–

Sen. Joe Manchin Holds Back Support for Social-Spending Bill

West Virginia Democrat says at WSJ’s CEO Council Summit that he is wary of the government putting more money into the economy

WASHINGTON— Sen. Joe Manchin declined to commit to voting for Democrats’ roughly $2 trillion social-policy and climate package, citing concerns about inflation and the length of programs, weeks before the Christmas deadline party leaders are racing to meet.

Mr. Manchin, a West Virginia Democrat, made the remarks during The Wall Street Journal’s CEO Council Summit at a pivotal moment for Democrats in Washington—and one where he has been a key figure. Because Senate Democrats are using a special budget maneuver to pass their education, healthcare and climate package without any GOP support, they can’t lose a single senator from their own party.

Mr. Manchin has supported the other two pillars of President Biden’s agenda this year. But the senator, who represents a state former President Donald Trump won by 40 points in 2020, continues to express concern about the bill’s impact on inflation and the deficit.

“The unknown we’re facing today is much greater than the need that people believe in this aspirational bill that we’re looking at,” Mr. Manchin said Tuesday. “We’ve gotta make sure we get this right. We just can’t continue to flood the market, as we’ve done.”

“We’ve done so many good things in the last 10 months, and no one is taking a breath,” he said.

Democrats say the package is fully paid for and point to reports from Moody’s Investors Service and others projecting no major inflation impact. Republicans have attacked the bill as wasteful and said it could fuel inflation.

Senators are currently discussing with the nonpartisan parliamentarian what provisions can comply with the budget maneuver, according to aides, putting some immigration- and drug-pricing-related provisions in peril. When that process will be complete isn’t clear.

Even if it passes the Senate, the legislation is expected to be different than the House-approved version and would need to be sent back to the House for final passage before Mr. Biden can sign it into law.

Mr. Manchin and Arizona Democratic Sen. Kyrsten Sinema had expressed concerns about the size and funding mechanisms of the bill, prompting Democrats to slim it down and make changes in the hopes of earning their support. Still, neither senator has committed to voting for the legislation.

Mr. Manchin also criticized the Biden administration’s vaccine rules for private employers and is expected to side with Republicans during a vote as soon as this week to nullify the mandate. Republicans are using a Senate maneuver to force a vote with a simple majority, so Mr. Manchin’s support along with Sen. Jon Tester (D., Mont.) and every Republican will pass the bill out of the Senate.

However, Democrats would have to join with Republicans to force a vote in the House, and it isn’t clear that will happen. Even then, Mr. Biden isn’t expected to sign the legislation, if it passed out of the House.

“I basically am 1,000% in favor of the federal government having a mandate [for employees]…private businesses, no,” Mr. Manchin said. “I don’t think the government has to make every decision for the private sector, you know. You’ve been doing quite well without us.”

Despite his willingness to side with Republicans, Mr. Manchin said he had no plans to leave the Democratic Party.

“I’m caught between the two, but the bottom line is, you have to be caucusing somewhere,” he said.

