—

Defending (sort of) European Economic Policy

I write frequently about the economic damagecaused by European fiscal policy, but today let’s comment on the (comparatively) good policies that exist on the other side of the Atlantic.

We’ll start with this video excerpt from a presentation last month.

–

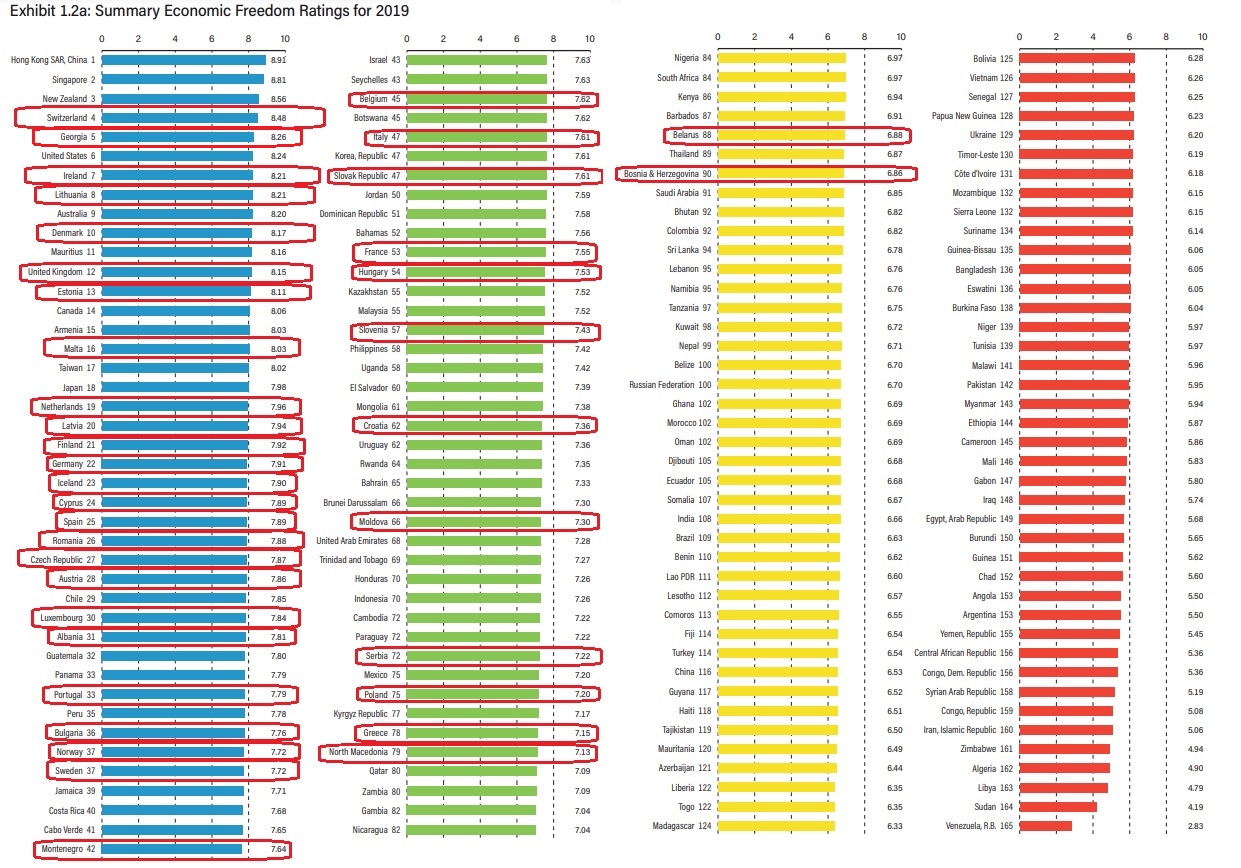

If you don’t have time to watch the video, everything you need to know is captured in this data from Economic Freedom of the World. As you can see, European nations (circled in red) dominate the top half.

Indeed, it’s safe the say that Europe dominates the top quartile (the blue nations, categorized as “mostly free”).

As I noted in the video, this does not mean these nations have great policy. Or even good policy.

But it does mean that European nations generally enjoy more economic liberty than countries from other parts of the world (or, if you like looking at the glass as half empty, they suffer from less economic repression).

If you dig into the details, what you will find is that Europeans nations generally have bad fiscal policy, but they tend to score highly in other areas (i.e., good rule of law, low levels of red tape, etc).

To be sure, not all European nations are the same. There’s a big difference between laissez-faire Switzerland and dirigiste Greece, for instance.

But I’ll close be reiterating a comment from the above video, which is that that there’s a much bigger gap between Greece and Venezuela than there is between the United States and Greece.

P.S. A new edition of Economic Freedom of the World has been released, but there were only minor changes for the United States (down one spot) and Europe. And if you look at the latest edition of the Heritage Foundation’s Index of Economic Freedom, the United States is only #25, lagging behind 17 European nations. Including all of the supposedlysocialist welfare states in Scandinavia.

New Competitiveness Rankings: Biden Wants to Copy the Wrong Nations

One of the my favorite publications from the Tax Foundation is the annual International Tax Competitiveness Index (here’s what I wrote in 2020 and 2019).

