–

–

Singapore vs. Hong Kong

I have written very favorably about Hong Kong and I have also sung the praises of Singapore. But if you want to know which jurisdiction has a brighter future, it certainly seems like Singapore will be the long-run winner.

–

The above video is a segment from my recent interview with the Soul of Enterprise, which mostly focused on fiscal issues such the debt limit and spending caps.

I was glad, however, that we briefly detoured to a discussion of the two Asian city states.

Neither jurisdiction is perfect, of course, but both Singapore and Hong Kong have very pro-market policies by global standards.

And they both showed that it is possible to escapethe “middle-income trap.”

But which one is doing the best?

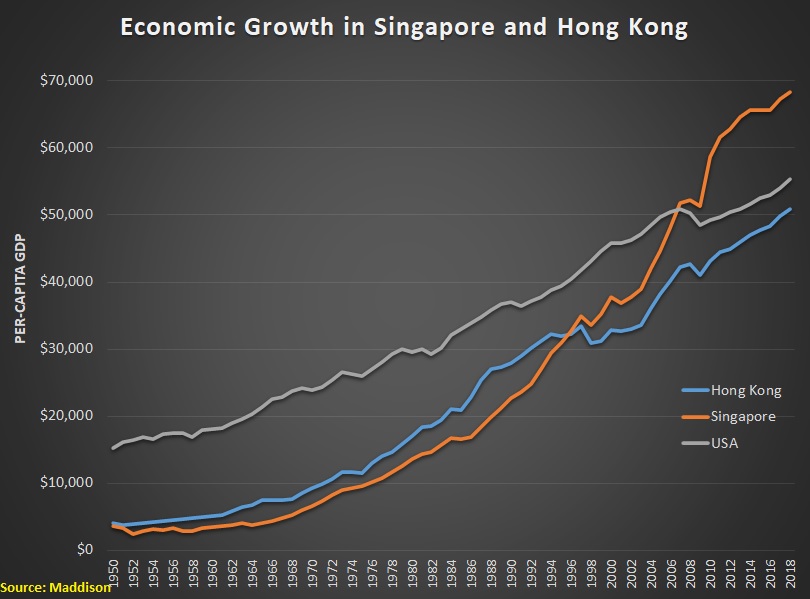

According to the Maddison data shown in this chart, Singapore has vaulted ahead in the past two decades.

I included the United States for purposes of comparison. And it is remarkable how both Singapore and Hong Kong used to be very poor by comparison.

But let’s get back to the main focus of today’s column.

A recent article in the U.K.-based Economistcompares Singapore and Hong Kong.

In economic dynamism, the state of the urban fabric and the vibrancy of civic life, which city comes top: Hong Kong or Singapore? Until not long ago, it was obvious…that Hong Kong won hands down. But recently the balance shifted. There is clearly no contest anymore. It is game over in favour of Singapore. …Hong Kong and Singapore, once dirt-poor, have astonishing success stories to tell.

Both are hubs for international finance, trade, transport and tourism. Both have attracted the brightest professional minds. …The imposition of a draconian national-security law in 2020 marked the obvious break in Hong Kong’s trajectory. …Some 200,000 expatriates have left Hong Kong in the past three years, along with even more Hong Kongers. By contrast, in 2022 the number of foreign professionals in Singapore grew by 16%… In 1997, the year of Hong Kong’s return to China, the two cities’ GDP per person was remarkably similar ($26,376 in Singapore, $27,330 in Hong Kong). Today Singapore’s is 1.7 times higher than Hong Kong’s. Singapore’s economy has grown by one-seventh since 2017; Hong Kong’s not at all. …Singapore is at a crossroads. Hong Kong has hit a dead end.

The bottom line is that China’s takeover of Hong Kong has had a negative effect.

As I noted in the video clip, economic policy has not moved significantly in the wrong direction, but entrepreneurs and investors do not trust Beijing.

That skepticism may be warranted.

P.S. As part of my anti-convergence club, I’ve compared Hong Kong and Cuba, along with Singapore and Jamaica.

More Evidence of China’s Faltering Economy

At the risk of oversimplifying, here’s the three-sentence trajectory of Chinese economic policy.

- Crippling communist failure and suffering under Mao.

- Partial reform during the “Washington Consensus” era.

- Backsliding to more statism under President Xi.

So what’s all that mean? Well, when you start with awful policy, then take a few steps in the right direction, only to then move back in the wrong direction, you probably won’t be an economic powerhouse.

And that’s exactly what we see in the data.

