–

There Are Very Good Reasons Why No Nation Has Ever Tried to Tax Unrealized Capital Gains

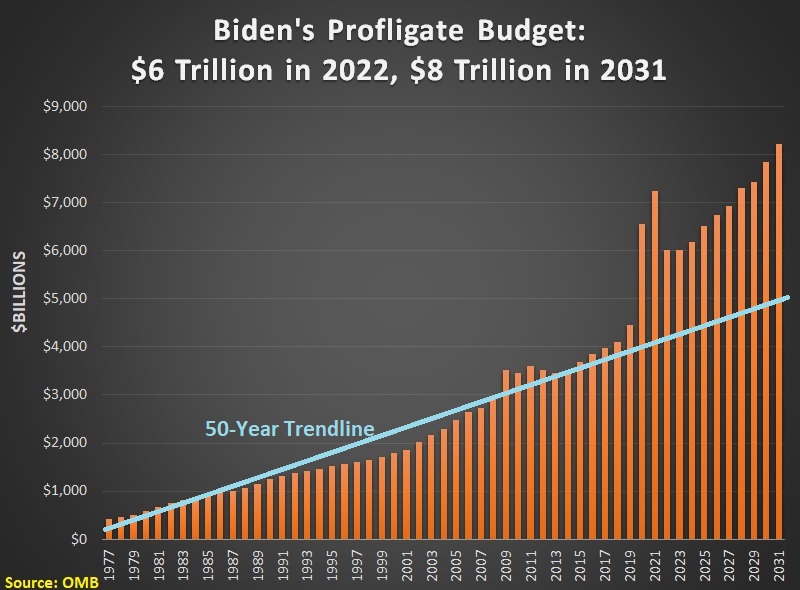

The Biden economic agenda can be summarized as follows: As much spending as possible, financed by as much taxation as possible, using lots of dishonest budget gimmicks to glue the pieces together.

But it turns out that higher taxes are not very popular, notwithstanding the delusions of Bernie Sanders, AOC, and the rest of the class-warfare crowd.

But it turns out that higher taxes are not very popular, notwithstanding the delusions of Bernie Sanders, AOC, and the rest of the class-warfare crowd.

If the latest reports are accurate, the left has given up on imposing higher corporate tax rates, higher personal tax rates, and making the death tax more onerous.

That’s the good news.

The bad news is that they’ve revived an awful idea to make capital gains taxes more onerous by taxing people on capital gains that only exist on paper.

In a column for the New York Times, Neil Irwin explains how the new scheme would work..

…congressional Democrats..are looking toward a change in the tax code that would reinvent how the government taxes investments… The Wyden plan would require the very wealthy — those with over $1 billion in assets

or three straight years of income over $100 million — to pay taxes based on unrealized gains. …It could create some very large tax bills… If a family’s $10 billion net worth rose to $11 billion in a single year, a capital-gains rate of 20 percent would imply a $200 million tax bill.

In other words, families would be taxed on theoretical gains rather than real gains.

Some have said this scheme is similar to a wealth tax, though it’s more accurate to say it’s a tax on changes in wealth.

Similarly bad consequences, with similarly big problems with complexity, but using a different design.

Mr. Irwin’s column also acknowledges some other problems with this proposed levy.

The proposal raises conceptual questions about what counts as income. When Americans buy assets — shares of stock, a piece of real estate, a business — that become more valuable over time, they owe tax only on the appreciation when they sell the asset. …The rationale is that just because something has increased in value doesn’t mean the owner has the cash on hand to pay taxes. Moreover, for those with complex holdings, like interests in multiple privately held companies, it could be onerous to calculate the change in valuations every year, with ambiguous results. …having a cutoff at which the new capital gains system applies could create perverse incentives… “If you have a threshold, you’re giving people a really strong incentive to rearrange their affairs to keep their income and wealth below the threshold,” said Leonard Burman, institute fellow at the Tax Policy Center.

In other words, this plan would be great news for accountants, lawyers, and other people involved with tax planning.

I support the right of people to minimize their taxes, of course, but I wish we had a simple and fair tax system so that there was no need for an entire industry of tax planners.

But I’m digressing. Let’s continue with our analysis of this latest threat to good tax policy.

Henry Olson opines in the Washington Post that it’s a big mistake to impose taxes on unrealized gains.

The Biden administration’s idea to tax billionaires’ unrealized capital gains…would be an unworkable and arguably unconstitutional mess that could harm everyone. …Tesla founder Elon Musk’s net worth rose by $126 billion last year as his company’s stock price soared, but he surely paid almost no tax on that because he never sold the stock. Biden’s plan would tax all of that rise, netting the federal government about $30 billion.

