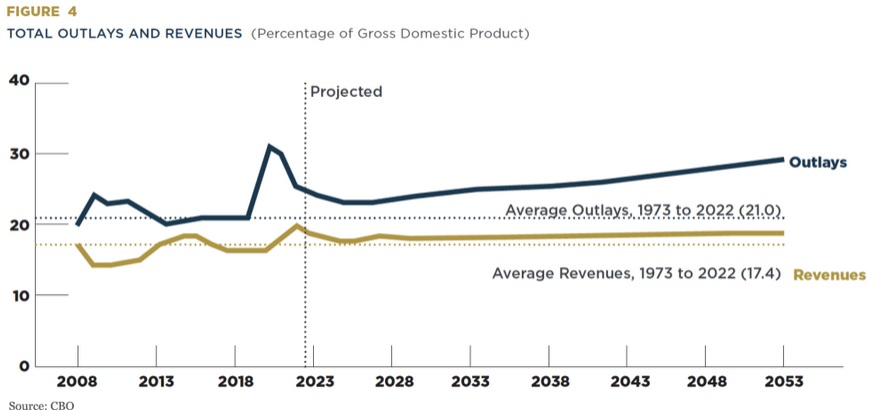

In the study, I included this chart from the Congressional Budget Office, which shows that the burden of federal spending is on a very bad upward trajectory over the next three decades.

The second part of the question also is easy to answer.

Reagan’s approach was to restrain spending and that same approach is needed today. Here’s some of what I wrote.

America’s spending problem today is worse than it was when Reagan was elected and inaugurated. The overall burden of spending has reached more than 24 percent of economic output and domestic spending by itself consumes more than 19 percent of GDP.

…All this spending…undermines growth by diverting resources from the productive sector of the economy. …Domestic discretionary spending is a very ripe target for budget savings. …Entitlements are the major budget challenge. More than 70 percent of the federal budget is allocated to these programs, and that share will increase since entitlement spending is projected to become an even bigger burden in the future. …some sort of spending restraint would be desirable. One option is a…spending cap. The best model in the United States is Colorado’s Taxpayer Bill of Rights. The TABOR provision in Colorado’s constitution effectively limits spending so that it cannot grow faster than the combination of inflation plus population. …Globally, the best model is Switzerland’s spending cap.

In the study, I explain that domestic discretionary spending should be significantly reduced, including elimination of various departments and agencies.

And I also make the case for entitlement reform, including Medicare, Medicaid, and Social Security.

And I also make the case for entitlement reform, including Medicare, Medicaid, and Social Security.

To conclude this column, let’s look at the big picture.

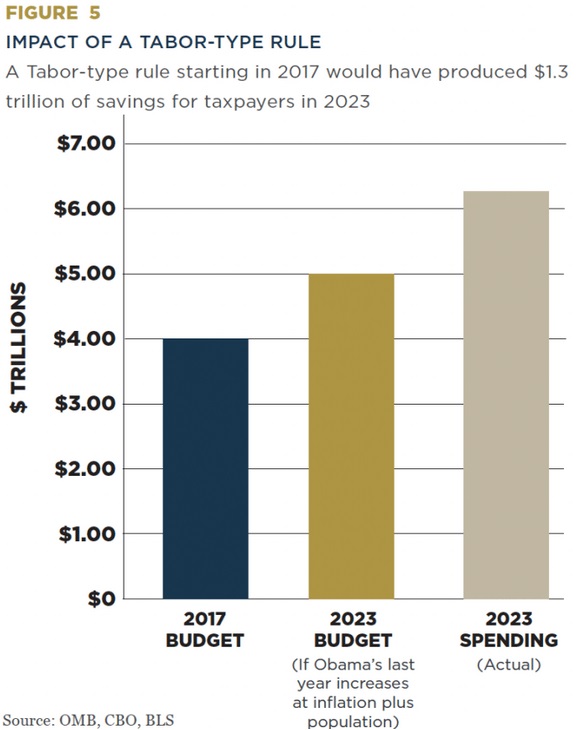

I wrote that some sort of spending cap is needed. To help make the case, I showed what would have happened to federal spending if Washington was subjected to a TABOR-style spending cap at the start of the Trump years.

As you can see in Figure 5. the savings would be enormous. Limiting spending increases to population plus inflation would have resulted in a federal budget of about $5 trillion for 2023, which is more than $1 trillion less than politicians actually spent.

