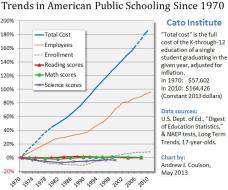

I’ve written many times about the shortcomings of government schools at the K-12 level. We spend more on our kids than any other nation, yet our test scores are comparatively dismal.

And one of my points, based on this very sobering chart from one of my Cato colleagues,  is that America’s educational performance took a turn in the wrong direction when the federal government became more involved starting about 40-50 years ago.

is that America’s educational performance took a turn in the wrong direction when the federal government became more involved starting about 40-50 years ago.

Well, the same unhappy story exists in the higher-education sector. Simply stated, there’s been an explosion of spending, much of it from Washington, yet the rate of return appears to be negative.

Let’s take a closer look at this issue.

Writing for the New York Times, Professor Paul Campos of the University of Colorado begins his column by giving the conventional-wisdom explanation of why it costs so much to go to college.

Once upon a time in America, baby boomers paid for college with the money they made from their summer jobs. Then, over the course of the next few decades, public funding for higher education was slashed. These radical cuts forced universities to raise tuition year after year, which in turn forced the millennial generation to take on crushing educational debt loads, and everyone lived unhappily ever after. This is the story college administrators like to tell when they’re asked to explain why, over the past 35 years, college tuition at public universities has nearly quadrupled, to $9,139 in 2014 dollars.

That’s a compelling story, and it surely has convinced a lot of people, but it has one tiny little problem. It’s utter nonsense.

That’s a compelling story, and it surely has convinced a lot of people, but it has one tiny little problem. It’s utter nonsense.

It is a fairy tale in the worst sense, in that it is not merely false, but rather almost the inverse of the truth. …In fact, public investment in higher education in America is vastly larger today, in inflation-adjusted dollars, than it was during the supposed golden age of public funding in the 1960s. Such spending has increased at a much faster rate than government spending in general. For example, the military’s budget is about 1.8 times higher today than it was in 1960, while legislative appropriations to higher education are more than 10 times higher. In other words, far from being caused by funding cuts, the astonishing rise in college tuition correlates closely with a huge increase in public subsidies for higher education. If over the past three decades car prices had gone up as fast as tuition, the average new car would cost more than $80,000.

Unfortunately, little of this money is being used for education.

…a major factor driving increasing costs is the constant expansion of university administration. According to the Department of Education data, administrative positions at colleges and universities grew by 60 percent between 1993 and 2009, which Bloomberg reported was 10 times the rate of growth of tenured faculty positions. Even more strikingly, an analysis by a professor at California Polytechnic University, Pomona, found that, while the total number of full-time faculty members in the C.S.U. system grew from 11,614 to 12,019 between 1975 and 2008, the total number of administrators grew from 3,800 to 12,183 — a 221 percent increase.

This is great news, but only if you’re a bureaucrat.

But if you think education dollars should be used to educate, it’s not very encouraging.

For example, check out this very depressing example of bureaucratic bloat at the University of California San Diego.

Now let’s zoom back out to the bigger issue. Professor Richard Vedder from Ohio University is even more critical of handouts for the higher-education sector. Here’s some of what he wrote for National Review.

America’s colleges and universities are terribly inefficient and excessively expensive, foster relatively little learning and ability to think critically, and turn out too many graduates who end up underemployed. These and related problems have grown sharply in the half century since the Higher Education Act of 1965 heralded a major expansion of the federal role in higher education.

Rich correctly points out that the federal government has made matters worse.

Rich correctly points out that the federal government has made matters worse.