Do the same for all the nation’s billionaires, and the feds could pull in loads of cash… If that sounds too good to be true, it’s because it is. …Privately held companies…are notoriously difficult to value. Rare but valuable items are even more difficult to fix an annual price. …Billionaires are precisely the people with the motive and the means to hire the best tax lawyers to fight the Internal Revenue Service at every step of the way, surely subjecting each tax return to excruciatingly long and expensive audits. …Expensive assets can go down in value, too, and billionaires would rightly insist that the IRS account for those reversals of fortune. …Would the IRS have to issue multi-billion dollar refund checks to return the billionaires’ quarterly estimated tax payments from earlier in the year?

These are all excellent points.

Henry also points out that the scheme may be unconstitutional.

The Constitution may not even permit taxation of unrealized gains. The 16th Amendment authorizes taxation of “income,”… Unrealized gains don’t fit under that rubric because the wealth is on paper, not in the hands of the owner to use as she wants.

And he closes with the all-important point that the current plan may target the richest of the rich, but sooner or later the rest of us would be in the crosshairs.

…it will only be a matter of time before lawmakers apply the tax to ordinary Americans. Anyone who owns a house or has a retirement account has unrealized capital gains. Billionaires get all the attention, but the real money is in the hands of the broader public, as the collective value of real estate and mutual funds dwarfs what the nation’s uber-wealthy hold. The government would love to get 25 percent of your 401(k)’s annual rise.

Amen. This is a point I’ve made in the past.

Simply stated, there are not enough rich people to finance European-sized government. Eventually we’ll all be treated like this unfortunate Spaniard.

I’ll close with a few wonky observations about tax policy.

- The government should not impose discriminatory extra layers taxation

on income that is saved and invested rather than consumed.

on income that is saved and invested rather than consumed. - This means there should be no capital gains tax, much less a tax on unrealized capital gains (or inflationary gains).

- This means there should be no wealth tax, whether levied on annual wealth or imposed on changes in wealth.

P.S. Biden, et al, claim we need higher taxes on the rich because the current system is unfair, yet there’s never any recognition that the United States collects a greater share of revenue from the rich than any other developed nations (not because our tax rates on the rich are higher than average, but rather because our tax rates on lower-income and middle-class taxpayers are much lower than average).

P.P.S. The bottom line is that taxing unrealized capital gains is such a crazy idea that even nations such as France and Greecehave never tried to impose such a levy.

Biden’s Tax Hike: The Political Calculus and Economic Cost

There are lots of reasons (here are five of them) to dislike the version of the Biden tax hike that was approved by the tax-writing committee in the House of Representatives.

From an economic perspective, it is bad for prosperity to penalize work, saving, investment, and productivity.

So why, then, do politicians pursue such policies?

Part of the answer is spite, but I think the biggest reason is they simply want more money to spend.

And if the economy suffers, they don’t worry about that collateral damage so long as their primary objective – getting more money to buy more votes – is achieved.

But the rest of should care, and a new report from the Tax Foundation offers a helpful way of showing why pro-tax politicians are misguided.

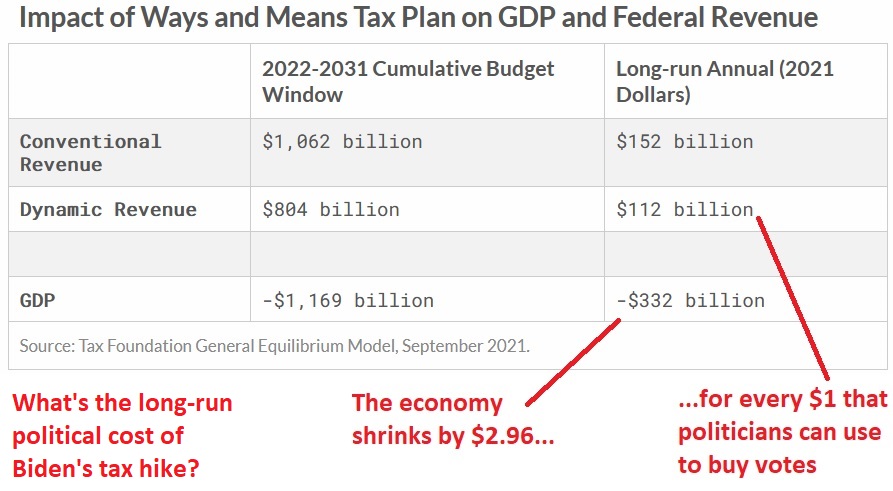

Here’s a table showing that the economy will lose almost $3 of output for every $1 that politicians can use for vote buying.