The bottom line is that TABOR has produced big savings for Colorado taxpayers, but those numbers would be dwarfed by nationwide savings is Washington was constrained by a spending cap.

P.S. Politicians who oppose spending restraint implicitly support massive tax increases on lower-income and middle-class households.

Defending the (Prudent Understanding of the) Laffer Curve

I’ve written dozens of articles about the Laffer Curveand most of that verbiage can be summarized in these five points.

- The Laffer Curve helps to illustrate that excessive tax rates result in less taxable activity.

- All public finance economists – even those on the left – agree there is a Laffer Curve.

- The Laffer Curve does not mean tax cuts are self-financing or that tax increases lose revenue.

- Different types of taxes produce different responses, so there is more than one Laffer Curve.

- There is a real debate about the shape of the Laffer Curve and the ideal point on the curve.

The fifth point recognizes that well-meaning and knowledgeable people can vigorously disagree.

Do changes in tax policy have big effects or small effects on the economy? How much revenue feedback will occur if there is a change in tax rates?

Just a couple of examples of questions that I have endlessly debated with reasonable folks on the left.

But let’s focus today on the unreasonable left. Or, to be more specific, let’s look at an editorial from the St. Louis Post-Dispatch.

Here are some portions of that newspaper’s simplistic screed.

…the deficit explosion…effectively disproved his theory that cutting taxes on the rich would increase government tax revenue. …Laffer continues to be unchastened…, even as Britain reels from a leadership shuffle caused by the catastrophic application of his very theories. Hand it to Laffer: Seldom does someone who is so often proven wrong have the gumption to maintain he’s right…

His famous “Laffer curve” presumes to prove that tax cuts for the rich will spur economic investment, causing such strong economic growth that the government’s tax revenue would actually rise instead of falling. …Yes, the economy was robust in the 1980s after Reagan’s historic tax cuts. But that’s also when the era of big budget deficits began. …congressional Republicans and President Donald Trump in 2017 slashed corporate taxes in what they claimed was a necessary economy-booster… Then-Treasury Secretary Stephen Mnuchin’s famous vow that the tax-cut plan would “pay for itself” in growth — the very definition of Laffer’s theory — has since been exposed as the voodoo it always was.

Almost every sentence in the above excerpt cries out for correction.

For instance, Reagan and his team never claimed that the 1981 tax cuts would be self-financing (though IRS data shows that lower tax rates on the rich did produce more revenue).

There were big deficits because of the 1980-1982 double-dip recession, and that spike in red ink mostly took place before Reagan’s tax cuts went into effect.

There were big deficits because of the 1980-1982 double-dip recession, and that spike in red ink mostly took place before Reagan’s tax cuts went into effect.

And it’s absurd to blame the United Kingdom’s political instability on tax cuts that never occurred.