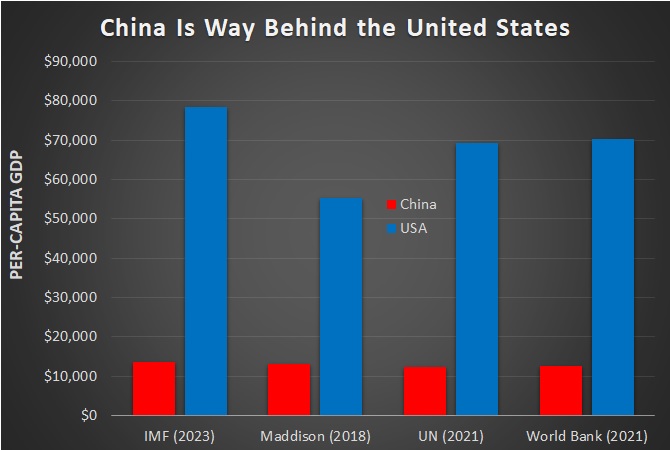

Here’s a chart showing that there is a huge gap between per-capita economic output in the United States and China. And that gap exists whether we rely on data from either the IMF, Maddison,* the UN, or World Bank.

That chart is the bad news (and it may be even worse than shown in the above data).

The good news is that China is no longer a miserably poor nation, like it was during the fully communist years under Mao.

But it also looks like China will never become a rich nation.

Especially when the government penalizes success. Which has very negative effects, as reported by the Economist.

Regulatory crackdowns have devastated once-thriving sectors like private education. Officials rage against “money worship”… China’s wealthy…have been looking to leave. …in 2022 some 10,800 high-net-worth individuals,

who have an average wealth of $6m, left the country, with the flow accelerating at the end of the year as covid controls eased. …Even more are expected to leave in 2023… In recent years, Singapore has been favoured. The city-state is the top destination for Chinese billionaires considering emigration… According to data from Singapore’s central bank, …it is likely that as many as 750 Chinese family offices were registered in Singapore.

Needless to say, it’s not a good sign when the geese with the golden eggs are flying away.

That being said, the problems in China go well beyond class warfare.

The country has a major problem with cronyism (a.k.a., industrial policy).

But I’ve written many times about that issue, so let’s look at another example of China’s bad policy. Li Yuan has an article in The New York Times about wasteful spending and excessive debt in the nation’s cities.

As part of the ruling Communist Party’s all-in push for economic growth this year, local governments already in debt from borrowing to pay for massive infrastructure are taking on additional debt. They’re building more roads, railways and industrial parks even though the economic returns on that activity are increasingly meager.

…China’s local governments..are in fiscal disarray. …According to official data, China’s 31 provincial governments owed around $5.1 trillion at the end of 2022, an increase of 66 percent from three years earlier. An International Monetary Fund report puts the number at $9.5 trillion, equivalent to half the country’s economy. …China is full of wasteful infrastructure that the government likes to brag about but that doesn’t serve the most urgent needs of the public. …The Chinese government likes to say the country has the longest and fastest high-speed railways in the world. But…most lines operate below capacity and at a great loss.

Sounds like Amtrak, but on steroids.

The bottom line is that China’s economy is both weak and fragile.

Which is unfortunate. A thriving China presumably is more likely to be a friendly China.

* The Maddison data is for 2018, and uses $2011 dollars rather than current dollars, which explains why it seems significantly different than the other sources.

P.S. Rather than invade Taiwan, China should copy its economic policies. Or copy the policies of other better-performing Asian Tigers. Heck, the recipe for prosperity is not complicated.

The Harmful Consequences of China’s Leftward Shift

Back in 2019, I divided China’s recent economic history into three periods.

- Mao’s utter and total failure

- Deng’s partial liberalization

- Xi’s backsliding to statism

The net result of these three periods is that China did enjoy some growth thanks to partial liberalization. The good news is that the wrenching destitution and suffering of the Mao years is now just an unpleasant memory.

But the bad news is that China is still not a rich nation.

But the bad news is that China is still not a rich nation.

It lags far behind the United States, and I noted just a few months ago that Poland has been out-performing China in recent decades.

And there’s no reason to expect much future progress because of Xi’s misguided policies.

Writing for National Review, Veronique de Rugy noted that Chinese officials are sabotaging the nation with industrial policy – and she warns against similar mistakes in the United States.

…some of us were always skeptical of the notion that China would achieve great economic success after having reversed its move toward market liberalization in 2012 and returned to central planning for its industrial policy. …The idea that a country can become rich through central planning is a myth.