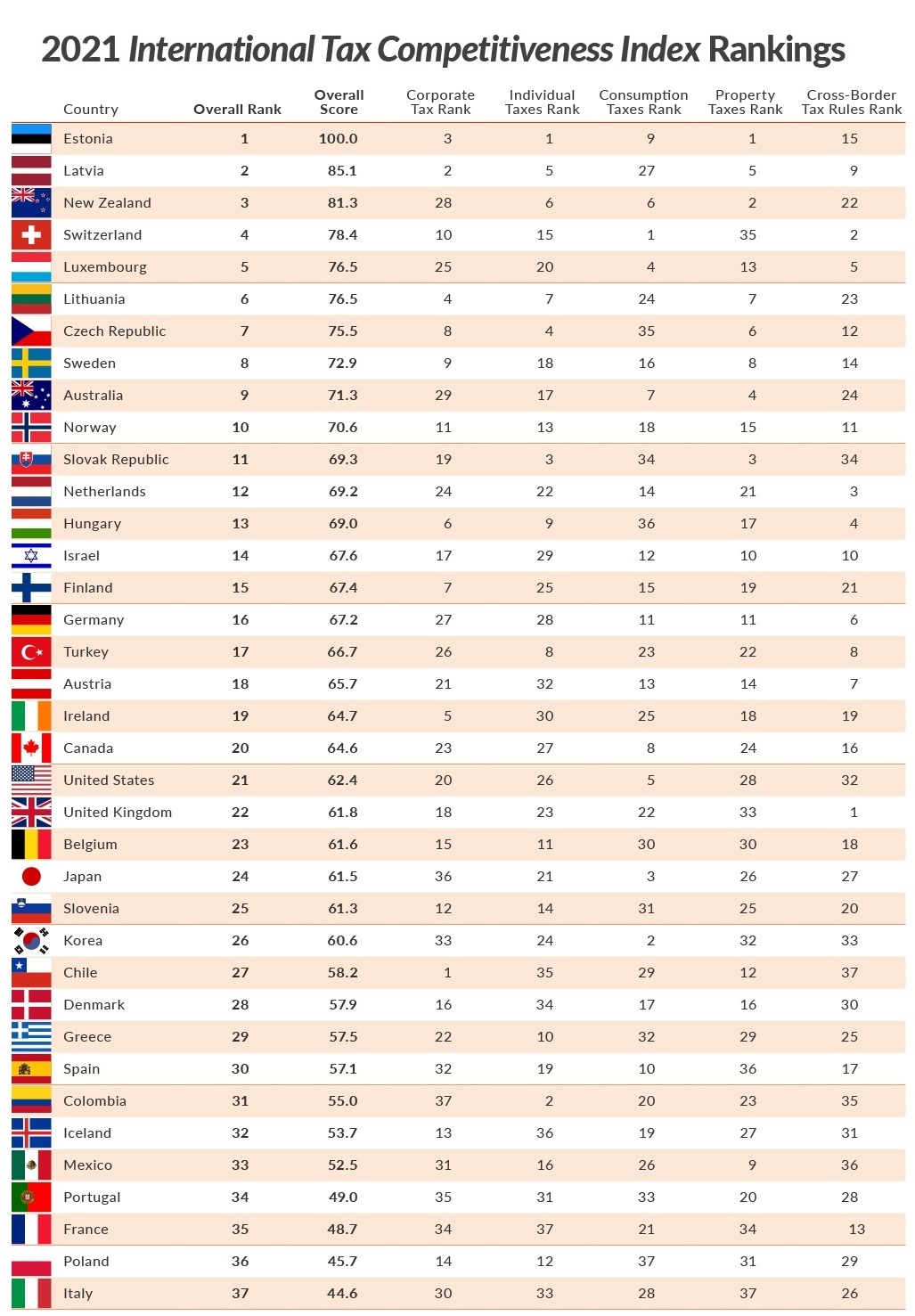

The 2021 Index, authored by Daniel Bunn and Elke Asen, has now been released, and you can see that Estonia has the most sensible policy.

Other Baltic nations also are highly ranked, as are Switzerlandand New Zealand.

It’s probably no surprise to see nations such as France and Italyscore so poorly, but Poland is a bit of a surprise.

Since most readers are from the United States, let’s specifically look at America’s rankings.

The U.S. does very will on consumption taxes (ranked #5), largely because we haven’t made the mistake of adding a value-added tax to our system.

By contrast, the U.S. is near the bottom (ranked #32) with regard to cross-border tax rules, though at least America is no longer in last place in that category, as was the case back in 2014.

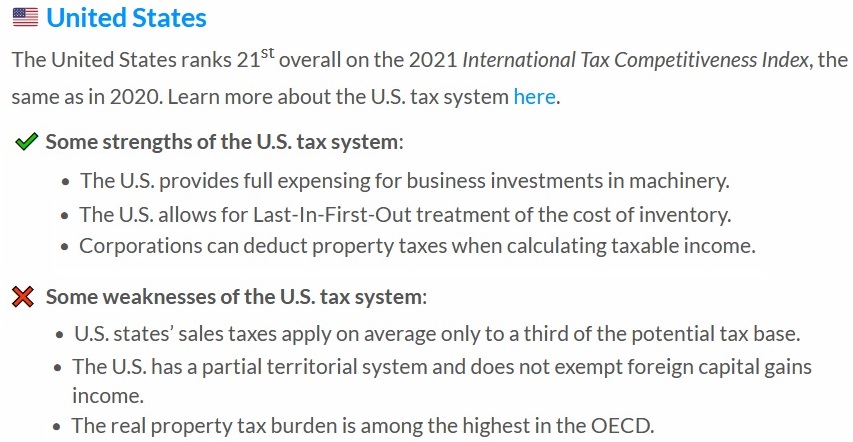

Here are some additional details for the folks who like to get in the weeds.

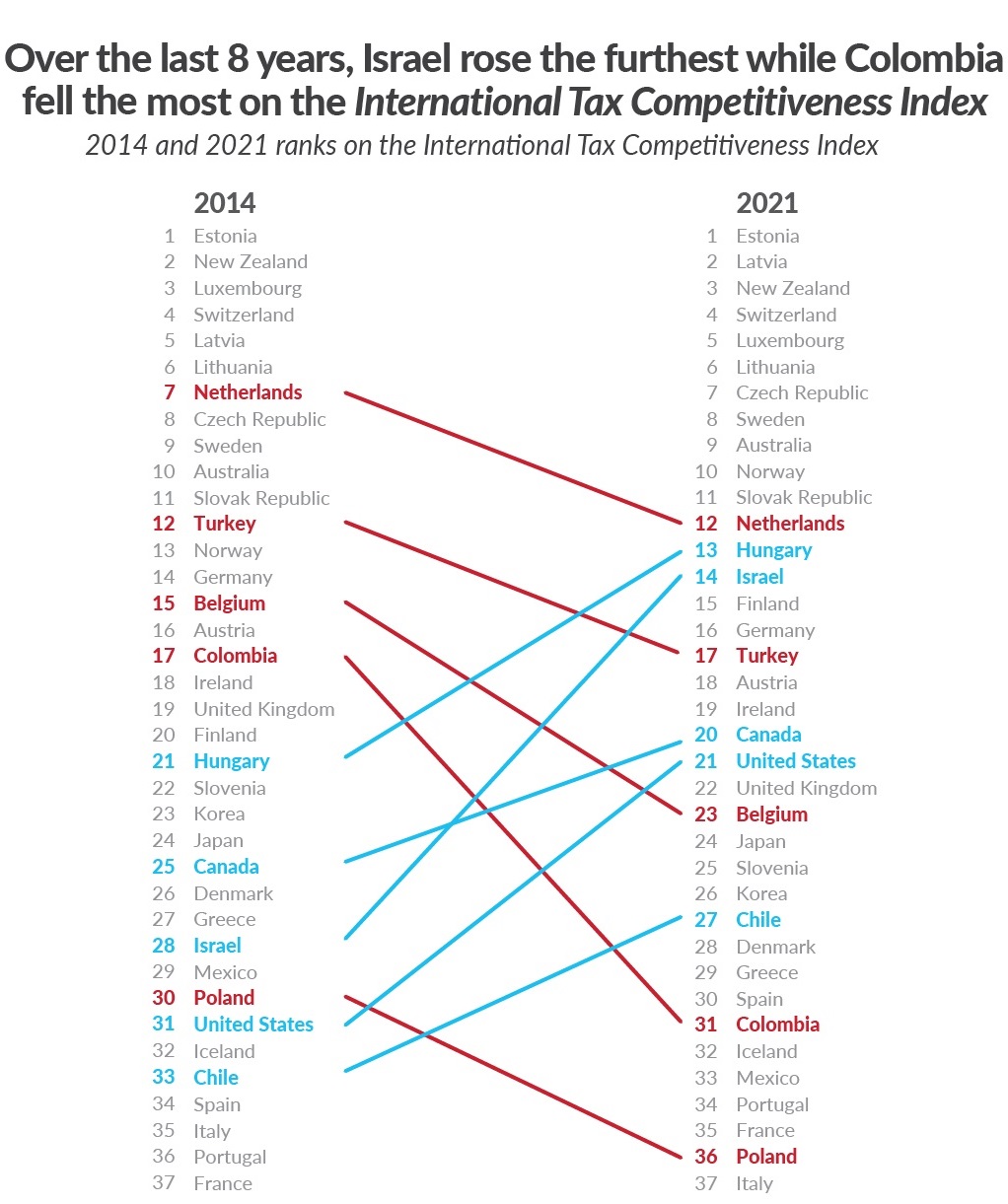

The Tax Foundation also released a companion article looking at which nations have enjoyed the biggest improvements or suffered the biggest declines since the Index first began back in 2014.

The United States has been a big winner thanks to the 2017 tax reform, but Israel wins the prize by jumping all the way from #28 to #14.

Colombia has the dubious honor of suffering the biggest decline.

Makes me wonder whether joining the pro-tax OECD (a process that began in 2013) played a role in the country’s shift in the wrong direction.

I’ll close with the sad observation that America’s progress will be reversed if Biden’s class-warfare tax plan is enacted. Earlier this year, the Tax Foundation estimated that the President’s plan would cause the United States to drop eight spots.

Call me crazy, but I don’t understand why folks on the left want the U.S. tax system to be more like Italy’s.

P.S. I would like to see the aggregate tax burden added as one of the variables in the Index, and it also would be interesting if more jurisdictions were included (zero-tax jurisdictions such as Bermuda and the Cayman Islands presumably would beat out Estonia, and it also would be interesting to see where anti-market nations such as China got ranked).

