Some people doubt that Ronald Reagan conservatism still works today like it did in the 1980’s and that those kind of conservatives can still win today but they can!!!!

Uploaded on Dec 23, 2010

The surge in nostalgia for President Reagan over the past two years is no surprise. When the American people are faced with tyrannical government, arrogant leadership, and failed policies, they tend to cling to good memories (along with their guns and religion). They also tend to take action, hence the Tea Party movement and the 2010 revolution. Watch this clip from 1982 and remember.

_____________________

Or made these comments in a sincere fashion?

Uploaded on Mar 6, 2010

The Founding Fathers fought tyranny, we must come together to fight again. Ronald Reagan believed that it was individual freedom that made America great

___________________________

It’s much more plausible to say that Republicans have lagged because they didn’t have candidates with a Reagan-style message.

But let’s assume, for the sake of argument, that Republicans would have fared poorly even if Reaganites had been nominated. Does “reform conservatism” offer a path to electoral salvation.

Here’s what Douthat identifies as the “two major premises” of reform conservatism.

1. First, he writes that the “core economic challenge facing the American experiment is not income inequality per se, but rather stratification and stagnation — weak mobility from the bottom of the income ladder and wage stagnation for the middle class.” Conservatives, he says, should strive to make “family life more affordable, upward mobility more likely, and employment easier to find.”

2. Second, he warns that the “existing welfare-state institutions we’ve inherited from the New Deal and the Great Society, however, often make these tasks harder rather than easier: Their exploding costs crowd out every other form of spending, require middle class tax increases and threaten to drag on economic growth.”

I’m not an expert on income mobility, so I’m not sure I would identify stratification and stagnation as the nation’s core economic challenge, but he may be right. Regardless, it’s definitely a good idea to have more mobility.

And I definitely agree that the welfare state hinders upward mobility by creating dependency. And he’s right that this is a drag on growth. That being said, I disagree with his assertion that rising entitlement expenditures crowd out other spending and lead to middle class tax hikes. Those things may happen at some point, particularly once we get into the peak years for retiring baby boomers, but they haven’t happened yet.

The more important question, at least to me, is what sort of policies do reform conservatives embrace? Here’s Douthat’s list, bolded, followed by my thoughts.

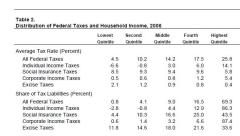

a. A tax reform that caps deductions and lowers rates, but also reduces the burden on working parents and the lower middle class, whether through an expanded child tax credit or some other means of reducing payroll tax liability.  I obviously like the idea of lowering rates and reducing deductions since that moves the system closer to a flat tax. That being said, it’s difficult to reduce the tax burden on the lower middle class since they pay very little income tax under the current system (see accompanying table from CBO). But I like the idea of addressing the payroll tax, though I disagree with their approach (see section “c” below).

I obviously like the idea of lowering rates and reducing deductions since that moves the system closer to a flat tax. That being said, it’s difficult to reduce the tax burden on the lower middle class since they pay very little income tax under the current system (see accompanying table from CBO). But I like the idea of addressing the payroll tax, though I disagree with their approach (see section “c” below).

b. A repeal or revision of Obamacare that aims to ease us toward a system of near-universal catastrophic health insurance, and includes some kind of flat tax credit or voucher explicitly designed for that purpose. I fully agree with repeal of Obamacare, and I think an unfettered marketplace would evolve into a system of near-universal catastrophic insurance, but I don’t want the federal government subsidizing or coercing that approach (though current healthcare policy has far more subsidies and coercion, so Douthat’s plan would be a big improvement over the status quo).

c. A Medicare reform along the lines of the Wyden-Ryan premium support proposal, and a Social Security reform focused on means testing and extending work lives rather than a renewed push for private accounts. I’m glad they embrace Medicare reform, but I’m puzzled by the hostility to personal retirement accounts. If you increase the retirement age and/or means test, youforce people to pay more and get less, yet Social Security already is a bad deal for younger workers. So why make it worse? How can that be good for those with low mobility? Personal accounts would be akin to a tax cut for such workers since the payroll tax would be transformed into something much closer to deferred compensation.

d. An immigration reform that tilts much more toward Canadian-style recruitment of high-skilled workers, and that doesn’t necessarily seek to accelerate the pace of low-skilled immigration. As I noted in this interview, I very much favor bringing more high-skilled people into the country.

e. A “market monetarist” monetary policy as an alternative both to further fiscal stimulus and to the tight money/fiscal austerity combination advanced by many Republicans today. I try to avoid monetary policy. That being said, I’m a bit skeptical of “market monetarism.” No nation has ever tried this system, so it’s uncharted territory, and I’m reluctant to embrace an approach which is premised on the notion that bubbles can’t exist (what about the tech bubble of the late 1990s or the housing bubble last decade?!?). I’m also suspicious of a system which requires an activist central bank. Watch this George Selgin video if you want to know why.

f. An attack not only on explicit subsidies for powerful incumbents (farm subsidies, etc.) but also other protections and implicit guarantees, in arenas ranging from copyright law to the problem of “Too Big To Fail.” Amen. I fully agree.

Since I’m a tax policy wonk, let me address in greater detail some of the tax reform proposals put forward by reform conservatives.

Jim Pethokoukis of the American Enterprise Institute is identified in the column as a reform conservative, and he recently expressed skepticism about the flat tax in a column for National Review.