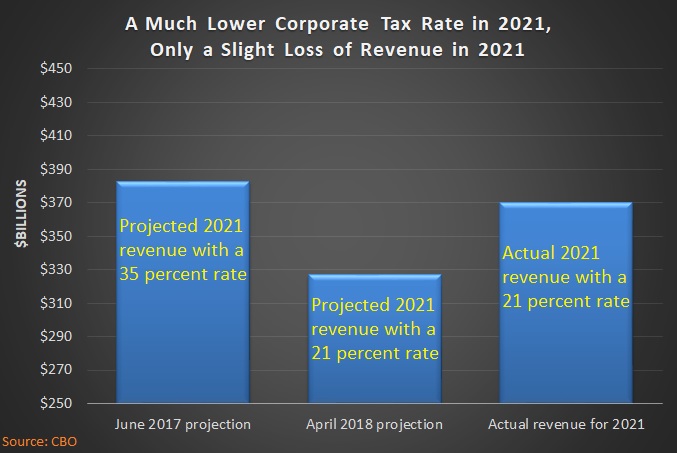

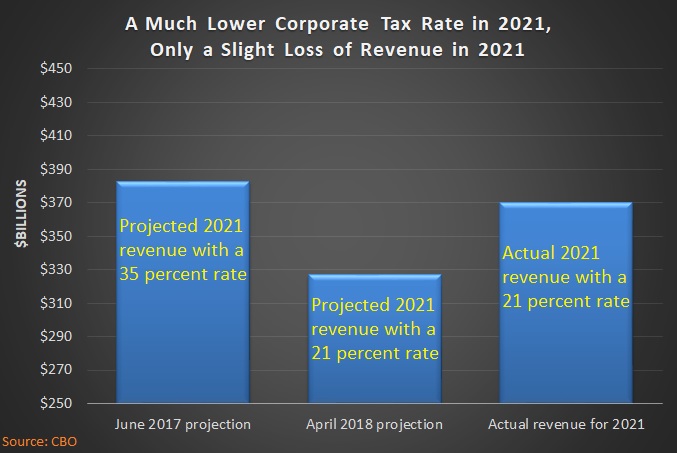

If Secretary Mnunchin claimed the entire tax cut would pay for itself, he clearly deserves to be mocked, but it’s worth noting that the lower corporate tax rate from the 2017 reform is very close to being self-financing.

Not that we should be surprised. Both the IMF and OECD have research showing that lower corporate tax rates do not necessarily lead to lower corporate tax revenues.

The bottom line is that the editorial board of the St. Louis Post-Dispatch obviously puts ideology above accuracy.

P.S. I can’t resist sharing one other excerpt from the editorial.

“The Kansas Experiment,” was a debacle. The state’s economy didn’t skyrocket, but the deficit did, forcing deep cuts to education before the legislature finally acknowledged defeat and reversed the tax cuts.

Once again, the editors are showing that ideology trumps accuracy. Here’s what really happened in Kansas. I hope we can have more defeats like that! Though I’ll be the first to admit that North Carolina is a much better role model.

Corporate Tax Rates and Taxable Income

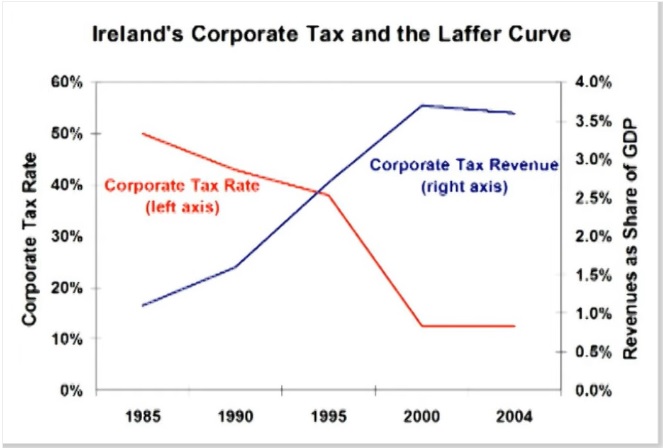

In the case of business taxation, the most visually powerful evidence for the Laffer Curve is what happened to corporate tax revenue in Ireland after the corporate tax rate was slashed from 50 percent to 12.5 percent.

Tax revenue increased dramatically. Not just in nominal terms. Not just in inflation-adjusted terms.

Tax revenue increased dramatically. Not just in nominal terms. Not just in inflation-adjusted terms.

Corporate receipts actually climbed as a share of GDP.

And this was during the decades when economic output was rapidly expanding.

In other words, the Irish government got a much bigger slice of a much bigger pie after tax rates were dramatically lowered.

Now let’s look at some evidence from a new study. Three professors from the University of Utah (Jeffrey Coles, Elena Patel, and Nather Seegert), and a Treasury Department economist (Matthew Smith) estimated what happens to taxable income for U.S. companies when there is a change in the corporate tax rate.

In response to a 10% increase in the expected marginal tax rate, private U.S. firms decrease taxable income by 9.1%, which indicates a discernibly more elastic response than prevailing estimates. This response reflects a decrease in taxable income of 3.0%

arising from real economic responses to a firm’s scale of operations and 6.1% arising from accounting transactions via (for example) revenue and expense timing. Responsiveness to the corporate tax rate is more elastic if a firm uses cash (9.9%) rather than accrual accounting (7.4%), if the firm is small (9.9%) rather than large (8.6%), and if the firm discounts future cash flows at a lower rate.

The paper is filled with equation, graphs, and jargon, but the above excerpt tells us everything we need to know.

When tax rates go up, taxable income goes down (both because there is less economic activity and because companies have more incentive to manipulate the tax code).

Thus confirming what I wrote back in 2016 about taxable income being the key variable.

By the way, this does not mean that lower tax rates lead to more revenue. Or that higher tax rate produce less revenue.

Such big swings only happen in rare circumstances.

But it does mean that politicians will not grab as much money as they hope when they increase tax rates. And that they won’t lose as much revenue as they fear when they lower tax rates (and we saw that most recently with the 2017 tax reform).

