—

A Practical Reason to Oppose Wealth Taxation

As an economist, I strongly oppose the wealth tax (as well as other forms of double taxation) because it’s foolish to impose additional layers of tax that penalize saving and investment.

Especially since there’s such a strong relationship between investment and worker compensation.

Especially since there’s such a strong relationship between investment and worker compensation.

The politicians may tell us they’re going to “soak the rich,” but the rest of us wind up getting wet.

That being said, there are also administrative reasons why wealth taxation is a fool’s game. One of them, which I mentioned as part of a recent tax debate, is the immense headache of trying to measure wealth every single year.

Yes, that’s not difficult if someone has assets such as stock in General Motors or Amazon. Bureaucrats from the IRS can simply go to a financial website and check the value for any given day.

But the value of many assets is very subjective (patents, royalties, art, heirlooms, etc), and that will create a never-ending source of conflict between taxpayers and the IRS if that awful levy is ever imposed.

Let’s look at a recent dispute involving another form of destructive double taxation. The New York Times has an interesting story about a costly dispute involving the death tax to be imposed on Michael Jackson’s family.

Michael Jackson died in 2009… But there was another matter that has taken more than seven years to litigate: Jackson’s tax bill with the Internal Revenue Service, in which the government and the estate held vastly different views about what Jackson’s name and likeness were worth when he died.

The I.R.S. thought they were worth $161 million. …Judge Mark V. Holmes of United States Tax Court ruled that Jackson’s name and likeness were worth $4.2 million, rejecting many of the I.R.S.’s arguments. The decision will significantly lower the estate’s tax burden… In a statement, John Branca and John McClain, co-executors of the Jackson estate, called the decision “a huge, unambiguous victory for Michael Jackson’s children.”

I’m glad the kids won this battle.

Michael Jackson paid tax when he first earned his money. Those earnings shouldn’t be taxed again simply because he died.

But the point I want to focus on today is that a wealth tax would require these kinds of fights every single year.

Given all the lawyers and accountants this will require, that goes well beyond adding insult to injury. Lots of time and money will need to be spent in order to (hopefully) protect households from a confiscatory tax that should never exist.

P.S. The potential administrative nightmare of wealth taxation, along with Biden’s proposal to tax unrealized capital gains at death, help to explain why the White House is proposing to turbo-charge the IRS’s budget with an additional $80 billion.

Five Visuals that Explain Why Higher Corporate Income Tax Rates Are Bad for America

I have a four-part series (here, here, here, and here) about the conceptual downsides of Joe Biden’s class-warfare approach to tax policy.

Now it’s time to focus on the component parts of his agenda. Today’s column will review his plan for a big increase in the corporate tax rate. But since I’ve written about corporate tax rates over and over and over again, we’re going to approach this issue is a new way.

I’m going to share five visuals that (hopefully) make a compelling case why higher tax rates on companies would be a big mistake.