I added my commentary (in red) to the table.

My takeaway is that it is reprehensible for politicians to cause nearly $3 of foregone prosperity so that they can spend another $1.

Garrett Watson, author of the report, uses more sedate language to describes the findings.

Using Tax Foundation’s General Equilibrium Model, we estimate that the Ways and Means tax plan would reduce long-run GDP by 0.98 percent, which in today’s dollars amounts to about $332 billion of lost output annually.

We estimate the plan would in the long run raise about $152 billion annually in new tax revenue, conventionally estimated in today’s dollars, meaning for every $1 in revenue raised, economic output would fall by $2.18. When the model accounts for the smaller economy, it estimates that the plan’s dynamic effects would reduce expected new tax collections to about $112 billion annually over the long run (also in today’s dollars), meaning for every $1 in revenue raised, economic output would fall by $2.96.

This is excellent analysis.

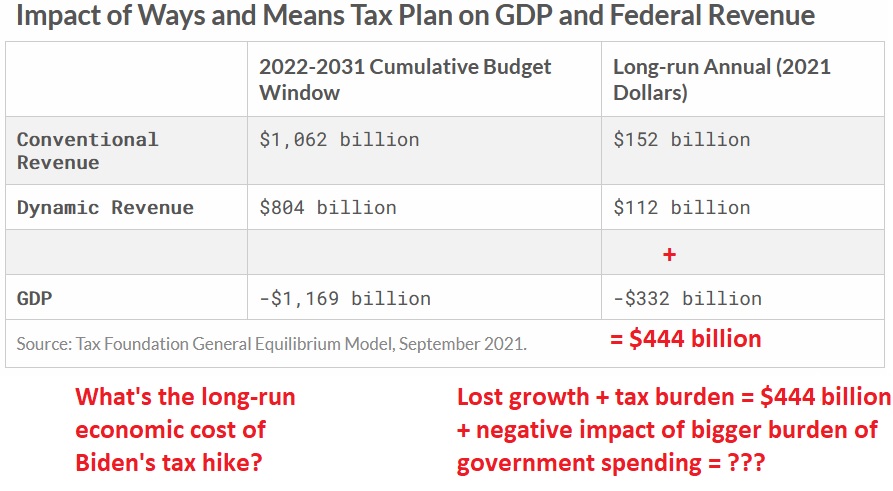

But I think it’s important to specify that political cost-benefit analysis (from the perspective of politicians) is not the same as economic cost-benefit analysis.

From an economic perspective, the foregone economic growth is a cost and the additional tax revenue for politicians also is a cost.

And I’ve augmented the table (again, in red) to show that the additional spending is yet another cost.

In other words, politicians are the main winners from Biden’s tax hike, and some of the interest groups getting additional handouts also might be winners (though I’ve previously pointed out that many of them wind up being losers as well in the long run).

P.S. The Tax Foundation model only measures the economic damage of higher taxes. If you also measure the harmful impact of more spending, the estimates of foregone economic output are much bigger.

High Implicit Tax Rates Trap Poor People in the Quicksand of Government Dependency

The welfare state and the so-called war on poverty has been very bad news for taxpayers.

But it’s also very bad news for poor people, in part because various redistribution programs can lure them out of the productive economy and into total dependency on government (and this will become an even bigger problem if Biden’s per-child handouts are approved).

But it’s also bad news because redistribution programs can result in very high implicit tax rates for low-income people who try to improve their lives by climbing the economic ladder.

But it’s also bad news because redistribution programs can result in very high implicit tax rates for low-income people who try to improve their lives by climbing the economic ladder.

I shared an example back in 2012, which showed how a single mother in Pennsylvania would be worse off with $57,000 of income instead of $29,000.

In other words, she would be dealing with a de facto marginal tax rate of more than 100 percent.

If you want to understand how this happens, Professors Craig Richardson and Richard McKenzie wrote about this topic in an article for The Library of Economics and Liberty.

…by expanding public assistance programs, the President’s plan will unavoidably impose a higher, hidden tax rate—known as an “implicit marginal income tax rate” (which we shorten to implicit tax rate)—on low-wage workers who receive welfare benefits. Those workers will pay an implicit tax rate because many welfare benefits are reduced as earnings rise.

Ironically, the poorest Americans often pay implicit tax rates that are far higher than the IRS’s explicit marginal income-tax rates imposed on the country’s highest income earners. …Consider a household that receives benefits from only two welfare programs, with one tapering off at 20 cents for each added dollar earned and another tapering off at 40 cents for each added dollar earned. Those cuts create an implicit tax rate of 60 percent, which means the worker has only 40 cents in additional spendable income for each added dollar earned. This implicit tax rate can be expected to affect work incentives in much the same way that a federal income tax rate does.