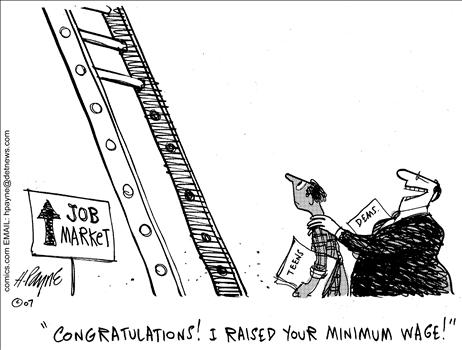

Washington is far more the problem than the solution to the current afflictions of American higher education. …Tuition has skyrocketed in the era since federal student-loan and grant programs started to become large in the late 1970s. Colleges have effectively confiscated federal loan and grant money designated for students and used it to help fund an academic arms race that has given us climbing walls, lazy rivers, and million-dollar university presidents — but declining literacy among college students and a massive mismatch between students’ labor-market expectations and the realities of the job market.

And you won’t be surprised to learn that federal handouts have backfired against low-income students.

…the primary goal of the federal student-aid programs was to improve access to college for lower-income persons. Here, the record is one of total failure: A smaller percentage of recent college graduates come from the bottom quartile of the income distribution today than was the case in 1970, when federal student-assistance programs were in their infancy.

To close on a semi-optimistic note, Prof. Vedder highlights some intriguing incremental reforms advanced by Senator Lamar Alexander of Tennessee, including the notion that handouts should be linked to performance.

…he seems to embrace the idea that colleges should have “skin in the game”: They should face financial consequences for admitting, and then failing to graduate, students who default on loans and have marginal educational backgrounds indicating that they were clearly ill prepared for truly higher education. …Users and providers of university services need to feel the pain associated with academic non-performance. Growing federal involvement in higher education has brought rising prices, falling quality, and student underemployment. While it is perhaps politically impossible to radically change the federal student financial-aid programs now, the Alexander move is an important first step to rethinking how we finance higher education.

Ultimately, though, we won’t solve the problem unless the federal government’s role is abolished, which is yet another reason to shut down the Department of Education in Washington.

P.S. Here’s a great video from Learn Liberty explaining why subsidies have translated into higher tuition.

P.P.S. Some people have their fingers crossed that there’s a “tuition bubble” that’s about to pop. I hope that’s true, and it may be happening in a few sectors such as law, but I don’t think the overall higher-education bubble will pop until and unless we end government subsidies and handouts.

P.P.P.S. I’m even against subsidies and handouts for economists!

_____________

Related posts:

Dan Mitchell quotes from Milton Friedman video on his blog!!!

________ Dan Mitchell quotes from Milton Friedman video on his blog!!! Wise Words on Regulation and Consumer Freedom from Milton Friedman December 26, 2014 by Dan Mitchell It’s time to correct a sin of omission. In five-plus years of blogging, I haven’t given nearly enough attention to the wisdom of the late (and great) Milton Friedman. […]

Open letter to President Obama (Part 687) Dan Mitchell, Ron Paul, and Milton Friedman on Immigration Debate (includes editorial cartoon)

Open letter to President Obama (Part 687) Milton Friedman (Emailed to White House on 6-25-13.) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to […]

Milton Friedman rightly pointed out that the crisis of the Great Depression was not a failure of the free market system but of government and Dan Mitchell concurs!!!

___________ Milton Friedman rightly pointed out that the crisis of the Great Depression was not a failure of the free market system but of government and Dan Mitchell concurs!!! Statist Policy and the Great Depression September 17, 2014 by Dan Mitchell It’s difficult to promote good economic policy when some policy makers have a deeply flawed […]

Open letter to President Obama (Part 558) Dan Mitchell reflects on Margaret Thatcher’s life

Open letter to President Obama (Part 558) (Emailed to White House on 6-10-13.) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get […]

Dan Mitchell on privatizing the post office!!!

Dan Mitchell on privatizing the post office!!! Time for a Free-Market Postal System March 25, 2014 by Dan Mitchell It’s not often that I agree with the Washington Post, but a government-run monopoly is not the best way to get mail delivered. Moreover, it’s not often that I agree with the timid (and sometimes reprehensible) […]

Dan Mitchell is right and we must reduce the size and power of Government!!!!