It’s an elegant, compelling model that might work splendidly if you were creating a tax code ex nihilo. …America, however, is in a much different place. Millions of individuals and businesses have made long-term plans based on expectations that the tax code will remain more or less the same. Half the nation, thanks to all those deductions and credits, pays no income tax. …it’s unlikely the U.S. can keep spending down at historical levels of 20 percent to 21 percent of GDP while also maintaining a floor for defense spending at 4 percent of output. The best a group of AEI scholars could manage was limiting spending to 23 percent of GDP by 2035.

The clear implication of his column is that we need a tax system that raises more revenue. I obviously disagree. We should never “feed the beast” by giving politicians more money to spend.

Pethokoukis also says the flat tax is politically unrealistic. Since I’m not expecting a flat tax in my lifetime, I obviously can’t argue with that statement. But he then proposes another plan that would be far less popular – and far more dangerous.

One solution is to take the essentially flat consumption tax devised by economists Robert Hall and Alvin Rabushka and give it a progressive rate structure. Or we could combine a consumption tax with a flat income tax on wealthier Americans, as suggested by Yale’s Michael Graetz.

So we should keep the income tax as a vehicle for class warfare and augment it with a VAT?!? Yeah, good luck trying to sell that idea. And Heaven help us if it ever succeeded since politicians would have another major source of tax revenue.

Another plan, which Douthat explicitly cites in his paper, was put together by Robert Stein, a former Bush Treasury official. He thinks traditional supply-side policies today are either irrelevant or unpopular.

Lowering tax rates today could still enhance the incentives to invest, particularly in the corporate sector. But the distortions caused by marginal tax rates are not nearly as great as they were in 1980. And attempts to solve other problems caused by the tax code itself — like the biases in favor of consumption over saving, or home building over business investment — could never in themselves garner the public support necessary for a major overhaul.

As I noted, I’m not holding my breath for a flat tax, so I can’t disagree with Stein’s prognostication.

He also has a very novel way of defining the problem we should be trying to fix.

…it is time to rethink how the tax code treats parents. …raising children is hardly just another pastime: It is one of the most important services any American can perform for our country. …even as Social Security and Medicare depend on large numbers of future workers, they have created an enormous fiscal bias against procreation, undermining an important motive for raising children: to safeguard against poverty in old age. ……our system of taxes and entitlements not only fails to reward parents — it actively discourages Americans from having children. …Recent studies (especially work by Michele Boldrin, Mariacristina De Nardi, and Larry Jones and by Isaac Ehrlich and Jinyoung Kim) show that Social Security and Medicare actually reduce the fertility rate by about 0.5 children per woman. In European countries, where retirement systems are larger, the effect is closer to one child per woman.

As a libertarian, the beginning section of that passage grated on me. My children are individuals, not a “service” to prop up entitlement programs. I agree with Stein that these programs are a problem, but the solution is to reform entitlements, not to rejigger the tax code in hopes of pumping out more taxpayers.

Stein disagrees.

Unfortunately, these negative effects on fertility cannot be cured simply by converting old-age entitlement programs into mandatory savings programs, as the Bush administration proposed for Social Security in 2005. After all, requiring workers to save for retirement through private financial instruments would also crowd out the traditional motive to raise kids.

Instead, he wants to change the tax system based on the notion that today’s kids are tomorrow’s taxpayers.

…the present value of future Social Security and Medicare contributions for a typical worker born today is about $150,000. Rewarding parents for creating these future contributions suggests annual tax relief of about $8,500 per child. To correct for this inadequate treatment of households with children, the existing dependent exemption for children, the child credit, the child-care credit, and the adoption credit should be replaced with one new $4,000 credit per child that can be used to offset both income and payroll taxes. (This amount is set much closer to the $3,250 figure than the $8,500 one mostly to reduce the plan’s negative impact on federal revenue.)

I have no philosophical objection to some form of exemption – or even credit – based on family size. Almost all flat tax systems, for instance, have some sort of family allowance.

But it’s also important to realize that bigger family allowances generally don’t have pro-growth effects. It’s the marginal tax rate that impacts incentives.

And Stein, unfortunately, would “pay” for his credits by raising marginal tax rates on a significant share of taxpayers.

Some of these costs would be offset by eliminating itemized deductions (other than mortgage interest and charitable contributions). The rest would have to be offset by allowing the top rate of 35% to touch more taxpayers than it currently affects. …who pays more? Primarily high-income workers, but also upper-middle-class taxpayers who do not have children in the home (either because they have decided not to raise children at all, or because their children have already turned 18). To be blunt, the plan is a tax hike on the rich and makes the tax code even more progressive than it is today.

To be fair, Stein also proposes some good policies such as AMT repeal and reductions in double taxation, so he’s definitely not in the Obama class-warfare camp. But it’s also fair to say that his plan won’t do much for growth. Some tax rates are lowered but others are increased.

Yet if you really want families to be in stronger shape, more growth is the only long-run solution.

Moreover, it’s not clear that Stein’s agenda would be terribly popular. Though I confess that’s just a guess since no politician has latched onto the idea in the years since the proposal was unveiled.

Returning to the broader issue of “reform conservatism,” it’s difficult to assign an overall grade to the movement since I’m not sure whether we’re supposed to interpret it as a political strategy or an economic plan.

Regardless, I guess I’m generally sympathetic. I assume the RCers want government to be smaller than it is today and I don’t think you have to be a 100 percent libertarian to be my ally in the fight to restrain excessive government. And I also think it’s a good idea for people to be thinking of how to best articulate a message of smaller government. Heck, I do that every time I go on TV or give a speech.

So I reserve the right to object to any of the specific proposals that reform conservatives put forward (such as the tax plans discussed above), but I like the project.

Related: