–

Least Surprising Headline of All Time

Government spending, almost by definition, is wasteful. But it’s worth distinguishing between two types of waste.

- Money that is spent properly but inefficiently.

- Money that is diverted by crooks and scammers.

Today, we’re going to focus on the second type of waste.

I’ve previously written about widespread fraud affecting programs such as Medicare, Medicaid, food stamps, welfare, disability, and the earned income credit.

Now let’s augment our previous analysis exposing how coronavirus-related spending has been a windfall for criminals.

We’ll start with a report from the Washington Post , authored by Tony Romm and Yeganeh Torbati. It contains a headline that begins with a quote that could apply to just about anything the government does.

Testifying at a little-noticed congressional hearing this spring, a top watchdog for the Labor Department estimated there could have been “at least” $163 billion in unemployment-related “overpayments,”

a projection that includes wrongly paid sums as well as “significant” benefits obtained by malicious actors. …In many cases, the criminals stole the unemployment funds using real Americans’ personal information. They bombarded states with applications filed in the names of actual workers or people in prison — sometimes to such a degree that, in the case of Maryland, fraudulent claims came to outnumber real requests for help..

You won’t be surprised to learn that some bureaucrats did not want to stop the fraud.

Some of the malicious actors potentially even avoided detection, at least for a time, after the Labor Department refused to supply information needed to assist federal fraud investigations.

And you also won’t be surprised to learn that some states allowed far more fraud than other states.

In California, state officials acknowledged in October 2021 that they may have paid out more than $20 billion in undeserved unemployment payments to criminals. That included at least $810 million that had been wrongly paid to applicants whose information matched the names of people in prison.

The Wall Street Journal also opined on the topic of wasteful covid-related spending, but its editorial focused on the $1.9 trillion boondoggle that was pushed through by Biden.

…what happened to the $1.9 trillion for Covid Democrats passed last March? Most went to transfer payments, including child tax credits, enhanced unemployment benefits

and stimulus checks. About a quarter subsidized state and local budgets and schools. Democrats appropriated a mere $80 billion for public health, only $16 billion of which was available for vaccines and therapies. …Democrats skimped on vaccine and therapies in order to ladle benefits to their political constituencies.

The bottom line is that Biden used the pandemic as an excuse to squander $1.9 trillion, even though at most only $80 billion of the money was for anything that was even vaguely related to vaccines and treatments.

From an economic perspective, that legislation was a spectacular failure.

I wonder whether we’ll ever learn how much of the remaining $1.82 trillion was wasted?

I’m guessing the answer is $1.82 trillion, but we won’t know how much was lost to run-of-the-mill waste and how much was lost to outright fraud.

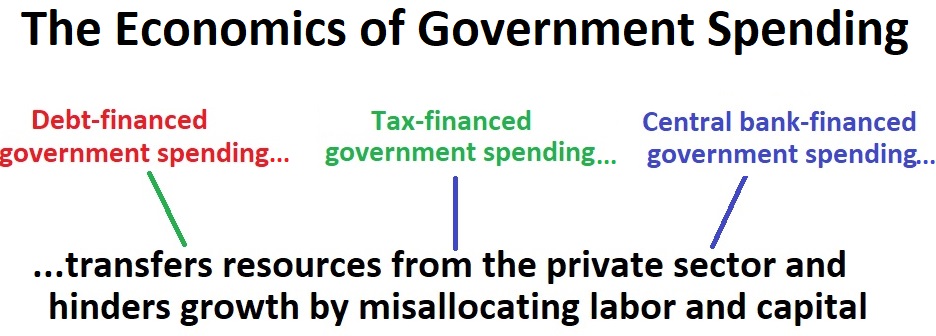

P.S. Don’t forget that all government spending, even the small fraction that is spent wisely and efficiently, imposes economic costs. For more information, click here, here, here, here, here, and here.

—-

MILTON FRIEDMAN ON SPENDING

I identified four heroes from the “Battle of Ideas” video I shared in late August – Friedrich Hayek, Milton Friedman, Ronald Reagan, and Margaret Thatcher. Here’s one of those heroes, Milton Friedman, explaining what’s needed to control big government.

Friedman Fundamentals: How To Control Big Government

For all intents and purposes, Friedman is pointing out that there’s a “public choice” incentive for government to expand.