Visual #1

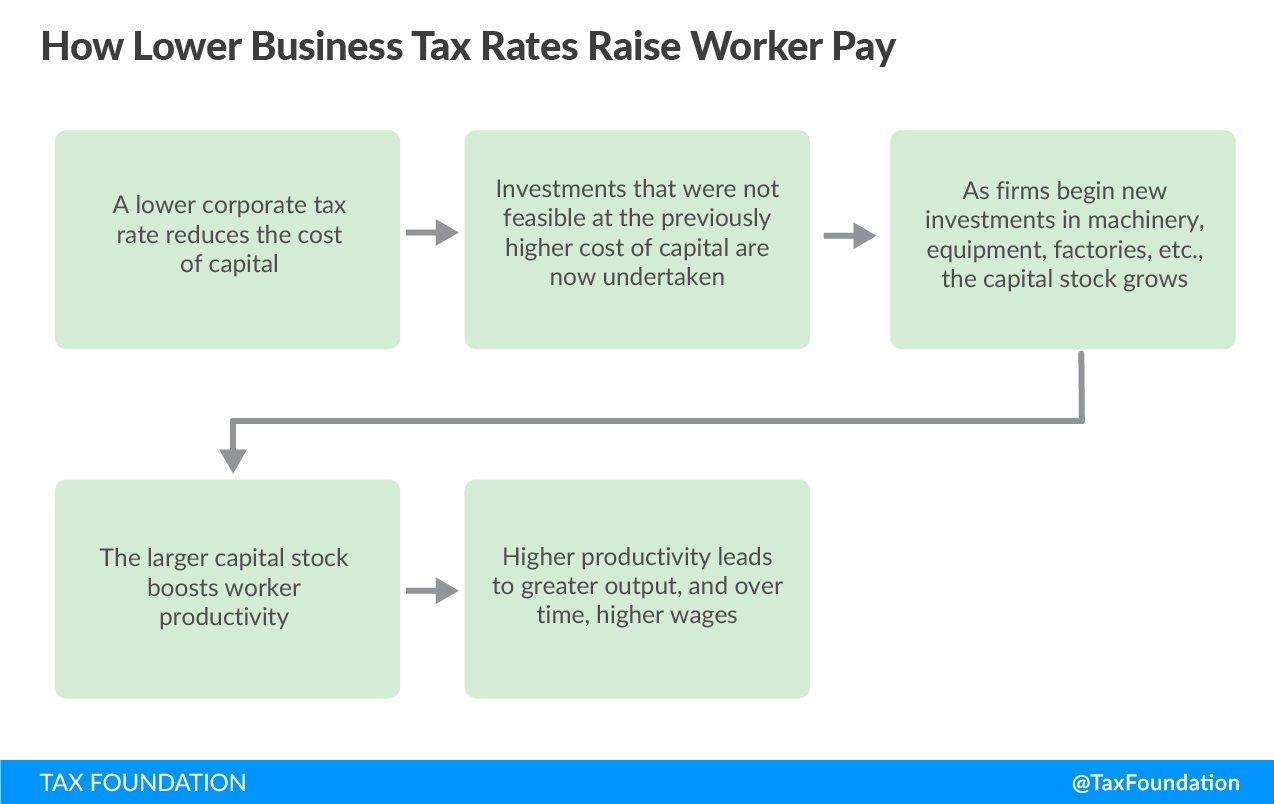

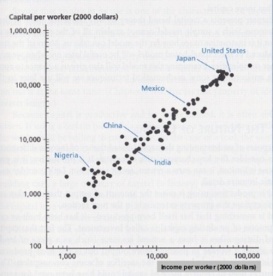

One thing every student should learn from an introductory economics class is that corporations don’t actually pay tax. Instead, businesses collect taxes that are actually borne by workers, consumers, and investors.

There’s lots of debate in the profession, of course, about which group bears what share of the tax. But there’s universal agreement that higher taxes lead to less investment, which leads to less productivity, which leads to lower pay.

Here’s a depiction of the relationship of corporate taxes and worker pay.

asdf

Visual #2

The previous image explains the theory. Now it’s time for some evidence.

Here’s a look at how much faster wages have grown in countries with low corporate tax rates compared to nations with high corporate tax rates.

Biden, for reasons beyond my comprehension, wants America on the red line.

And his staff economists apparently don’t understand (or don’t care about) the link between investment and wages.

Visual #3

Here’s some more evidence.

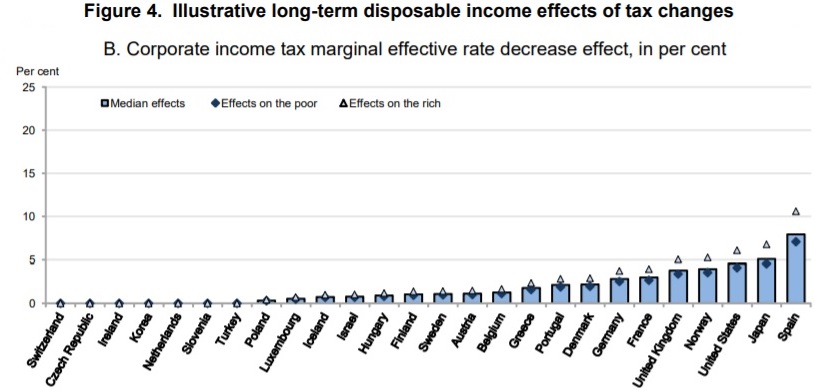

And it comes from an unexpected source, the pro-tax Organization for Economic Cooperation and Development(OECD).

