_________

Quantifying the Damage of Biden’s Plan for Higher Taxes on Capital Gains, Part I

Public finance theory teaches us that the capital gains tax should not exist. Such a levy exacerbates the bias against saving and investment, which reduces innovation, hinders economic growth, and lowers worker compensation.

All of which helps to explain why President Biden’s proposals to increase the tax burden on capital gains are so misguided.

He wants a radical increase in the tax rate on capital gains – from 23.8 percent to 43.4 percent, the highest burden in the world.

He wants a radical increase in the tax rate on capital gains – from 23.8 percent to 43.4 percent, the highest burden in the world.- He wants to impose capital gains tax on assets when people die, even if assets aren’t sold and there are not any actual capital gains.

Thanks to some new research from Professor John Diamond of Rice University, we can now quantify the likely damage if Biden’s proposals get enacted.

Here’s some of what he wrote in his new study.

We use a computable general equilibrium model of the U.S. economy to simulate the economic effects of these policy changes… The model is a dynamic, overlapping generations, computable general equilibrium model of the U.S. economy that focuses on the macroeconomic and transitional effects of tax reforms.

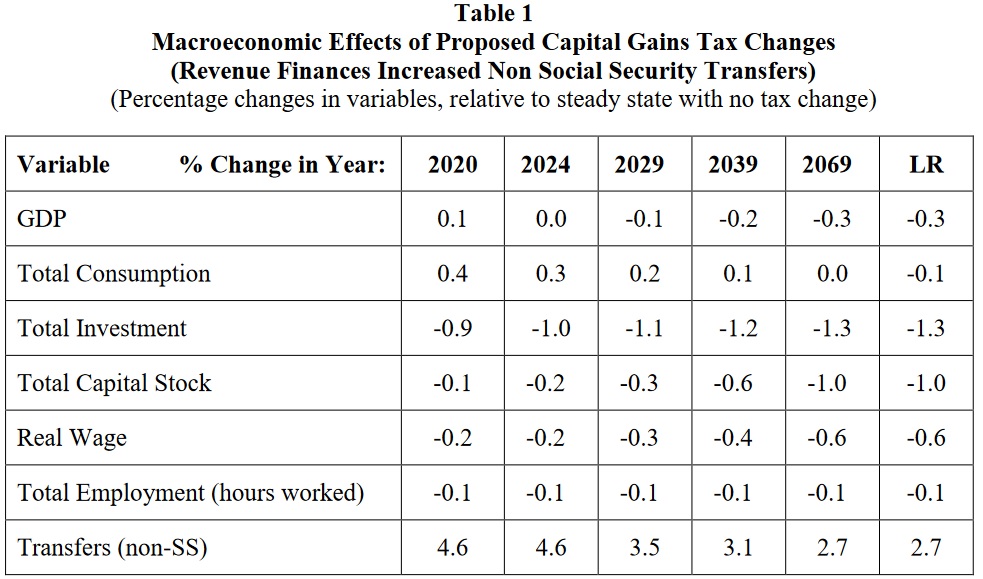

…The simulation results in Table 1 show that GDP falls by roughly 0.1 percent 10 years after reform and 0.3 percent 50 years after reform, which implies per household income declines by roughly $310 after 10 years and $1,200 after 50 years. The long run decline in GDP is due to a decline in the capital stock of 1.0 percent and a decline in total hours worked of 0.1 percent. …this would be roughly equivalent to a loss of approximately 209,000 jobs in that year. Real wages decrease initially by 0.2 percent and by 0.6 percent in the long run.

Here is a summary of the probable economic consequences of Biden’s class-warfare scheme.

But the above analysis should probably be considered a best-case scenario.

Why? Because the capital gains tax is not indexed for inflation, which means investors can wind up paying much higher effective tax rates if prices are increasing.

And in a world of Keynesian monetary policy, that’s a very real threat.

So Prof. Diamond also analyzes the impact of inflation.

