Ernie Dumas in the Arkansas Times, Jan 18, 2012 argued:

A big majority of Americans are concerned about growing income inequality and government favor for the rich, and they understand that lower taxes do directly affect federal budget deficits, which Republican orthodoxy for 30 years has denied.

However, I like most Republicans would argue the problem is spending and not taxes. Take a look at this video and article from the Cato Institute concerning Illinios’ recent experience.

Illinois Downgrade: More Evidence that Higher Taxes Make Fiscal Problems Worse

Posted by Daniel J. Mitchell

I don’t blame Democrats for wanting to seduce Republicans into a tax-increase trap. Indeed, I completely understand why some Democrats said their top political goal was getting the GOP to surrender the no-tax-hike position.

I’m mystified, though, why some Republicans are willing to walk into such a trap. If you were playing chess against someone, and that person kept pleading with you to make a certain move, wouldn’t you be a tad bit suspicious that your opponent really wasn’t trying to help you win?

When I talk to the Republicans who are open to tax hikes, they sometimes admit that their party will suffer at the polls for agreeing to the hikes, but they say it’s the right thing to do because of all the government red ink.

I suppose that’s a noble sentiment, though I find that most GOPers who are open to tax hikes also tend to be big spenders, so I question their sincerity (with Senator Coburn being an obvious exception).

But even if we assume that all of them are genuinely motivated by a desire to control deficits and debt, shouldn’t they be asked to provide some evidence that higher taxes are an effective way of fixing the fiscal policy mess?

I’m not trying to score debating points. This is a serious question.

European nations, for instance, have been raising taxes for decades, almost always saying the higher taxes were necessary to balance budgets and control red ink. Yet that obviously hasn’t worked. Europe’s now in the middle of a fiscal crisis.

So why do some people think we should mimic the French and the Greeks?

But we don’t need to look overseas for examples. Look at what’s happened in Illinois, where politicians recently imposed a giant tax hike.

The Wall Street Journal opined this morning on the results. Here are the key passages:

Run up spending and debt, raise taxes in the naming of balancing the budget, but then watch as deficits rise and your credit-rating falls anyway. That’s been the sad pattern in Europe, and now it’s hitting that mecca of tax-and-spend government known as Illinois.

…Moody’s downgraded Illinois state debt to A2 from A1, the lowest among the 50 states. That’s worse even than California.

…This wasn’t supposed to happen. Only a year ago, Governor Pat Quinn and his fellow Democrats raised individual income taxes by 67% and the corporate tax rate by 46%. They did it to raise $7 billion in revenue, as the Governor put it, to “get Illinois back on fiscal sound footing” and improve the state’s credit rating. So much for that.

…And—no surprise—in part because the tax increases have caused companies to leave Illinois, the state budget office confesses that as of this month the state still has $6.8 billion in unpaid bills and unaddressed obligations.

In other words, higher taxes led to fiscal deterioration in Illinois, just as tax increases in Europe have been followed by bad outcomes.

Whenever any politician argues in favor of a higher tax burden, just keep these two points in mind:

1. Higher taxes encourage more government spending.

2. Higher taxes don’t raise as much money as politicians claim.

The combination of these two factors explains why higher taxes make things worse rather than better. And they explain why Europe is in trouble and why Illinois is in trouble.

The relevant issue is whether the crowd in Washington should copy those failed examples. As this video explains, higher taxes are not the solution.

Uploaded by CFPEcon101 on May 3, 2011

This Economics 101 video from the Center for Freedom and Prosperity gives seven reasons why the political elite are wrong to push for more taxes. If allowed to succeed, the hopelessly misguided pushing to raise taxes would only worsen our fiscal mess while harming the economy.

The seven reasons provided by the video against this approach are as follows:

1) Tax increases are not needed;

2) Tax increases encourage more spending;

3) Tax increases harm economic performance;

4) Tax increases foment social discord;

5) Tax increases almost never raise as much revenue as projected;

6) Tax increases encourage more loopholes; and,

7) Tax increases undermine competitiveness

_____________________

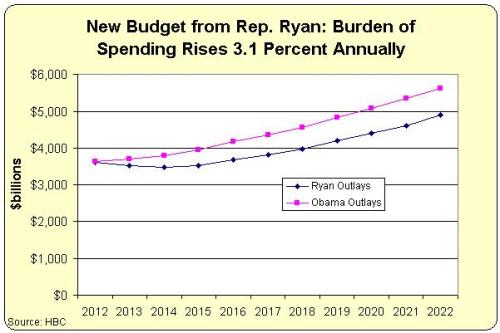

Heck, I’ve already explained that more than 100 percent of America’s long-fun fiscal challenge is government spending. So why reward politicians for overspending by letting them confiscate more of our income?