The Economics of Redistributionism

Back in 2016, I created a 2×2 matrix to illustrate the difference between redistributionism (tax Person A and give to Person B) and state planning (politicians and bureaucrats trying to steer the economy, either through direct ownership or industrial policy).

The main point of that column was to show that countries should try to be in the top-left section, where there is less redistribution and less government control.

But I also wanted to help people understand that redistributionism and socialism are not the same thing.

For instance, Sweden (in the bottom-left box) is a capitalist economy with a big welfare state, whereas China (in the top-right box) doesn’t have much redistribution but government has substantial control over economic activity.

From an American perspective, the good news is that the U.S. currently is in the top-left box.

The bad news is that President Biden wants the country in the bottom-left box. So, if we want to be technically accurate, we should not accuse him of socialism.

Instead, as Antony Davies and James Harrigan explained in a column for the Foundation for Economic Education, the real threat to the nation is “transferism.”

Socialism is state control of the means of production. …By contrast, capitalism is simply private ownership of the means of production. …more than four in ten Americans think “some form of socialism” is a good thing. But what is “some form of socialism?” A society is either socialist or it isn’t.The state either owns the means of production or it doesn’t. There is no middle ground. …It appears that what Americans really have in mind when they think about socialism is not an economic system but particular economic outcomes. …they are advocating what we should really call “transferism.” Transferism is a system in which one group of people forces a second group to pay for things that the people believe they, or some third group, should have. Transferism isn’t about controlling the means of production. It is about the forced redistribution of what’s produced.

Davies and Harrigan are correct.

Moreover, they deserve credit for predicting the future since they wrote the column in 2019!

Now let’s consider whether redistributionism (or transferism) is a good idea.

I’ve previously explained that a big welfare state causes economic damage, even if a nation otherwise is very pro-capitalist.

Consider, for instance, the remarkable data showing how Swedish-Americans and Danish-Americans generate much more prosperity than Swedes and Danes who still live in Scandinavia.

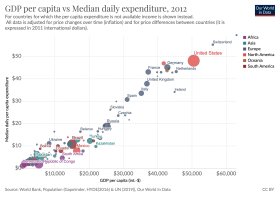

Or consider the income data showing how average Americans enjoy much higher living standards than their European counterparts (either in Nordic nations or elsewhere).

What’s worrisome is that Biden wants a much bigger welfare state and he doesn’t seem to understand that European-sized government means anemic European-style economic performance.

This is the message that Bret Stephens shared in one of his recent columns for the New York Times.

He starts by describing Biden’s agenda.

President Biden charts a course toward the largest expansion of government since Lyndon Johnson’s Great Society. After signing a $1.9 trillion Covid-19 relief bill in March and proposing a $1.5 trillion discretionary budget in April (a 16 percent increase from this year, on top of what’s likely to be at least $3 trillion in mandatory spending on programs like Medicare and Medicaid), the president wants $2.3 trillion more for infrastructure and $1.8 trillion for new social programs. That’s $7.5 trillion in discretionary spending. To put the number in perspective, we spent $4.1 trillion in inflation-adjusted dollars over nearly four years to wage and win the Second World War. What will America get for the money?

He then points out the potential consequences.

…before the U.S. takes this leap into a full-blown American social-welfare state, moderates in Congress like Senator Joe Manchin or Representative Jim Costa ought to ask: What’s the catch? …The real catch is that massive government spending has hidden costs that are difficult to capture in numbers alone. Take another look at Europe. Why does R&D spending in the European Union persistently lag that in the U.S. …Why does Europe’s tech start-up scene…so notably lag its competitors…? Perhaps…social safety nets typically come at the expense of risk-taking and economic dynamism. And why is France, which, according to the Organization for Economic Cooperation and Development, spends more on social welfare than any other nation in the developed world, such an unhappy place, with chronically high unemployment, endless labor unrest, a decades-old brain drain, rising political extremism, a wealth tax that failed and a medical system that was on the brink of collapse long before Covid struck? …Beyond the gargantuan cost, Congress should think very hard about the real catch: transforming America into a kinder, gentler place of permanent decline.

Amen.

Biden’s agenda inevitably will erode societal capital, leading to less work (because of lavish freebies such as per-child handouts) and lower levels of entrepreneurship (because of tax penalties on investment and risk-taking).

And this can lead to a tipping point, which is illustrated by my Theorem of Societal Collapse.

By Historical Standards, Today’s Americans Are Fantastically Wealthy

I’ve spent several decades trying to convince people that we should have free markets and small government in order to increase national prosperity.

Indeed, I’ve even pointed out how very small increases in annual growth can lead to big improvements in living standards over just a couple of decades.

But some folks on the left are not very receptive to this argument. They genuinely (but incorrectly) seem to think the economy is a fixed pie (which also explains, at least in part, why they are so focused on redistribution).

So let’s share some hard data in hopes of getting them to understand that more prosperity is possible.

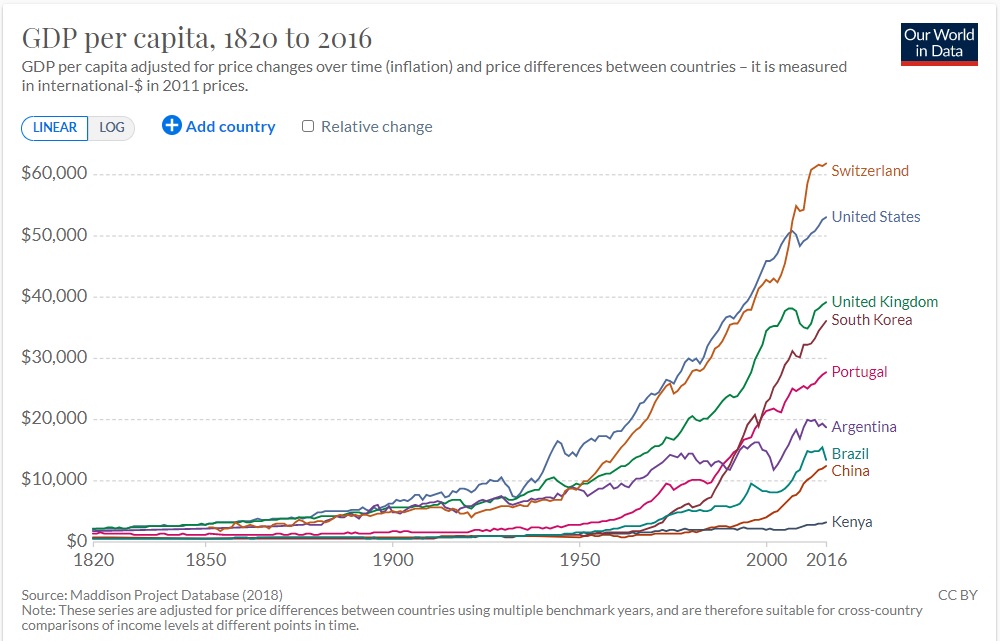

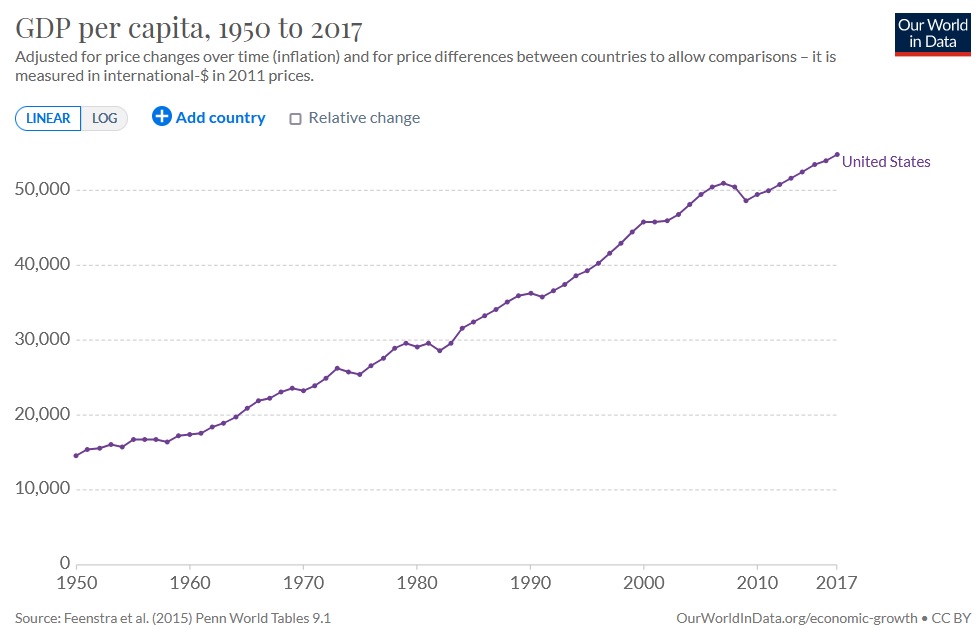

We’ll start will this chart of inflation-adjusted per-capita economic output in the United States, which comes from Oxford University’s Our World in Data.

