Another Honest Leftist Admits Big Government Requires Big Tax Hikes on the Middle Class

It’s simple to mock Democrats like Joe Biden, Alexandria Ocasio-Cortez, and Bernie Sanders. One reason they’re easy targets is they want people to believe that America can finance a European-style welfare state with higher taxes on the rich.

That’s nonsensical. Simply stated, there are not enough rich people and they don’t earn enough money (and they have relatively easy ways of protecting themselves if their tax rates are increased).

Some folks on the left admit this is true. I’ve shared many examples of big-government proponents who openly acknowledge that lower-income and middle-class people will need to be pillaged as well.

- The editors at the New York Times endorsed higher taxes on the middle class in 2010.

- The then-House Majority Leader Steny Hoyer also gave a green light that year to higher taxes on the middle class.

- In 2012, MIT professor and former IMF official Simon Johnson argued that the middle class should pay more tax.

The Washington Post also called for higher taxes on the middle class a few years ago, as did Vice President Joe Biden’s former economist.

The Washington Post also called for higher taxes on the middle class a few years ago, as did Vice President Joe Biden’s former economist.- A New York Times columnist also called for broad-based tax hikes on the middle class in 2012.

- A Senior Fellow from Demos also argued for higher taxes on all Americans that year, specifically targeting the middle class.

- In 2013, the New York Times again editorialized in favor of higher tax burdens on the middle class.

- In 2017, two UCLA law professors endorsed big tax increases on ordinary people.

- Also that year, a columnist for US News & World Report urged higher taxes on middle-income people.

- In 2019, an out-of-the-closet socialist admitted a big welfare state requires big tax hikes on lower-income and middle-class people.

- Last year, two leftists opined in the Washington Post that ordinary people need to pay much higher taxes to finance bigger government.

I disagree with these people on policy, but I applaud them for being straight shooters. They get membership in my “Honest Leftists” club.

And we have a new member of that group.

Catherine Rampell opines in the Washington Post that President Biden should tax openly embrace tax increases on everybody.

President Biden is trying to address…big, thorny problems…with one hand tied behind his back. Yet he’s the one who tied it, with a pledge to bankroll every solution solely by soaking the rich. …Some have compared Biden’s efforts to Franklin D. Roosevelt’s New Deal, Lyndon B. Johnson’s Great Society or other ambitious endeavors of the pre-Reagan era — when government was more commonly seen as a solution rather than the problem. …Like many Democrats before him, Biden has promised to pay for government expansions by raising taxes only on corporations and the “rich,” everyone else spared.

Exactly who counts as “rich” is an ever-shrinking sliver of the population. Barack Obama defined it as households making $250,000 or more a year; now, Biden says it’s anyone making $400,000 or more. …more than 95 percent of Americans are excluded from helping to foot the bill… But…there aren’t enough ultrarich people and megacorporations out there to fund the massive new economic investments and social services Democrats say they want… Democrats sometimes point to Sweden or Denmark as examples of generous, successful welfare states. But in those countries, taxes are higher and broader-based. Here, the middle class pays much lower taxes… Here’s the argument I wish Biden would make: These new spending projects are worth doing. …we should all be financially invested in their success, at least a little. Taxation is the price we pay for a civilized society, as Supreme Court Justice Oliver Wendell Holmes Jr. put it. …If Biden wants to permanently transform the role of government, that may need to be his trajectory.

Needless to say, I fundamentally disagree with Ms. Rampell’s support for an even bigger welfare state, regardless of which taxpayers are being pillaged.

But at least she wants to pay for it and knows that means the IRS reaching into all of our pockets. And kudos to her for acknowledging the high tax burdens on lower-income and middle-class people in nations such as Sweden and Denmark.

Though I can’t resist commenting on the quote (“Taxation is the price we pay for a civilized society”) from Oliver Wendell Holmes.

People on the left love to cite that sentence, but they conveniently never explain that Holmes reportedly made that statement in 1904, nine years before there was an income tax, and then again in 1927, when federal taxes amounted to only $4 billion and the federal government consumed only about 5 percent of economic output.