I’ll close by noting that this is additional evidence for why we should be thankful that Biden’s proposal for higher corporate tax rates was not enacted.

P.S. The chart at the beginning of this column may be the most visually powerful evidence for the corporate Laffer Curve. The most empirically powerful evidence, however, comes from very unlikely sources – the pro-tax IMF and the pro-tax OECD.

March 3, 2021

President Biden c/o The White House

1600 Pennsylvania Avenue NW

Washington, DC 20500

Dear Mr. President,

______________________________

Dan Mitchell shows how ignoring the Laffer Curve is like running a stop sign!!!!

Can You Spell L-A-F-F-E-R C-U-R-V-E?

July 12, 2013 by Dan Mitchell

I’m thinking of inventing a game, sort of a fiscal version of Pin the Tail on the Donkey.

Only the way it will work is that there will be a map of the world and the winner will be the blindfolded person who puts their pin closest to a nation such asAustralia or Switzerland that has a relatively low risk of long-run fiscal collapse.

That won’t be an easy game to win since we have data from the BIS, OECD, and IMF showing that government is growing far too fast in the vast majority of nations.

That won’t be an easy game to win since we have data from the BIS, OECD, and IMF showing that government is growing far too fast in the vast majority of nations.

We also know that many states and cities suffer from the same problems.

A handful of local governments already have hit the fiscal brick wall, with many of them (gee, what a surprise) from California.

The most spectacular mess, though, is about to happen in Michigan.

The Washington Post reports that Detroit is on the verge of fiscal collapse.

After decades of sad and spectacular decline, it has come to this for Detroit: The city is $19 billion in debt and on the edge of becoming the nation’s largest municipal bankruptcy. An emergency manager says the city can make good on only a sliver of what it owes — in many cases just pennies on the dollar.

This is a dog-bites-man story. Detroit’s problems are the completely predictable result of excessive government. Just as statism explains the problems of Greece. And the problems of California. And the problems of Cyprus. And theproblems of Illinois.

I could continue with a long list of profligate governments, but you get the idea. Some of these governments are collapsing at a quicker pace and some at a slower pace. But all of them are in deep trouble because they don’t follow my Golden Rule about restraining the burden of government spending so that it grows slower than the private sector.

Detroit obviously is an example of a government that is collapsing sooner rather than later.

Detroit obviously is an example of a government that is collapsing sooner rather than later.

Why? Simply stated, as the size and scope of the public sector increased, that created very destructive economic and political dynamics.

More and more people got lured into the wagon of government dependency, which puts an ever-increasing burden on a shrinking pool of producers.

Meanwhile, organized interest groups such as government bureaucrats used their political muscle to extract absurdly excessive compensation packages, putting an even larger burden of the dwindling supply of taxpayers.

But that’s not the main focus of this post. Instead, I want to highlight a particular excerpt from the article and make a point about how too many people are blindly – perhaps willfully – ignorant of the Laffer Curve.

Check out this sentence.

Property tax collections are down 20 percent and income tax collections are down by more than a third in just the past five years — despite some of the highest tax rates in the state.

This is a classic “Fox Butterfield mistake,” which occurs when someone fails to recognize a cause-effect relationship. In this case, the reporter should have recognized that tax collections are down because Detroit has very high tax rates.

The city has a lot more problems than just high tax rates, of course, but can there be any doubt that productive people have very little incentive to earn and report taxable income in Detroit?

And that’s the essential insight of the Laffer Curve. Politicians can’t – or at least shouldn’t – assume that a 20 percent increase in tax rates will lead to a 20 percent increase in tax revenue. They also have to consider the degree to which a higher tax rate will cause a change in taxable income.

In some cases, higher tax rates will discourage people from earning more taxable income.

In some cases, higher tax rates will discourage people from reporting all the income they earn.

In some cases, higher tax rates will encourage people to utilize tax loopholes to shrink their taxable income.

In some cases, higher tax rates will encourage migration, thus causing taxable income to disappear.

Here’s my three-part video series on the Laffer Curve. Much of this is common sense, though it needs to be mandatory viewing for elected officials (as well as the bureaucrats at the Joint Committee on Taxation).

