The 4 Ways to Spend Money by Milton Friedman

![]()

Uploaded by Sidewinder77 on Aug 26, 2006

1. You spend your own money on yourself.

2. You spend your own money on someone else.

3. You spend someone else’s money on yourself.

4. You spend someone else’s money on someone else.

___________

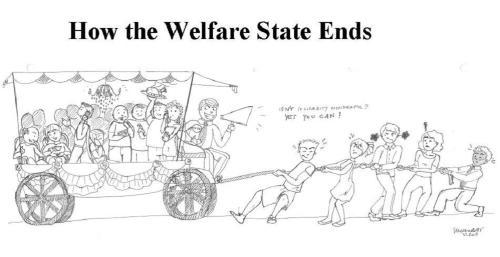

We need a Balanced Budget Amendment today so we can limit the amount of money the federal government can spend. Why does the government spend our money so foolishly? Milton Friedman has the answer below.

Friedman’s Four Ways

By Ron Ross on 10.5.11 @ 6:08AM

Who’s spending whose money? That’s the crucial question.

Sometimes the explanation for vexing problems is clear as can be after you see it. A perfect example is an observation made by the late Milton Friedman in a 2004 interview with Fox News:

There are four ways to spend money. You can spend your own money on yourself. When you do that, why you really watch out for what you’re doing, and you try to get the most for your money. Then you can spend your own money on somebody else. For example, I buy a birthday present for someone. Well then, I’m not so careful about the content of the present, but I’m very careful about the cost. Then, I can spend somebody else’s money on myself. And if I spend somebody else’s money on myself, then I’m going to have a good lunch! Finally, I can spend somebody else’s money on somebody else. And if I spend somebody else’s money on somebody else, I’m not concerned about how much it costs, and I’m not concerned about what I get. And that’s government. And that’s close to 40 percent of our national income.

It would be nearly impossible to exaggerate how many of our current economic problems are explained by Friedman’s four ways of spending money. Think of the four ways in the order they’re presented as S1, S2, S3, and S4. As Friedman explains, the effectiveness of how money is spent declines inexorably as you move from S1 to S4.

The important demarcation line in ways money can be spent is between S2 and S3. In other words, the issue that matters most is your money versus someone else’s money. If you’re spending your own money on someone else, your spouse or children, for example, you still take the expenditure seriously. You still pay a price if you don’t look for bargains.

A new Gallup survey finds that “Americans believe, on average, that the federal government wastes 51 cents of every tax dollar, similar to a year ago, but up significantly from 46 cents a decade ago and from an average 43 cents three decades ago.” This is a good example of “the wisdom of crowds.” The trend shows that the crowd is wising up regarding the implications of gargantuan government.

The survey respondents are correct in their assessment of how government spends money, and you need go no further than Friedman’s distinctions of how to spend money in understanding the source of the problem.

My guess would be that many of the respondents would think the government doesn’t necessarily need to waste half the public’s money. The problem, however, is it’s the nature of the beast. Because of the realities Friedman refers to, the government will never be able to spend money as effectively as the private sector.

The problems associated with how the government spends money are not the result of who’s running the government. The problems are systemic. Unless government is seriously downsized, waste and inefficiency will remain problems no matter which party is in power.

The source of the problem can be further clarified by keeping in mind the observations of another economist, Steven Landsburg: “Most of economics can be summarized in four words: People respond to incentives.” (That’s the first sentence in his excellent book, The Armchair Economist.)

The incentives for spending money wisely and efficiently are simply too weak when it’s not your own money. It’s no skin off your nose if the benefits of the expenditure are a small fraction of the costs. When it’s your own funds being used, you will not only restrict your expenditures to things having more benefits than costs, you will choose the ones you think will have the highest ratio of benefits to costs.

When it’s your own money you’re spending, it costs you something when you spend it foolishly. That’s not to say that we never spend our own money foolishly, but it comes out of our own hides when we do. When we spend our own money foolishly, we’re left with less money to spend well. It’s a self-policing structure. Of course, your incentives are even stronger when you worked hard for the money in question.

When a politician or bureaucrat spends taxpayer money it’s treated essentially a freebie. It’s only natural that taxpayer money gets treated like monopoly money. Politicians and bureaucrats have virtually no incentive to care about the value of an expenditure or its cost. This is a profound disadvantage of public spending that will never, ever go away.

Contrary to the straw-man accusations of some liberals, conservatives do not advocate zero government expenditures. Conservatives definitely are not anarchists. Nevertheless, the inherent and inescapable inferiority of spending someone else’s money on someone else is a strong argument for minimizing the size of government. The public’s opinion that the amount of government waste has been increasing parallels the exponential growth of government.

The Solyndra fiasco is another recent confirmation of Friedman’s observations. Despite alarm bells going off, the Obama administration pushed the doomed endeavor forward. Why not? It wasn’t their money, after all. Because it has now becoming so notorious, it appears the administration may pay a political price. Nevertheless, half a billion dollars of taxpayer money has gone down a rat hole. Unfortunately, Solyndra is the rule, not the exception. Absurdly generous public employee pension plans are another predictable result of spending someone else’s money.

Friedman said that the fourth spending alternative is how we spend forty percent of GDP. He was, I think, referring only to budgetary expenditures. Forty percent is a lot. Unfortunately, it understates the full extent of the problem.

The vast regulatory apparatus of the government is basically a system of spending someone else’s money on someone else. It is estimated that government regulations currently cost the economy $1.7 trillion a year. For example, requiring a private business owner to spend hundreds of thousands of dollars to comply with the American with Disabilities Act is a clear case of spending someone else’s money on someone else. Requiring a private business to spend a million dollars doing an “environmental impact report” is a clear example of spending someone else’s money on someone else. Spending a million dollars or more on an EIR, in fact, is an example of spending someone else’s money for no one and for nothing. Minimum wage laws likewise are a case of spending someone else’s money on someone else.

The billions of hours Americans spend each year preparing their tax returns is a case of spending someone else’s time on someone else. Time is money, as they say, and most people I know complain a lot more about a scarcity of time than they do of money.

When you spend your own money (or time) on yourself, or for your loved ones, the process is essentially self-regulating. The incentives are automatically aligned with waste minimization. When such incentives are not present, elaborate and complex systems of rules and artificial punishments must be put in their place. There can never be enough rules and regulations to match the effectiveness and elegance of the self-regulating market.

Casual empiricism certainly suggests that higher taxes are associated with more government, not less red ink. We see this, for instance, in the

Casual empiricism certainly suggests that higher taxes are associated with more government, not less red ink. We see this, for instance, in the  What about the facts? Bill does some regression analysis for the 1949-2005 period, where he looks at the change in federal spending as a share of GDP and tests its relationship with the level of tax receipts as a share of GDP, the change in the unemployment rate, and the change in interest payments (the latter two variables are there to hopefully wash out the effects of the business cycle and to limit the analysis to the spending that lawmakers actually can control).

What about the facts? Bill does some regression analysis for the 1949-2005 period, where he looks at the change in federal spending as a share of GDP and tests its relationship with the level of tax receipts as a share of GDP, the change in the unemployment rate, and the change in interest payments (the latter two variables are there to hopefully wash out the effects of the business cycle and to limit the analysis to the spending that lawmakers actually can control).