________ Dan Mitchell is right and we must reduce the size and power of Government!!!! Thanks to Obamacare and the IRS, You’re at Risk of Having Your Identity Stolen and Your Bank Account Emptied December 3, 2013 by Dan Mitchell There are many reason I don’t like Obamacare, including its punitive impact on taxpayers and the […]

Dan Mitchell of the Cato Institute has noted, “I’m all in favor of bringing federal government spending back down to about 18 percent of GDP, which is where it was when Bill Clinton left office.”

________ Dan Mitchell of the Cato Institute has noted, “I’m all in favor of bringing federal government spending back down to about 18 percent of GDP, which is where it was when Bill Clinton left office.” The Rise (and Upcoming Fall) of the Welfare State in the Western World November 12, 2013 by Dan Mitchell I […]

Cartoons from Dan Mitchell’s blog that demonstrate what overspending will do

I have put up lots of cartoons from Dan Mitchell’s blog before and they have got lots of hits before. Many of them have dealt with the economy, eternal unemployment benefits, socialism, Greece, welfare state or on gun control. It is sad to see our federal government spend away our children’s future but when some of the states are doing that […]

Cartoons from Dan Mitchell’s blog that demonstrate how stupid government can be

I have put up lots of cartoons from Dan Mitchell’s blog before and they have got lots of hits before. Many of them have dealt with the economy, eternal unemployment benefits, socialism, Greece, welfare state or on gun control. Government Stupidity Defies Satire When a $50 Light Bulb Wins an Affordability Prize March 16, 2012 by Dan Mitchell I’ve written about the […]

Cartoons from Dan Mitchell’s blog that demonstrate what Obama is doing to our economy

I have put up lots of cartoons from Dan Mitchell’s blog before and they have got lots of hits before. Many of them have dealt with the economy, eternal unemployment benefits, socialism, Greece, welfare state or on gun control. Two More Excellent Political Cartoons April 26, 2011 by Dan Mitchell I praised Michael Ramirez a few days ago for his clever political cartoons, […]

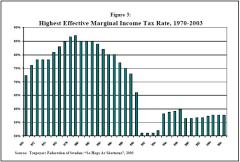

…And the reason for their bold fashion choices lay not just in the pop glamour of the late 70s and early 80s, but also in the Swedish tax code. According to Abba: The Official Photo Book, published to mark 40 years since they won Eurovision with Waterloo, the band’s style was influenced in part by laws that allowed the cost of outfits to be deducted against tax – so long as the costumes were so outrageous they could not possibly be worn on the street.

…And the reason for their bold fashion choices lay not just in the pop glamour of the late 70s and early 80s, but also in the Swedish tax code. According to Abba: The Official Photo Book, published to mark 40 years since they won Eurovision with Waterloo, the band’s style was influenced in part by laws that allowed the cost of outfits to be deducted against tax – so long as the costumes were so outrageous they could not possibly be worn on the street. Or, returning to the example of ABBA, perhaps they should have used these outfits since there wouldn’t be much cost to deduct and that would have boosted taxable income.

Or, returning to the example of ABBA, perhaps they should have used these outfits since there wouldn’t be much cost to deduct and that would have boosted taxable income.

AWESOME commentary!! Thank you!

[…] By Dan Mitchell […]

The freedom to associate with, work with, deal with is the most fundamental rights. Let folks sort it all out on their own. If somebody doesn’t want to be bothered with me, that’s fine. It’s happened and it’s perfectly ok.

[…] WordPress Blogger Dan Morris writes this in his blog entitled, “Liberty, Morality and Discrimination.” […]

One of your better posts Mr. Dan.

I am curious about one thing, though. What do these RFRA laws accomplish that the First Amendment hasn’t already covered?