The obvious takeaway from this data is that Americans are much richer today than they were after World War II. Adjusted for inflation, we’re now about four times richer than our grandparents.

Some of our friends on the left may be thinking these numbers are distorted, that average output has only increased because the rich have gotten so much richer.

Well, it is true that the rich have gotten richer. But it’s also true that the rest of us have become richer as well.

Which is why I shared data earlier this year showing median living standards rather than mean (average) living standards.

Folks on the left may also suspect that the post-1950 data is an anomaly. In other words, maybe I’m guilty of cherry-picking data.

That’s a common practice in the world of policy, so I don’t blame people for being suspicious.

So take a look at this chart, which I also first shared earlier this year. It shows that the increase in living standards has been even more dramatic if you look at changes since 1820.

By the way, none of these observations are new. Back in 1997, Micahel Cox and Richard Alm wrote a must-read article for the Dallas Federal Reserve Bank’s Annual Report.

Here are some of their findings.

What really matters…isn’t what something costs in money; it’s what it costs in time. Making money takes time, so when we shop, we’re really spending time. The real cost of living isn’t measured in dollars and cents but in the hours and minutes we must work to live. …A pair of stockings cost just 25¢ a century ago. This sounds wonderful until we learn that a worker of the era earned only 14.8¢ an hour.So paying for the stockings took 1 hour 41 minutes of work. Today a better pair requires only about 18 minutes of work. …In calculating our cost of living, a good place to start is with the basics—food, shelter and clothing. In terms of time on the job, the cost of a half-gallon of milk fell from 39 minutes in 1919 to 16 minutes in 1950, 10 minutes in 1975 and 7 minutes in 1997. A pound of ground beef steadily declined from 30 minutes in 1919 to 23 minutes in 1950, 11 minutes in 1975 and 6 minutes in 1997. Paying for a dozen oranges required 1 hour 8 minutes of work in 1919. Now it takes less than 10 minutes, half what it did in 1950.

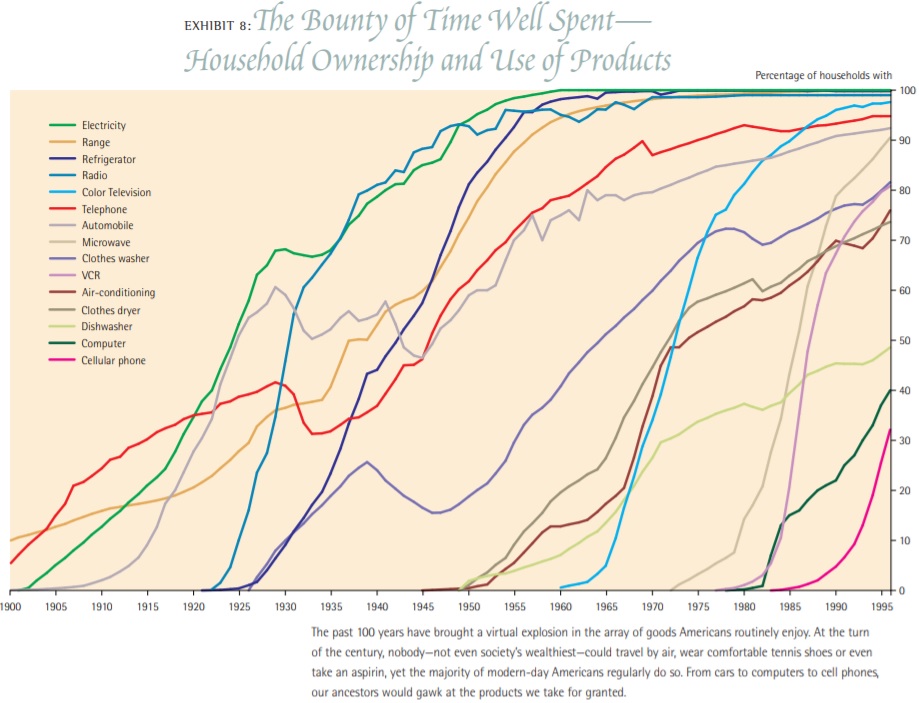

These two visuals from the article are very informative.

First, look at how consumer products went from rare luxuries early in the 20th century to everyday products by the end of the century.

Equally important, these products have become cheaper and cheaper over time.

As illustrated by this second visual from the article.

All the data in the Cox-Alm article is more than 20 years old, so the numbers would be even more impressive today.

Indeed, you can see some more up-to-date data from Mark Perry, Steve Horwitz, and James Pethokoukis.

Professor Don Boudreaux put these numbers in context a few years ago in a column for the Foundation for Economic Education. Here’s some of what he wrote.

What is the minimum amount of money that you would demand in exchange for your going back to live even as John D. Rockefeller lived in 1916? …Think about it. …If you were a 1916 American billionaire you could, of course, afford prime real-estate. You could afford a home on 5th Avenue or one overlooking the Pacific Ocean… But when you traveled from your Manhattan digs to your west-coast palace, it would take a few days, and if you made that trip during the summer months, you’d likely not have air-conditioning in your private railroad car.…You could neither listen to radio (the first commercial radio broadcast occurred in 1920) nor watch television. …Obviously, you could not download music. …Your telephone was attached to a wall. You could not use it to Skype. …Even the best medical care back then was horrid by today’s standards: it was much more painful and much less effective. …Antibiotics weren’t available. …Dental care wasn’t any better. …You were completely cut off from the cultural richness that globalization has spawned over the past century. …I wouldn’t be remotely tempted to quit the 2016 me so that I could be a one-billion-dollar-richer me in 1916. This fact means that, by 1916 standards, I am today more than a billionaire. It means, at least given my preferences, I am today materially richer than was John D. Rockefeller.

The bottom line is that we have become richer and we can continue to become richer.

But how fast things improve is partly a function of government policy. If we can impose some restraints on the size and scope of government, that will give the private sector some breathing room to grow and prosper.

In other words, we don’t need perfect policy, but it is important to at least have good policy.

Will Biden Resuscitate Obama’s Reprehensible “Operation Choke Point”?

Some policies will improve with Biden in the White House, most notably trade, but also government spending (not because Biden is good, but rather because Republicans will go back to pretending to be fiscally conservative).

But some policies will move in the wrong direction. Biden is awful on tax policy, for instance, though I expect Republicans in the Senate will block his class-warfare agenda.

Biden is also very bad on regulatory issues. Unfortunately, this is an area where the new President (and his appointees) will have plenty of authority to shift policy in the wrong direction.

I’m especially worried that Biden will resuscitate an Obama-era policy of strong-arming banks so they won’t do business with unpopular industries. This video, which I first shared back in 2016, explains this reprehensible policy

Norbert Michel of the Heritage Foundation, in a column for Forbes, provides some additional background on the policy.

