–

Grading the DeSantis Economic Plan

During the 2016 presidential cycle, I graded the tax reform plans of various presidential candidates based on factors such as marginal tax rates, double taxation, and fairness.

For the 2024 cycle, candidates have been disappointingly reluctant to make specific proposals about tax policy. Heck, most of them have very little to say about economic policy in general.

So I was excited when I read that Florida’s governor, Ron DeSantis, was unveiling an economic plan. The good news is that he seems to favor a smaller burden of government. The bad news is that he is not very specific.

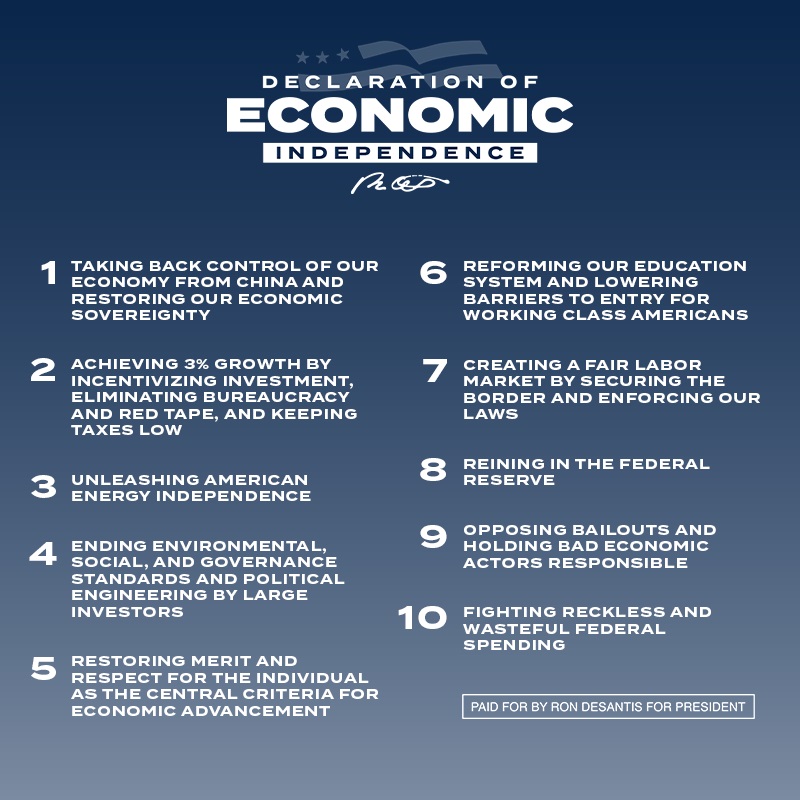

His theme is to have a Declaration of Economic Independence.

There’s a lot to like on the above list, but also some items that may cause heartburn.

But my main reaction is that we don’t see details. Even if you go to the DeSantis website, there are very few specific policy proposals (though the ones I did find – such as support for full expensing and opposition to a central bank digital currency – are admirable).

The Wall Street Journal editorialized about the DeSantis plan and found many positive features.

Mr. DeSantis’s economic plan calls for “ambitious tax and regulatory reform,” including making permanent “full immediate expensing” for businesses. Ditto for today’s tax rates on personal income. …he says he’d simplify the tax code further, while purging “K Street carveouts and loopholes.”

This is the right instinct, though we await specifics. …It says Mr. DeSantis’s appointee to lead the Federal Reserve would “focus on maintaining a stable dollar instead of the political pressures of the day.” Stable money is essential to rising incomes, and GOP candidates should make it the basis for any economic program. …The plan says he’d “support school choice nationwide…” As for college, he wants to stop government subsidies for “useless degrees” by making “universities, not taxpayers, responsible for the loans their students accrue.”

But the editors also worried that the Florida governor is using populist rhetoric…and perhaps even supporting populist policies.