@Richards, signifies the State’s interest in pursuing the right rather than awaiting the inefficient, political warped, misguided action of the corrupt Fed.gov. Dismiss the adjectives if you must, but truth outlives all sheep. ©2015

“compelling state interest” is a judicial fraud on the Constitution and The People; clearly the limited rights of government found in the Constitution did not grant such fabrication. The concept arose out of a politically charged case in which the government could not get its way (the government always steals rights when the asses in charge can’t get their way), so the not-so-supreme court was pressured into a non-existent, unsupportable, bogus concept that an inanimate object had some intelligence (something those running government lack as is evidenced every day) that granted consciousness to extent of conceiving and having “an interest”, an otherwise entirely human emotion/concept. The judge was (and still is if you can understand the founding documents) of poor intellect, and politically weak, to pass this bullshit off as law. The only conception government has is the will of The People; all others are without constitutional ground and no validity–and should be ardently rejected by The People in strong Jeffersonian style. ©2015

PS. “Shays’ Rebellion — a sometimes-violent uprising of farmers angry over conditions in Massachusetts in 1786 — prompted Thomas Jefferson to express the view that “a little rebellion now and then is a good thing” for America. Unlike other leaders of The Republic, Jefferson felt that the people had a right to express their grievances against the government, even if those grievances might take the form of violent action.” Every morning as the proletariat awakes the first thing on their mind should be rebellion against government, all of them and completely. That makes for a great America. (And leads to smaller government and a working republic.)

This is the best single article I have seen on this subject. Very thoughtful and appreciated the links. Strongly agree with Murdock’s contention that RFRA doesn’t go far enough – nobody should ever have to do or produce anything that is against their scruples, whatever the source of their conscience. As many of the articles described, the targeting of wedding vendors who obviously could believe that a wedding is a sacred ceremony, feel they play a significant role in the event, and take pride in their work while at the same time believing a homosexual wedding ceremony is a profanation of something they hold holy was probably the impetus for the state RFRA laws. The government coercion to participate is the abhorrent value.

I hope Mr. Cook is understanding of my choice to associate with android but not Apple.

If we abandon the traditional core principles of morality rooted in Christian philosophy and natural law, then what determines an act or belief to be “immoral” and how do we distinguish it from being “unpopular” or “politically incorrect.”

I am a Roman catholic. Do I have a right to embrace our catechism teachings developed over many centuries, or do I have to kowtow to the prevailing elites and say I am personally offended by those who refuse to sell their goods and services for use at gay weddings? Do I have a right to maintain that marriage is a solemn and holy union between a man and a woman, and dissent with those who toss centuries of Christian philosophy aside to impose their enlightened view?

Similarly, may I continue to maintain that life is not only precious, it is more precious and profound than we can ever know, even though the enlightened elites insist I defer to the moral development of those with wombs, or those who administer death row justice, or those who allocate funds for medicare purposes and thus hold life and death power over their supplicants?

This new tactic of imposed orthodoxy in the name of tolerance is not about moral formation (or tolerance), it’s about fascist control. “Immoral” is becoming the label associated with those who resist the Regime’s dictates in some way. It is so intellectually shallow, but the prevailing dearth of critical thinking in the electorate not only makes it possible, it allows the fascism to thrive.

I had not quite realized what a sexist bigot I am.

Just think about it. When it came to the most important relationship in my life I did not even consider for a minute marrying a man. I squarely and resolutely discriminated based on gender by being dead set on marrying a woman.

Perhaps some day people will see the light and pass laws for gender neutrality in marriage. Mr Cook will be happy. Nothing too coercive. Just subsidies and perhaps some modest penalties, like excise taxes, to encourage transition to a balanced society with 25% male-male marriages, 50% male-female and 25% female-female. Or should it be 33%,33%,33% ? Tell you what. Let’s vote and whoever wins gets to impose their quota. Yes we can!

Reblogged this on Brian By Experience.

Good post and good comments.

[…] « Liberty, Morality, and Discrimination […]

Mark,

Great questions.

I for one believe you have every right to hold all those beliefs.

I would challenge you on the question of abortion, however, on the grounds of voluntary association, specifically whether or not force is justified to prevent it (not whether or not the act is immoral).