Even economists at that Paris-based bureaucracy have produced studies confirming that lower tax rates lead to higher disposable income for people.

Needless to say, if lower tax rates lead to more disposable income, then higher tax rates will lead to less disposable income.

We should have learned during the Obama years that ordinary people pay the price when politicians practice class warfare.

Visual #4

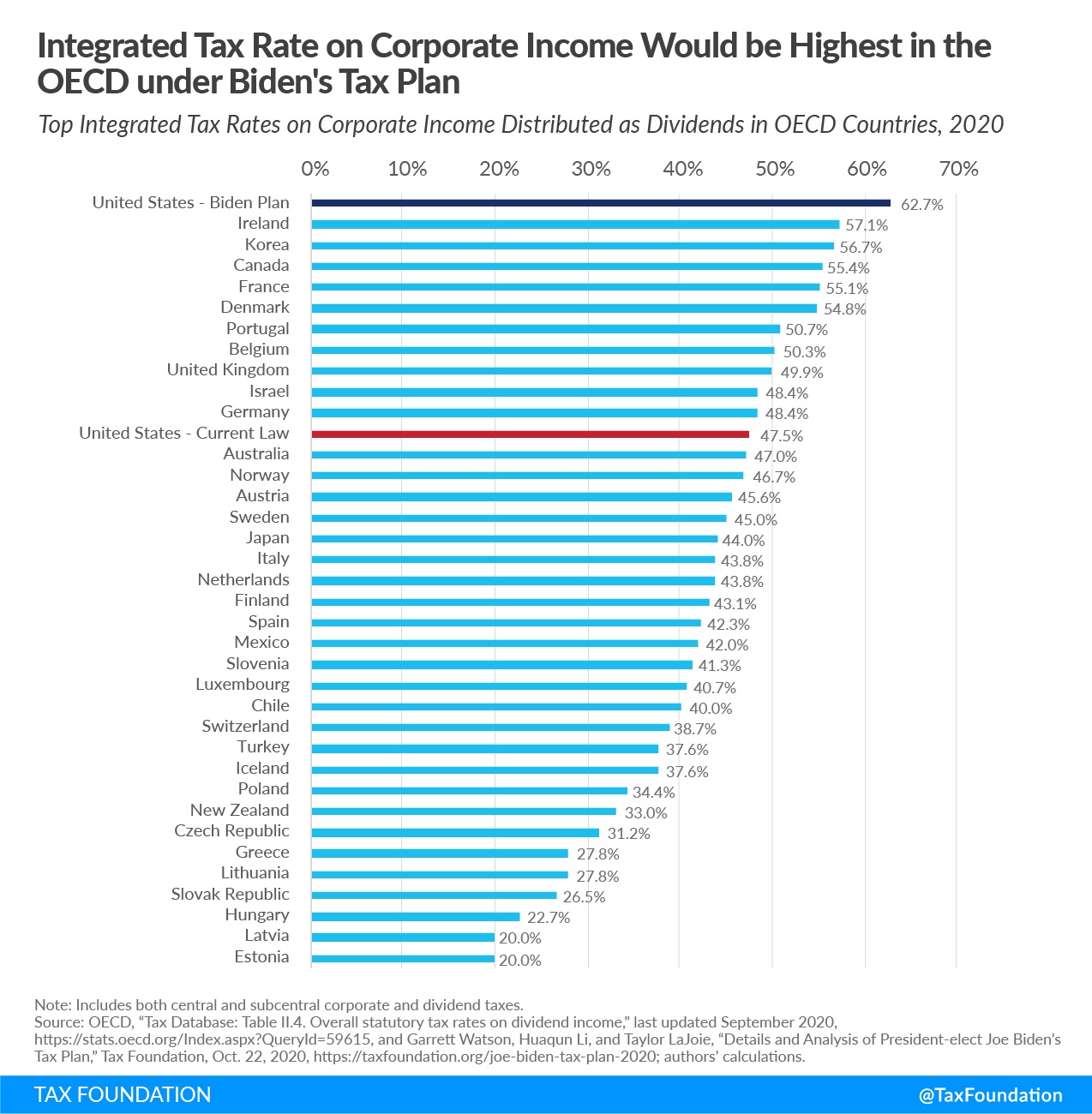

It’s very bad news that Biden wants a big increase in the corporate tax rate, but let’s not forget that the IRS double-taxes corporate income (i.e., that same income is subject to a second layer of tax when shareholders receive dividends).