To counteract that disturbing trend, he explains that we need a high level of “societal capital.” In other words, we need a self-reliant and ethical populace – i.e., people who realize it’s wrong to use the coercive power of government to take from others.

Sadly, I don’t think that’s an accurate description of today’s United States.

So how, then, can we get control of government?

Since politicians are unlikely to control spending in the short run (their time horizon is always the next election), our best hope is to get them to agree to a rule that constrains what can happen in the future.

I’ve repeatedly argued in favor of a spending cap. Such a policy has a proven track record, and is far more effective than a balanced budget requirement.

I’ve repeatedly argued in favor of a spending cap. Such a policy has a proven track record, and is far more effective than a balanced budget requirement.

That’s what should happen.

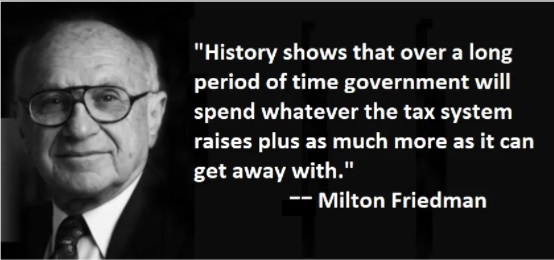

Now let’s focus on what shouldn’t happen. As Milton Friedman famously observed in 2001, tax increases are never the solution because politicians will simply spend any additional revenue (and the tax increases also will hurt the economy and cause Laffer-Curve feedback effects).

P.S. You can enjoy more wisdom from Friedman on issues such as the role of the firm, spending other people’s money, and so-called Robber Barons.

P.P.S. On the issue of spending other people’s money, here’s an example of Jay Leno channeling Friedman.

ECB and IMF Studies Show Spending Caps Are the Ideal Fiscal Rule

Back in 2017, the Center for Freedom and Prosperity released this video to help explain why spending caps are the most sensible and sustainable fiscal rule.

Switzerland actually has a spending cap in its constitution, and similar fiscal rules also exist in Hong Kong and the state of Colorado.

These policies have produced very good results.

There are many reasons to support a spending cap, including the obvious observation that an expenditure limit (as it is sometimes called) directly addresses the actual problem of excessive government.

And addressing the underlying disease works better than rules that focus on symptoms, such as balanced budget requirements or anti-deficit mandates.

You’ll notice toward the end of the video that the narrator cites pro-spending cap research from international bureaucracies, which is remarkable since those institutions normally have a biasfor bigger government.

I’ve also written about that research, citing studies by the International Monetary Fund (here and here), the Organization for Economic Cooperation and Development (here and here) and the European Central Bank (here).

Today, let’s look at more evidence from these bureaucracies.

We’ll start with a new study from the European Central Bank. Here’s some of what the authors (Nicholai Benalal, Maximilian Freier, Wim Melyn, Stefan Van Parys, and Lukas Reiss) found when comparing spending limits and anti-deficit rules.

…this paper provides an in-depth assessment of two alternative measures of fiscal consolidation and expansion: the change in the structural balance (dSB) and the expenditure benchmark (EB). Both the dSB and the EB are currently used to assess compliance with the fiscal rules under the Stability and Growth Pact (SGP).

…The EB was introduced as an indicator in 2011, and has gained in importance relative to the dSB since the European Commission began to put more emphasis on it in 2016. …A comparison of the fiscal performance of euro area countries reveals significant differences depending on whether the assessment is based on the dSB or the EB. …this paper finds that the EB has advantages over the dSB as a fiscal performance indicator. …expenditure rules…provide more predictability in fiscal requirements. …Even more importantly, the EB can be shown to be less procyclical as a fiscal rule than the dSB.

Let’s also review some 2019 research from the International Monetary Fund.

This study (authored by Kodjovi Eklou and Marcelin Joanis) looks at whether fiscal rules can constrain vote-buying politicians.

In order to increase their chances of reelection, politicians are known to undertake fiscal manipulations, especially in election years. These fiscal manipulations typically take the form of increased public expenditure…

Many countries, both developed and developing, have adopted fiscal rules in recent decades as an attempt to enforce fiscal discipline. …In this paper, we employ a cross-country panel dataset in order to test whether fiscal rules adopted in developing countries have been effective in constraining political budget cycles. The dataset covers 67 developing countries over the period 1985-2007. …Our dependent variable is the general government’s final consumption expenditure as a share of GDP.