Biden’s Misguided Plan for a Bigger Welfare State

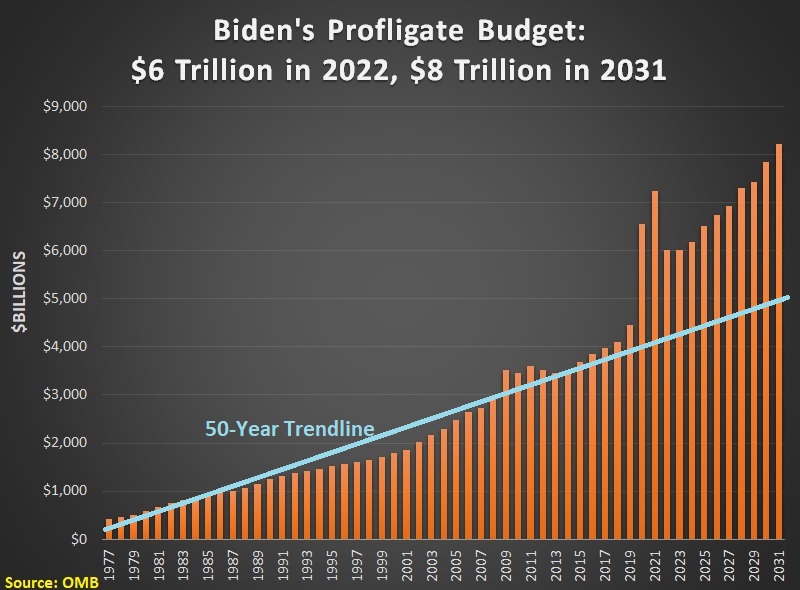

President Biden pushed through $1.9 trillion of new spendingearlier this year, but that so-called stimulus plan was mostly for one-time giveaways. As I warn in this recent discussion on Denver’s KHOW, we should be much more worried about his proposals to permanently expand the welfare state.

When I first got to Washington, I would be upset that politicians wanted to add billions of dollars to the burden of government.

Well, those were the good ol’ days. Biden is proposing to divert trillions of dollars from the private sector to expand the welfare state.

Well, those were the good ol’ days. Biden is proposing to divert trillions of dollars from the private sector to expand the welfare state.

Even worse, he wants to make more Americans dependent on the federal government.

Maybe that’s a smart way of buying votes, but it will erode societal capital.

John Cogan and Daniel Heil of the Hoover Institution warned about the consequences of this dependency agenda in a columnfor the Wall Street Journal.

The federal government’s system of entitlements is the largest money-shuffling machine in human history, and President Biden intends to make it a lot bigger. His American Families Plan—which he recently attempted to tie to a bipartisan infrastructure deal

—proposes to extend the reach of federal entitlements to 21 million additional Americans, the largest expansion since Lyndon B. Johnson’s Great Society. …more than half of working-age households would be on the entitlement rolls if the plan were enacted in its current form. …57% of all married-couple children would receive federal entitlement benefits, and more than 80% of single-parent households would be on the entitlement rolls.

Many of the handouts would go to people with middle-class incomes.

And higher.

…The American Families Plan proposes several new entitlement programs. One promises students the government will pick up the entire cost of community-college tuition; another promises families earning 1.5 times their state’s median income that Washington will cover all daycare expenses above 7% of family income for children under 5;

still another promises workers up to 12 weeks of federally financed wage subsidies to take time off to care for newborns or sick family members. …Two-parent households with two preschool-age children and incomes up to $130,000 would qualify for federal cash assistance for daycare. Single parents with two preschoolers and incomes up to $113,000 would qualify. And some families with incomes over $200,000 would be eligible for health-insurance subsidies. Other parts of the plan, such as paid leave and free community college, have no income limits at all.

The Wall Street Journal opined on this issue last month. Here are the key passages from their editorial.

The entitlements are by far the biggest long-term economic threat from the Biden agenda. …entitlements that spend automatically based on eligibility are nearly impossible to repeal, or even reform, and they represent a huge tax-and-spend wedge far into the future.

…We’d highlight two points. First is the dishonesty about costs. Entitlements always start small but then soar. The Biden Families Plan is even more dishonest than usual. For example, it pretends the child tax credit ends in 2025, so its cost is $449 billion over the 10-year budget window that is used for reconciliation bills that require only 51 votes to pass the Senate. But a future Congress will never repeal the credit. …Second, these programs aren’t intended as a “safety net” for the poor or those temporarily down on their luck. They are explicitly designed to make the middle class dependent on government handouts.

The editorial explicitly warns that the United States will economically suffer if politicians copy Europe’s counterproductive redistributionism.