…malinvestment, economic distortion, and politically driven policies replete with special-interest-driven handouts, all of which are characteristic features of central planning, eventually inflict a sizeable economic toll that’s impossible to hide. When this happens, the economy slows, companies collapse. …we have a deep historical record that shows repeatedly that state direction of economic activity impoverishes rather than enriches. Many people in America today — on the left and right — still have faith that central planning can work economic marvels, and that we should therefore emulate China’s policies. …Too many politicians, economists, and pundits are invested in the illusion that — equipped with models that can ostensibly predict the future — they can design clever plans to organize the economy.

It’s no surprise that bad policy has bad economic consequences. But it also appears that bad policy has adverse psychological effects as well.

Here are some excerpts from a Washington Postcolumn by Nicholas Eberstadt of the American Enterprise Institute.

China is in the midst of a quiet but stunning nationwide collapse of birthrates. …China’s nosedive in childbearing is a silent alarm. It signals deep disaffection with the bleak future the regime is engineering for its subjects. In this land without democracy, the birth collapse can be read as a landslide vote of no confidence in President Xi Jinping’s rule.

…Since 2013 — the year Xi completed his ascent to power — the rate of first marriages in China has fallen by well over half. Headlong flights from bothchildbearing and marriage are taking place in China today. …Birth shocks of this order almost never occur under stable modern governments during peacetime. …“the birth of a baby,” in the words of the government-run publication People’s Daily, remains “a state affair.” But now Beijing wants morebabies from its subjects. A dictatorship may use bayonets to depress birthrates — but it is much trickier to deploy police state tactics to force birthrates up. …The dictatorship has brought this demographic defiance upon itself.

Unhappy and pessimistic people don’t have children.

And some of them also will vote with their feet, as reported by Jason Douglas, Keith Zhai, and Stella Yifan Xie for the Wall Street Journal.

Well-heeled Chinese are leaving China for Singapore, attracted by the city-state’s low taxes and high-quality education, amid anxiety over China’s direction under leader Xi Jinping. …Around 10,800 wealthy Chinese left the country in 2022, according to estimates from New World Wealth, a research firmthat tracks the movements and spending habits of the world’s high-net-worth citizens.

…Singapore…has particular attractions for Chinese citizens. It is relatively close to Hong Kong and the Chinese mainland, Mandarin is widely spoken alongside English, and the city boasts excellent schools and a financial sector heavily focused on wealth management. …permanent residency and a fast-track route to Singaporean citizenship are available for those willing to invest at least 2.5 million Singapore dollars ($1.9 million) in new or existing Singapore businesses. …another factor driving Chinese nationals to move abroad is unease over a darkening climate for accumulating wealth in China, as Mr. Xi talks up the need for greater redistribution in his drive for a more egalitarian society.

I’m not surprised that class warfare discourages entrepreneurs. That’s true everywhere in the world.

The exodus from China also was addressed by Li Yuan in an article for the New York Times.

They went to Singapore, Dubai, Malta, London, Tokyo and New York — anywhere but their home country of China, where they felt that their assets, and their personal safety, were increasingly at the mercy of the authoritarian government.

…Many of them are still scarred by the last few years, during which China’s leadership went after the country’s biggest private enterprises, vilified its most celebrated entrepreneurs, decimated entire industries with arbitrary regulation… Singapore works because about three million of its citizens, or three-quarters, are ethnic Chinese, and many speak Mandarin. They also like that it is business-friendly and global-minded and, most of all, upholds the rule of law. …For decades, Hong Kong played the role of safe haven for mainland entrepreneurs because of its autonomy from China. That crumbled after Beijing introduced a national security law in the territory in 2020.

Given that is used to be a role model, the last two sentences about Hong Kong are rather depressing.

I’ll close by observing that China’s economic outlook may be even worse than we think because of dishonest data. And if China follows bad advice from the IMF and OECD, the outlook will become even gloomier.

Testing Milton Friedman: Free Markets – Full Video

Hong Kong and the Miracle of Compounding Long-Run Growth

March 11, 2016 by Dan Mitchell

Hong Kong is a truly remarkable jurisdiction.

Can you name, after all, another government in the world that brags about how little it spends on redistribution programs andhow few people are dependent on government?

that brags about how little it spends on redistribution programs andhow few people are dependent on government?

And how many jurisdictions adopt private Social Security systems to help make sure the burden of government spending doesn’t climb above 20 percent of GDP?