The combined effect, as shown in this visual, is that the United States will have the dubious honor of having the highest effective corporate tax rate in the entire developed world.

Call me crazy, but I don’t think that’s a recipe for jobs and investment in America.

Visual #5

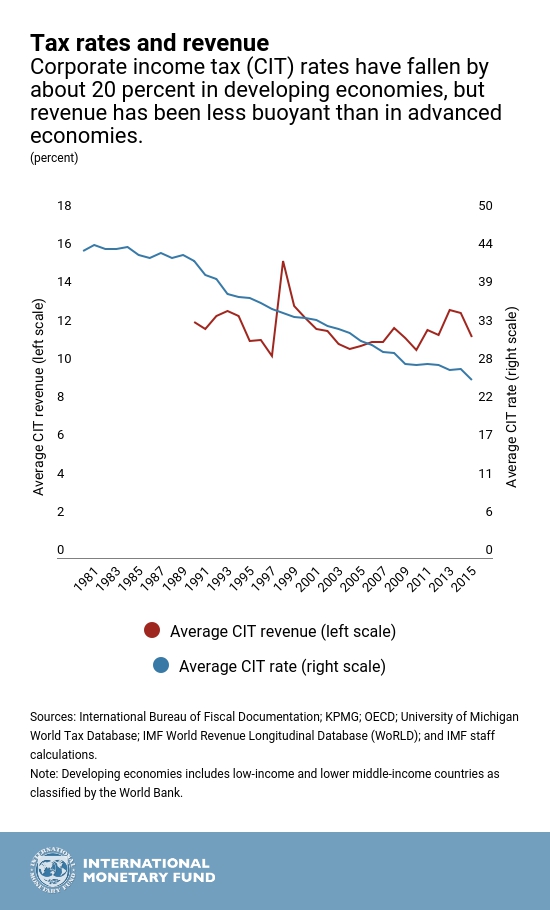

The economic damage of higher corporate tax rates means that there is less taxable income (i.e., we need to remember the Laffer Curve).

Will the damage be so extensive, causing taxable income to fall so much, that the IRS collects less revenue with a higher tax rate?

We’ll learn the answer to that question over time, but we have some very strong evidence from the IMF that lower corporate tax rates don’t lead to less revenue. As you can see from this chart, revenues held steady as tax rates plummeted over the past few decades.

In other words, lower rates led to enough additional economic activity that governments have collected just as much money with lower tax rates. But now Biden wants to run this experiment in reverse.

It’s possible the government will collect more revenue, of course, but only at a very high cost to workers, consumers, and shareholders.

By the way, there’s OECD data showing the exact same thing.

Those pictures probably tell you everything you need to know about this issue.

But let’s add some more analysis. The Wall Street Journal opined today on Biden’s class-warfare agenda. Here are some of the key passages from the editorial.

The bill for President Biden’s agenda is coming due, starting with Wednesday’s proposal for the largest corporate tax increase in decades. …Mr. Biden’s corporate increase amounts to the restoration of the Obama-era corporate tax burden, only much more so. …Mr. Biden wants to raise the corporate rate back up to 28%, but that’s the least of his proposals. He also wants to add penalties that would make inversions punitive, and he’d impose a global minimum corporate tax of 21%.

This would shoot the tax burden on U.S. companies back toward the top of the developed world list. …The larger Biden goal is to end global tax competition… “The United States can lead the world to end the race to the bottom on corporate tax rates,” says the White House fact sheet. Mr. Biden says he wants “other countries to adopt strong minimum taxes on corporations” so nations like Ireland can no longer compete for capital with lower tax rates. This has long been the dream of the French and Germans, working through the Organization for Economic Cooperation and Development. …All of this is in addition to the looming Biden tax increases on dividends, capital gains and other investment income. …Mr. Biden’s corporate tax increases will hit the middle class hard—in the value of their 401(k)s, the size of their pay packets, and what they pay for goods and services.

Amen.

