President Obama c/o The White House

1600 Pennsylvania Avenue NW

Washington, DC 20500

Dear Mr. President,

I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here.

If our country is the grow the economy and get our budget balanced it will not be by raising taxes!!! The recipe for success was followed by Ronald Reagan in the 1980’s when he cut taxes and limited spending. As far as limiting spending goes only Bill Clinton (with his Republican Congress) were ability to control the growth of government better than Reagan.

I had the pleasure of hearing Arthur Laffer speak in 1981 and he predicted all the economic growth that we would see because of the Reagan tax cuts and he was right. Unfortunately in California today they have forgotten all of those lessons!!!

California Is the Canary in the Class-Warfare Coal Mine

May 14, 2012 by Dan Mitchell

President Obama’s fiscal policy is a dismal mixture. On spending, he wants a European-style welfare state. On taxes, he is fixated on class-warfare tax policy.

If we want to know the consequences of that approach, we can look at the ongoing collapse of Greece. Or, if we don’t like overseas examples, we can look at California.

If the (formerly) Golden State is any example, it turns out that having high tax rates doesn’t necessarily translate into high tax revenues. Here’s a blurb from an editorial in today’s Wall Street Journal.

California Controller John Chiang reported last week that April tax collections were a gigantic 20.2%, or $2.44 billion, below 2012-13 budget projections. …Among the biggest surprises is a 21.5% or nearly $2 billion decline in personal income tax payments from what Governor Jerry Brown had anticipated. This reinforces the point that when states rely too heavily on the top 1% of taxpayers to pay the bills, fiscal policy is a roller coaster ride. California is suffering this tax drought even as most other states enjoy a revenue rebound. State tax collections were up nationally by 8.9% last year, according to the Census Bureau, and this year revenues are up by double digits in many states. The state comptroller reports that Texas is enjoying 10.9% growth in its sales taxes (it has no income tax), while California can’t seem to keep up despite one of the highest tax rates in the land.

The WSJ editorial suggests a supply-side response, but you won’t be surprised to learn that the state’s kleptomaniac governor is pushing an Obama-style soak-the-rich tax hike.

This would seem to suggest that California should try cutting tax rates to keep more people and business in the state, but Sacramento is intent on raising them again. Governor Brown and the public-employee unions are sponsoring a ballot initiative in November to raise the state sales tax by a quarter point to 7.5% and to raise the top marginal income-tax rate to 13.3% from 10.3%. This will make the state even more reliant on the fickle revenue streams provided by the rich. Meanwhile, an analysis by Joseph Vranich, who studies migration of businesses from one state to another, finds that since 2009 the flight of businesses out of California “has increased fivefold due to high taxes and regulatory costs.”

I’ll be very curious to see what happens this November when the people of California vote in the referendum. Will they be like the morons in Oregon, who approved a class-warfare tax hike? Or will they be like the voters of Switzerland and reject class warfare?

Sadly, I suspect Oregon will be their role model – even though that decision hurt the Beaver State’s economy.

But while voters can impose higher taxes, they can’t repeal the laws of economics. So if California voters do the wrong thing, they will learn a hard lesson about the Laffer Curve.

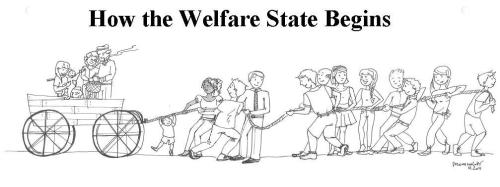

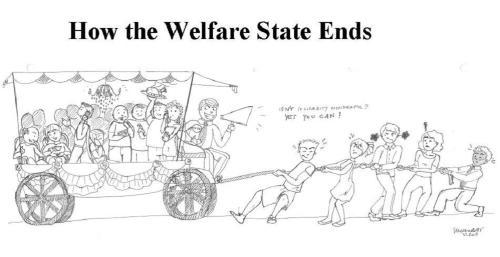

And then, as this cartoon demonstrates, they’ll learn the ultimate lesson about not biting the hand that you mooch from.

___________

Thank you so much for your time. I know how valuable it is. I also appreciate the fine family that you have and your commitment as a father and a husband.

Sincerely,

Everette Hatcher III, 13900 Cottontail Lane, Alexander, AR 72002, ph 501-920-5733, lowcostsqueegees@yahoo.com

The Laffer Curve, Part III: Dynamic Scoring

Federal Spending per Household Is Skyrocketing

Federal Spending per Household Is Skyrocketing Federal Spending Grew More Than Ten Times Faster Than Median Income

Federal Spending Grew More Than Ten Times Faster Than Median Income

Defense Spending Has Declined While Entitlement Spending Has Increased

Defense Spending Has Declined While Entitlement Spending Has Increased More Than Half of the President’s Budget Would Be Spent on Entitlement Programs

More Than Half of the President’s Budget Would Be Spent on Entitlement Programs

Mandatory Spending Has Increased Five Times Faster Than Discretionary Spending

Mandatory Spending Has Increased Five Times Faster Than Discretionary Spending Obama’s Budget Would Reduce National Defense Spending

Obama’s Budget Would Reduce National Defense Spending