Choke Point consisted of bureaucrats in several independent federal agencies taking it upon themselves to shut legal businesses – such as payday lenders and firearms dealers – out of the banking system. Given the nature of the U.S. regulatory framework, this operation was easy to pull off.Officials at the Federal Deposit Insurance Corporation (FDIC), for instance, simply had to inform the banks they were overseeing that the government considered certain types of their customers “high risk.” The mere implication of a threat was enough to pressure banks into closing accounts, because no U.S. bank wants anything to do with extra audits or investigations from their regulator, much less additional operating restrictions or civil and criminal charges. Banks are incredibly sensitive to any type of pressure from federal regulators, and they know that the regulators have enormous discretion.

In a column for the Wall Street Journal earlier this year, Phil Gramm and Mike Solon elaborated on the left’s campaign to politicize the banking system.

Banking was used as a weapon against legal, solvent businesses by the Obama administration during Operation Choke Point, a program to deny the disfavored access to banking services. The Federal Deposit Insurance Corp. labeled certain businesses “high risk,” including firearms and ammunition dealers, check-cashers, payday lenders and fireworks vendors. Unelected regulators, not Congress or courts, marked these industries as “dirty business” and made it “unacceptable for an insured depository institution” to offer them banking services. …With Democrats unable to ban guns legislatively, Rep. Carolyn Maloney admonished banks at a recent hearing to not “finance gun slaughter.” When she urged JPMorgan to deny credit for legal firearm sales as other banks had done, the CEO responded, “We can certainly consider that. Yes.” At the same hearing, Rep. Rashida Tlaib challenged bank CEOs: “Will any of your banks make a commitment to phase out your investments in fossil fuels and dirty energy?” The CEOs declined to defend fossil fuels… Letting political intimidation dictate the availability of private credit endangers freedom and stifles productivity growth and job creation. …The use of political intimidation to allocate capital is an assault on economic efficiency and freedom.

There is, however, a bit of good news.

The Trump Administration ended Operation Choke Point back in 2017.

And, although it is happening at the last minute, the Trump Administration is now trying to strengthen the rule of law so banks won’t feel pressured to discriminate against certain industries in the future.

In a column published yesterday by the Wall Street Journal, Brian Brooks and Charles Calomiris of the Office of the Comptroller of the Currency (OCC) explain the new rule that their agency has unveiled.

…there have been too many allegations of banks cutting off vital services, credit and capital that legal businesses rely on to create jobs, meet community needs and support the economy. The Office of the Comptroller of the Currency, where we serve as acting comptroller and chief economist, respectively, on Friday proposed a rule to prevent banks from discriminating against legal businesses and individuals.The rule would require bankers to do what they do best: assess risk and underwrite credit decisions. …politically driven discrimination against particular industries has threatened fairness in banking. Under the Obama administration, Operation Choke Point, in which the OCC did not take part, involved regulators discouraging banks from serving legal and constitutionally protected businesses such as payday lenders and gun and ammunition sellers. …the Dodd-Frank Act of 2010 added to the OCC’s traditional mission of safety and soundness the obligation to ensure fair access to financial services… Banks may not exclude entire parts of the economy for reasons unrelated to objective, quantifiable risks specific to an individual customer.

Sadly, if Biden has the same attitude as Obama about the rule of law, a future OCC can reverse anything Trump’s people adopt.

I’ll close with a libertarian-minded observation.

Because I believe in freedom of association, I think banks should have the liberty to discriminate against specific businesses, or even entire industries.

But there’s a big difference between banks choosing to discriminate and being coerced into such behavior by government regulators.

So it was disgusting that Obama’s regulators went after industries they didn’t like, such as gun dealers.

But it would be equally reprehensible if a Republican Administration went after an industry it didn’t like, such as legal marijuana.

P.S. The broader lesson to learn from Operation Choke Point is that regulatory power for governments is a vehicle for corruptionand malfeasance.

——

The Case Against Biden’s Class-Warfare Tax Policy, Part II

In Part I of this series, I expressed some optimism that Joe Biden would not aggressively push his class-warfare tax plan, particularly since Republicans almost certainly will wind up controlling the Senate.

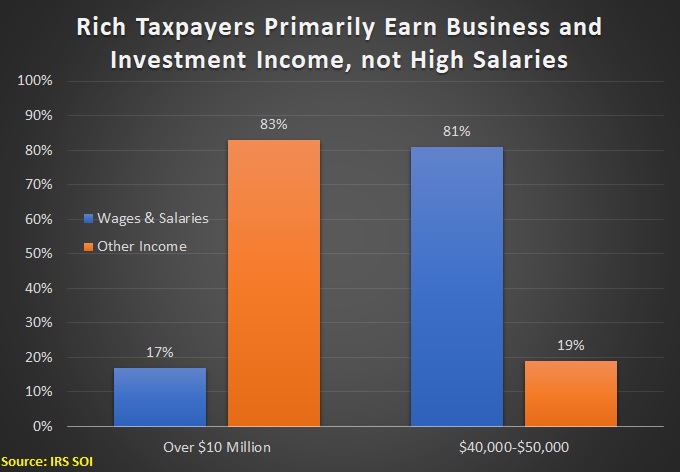

But the main goal of that column was to explain that the internal revenue code already is heavily weighted against investors, entrepreneurs, business owners and other upper-income taxpayers.

And to underscore that point, I shared two charts from Brian Riedl’s chartbook to show that the “rich” are now paying a much larger share of the tax burden – notwithstanding the Reagan tax cuts, Bush tax cuts, and Trump tax cuts – than they were 40 years ago.

Not only that, but the United States has a tax system that is more “progressive” than all other developed nations (all of whom also impose heavy tax burdens on upper-income taxpayers, but differ from the United States in that they also pillage lower-income and middle-class residents).

In other words, Biden’s class-warfare tax plan is bad policy.

Today’s column, by contrast, will point out that his tax increases are impractical. Simply stated, they won’t collect much revenue because people change their behavior when incentives to earn and report income are altered.

This is especially true when looking at upper-income taxpayers who – compared to the rest of us – have much greater ability to change the timing, level, and composition of their income.

This helps to explain why rich people paid five times as much tax to the IRS during the 1980s when Reagan slashed the top tax rate from 70 percent to 28 percent.

When writing about this topic, I normally use the Laffer Curve to help people understand why simplistic assumptions about tax policy are wrong (that you can double tax revenue by doubling tax rates, for instance). And I point out that even folks way on the left, such as Paul Krugman, agree with this common-sense view (though it’s also worth noting that some people on the right discredit the concept by making silly assertions that “all tax cuts pay for themselves”).

But instead of showing the curve again, I want to go back to Brian Riedl’s chartbook and review his data on of revenue changes during the eight years of the Obama Administration.

It shows that Obama technically cut taxes by $822 billion (as further explained in the postscript, most of that occurred when some of the Bush tax cuts were made permanent by the “fiscal cliff” deal in 2012) and raised taxes by $1.32 trillion (most of that occurred as a result of the Obamacare legislation).

If we do the math, that means Obama imposed a cumulative net tax increase of about $510 billion during his eight years in office

But, if you look at the red bar on the chart, you’ll see that the government didn’t wind up with more money because of what the number crunchers refer to as “economic and technical reestimates.”

Indeed, those reestimates resulted in more than $3.1 trillion of lost revenue during the Obama years.

I don’t want the politicians and bureaucrats in Washington to have more tax revenue, but I obviously don’t like it when tax revenues shrink simply because the economy is stagnant and people have less taxable income.

Yet that’s precisely what we got during the Obama years.

To be sure, it would be inaccurate to assert that revenues declined solely because of Obama’s tax increase. There were many other bad policies that also contributed to taxable income falling short of projections.

Heck, maybe there was simply some bad luck as well.

But even if we add lots of caveats, the inescapable conclusion is that it’s not a good idea to adopt policies – such as class-warfare tax rates – that discourage people from earning and reporting taxable income.