…capital gains are not adjusted for inflation and thus much of the taxable gains are not reflective of a real increase in wealth. Taxing nominal gains will reduce the after-tax rate of return and lead to less investment, especially in periods of higher inflation. …taxing the nominal value will reduce the real rate of return on investment, and may do so by enough to result in negative rates of return in periods of moderate to high inflation. Lower real rates of return reduce investment, the size of the capital stock, productivity, growth in wage rates, and labor supply. …Accounting for inflation in the model would exacerbate other existing distortions… An increase in the capital gains tax rate or repealing step up of basis will make investments in owner-occupied housing more attractive relative to other corporate and non-corporate investments.

Here’s what happens to the estimates of economic damage in a world with higher inflation?

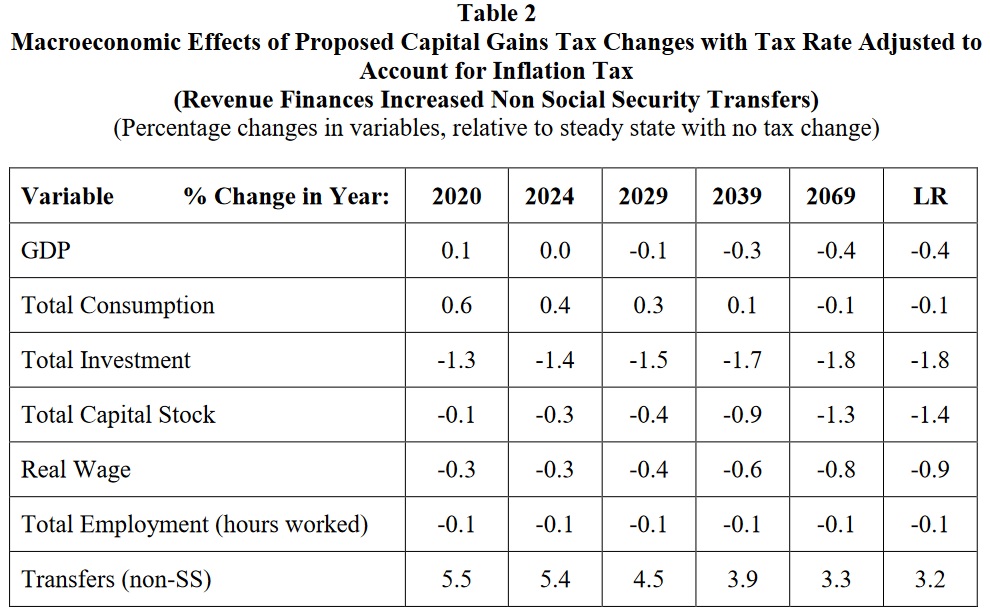

Assuming the inflation rate is one percentage point higher on average (3.2 percent instead of 2.2 percent) implies that a rough estimate of the capital gains tax rate on nominal plus real returns would be 1.5 times higher than the real increase in the capital gains tax rate used in the standard model with no inflation. Table 2 shows the results of adjusting the capital gains tax rates by a factor of 1.5 to account for the effects of inflation. In this case, GDP falls by roughly 0.1 percent 10 years after reform and 0.4 percent 50 years after reform, which implies per household income declines by roughly $453 after 10 years and $1,700 after 50 years.

Here’s the table showing the additional economic damage. As you can see, the harm is much greater.

I’ll conclude with two comments.

- First, inflation is obviously bad for citizens. But as I wrote more than 10 years ago, it’s profitable for governments.

- Second, even seemingly small differences in economic growth produce big differences in long-run living standards.

P.S. If (already-taxed) corporate profits are distributed to shareholders, there’s a second layer of tax on those dividends. If the money is instead used to expand the business, it presumably will increase the value of shares (a capital gain) because of an expectation of higher future income (which will be double taxedwhen it occurs).

States Lowering Income Tax Rates

The best news of 2021 almost surely is the big expansion of school choice in several states.

That’s a great development, especially for poor and minority families.