Here’s what the authors concluded about the effectiveness of spending caps.

Our empirical evidence in a sample of 67 developing countries over the period 1985-2007, shows that fiscal rules cause fiscal discipline over the electoral cycle. More specifically, in election years with fiscal rules in place, public consumption is reduced by 1.65% point of GDP as compared to election years without these rules. Furthermore, the effectiveness of these rules depends on their type… In particular, expenditure rules, rules covering the general government and rules characterized by a monitoring body outside the government dampen political budget cycles in government consumption.

Indeed, footnote 12 of the paper specifically notes the superiority of expenditure limits.

…the results show that public consumption is reduced by 2.44% points during election years with expenditure rules in place. The findings on expenditure rules are consistent with Cordes et al. (2015) who show that the compliance rate for these rules are high.

Last but not least, the fiscal experts at the Office of Management and Budget included in Trump’s final budget some very encouraging language at the end of Chapter 10 of the Analytical Perspectives.

…additional efforts to control spending are needed. Several budget process reforms should be considered, including setting spending caps… Outlay caps that are consistent with the historical average as a share of gross domestic product (GDP),

post-World War II levels could be enforced with sequestration across programs similar to other budget enforcement regimes. An outlay cap on mandatory spending would complement discretionary caps, which have been in place since 2013. The Budget proposes to continue discretionary caps through 2025 at declining levels and declining levels through 2030.

Trump was a big spender, of course, but at least there were people in his administration who realized there was a problem.

And they recognized the right solution.

P.S. It’s also interesting that the authors of the IMF study found that fiscal rules work better in democracies.

…estimates focusing on the subsample of democratic elections. The effect of fiscal rules on the political budget cycle is larger… More specifically, public consumption is reduced by 2.46% point of GDP (while it is 1.65% point in the baseline).

This may not bode well for the durability of Hong Kong’s spending cap.

The authors also found that foreign aid makes it less likely that a government will follow sensible policy.

Foreign aid, which relaxes the budget constraint of the government, is negatively correlated with the probability of having fiscal rules.

Needless to say, nobody should be surprised to learn that foreign aid undermines good policy.

Yes, Starve the Beast

As part of a recent discussion with Gene Tunny in Australia, I explained why I support “Starve the Beast,” which means keeping taxes as low as possible to help achieve the goal of spending restraint.

The premise of Starve the Beast is very simple.

Politicians like to spend money and they don’t particularly care whether that spending is financed by taxes or financed by borrowing (both bad options).

As Milton Friedman sagely observed, that means they will spend every penny they collect in taxes plus as much additional spending financed by borrowing that the political system will allow.

As Milton Friedman sagely observed, that means they will spend every penny they collect in taxes plus as much additional spending financed by borrowing that the political system will allow.

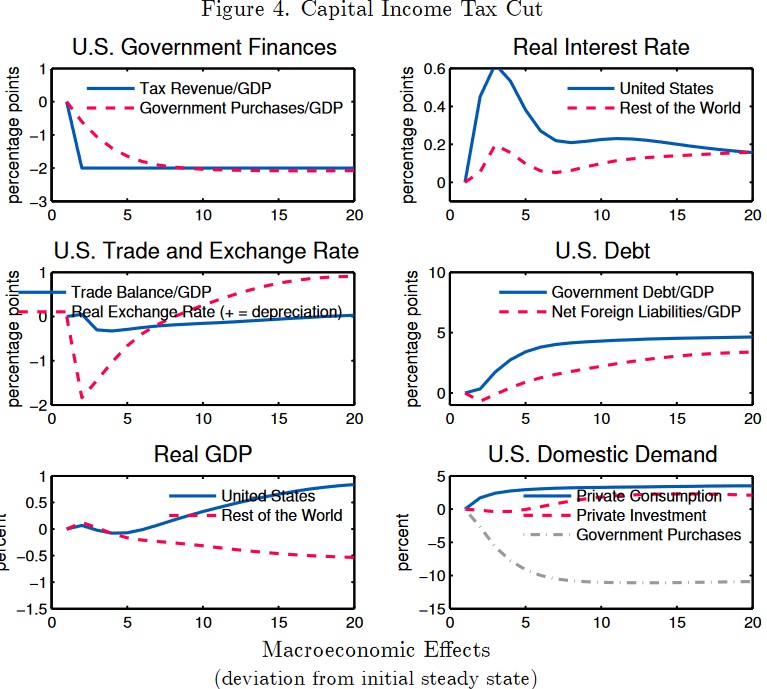

The IMF published a study on this issue about 10 years ago. The authors (Michael Kumhof, Douglas Laxton, and Daniel Leigh) assert that there’s no way of knowing whether Starve the Beast will lead to good or bad results.