The bottom line is that we should hope Biden’s proposed tax increases die a quick death.

P.S. The “fiscal cliff” was the term used to describe the scheduled expiration of the 2001 and 2003 Bush tax cuts. According to the way budget data is measured in Washington, extending some of those provisions counted as a tax cut even though the practical impact was to protect people from a tax increase.

P.P.S. Even though Biden absurdly asserted that paying higher taxes is “patriotic,” it’s worth pointing out that he engaged in very aggressive tax avoidance to protect his family’s money.

President Joe Biden Will Be Bad, but a President Kamala Harris Would Be Worse

Joe Biden has a very misguided economic agenda. I’m especially disturbed by his class-warfare tax agenda, which will be bad news for American workers and American competitiveness.

The good news, as I wrote earlier this year, is that he probably isn’t serious about some of his worst ideas.

Biden is a statist, but not overly ideological. His support for bigger government is largely a strategy of catering to the various interest groups that dominate the Democratic Party. The good news is that he’s an incrementalist and won’t aggressively push for a horrifying FDR-style agenda if he gets to the White House.

But what if Joe Biden’s health deteriorates and Kamala Harris – sooner or later – winds up in charge?

That’s rather troubling since her agenda was far to the left of Biden’s when they were competing for the Democratic nomination.

And it doesn’t appear that being Biden’s choice for Vice President has led her to moderate her views. Consider this campaign ad, where she openly asserted that “equitable treatment means we all end up at the same place.”

The notion that we should strive for equality of outcomes rather than equality of opportunity is horrifying.

For all intents and purposes,Harris has embraced a harsh version of redistributionism where everyone above average is punished and everyone below average is rewarded.

This goes way beyond a safety net and it’s definitely a recipe for economic misery since people on both sides of the equationhave less incentive to be productive.

I’m not the only one to be taken aback by Harris’ dogmatic leftism.

Robby Soave, writing for Reason, is very critical of her radical outlook.

Harris gives voice to a leftist-progressive narrative about the importance of equity—equal outcomes—rather than mere equality before the law. …Harris contrasted equal treatment—all people getting the same thing—with equitable treatment,which means “we all end up at the same place.” …This may seem like a trivial difference, but when it comes to public policy, the difference matters. A government shouldbe obligated to treat all citizens equally, giving them the same access to civil rights and liberties like voting, marriage, religious freedom, and gun ownership. …A mandate to foster equity, though, would give the government power to violate these rights in order to achieve identical social results for all people.

And, in a column for National Review, Brad Polumbo expresses similar reservations about her views.

Whether she embraces the label “socialist” or not, Harris’s stated agenda and Senate record both reveal her to be positioned a long way to the left on matters of economic policy. From health care to the environment to housing, Harris thinks the answer to almost every problem we face is simply more government and more taxpayer money — raising taxes and further indebting future generations in the process.…Harris…supports an astounding $40 trillion in new spending over the next decade. In a sign of just how far left the Democratic Party has shifted on economics, Harris backs more than 20 times as much spending as Hillary Clinton proposed in 2016. …And this is not just a matter of spending. During her failed presidential campaign, Harris supported a federal-government takeover of health care… The senator jumped on the “Green New Deal” bandwagon as well. She co-sponsored the Green New Deal resolution in the Senate that called for a “new national, social, industrial, and economic mobilization on a scale not seen since World War II and the New Deal era.” …she supports enacting price controls on housing across the country. …The left-wing group Progressive Punch analyzed Harris’s voting record and found that she is the fourth-most liberal senator, more liberal even than Massachusetts senator Elizabeth Warren. Similarly, the nonpartisan organization GovTrack.us deemed Harris the furthest-left member of the Senate for the 2019 legislative year. (Spoiler alert: If your voting record is to the left of Bernie Sanders, you might be a socialist.)

To be fair, Harris is simply a politician, so we have no idea what she really believes. Her hard-left agenda might simply be her way of appealing to Democratic voters, much as Republicans who run for president suddenly decide they support big tax cuts and sweeping tax reform.

But whether she’s sincere or insincere, it’s troubling that she actually says it’s the role of government to make sure we all “end up at the same place.”

Let’s close with a video clip from Milton Friedman. At the risk of understatement, he has a different perspective than Ms. Harris.

Since we highlighted Harris’ key quote, let’s also highlight the key quote from Friedman.

Amen.

P.S. It appears Republicans will hold the Senate, which presumably (hopefully?) means that any radical proposals would be dead on arrival, regardless of whether they’re proposed by Biden or Harris.

P.P.S. Harris may win the prize for the most economically illiterate proposal of the 2020 campaign.

——

Will Biden’s Class-Warfare Tax Plan Lead to an Exodus of Job Creators?

After Barack Obama took office (and especially after he was reelected), there was a big uptick in the number of rich people who chose to emigrate from the United States.

There are many reasons wealthy people choose to move from one nation to another, but Obama’s embrace of class-warfare tax policy (including FATCA) was seen as a big factor.

Joe Biden’s tax agenda is significantly more punitive than Obama’s, so we may see something similar happen if he wins the 2020 election.

Given the economic importance of innovators, entrepreneurs, and inventors, this would be not be good news for the American economy.

The New York Times reported late last year that the United States could be shooting itself in the foot by discouraging wealthy residents.

…a different group of Americans say they are considering leaving — people of both parties who would be hit by the wealth tax… Wealthy Americans often leave high-tax states like New York and California for lower-tax ones like Florida and Texas. But renouncing citizenship is a far more permanent, costly and complicated proposition. …“America’s the most attractive destination for capital, entrepreneurs and people wanting to get a great education,” said Reaz H. Jafri, a partner and head of the immigration practice at Withers, an international law firm. “But in today’s world, when you have other economic centers of excellence — like Singapore, Switzerland and London — people don’t view the U.S. as the only place to be.” …now, the price may be right to leave. While the cost of expatriating varies depending on a person’s assets, the wealthiest are betting that if a Democrat wins…, leaving now means a lower exit tax. …The wealthy who are considering renouncing their citizenship fear a wealth tax less than the possibility that the tax on capital gains could be raised to the ordinary income tax rate, effectively doubling what a wealthy person would pay… When Eduardo Saverin, a founder of Facebook…renounced his United States citizenship shortly before the social network went public, …several estimates said that renouncing his citizenship…saved him $700 million in taxes.

The migratory habits of rich people make a difference in the global economy.

Here are some excerpts from a 2017 Bloomberg story.

Australia is luring increasing numbers of global millionaires, helping make it one of the fastest growing wealthy nations in the world… Over the past decade, total wealth held in Australia has risen by 85 percent compared to 30 percent in the U.S. and 28 percent in the U.K… As a result, the average Australian is now significantly wealthier than the average American or Briton. …Given its relatively small population, Australia also makes an appearance on a list of average wealth per person. This one is, however, dominated by small tax havens.

Here’s one of the charts from the story.

As you can see, Australia is doing very well, though the small tax havens like Monaco are world leaders.

I’m mystified, however, that the Cayman Islands isn’t listed.

But I’m digressing.

Let’s get back to our main topic. It’s worth noting that even Greece is seeking to attract rich foreigners.

The new tax law is aimed at attracting fresh revenues into the country’s state coffers – mainly from foreigners as well as Greeks who are taxed abroad – by relocating their tax domicile to Greece, as it tries to woo “high-net-worth individuals” to the Greek tax register.The non-dom model provides for revenues obtained abroad to be taxed at a flat amount… Having these foreigners stay in Greece for at least 183 days a year, as the law requires, will also entail expenditure on accommodation and everyday costs that will be added to the Greek economy. …most eligible foreigners will be able to considerably lighten their tax burden if they relocate to Greece…nevertheless, the amount of 500,000 euros’ worth of investment in Greece required of foreigners and the annual flat tax of 100,000 euros demanded (plus 20,000 euros per family member) may keep many of them away.