…on present trend the U.S. is falling into the same entitlement trap as Western Europe. Entitlement spending requires higher taxes, which grab 40% or more of GDP. Economic growth declines as more money

flows to transfer payments instead of investment. The entitlement state becomes too large to afford but also too politically entrenched to reform. …Only a decade ago the Tea Party fought ObamaCare. Now most Beltway conservatives worry more about Big Tech than they do Big Government. If the Biden Families Plan passes, these conservatives will find themselves spending the rest of their careers as tax collectors for the entitlement state.

Amen. I’m baffled when folks on the left argue that we should “catch up” with Europe.

Are they not aware that American living standards are far higher? Do they not understand that low-income people in the United States often have more income than middle-class people on the other side of the Atlantic Ocean?

P.S. As I mentioned in the interview, the 21st century has been bad news for fiscal policy, with two big-government Republicans and two big-government Democrats.

P.S. As I mentioned in the interview, the 21st century has been bad news for fiscal policy, with two big-government Republicans and two big-government Democrats.

For what it’s worth, the $3,000-per-child handouts are Biden’s most damaging idea. In one fell swoop, he would create a trillion-dollar entitlement program and repeal the successful Clinton-Gingrich welfare reform.

New Leak of Taxpayer Info Is (More) Evidence of IRS Corruption

I sometimes try to go easy on the IRS. After all, our wretched tax system is largely the fault of politicians, who have spent the past 108 years creating a punitive and corrupt set of tax laws.

But there is still plenty of IRS behavior to criticize. Most notably, the tax agency allowed itself to be weaponized by the Obama White House, using its power to persecute and harass organizations associated with the “Tea Party.”

using its power to persecute and harass organizations associated with the “Tea Party.”

That grotesque abuse of power largely was designed to weaken opposition to Obama’s statist agenda and make it easier for him to win re-election.

Now there’s a new IRS scandal. In hopes of advancing President Biden’s class-warfare agenda, the bureaucrats have leaked confidential taxpayer information to ProPublica, a left-wing website.

Here’s some of what that group posted.

ProPublica has obtained a vast trove of Internal Revenue Service data on the tax returns of thousands of the nation’s wealthiest people, covering more than 15 years. …ProPublica undertook an analysis that has never been done before.

We compared how much in taxes the 25 richest Americans paid each year to how much Forbes estimated their wealth grew in that same time period. We’re going to call this their true tax rate. …those 25 people saw their worth rise a collective $401 billion from 2014 to 2018. They paid a total of $13.6 billion in federal income taxes in those five years, the IRS data shows. That’s a staggering sum, but it amounts to a true tax rate of only 3.4%.

Since I’m a policy wonk, I’ll first point out that ProPublicacreated a make-believe number. We (thankfully) don’t tax wealth in the United States.

So Elon Musk’s income is completely unrelated to what happened to the value of his Tesla shares. The same is true for Jeff Bezos’ income and the value of his Amazon stock.*

And the same thing is true for the rest of us. If our IRA or 401(k) rises in value, that doesn’t mean our taxable income has increased. If our home becomes more valuable, that also doesn’t count as taxable income.

The Wall Street Journal opined on this topic today and made a similar point.

There is no evidence of illegality in the ProPublica story. …ProPublica knows this, so its story tries to invent a scandal by calculating

what it calls the “true tax rate” these fellows are paying. This is a phony construct that exists nowhere in the law and compares how much the “wealth” of these individuals increased from 2014 to 2018 compared to how much income tax they paid. …what Americans pay is a tax on income, not wealth.

Some journalists don’t understand this distinction between income and wealth.

Or perhaps they do understand, but pretend otherwise because they see their role as being handmaidens of the Biden Administration.

Consider these excerpts from a column by Binyamin Appelbaum of the New York Times.

Jeff Bezos…added an estimated $99 billion in wealth between 2014 and 2018 but reported only $4.22 billion in taxable income during that period.

Warren Buffett, who amassed $24.3 billion in new wealth over those years, reported $125 million in taxable income. …some of the wealthiest people in the United States essentially live under a different system of income taxation from the rest of us.