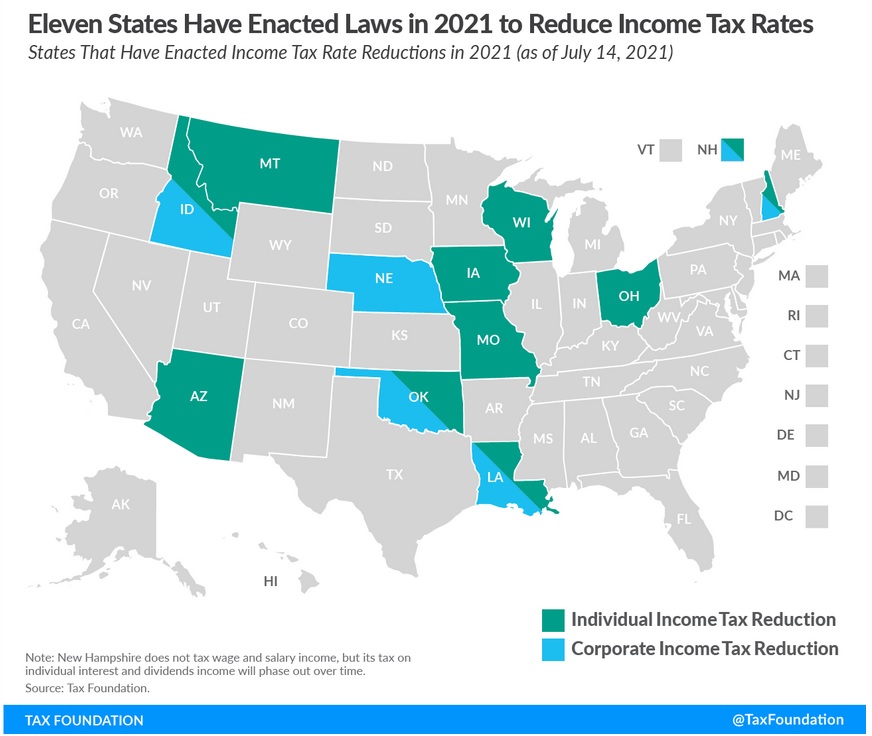

But there’s another positive trend at the state level. As indicated by this map from the Tax Foundation, tax rates have been reduced in several jurisdictions.

I’ve already written about Arizona’s very attractive tax reform, though I also acknowledged that the new law mostly stops the tax system from getting worse (because of a bad 2020 referendum result).

But stopping something bad is an achievement, regardless.

What about other states? The Tax Foundation’s article has all the details you could possibly want, including phase-in times and presence (in some states) of revenue triggers.

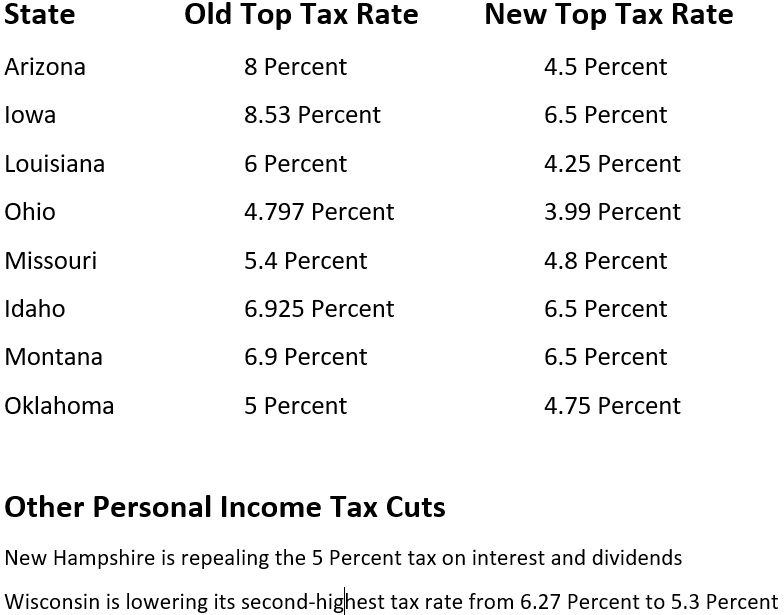

For purposes of today’s column, let’s simply focus on what’s happening to top tax rates. Here’s a table with the key results, ranked by the size of the rate reduction.