The system is too restrictive, but it will make the beleaguered nation an attractive destination for some rich people. After all, they don’t even have to pay a flat tax, just a flat fee.

Italy has enjoyed some success with a similar regime to entice millionaires.

Last but not least, an article published last year has some fascinating details on the where rich people move and why they move.

The world’s wealthiest people are also the most mobile. High net worth individuals (HNWIs) – persons with wealth over US$1 million – may decide to pick up and move for a number of reasons. In some cases they are attracted by jurisdictions with more favorable tax laws… Unlike the middle class, wealthy citizens have the means to pick up and leave when things start to sideways in their home country. An uptick in HNWI migration from a country can often be a signal of negative economic or societal factors influencing a country. …Time-honored locations – such as Switzerland and the Cayman Islands – continue to attract the world’s wealthy, but no country is experiencing HNWI inflows quite like Australia. …The country has a robust economy, and is perceived as being a safe place to raise a family. Even better, Australia has no inheritance tax

Here’s a map from the article.

The good news is that the United States is attracting more millionaires than it’s losing (perhaps because of the EB-5 program).

The bad news is that this ratio could flip after the election. Indeed, it may already be happening even though recent data on expatriation paints a rosy picture.

The bottom line is that the United States should be competing to attract millionaires, not repel them. Assuming, of course, politicians care about jobs and prosperity for the rest of the population.

P.S. American politicians, copying laws normally imposed by the world’s most loathsome regimes, have imposed an “exit tax” so they can grab extra cash from rich people who choose to become citizens elsewhere.

P.P.S. I’ve argued that Australia is a good place to emigrate even for those of us who aren’t rich.

—-

Question of the Week: Which Department of the Federal Government Should Be the First to Be Abolished?

I was asked last week which entitlement program is most deserving of reform.

While acknowledging that Social Security and Medicare also are in desperate need of modernization, I wrote that Medicaid reformshould be the first priority.

But I’d be happy if we made progress on any type of entitlement reform, so I don’t think there are right or wrong answers to this kind of question.

We have the same type of question this week. A reader sent an email to ask “Which federal department should be abolished first?”

I guess this is what is meant when people talk about a target-rich environment. We have an abundance of candidates:

- Department of Education

- Department of Agriculture

- Department of Energy

- Department of Veterans Affairs

- Department of Transportation

But if I have to choose, I think the Department of Housing and Urban Development should be first on the chopping block.

Raze the building and put a layer of salt over the earth to make sure it can never spring back to life

I’ve already argued that there should be no federal government involvement in the housing sector and made the same argument on TV. And I’ve also shared some horror stories about HUD waste and incompetence.

- HUD engages in racism and social engineering.

- Urban renewal projects destroy neighborhoods and foment corruption.

- HUD subsidies are grotesquely wasteful.

- There are epidemic levels of waste, fraud, and abuse at HUD.

Heck, I even made HUD the background image for my video on the bloated and overpaid bureaucracy in Washington.

It’s also worth noting that there’s nothing about housing in Article I, Section VIII, of the Constitution. For those of us who have old-fashioned values about playing by the rules, that means much of what takes place in Washington – including housing handouts – is unconstitutional.

Simply stated, there is no legitimate argument for HUD. And I think there would be the least political resistance.

As with the answer to the question about entitlements, this is a judgment call. I’d be happy to be proven wrong if it meant that politicians were aggressively going after another department. Anything that reduces the burden of government spending is a step in the right direction

Milton Friedman on Spending

October 3, 2020 by Dan Mitchell

I identified four heroes from the “Battle of Ideas” video I shared in late August – Friedrich Hayek, Milton Friedman, Ronald Reagan, and Margaret Thatcher. Here’s one of those heroes, Milton Friedman, explaining what’s needed to control big government.

—

Why Milton Friedman Saw School Choice as a First Step, Not a Final One

On his birthday, let’s celebrate Milton Friedman’s vision of enabling parents, not government, to be in control of a child’s education.

Wednesday, July 31, 2019

Kerry McDonald

EducationMilton FriedmanSchool ChoiceSchooling

Libertarians and others are often torn about school choice. They may wish to see the government schooling monopoly weakened, but they may resist supporting choice mechanisms, like vouchers and education savings accounts, because they don’t go far enough. Indeed, most current choice programs continue to rely on taxpayer funding of education and don’t address the underlying compulsory nature of elementary and secondary schooling.

Skeptics may also have legitimate fears that taxpayer-funded education choice programs will lead to over-regulation of previously independent and parochial schooling options, making all schooling mirror compulsory mass schooling, with no substantive variation.

Friedman Challenged Compulsory Schooling Laws

Milton Friedman had these same concerns. The Nobel prize-winning economist is widely considered to be the one to popularize the idea of vouchers and school choice beginning with his 1955 paper, “The Role of Government in Education.” His vision continues to be realized through the important work of EdChoice, formerly the Friedman Foundation for Education Choice, that Friedman and his economist wife, Rose, founded in 1996.

July 31 is Milton Friedman’s birthday. He died in 2006 at the age of 94, but his ideas continue to have an impact, particularly in education policy.

Friedman saw vouchers and other choice programs as half-measures. He recognized the larger problems of taxpayer funding and compulsion, but saw vouchers as an important starting point in allowing parents to regain control of their children’s education. In their popular book, Free To Choose, first published in 1980, the Friedmans wrote:

We regard the voucher plan as a partial solution because it affects neither the financing of schooling nor the compulsory attendance laws. We favor going much farther. (p.161)

They continued:

The compulsory attendance laws are the justification for government control over the standards of private schools. But it is far from clear that there is any justification for the compulsory attendance laws themselves. (p. 162)

The Friedmans admitted that their “own views on this have changed over time,” as they realized that “compulsory attendance at schools is not necessary to achieve that minimum standard of literacy and knowledge,” and that “schooling was well-nigh universal in the United States before either compulsory attendance or government financing of schooling existed. Like most laws, compulsory attendance laws have costs as well as benefits. We no longer believe the benefits justify the costs.” (pp. 162-3)

Still, they felt that vouchers would be the essential starting point toward chipping away at monopoly mass schooling by putting parents back in charge. School choice, in other words, would be a necessary but not sufficient policy approach toward addressing the underlying issue of government control of education.

Vouchers as a First Step

In their book, the Friedmans presented the potential outcomes of their proposed voucher plan, which would give parents access to some or all of the average per-pupil expenditures of a child enrolled in public school. They believed that vouchers would help create a more competitive education market, encouraging education entrepreneurship. They felt that parents would be more empowered with greater control over their children’s education and have a stronger desire to contribute some of their own money toward education. They asserted that in many places “the public school has fostered residential stratification, by tying the kind and cost of schooling to residential location” and suggested that voucher programs would lead to increased integration and heterogeneity. (pp. 166-7)

To the critics who said, and still say, that school choice programs would destroy the public schools, the Friedmans replied that these critics fail to

explain why, if the public school system is doing such a splendid job, it needs to fear competition from nongovernmental, competitive schools or, if it isn’t, why anyone should object to its “destruction.” (p. 170)

What I appreciate most about the Friedmans discussion of vouchers and the promise of school choice is their unrelenting support of parents. They believed that parents, not government bureaucrats and intellectuals, know what is best for their children’s education and well-being and are fully capable of choosing wisely for their children—when they have the opportunity to do so.

They wrote:

Parents generally have both greater interest in their children’s schooling and more intimate knowledge of their capacities and needs than anyone else. Social reformers, and educational reformers in particular, often self-righteously take for granted that parents, especially those who are poor and have little education themselves, have little interest in their children’s education and no competence to choose for them. That is a gratuitous insult. Such parents have frequently had limited opportunity to choose. However, U.S. history has demonstrated that, given the opportunity, they have often been willing to sacrifice a great deal, and have done so wisely, for their children’s welfare. (p. 160).

Sign-Up: Receive Kerry’s Weekly Parenting and Education Newsletter!