Sometimes Mr. DeSantis sounds like an optimistic believer in economic freedom, arguing that the way to produce broad prosperity is to get government out of the way. With the next breath, he’s a Trumpian who wants industrial policy, speaks ominously of “large corporations,” and pits the middle class against “elites.” The Governor is trying to advance conservative policy while simultaneously appealing to Mr. Trump’s base. …He needs a vision for American renewal that transcends Mr. Biden’s plans to use big government for income redistribution and Mr. Trump’s desire to use it for political “retribution.”

Probably the most disappointing feature of the DeSantis plan is that absence of any plan to restrain the burden of government spending.

My former colleague Brian Riedl is similarly frustrated (though he focuses more on red ink while I care about excessive spending).

For what it is worth, DeSantis got very high scores for fiscal policy from both the Club for Growth and the National Taxpayers Union while serving as a Congressman last decade.

So I suspect he knows what should be done(including genuine entitlement reform), but is afraid Trump will attack him from the left.

Which is strange since he has a great opportunity to attack Trump from the right by pointing out his bad track record on spending (and bad future agenda on taxes).

The Debt Limit and Long-Overdue Spending Restraint

Regarding the debt ceiling, the hysterical headlinesabout default and an economic apocalypse are silly because the Treasury Department surely will “prioritize” if Republicans and Democrats don’t reach an agreement.

The above clip was taken from an interview last week with the Soul of Enterprise.

I wasn’t intending to write about this topic,  but it’s getting a lot of attention now that the deadline is approaching.

but it’s getting a lot of attention now that the deadline is approaching.

If you want to understand the real issue, there is an excellent column in the Wall Street Journal by former Senator Phil Gramm and his long-time aide, Mike Solon.

They explain that the fight is between House Republicans, who want domestic discretionary spending to grow at a slower rate and Democrats in the Senate and White House who want it to grow at a faster rate.

Here’s some of what they wrote.

Of the $5 trillion of stimulus payments between 2020 and 2022, some $362 billion has yet to be spent. The House debt-limit bill proposes to claw back $30 billion—or some 8% of the unspent balance. Only in Mr. Biden’s White House and Mr. Schumer’s Senate Democratic Caucus could such a modest proposal be considered extreme.

…The most recent CBO estimate projects that fiscal 2024 discretionary spending will clock in at $1.864 trillion—a 10% real increase from the pre-pandemic estimate. …This growth in nondefense discretionary spending is the post-pandemic bow wave that Mr. McCarthy’s debt-limit plan seeks to mitigate. Even if the House GOP’s proposed reductions in discretionary-spending growth took effect, total discretionary spending would still be 2.4% more in inflation-adjusted dollars than the CBO’s 2020 projection for fiscal 2024. …A clean debt-ceiling hike would give us more government spending, and the House GOP’s proposal would allow more private spending. Only in Washington is that a hard choice.

Needless to say, I disagree with both sides. There should be deep and genuine cuts in domestic discretionary spending.

But a slower increase is better than a faster increase. And I reckon any support for fiscal restraint by Republicans is welcome after the reckless profligacy of the Trump years.

The bottom line is that fights over the debt limit are messy, but if we actually got some good policy reforms, such battles could save us from something very bad in the future.

The best way to destroy the welfare trap is to put in Milton Friedman’s negative income tax.

A Picture of How Redistribution Programs Trap the Less Fortunate in Lives of Dependency

I wrote last year about the way in which welfare programs lead to very high implicit marginal tax rates on low-income people. More specifically, they lose handouts when they earn income. As such, it is not very advantageous for them to climb the economic ladder because hard work is comparatively unrewarding.

Thanks to the American Enterprise Institute, we now have a much more detailed picture showing the impact of redistribution programs on the incentive to earn more money.

It’s not a perfect analogy since people presumably prefer cash to in-kind handouts, but the vertical bars basically represent living standards for any given level of income that is earned (on the horizontal axis).

Needless to say, there’s not much reason to earn more income when living standards don’t improve. May as well stay home and good off rather than work hard and produce.

This is why income redistribution is so destructive, not just to taxpayers, but also to the people who get trapped into dependency. Which is exactly the point made in this video.