Kudos to Arizona, of course, but Iowa and Louisiana also deserve praise for significantly dropping their top tax rates.

As these states move in the right direction, keep in mind that some states are shifting (or trying to shift) in the wrong direction.

And bigger differences between sensible states and class-warfare states will increase interstate tax migration – with predictable political consequences.

High-tax states are languishing but zero-income-tax states such as Texas are growing rapidly!!!!

Texas Is Booming…but CNN Doesn’t Want You to Know Why

September 30, 2014 by Dan Mitchell

Much of my writing is focused on the real-world impact of government policy, and this is why I repeatedly look at the relative economic performance of big government jurisdictions and small government jurisdictions.

But I don’t just highlight differences between nations. Yes, it’s educational to look at North Korea vs. South Korea or Chile vs. Venezuela vs. Argentina, but I also think you can learn a lot by looking at what’s happening with different states in America.

So we’ve looked at high-tax states that are languishing, such as California and Illinois, and compared them to zero-income-tax states such as Texas.

With this in mind, you can understand that I was intrigued to see that even the establishment media is noticing that Texas is out-pacing the rest of the nation.

Here are some excerpts from a report by CNN Money on rapid population growth in Texas.

More Americans moved to Texas in recent years than any other state: A net gain of more than 387,000 in the latest Census for 2013. …Five Texas cities — Austin, Houston, San Antonio, Dallas and Fort Worth — were among the top 20 fastest growing large metro areas. Some smaller Texas metro areas grew even faster. In oil-rich Odessa, the population grew 3.3% and nearby Midland recorded a 3% gain.

But why is the population growing?

Well, CNN Money points out that low housing prices and jobs are big reasons.

And on the issue of housing, the article does acknowledge the role of “easy regulations” that enable new home construction.

But on the topic of jobs, the piece contains some good data on employment growth, but no mention of policy.

Jobs is the No. 1 reason for population moves, with affordable housing a close second. …Jobs are plentiful in Austin, where the unemployment rate is just 4.6%. Moody’s Analytics projects job growth to average 4% a year through 2015. Just as important, many jobs there are well paid: The median income of more than $75,000 is nearly 20% higher than the national median.

That’s it. Read the entire article if you don’t believe me, but the reporter was able to write a complete article about the booming economy in Texas without mentioning – not even once – that there’s no state income tax.

But that wasn’t the only omission.

The article doesn’t mention that Texas is the 4th-best state in the Tax Foundation’s ranking of state and local tax burdens.

The article doesn’t mention that Texas was the least oppressive state in the Texas Public Policy Foundation’s Soft Tyranny Index.

The article doesn’t mention that Texas was ranked #20 in a study of the overall fiscal condition of the 50 states.

The article doesn’t mention that Texas is in 4th place in a combined ranking of economic freedom in U.S. state and Canadian provinces.

The article doesn’t mention that Texas was ranked #11 in the Tax Foundation’s State Business Tax Climate Index.

The article doesn’t mention that Texas is in 14th place in the Mercatus ranking of overall freedom for the 50 states (and in 10th place for fiscal freedom).

By the way, I’m not trying to argue that Texas is the best state.

Indeed, it only got the top ranking in one of the measures cited above.

My point, instead, is simply to note that it takes willful blindness to write about the strong population growth and job performance of Texas without making at least a passing reference to the fact that it is a low-tax, pro-market state.

At least compared to other states. And especially compared to the high-tax states that are stagnating.

Such as California, as illustrated by this data and this data, as well as this Lisa Benson cartoon.

Such as Illinois, as illustrated by this data and this Eric Allie cartoon.

And I can’t resist adding this Steve Breen cartoon, if for no other reason that it reminds me of another one of his cartoons that I shared last year.