Let’s conclude with some gallows humor.

This meme shows how some of our leftist friends will celebrate if the tax increase is imposed.

P.S. Here’s a depressing final observation. Decades of experience have led me to conclude that many folks on the left support class-warfare tax policy because they are primarily motivated by a spiteful desire to punish success rather than provide upward mobility for the poor.

Free-market economics meets free-market policies at The Heritage Foundation’s Tenth Anniversary dinner in 1983. Nobel Laureate Milton Friedman and his wife Rose with President Ronald Reagan and Heritage President Ed Feulner.

Since the passing of Milton Friedman who was my favorite economist, I have been reading the works of Daniel Mitchell and he quotes Milton Friedman a lot, and you can reach Dan’s website here.

Mitchell’s career as an economist began in the United States Senate, working for Oregon Senator Bob Packwood and the Senate Finance Committee. He also served on the transition team of President-Elect Bush and Vice President-Elect Quayle in 1988. In 1990, he began work at the Heritage Foundation. At Heritage, Mitchell worked on tax policy issues and began advocating for income tax reform.[1]

In 2007, Mitchell left the Heritage Foundation, and joined the Cato Institute as a Senior Fellow. Mitchell continues to work in tax policy, and deals with issues such as the flat tax and international tax competition.[2]

In addition to his Cato Institute responsibilities, Mitchell co-founded the Center for Freedom and Prosperity, an organization formed to protect international tax competition.[1]

January 27, 2021

President Biden, c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500

Dear Mr. President,

The federal government debt is growing so much that it is endangering us because if things keep going like they are now we will not have any money left for the national defense because we are so far in debt as a nation. We have been spending so much on our welfare state through food stamps and other programs that I am worrying that many of our citizens are becoming more dependent on government and in many cases they are losing their incentive to work hard because of the welfare trap the government has put in place. Other nations in Europe have gone down this road and we see what mess this has gotten them in. People really are losing their faith in big government and they want more liberty back. It seems to me we have to get back to the founding principles that made our country great. We also need to realize that a big government will encourage waste and corruption. The recent scandals in our government have proved my point. In fact, the jokes you made at Ohio State about possibly auditing them are not so funny now that reality shows how the IRS was acting more like a monster out of control. Also raising taxes on the job creators is a very bad idea too. The Laffer Curve clearly demonstrates that when the tax rates are raised many individuals will move their investments to places where they will not get taxed as much.

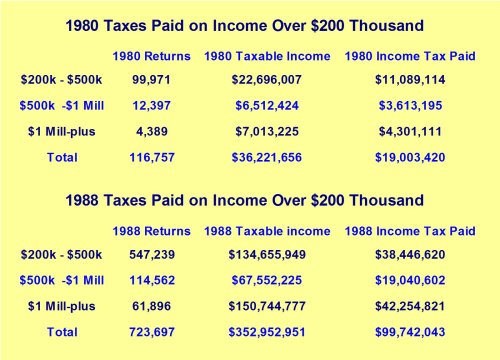

What did we learn from the Laffer Curve in the 1980’s? Lowering top tax rate from 70% to 28% from 1980 to 1988 and those earning over $200,000 paid 99 billion in taxes instead of 19 billion!!!!

A Lesson on the Laffer Curve for Barack Obama

November 6, 2011 by Dan Mitchell

_____________

Thank you so much for your time. I know how valuable it is. I also appreciate the fine family that you have and your commitment as a father and a husband.

Sincerely,

Everette Hatcher III, 13900 Cottontail Lane, Alexander, AR 72002, ph 501-920-5733,

Related posts:

“The Power of the Market” episode of Free to Choose in 1990 by Milton Friedman (Part 5)

Milton Friedman The Power of the Market 5-5 How can we have personal freedom without economic freedom? That is why I don’t understand why socialists who value individual freedoms want to take away our economic freedoms. I wanted to share this info below with you from Milton Friedman who has influenced me greatly over the […]

“The Power of the Market” episode of Free to Choose in 1990 by Milton Friedman (Part 4)

Milton Friedman The Power of the Market 4-5 How can we have personal freedom without economic freedom? That is why I don’t understand why socialists who value individual freedoms want to take away our economic freedoms. I wanted to share this info below with you from Milton Friedman who has influenced me greatly over the […]