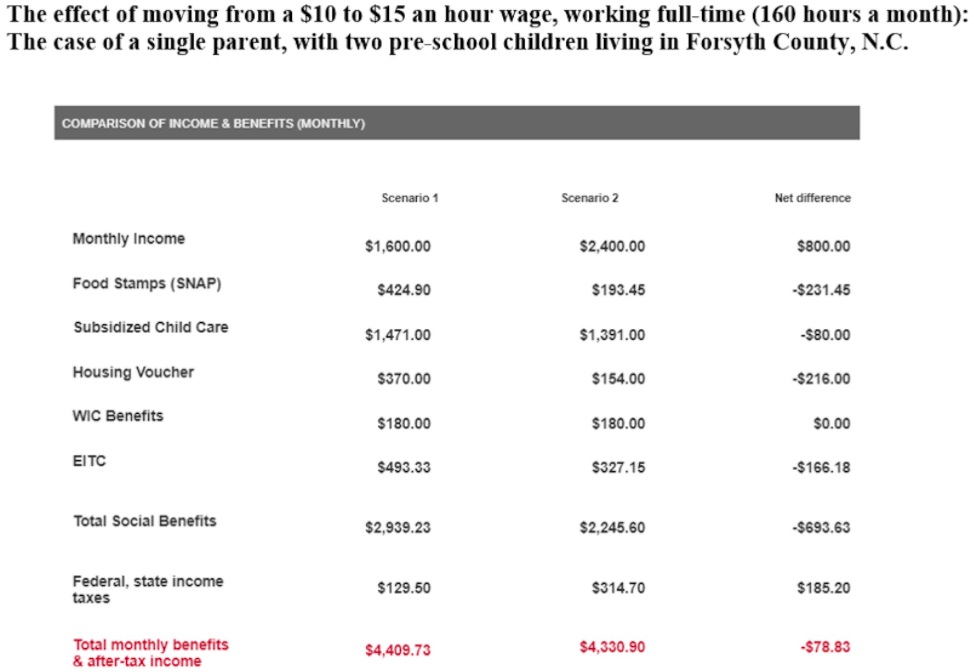

The authors cite a real-world example.

…consider a real-life, low-income single mother of two children in Forsyth County, North Carolina earning $10 an hour in a full-time job, which means she has a monthly earned income of $1,600 (or $19,200 annually). Suppose the single mother receives monthly benefits from five welfare programs: $425 in food stamps, $1,471 in subsidized childcare, $370 in housing subsidies, $180 in WIC benefits, and $493 in an earned income tax credit (EITC). Her monthly welfare benefits will total $2,939 (or $35,271 a year). Now, suppose the single mother takes a new job paying $15 an hour, a 50 percent increase. Her monthly earned income will rise by $800 to $2,400 (with her annual income rising to $28,800 a year, an annual earnings increase of $9,600). However, she will face decreases in four out of her five monthly benefit streams, with each benefit reduction based on the same $800-increase in earnings (a problem known among welfare researchers as the “cumulative stacked effect”). The single mother will lose $231 in food stamps, $80 in childcare benefits, $216 in housing benefits, and $166 in EITC. Her total decrease in monthly benefits will reach $694 (which means her annual benefit total will drop by $8,328).4 Her implicit tax rate on her added monthly earnings of $800 is 87 percent—more than two times the highest explicit marginal tax rate proposed for the rich. …In addition, the single mother will be required to pay an added $185 a month in federal and state income taxes on her added earned monthly income of $800, which is an explicit tax rate of 23 percent. Adding the 87 percent implicit tax rate to the 23 percent explicit tax rate leads to an overall tax rate of 110 percent. Her raise has left her $79 per month poorer in lost wages and benefits—surely a strong disincentive for her to take the higher paying job.

Here’s a table showing those results.

If you want more evidence, check out Chart 7 from this columnand Figure 8 from this column.

And the same problem exists in other nations as well.

P.S. Obamacare may have lured as many as 2 million people into full dependency.

P.P.S. I already mentioned how Biden’s per-child handouts could lure many more into full dependency, but “basic income” could be far worse.

Biden’s Misguided Plan for a Bigger Welfare State

President Biden pushed through $1.9 trillion of new spendingearlier this year, but that so-called stimulus plan was mostly for one-time giveaways. As I warn in this recent discussion on Denver’s KHOW, we should be much more worried about his proposals to permanently expand the welfare state.

When I first got to Washington, I would be upset that politicians wanted to add billions of dollars to the burden of government.

Well, those were the good ol’ days. Biden is proposing to divert trillions of dollars from the private sector to expand the welfare state.

Well, those were the good ol’ days. Biden is proposing to divert trillions of dollars from the private sector to expand the welfare state.

Even worse, he wants to make more Americans dependent on the federal government.

Maybe that’s a smart way of buying votes, but it will erode societal capital.

John Cogan and Daniel Heil of the Hoover Institution warned about the consequences of this dependency agenda in a columnfor the Wall Street Journal.

The federal government’s system of entitlements is the largest money-shuffling machine in human history, and President Biden intends to make it a lot bigger. His American Families Plan—which he recently attempted to tie to a bipartisan infrastructure deal

—proposes to extend the reach of federal entitlements to 21 million additional Americans, the largest expansion since Lyndon B. Johnson’s Great Society. …more than half of working-age households would be on the entitlement rolls if the plan were enacted in its current form. …57% of all married-couple children would receive federal entitlement benefits, and more than 80% of single-parent households would be on the entitlement rolls.

Many of the handouts would go to people with middle-class incomes.

And higher.

…The American Families Plan proposes several new entitlement programs. One promises students the government will pick up the entire cost of community-college tuition; another promises families earning 1.5 times their state’s median income that Washington will cover all daycare expenses above 7% of family income for children under 5;

still another promises workers up to 12 weeks of federally financed wage subsidies to take time off to care for newborns or sick family members. …Two-parent households with two preschool-age children and incomes up to $130,000 would qualify for federal cash assistance for daycare. Single parents with two preschoolers and incomes up to $113,000 would qualify. And some families with incomes over $200,000 would be eligible for health-insurance subsidies. Other parts of the plan, such as paid leave and free community college, have no income limits at all.

The Wall Street Journal opined on this issue last month. Here are the key passages from their editorial.

The entitlements are by far the biggest long-term economic threat from the Biden agenda. …entitlements that spend automatically based on eligibility are nearly impossible to repeal, or even reform, and they represent a huge tax-and-spend wedge far into the future.

…We’d highlight two points. First is the dishonesty about costs. Entitlements always start small but then soar. The Biden Families Plan is even more dishonest than usual. For example, it pretends the child tax credit ends in 2025, so its cost is $449 billion over the 10-year budget window that is used for reconciliation bills that require only 51 votes to pass the Senate. But a future Congress will never repeal the credit. …Second, these programs aren’t intended as a “safety net” for the poor or those temporarily down on their luck. They are explicitly designed to make the middle class dependent on government handouts.

The editorial explicitly warns that the United States will economically suffer if politicians copy Europe’s counterproductive redistributionism.

…on present trend the U.S. is falling into the same entitlement trap as Western Europe. Entitlement spending requires higher taxes, which grab 40% or more of GDP. Economic growth declines as more money

flows to transfer payments instead of investment. The entitlement state becomes too large to afford but also too politically entrenched to reform. …Only a decade ago the Tea Party fought ObamaCare. Now most Beltway conservatives worry more about Big Tech than they do Big Government. If the Biden Families Plan passes, these conservatives will find themselves spending the rest of their careers as tax collectors for the entitlement state.

Amen. I’m baffled when folks on the left argue that we should “catch up” with Europe.

Are they not aware that American living standards are far higher? Do they not understand that low-income people in the United States often have more income than middle-class people on the other side of the Atlantic Ocean?

P.S. As I mentioned in the interview, the 21st century has been bad news for fiscal policy, with two big-government Republicans and two big-government Democrats.

P.S. As I mentioned in the interview, the 21st century has been bad news for fiscal policy, with two big-government Republicans and two big-government Democrats.

For what it’s worth, the $3,000-per-child handouts are Biden’s most damaging idea. In one fell swoop, he would create a trillion-dollar entitlement program and repeal the successful Clinton-Gingrich welfare reform.

New Leak of Taxpayer Info Is (More) Evidence of IRS Corruption

I sometimes try to go easy on the IRS. After all, our wretched tax system is largely the fault of politicians, who have spent the past 108 years creating a punitive and corrupt set of tax laws.

But there is still plenty of IRS behavior to criticize. Most notably, the tax agency allowed itself to be weaponized by the Obama White House, using its power to persecute and harass organizations associated with the “Tea Party.”

using its power to persecute and harass organizations associated with the “Tea Party.”

That grotesque abuse of power largely was designed to weaken opposition to Obama’s statist agenda and make it easier for him to win re-election.

Now there’s a new IRS scandal. In hopes of advancing President Biden’s class-warfare agenda, the bureaucrats have leaked confidential taxpayer information to ProPublica, a left-wing website.