The Laffer Curve, Part I: Understanding the Theory

Uploaded by afq2007 on Jan 28, 2008

The Laffer Curve charts a relationship between tax rates and tax revenue. While the theory behind the Laffer Curve is widely accepted, the concept has become very controversial because politicians on both sides of the debate exaggerate. This video shows the middle ground between those who claim “all tax cuts pay for themselves” and those who claim tax policy has no impact on economic performance. This video, focusing on the theory of the Laffer Curve, is Part I of a three-part series. Part II reviews evidence of Laffer-Curve responses. Part III discusses how the revenue-estimating process in Washington can be improved. For more information please visit the Center for Freedom and Prosperity’s web site: http://www.freedomandprosperity.org

Part 2

Part 3

P.S. Just in case it’s not clear from the videos, we don’t want to be at the revenue-maximizing point on the Laffer Curve.

P.P.S. Amazingly, even the bureaucrats at the IMF recognize that there’s a point when taxes are so onerous that further increases don’t generate revenue.

P.P.P.S. At least CPAs understand the Laffer Curve, probably because they help their clients reduce their tax exposure to greedy governments.

P.P.P.P.S. I offered a Laffer Curve lesson to President Obama, but I doubt it had any impact.

___________________________

Thank you so much for your time. I know how valuable it is. I also appreciate the fine family that you have and your commitment as a father and a husband.

Sincerely,

Everette Hatcher III, 13900 Cottontail Lane, Alexander, AR 72002, ph 501-920-5733,

Williams with Sowell – Minimum Wage

Thomas Sowell

Thomas Sowell – Reducing Black Unemployment

—-

Related posts:

Dan Mitchell: Question of the Week: Has the European Fiscal Crisis Ended?

We got to cut spending or we will be in a fiscal crisis like Greece!!! Question of the Week: Has the European Fiscal Crisis Ended? January 12, 2013 by Dan Mitchell I’ve frequently commented on Europe’s fiscal mess and argued that excessive government spending is responsible for both the sovereign debt crisis and the economic stagnation […]

Taxes made simple by Dan Mitchell of the Cato Institute

The Flat Tax: How it Works and Why it is Good for America Uploaded by afq2007 on Mar 29, 2010 This Center for Freedom and Prosperity Foundation video shows how the flat tax would benefit families and businesses, and also explains how this simple and fair system would boost economic growth and eliminate the special-interest […]

Cartoons from Dan Mitchell’s blog that demonstrate what Obama is doing to our economy (Obama’s out of control spending not helped by raising taxes on rich)

I have put up lots of cartoons from Dan Mitchell’s blog before and they have got lots of hits before. Many of them have dealt with the economy, eternal unemployment benefits, socialism, Greece, welfare state or on gun control. President Obama really does think that all his answers lie in raising taxes on the rich when the […]

Dan Mitchell of the Cato Institute gives overview of economic policy and he praises Clinton and Reagan

__________ President Reagan, Nancy Reagan, Tom Selleck, Dudley Moore, Lucille Ball at a Tribute to Bob Hope’s 80th birthday at the Kennedy Center. 5/20/83. __________________________ Dan Mitchell is very good at giving speeches and making it very simple to understand economic policy and how it affects a nation. Mitchell also talks about slowing the growth […]

Cartoons from Dan Mitchell’s blog that demonstrate what Obama is doing to our economy (cartoon on entitlements)

The Laffer Curve – Explained Uploaded by Eddie Stannard on Nov 14, 2011 This video explains the relationship between tax rates, taxable income, and tax revenue. The key lesson is that the Laffer Curve is not an all-or-nothing proposition, where we have to choose between the exaggerated claim that “all tax cuts pay for themselves” […]

Open letter to President Obama (Part 296) (Laffer curve strikes again!!)

President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here. The way […]

Open letter to President Obama (Part 282, How the Laffer Curve worked in the 20th century over and over again!!!)

Dan Mitchell does a great job explaining the Laffer Curve President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a […]

Laffer curve hits tax hikers pretty hard (includes cartoon)

I have put up lots of cartoons from Dan Mitchell’s blog before and they have got lots of hits before. Many of them have dealt with the economy, eternal unemployment benefits, socialism, Greece, welfare state or on gun control. Today’s cartoon deals with the Laffer curve. Revenge of the Laffer Curve…Again and Again and Again March 27, 2013 […]

Editorial cartoon from Dan Mitchell’s blog on California’s sorry state of affairs

I have put up lots of cartoons from Dan Mitchell’s blog before and they have got lots of hits before. Many of them have dealt with the sequester, economy, eternal unemployment benefits, socialism, minimum wage laws, tax increases, social security, high taxes in California, Obamacare, Greece, welfare state or on gun control. President Obama’s favorite state must be California because […]