Mr. Appelbaum is wrong. The rich have a lot more assets than the rest of us, but they operate under the same rules.

If I have an asset that increases in value, that doesn’t count as taxable income. And it isn’t income. It’s merely a change in net wealth.

And the same is true if Bill Gates has an asset that increases in value.

Now that we’ve addressed the policy mistakes, let’s turn our attention to the scandal of IRS misbehavior.

The WSJ‘s editorial addresses the agency’s grotesque actions.

Less than half a year into the Biden Presidency, the Internal Revenue Service is already at the center of an abuse-of-power scandal. …ProPublica, a website whose journalism promotes progressive causes, published information from what it said are 15 years of the tax returns of Jeff Bezos, Warren Buffett and other rich Americans. …The story arrives amid the Biden Administration’s effort to pass the largest tax increase as a share of the economy since 1968. …The timing here is no coincidence, comrade. …someone leaked confidential IRS information about individuals to serve a political agenda. This is the same tax agency that pursued a vendetta against conservative nonprofit groups during the Obama Administration. Remember Lois Lerner? This is also the same IRS that Democrats now want to infuse with $80 billion more… As part of this effort, Mr. Biden wants the IRS to collect “gross inflows and outflows on all business and personal accounts from financial institutions.” Why? So the information can be leaked to ProPublica? …Congress should also not trust the IRS with any more power and money than it already has.

And Charles Cooke of National Review also weighs in on the implications of a weaponized and partisan IRS.

We cannot trust the IRS. “Oh, who cares?” you might ask. “The victims are billionaires!” And indeed, they are. But I care. For a start, they’re American citizens, and they’re entitled to the same rights — and protected by the same laws — as everyone else. …Besides, even if one wants to be entirely amoral about it, one should consider that if their information can be spilled onto the Internet, anyone’s can.

…A government that is this reckless or sinister with the information of men who are lawyered to the eyeballs is unlikely to worry too much about being reckless or sinister with your information. …The IRS wields an extraordinary amount of power, and there will always be somebody somewhere who thinks that it should be used to advance their favorite political cause. Our refusal to indulge their calls is one of the many things that prevents us from descending into the caprice and chaos of your average banana republic. …Does that bother you? It should.

What’s especially disgusting is that the Biden Administration wants to reward IRS corruption with giant budget increases, bolstered by utterly fraudulent numbers.

Needless to say, that would be a terrible idea (sadly, Republicans in the past have been sympathetic to expanding the size of the tax bureaucracy).

*Financial assets such as stocks generally increase in value because of an expectation of bigger streams of income in the future (such as dividends). Those income streams are taxed (often multiple times) when (and if) they actually materialize.

Open letter to President Obama (Part 644)

(Emailed to White House on 6-10-13.)

President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500

Dear Mr. President,

I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here.

The federal government debt is growing so much that it is endangering us because if things keep going like they are now we will not have any money left for the national defense because we are so far in debt as a nation. We have been spending so much on our welfare state through food stamps and other programs that I am worrying that many of our citizens are becoming more dependent on government and in many cases they are losing their incentive to work hard because of the welfare trap the government has put in place. Other nations in Europe have gone down this road and we see what mess this has gotten them in. People really are losing their faith in big government and they want more liberty back. It seems to me we have to get back to the founding principles that made our country great. We also need to realize that a big government will encourage waste and corruption. The recent scandals in our government have proved my point. In fact, the jokes you made at Ohio State about possibly auditing them are not so funny now that reality shows how the IRS was acting more like a monster out of control. Also raising taxes on the job creators is a very bad idea too. The Laffer Curve clearly demonstrates that when the tax rates are raised many individuals will move their investments to places where they will not get taxed as much.

______________________

We can fix the IRS problem by going to the flat tax and lowering the size of government.

Did President Obama and his team of Chicago cronies deliberately target the Tea Party in hopes of thwarting free speech and political participation?

Was this part of a campaign to win the 2012 election by suppressing Republican votes?