P.S. Most of you know that I’m not a fan of the Organization for Economic Cooperation and Development because the Paris-based bureaucracy has such statist impulses. But even the OECD has written about the negative impact of overly generous welfare programs on incentives for productive behavior.

Related posts:

Open letter to President Obama (Part 117B)

Milton Friedman’s Free to Choose – Ep.4 (1/7) – From Cradle to Grave President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for […]

Milton Friedman remembered at 100 years from his birth (Part 5)

Testing Milton Friedman – Preview Uploaded by FreeToChooseNetwork on Feb 21, 2012 2012 is the 100th anniversary of Milton Friedman’s birth. His work and ideas continue to make the world a better place. As part of Milton Friedman’s Century, a revival of the ideas featured in the landmark television series Free To Choose are being […]

40% of USA on government dole, need to eliminate welfare and put in Friedman’s negative income tax

Eight Reasons Why Big Government Hurts Economic Growth We got to cut these welfare programs before everyone stops working and wants to get the free stuff. The Bible says if you don’t work then you should not eat. It also says that churches should help the poor but it doesn’t say that the government should […]

Free or equal? 30 years after Milton Friedman’s Free to Choose (Part 2)

Johan Norberg – Free or Equal – Free to Choose 30 years later 2/5 Published on Jun 10, 2012 by BasicEconomics In 1980 economist and Nobel laureate Milton Friedman inspired market reform in the West and revolutions in the East with his celebrated television series “Free To Choose.” Thirty years later, in this one-hour documentary, […]

Milton Friedman remembered at 100 years from his birth (Part 4)

I ran across this very interesting article about Milton Friedman from 2002: Friedman: Market offers poor better learningBy Tamara Henry, USA TODAY By Doug Mills, AP President Bush honors influential economist Milton Friedman for his 90th birthday earlier this month. About an economist Name:Milton FriedmanAge: 90Background: Winner of the 1976 Nobel Prize for economic science; […]

Transcript and video of Milton Friedman on Bill Clinton and Ronald Reagan (Part 2)

Below is a discussion from Milton Friedman on Bill Clinton and Ronald Reagan. February 10, 1999 | Recorded on February 10, 1999 audio, video, and blogs » uncommon knowledge PRESIDENTIAL REPORT CARD: Milton Friedman on the State of the Union with guest Milton Friedman Milton Friedman, Senior Research Fellow, Hoover Institution and Nobel Laureate in […]

If converted to cash and simply given to the recipients welfare check would be $44,000 per family of four

Milton Friedman came up with the idea of eliminating all welfare programs and putting in a negative income tax that would eliminate the welfare trap. However, our federal government just doesn’t listen to reason. Obama Ends Welfare Reform as We Know It, Calls for $12.7 Trillion in New Welfare Spending Robert Rector July 17, 2012 […]

Milton Friedman explains negative income tax to William F. Buckley in 1968

December 06, 2011 03:54 PM Milton Friedman Explains The Negative Income Tax – 1968 0 comments By Gordonskene enlarge Milton Friedman and friends.DOWNLOADS: 36 PLAYS: 35 Embed The age-old question of Taxes. In the early 1960′s Economist Milton Friedman adopted an idea hatched in England in the 1950′s regarding a Negative Income Tax, to […]

Listing of transcripts and videos of “Free to Choose” episode 4 – From Cradle to Grave on www.theDailyHatch.org

In the last few years the number of people receiving Food Stamps has skyrocketed. President Obama has not cut any federal welfare programs but has increased them, and he has used class warfare over and over the last few months and according to him equality at the finish line is the equality that we should […]

Milton Friedman remembered at 100 years from his birth (Part 2)

Testing Milton Friedman – Preview Uploaded by FreeToChooseNetwork on Feb 21, 2012 2012 is the 100th anniversary of Milton Friedman’s birth. His work and ideas continue to make the world a better place. As part of Milton Friedman’s Century, a revival of the ideas featured in the landmark television series Free To Choose are being […]