As I wrote in 2013, “I’ll gladly pay for that amount of civilization.”

Let’s close with a couple of tweets that underscore how Democrats are pushing for giant spending increases, well beyond what can be financed by confiscating more money from the rich.

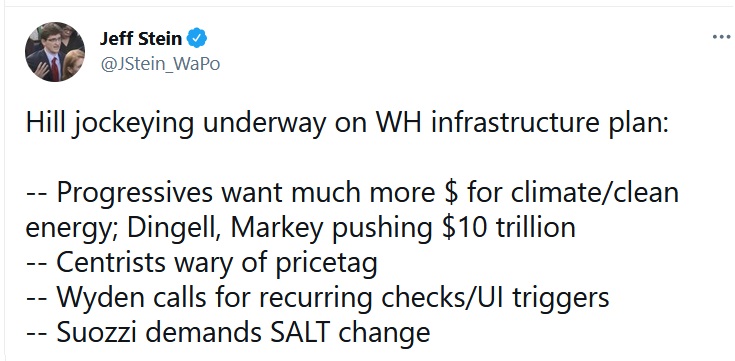

First, a reporter from the Washington Post lists some of the insanely expensive spending schemes being pushed on Capitol Hill.

I assume the “recurring checks” is a reference to the new per-child handouts in Biden’s so-called American Rescue Plan.

And “SALT change” refers to restoring the state and local tax deduction, which is supported by many Democrats from high-tax states even though (or perhaps because) it is a huge tax break for the rich.

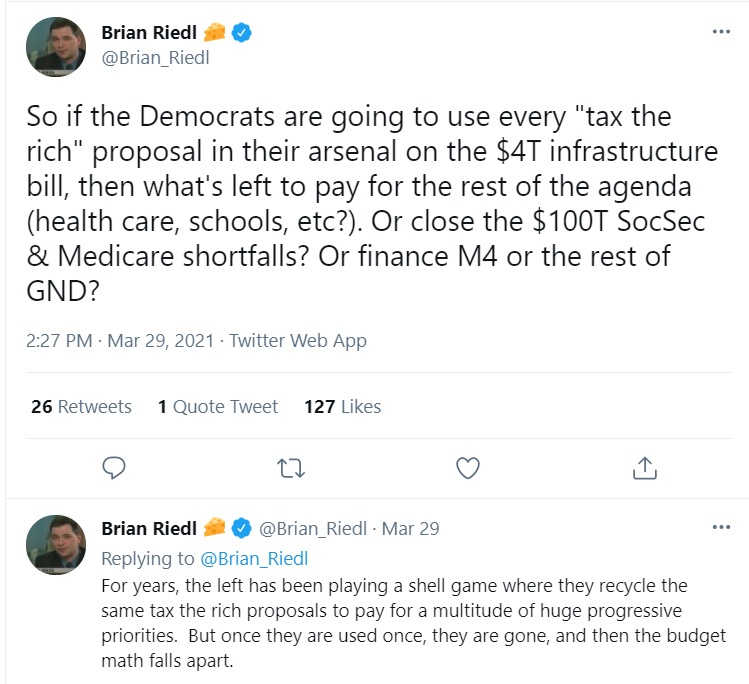

Next we have a couple of tweets from Brian Riedl of the Manhattan Institute. He correctly points out that Democrats are using just about every available class-warfare tax scheme, yet that money will only finance a fraction of their spending wish list.

Brian is right.

What tax increases (on the rich) will be left when the left want to push their “green new deal“? Or the “public option” for Medicare? Or any of the other spending schemes circulating in Washington.

The bottom line is that – sooner or later – politicians will follow Ms. Rampell’s advice and squeeze you and me.

P.S. It’s not a good idea to turn America into a European-style welfare state – unless the goal is much lower living standards.

Open letter to President Obama (Part 466)

(Emailed to White House on 4-9-13.)