Here’s some of what that group posted.

ProPublica has obtained a vast trove of Internal Revenue Service data on the tax returns of thousands of the nation’s wealthiest people, covering more than 15 years. …ProPublica undertook an analysis that has never been done before.

We compared how much in taxes the 25 richest Americans paid each year to how much Forbes estimated their wealth grew in that same time period. We’re going to call this their true tax rate. …those 25 people saw their worth rise a collective $401 billion from 2014 to 2018. They paid a total of $13.6 billion in federal income taxes in those five years, the IRS data shows. That’s a staggering sum, but it amounts to a true tax rate of only 3.4%.

Since I’m a policy wonk, I’ll first point out that ProPublicacreated a make-believe number. We (thankfully) don’t tax wealth in the United States.

So Elon Musk’s income is completely unrelated to what happened to the value of his Tesla shares. The same is true for Jeff Bezos’ income and the value of his Amazon stock.*

And the same thing is true for the rest of us. If our IRA or 401(k) rises in value, that doesn’t mean our taxable income has increased. If our home becomes more valuable, that also doesn’t count as taxable income.

The Wall Street Journal opined on this topic today and made a similar point.

There is no evidence of illegality in the ProPublica story. …ProPublica knows this, so its story tries to invent a scandal by calculating

what it calls the “true tax rate” these fellows are paying. This is a phony construct that exists nowhere in the law and compares how much the “wealth” of these individuals increased from 2014 to 2018 compared to how much income tax they paid. …what Americans pay is a tax on income, not wealth.

Some journalists don’t understand this distinction between income and wealth.

Or perhaps they do understand, but pretend otherwise because they see their role as being handmaidens of the Biden Administration.

Consider these excerpts from a column by Binyamin Appelbaum of the New York Times.

Jeff Bezos…added an estimated $99 billion in wealth between 2014 and 2018 but reported only $4.22 billion in taxable income during that period.

Warren Buffett, who amassed $24.3 billion in new wealth over those years, reported $125 million in taxable income. …some of the wealthiest people in the United States essentially live under a different system of income taxation from the rest of us.

Mr. Appelbaum is wrong. The rich have a lot more assets than the rest of us, but they operate under the same rules.

If I have an asset that increases in value, that doesn’t count as taxable income. And it isn’t income. It’s merely a change in net wealth.

And the same is true if Bill Gates has an asset that increases in value.

Now that we’ve addressed the policy mistakes, let’s turn our attention to the scandal of IRS misbehavior.

The WSJ‘s editorial addresses the agency’s grotesque actions.

Less than half a year into the Biden Presidency, the Internal Revenue Service is already at the center of an abuse-of-power scandal. …ProPublica, a website whose journalism promotes progressive causes, published information from what it said are 15 years of the tax returns of Jeff Bezos, Warren Buffett and other rich Americans. …The story arrives amid the Biden Administration’s effort to pass the largest tax increase as a share of the economy since 1968. …The timing here is no coincidence, comrade. …someone leaked confidential IRS information about individuals to serve a political agenda. This is the same tax agency that pursued a vendetta against conservative nonprofit groups during the Obama Administration. Remember Lois Lerner? This is also the same IRS that Democrats now want to infuse with $80 billion more… As part of this effort, Mr. Biden wants the IRS to collect “gross inflows and outflows on all business and personal accounts from financial institutions.” Why? So the information can be leaked to ProPublica? …Congress should also not trust the IRS with any more power and money than it already has.

And Charles Cooke of National Review also weighs in on the implications of a weaponized and partisan IRS.

We cannot trust the IRS. “Oh, who cares?” you might ask. “The victims are billionaires!” And indeed, they are. But I care. For a start, they’re American citizens, and they’re entitled to the same rights — and protected by the same laws — as everyone else. …Besides, even if one wants to be entirely amoral about it, one should consider that if their information can be spilled onto the Internet, anyone’s can.

…A government that is this reckless or sinister with the information of men who are lawyered to the eyeballs is unlikely to worry too much about being reckless or sinister with your information. …The IRS wields an extraordinary amount of power, and there will always be somebody somewhere who thinks that it should be used to advance their favorite political cause. Our refusal to indulge their calls is one of the many things that prevents us from descending into the caprice and chaos of your average banana republic. …Does that bother you? It should.

What’s especially disgusting is that the Biden Administration wants to reward IRS corruption with giant budget increases, bolstered by utterly fraudulent numbers.

Needless to say, that would be a terrible idea (sadly, Republicans in the past have been sympathetic to expanding the size of the tax bureaucracy).