No wonder Hong Kong routinely is at the top of the rankings in both Economic Freedom of the World and the Index of Economic Freedom.

Here is some additional evidence of Hong Kong’s sensible approach. Below is a slide from a presentation by Hong Kong government officials, quoting the current Financial Secretary and all his predecessors, covering both the period of Chinese sovereignty and British sovereignty. As you can see, the one constant theme is free markets and small government.

For additional background, let’s enjoy the insight of one of these men.

In a column for Reason, my Cato Institute colleague Marian Tupy reminisces on his meeting with John Cowperthwaite, one of the British-appointed economic advisers.

…a young Scottish civil servant named John Cowperthwaite arrived in the colony to oversee its economic development. Some 50 years later, I met Cowperthwaite in St Andrews, Scotland, where I was a student and he was enjoying his retirement. As he told me, “I came to Hong Kong and found the economy working just fine. So, I left it that way.” …Of all the policies that we discussed, one stands out in my mind. I asked him to name the one reform that he was most proud of. “I abolished the collection of statistics,” he replied. Cowperthwaite believed that statistics are dangerous, because they enable social engineers of all stripes to justify state intervention in the economy. At some point during our first conversation I managed to irk him by suggesting that he was chiefly known “for doing nothing.” In fact, he pointed out, keeping the British political busy-bodies from interfering in Hong Kong’s economic affairs took up a large portion of his time.

I especially like Cowperthwaite’s insight about the downside risk of letting governments collect a lot of data.

Something that’s worth considering in a world where governments want to engage in massive data collection and data sharing for purposes of imposing and enforcing bad global tax policy.

But let’s not get sidetracked. Economic freedom in Hong Kong is today’s topic. With that in mind, here’s a chart from Marian’s column. It shows that Hong Kong used to be much poorer than the United Kingdom. But after decades of faster growth (thanks to good policy), Hong Kong is now more prosperous than its former colonial master.

In other words, Hong Kong didn’t just converge with one of the world’s richest countries, which by itself would be a remarkable and unusual achievement. It actually became richer.

This is tremendous evidence on the benefits of good policy and the importance of strong, long-run growth.

Let’s close by looking at this issue of growth and development. Here’s a video from Marginal Revolution, narrated by Professor Alex Tabarrok of George Mason University. You should watch it from start to finish, but if you’re pressed for time, make sure to at least watch the first 2:10.

Puzzle of Growth: Rich Countries and Poor Countries

There are two things that are worth emphasizing from the video.

The productivity of workers (and therefore the pay of workers) is dependent on the quantity and quality of capital.

Entrepreneurs play a key role in figuring out the best ways of mixing labor and capital and this innovation boosts productivity.

By the way, there are two sins of omission in the video. If you watch the whole thing, you’ll notice it mentions that strong economic performance is linked to therule of law, property rights, free trade, and sensible regulation.

All that is true. But what about a stable monetary system? And what about areasonable tax regime and a modest burden of government spending?

But I’m nitpicking. Let’s close with another video from Marginal Revolution. You should once again watch the entire video, but for those in a rush, I adjusted the settings so it starts at the most important part.

Growth Rates Are Crucial

The video uses GDP data that is adjusted for both inflation and population, which is a very useful approach. But the key lesson, as Professor Tabarrok explained, is that even small sustained changes in growth have enormous implications for long-run prosperity.

Indeed, that’s why Hong Kong is now richer than the United Kingdom. And it’s also worth noting that Hong Kong (and Singapore) are passing the United States.

Related posts:

FRIEDMAN FRIDAY Milton Friedman’s FREE TO CHOOSE “The Tyranny of Control” Transcript and Video (60 Minutes)

Milton Friedman’s FREE TO CHOOSE “The Tyranny of Control” Transcript and Video (60 Minutes) In 1980 I read the book FREE TO CHOOSE by Milton Friedman and it really enlightened me a tremendous amount. I suggest checking out these episodes and transcripts of Milton Friedman’s film series FREE TO CHOOSE: “The Failure of Socialism” and […]

FRIEDMAN FRIDAY “The Tyranny of Control” in Milton Friedman’s FREE TO CHOOSE Part 7 of 7 (Transcript and Video) “I’m not pro business, I’m pro free enterprise, which is a very different thing, and the reason I’m pro free enterprise”

In 1980 I read the book FREE TO CHOOSE by Milton Friedman and it really enlightened me a tremendous amount. I suggest checking out these episodes and transcripts of Milton Friedman’s film series FREE TO CHOOSE: “The Failure of Socialism” and “What is wrong with our schools?” and “Created Equal” and From Cradle to Grave, […]