…there is no consensus regarding the macroeconomic and welfare consequences of implementing a starve-the-beast approach, henceforth referred to as STB. …it could be beneficial in the ideal case in which it results in cuts in entirely wasteful government spending.

In particular, lower spending frees up resources for private consumption, and the associated lower tax rates reduce distortions in the economy. On the other hand, …lower government spending may itself entail welfare losses…if it augments the productivity of private factors of production. …the paper examines whether the principal macroeconomic variables such as GDP and consumption, both in the United States and in the rest of the world, respond positively to this policy. …In addition, the paper assesses how the welfare effects depend on the degree to which government spending directly contributes to household welfare or to productivity.

The authors don’t really push any particular conclusion. Instead, they show various economic outcomes depending on with assumptions one adopts.

Since plenty of research shows that government spending is not a net plus for the economy (even IMF economists agree on that point), and because I think a less-punitive tax system is possible (and desirable) if there’s a smaller burden of government spending, I think the findings shown in Figure 4 make the most sense.

Now let’s shift from academic analysis to policy analysis.

In a piece for National Review back in July 2020, Jim Geraghty notes that Starve the Beast has an impact on government finances at the state level.

…we’re probably not going to see a massive expansion of government at the state level in the coming year or two. …Thanks to the pandemic lockdown bringing vast swaths of the economy to a halt, state tax revenues are plummeting.

…So states will have much less tax revenue, constitutional balanced-budget requirements that are not easily repealed, and a limited amount of budgetary tricks to work around it. State governments could attempt to raise taxes, but that’s going to be unpopular and hurt state economies when they’re already struggling. Add it all up and it’s a tough set of circumstances for a dramatic expansion of government, no matter how ardently progressive the governor and state legislatures are.

For what it’s worth, Geraghty warned in the article that fiscal restraint by state governments wouldn’t happen if the federal government turned on the spending spigot.

And that, of course, is exactly what happened.

Now let’s look at the most unintentional endorsement of Stave the Beast.

A couple of years ago, Paul Krugman sort of admitted that cutting taxes was a potentially effective strategy for spending restraint.

…the same Republicans now wringing their hands over budget deficits…blew up that same deficit by enacting a huge tax cut for corporations and the wealthy. …this has been the G.O.P.’s budget strategy for decades. First, cut taxes. Then, bemoan the deficit created by those tax cuts and demand cuts in social spending.

Lather, rinse, repeat. This strategy, known as “starve the beast,” has been around since the 1970s, when Republican economists like Alan Greenspan and Milton Friedman began declaring that the role of tax cuts in worsening budget deficits was a feature, not a bug. As Greenspan openly put it in 1978, the goal was to rein in spending with tax cuts that reduce revenue, then “trust that there is a political limit to deficit spending.” …voters should realize that the threat to programs… Social Security and Medicare as we know them will be very much in danger.

In other words, Krugman doesn’t like Starve the Beast because he fears it is effective (just like he also acknowledges the Laffer Curve, even though he’s opposed to tax cuts).

Let’s close by looking at some very powerful real-world evidence. Over the past 50 years, there’s been a massive increase in the tax burden in Western Europe.

Let’s close by looking at some very powerful real-world evidence. Over the past 50 years, there’s been a massive increase in the tax burden in Western Europe.

Did all that additional tax revenue lead to lower deficits and less debt?

Nope, the opposite happened. European politicians spent every penny of the new tax revenue (much of it from value-added taxes). And then they added even more spending financed by additional borrowing.

To be fair, one could argue that this was an argument for the view of “Don’t Feed the Beast” rather than “Starve the Beast,” but it nonetheless shows that more money in the hands of politicians simply means more spending. And more red ink.

P.S. I had a discussion last year with Gene Tunny about the issue of “state capacity libertarianism.”