Voucher Programs Today

Today, school voucher programs exist in 15 states plus the District of Columbia. These programs have consistently shown that when parents are given the choice to opt-out of an assigned district school, many will take advantage of the opportunity. In Washington, D.C., low-income parents who win a voucher lottery send their children to private schools.

The most recent three-year federal evaluationof voucher program participants found that while student academic achievement was comparable to achievement for non-voucher students remaining in public schools, there were statistically significant improvements in other important areas. For instance, voucher participants had lower rates of chronic absenteeism than the control groups, as well as higher student satisfaction scores. There were also tremendous cost-savings.

In Wisconsin, the Milwaukee Parental Choice Program has served over 28,000 low-income students attending 129 participating private schools.

According to Corey DeAngelis, Director of School Choice at the Reason Foundation and a prolific researcher on the topic, the recent analysis of the D.C. voucher program “reveals that private schools produce the same academic outcomes for only a third of the cost of the public schools. In other words, school choice is a great investment.”

In Wisconsin, the Milwaukee Parental Choice Program was created in 1990 and is the nation’s oldest voucher program. It currently serves over 28,000 low-income students attending 129 participating private schools. Like the D.C. voucher program, data on test scores of Milwaukee voucher students show similar results to public school students, but non-academic results are promising.

Increased Access and Decreased Crime

Recent research found voucher recipients had lower crime rates and lower incidences of unplanned pregnancies in young adulthood. On his birthday, let’s celebrate Milton Friedman’s vision of enabling parents, not government, to be in control of a child’s education.

According to Howard Fuller, an education professor at Marquette University, founder of the Black Alliance for Educational Options, and one of the developers of the Milwaukee voucher program, the key is parent empowerment—particularly for low-income minority families.

In an interview with NPR, Fuller said: “What I’m saying to you is that there are thousands of black children whose lives are much better today because of the Milwaukee parental choice program,” he says.

“They were able to access better schools than they would have without a voucher.”

Putting parents back in charge of their child’s education through school choice measures was Milton Friedman’s goal. It was not his ultimate goal, as it would not fully address the funding and compulsion components of government schooling; but it was, and remains, an important first step. As the Friedmans wrote in Free To Choose:

The strong American tradition of voluntary action has provided many excellent examples that demonstrate what can be done when parents have greater choice. (p. 159).

On his birthday, let’s celebrate Milton Friedman’s vision of enabling parents, not government, to be in control of a child’s education.

Related posts:

“Friedman Friday” (“Free to Choose” episode 1 – Power of the Market. part 7 of 7)

Michael Harrington: If you don’t have the expertise, the knowledge technology today, you’re out of the debate. And I think that we have to democratize information and government as well as the economy and society. FRIEDMAN: I am sorry to say Michael Harrington’s solution is not a solution to it. He wants minority rule, I […] By Everette Hatcher III | Posted in Current Events, Milton Friedman | Edit | Comments (0)

“Friedman Friday” (“Free to Choose” episode 1 – Power of the Market. part 6 of 7)

PETERSON: Well, let me ask you how you would cope with this problem, Dr. Friedman. The people decided that they wanted cool air, and there was tremendous need, and so we built a huge industry, the air conditioning industry, hundreds of thousands of jobs, tremendous earnings opportunities and nearly all of us now have air […] By Everette Hatcher III | Posted in Current Events, Milton Friedman | Edit | Comments (0)

“Friedman Friday” (“Free to Choose” episode 1 – Power of the Market. part 5 of 7)

Part 5 Milton Friedman: I do not believe it’s proper to put the situation in terms of industrialist versus government. On the contrary, one of the reasons why I am in favor of less government is because when you have more government industrialists take it over, and the two together form a coalition against the ordinary […] By Everette Hatcher III | Posted in Current Events, Milton Friedman | Edit | Comments (0)

“Friedman Friday” (“Free to Choose” episode 1 – Power of the Market. part 4 of 7)

The fundamental principal of the free society is voluntary cooperation. The economic market, buying and selling, is one example. But it’s only one example. Voluntary cooperation is far broader than that. To take an example that at first sight seems about as far away as you can get __ the language we speak; the words […] By Everette Hatcher III | Posted in Current Events, Milton Friedman | Edit | Comments (0)

“Friedman Friday” (“Free to Choose” episode 1 – Power of the Market. part 3 of 7)

_________________________ Pt3 Nowadays there’s a considerable amount of traffic at this border. People cross a little more freely than they use to. Many people from Hong Kong trade in China and the market has helped bring the two countries closer together, but the barriers between them are still very real. On this side […] By Everette Hatcher III | Posted in Current Events, Milton Friedman | Edit | Comments (0)

“Friedman Friday” (“Free to Choose” episode 1 – Power of the Market. part 2 of 7)

Aside from its harbor, the only other important resource of Hong Kong is people __ over 4_ million of them. Like America a century ago, Hong Kong in the past few decades has been a haven for people who sought the freedom to make the most of their own abilities. Many of them are […] By Everette Hatcher III | Posted in Current Events, Milton Friedman | Edit | Comments (0)

“Friedman Friday” (“Free to Choose” episode 1 – Power of the Market. part 1of 7)

“FREE TO CHOOSE” 1: The Power of the Market (Milton Friedman) Free to Choose ^ | 1980 | Milton Friedman Posted on Monday, July 17, 2006 4:20:46 PM by Choose Ye This Day FREE TO CHOOSE: The Power of the Market Friedman: Once all of this was a swamp, covered with forest. The Canarce Indians […]

Milton Friedman The Power of the Market 1-5

Debate on Milton Friedman’s cure for inflation

If you would like to see the first three episodes on inflation in Milton Friedman’s film series “Free to Choose” then go to a previous post I did. Ep. 9 – How to Cure Inflation [4/7]. Milton Friedman’s Free to Choose (1980) Uploaded by investbligurucom on Jun 16, 2010 While many people have a fairly […]

By Everette Hatcher III | Also posted in Current Events | Tagged dr friedman, expansion history, income tax brackets, political courage, www youtube | Edit | Comments (0)

“Friedman Friday” Milton Friedman believed in liberty (Interview by Charlie Rose of Milton Friedman part 1)

Charlie Rose interview of Milton Friedman My favorite economist: Milton Friedman : A Great Champion of Liberty by V. Sundaram Milton Friedman, the Nobel Prize-winning economist who advocated an unfettered free market and had the ear of three US Presidents – Nixon, Ford and Reagan – died last Thursday (16 November, 2006 ) in San Francisco […] By Everette Hatcher III | Posted in Milton Friedman | Edit | Comments (0)

What were the main proposals of Milton Friedman?

Stearns Speaks on House Floor in Support of Balanced Budget Amendment Uploaded by RepCliffStearns on Nov 18, 2011 Speaking on House floor in support of Balanced Budget Resolution, 11/18/2011 ___________ Below are some of the main proposals of Milton Friedman. I highly respected his work. David J. Theroux said this about Milton Friedman’s view concerning […] By Everette Hatcher III | Posted in Milton Friedman | Edit | Comments (0)

“Friedman Friday,” EPISODE “The Failure of Socialism” of Free to Choose in 1990 by Milton Friedman (Part 1)

Milton Friedman: Free To Choose – The Failure Of Socialism With Ronald Reagan (Full) Published on Mar 19, 2012 by NoNationalityNeeded Milton Friedman’s writings affected me greatly when I first discovered them and I wanted to share with you. We must not head down the path of socialism like Greece has done. Abstract: Ronald Reagan […] By Everette Hatcher III | Posted in Milton Friedman, President Obama | Edit | Comments (1)

Defending Milton Friedman

What a great defense of Milton Friedman!!!! Defaming Milton Friedman by Johan Norberg This article appeared in Reason Online on September 26, 2008 PRINT PAGE CITE THIS Sans Serif Serif Share with your friends: ShareThis In the future, if you tell a student or a journalist that you favor free markets and limited government, there is […]