FRIEDMAN FRIDAY “The Tyranny of Control” in Milton Friedman’s FREE TO CHOOSE Part 6 of 7 (Transcript and Video) “We are the ones who promote freedom, and free enterprise, and individual initiative, And what do we do? We force puny little Hong Kong to impose limits, restrictions on its exports at tariffs, in order to protect our textile workers”

In 1980 I read the book FREE TO CHOOSE by Milton Friedman and it really enlightened me a tremendous amount. I suggest checking out these episodes and transcripts of Milton Friedman’s film series FREE TO CHOOSE: “The Failure of Socialism” and “What is wrong with our schools?” and “Created Equal” and From Cradle to Grave, […]

FRIEDMAN FRIDAY “The Tyranny of Control” in Milton Friedman’s FREE TO CHOOSE Part 5 of 7 (Transcript and Video) “There is no measure whatsoever that would do more to prevent private monopoly development than complete free trade”

In 1980 I read the book FREE TO CHOOSE by Milton Friedman and it really enlightened me a tremendous amount. I suggest checking out these episodes and transcripts of Milton Friedman’s film series FREE TO CHOOSE: “The Failure of Socialism” and “What is wrong with our schools?” and “Created Equal” and From Cradle to Grave, […]

FRIEDMAN FRIDAY “The Tyranny of Control” in Milton Friedman’s FREE TO CHOOSE Part 4 of 7 (Transcript and Video) ” What we need are constitutional restraints on the power of government to interfere with free markets in foreign exchange, in foreign trade, and in many other aspects of our lives.”

In 1980 I read the book FREE TO CHOOSE by Milton Friedman and it really enlightened me a tremendous amount. I suggest checking out these episodes and transcripts of Milton Friedman’s film series FREE TO CHOOSE: “The Failure of Socialism” and “What is wrong with our schools?” and “Created Equal” and From Cradle to Grave, […]

FRIEDMAN FRIDAY “The Tyranny of Control” in Milton Friedman’s FREE TO CHOOSE Part 3 of 7 (Transcript and Video) “When anyone complains about unfair competition, consumers beware, That is really a cry for special privilege always at the expense of the consumer”

In 1980 I read the book FREE TO CHOOSE by Milton Friedman and it really enlightened me a tremendous amount. I suggest checking out these episodes and transcripts of Milton Friedman’s film series FREE TO CHOOSE: “The Failure of Socialism” and “What is wrong with our schools?” and “Created Equal” and From Cradle to Grave, […]

FRIEDMAN FRIDAY “The Tyranny of Control” in Milton Friedman’s FREE TO CHOOSE Part 2 of 7 (Transcript and Video) “As always, economic freedom promotes human freedom”

In 1980 I read the book FREE TO CHOOSE by Milton Friedman and it really enlightened me a tremendous amount. I suggest checking out these episodes and transcripts of Milton Friedman’s film series FREE TO CHOOSE: “The Failure of Socialism” and “What is wrong with our schools?” and “Created Equal” and From Cradle to Grave, […]

FRIEDMAN FRIDAY “The Tyranny of Control” Milton Friedman’s FREE TO CHOOSE Part 1 of 7 (Transcript and Video) “Adam Smith’s… key idea was that self-interest could produce an orderly society benefiting everybody, It was as though there were an invisible hand at work”

In 1980 I read the book FREE TO CHOOSE by Milton Friedman and it really enlightened me a tremendous amount. I suggest checking out these episodes and transcripts of Milton Friedman’s film series FREE TO CHOOSE: “The Failure of Socialism” and “What is wrong with our schools?” and “Created Equal” and From Cradle to Grave, […]

Open letter to President Obama (Part 654) “The Tyranny of Control” in Milton Friedman’s FREE TO CHOOSE Part 7 of 7 (Transcript and Video) “I’m not pro business, I’m pro free enterprise, which is a very different thing, and the reason I’m pro free enterprise”

Open letter to President Obama (Part 654) (Emailed to White House on July 22, 2013) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you […]

Open letter to President Obama (Part 650) “The Tyranny of Control” in Milton Friedman’s FREE TO CHOOSE Part 6 of 7 (Transcript and Video) “We are the ones who promote freedom, and free enterprise, and individual initiative, And what do we do? We force puny little Hong Kong to impose limits, restrictions on its exports at tariffs, in order to protect our textile workers”

Open letter to President Obama (Part 650) (Emailed to White House on July 22, 2013) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you […]

_________