President Obama c/o The White House 1600 Pennsylvania Avenue NW Washington, DC 20500

Dear Mr. President,

I know that you receive 20,000 letters a day and that you actually read 10 of them every day. I really do respect you for trying to get a pulse on what is going on out here.

___________

When I see taxes go up then I expect to see people try to avoid paying the higher taxes. Why can’t liberals see that is going to happen? Look at this stats below.

The Laffer Curve Bites Ireland in the Butt

March 19, 2013 by Dan Mitchell

Cigarette butt, to be more specific.

All over the world, governments impose draconian taxes on tobacco, and then they wind up surprised that projected revenues don’t materialize. We’ve seen this in Bulgaria and Romania, and we’ve seen this Laffer Curve effect in Washington, DC, and Michigan.

Even the Government Accountability Office has found big Laffer Curve effects from tobacco taxation.

And now we’re seeing the same result in Ireland.

Here are some details from an Irish newspaper.

…new Department of Finance figures showing that tobacco excise tax receipts are falling dramatically short of targets, even though taxes have increased and the number of people smoking has remained constant…the latest upsurge in smuggling…is costing the state hundreds of millions in lost revenue. Criminal gangs are openly selling smuggled cigarettes on the streets of central Dublin and other cities, door to door and at fairs and markets. Counterfeit cigarettes can be brought to the Irish market at a cost of just 20 cents a pack and sold on the black market at €4.50. The average selling price of legitimate cigarettes is €9.20 a pack. …Ireland has the most expensive cigarettes in the European Union, meaning that smugglers can make big profits by offering them at cheaper prices.

I have to laugh at the part of the article that says, “receipts are falling dramatically short of targets, even though taxes have increased.”

This is what’s called the Fox Butterfield effect, when a leftist expresses puzzlement about something that’s actually common sense. Named after a former New York Times reporter,  who was baffled that more people were in prison at the same time that crime rates were falling, it also shows up in tax policy when statists are surprised that tax revenues don’t automatically rise when tax rates become oppressive.

who was baffled that more people were in prison at the same time that crime rates were falling, it also shows up in tax policy when statists are surprised that tax revenues don’t automatically rise when tax rates become oppressive.

Ireland, by the way, should know better. About the only good policy left in the Emerald Isle is the low corporate tax rate. And as you can see in this video, that policy has yielded very good results.

The Laffer Curve, Part II: Reviewing the Evidence

My favorite example from that video, needless to say, is what happened during the Reagan years, when the rich paid much more to the IRS after their tax rates were slashed.

P.S. You won’t be surprised to learn that a branch of the United Nations is pushing for global taxation of tobacco. To paraphrase Douglas McArthur, “Bad ideas never die, they become global.”

____________

This fellow in the cartoon below will not stick around to pull the sled will he?

The Grinch Who Stole Prosperity

December 17, 2012 by Dan Mitchell

You can see one of my favorite political cartoons, produced by Chuck Asay, by clicking this link. It shows how a burdensome welfare state undermines growth by creating too heavy a load for the economy to carry.

Here’s a Lisa Benson cartoon that makes a similar point, but it focuses on Obama’s class-warfare tax policy.

What makes the cartoon especially effective is that it not only shows that higher tax burden is designed to finance more spending, but also it makes clear that soaking-the-rich won’t be enough.

I’ve already cited a bunch of semi-honest leftists who admit that their real goal is taxing the middle class (probably with a value-added tax!), so we can’t say we haven’t been warned.

P.S. My two other favorite Lisa Benson cartoons can be enjoyed here and here.

P.P.S. For Chuck Asay fans, my two other top choices for his work can be seen here and here.

___________________

Thank you so much for your time. I know how valuable it is. I also appreciate the fine family that you have and your commitment as a father and a husband.

Sincerely,

Everette Hatcher III, 13900 Cottontail Lane, Alexander, AR 72002, ph 501-920-5733, lowcostsqueegees@yahoo.com