Perhaps, but I’ve warned that it’s never a good idea to assume top-down conspiracies when corruption, incompetence, politics, ideology, greed, and self-interest are better explanations for what happens in Washington.

Writing for the Washington Examiner, Tim Carney has a much more sober and realistic explanation of what happened at the IRS.

If you take a group of Democrats who are also unionized government employees, and put them in charge of policing political speech, it doesn’t matter how professional and well-intentioned they are. The result will be much like the debacle in the Cincinnati office of the IRS. …there’s no reason to even posit evil intent by the IRS officials who formulated, approved or executed the inappropriate guidelines for picking groups to scrutinize most closely. …The public servants figuring out which groups qualified for 501(c)4 “social welfare” non-profit status were mostly Democrats surrounded by mostly Democrats. …In the 2012 election, every donation traceable to this office went to President Obama or liberal Sen. Sherrod Brown. This is an environment where even those trying to be fair could develop a disproportionate distrust of the Tea Party. One IRS worker — a member of NTEU and contributor to its PAC, which gives 96 percent of its money to Democratic candidates — explained it this way: “The reason NTEU mostly supports Democratic candidates for office is because Democratic candidates are mostly more supportive of civil servants/government employees.”

Tim concludes with a wise observation.

As long as we have a civil service workforce that leans Left, and as long as we have an income tax system that requires the IRS to police political speech, conservative groups can always expect special IRS scrutiny.

And my colleague Doug Bandow, in an article for the American Spectator, adds his sage analysis.

The real issue is the expansive, expensive bureaucratic state and its inherent threat to any system of limited government, rule of law, and individual liberty. …the broader the government’s authority, the greater its need for revenue, the wider its enforcement power, the more expansive the bureaucracy’s discretion, the increasingly important the battle for political control, and the more bitter the partisan fight, the more likely government officials will abuse their positions, violate rules, laws, and Constitution, and sacrifice people’s liberties. The blame falls squarely on Congress, not the IRS.

I actually think he is letting the IRS off the hook too easily.

- It has thieving employees.

It has incompetent employees.

It has incompetent employees.- It has thuggish employees.

- It has brainless employees.

- It has protectionist employees.

- It has wasteful employees.

- And it has victimizing employees.

But Doug’s overall point obviously is true.

…the denizens of Capitol Hill also have created a tax code marked by outrageous complexity, special interest electioneering, and systematic social engineering. Legislators have intentionally created avenues for tax avoidance to win votes, and then complained about widespread tax avoidance to win votes.

So what’s the answer?

The most obvious response to the scandal — beyond punishing anyone who violated the law — is tax reform. Implement a flat tax and you’d still have an IRS, but the income tax would be less complex, there would be fewer “preferences” for the agency to police, and rates would be lower, leaving taxpayers with less incentive for aggressive tax avoidance. …Failing to address the broader underlying factors also would merely set the stage for a repeat performance in some form a few years hence. …More fundamentally, government, and especially the national government, should do less. Efficient social engineering may be slightly better than inefficient social engineering, but no social engineering would be far better.

Amen. Let’s rip out the internal revenue code and replace it with a simple and fair flat tax.

But here’s the challenge. We know the solution, but it will be almost impossible to implement good policy unless we figure out some way to restrain the spending side of the fiscal ledger.

___________________________

At the risk of over-simplifying, we will never get tax reform unless we figure out how to implement entitlement reform.

Here’s another Foden cartoon, which I like because it has the same theme asthis Jerry Holbert cartoon, showing big government as a destructive and malicious force.

_____________

Thank you so much for your time. I know how valuable it is. I also appreciate the fine family that you have and your commitment as a father and a husband.

Sincerely,

Everette Hatcher III, 13900 Cottontail Lane, Alexander, AR 72002, ph 501-920-5733, lowcostsqueegees@yahoo.com

Related Posts:

We know the IRS commissioner wasn’t telling the truth in March 2012, when he testified: “There’s absolutely no targeting.”