“The Power of the Market” episode of Free to Choose in 1990 by Milton Friedman (Part 3)

Milton Friedman The Power of the Market 3-5 How can we have personal freedom without economic freedom? That is why I don’t understand why socialists who value individual freedoms want to take away our economic freedoms. I wanted to share this info below with you from Milton Friedman who has influenced me greatly over the […]

“The Power of the Market” episode of Free to Choose in 1990 by Milton Friedman (Part 2)

Milton Friedman The Power of the Market 2-5 How can we have personal freedom without economic freedom? That is why I don’t understand why socialists who value individual freedoms want to take away our economic freedoms. I wanted to share this info below with you from Milton Friedman who has influenced me greatly over the […]

“The Power of the Market” episode of Free to Choose in 1990 by Milton Friedman (Part 1)

Milton Friedman The Power of the Market 1-5 How can we have personal freedom without economic freedom? That is why I don’t understand why socialists who value individual freedoms want to take away our economic freedoms. I wanted to share this info below with you from Milton Friedman who has influenced me greatly over the […]

Open letter to President Obama (Part 296) (Laffer curve strikes again!!)

President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here. The way […]

Open letter to President Obama (Part 282, How the Laffer Curve worked in the 20th century over and over again!!!)

Dan Mitchell does a great job explaining the Laffer Curve President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a […]

Laffer curve hits tax hikers pretty hard (includes cartoon)

I have put up lots of cartoons from Dan Mitchell’s blog before and they have got lots of hits before. Many of them have dealt with the economy, eternal unemployment benefits, socialism, Greece, welfare state or on gun control. Today’s cartoon deals with the Laffer curve. Revenge of the Laffer Curve…Again and Again and Again March 27, 2013 […]

Portugal and the Laffer Curve

Class Warfare just don’t pay it seems. Why can’t we learn from other countries’ mistakes? Class Warfare Tax Policy Causes Portugal to Crash on the Laffer Curve, but Will Obama Learn from this Mistake? December 31, 2012 by Dan Mitchell Back in mid-2010, I wrote that Portugal was going to exacerbate its fiscal problems by raising […]

President Obama ignores warnings about Laffer Curve

The Laffer Curve – Explained Uploaded by Eddie Stannard on Nov 14, 2011 This video explains the relationship between tax rates, taxable income, and tax revenue. The key lesson is that the Laffer Curve is not an all-or-nothing proposition, where we have to choose between the exaggerated claim that “all tax cuts pay for themselves” […]

Harding,Kennedy and Reagan proved that the Laffer Curve works

I enjoyed this article below because it demonstrates that the Laffer Curve has been working for almost 100 years now when it is put to the test in the USA. I actually got to hear Arthur Laffer speak in person in 1981 and he told us in advance what was going to happen the 1980′s […]

The Laffer Curve Wreaks Havoc in the United Kingdom

I got to hear Arthur Laffer speak back in 1981 and he predicted what would happen in the next few years with the Reagan tax cuts and he was right with every prediction. The Laffer Curve Wreaks Havoc in the United Kingdom July 1, 2012 by Dan Mitchell Back in 2010, I excoriated the new […]

Liberals act like the Laffer Curve does not exist.

Raising taxes will not work. Liberals act like the Laffer Curve does not exist. The Laffer Curve Shows that Tax Increases Are a Very Bad Idea – even if They Generate More Tax Revenue April 10, 2012 by Dan Mitchell The Laffer Curve is a graphical representation of the relationship between tax rates, tax revenue, and […]

Open letter to President Obama (Part 328)

(This letter was emailed to White House on 11-21-11.) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse […]

Two Lessons from Coolidge: Small government is the best way to achieve competent and effective government and Higher tax rates don’t automatically lead to more tax revenue

Will Rogers has a great quote that I love. He noted, “Lord, the money we do spend on Government and it’s not one bit better than the government we got for one-third the money twenty years ago”(Paula McSpadden Love, The Will Rogers Book, (1972) p. 20.) Dan Mitchell praises Calvin Coolidge for keeping the federal government small. […]

Posted in Cato Institute, Economist Dan Mitchell, spending out of control, Taxes Edit