–

Biden Rewards Misbehavior and Encourages Future Problems by Bailing Out Union Pension Plans

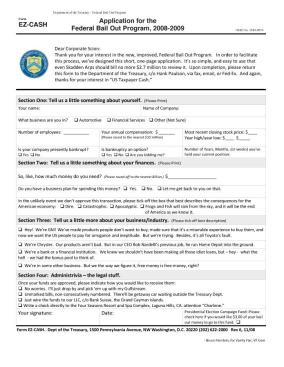

Back during the TARP bailout of Wall Street, a clever person created a satirical bailout application form.

It was amusing, of course, but also made a serious point about “moral hazard,” which is what happens when government policy rewards bad behavior.

I’m in favor of risk taking, and I certainly don’t object to people earning lots of income when they make astute choices.

But it sends a terrible signal if we bail them out when they make bad choices.

That approach tells others to go overboard with speculation. After all, heads they win, tails the taxpayers lose (as illustrated by this clever cartoon).

Sadly, politicians routinely encourage moral hazard by providing bailouts and other subsidies to their cronies, campaign contributors, and political supporters (including not just Wall Street, but also auto companies, cities, health insurance companies, imprudent homeowners, Fannie Mae/Freddie Mac, and entire nations).

And now we can add union pension plans to the list. Here are some excerpts from an editorial in yesterday’s Wall Street Journal.

Democrats sold their $1.9 trillion spending bill in 2021 as Covid “relief,” but it included some $86 billion to shore up more than 200 ailing union multi-employer pension plans. The $36 billion for the Teamsters’ Central States Pension Fund is the largest tranche awarded so far, but Mr. Biden assured his labor friends on Thursday that more is on the way. …Central States last year was only 17% funded and projected to collapse in a few years.

…Congress in 2014 acted to prevent this death spiral by passing bipartisan legislation that let sick plans reduce benefits and make other changes to avoid insolvency. Eighteen plans took advantage of the law, but Democrats then had second thoughts and decided to ding taxpayers instead. …Last year’s union, er, Covid relief bill lets the PBGC make lump sum payments to keep some sick 200 multi-employer plans solvent through 2051 and fully restore benefits in the 18 plans that had cuts. Notably, the law prohibits the PBGC from conditioning aid on governance reforms or funding rules. But it doesn’t forbid benefit increases. So the failings that got these plans in trouble will continue and may lead to future bailouts. Government unions with under-funded pensions in New Jersey and Illinois will surely demand one too.

Back in July, Eric Boehm of Reason warned that this was going to happen and that it would be a very bad idea.

The bailout was approved last year as part of the American Rescue Plan, the $1.9 trillion emergency spending bill…the multiemployer pension plan bailout is arguably the least defensible provision in a bill that was full of indefensible spending.

…Reps. Virginia Foxx (R–N.C.) and Rick Allen (R–Ga.), respectively the top Republicans on the Education and Labor Committee and the Health, Employment, Labor, and Pensions Subcommittee, in a joint statement…added, “creates perverse incentives for further mismanagement and underfunding and leaves the taxpayer holding the bag.” …this is something of a no-brainer. Biden delivered a major win to his labor union allies, put the cost on the taxpayers’ tab, and took a victory lap for doing it. …And everyone else gets to pay for it.

That same month, and

Multiemployer plans often promise beneficiaries more benefits than they can afford. Many are governed by a board of trustees with equal representation from unions and employers—a recipe for increasing benefits but not funding them. …Congress and the Biden administration wrote a blank check to political supporters under the guise of Covid relief.

…The most egregious aspect of the bailout is that it made no attempt at structural reform. Plans are free to continue the practices that got them into trouble in the first place. …The PBGC’s new projected insolvency date is 2055, four years after the bailout funds end. The pension scheme is set up for failure—or another bailout—in three decades. Bailouts should be conditioned on reforms. In prior bailout legislation…Congress tried to address the causes of the failures that made a bailout necessary. But with multiemployer pension plans, lawmakers made no attempt to fix anything—they merely spent taxpayer money.

What’s most upsetting about this bailout is not the money that’s being squandered today.

It’s the fact that this bailout will make future bailouts more likely.

But future spending on additional bailouts is just part of the problem. There’s also a macro cost to the economy because the allocation of capital will be distorted.

Investors will take imprudent risks because there is a greater-than-zero chance (in some cases, probably close to 100 percent) that politicians will shift future losses on to the backs of taxpayers.