*Financial assets such as stocks generally increase in value because of an expectation of bigger streams of income in the future (such as dividends). Those income streams are taxed (often multiple times) when (and if) they actually materialize.

Open letter to President Obama (Part 644)

(Emailed to White House on 6-10-13.)

President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500

Dear Mr. President,

I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here.

The federal government debt is growing so much that it is endangering us because if things keep going like they are now we will not have any money left for the national defense because we are so far in debt as a nation. We have been spending so much on our welfare state through food stamps and other programs that I am worrying that many of our citizens are becoming more dependent on government and in many cases they are losing their incentive to work hard because of the welfare trap the government has put in place. Other nations in Europe have gone down this road and we see what mess this has gotten them in. People really are losing their faith in big government and they want more liberty back. It seems to me we have to get back to the founding principles that made our country great. We also need to realize that a big government will encourage waste and corruption. The recent scandals in our government have proved my point. In fact, the jokes you made at Ohio State about possibly auditing them are not so funny now that reality shows how the IRS was acting more like a monster out of control. Also raising taxes on the job creators is a very bad idea too. The Laffer Curve clearly demonstrates that when the tax rates are raised many individuals will move their investments to places where they will not get taxed as much.

______________________

We can fix the IRS problem by going to the flat tax and lowering the size of government.

Did President Obama and his team of Chicago cronies deliberately target the Tea Party in hopes of thwarting free speech and political participation?

Was this part of a campaign to win the 2012 election by suppressing Republican votes?

Perhaps, but I’ve warned that it’s never a good idea to assume top-down conspiracies when corruption, incompetence, politics, ideology, greed, and self-interest are better explanations for what happens in Washington.

Writing for the Washington Examiner, Tim Carney has a much more sober and realistic explanation of what happened at the IRS.

If you take a group of Democrats who are also unionized government employees, and put them in charge of policing political speech, it doesn’t matter how professional and well-intentioned they are. The result will be much like the debacle in the Cincinnati office of the IRS. …there’s no reason to even posit evil intent by the IRS officials who formulated, approved or executed the inappropriate guidelines for picking groups to scrutinize most closely. …The public servants figuring out which groups qualified for 501(c)4 “social welfare” non-profit status were mostly Democrats surrounded by mostly Democrats. …In the 2012 election, every donation traceable to this office went to President Obama or liberal Sen. Sherrod Brown. This is an environment where even those trying to be fair could develop a disproportionate distrust of the Tea Party. One IRS worker — a member of NTEU and contributor to its PAC, which gives 96 percent of its money to Democratic candidates — explained it this way: “The reason NTEU mostly supports Democratic candidates for office is because Democratic candidates are mostly more supportive of civil servants/government employees.”

Tim concludes with a wise observation.

As long as we have a civil service workforce that leans Left, and as long as we have an income tax system that requires the IRS to police political speech, conservative groups can always expect special IRS scrutiny.

And my colleague Doug Bandow, in an article for the American Spectator, adds his sage analysis.

The real issue is the expansive, expensive bureaucratic state and its inherent threat to any system of limited government, rule of law, and individual liberty. …the broader the government’s authority, the greater its need for revenue, the wider its enforcement power, the more expansive the bureaucracy’s discretion, the increasingly important the battle for political control, and the more bitter the partisan fight, the more likely government officials will abuse their positions, violate rules, laws, and Constitution, and sacrifice people’s liberties. The blame falls squarely on Congress, not the IRS.

I actually think he is letting the IRS off the hook too easily.

- It has thieving employees.

It has incompetent employees.

It has incompetent employees.- It has thuggish employees.

- It has brainless employees.

- It has protectionist employees.

- It has wasteful employees.

- And it has victimizing employees.

But Doug’s overall point obviously is true.

…the denizens of Capitol Hill also have created a tax code marked by outrageous complexity, special interest electioneering, and systematic social engineering. Legislators have intentionally created avenues for tax avoidance to win votes, and then complained about widespread tax avoidance to win votes.

So what’s the answer?

The most obvious response to the scandal — beyond punishing anyone who violated the law — is tax reform. Implement a flat tax and you’d still have an IRS, but the income tax would be less complex, there would be fewer “preferences” for the agency to police, and rates would be lower, leaving taxpayers with less incentive for aggressive tax avoidance. …Failing to address the broader underlying factors also would merely set the stage for a repeat performance in some form a few years hence. …More fundamentally, government, and especially the national government, should do less. Efficient social engineering may be slightly better than inefficient social engineering, but no social engineering would be far better.

Amen. Let’s rip out the internal revenue code and replace it with a simple and fair flat tax.

But here’s the challenge. We know the solution, but it will be almost impossible to implement good policy unless we figure out some way to restrain the spending side of the fiscal ledger.