Friedman & Sowell: Should Our School System Be Privatized?

What if the NFL Was Run Like the Government School System?

October 4, 2011 by Dan Mitchell

Regular readers know that the two things that get me most excited are the Georgia Bulldogs and the fight against a bloated public sector that is ineffective in the best of circumstances and more often than not is a threat to our freedoms.

So you will not be surprised to know that I am delighted that former Georgia Bulldog star Fran Tarkenton (who also happened to play in the NFL) has a superb piece in the Wall Street Journal ripping apart the inherent inefficiency of government-run monopoly schools.

Here is the key passage.

Imagine the National Football League in an alternate reality. Each player’s salary is based on how long he’s been in the league. It’s about tenure, not talent. The same scale is used for every player, no matter whether he’s an All-Pro quarterback or the last man on the roster. For every year a player’s been in this NFL, he gets a bump in pay. The only difference between Tom Brady and the worst player in the league is a few years of step increases. And if a player makes it through his third season, he can never be cut from the roster until he chooses to retire, except in the most extreme cases of misconduct. Let’s face the truth about this alternate reality: The on-field product would steadily decline. Why bother playing harder or better and risk getting hurt? No matter how much money was poured into the league, it wouldn’t get better. In fact, in many ways the disincentive to play harder or to try to stand out would be even stronger with more money. Of course, a few wild-eyed reformers might suggest the whole system was broken and needed revamping to reward better results, but the players union would refuse to budge and then demonize the reform advocates: “They hate football. They hate the players. They hate the fans.” The only thing that might get done would be building bigger, more expensive stadiums and installing more state-of-the-art technology. But that just wouldn’t help.

This sounds absurd, of course, but Mr. Tarkenton goes on to explain that this is precisely how government schools operate.

If you haven’t figured it out yet, the NFL in this alternate reality is the real-life American public education system. Teachers’ salaries have no relation to whether teachers are actually good at their job—excellence isn’t rewarded, and neither is extra effort. Pay is almost solely determined by how many years they’ve been teaching. That’s it. After a teacher earns tenure, which is often essentially automatic, firing him or her becomes almost impossible, no matter how bad the performance might be. And if you criticize the system, you’re demonized for hating teachers and not believing in our nation’s children. Inflation-adjusted spending per student in the United States has nearly tripled since 1970. According to the Organization for Economic Cooperation and Development, we spend more per student than any nation except Switzerland, with only middling results to show for it.

Actually, I will disagree with the last sentence of this excerpt. We’re not even getting “middling results.” Here’s a chart from an earlier post showing that we’ve gotten more bureaucracy and more spending but no improvement over the past 40 years.

So what’s the solution to this mess? Well, since government is the problem, it stands to reason that competition and markets are the answer.

Sweden, Chile, and the Netherlands are just some of the countries that have seen good results after breaking up state-run education monopolies.

Watch this video to get more details.

Economics 101: School Choice Example Shows Why Government Monopolies Are Bad

Related posts:

FRIEDMAN FRIDAY Milton Friedman’s FREE TO CHOOSE “The Tyranny of Control” Transcript and Video (60 Minutes)

Milton Friedman’s FREE TO CHOOSE “The Tyranny of Control” Transcript and Video (60 Minutes) In 1980 I read the book FREE TO CHOOSE by Milton Friedman and it really enlightened me a tremendous amount. I suggest checking out these episodes and transcripts of Milton Friedman’s film series FREE TO CHOOSE: “The Failure of Socialism” and […]

FRIEDMAN FRIDAY “The Tyranny of Control” in Milton Friedman’s FREE TO CHOOSE Part 7 of 7 (Transcript and Video) “I’m not pro business, I’m pro free enterprise, which is a very different thing, and the reason I’m pro free enterprise”

In 1980 I read the book FREE TO CHOOSE by Milton Friedman and it really enlightened me a tremendous amount. I suggest checking out these episodes and transcripts of Milton Friedman’s film series FREE TO CHOOSE: “The Failure of Socialism” and “What is wrong with our schools?” and “Created Equal” and From Cradle to Grave, […]

FRIEDMAN FRIDAY “The Tyranny of Control” in Milton Friedman’s FREE TO CHOOSE Part 6 of 7 (Transcript and Video) “We are the ones who promote freedom, and free enterprise, and individual initiative, And what do we do? We force puny little Hong Kong to impose limits, restrictions on its exports at tariffs, in order to protect our textile workers”