Portugal and the Laffer Curve

Class Warfare just don’t pay it seems. Why can’t we learn from other countries’ mistakes? Class Warfare Tax Policy Causes Portugal to Crash on the Laffer Curve, but Will Obama Learn from this Mistake? December 31, 2012 by Dan Mitchell Back in mid-2010, I wrote that Portugal was going to exacerbate its fiscal problems by raising […]

Political arguments against higher taxes from Dan Mitchell

Republicans would be stupid to raise taxes. Don’t Get Bamboozled by the Fiscal Cliff: Five Policy Reasons and Five Political Reasons Why Republicans Should Keep their No-Tax-Hike Promises December 6, 2012 by Dan Mitchell The politicians claim that they are negotiating about how best to reduce the deficit. That irks me because our fiscal problem is […]

President Obama ignores warnings about Laffer Curve

The Laffer Curve – Explained Uploaded by Eddie Stannard on Nov 14, 2011 This video explains the relationship between tax rates, taxable income, and tax revenue. The key lesson is that the Laffer Curve is not an all-or-nothing proposition, where we have to choose between the exaggerated claim that “all tax cuts pay for themselves” […]

Dan Mitchell looks at Obama’s tax record

Dan Mitchell’s article and the video from his organization takes a hard look at President Obama’s tax record. Dissecting Obama’s Record on Tax Policy October 30, 2012 by Dan Mitchell The folks at the Center for Freedom and Prosperity have been on a roll in the past few months, putting out an excellent series of videos […]

Dan Mitchell: “Romney is Right that You Can Lower Tax Rates and Reduce Tax Preferences without Hurting the Middle Class”

The Laffer Curve, Part I: Understanding the Theory Uploaded by afq2007 on Jan 28, 2008 The Laffer Curve charts a relationship between tax rates and tax revenue. While the theory behind the Laffer Curve is widely accepted, the concept has become very controversial because politicians on both sides of the debate exaggerate. This video shows […]

The Laffer Curve Wreaks Havoc in the United Kingdom

I got to hear Arthur Laffer speak back in 1981 and he predicted what would happen in the next few years with the Reagan tax cuts and he was right with every prediction. The Laffer Curve Wreaks Havoc in the United Kingdom July 1, 2012 by Dan Mitchell Back in 2010, I excoriated the new […]

Dan Mitchell: Maryland to Texas, but Not Okay to Move from the United States to Singapore?

You can’t blame someone for leaving one state for another if they have a better an opportunity to make money. Maryland to Texas, but Not Okay to Move from the United States to Singapore? July 12, 2012 by Dan Mitchell I’ve commented before about entrepreneurs, investors, and small business owners migrating from high tax states such […]

Liberals act like the Laffer Curve does not exist.

Raising taxes will not work. Liberals act like the Laffer Curve does not exist. The Laffer Curve Shows that Tax Increases Are a Very Bad Idea – even if They Generate More Tax Revenue April 10, 2012 by Dan Mitchell The Laffer Curve is a graphical representation of the relationship between tax rates, tax revenue, and […]

Dan Mitchell shows why soak-the-rich tax policy does not work

Dan Mitchell of the Cato Institute shows why Obama’s plan to tax the rich will not solve our deficit problem. Explaining in the New York Post Why Obama’s Soak-the-Rich Tax Policy Is Doomed to Failure April 17, 2012 by Dan Mitchell I think high tax rates on certain classes of citizens are immoral and discriminatory. If the […]

Dan Mitchell of the Cato Institute takes on liberals on PBS

You want the rich to pay more? Dan Mitchell observed:I explained that “rich” taxpayers declared much more income and paid much higher taxes after Reagan reduced the top tax rate from 70 percent to 28 percent. Liberals don’t understand good tax policies. Against 3-1 Odds, Promoting Good Tax Policy on Government TV April 12, 2012 by […]

Dan Mitchell of the Cato Institute takes on the Buffett Rule

Class warfare again from President Obama. Rejecting the Buffett Rule and Fighting Obama’s Class Warfare on CNBC April 10, 2012 by Dan Mitchell I’ve already explained why Warren Buffett is either dishonest or clueless about tax policy. Today, on CNBC, I got to debate the tax scheme that President Obama has named after the Omaha investor. […]

By Everette Hatcher III | Posted in Cato Institute, Taxes | Edit | Comments (0)