Voluntary association imposes a limit on contracts, namely that one may enter into contracts with others, but only to the extent the contract does not infringe upon the principle of voluntary association. For instance, one may enter into a contract to be another’s slave, but if the slave at any point decides to stop being a slave, he or she cannot be bound by the contract, because the enforcement of the contract violates the principle of voluntary association.

This principle does not, however excuse the debtor who decides to stop paying his or her creditor. The difference between these two being that in the case of the slave breaking his or her contract, the individual is simply assuming his or her own natural right to self ownership; no property of the former slave “owner” has been stolen, since his or her ownership claim on the slave was illegitimate or unenforceable. In the case of the debtor, theft has clearly occurred due to the exchange of legitimate property (loaned funds) by the creditor to the debtor. The debtor unwilling to pay back his or her debt has committed theft, whereas the unwilling slave has not.

In the case of abortion, the pregnant mother and the baby basically have an unwritten contract in which the mother will allow the unborn baby to survive inside her parasitically until the baby is ready to be born, at which point the mother risks her own death in the act of childbirth. If at some point during the pregnancy, the mother decides to end the “contract,” all she is really doing is breaking her unborn baby’s illegitimate ownership claim over her life. The mother cannot be forced to be a slave to her children, born or unborn, or conversely, the child has no right to receive life giving nourishment from his or her mother.

This is all based on the theory of natural rights, which states that no right is legitimate if it requires the services of another to exercise that right. Parents should not be forced to take care of their kids. It needs to be a moral choice.

All life is precious, but so is self ownership. Abortion is undoubtedly not something to be celebrated, and almost all believe it to be immoral. It is a terribly unfortunate situation when a parent decides to neglect a child, especially to the point of death, but the failure to act is not an enforceable crime.

Rothbard’s “Ethics of Liberty” delves into more detail if you are interested in this line of reasoning.

“Freed of most restraints against government action and populated by citizens increasingly oblivious to this nation’s founding principles, America is slouching into tyranny. Little by little. Day by day. ”

none of this is about morality… or equality… it’s about creeping fascism… political advantage… and ultimately nullifying the constitution… the objective is to create the American Reich… every detail of American life controlled by the political and bureaucratic elite… the nature of religious affiliations… business practices… personal finance… education and socialization…. all the privy of the ideologically insane…

“bye-bye miss American pie…”

Reblogged this on a political idealist..

“Indiana Pizzeria Owners Go into Hiding”

by

Rick Moran

“The online threats haven’t stopped since Crystal O’Connor told a South Bend TV station that she wouldn’t cater a gay wedding. In fact, the ugliness has gotten so bad, that the family has gone into hiding.”

the same tactics were in use Europe in the 30s… in those days they called themselves the “Pretorian Guard…”

http://pjmedia.com/tatler/2015/04/04/indiana-pizzeria-owners-go-into-hiding/

Reblogged this on Beware the Fury of a Patient Man.

What seems to be missing from these arguments is the fact that people are discriminating against a behavior, not a person. Societies discriminate against deviant behaviors and relationships all the time. This is different from civil rights cases where a superficial quality was the basis for judgement, i.e. skin color. You can’t tell a gay person from a straight person if they walk through your door. They have to tell you they engage in a specific behavior.

I’d like to know why more people don’t consider homosexual behavior as a moral hazard. Their behavior puts themselves and others at risk with the costs being mitigated by society. Look up the STD infections among gay men compared to the general population. Although not always illegal, we don’t encourage or reward moral hazard behaviors.

The starting point for so many of these arguments is that homosexuals are just another disenfranchised group like blacks or women but there is a natural reason why this group makes up such a small percentage of the population. Being black or female is not a defective condition. Homosexual relationships are a biological dead end. They have zero potential for producing offspring. One way of defining marriage is a social constraint on the two people who have the potential to produce children. The mother and father are known quantities who assume responsibilities for the child they created. A gay couple do not meet this criteria therefore has no need to marry. Why redefine marriage in order to include a non-normal population subset? Why give this group a special set of rights when no other non-normal sexual relationship has them. How can one say discriminating against an immoral behavior is also immoral?