___________________________

At the risk of over-simplifying, we will never get tax reform unless we figure out how to implement entitlement reform.

Here’s another Foden cartoon, which I like because it has the same theme asthis Jerry Holbert cartoon, showing big government as a destructive and malicious force.

_____________

Thank you so much for your time. I know how valuable it is. I also appreciate the fine family that you have and your commitment as a father and a husband.

Sincerely,

Everette Hatcher III, 13900 Cottontail Lane, Alexander, AR 72002, ph 501-920-5733, lowcostsqueegees@yahoo.com

Related Posts:

We know the IRS commissioner wasn’t telling the truth in March 2012, when he testified: “There’s absolutely no targeting.”

We know the IRS commissioner wasn’t telling the truth in March 2012, when he testified: “There’s absolutely no targeting.”However, Lois Lerner knew different when she misled people with those words. Two important points made by Noonan in the Wall Street Journal in the article below: First, only conservative groups were targeted in this scandal by […]

A great cartoonist takes on the IRS!!!!

Ohio Liberty Coalition versus the I.R.S. (Tom Zawistowski) Published on May 20, 2013 The Ohio Liberty Coalition was among tea party groups that received special scrutiny from the I.R.S. Tom Zawistowski says his story is not unique. He argues the kinds of questions the I.R.S. asked his group amounts to little more than “opposition research.” Video […]

“Schaeffer Sundays” Francis Schaeffer’s own words concerning what the First Amendment means

Francis Schaeffer: “Whatever Happened to the Human Race?” (Episode 2) SLAUGHTER OF THE INNOCENTS Published on Oct 6, 2012 by AdamMetropolis The 45 minute video above is from the film series created from Francis Schaeffer’s book “Whatever Happened to the Human Race?” with Dr. C. Everett Koop. This book really helped develop my political views concerning […]

Cartoonists show how stupid the IRS is acting!!!

We got to lower the size of government so we don’t have these abuses like this in the IRS. Cartoonists v. the IRS May 23, 2013 by Dan Mitchell Call me perverse, but I’m enjoying this IRS scandal. It’s good to see them suffer a tiny fraction of the agony they impose on the American people. I’ve already […]

Dear Senator Pryor, why not pass the Balanced Budget Amendment? (“Thirsty Thursday”, Open letter to Senator Pryor)

Dear Senator Pryor, Why not pass the Balanced Budget Amendment? As you know that federal deficit is at all time high (1.6 trillion deficit with revenues of 2.2 trillion and spending at 3.8 trillion). On my blog http://www.HaltingArkansasLiberalswithTruth.com I took you at your word and sent you over 100 emails with specific spending cut ideas. However, […]

Video from Cato Institute on IRS Scandal

Is the irs out of control? Here is the link from cato: MAY 22, 2013 8:47AM Can You Vague That Up for Me? By TREVOR BURRUS SHARE As the IRS scandal thickens, targeted groups are coming out to describe their ordeals in dealing with that most-reviled of government agencies. The Ohio Liberty Coalition was one of […]

IRS cartoons from Dan Mitchell’s blog

Get Ready to Be Reamed May 17, 2013 by Dan Mitchell With so many scandals percolating, there are lots of good cartoons being produced. But I think this Chip Bok gem deserves special praise. It manages to weave together both the costly Obamacare boondoggle with the reprehensible politicization of the IRS. So BOHICA, my friends. If […]

Obama jokes about audit of Ohio St by IRS then IRS scandal breaks!!!!!

You want to talk about irony then look at President Obama’s speech a few days ago when he joked about a potential audit of Ohio St by the IRS then a few days later the IRS scandal breaks!!!! The I.R.S. Abusing Americans Is Nothing New Published on May 15, 2013 The I.R.S. targeting of tea party […]

Dear Senator Pryor, why not pass the Balanced Budget Amendment? (“Thirsty Thursday”, Open letter to Senator Pryor)

Dear Senator Pryor, Why not pass the Balanced Budget Amendment? As you know that federal deficit is at all time high (1.6 trillion deficit with revenues of 2.2 trillion and spending at 3.8 trillion). On my blog http://www.HaltingArkansasLiberalswithTruth.com I took you at your word and sent you over 100 emails with specific spending cut ideas. However, […]

We could put in a flat tax and it would enable us to cut billions out of the IRS budget!!!!

We could put in a flat tax and it would enable us to cut billions out of the IRS budget!!!! May 14, 2013 2:34PM IRS Budget Soars By Chris Edwards Share The revelations of IRS officials targeting conservative and libertarian groups suggest that now is a good time for lawmakers to review a broad range […]