Speaking of humor, this Chuck Asay cartoon speculates on how future archaeologists will view California. And this joke about Texas, California, and a coyote is among my most-viewed blog posts.

All jokes aside, I want to reiterate what I wrote above. Texas is far from perfect. There’s too much government in the Lone Star state. It’s only a success story when compared to California.

P.S. Paul Krugman has tried to defend California, which has made him an easy target. I debunked him earlier this year, and I also linked to a superb Kevin Williamson takedown of Krugman at the bottom of this post.

P.P.S. Once again, I repeat the two-part challenge I’ve issued to the left. I’ll be happy if any statists can successfully respond to just one of the two questions I posed.

Related posts:

California is the Greece of the USA, but Texas is not perfect either!!!

California is the Greece of the USA, but Texas is not perfect either!!! Just Because California Is Terrible, that Doesn’t Mean Texas Is Perfect January 21, 2013 by Dan Mitchell Texas is in much better shape than California. Taxes are lower, in part because Texas has no state income tax. No wonder the Lone Star State […]

Dan Mitchell on Texas v. California (includes editorial cartoon)

We should lower federal taxes because jobs are going to states like Texas that have low taxes. (We should lower state taxes too!!) What Can We Learn by Comparing the Employment Situation in Texas vs. California? April 3, 2013 by Dan Mitchell One of the great things about federalism, above and beyond the fact that it […]

Ark Times blogger claims California is better than Texas but facts don’t bear that out (3 great political cartoons)

I got on the Arkansas Times Blog and noticed that a person on there was bragging about the high minimum wage law in San Francisco and how everything was going so well there. On 2-15-13 on the Arkansas Times Blog I posted: Couldn’t be better (the person using the username “Couldn’t be better) is bragging […]

California burdensome government causing some of business community to leave for Texas

Does Government Have a Revenue or Spending Problem? People say the government has a debt problem. Debt is caused by deficits, which is the difference between what the government collects in tax revenue and the amount of government spending. Every time the government runs a deficit, the government debt increases. So what’s to blame: too […]

Arkansas Times blogger picks California business environment over Texas, proves liberals don’t live in real world(Part 2)

Former California Governor Arnold Schwarzenegger with his family I posted a portion of an article by John Fund of the Wall Street Journal that pointed out that many businesses are leaving California because of all of their government red tape and moving to Texas. My username is SalineRepublican and this is […]

John Fund’s talk in Little Rock 4-27-11(Part 4):Responding to liberals who criticize states like Texas that don’t have the red tape that California has

John Fund at Chamber Day, Part 1 Last week I got to attend the first ever “Conservative Lunch Series” presented by KARN and Americans for Prosperity Foundation at the Little Rock Hilton on University Avenue. This monthly luncheon will be held the fourth Wednesday of every month. The speaker for today’s luncheon was John Fund. John […]

California and France have raised taxes so much that it has hurt economic growth!!!

___________ California and France have raised taxes so much that it has hurt economic growth!!! Mirror, Mirror, on the Wall, which Nation and State Punish Success Most of All? September 25, 2014 by Dan Mitchell I’ve shared some interested rankings on tax policy, including a map from the Tax Foundation showing which states have the earliest […]

Jerry Brown raised taxes in California and a rise in the minimum wage, but it won’t work like Krugman thinks!!!

___________ Jerry Brown raised taxes in California and a rise in the minimum wage, but it won’t work like Krugman thinks!!!! This cartoon below shows what will eventually happen to California and any other state that keeps raising taxes higher and higher. Krugman’s “Gotcha” Moment Leaves Something to Be Desired July 25, 2014 by […]

Open letter to President Obama (Part 573) Are the states of Illinois and California going to join Detroit in Bankruptcy one day?

Open letter to President Obama (Part 573) (Emailed to White House on 7-29-13.) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get […]

Open letter to President Obama (Part 561) We should lower federal taxes because jobs are going to states like Texas that have low taxes

Open letter to President Obama (Part 561) (Emailed to White House on 6-25-13.) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get […]