I respect the Cato Institute and especially Dan Mitchell and here is an article he just wrote:

Does It Matter that Paul Ryan Is on the GOP Ticket?

August 11, 2012 by Dan Mitchell

The honest answer is that it probably means nothing. I don’t think there’s been an election in my lifetime that was impacted by the second person on a presidential ticket.

And a quick look at Intrade.com shows that Ryan’s selection hasn’t (at least yet) moved the needle. Obama is still in the high 50s.

And a quick look at Intrade.com shows that Ryan’s selection hasn’t (at least yet) moved the needle. Obama is still in the high 50s.

Moreover, the person who becomes Vice President usually plays only a minor role in Administration policy.

With those caveats out of the way, the Ryan pick is mostly good news.

Here are the reasons why I’m happy.

- I think Ryan genuinely believes in small government, low tax rates, and free markets. Heck, he’s even read Ayn Rand, and is willing to admit that he likes her writings.

- Ryan put together a good budget and got the Republican Party to rally around the plan – a remarkable achievement considering that the same GOPers had just spent 8 years supporting the irresponsible fiscal policies of the Bush Administration.

- He understands that not all entitlement reform is created equal. Instead of supporting means-testing (which produces implicit higher marginal tax rates) and unsustainable price controls, Ryan got his colleagues to support Medicaid block grants and premium support (or vouchers) for Medicare.

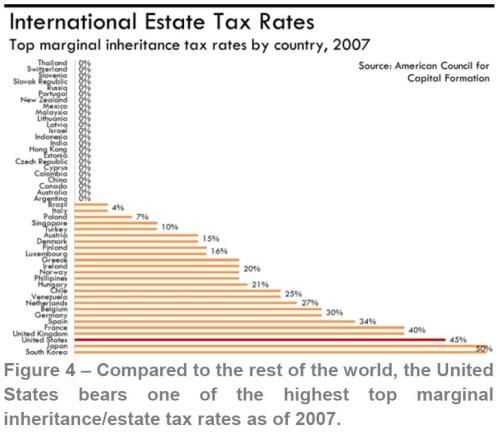

- Ryan is a proponent of the flat tax and can competently discuss not only the importance of low tax rates, but also why double taxation is misguided and why it’s wrong to use the tax code to pick winners and losers.

Here are two reasons why I’m worried.

- Both Romney and Ryan are somewhat sympathetic to a value-added tax. My worst-case scenario is they win the election, but then can’t get a good budget approved because of some squishy Republican senators who put self interest above national interest. Romney and Ryan then decide that this European-style national sales tax is the only way – on paper – of making the budget balance. In reality, of course, we’ll suffer the same fate as Europe since the VAT revenues will be used to finance ever-larger government.

- Ryan has some very bad votes in his past, including support for TARP, the auto bailout, the no-bureaucrat-left-behind education legislation, and the reckless Medicare prescription drug entitlement. Everyone says to ignore those votes because Ryan knew he was voting the wrong way, but if he’s already made some deliberately bad decisions for political reasons, what’s to stop him from making more deliberately bad decisions for political reasons?

But as I said above, don’t read too much into Ryan’s selection. if Republicans win, Romney will be the one calling the shots.

Though this does give Ryan a big advantage the next time there’s an open contest for the GOP nomination – either 2016 or 2020.

P.S. I suspect putting Ryan on the ticket will shift Wisconsin into the GOP column. Based on my last prediction, that would be enough to defeat Obama. But I’ll have to contemplate whether the pick hurts Romney’s chances in another state. You’ll have to wait until September 6 for my updated election prediction.

P.P.S. For those who care about politics, some are saying that selecting Ryan was risky because it gives Obama and his allies an opportunity to demagogue the GOP ticket about entitlement reform. I disagree. Even if Romney picked Nancy Pelosi, that demagoguery was going to happen. Heck, they’ve already accused Romney of causing a woman’s death, so I hardly think they’ll be bashful about throwing around other accusations.

Related posts:

Churches, not the government, have traditionally helped the poor in the long history of the USA

If you look at the first 150 years of our nation’s history you will find practically no welfare or assistance to the poor coming from the government. In fact, most of the help came from local churches. During the last few decades the government had created the welfare trap that robs people of responsibility to […]

Obamacare: A Medicaid Monster

Cato’s Michael F. Cannon Discusses ObamaCare’s Individual Mandate Uploaded by catoinstitutevideo on Mar 26, 2012 http://www.cato.org/event.php?eventid=9074 The individual mandate to purchase health insurance is the linchpin of the Patient Protection and Affordable Care Act. It is among the issues to be handled by the Supreme Court beginning March 26, 2012. Michael F. Cannon is the […]

Taxed Enough Already? Just wait until Obamacare kicks in

Tim Sandefur Discusses ObamaCare’s Medicaid Expansion Uploaded by catoinstitutevideo on Mar 26, 2012 http://www.cato.org/event.php?eventid=9074 Tim Sandefur of the Pacific Legal Foundation explains some of the implications of the Affordable Care Act’s Medicaid expansion. ___________________ Obamacare will tax us to death. Here is a chart from the Heritage Foundation: Created on March 23, 2012 DOWNLOAD HIGH-RES […]

Interview with Paul Ryan

Rep. Paul Ryan’s Budget Problem – CBN.com A biblical justification for getting our spending in order. Subsidiarity: An Important Principle in Federal Budget Debates Ryan Messmore April 16, 2012 at 1:00 pm How should one’s faith shape his or her engagement in the policy arena? Political Correspondent David Brody recently asked that question of House […]

Obama wants to claim Reagan again

I have a son named Wilson Daniel Hatcher and he is named after two of the most respected men I have ever read about : Daniel from the Old Testament and Ronald Wilson Reagan. One of the thrills of my life was getting to hear President Reagan speak in the beginning of November of […]

Obama is easy to make fun of at times

Exempting half the people from paying income tax does not seem like a bright idea. President Obama has a funny way of spinning that. Dan Mitchell’s blog has a good way of presenting that. Obama’s Understanding of Taxation, Captured by a Cartoon July 11, 2011 by Dan Mitchell I’ve already posted on Obama’s class-warfare approach to […]

Dan Mitchell of the Cato Institute on President Obama’s “Social Darwinism speech”

Dan Mitchell of the Cato Institute rightly has pointed out that President Obama is off base to be critical of Paul Ryan’s budget since it allows the government to grow by over 3% each year and he wished that the Republicans would taking a sharper knife to the budget cuts!!!! Appearing on PBS to Debate […]