We know the IRS commissioner wasn’t telling the truth in March 2012, when he testified: “There’s absolutely no targeting.”However, Lois Lerner knew different when she misled people with those words. Two important points made by Noonan in the Wall Street Journal in the article below: First, only conservative groups were targeted in this scandal by […]

A great cartoonist takes on the IRS!!!!

Ohio Liberty Coalition versus the I.R.S. (Tom Zawistowski) Published on May 20, 2013 The Ohio Liberty Coalition was among tea party groups that received special scrutiny from the I.R.S. Tom Zawistowski says his story is not unique. He argues the kinds of questions the I.R.S. asked his group amounts to little more than “opposition research.” Video […]

“Schaeffer Sundays” Francis Schaeffer’s own words concerning what the First Amendment means

Francis Schaeffer: “Whatever Happened to the Human Race?” (Episode 2) SLAUGHTER OF THE INNOCENTS Published on Oct 6, 2012 by AdamMetropolis The 45 minute video above is from the film series created from Francis Schaeffer’s book “Whatever Happened to the Human Race?” with Dr. C. Everett Koop. This book really helped develop my political views concerning […]

Cartoonists show how stupid the IRS is acting!!!

We got to lower the size of government so we don’t have these abuses like this in the IRS. Cartoonists v. the IRS May 23, 2013 by Dan Mitchell Call me perverse, but I’m enjoying this IRS scandal. It’s good to see them suffer a tiny fraction of the agony they impose on the American people. I’ve already […]

Dear Senator Pryor, why not pass the Balanced Budget Amendment? (“Thirsty Thursday”, Open letter to Senator Pryor)

Dear Senator Pryor, Why not pass the Balanced Budget Amendment? As you know that federal deficit is at all time high (1.6 trillion deficit with revenues of 2.2 trillion and spending at 3.8 trillion). On my blog http://www.HaltingArkansasLiberalswithTruth.com I took you at your word and sent you over 100 emails with specific spending cut ideas. However, […]

Video from Cato Institute on IRS Scandal

Is the irs out of control? Here is the link from cato: MAY 22, 2013 8:47AM Can You Vague That Up for Me? By TREVOR BURRUS SHARE As the IRS scandal thickens, targeted groups are coming out to describe their ordeals in dealing with that most-reviled of government agencies. The Ohio Liberty Coalition was one of […]

IRS cartoons from Dan Mitchell’s blog

Get Ready to Be Reamed May 17, 2013 by Dan Mitchell With so many scandals percolating, there are lots of good cartoons being produced. But I think this Chip Bok gem deserves special praise. It manages to weave together both the costly Obamacare boondoggle with the reprehensible politicization of the IRS. So BOHICA, my friends. If […]

Obama jokes about audit of Ohio St by IRS then IRS scandal breaks!!!!!

You want to talk about irony then look at President Obama’s speech a few days ago when he joked about a potential audit of Ohio St by the IRS then a few days later the IRS scandal breaks!!!! The I.R.S. Abusing Americans Is Nothing New Published on May 15, 2013 The I.R.S. targeting of tea party […]

Dear Senator Pryor, why not pass the Balanced Budget Amendment? (“Thirsty Thursday”, Open letter to Senator Pryor)

Dear Senator Pryor, Why not pass the Balanced Budget Amendment? As you know that federal deficit is at all time high (1.6 trillion deficit with revenues of 2.2 trillion and spending at 3.8 trillion). On my blog http://www.HaltingArkansasLiberalswithTruth.com I took you at your word and sent you over 100 emails with specific spending cut ideas. However, […]

We could put in a flat tax and it would enable us to cut billions out of the IRS budget!!!!

We could put in a flat tax and it would enable us to cut billions out of the IRS budget!!!! May 14, 2013 2:34PM IRS Budget Soars By Chris Edwards Share The revelations of IRS officials targeting conservative and libertarian groups suggest that now is a good time for lawmakers to review a broad range […]