That’s not a free market. After all, capitalism without bankruptcy is like religion without hell.

P.S. I also worry the bailout of union pension plans will be a precursor to bailouts of unfunded promises for state and local bureaucrats.

Uploaded by mearbhrach on Jul 14, 2007

In his book “Capitalism and Freedom” (1962) Milton Friedman (1912-2006) advocated minimizing the role of government in a free market as a means of creating political and social freedom.

An excerpt from an interview with Phil Donahue in 1979.

http://en.wikipedia.org/wiki/Milton_Friedman

___________-

On the Phil Donohue Show Milton Friedman noted:

― Milton Friedman

The Economics of Greed

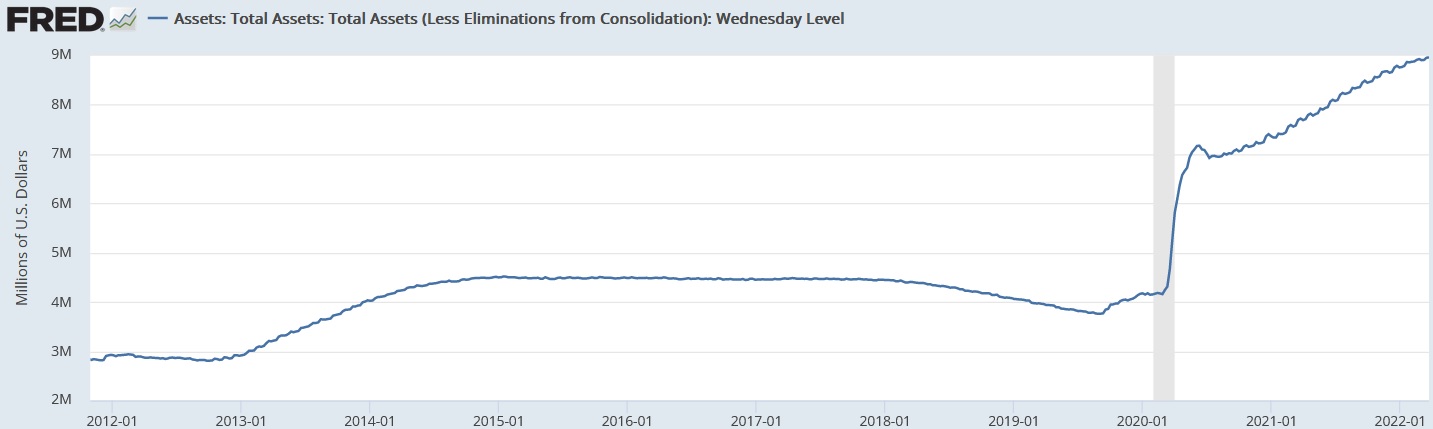

Looking back on the 2008 financial crisis, it seems clear that much of that mess was caused by bad government policy, especially easy money from the Federal Reserve and housing subsidies from Fannie Mae and Freddie Mac.

Many of my left-leaning friends, by contrast, assert that “Wall Street greed” was the real culprit.

I have no problem with the notion that greed plays a role in financial markets, but people on Wall Street presumably were equally greedy in the 1980s and 1990s. So why didn’t we also have financial crises during those decades?

Isn’t it more plausible to think that one-off factorsmay have caused markets to go awry?

I took that trip down Memory Lane because of a rather insipid tweet from my occasional sparringpartner, Robert Reich. He wants his followers to think that inflation is caused by “corporate greed.”

For what it’s worth, I agree that corporations are greedy. I’m sure that they are happy when they can charge more for their products.

But that’s hardly an explanation for today’s inflation.

After all, corporations presumably were greedy back in 2015. And in 2005. And in 1995. So why didn’t we also have high inflation those years as well?

If Reich understood economics, he could have pointed out that today’s inflation was caused by the Federal Reserve and also absolved Biden by explaining that the Fed’s big mistake occurred when Trump was in the White House.

I don’t expect Reich to believe me, so perhaps he’ll listen to Larry Summers, who also served in Bill Clinton’s cabinet.

But I won’t hold my breath.

As Don Boudreaux has explained, Reich is not a big fan of economic rigor and accuracy.

P.S. Reich also blamed antitrust policy, but we have had supposedly “weak antitrust enforcement” since the 1980s. So why did inflation wait until 2021 to appear?

P.P.S. In addition to being wrong about the cause of the 2008 crisis, my left-leaning friends also were wrong about the proper response to the crisis.