In 1980 I read the book FREE TO CHOOSE by Milton Friedman and it really enlightened me a tremendous amount. I suggest checking out these episodes and transcripts of Milton Friedman’s film series FREE TO CHOOSE: “The Failure of Socialism” and “What is wrong with our schools?” and “Created Equal” and From Cradle to Grave, […]

FRIEDMAN FRIDAY “The Tyranny of Control” in Milton Friedman’s FREE TO CHOOSE Part 5 of 7 (Transcript and Video) “There is no measure whatsoever that would do more to prevent private monopoly development than complete free trade”

In 1980 I read the book FREE TO CHOOSE by Milton Friedman and it really enlightened me a tremendous amount. I suggest checking out these episodes and transcripts of Milton Friedman’s film series FREE TO CHOOSE: “The Failure of Socialism” and “What is wrong with our schools?” and “Created Equal” and From Cradle to Grave, […]

FRIEDMAN FRIDAY “The Tyranny of Control” in Milton Friedman’s FREE TO CHOOSE Part 4 of 7 (Transcript and Video) ” What we need are constitutional restraints on the power of government to interfere with free markets in foreign exchange, in foreign trade, and in many other aspects of our lives.”

In 1980 I read the book FREE TO CHOOSE by Milton Friedman and it really enlightened me a tremendous amount. I suggest checking out these episodes and transcripts of Milton Friedman’s film series FREE TO CHOOSE: “The Failure of Socialism” and “What is wrong with our schools?” and “Created Equal” and From Cradle to Grave, […]

FRIEDMAN FRIDAY “The Tyranny of Control” in Milton Friedman’s FREE TO CHOOSE Part 3 of 7 (Transcript and Video) “When anyone complains about unfair competition, consumers beware, That is really a cry for special privilege always at the expense of the consumer”

In 1980 I read the book FREE TO CHOOSE by Milton Friedman and it really enlightened me a tremendous amount. I suggest checking out these episodes and transcripts of Milton Friedman’s film series FREE TO CHOOSE: “The Failure of Socialism” and “What is wrong with our schools?” and “Created Equal” and From Cradle to Grave, […]

FRIEDMAN FRIDAY “The Tyranny of Control” in Milton Friedman’s FREE TO CHOOSE Part 2 of 7 (Transcript and Video) “As always, economic freedom promotes human freedom”

In 1980 I read the book FREE TO CHOOSE by Milton Friedman and it really enlightened me a tremendous amount. I suggest checking out these episodes and transcripts of Milton Friedman’s film series FREE TO CHOOSE: “The Failure of Socialism” and “What is wrong with our schools?” and “Created Equal” and From Cradle to Grave, […]

FRIEDMAN FRIDAY “The Tyranny of Control” Milton Friedman’s FREE TO CHOOSE Part 1 of 7 (Transcript and Video) “Adam Smith’s… key idea was that self-interest could produce an orderly society benefiting everybody, It was as though there were an invisible hand at work”

In 1980 I read the book FREE TO CHOOSE by Milton Friedman and it really enlightened me a tremendous amount. I suggest checking out these episodes and transcripts of Milton Friedman’s film series FREE TO CHOOSE: “The Failure of Socialism” and “What is wrong with our schools?” and “Created Equal” and From Cradle to Grave, […]

Open letter to President Obama (Part 654) “The Tyranny of Control” in Milton Friedman’s FREE TO CHOOSE Part 7 of 7 (Transcript and Video) “I’m not pro business, I’m pro free enterprise, which is a very different thing, and the reason I’m pro free enterprise”

Open letter to President Obama (Part 654) (Emailed to White House on July 22, 2013) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you […]

Open letter to President Obama (Part 650) “The Tyranny of Control” in Milton Friedman’s FREE TO CHOOSE Part 6 of 7 (Transcript and Video) “We are the ones who promote freedom, and free enterprise, and individual initiative, And what do we do? We force puny little Hong Kong to impose limits, restrictions on its exports at tariffs, in order to protect our textile workers”

Open letter to President Obama (Part 650) (Emailed to White House on July 22, 2013) President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear Mr. President, I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you […]

_________