Milton Friedman’s negative income tax explained by Friedman in 1968:

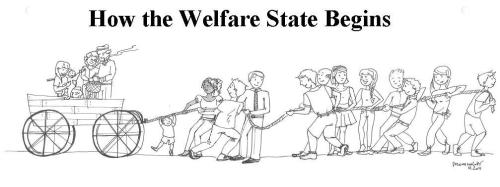

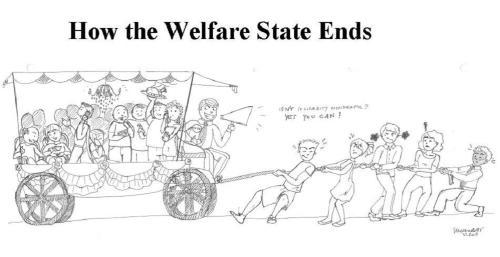

We need to cut back on the Food Stamp program and not try to increase it. What really upsets me is that when the government gets involved in welfare there is a welfare trap created for those who become dependent on the program. Once they go out and get a job then they are stripped away from the welfare program and that encourages them to avoid working and sit on the couch. (Milton Friedman’s negative income tax is a good solution.)

Now we have the government running ads trying to get people to join this type of lifestyle. I think it is the most cruel thing you can do to a struggling poor person. Working is the only way a person can climb up the ladder and falling in the welfare trap hurts the poor’s chance of succeeding in the future.

Obama’s Using Our Tax Dollars to Leverage More Food Stamp Dependency

June 26, 2012 by Dan Mitchell

In past posts, I’ve groused about food stamp abuse, including people using them to buy luxury coffee at Starbucks and to purchase steaks and lobster. I’ve complained about college kids scamming the program, the “Octo-Mom” mooching off the program, and the Obama Administration rewarding states that sign up more food stamp recipients.

Well, the Obama White House is doubling down on creating more dependency, spending tax dollars to increase the number of people on food stamps.

Here are some of disturbing details from a CNN report.

More than one in seven Americans are on food stamps, but the federal government wants even more people to sign up for the safety net program. The U.S. Department of Agriculture has been running radio ads for the past four months encouraging those eligible to enroll. …The department is spending between $2.5 million and $3 million on paid spots, and free public service announcements are also airing. The campaign can be heard in California, Texas, North Carolina, South Carolina, Ohio, and the New York metro area. …President Bush launched a recruitment campaign, which pushed average participation up by 63% during his eight years in office. The USDA began airing paid radio spots in 2004. President Obama’s stimulus act made it easier for childless, jobless adults to qualify for the program and increased the monthly benefit by about 15% through 2013.

Last year, I semi-defended Newt Gingrich when he was attacked for calling Obama the “Food Stamp” President.  Citing this chart, I wrote that, “It certainly looks like America is becoming a food stamp nation.”

Citing this chart, I wrote that, “It certainly looks like America is becoming a food stamp nation.”

But my bigger point is that welfare is bad for both taxpayers and the people who get trapped into relying on big government.

The ideal approach, as explained in this video, is to get the federal government out of the business of redistributing income. We are far more likely to get better results if we let states experiment with different approaches.

House Republicans, to their credit, already want to do this with Medicaid. So why not block grant all social welfare programs?

The icing on the cake is that no longer would the federal government be running ads to lure people into dependency.

Related posts:

We can no longer afford the welfare state (Part 7)

Ep. 4 – From Cradle to Grave [7/7]. Milton Friedman’s Free to Choose (1980) With the national debt increasing faster than ever we must make the hard decisions to balance the budget now. If we wait another decade to balance the budget then we will surely risk our economic collapse. The first step is to […]

We can no longer afford the welfare state (Part 6)

Ep. 4 – From Cradle to Grave [6/7]. Milton Friedman’s Free to Choose (1980) With the national debt increasing faster than ever we must make the hard decisions to balance the budget now. If we wait another decade to balance the budget then we will surely risk our economic collapse. The first step is to […]

We can no longer afford the welfare state (Part 5)

Ep. 4 – From Cradle to Grave [5/7]. Milton Friedman’s Free to Choose (1980) With the national debt increasing faster than ever we must make the hard decisions to balance the budget now. If we wait another decade to balance the budget then we will surely risk our economic collapse. The first step is to […]

We can no longer afford the welfare state (Part 4)

Ep. 4 – From Cradle to Grave [4/7]. Milton Friedman’s Free to Choose (1980) With the national debt increasing faster than ever we must make the hard decisions to balance the budget now. If we wait another decade to balance the budget then we will surely risk our economic collapse. The first step is to […]

We can no longer afford the welfare state (Part 3)

Ep. 4 – From Cradle to Grave [3/7]. Milton Friedman’s Free to Choose (1980) With the national debt increasing faster than ever we must make the hard decisions to balance the budget now. If we wait another decade to balance the budget then we will surely risk our economic collapse. The first step is to […]

We can no longer afford the welfare state (Part 2)

With the national debt increasing faster than ever we must make the hard decisions to balance the budget now. If we wait another decade to balance the budget then we will surely risk our economic collapse. The first step is to remove all welfare programs and replace them with the negative income tax program that […]

We can no longer afford the welfare state (Part 1)

Milton Friedman – The Negative Income Tax Published on May 11, 2012 by LibertyPen In this 1968 interview, Milton Friedman explained the negative income tax, a proposal that at minimum would save taxpayers the 72 percent of our current welfare budget spent on administration. http://www.LibertyPen.com Source: Firing Line with William F Buckley Jr. ________________ Milton […]

“I hate pretending to be a fiscal conservative”

“I hate pretending to be a fiscal conservative”